Colliers International Group Inc. Announces US$300 Million Bought Deal Public Offering of Equity

February 22 2024 - 4:37PM

Colliers International Group Inc. (TSX and NASDAQ: CIGI)

(“Colliers” or the “Company”) has announced today that it has

entered into an agreement with a syndicate of underwriters led by

BMO Capital Markets and J.P. Morgan, under which the underwriters

have agreed to buy on a “bought deal” basis 2,479,500

subordinate voting shares (the “Subordinate Voting Shares”), at a

price of US$121.00 per Subordinate Voting Share for gross proceeds

of approximately US$300 million (the “Offering”). Colliers has

granted the Underwriters an option, exercisable at the offering

price for a period of 30 days following the closing of the

Offering, to purchase up to an additional 15% of the Offering to

cover over-allotments, if any. The Offering is expected to close on

or about February 28, 2024.

The net proceeds of the Offering will be used to

repay balances outstanding on the Company’s credit facility and are

intended to create additional capacity to fund potential future

acquisition opportunities and growth initiatives, and for general

corporate purposes.

The Subordinate Voting Shares are being offered

for sale pursuant to the Offering in all of the provinces and

territories of Canada, other than Quebec, by way of a prospectus

supplement (the “Prospectus Supplement”) to the Company’s Canadian

short form base shelf prospectus dated February 20, 2024 (the “Base

Shelf Prospectus”). The Subordinate Voting Shares are being offered

for sale in the public offering in the United States pursuant to an

effective registration statement on Form F-10 (the “Registration

Statement”) filed under the Canada/U.S. multi-jurisdictional

disclosure system. Before investing, prospective purchasers in

Canada should read the Prospectus Supplement, the Base Shelf

Prospectus, and the documents incorporated by reference therein,

and prospective purchasers in the United States should read the

Registration Statement and the documents incorporated by reference

therein for more complete information about the Company and the

Offering. Subordinate Voting Shares may also be offered on a

private placement basis in other international jurisdictions in

reliance on applicable private placement exemptions.

Copies of the Prospectus Supplement, the Base

Shelf Prospectus, and the Registration Statement, when available,

may be obtained upon request in Canada by contacting BMO Nesbitt

Burns Inc., Brampton Distribution Centre C/O The Data Group of

Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2 by

telephone at 905-791-3151 Ext 4312 or by email at

torbramwarehouse@datagroup.ca, or J.P. Morgan Securities Canada

Inc., Suite 4500, TD Bank Tower, 66 Wellington Street West,

Toronto, ON M5K 1E7, or by telephone: Canada Sales 416-981-9233 and

in the United States by contacting BMO Capital Markets Corp., Attn:

Equity Syndicate Department, 151 W 42nd Street, 32nd Floor, New

York, NY 10036, or by telephone at (800) 414-3627 or by email at

bmoprospectus@bmo.com, or J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, Phone: 866-803-9204. Copies of the applicable offering

documents, when available, can be obtained free of charge under the

Company’s profile on SEDAR+ at www.sedarplus.com and EDGAR at

www.sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading

diversified professional services and investment management

company. With operations in 66 countries, our 19,000 enterprising

professionals work collaboratively to provide expert real estate

and investment advice to clients. For more than 29 years, our

experienced leadership with significant inside ownership has

delivered compound annual investment returns of approximately 20%

for shareholders. With annual revenues of $4.3 billion and $98

billion of assets under management, Colliers maximizes the

potential of property and real assets to accelerate the success of

our clients, our investors and our people.

Forward-looking Statements

This press release includes

forward-looking statements. Forward-looking statements include the

Company’s financial performance outlook and statements regarding

goals, beliefs, strategies, objectives, plans or current

expectations, including with respect to the Offering and the

anticipated use of proceeds therefrom. These statements involve

known and unknown risks, uncertainties and other factors which may

cause the actual results to be materially different from any future

results, performance or achievements contemplated in the

forward-looking statements. Such factors include: economic

conditions, especially as they relate to commercial and consumer

credit conditions and consumer spending, particularly in regions

where our business may be concentrated; commercial real estate

property values, vacancy rates and general conditions of financial

liquidity for real estate transactions; trends in pricing and risk

assumption for commercial real estate services; the effect of

significant movements in average capitalization rates across

different property types; a reduction by companies in their

reliance on outsourcing for their commercial real estate needs,

which would affect revenues and operating performance; competition

in the markets served by the Company; the ability to attract new

clients and to retain major clients and renew related contracts;

the ability to retain and incentivize producers; increases in wage

and benefit costs; the effects of changes in interest rates on the

cost of borrowing; unexpected increases in operating costs, such as

insurance, workers’ compensation and health care; changes in the

frequency or severity of insurance incidents relative to historical

experience; the effects of changes in foreign exchange rates in

relation to the US dollar on the Company’s Canadian dollar, Euro,

Australian dollar and UK pound sterling denominated revenues and

expenses; the impact of pandemics on client demand for the

Company’s services, the ability of the Company to deliver its

services and the health and productivity of its employees; the

impact of global climate change; the impact of political events

including elections, referenda, trade policy changes, immigration

policy changes, hostilities and terrorism on the Company’s

operations; the ability to identify and make acquisitions at

reasonable prices and successfully integrate acquired operations;

the ability to execute on, and adapt to, information technology

strategies and trends; the ability to comply with laws and

regulations related to our global operations, including real estate

and mortgage banking licensure, labour and employment laws and

regulations, as well as the anti-corruption laws and trade

sanctions; and changes in government laws and policies at the

federal, state/provincial or local level that may adversely impact

the business.

Additional information and risk factors

are identified in the Company’s other periodic filings with

Canadian and US securities regulators, including those identified

in the Company’s annual information form for the year ended

December 31, 2023 under the heading “Risk factors” (a copy of which

may be obtained at www.sedarplus.com or as part of the Company’s

Form 40-F available at www.sec.gov). Forward looking statements

contained in this press release are made as of the date hereof and

are subject to change. All forward-looking statements in this press

release are qualified by these cautionary statements. Except as

required by applicable law, Colliers undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or

otherwise.

COMPANY CONTACTS:

Jay HennickGlobal Chairman and CEO

Christian MayerChief Financial Officer(416)

960-9500

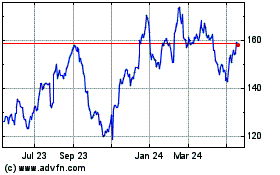

Colliers (TSX:CIGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Colliers (TSX:CIGI)

Historical Stock Chart

From Dec 2023 to Dec 2024