Cronos Group Inc. (NASDAQ: CRON) (TSX: CRON)

(“

Cronos Group” or the

“

Company”), today announced financial results and

business highlights for the second quarter and first-half ended

June 30, 2019.

“During the second quarter, Cronos Group

expanded its R&D capabilities, innovation expertise and global

infrastructure network in what has been a year of tremendous

growth,” said Mike Gorenstein, CEO of Cronos Group. “We opened

Cronos Device Labs, our new global R&D center in Israel,

announced the acquisition of our new state-of-the-art fermentation

facility and added Dr. Todd Abraham as Chief Innovation Officer to

our executive leadership team.”

“We also took steps to enter the U.S. market

with our recent acquisition of Redwood Holding’s hemp-based CBD

platform. As we look ahead, we will continue to capitalize on this

momentum by building on our partnerships with Altria and Gingko

Bioworks and leveraging our collective resources and expertise to

realize the significant potential in the growing cannabis

industry.”

Financial Results Second Quarter

2019

| ($ in 000s, except where

noted otherwise) |

|

Three Months Ended |

|

|

|

|

|

Six Months Ended |

|

|

|

|

| |

|

June 30, |

|

|

Change |

|

|

June 30, |

|

|

Change |

|

| |

|

2019 |

|

|

2018 |

|

|

$ |

|

|

% |

|

|

2019 |

|

|

2018 |

|

|

$ |

|

|

% |

|

| Financial

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue |

|

$ |

10,237 |

|

|

$ |

3,394 |

|

|

$ |

6,843 |

|

|

|

202 |

% |

|

$ |

16,707 |

|

|

$ |

6,339 |

|

|

$ |

10,368 |

|

|

|

164 |

% |

|

Gross Margin before Fair Value Adjustments |

|

|

53 |

% |

|

|

63 |

% |

|

-- |

|

|

-- |

|

|

|

54 |

% |

|

|

55 |

% |

|

-- |

|

|

-- |

|

|

Adjusted EBITDA(1) |

|

$ |

(17,772 |

) |

|

$ |

(2,396 |

) |

|

$ |

(15,376 |

) |

|

|

642 |

% |

|

$ |

(26,719 |

) |

|

$ |

(3,896 |

) |

|

$ |

(22,823 |

) |

|

|

586 |

% |

|

Extract Sales (% of Net Product Revenue) |

|

|

20 |

% |

|

|

19 |

% |

|

-- |

|

|

-- |

|

|

|

21 |

% |

|

|

14 |

% |

|

-- |

|

|

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kilograms Sold |

|

|

1,584 |

|

|

|

477 |

|

|

|

1,107 |

|

|

|

232 |

% |

|

|

2,695 |

|

|

|

978 |

|

|

|

1,717 |

|

|

|

176 |

% |

|

Net Product Revenue / Gram Sold |

|

$ |

6.44 |

|

|

$ |

7.03 |

|

|

$ |

(0.59 |

) |

|

|

(8 |

%) |

|

$ |

6.15 |

|

|

$ |

6.37 |

|

|

$ |

(0.22 |

) |

|

|

(3 |

%) |

|

Cost of Sales before Fair Value Adj. / Gram Sold |

|

|

3.01 |

|

|

|

2.63 |

|

|

|

0.38 |

|

|

|

14 |

% |

|

|

2.87 |

|

|

|

2.88 |

|

|

|

(0.01 |

) |

|

|

(0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

Sheet(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

1,579,231 |

|

|

$ |

89,609 |

|

|

$ |

1,489,622 |

|

|

|

1,662 |

% |

|

$ |

1,579,231 |

|

|

$ |

89,609 |

|

|

$ |

1,489,622 |

|

|

|

1,662 |

% |

|

Short-Term Investments |

|

|

744,936 |

|

|

|

— |

|

|

|

744,936 |

|

|

NA |

|

|

|

744,936 |

|

|

|

— |

|

|

|

744,936 |

|

|

NA |

|

|

Derivative Liabilities |

|

|

1,399,594 |

|

|

|

— |

|

|

|

1,399,594 |

|

|

NA |

|

|

|

1,399,594 |

|

|

|

— |

|

|

|

1,399,594 |

|

|

NA |

|

(1) See “General

Matters – Non-IFRS Measures” for information related to Adjusted

EBITDA. (2) Dollar amounts

are as of the last day of the period indicated.

- Net revenue was $10.2 million in Q2 2019, representing

a 202% increase from $3.4 million in Q2 2018, primarily

driven by the launch of the adult-use market in Canada. Net revenue

increased 58% quarter-over-quarter from $6.5 million in the first

quarter of 2019, primarily driven by increased sales in CBD oil,

which carries no excise tax reduction and increased sales of dry

flower.

- 1,584 kilograms were sold in Q2 2019, representing a 232%

increase from 477 kilograms sold in Q2 2018, primarily driven

by increased cannabis production and the launch of the adult-use

market in Canada. Kilograms sold increased 43% quarter-over-quarter

from 1,111 kilograms sold in the first quarter of 2019, primarily

driven by increased cannabis production.

- Cost of sales before fair value adjustments per gram sold was

$3.01 in Q2 2019, representing a 14% increase from $2.63

in Q2 2018 and a 12% increase from $2.69 in the first quarter

of 2019. The increase quarter-over-quarter was driven by higher

processing cost on a per gram basis.

- The Company experienced continued growth in cannabis oil sales,

which represented 20% of net product revenue in Q2 2019

compared to 19% in Q2 2018.

| ($ in 000s, except where

noted otherwise) |

|

Second |

|

|

First |

|

|

|

|

| |

|

Quarter |

|

|

Quarter |

|

|

Change |

|

| |

|

2019 |

|

|

2019 |

|

|

$ |

|

|

% |

|

| Financial

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue |

|

$ |

10,237 |

|

|

$ |

6,470 |

|

|

$ |

3,767 |

|

|

|

58 |

% |

|

Gross Margin before Fair Value Adjustments |

|

|

53 |

% |

|

|

54 |

% |

|

-- |

|

|

-- |

|

|

Adjusted EBITDA(1) |

|

$ |

(17,772 |

) |

|

$ |

(8,947 |

) |

|

$ |

(8,825 |

) |

|

|

99 |

% |

|

Extract Sales (% of Net Product Revenue) |

|

|

20 |

% |

|

|

23 |

% |

|

-- |

|

|

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kilograms Sold |

|

|

1,584 |

|

|

|

1,111 |

|

|

|

473 |

|

|

|

43 |

% |

|

Net Product Revenue / Gram Sold |

|

$ |

6.44 |

|

|

$ |

5.73 |

|

|

$ |

0.71 |

|

|

|

12 |

% |

|

Cost of Sales before Fair Value Adj. / Gram Sold |

|

|

3.01 |

|

|

|

2.69 |

|

|

|

0.32 |

|

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

Sheet(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

1,579,231 |

|

|

$ |

2,418,277 |

|

|

$ |

(839,046 |

) |

|

|

(35 |

%) |

|

Short-Term Investment |

|

|

744,936 |

|

|

|

— |

|

|

|

744,936 |

|

|

NA |

|

|

Derivative Liabilities |

|

|

1,399,594 |

|

|

|

1,664,275 |

|

|

|

(264,681 |

) |

|

|

(16 |

%) |

(1) See “General

Matters – Non-IFRS Measures” for information related to Adjusted

EBITDA. (2) Dollar amounts

are as of the last day of the period indicated.

Business Highlights

Global Supply Chain

Cronos Group is transitioning its current production footprint

towards an efficient global supply chain model, which is expected

to employ a combination of wholly-owned production facilities,

third-party suppliers and global production partnerships, all of

which is anticipated to support the manufacturing of the Company’s

adult consumer goods. The Company remains focused on establishing

industry-leading methodologies and best practices at Peace

Naturals, the Company’s center of excellence, and leveraging

expertise to create high quality domestic and international

products that resonate with consumers.

In anticipation of the derivative market launching in Canada

this fall, Cronos Group expanded its Canadian footprint with a

cannabis concentrate supply agreement with MediPharm Labs Corp.

(“MediPharm Labs”) in May 2019. MediPharm Labs

will supply Cronos Group with approximately $30 million of cannabis

concentrate over 18-months, and, subject to certain renewal and

purchase options, potentially up to $60 million over 24-months.

Additionally, Cronos Group and MediPharm Labs have entered into a

tolling agreement, where Cronos Group may supply bulk cannabis to

MediPharm Labs extraction facility to fulfill certain additional

processing needs of the Company.

In July 2019, subsequent to the end of the

second quarter, the Company entered into a contract manufacturing

agreement with Heritage Cannabis Holdings Corp.

(“Heritage”), a cannabis producer based in British

Columbia. Heritage will be providing cannabis extract and services

related to the filling and packaging of vaporizer devices for the

Canadian cannabis adult-use and medical markets. The agreement has

a two-year term with an option to extend upon agreement by both

parties, at an annual potential contract value of $35 million,

based on current projections.

Global Sales and Distribution

Cronos Group remains committed to leading the

industry forward responsibly as derivative products are introduced

to the Canadian marketplace this fall. Along with Cronos Group’s

internal capabilities, the Company has partnered with third-party

producers to support the Company’s entry into the vaporizer

category in Canada. Both aforementioned third-party suppliers are

expected to utilize the Company’s proprietary formulations for

production.

Intellectual Property

Initiatives

In May 2019, Cronos Group established Cronos Device Labs, a

global research and development (“R&D”) center

for vaporizer innovation. Cronos Device Labs’ advanced facility is

based in Israel, a leader in cannabis R&D, and supports Cronos

Group’s efforts to develop next-generation vaporizer products that

are designed specifically for cannabinoid applications.

Cronos Device Labs, which is equipped with an experienced team

of product development talent, advanced vaporizer technology and

analytical testing infrastructure, serves as the global center of

R&D for the Company’s vaporizer devices.

The 23-member team at Cronos Device Labs, which brings to Cronos

Group over 80 years of combined expertise in vaporizer development,

is comprised of product designers, mechanical, electrical and

software engineers, and analytical and formulation scientists.

Cronos Device Labs significantly enhances Cronos Group’s technology

and development capabilities and is expected to enable the Company

to deliver expanded product offerings to customers that are

specially tailored to cannabinoid use.

Subsequent to the end of the second quarter,

Cronos Group closed the previously announced acquisition of an

84,000 square foot GMP compliant fermentation and manufacturing

facility in Winnipeg, Manitoba from Apotex Fermentation Inc.

(“AFI”) on July 31, 2019. The state-of-the-art

facility, which will operate as “Cronos Fermentation”, includes

fully equipped laboratories covering microbiology, organic and

analytical chemistry, quality control and method development as

well as two large scale microbial fermentation production areas

with a combined production capacity of 102,000L, three downstream

processing plants, and bulk product and packaging capabilities.

The acquisition was funded using existing cash

on hand and is expected to provide the fermentation and

manufacturing capabilities the Company needs in order to capitalize

on the progress underway with Ginkgo Bioworks, Inc.

(“Ginkgo Bioworks”). The Ginkgo Bioworks

partnership aims to bring innovation and biological manufacturing

to the cannabis industry, which would allow for cannabinoid

production at large scale and with greater efficiency compared to

traditional cultivation and extraction. Commercial production at

the facility is subject to completion of the equipment alignment

for cannabinoid-based production, the receipt of the appropriate

licenses from Health Canada to produce cultured cannabinoids under

the Cannabis Act (Canada) and the achievement of

certain milestones under the strategic partnership with Ginkgo

Bioworks.

Brand Portfolio

Subsequent to the end of the second quarter,

Cronos Group entered into a definitive agreement to acquire four of

Redwood Holding Group, LLC’s operating subsidiaries (collectively,

“Redwood”). Redwood manufactures, markets and

distributes hemp-derived CBD infused skincare and other consumer

products online and through retail and hospitality partner channels

in the United States under the Lord Jones™ brand. Redwood’s

products use pure hemp oil that contains natural phytocannabinoids

and terpenes found in the plant.

Under the terms of the agreement, Cronos Group

will acquire Redwood for approximately US$300 million, net of

Redwood’s estimated cash and debt and subject to a customary

working capital adjustment. US$225 million of the total

consideration (subject to the foregoing adjustments) will be paid

in cash with the balance paid in newly issued Cronos Group common

shares. Cronos Group will fund the cash portion of the transaction

with cash on hand. The acquisition is expected to close in the

third quarter of 2019, subject to customary closing conditions and

regulatory approvals.

Conference Call

The Company will host a conference call and live

audio webcast on Thursday, August 8, 2019 at 8:30 a.m. EST to

discuss second quarter 2019 results. The call will last

approximately one hour. Instructions for the conference call are

provided below:

- Live audio webcast:

https://ir.thecronosgroup.com/events/event-details/second-quarter-2019-earnings-conference-call

- Toll Free from the U.S. and Canada dial-in: (866) 795-2258

- International dial-in: (409) 937-8902

- Conference ID: 3164005

An audio replay of the call will be archived on the Company’s

website for replay.

About Cronos Group

Cronos Group is an innovative global cannabinoid

company with international production and distribution across five

continents. Cronos Group is committed to building disruptive

intellectual property by advancing cannabis

research, technology and product development. With a

passion to responsibly elevate the consumer experience, Cronos

Group is building an iconic brand portfolio. Cronos Group’s

portfolio includes PEACE NATURALS™, a global health and

wellness platform, and two adult-use brands COVE™ and

Spinach™. To learn more about Cronos Group and its brands,

please visit: www.thecronosgroup.com; www.peacenaturals.com;

www.covecannabis.ca; www.spinachcannabis.com.

Forward-looking statementsThis

press release contains "forward-looking information" and

"forward-looking statements" within the meaning of applicable

securities laws (collectively, "forward-looking statements"), which

are based on the Company’s current internal expectations,

estimates, projections, assumptions and beliefs. All information

contained herein that is not clearly historical in nature may

constitute forward-looking statements. In some cases,

forward-looking statements can be identified by the use of

forward-looking terminology such as “may”, “will”, “expect”,

“likely”, “should”, “would”, “plan”, “anticipate”, “intend”,

“potential”, “proposed”, “estimate”, “believe”, or other similar

words, expressions, phrases, including negative and grammatical

variations thereof, or statements that certain events or conditions

“may” or “will” happen, or by discussions of strategy.

Forward-looking statements include estimates, plans, expectations,

opinions, forecasts, projections, targets, guidance or other

statements that are not statements of historical fact.

Forward-looking statements are provided for the purposes of

assisting the reader in understanding our financial performance,

financial position and cash flows as at and for periods ended on

certain dates and to present information about management's current

expectations and plans relating to the future and the reader is

cautioned that such information may not be appropriate for any

other purpose. Some of the forward-looking statements contained in

this press release, include, but are not limited to, statements

with respect to: the anticipated benefits of our joint ventures,

strategic alliances, research and development initiatives,

acquisitions and other commercial arrangements, including the

ability to produce and distribute the target cannabinoids under our

strategic partnership with Ginkgo Bioworks, Inc., the ability to

build innovative vaporizer products and expand product offerings

through Cronos Device Labs and the ability to further create and

scale hemp-derived consumer products through the Company’s

acquisition of Redwood; expectations regarding the Company’s

acquisition of Redwood, including anticipated timing of closing of

the acquisition and the anticipated benefits therefrom; our ability

to execute on our growth strategy, including the construction of

production facilities and the commencement of operations by our

joint ventures and the timing thereof; the ability of Cronos Group,

our joint ventures, strategic partners and commercial

counterparties to obtain all necessary licenses, permits and

approvals; our ability to expand our distribution network and

global footprint; our business and operations; our strategy for

future growth; our intention to build an international iconic brand

portfolio and develop disruptive intellectual property; and the

growth potential of the cannabis industry and our ability to

realize such opportunity. No forward-looking statement can be

guaranteed and Cronos Group cannot guarantee the forward-looking

statements contained herein. Forward-looking statements are based

upon certain material assumptions that were applied in drawing a

conclusion or making a forecast or projection, including

management's perceptions of historical trends, current conditions

and expected future developments, as well as other considerations

that are believed to be appropriate in the circumstances. While we

consider these assumptions to be reasonable based on information

currently available to management, there is no assurance that such

expectations will prove to be correct. By their nature,

forward-looking statements are subject to inherent risks and

uncertainties that may be general or specific and which give rise

to the possibility that expectations, forecasts, predictions,

projections or conclusions will not prove to be accurate, that

assumptions may not be correct and that objectives, strategic goals

and priorities will not be achieved. A variety of factors,

including known and unknown risks, many of which are beyond our

control, could cause actual results to differ materially from the

forward-looking statements in this press release. Such factors

include, without limitation, those discussed in the Company's most

recent management’s discussion and analysis and the Company’s

annual information form for the year ended December 31, 2018, both

of which have been filed on the Company’s profile on SEDAR at

www.sedar.com and on EDGAR at www.sec.gov. Readers are cautioned to

consider these and other factors, uncertainties and potential

events carefully and not to put undue reliance on forward-looking

statements. Forward-looking statements contained herein are made as

of the date of this press release and are based on the beliefs,

estimates, expectations and opinions of management on the date such

forward-looking statements are made. The Company undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, estimates or opinions,

future events or results or otherwise or to explain any material

difference between subsequent actual events and such

forward-looking statements, except as required by applicable

law.

All references in this press release to

“dollars”, “C$” or “$” are to Canadian dollars and all references

to “US$” are to United States dollars.

| Cronos

Group Inc. |

| Unaudited

Condensed Interim Consolidated Statements of Financial

Position |

| As at

June 30, 2019 and December 31, 2018 |

| (in thousands of

CDN $) |

| |

|

Notes |

|

As

atJune 30,2019 |

|

|

As

atDecember 31,2018 |

| Assets |

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

22(a) |

|

$ |

1,579,231 |

|

|

$ |

32,634 |

|

Short-term investments |

|

22(a) |

|

|

744,936 |

|

|

|

- |

|

Interest receivable |

|

22(a) |

|

|

5,751 |

|

|

|

- |

|

Accounts receivable |

|

22(a) |

|

|

11,960 |

|

|

|

4,163 |

|

Sales taxes receivable |

|

|

|

|

7,936 |

|

|

|

3,419 |

|

Prepaid expenses and other assets |

|

|

|

|

7,079 |

|

|

|

3,876 |

|

Biological assets |

|

4 |

|

|

10,032 |

|

|

|

9,074 |

|

Inventory |

|

4 |

|

|

41,667 |

|

|

|

11,584 |

|

Total current assets |

|

|

|

|

2,408,592 |

|

|

|

64,750 |

| Advances to joint

ventures |

|

5,22(a) |

|

|

26,608 |

|

|

|

6,395 |

| Net investments in equity

accounted investees |

|

5 |

|

|

2,025 |

|

|

|

4,038 |

| Other investments |

|

6 |

|

|

300 |

|

|

|

705 |

| Loans receivable |

|

7,22(a) |

|

|

16,664 |

|

|

|

314 |

| Property, plant and

equipment |

|

8 |

|

|

196,718 |

|

|

|

171,720 |

| Right-of-use assets |

|

3,11 |

|

|

3,359 |

|

|

|

171 |

| Intangible assets |

|

9 |

|

|

11,461 |

|

|

|

11,234 |

| Goodwill |

|

9 |

|

|

1,792 |

|

|

|

1,792 |

|

Total assets |

|

|

|

$ |

2,667,519 |

|

|

$ |

261,119 |

| |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

Accounts payable and other liabilities |

|

22(b) |

|

|

30,747 |

|

|

|

15,372 |

|

Holdbacks payable |

|

22(b) |

|

|

2,274 |

|

|

|

7,887 |

|

Government remittances payable |

|

22(b) |

|

|

630 |

|

|

|

1,123 |

|

Current portion of lease obligations |

|

3,11,22(b) |

|

|

417 |

|

|

|

41 |

|

Construction loan payable |

|

12,22(b) |

|

|

- |

|

|

|

20,951 |

|

Derivative liabilities |

|

13,22(b) |

|

|

1,399,594 |

|

|

|

- |

|

Total current liabilities |

|

|

|

|

1,433,662 |

|

|

|

45,374 |

| Lease obligations |

|

3,11,22(b) |

|

|

3,109 |

|

|

|

119 |

| Due to non-controlling

interests |

|

10,22(b) |

|

|

2,249 |

|

|

|

2,136 |

| Deferred income tax

liability |

|

20 |

|

|

4,036 |

|

|

|

1,850 |

|

Total liabilities |

|

|

|

$ |

1,443,056 |

|

|

$ |

49,479 |

| Shareholders'

equity |

|

|

|

|

|

|

|

|

|

|

Share capital |

|

14(a) |

|

|

559,296 |

|

|

|

225,500 |

|

Warrants |

|

15(a) |

|

|

754 |

|

|

|

1,548 |

|

Stock options |

|

15(b) |

|

|

8,573 |

|

|

|

6,241 |

|

Retained earnings (accumulated deficit) |

|

|

|

|

655,047 |

|

|

|

(22,715 |

|

Accumulated other comprehensive income |

|

|

|

|

944 |

|

|

|

930 |

|

Total equity attributable to shareholders of Cronos Group |

|

|

|

|

1,224,614 |

|

|

|

211,504 |

|

Non-controlling interests |

|

3,10 |

|

|

(151 |

) |

|

|

136 |

|

Total shareholders' equity |

|

|

|

|

1,224,463 |

|

|

|

211,640 |

|

Total liabilities and shareholders' equity |

|

|

|

$ |

2,667,519 |

|

|

$ |

261,119 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

19 |

|

|

|

|

|

|

|

| Subsequent events |

|

25 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| The accompanying

notes are an integral part of these unaudited condensed interim

consolidated financial statements |

| Cronos Group

Inc. Unaudited Condensed Interim Consolidated

Statements of Operations and Comprehensive Income

(Loss)For the three and six months ended

June 30, 2019 and

June 30, 2018(in

thousands of CDN $, except share and per share amounts) |

|

|

|

Three Months EndedJune 30, |

|

|

Six Months

EndedJune 30, |

|

| |

|

Notes |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Gross

revenue |

|

16 |

|

$ |

10,787 |

|

|

$ |

3,394 |

|

|

$ |

17,772 |

|

|

$ |

6,339 |

|

|

Excise taxes |

|

|

|

|

(550 |

) |

|

|

- |

|

|

|

(1,065 |

) |

|

|

- |

|

| Net

revenue |

|

|

|

|

10,237 |

|

|

|

3,394 |

|

|

|

16,707 |

|

|

|

6,339 |

|

| Cost of

sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales before fair

value adjustments |

|

|

|

|

4,762 |

|

|

|

1,254 |

|

|

|

7,746 |

|

|

|

2,821 |

|

| Gross profit before

fair value adjustments |

|

|

|

|

5,475 |

|

|

|

2,140 |

|

|

|

8,961 |

|

|

|

3,518 |

|

| Fair value

adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized change in fair value of biological assets |

|

4 |

|

|

(4,024 |

) |

|

|

(6,831 |

) |

|

|

(17,577 |

) |

|

|

(9,575 |

) |

|

Realized fair value adjustments on inventory sold in the

period |

|

|

|

|

3,557 |

|

|

|

2,625 |

|

|

|

7,279 |

|

|

|

4,819 |

|

|

Total fair value adjustments |

|

|

|

|

(467 |

) |

|

|

(4,206 |

) |

|

|

(10,298 |

) |

|

|

(4,756 |

) |

| Gross

profit |

|

|

|

|

5,942 |

|

|

|

6,346 |

|

|

|

19,259 |

|

|

|

8,274 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

|

|

5,358 |

|

|

|

364 |

|

|

|

6,858 |

|

|

|

950 |

|

|

Research and development |

|

|

|

|

3,076 |

|

|

|

- |

|

|

|

4,633 |

|

|

|

- |

|

|

General and administrative |

|

|

|

|

15,176 |

|

|

|

4,219 |

|

|

|

24,787 |

|

|

|

6,680 |

|

|

Share-based payments |

|

15(b) |

|

|

2,002 |

|

|

|

950 |

|

|

|

2,739 |

|

|

|

1,724 |

|

|

Depreciation and amortization |

|

8,9,11 |

|

|

675 |

|

|

|

323 |

|

|

|

1,145 |

|

|

|

608 |

|

|

Total operating expenses |

|

|

|

|

26,287 |

|

|

|

5,856 |

|

|

|

40,162 |

|

|

|

9,962 |

|

| Operating

loss |

|

|

|

|

(20,345 |

) |

|

|

490 |

|

|

|

(20,903 |

) |

|

|

(1,688 |

) |

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense) |

|

|

|

|

12,531 |

|

|

|

(37 |

) |

|

|

15,251 |

|

|

|

(59 |

) |

|

Financing and transaction costs |

|

12,13,25 |

|

|

(4,505 |

) |

|

|

- |

|

|

|

(34,066 |

) |

|

|

- |

|

|

Gain on revaluation of derivative liabilities |

|

13 |

|

|

263,943 |

|

|

|

- |

|

|

|

700,326 |

|

|

|

- |

|

|

Share of (loss) income from investments in equity accounted

investees |

|

5 |

|

|

(991 |

) |

|

|

3 |

|

|

|

(1,255 |

) |

|

|

44 |

|

|

Gain on disposal of Whistler |

|

5 |

|

|

- |

|

|

|

- |

|

|

|

20,606 |

|

|

|

- |

|

|

Gain on other investments |

|

6 |

|

|

- |

|

|

|

- |

|

|

|

924 |

|

|

|

221 |

|

|

Total other income |

|

|

|

|

270,978 |

|

|

|

(34 |

) |

|

|

701,786 |

|

|

|

206 |

|

| Income (loss) before income

taxes |

|

|

|

|

250,633 |

|

|

|

456 |

|

|

|

680,883 |

|

|

|

(1,482 |

) |

| Deferred income tax (recovery)

expense |

|

20 |

|

|

(335 |

) |

|

|

(267 |

) |

|

|

2,222 |

|

|

|

(1,155 |

) |

|

Net income (loss) |

|

|

|

$ |

250,968 |

|

|

$ |

723 |

|

|

$ |

678,661 |

|

|

$ |

(327 |

) |

|

Net income (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cronos Group |

|

|

|

$ |

251,117 |

|

|

$ |

723 |

|

|

$ |

678,946 |

|

|

$ |

(327 |

) |

|

Non-controlling interests |

|

10 |

|

|

(149 |

) |

|

|

- |

|

|

|

(285 |

) |

|

|

- |

|

|

|

|

|

|

$ |

250,968 |

|

|

$ |

723 |

|

|

$ |

678,661 |

|

|

$ |

(327 |

) |

| Other comprehensive

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on revaluation and disposal of other investments, net of

tax |

|

6,20 |

|

$ |

- |

|

|

$ |

39 |

|

|

$ |

103 |

|

|

$ |

4 |

|

|

Foreign exchange loss on translation of foreign operations |

|

2(a),10 |

|

|

(104 |

) |

|

|

- |

|

|

|

(87 |

) |

|

|

- |

|

|

Total other comprehensive income (loss) |

|

|

|

|

(104 |

) |

|

|

39 |

|

|

|

16 |

|

|

|

4 |

|

| Comprehensive income

(loss) |

|

|

|

$ |

250,864 |

|

|

$ |

762 |

|

|

$ |

678,677 |

|

|

$ |

(323 |

) |

| Comprehensive income

(loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cronos Group |

|

|

|

$ |

251,011 |

|

|

$ |

762 |

|

|

$ |

678,960 |

|

|

$ |

(323 |

) |

|

Non-controlling interests |

|

10 |

|

|

(147 |

) |

|

|

- |

|

|

|

(283 |

) |

|

|

- |

|

| |

|

|

|

$ |

250,864 |

|

|

$ |

762 |

|

|

$ |

678,677 |

|

|

$ |

(323 |

) |

| Earnings (loss) per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

17 |

|

$ |

0.75 |

|

|

$ |

0.00 |

|

|

$ |

2.14 |

|

|

$ |

(0.00 |

) |

|

Diluted |

|

17 |

|

$ |

0.22 |

|

|

$ |

0.00 |

|

|

$ |

0.58 |

|

|

$ |

(0.00 |

) |

| Weighted average

number of outstanding shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

17 |

|

|

334,665,873 |

|

|

|

175,529,196 |

|

|

|

317,940,749 |

|

|

|

166,343,078 |

|

|

Diluted |

|

17 |

|

|

374,676,595 |

|

|

|

211,524,230 |

|

|

|

364,872,093 |

|

|

|

166,343,078 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The accompanying

notes are an integral part of these unaudited condensed interim

consolidated financial statements |

|

| Cronos Group

Inc.Unaudited Condensed Interim Consolidated Statements of Cash

FlowsFor the three and six months ended June 30, 2019 and

June 30, 2018(in thousands of CDN $) |

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months EndedJune 30, |

|

|

Six Months

EndedJune 30, |

|

| |

|

Notes |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Operating

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

|

$ |

250,968 |

|

|

$ |

723 |

|

|

$ |

678,661 |

|

|

$ |

(327 |

) |

| Items not affecting cash and

cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized change in fair value of biological assets |

|

4 |

|

|

(4,024 |

) |

|

|

(6,831 |

) |

|

|

(17,577 |

) |

|

|

(9,575 |

) |

|

Realized fair value adjustments on inventory sold in the

period |

|

|

|

|

3,557 |

|

|

|

2,625 |

|

|

|

7,279 |

|

|

|

4,819 |

|

|

Share-based payments |

|

15(b) |

|

|

2,002 |

|

|

|

950 |

|

|

|

2,739 |

|

|

|

1,724 |

|

|

Depreciation and amortization |

|

8,9,11 |

|

|

675 |

|

|

|

323 |

|

|

|

1,145 |

|

|

|

608 |

|

|

Depreciation relieved on inventory sold |

|

21 |

|

|

363 |

|

|

|

47 |

|

|

|

598 |

|

|

|

216 |

|

|

Gain on revaluation of derivative liabilities |

|

13 |

|

|

(263,943 |

) |

|

|

- |

|

|

|

(700,326 |

) |

|

|

- |

|

|

Share of loss (income) from investments in equity accounted

investees |

|

5 |

|

|

991 |

|

|

|

(3 |

) |

|

|

1,255 |

|

|

|

(44 |

) |

|

Gain on disposal of Whistler |

|

5 |

|

|

- |

|

|

|

- |

|

|

|

(20,606 |

) |

|

|

- |

|

|

Gain on other investments |

|

6 |

|

|

- |

|

|

|

- |

|

|

|

(924 |

) |

|

|

(221 |

) |

|

Deferred income tax (recovery) expense |

|

20 |

|

|

(335 |

) |

|

|

(267 |

) |

|

|

2,222 |

|

|

|

(1,155 |

) |

|

Foreign exchange loss (gain) |

|

|

|

|

178 |

|

|

|

4 |

|

|

|

92 |

|

|

|

(12 |

) |

| Net changes in non-cash

working capital |

|

21 |

|

|

(47,860 |

) |

|

|

(4,437 |

) |

|

|

(30,541 |

) |

|

|

(16,662 |

) |

| Cash and cash equivalents used

in operating activities |

|

|

|

|

(57,428 |

) |

|

|

(6,866 |

) |

|

|

(75,983 |

) |

|

|

(20,629 |

) |

| Investing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of short-term investments |

|

|

|

|

(744,936 |

) |

|

|

- |

|

|

|

(744,936 |

) |

|

|

- |

|

|

Advances to joint ventures |

|

5 |

|

|

(5,481 |

) |

|

|

- |

|

|

|

(21,293 |

) |

|

|

- |

|

|

Investments in equity accounted investees |

|

5 |

|

|

- |

|

|

|

- |

|

|

|

(2,200 |

) |

|

|

- |

|

|

Proceeds from sale of other investments |

|

6 |

|

|

- |

|

|

|

280 |

|

|

|

26,078 |

|

|

|

967 |

|

|

Payment to exercise ABcann warrants |

|

6 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(113 |

) |

|

Advances on loans receivable |

|

7 |

|

|

(16,350 |

) |

|

|

- |

|

|

|

(16,350 |

) |

|

|

- |

|

|

Purchase of property, plant and equipment |

|

8 |

|

|

(14,445 |

) |

|

|

(30,025 |

) |

|

|

(27,899 |

) |

|

|

(37,667 |

) |

|

Purchase of intangible assets |

|

9 |

|

|

(577 |

) |

|

|

(38 |

) |

|

|

(628 |

) |

|

|

(169 |

) |

|

Advance to Cronos Israel |

|

10 |

|

|

- |

|

|

|

(378 |

) |

|

|

- |

|

|

|

(1,304 |

) |

| Cash and cash equivalents used

in investing activities |

|

|

|

|

(781,789 |

) |

|

|

(30,161 |

) |

|

|

(787,228 |

) |

|

|

(38,286 |

) |

| Financing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advance from non-controlling interests |

|

10 |

|

|

2 |

|

|

|

- |

|

|

|

113 |

|

|

|

- |

|

|

Repayment of lease obligations |

|

11 |

|

|

(184 |

) |

|

|

- |

|

|

|

(216 |

) |

|

|

- |

|

|

Repayment of construction loan payable |

|

12 |

|

|

- |

|

|

|

- |

|

|

|

(21,311 |

) |

|

|

- |

|

|

Payment of accrued interest on construction loan payable |

|

12 |

|

|

- |

|

|

|

- |

|

|

|

(121 |

) |

|

|

(185 |

) |

|

Advance under Credit Facility |

|

12 |

|

|

- |

|

|

|

- |

|

|

|

65,000 |

|

|

|

- |

|

|

Repayment of Credit Facility |

|

12 |

|

|

- |

|

|

|

- |

|

|

|

(65,000 |

) |

|

|

- |

|

|

Proceeds from Altria Investment |

|

13,14(a) |

|

|

- |

|

|

|

- |

|

|

|

2,434,757 |

|

|

|

- |

|

|

Proceeds from share issuance |

|

14(a) |

|

|

- |

|

|

|

100,032 |

|

|

|

- |

|

|

|

146,032 |

|

|

Share issuance costs |

|

14(a) |

|

|

(101 |

) |

|

|

(6,363 |

) |

|

|

(5,002 |

) |

|

|

(9,444 |

) |

|

Proceeds from exercise of warrants and options |

|

15(a),(b) |

|

|

750 |

|

|

|

599 |

|

|

|

1,932 |

|

|

|

2,913 |

|

|

Withholding taxes paid on share appreciation rights |

|

15(b) |

|

|

(569 |

) |

|

|

- |

|

|

|

(1,116 |

) |

|

|

- |

|

|

Proceeds from exercise of Top-up Rights |

|

13(c),14(b) |

|

|

828 |

|

|

|

- |

|

|

|

828 |

|

|

|

- |

|

| Cash and cash equivalents

provided by financing activities |

|

|

|

|

726 |

|

|

|

94,268 |

|

|

|

2,409,864 |

|

|

|

139,316 |

|

| Net change in cash and cash

equivalents |

|

|

|

|

(838,491 |

) |

|

|

57,241 |

|

|

|

1,546,653 |

|

|

|

80,401 |

|

| Cash and cash equivalents -

beginning of period |

|

|

|

|

2,417,855 |

|

|

|

32,368 |

|

|

|

32,634 |

|

|

|

9,208 |

|

| Effects of foreign exchange on

cash and cash equivalents |

|

|

|

|

(133 |

) |

|

|

- |

|

|

|

(56 |

) |

|

|

- |

|

| Cash and cash

equivalents - end of period |

|

|

|

$ |

1,579,231 |

|

|

$ |

89,609 |

|

|

$ |

1,579,231 |

|

|

$ |

89,609 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental cash flow

information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid |

|

|

|

$ |

77 |

|

|

$ |

189 |

|

|

$ |

752 |

|

|

$ |

496 |

|

|

Interest received |

|

|

|

|

10,054 |

|

|

|

- |

|

|

|

10,054 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The accompanying

notes are an integral part of these unaudited condensed interim

consolidated financial statements |

|

Non-IFRS Measures

The Company uses certain measures that are not

recognized under International Financial Reporting Standards

(“IFRS”), do not have any standardized meaning

prescribed by IFRS and therefore may not be comparable to similar

measures presented by other companies. Rather, these measures are

provided as a supplement to those IFRS measures to provide

additional information regarding the Company’s results of

operations from management’s perspective. Accordingly, non-IFRS

measures should not be considered a substitute for, or superior to,

the financial information prepared and presented in accordance with

IFRS. Each non-IFRS measure is reconciled to its most directly

comparable IFRS measure.

Adjusted EBITAdjusted earnings before interest

and tax (“Adjusted EBIT”) is used by management as

a supplemental measure to review and assess operating performance

and trends on a comparable basis. Adjusted EBIT is defined as net

income or loss, excluding interest expense, interest income,

deferred income tax expense or recovery, share-based payments,

unrealized change in the fair value of biological assets, realized

fair value adjustments on inventory sold, financing costs, gain on

revaluation of derivative liabilities, share of income or loss from

investments in equity accounted investees and gain or loss on

investments. The Company believes that Adjusted EBIT is useful to

compare its operating profitability across periods.

Adjusted EBITDAAdjusted earnings before

interest, tax, depreciation and amortization (“Adjusted

EBITDA”) is used by management as a supplemental measure

to review and assess operating performance and trends on a

comparable basis. Adjusted EBITDA is defined as Adjusted EBIT

excluding depreciation and amortization. The Company believes that

Adjusted EBITDA is useful to compare its ability to generate cash

from operations across periods.

Reconciliation of non-IFRS measuresA

reconciliation of Adjusted EBIT and Adjusted EBITDA to net income,

the most directly comparable IFRS measure, is presented in the

following table.

| ($ in 000s) |

|

Second |

|

|

First |

|

|

Second |

|

| |

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

|

|

2019 |

|

|

2019 |

|

|

2018 |

|

| Net Income (Loss) |

|

$ |

250,968 |

|

|

$ |

427,693 |

|

|

$ |

723 |

|

| Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest (Income) Expense |

|

|

(12,531 |

) |

|

|

(2,720 |

) |

|

|

37 |

|

|

Deferred Income Tax Expense (Recovery) |

|

|

(335 |

) |

|

|

2,557 |

|

|

|

(267 |

) |

|

Share-Based Payments |

|

|

2,002 |

|

|

|

737 |

|

|

|

950 |

|

|

Unrealized Change in Fair Value of Biological Assets |

|

|

(4,024 |

) |

|

|

(13,553 |

) |

|

|

(6,831 |

) |

|

Realized Fair Value Adjustments on Inventory Sold |

|

|

3,557 |

|

|

|

3,722 |

|

|

|

2,625 |

|

|

Financing and Transaction Costs |

|

|

4,505 |

|

|

|

29,561 |

|

|

|

— |

|

|

Gain on Revaluation of Derivative Liabilities |

|

|

(263,943 |

) |

|

|

(436,383 |

) |

|

|

— |

|

|

Share of Loss (Income) from Investments in Equity Accounted

Investees |

|

|

991 |

|

|

|

264 |

|

|

|

(3 |

) |

|

Gain on Disposal of Whistler |

|

|

— |

|

|

|

(20,606 |

) |

|

|

— |

|

|

Gain on Other Investments |

|

|

— |

|

|

|

(924 |

) |

|

|

— |

|

|

Adjusted EBIT |

|

|

(18,810 |

) |

|

|

(9,652 |

) |

|

|

(2,766 |

) |

|

Depreciation and Amortization |

|

|

1,038 |

|

|

|

705 |

|

|

|

370 |

|

|

Adjusted EBITDA |

|

|

(17,772 |

) |

|

|

(8,947 |

) |

|

|

(2,396 |

) |

For further information, please

contact:Anna Shlimak Investor Relations Tel: (416)

504-0004 investor.relations@thecronosgroup.com

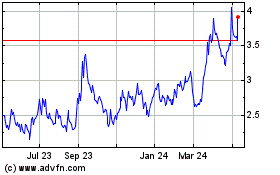

Cronos (TSX:CRON)

Historical Stock Chart

From Jun 2024 to Jul 2024

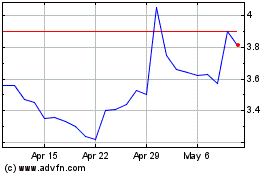

Cronos (TSX:CRON)

Historical Stock Chart

From Jul 2023 to Jul 2024