Baytex Energy Corp. ("Baytex")(TSX, NYSE: BTE) reports its

operating and financial results for the three months and year ended

December 31, 2019 (all amounts are in Canadian dollars unless

otherwise noted).

“2019 was an exceptional year with $1 billion

EBITDA, $329 million of free cash flow and a 17% reduction in net

debt. During the first quarter of 2020, we enhanced our long-term

note maturity schedule and extended the term of our revolving

credit facilities to 2024. Our operations continue to perform well

with strong capital efficiencies in each of our core properties

(Eagle Ford, Viking and Heavy Oil). Together, these measures give

us confidence and significant flexibility to execute our business

plan to continue driving free cash flow and strengthening our

balance sheet,” commented Ed LaFehr, President and Chief Executive

Officer.

2019 Highlights

We released preliminary unaudited financial and

operating results on January 20, 2020 in conjunction with the

release of our 2019 reserves. Our audited financial and operating

results for the three months and year ended December 31, 2019 are

unchanged from the preliminary results.

- Generated production of 96,360

boe/d (83% oil and NGL) during Q4/2019 and 97,680 boe/d for

full-year 2019, exceeding the high end of guidance.

- Exploration and development

expenditures totaled $153 million in Q4/2019, bringing aggregate

spending for 2019 to $552 million, which is at the low end of our

original guidance.

- Delivered adjusted funds flow of

$232 million ($0.42 per basic share) in Q4/2019 and $902 million

($1.62 per basic share) for 2019.

- Generated EBITDA of $256 million in

Q4/2019 and $1.01 billion for 2019.

- Reduced net debt by $100 million in

Q4/2019 and by $393 million in 2019 with free cash flow along with

a strengthening of the Canadian dollar relative to the U.S. dollar.

Net debt totaled $1.87 billion at December 31, 2019.

- Achieved a strong year of reserves

development with proved developed producing reserves increasing 5%

with finding & development costs of $13.04/boe and a recycle

ratio of 2.3x.

Bond Refinancing and Bank Credit

Extension

- On February 6, 2020, we issued

US$500 million principal amount of 8.75% senior unsecured notes due

April 1, 2027. Net proceeds have been used to redeem US$400 million

principal amount of 5.125% senior unsecured notes due 2021. We also

called for redemption $300 million principal amount of 6.625%

senior unsecured notes due 2022 on March 6, 2020.

- On March 3, 2020, we extended the

maturity of our revolving credit facilities and term loan to April

2, 2024 (from June 4, 2021). The credit facilities total

approximately $1,046 million and do not require annual or

semi-annual reviews.

2020 Outlook

Our 2020 guidance remains unchanged as we target

production of 93,000 to 97,000 boe/d with exploration and

development expenditures of $500 to $575 million. Our exploration

and development program is expected to be fully funded from

adjusted funds flow at the forward strip(1) and we have the

operational flexibility to adjust our spending plans based on

changes in commodity prices. For 2020, we have entered into hedges

on approximately 48% of our net crude oil exposure, largely

utilizing a 3-way option structure that provides WTI price

protection at US$58.04/bbl.

(1) 2020 full-year pricing assumptions:

WTI - US$48.64/bbl; LLS - US$51.39/bbl; WCS differential -

US$16.15/bbl; MSW differential – US$5.51/bbl, NYMEX Gas -

US$1.97/mcf; AECO Gas - $1.79/mcf and Exchange Rate (CAD/USD) -

1.336.

|

|

Three Months Ended |

Years Ended |

|

|

|

December 31,2019 |

September 30,2019 |

|

December 31,2018 |

December 31,2019 |

December 31,2018 |

|

|

FINANCIAL (thousands of Canadian dollars,

except per common share amounts) |

|

|

|

|

|

|

|

Petroleum and natural gas sales |

$ |

445,895 |

|

$ |

424,600 |

|

$ |

358,437 |

|

$ |

1,805,919 |

|

$ |

1,428,870 |

|

|

Adjusted funds flow (1) |

232,147 |

|

213,379 |

|

110,828 |

|

902,426 |

|

472,983 |

|

|

Per share - basic |

0.42 |

|

0.38 |

|

0.20 |

|

1.62 |

|

1.35 |

|

|

Per share - diluted |

0.42 |

|

0.38 |

|

0.20 |

|

1.62 |

|

1.35 |

|

|

Net income (loss) |

(117,772 |

) |

15,151 |

|

(231,238 |

) |

(12,459 |

) |

(325,309 |

) |

|

Per share - basic |

(0.21 |

) |

0.03 |

|

(0.42 |

) |

(0.02 |

) |

(0.93 |

) |

|

Per share - diluted |

(0.21 |

) |

0.03 |

|

(0.42 |

) |

(0.02 |

) |

(0.93 |

) |

| |

|

|

|

|

|

|

|

Capital Expenditures |

|

|

|

|

|

|

|

Exploration and development expenditures (1) |

$ |

153,117 |

|

$ |

139,085 |

|

$ |

184,162 |

|

$ |

552,291 |

|

$ |

495,721 |

|

|

Acquisitions, net of divestitures |

563 |

|

(30 |

) |

229 |

|

2,180 |

|

1,603,850 |

|

|

Total oil and natural gas capital expenditures |

$ |

153,680 |

|

$ |

139,055 |

|

$ |

184,391 |

|

$ |

554,471 |

|

$ |

2,099,571 |

|

| |

|

|

|

|

|

|

|

Net Debt |

|

|

|

|

|

|

|

Bank loan (2) |

$ |

506,471 |

|

$ |

570,792 |

|

$ |

522,294 |

|

$ |

506,471 |

|

$ |

522,294 |

|

|

Long-term notes (2) |

1,337,200 |

|

1,359,480 |

|

1,596,323 |

|

1,337,200 |

|

1,596,323 |

|

|

Long-term debt |

1,843,671 |

|

1,930,272 |

|

2,118,617 |

|

1,843,671 |

|

2,118,617 |

|

|

Working capital deficiency |

28,120 |

|

41,067 |

|

146,550 |

|

28,120 |

|

146,550 |

|

|

Net debt (1) |

$ |

1,871,791 |

|

$ |

1,971,339 |

|

$ |

2,265,167 |

|

$ |

1,871,791 |

|

$ |

2,265,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Outstanding - basic (thousands) |

|

|

|

|

|

|

|

Weighted average |

558,228 |

|

557,888 |

|

554,036 |

|

557,048 |

|

351,542 |

|

|

End of period |

558,305 |

|

557,972 |

|

554,060 |

|

558,305 |

|

554,060 |

|

|

BENCHMARK PRICES |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil |

|

|

|

|

|

|

|

|

|

|

|

|

WTI (US$/bbl) |

$ |

56.96 |

|

$ |

56.45 |

|

$ |

58.81 |

|

$ |

57.03 |

|

$ |

64.77 |

|

|

LLS (US$/bbl) |

60.73 |

|

61.88 |

|

66.64 |

|

62.84 |

|

|

70.09 |

|

|

LLS differential to WTI (US$/bbl) |

3.77 |

|

5.43 |

|

7.83 |

|

5.81 |

|

|

5.32 |

|

|

Edmonton par ($/bbl) |

68.10 |

|

68.41 |

|

42.68 |

|

69.22 |

|

|

69.31 |

|

|

Edmonton par differential to WTI (US$/bbl) |

(5.37 |

) |

(4.66 |

) |

(26.51 |

) |

(4.86 |

) |

|

(11.30 |

) |

|

WCS heavy oil ($/bbl) |

54.29 |

|

58.39 |

|

25.62 |

|

58.75 |

|

|

49.85 |

|

|

WCS differential to WTI (US$/bbl) |

(15.83 |

) |

(12.24 |

) |

(39.42 |

) |

(12.75 |

) |

|

(26.31 |

) |

|

Natural gas |

|

|

|

|

|

|

|

|

|

|

|

|

NYMEX (US$/mmbtu) |

$ |

2.50 |

|

$ |

2.23 |

|

$ |

3.64 |

|

$ |

2.63 |

|

$ |

3.09 |

|

|

AECO ($/mcf) |

2.34 |

|

1.04 |

|

1.94 |

|

1.62 |

|

|

1.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAD/USD average exchange rate |

1.3201 |

|

1.3207 |

|

1.3215 |

|

1.3269 |

|

|

1.2962 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Three Months Ended |

Years Ended |

|

|

|

December 31,2019 |

|

September 30,2019 |

|

December 31,2018 |

|

December 31,2019 |

|

December 31,2018 |

|

|

OPERATING |

|

|

|

|

|

|

|

Daily Production |

|

|

|

|

|

|

|

Light oil and condensate (bbl/d) |

43,906 |

42,829 |

|

44,987 |

|

43,587 |

|

29,264 |

|

|

Heavy oil (bbl/d) |

27,050 |

25,712 |

|

26,339 |

|

26,741 |

|

25,954 |

|

|

NGL (bbl/d) |

8,699 |

9,543 |

|

10,327 |

|

10,229 |

|

9,745 |

|

|

Total liquids (bbl/d) |

79,655 |

78,084 |

|

81,653 |

|

80,557 |

|

64,963 |

|

|

Natural gas (mcf/d) |

100,235 |

101,054 |

|

103,424 |

|

102,742 |

|

92,971 |

|

|

Oil equivalent (boe/d @ 6:1) (3) |

96,360 |

94,927 |

|

98,890 |

|

97,680 |

|

80,458 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Netback (thousands of Canadian dollars) |

|

|

|

|

|

|

|

Total sales, net of blending and other expense (4) |

$ |

427,728 |

|

$ |

411,650 |

|

$ |

344,682 |

|

$ |

1,737,124 |

|

$ |

1,360,038 |

|

|

Royalties |

(77,282 |

) |

(75,017 |

) |

(79,765 |

) |

(320,241 |

) |

(313,754 |

) |

|

Operating expense |

(99,573 |

) |

(97,377 |

) |

(97,857 |

) |

(397,716 |

) |

(311,592 |

) |

|

Transportation expense |

(8,840 |

) |

(9,903 |

) |

(10,994 |

) |

(43,942 |

) |

(36,869 |

) |

|

Operating netback (1) |

$ |

242,033 |

|

$ |

229,353 |

|

$ |

156,066 |

|

$ |

975,225 |

|

$ |

697,823 |

|

|

General and administrative |

(9,893 |

) |

(9,934 |

) |

(14,096 |

) |

(45,469 |

) |

(45,825 |

) |

|

Cash financing and interest |

(24,389 |

) |

(26,752 |

) |

(27,933 |

) |

(107,417 |

) |

(104,318 |

) |

|

Realized financial derivatives gain (loss) |

22,956 |

|

20,857 |

|

(3,063 |

) |

75,620 |

|

(73,165 |

) |

|

Other (5) |

1,440 |

|

(145 |

) |

(146 |

) |

4,467 |

|

(1,532 |

) |

|

Adjusted funds flow (1) |

$ |

232,147 |

|

$ |

213,379 |

|

$ |

110,828 |

|

$ |

902,426 |

|

$ |

472,983 |

|

| |

|

|

|

|

|

|

|

Netback (per boe) |

|

|

|

|

|

|

|

Total sales, net of blending and other expense (4) |

$ |

48.25 |

|

$ |

47.14 |

|

$ |

37.89 |

|

$ |

48.72 |

|

$ |

46.31 |

|

|

Royalties |

(8.72 |

) |

(8.59 |

) |

(8.77 |

) |

(8.98 |

) |

(10.68 |

) |

|

Operating expense |

(11.23 |

) |

(11.15 |

) |

(10.76 |

) |

(11.16 |

) |

(10.61 |

) |

|

Transportation expense |

(1.00 |

) |

(1.13 |

) |

(1.21 |

) |

(1.23 |

) |

(1.26 |

) |

|

Operating netback (1) |

$ |

27.30 |

|

$ |

26.27 |

|

$ |

17.15 |

|

$ |

27.35 |

|

$ |

23.76 |

|

|

General and administrative |

(1.12 |

) |

(1.14 |

) |

(1.55 |

) |

(1.28 |

) |

(1.56 |

) |

|

Cash financing and interest |

(2.75 |

) |

(3.06 |

) |

(3.07 |

) |

(3.01 |

) |

(3.55 |

) |

|

Realized financial derivatives gain (loss) |

2.59 |

|

2.39 |

|

(0.34 |

) |

2.12 |

|

(2.49 |

) |

|

Other (5) |

0.16 |

|

(0.03 |

) |

(0.02 |

) |

0.13 |

|

(0.05 |

) |

|

Adjusted funds flow (1) |

$ |

26.18 |

|

$ |

24.43 |

|

$ |

12.17 |

|

$ |

25.31 |

|

$ |

16.11 |

|

Notes:

- The terms “adjusted funds flow”,

“exploration and development expenditures”, “net debt” and

“operating netback” do not have any standardized meaning as

prescribed by Canadian Generally Accepted Accounting Principles

(“GAAP”) and therefore may not be comparable to similar measures

presented by other companies where similar terminology is used. See

the advisory on non-GAAP measures at the end of this press

release.

- Principal amount of instruments.

The carrying amount of debt issue costs associated with the bank

loan and long-term notes are excluded on the basis that these

amounts have been paid by Baytex and do not represent an additional

source of capital or repayment obligations.

- Barrel of oil equivalent ("boe")

amounts have been calculated using a conversion rate of six

thousand cubic feet of natural gas to one barrel of oil. The use of

boe amounts may be misleading, particularly if used in isolation. A

boe conversion ratio of six thousand cubic feet of natural gas to

one barrel of oil is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead.

- Realized heavy oil prices are

calculated based on sales dollars, net of blending and other

expense. We include the cost of blending diluent in our realized

heavy oil sales price in order to compare the realized pricing on

our produced volumes to the WCS benchmark.

- Other is comprised of realized

foreign exchange gain or loss, other income or expense, current

income tax expense or recovery and payments on onerous contracts.

Refer to the 2019 MD&A for further information on these

amounts.

Operating Results

Our 2019 operating and financial results

demonstrate the benefits of our diversified oil weighted portfolio

and our commitment to allocate capital effectively, generate free

cash flow and further strengthen our balance sheet.

Our production exceeded the high end of our

annual guidance with outstanding capital efficiencies in our

development program and each of our core properties (Eagle Ford,

Viking and Heavy Oil) generated an operating netback in excess of

exploration and development expenditures. We also achieved a strong

year of reserves development with proved developed producing

reserves increasing 5% with finding & development costs of

$13.04/boe and a recycle ratio of 2.3x.

Production during the fourth quarter averaged

96,360 boe/d (83% oil and NGL), as compared to 94,927 boe/d (82%

oil and NGL) in Q3/2019. Production in 2019 averaged 97,680 boe/d

as compared to 80,458 boe/d in 2018. Exploration and development

expenditures totaled $153 million in Q4/2019 and $552 million for

full-year 2019. We participated in the completion of 417 (313.9

net) wells with a 99% success rate during the year.

The following table compares our 2019 results to

our 2019 original budget guidance.

|

|

2019 Original Guidance (1) |

|

2019 Results |

|

Exploration and development expenditures |

$550 - $650 million |

|

$552.3 million |

| Production (boe/d) |

93,000 - 97,000 |

|

97,680 |

| |

|

|

|

| Expenses: |

|

|

|

| Royalty rate |

20.0% |

|

18.4% |

| Operating |

$10.75 - $11.25/boe |

|

$11.16/boe |

| Transportation |

$1.25 - $1.35/boe |

|

$1.23/boe |

| General and

administrative |

~ $46 million ($1.30/boe) |

|

$45.5 million ($1.28/boe) |

| Interest |

~ $112 million ($3.23/boe) |

|

$107.4 million ($3.01/boe) |

| |

|

|

|

| Leasing expenditures |

$5 million |

|

$6 million |

| Asset

retirement obligations |

$17 million |

|

$15 million |

Note:

- As announced on December 17, 2018.

Includes updated guidance on May 2, 2019 for general and

administrative expenses and leasing expenditures to reflect a

change associated with the adoption of IFRS 16.

Eagle Ford and Viking Light Oil

Production in the Eagle Ford averaged 38,567

boe/d (78% oil and NGL) during Q4/2019, as compared to 36,793 boe/d

in Q3/2019. Production for 2019 averaged 39,055 boe/d, as compared

to 37,076 boe/d in 2018. In 2019, we invested $178 million on

exploration and development in the Eagle Ford and generated an

operating netback of $416 million.

In the Eagle Ford, we continued to see strong

well performance driven by enhanced completions across our acreage

position. In 2019, we participated in the drilling of 96 (20.2 net)

wells and commenced production from 109 (25.1 net) wells. The wells

brought on-stream during 2019 generated an average 30-day initial

production rate of approximately 1,900 boe/d per well, which

represents an approximate 8% improvement over wells brought

on-stream in 2018.

Production in the Viking averaged 22,050 boe/d

(91% oil and NGL) during Q4/2019, as compared to 22,198 boe/d in

Q3/2019. Production for the full-year 2019 averaged 22,546 boe/d.

In 2019, we invested $266 million on exploration and development in

the Viking and generated an operating netback of $349 million.

In the Viking, we maintained an active pace of

development in 2019, drilling 275 (243.6 net) wells and commencing

production from 271 (239.7 net) wells. In 2019, over 90% of our

drilling program was extended reach horizontal wells. We also added

229 net high quality drilling opportunities through multiple deals

and asset swaps.

Heavy Oil

Our heavy oil assets at Peace River and

Lloydminster produced a combined 29,707 boe/d (91% oil and NGL)

during the fourth quarter, as compared to 28,483 boe/d in Q3/2019.

We drilled 40 (40.0 net) heavy oil wells in 2019, including 34 net

wells at Lloydminster and six net wells at Peace River. In 2019, we

invested $80 million on exploration and development on our heavy

oil assets and generated an operating netback of $188 million.

East Duvernay Shale Light Oil

We continue to advance the delineation of the

East Duvernay Shale, an early stage, high operating netback light

oil resource play. As of December 31, 2019, we have drilled seven

wells at Pembina, confirming the prospectivity of our acreage. Two

wells brought on-stream in 2019 generated an average 30-day initial

production rate of approximately 1,050 boe/d per well (75% oil and

NGL) and are in the top 15% of all wells drilled to date in the

play.

In Q1/2020, we drilled two wells at Pembina and

completion activities are scheduled for Q2/2020. The success of our

drilling program in the Pembina area has significantly de-risked

our approximately 38 kilometer long acreage fairway, where we hold

275 sections (100% working interest) of Duvernay land.

Financial Review

We delivered adjusted funds flow of $232 million

($0.42 per basic share) in Q4/2019 and $902 million ($1.62 per

basic share) in 2019. This resulted in free cash flow of $73

million in Q4/2019 and $329 million in 2019. This strong free cash

flow, along with the Canadian dollar strengthening relative to the

U.S. dollar, contributed to a 17% reduction in our net debt this

year.

We recorded a net loss of $118 million ($0.21

per basic share) in Q4/2019 and $12 million ($0.02 per basic share)

in 2019. The net loss is attributable to a non-cash impairment

charge of $188 million on our heavy oil assets and reflects lower

heavy oil prices and a change in development plan for our thermal

projects at Peace River.

We realized an operating netback of $27.30/boe

in Q4/2019, as compared to $26.27/boe in Q3/2019 and $17.15/boe in

Q4/2018. Including financial derivatives, our operating netback

improved to $29.89/boe, as compared to $16.81/boe in Q4/2018. Our

Canadian operations generated an operating netback of $24.72/boe

during Q4/2019 while our Eagle Ford asset generated an operating

netback of $31.17/boe.

The following table summarizes our operating

netbacks for the periods noted.

| |

Three Months Ended December 31 |

|

|

2019 |

2018 |

|

($ per boe except for production) |

|

Canada |

|

|

U.S. |

|

|

Total |

|

|

Canada |

|

|

U.S. |

|

|

Total |

|

|

Production (boe/d) |

57,794 |

|

38,566 |

|

96,360 |

|

60,453 |

|

38,437 |

|

98,890 |

|

| |

|

|

|

|

|

|

|

Total sales, net of blending and other (1) |

$ |

45.52 |

|

$ |

52.33 |

|

$ |

48.25 |

|

$ |

24.04 |

|

$ |

59.66 |

|

$ |

37,89 |

|

|

Royalties |

(4.73 |

) |

(14.69 |

) |

(8.72 |

) |

(3.10 |

) |

(17.68 |

) |

(8.77 |

) |

|

Operating expense |

(14.41 |

) |

(6.47 |

) |

(11.23 |

) |

(13.42 |

) |

(6.56 |

) |

(10.76 |

) |

|

Transportation expense |

(1.66 |

) |

— |

|

(1.00 |

) |

(1.98 |

) |

— |

|

(1.21 |

) |

|

Operating netback (2) |

$ |

24.72 |

|

$ |

31.17 |

|

$ |

27.30 |

|

$ |

5.54 |

|

$ |

35.42 |

|

$ |

17.15 |

|

|

Realized financial derivatives gain (loss) |

— |

|

— |

|

2.59 |

|

— |

|

— |

|

(0.34 |

) |

|

Operating netback after financial derivatives |

$ |

24.72 |

|

$ |

31.17 |

|

$ |

29.89 |

|

$ |

5.54 |

|

$ |

35.42 |

|

$ |

16.81 |

|

Notes:

- Realized heavy oil prices are calculated based on sales

dollars, net of blending and other expense. We include the cost of

blending diluent in our realized heavy oil sales price in order to

compare the realized pricing on our produced volumes to the WCS

benchmark.

- The term “operating netback” does not have any standardized

meaning as prescribed by Canadian Generally Accepted Accounting

Principles (“GAAP”) and therefore may not be comparable to similar

measures presented by other companies where similar terminology is

used. See the advisory on non-GAAP measures at the end of this

press release.

Balance Sheet and Liquidity

In 2019, we set a priority to further deleverage

and strengthen our balance sheet. We delivered on this commitment

as highlighted by the following key milestones:

- We generated free cash flow of $73 million in Q4/2019 and $329

million in 2019.

- We reduced net debt by $100 million in Q4/2019 and by $393

million in 2019 due to the strong free cash flow and a

strengthening of the Canadian dollar relative to the U.S.

dollar.

- We completed the early redemption of US$150 million principal

amount of 6.75% senior unsecured notes due February 17, 2021

at par on September 13, 2019.

Subsequent to year-end, we further improved our

financial position:

- We enhanced our long-term note maturity schedule which provides

us significant flexibility and liquidity to execute our business

plan.

- On February 5, 2020, we issued US$500 million principal amount

of 8.75% senior unsecured notes, which mature on April 1, 2027.

These notes are redeemable at our option, in whole or in part, at

specified redemption prices after April 1, 2023.

- On February 20, 2020, we redeemed US$400 million principal

amount of 5.125% senior unsecured notes due June 1, 2021

at par.

- We issued a redemption notice for $300 million principal amount

of 6.625% senior unsecured notes due July 19, 2022 for

redemption on March 6, 2020 at 101.104% of the principal

amount.

- Following these redemptions, our next long-term note maturity

will be June 2024.

- We amended our credit facilities to extend the maturities of

our revolving facilities and term loan to April 2, 2024. The credit

facilities are not borrowing base facilities and do not require

annual or semi-annual reviews. Our facilities total approximately

$1,046 million and include US$575 million of revolving credit

facilities and a $300 million term loan.

Our net debt, which includes our bank loan,

long-term notes and working capital, totaled $1,872 million at

December 31, 2019, down 17% from $2,265 million at December

31, 2018. Following the US$500 million note issue and the

redemption of the US$400 million and $300 million notes, our credit

facilities are approximately one-third undrawn, we retain over $300

million of liquidity and the weighted average interest rate on our

long-term debt is approximately

6%.

Risk Management

To manage commodity price movements we utilize

various financial derivative contracts and crude-by-rail to reduce

the volatility in our adjusted funds flow. We realized a

financial derivatives gain of $76 million in 2019, as compared to a

loss of $73 million in 2018.

For 2020, we have entered into hedges on

approximately 48% of our net crude oil exposure, largely utilizing

a 3-way option structure on 24,500 bbl/d that provides WTI price

protection at US$58.04/bbl with upside participation to

US$63.06/bbl. The 3-way contracts are structured as follows:

|

WTI |

Baytex Receives (1) |

| At or below US$50.44/bbl |

WTI + US$7.60/bbl |

| Between US$50.44/bbl and

US$58.04/bbl |

US$58.04/bbl |

| Between US$58.04/bbl and

US$63.06/bbl |

WTI |

| Above

US$63.06/bbl |

US$63.06/bbl |

Note:

- The price Baytex receives

represents an average of all contracts entered into.

In addition to the 3-way options, we have

WTI-based fixed price swaps on 3,500 bbl/d at US$57.40/bbl for

2020. We also have WTI-MSW basis differential swaps for 4,250

bbl/d of our light oil production in Canada at US$6.19/bbl.

Crude-by-rail is an integral part of our egress

and marketing strategy for our heavy oil production. For 2020, we

are contracted to deliver approximately 11,500 bbl/d of our heavy

oil volumes to market by rail. In addition, we have WCS

differential hedges on 5,500 bbl/d at a WTI-WCS differential of

US$16.25/bbl.

A complete listing of our financial derivative

contracts can be found in Note 20 to our 2019 financial

statements.

2020 Outlook

We have a high quality and diversified oil

portfolio with a strong drilling inventory of approximately 10 or

more years in each of our core areas (Viking, Eagle Ford and Heavy

Oil). Our commitment remains to deliver stable production, generate

free cash flow and further strengthen our balance sheet.

Our 2020 annual guidance remains unchanged as we

target production of 93,000 to 97,000 boe/d with exploration and

development expenditures of $500 to $575 million. For Q1/2020,

production is trending above 97,000 boe/d with exploration and

development expenditures of approximately $200 million, consistent

with our plan and capital guidance range.

Our exploration and development program is

expected to be fully funded from adjusted funds flow at the forward

strip(1) and we have the operational flexibility to adjust our

spending plans based on changes in commodity prices.

(1) 2020 full-year

pricing assumptions: WTI - US$48.64/bbl; LLS - US$51.39/bbl; WCS

differential - US$16.15/bbl; MSW differential – US$5.51/bbl, NYMEX

Gas - US$1.97/mcf; AECO Gas - $1.79/mcf and Exchange Rate (CAD/USD)

- 1.336.

The following table summarizes our 2020 annual

guidance.

|

Exploration and development expenditures |

$500 - $575 million |

|

Production (boe/d) |

93,000 to 97,000 |

|

|

|

|

Expenses: |

|

|

Royalty rate |

18.0% - 18.5% |

|

Operating |

$11.25 - $12.00/boe |

|

Transportation |

$1.20 - $1.30/boe |

|

General and administrative |

$45 million ($1.30/boe) |

|

Interest |

$112 million ($3.23/boe) |

|

|

|

|

Leasing expenditures |

$7 million |

|

Asset retirement obligations |

$19 million |

Board Appointment

The Board of Directors is pleased to announce

the appointment of Don Hrap as a director of Baytex.

“We are very pleased that Don has joined the

Baytex board. His business knowledge, strategic perspective and

tremendous breadth of experience across U.S. and Canadian energy

will serve the board and Baytex well in the years ahead,” commented

Mark Bly, Chairman of Baytex.

Mr. Hrap has spent 35 years in the upstream oil

and gas business, primarily holding executive positions in North

America. From 2009-2018, he served as President, Lower 48 at

ConocoPhillips with strong breadth and depth of experience across

several U.S. oil resource plays. Prior to this at ConocoPhillips,

Mr. Hrap was senior vice president of Western Canada Gas. He joined

ConocoPhillips in 2006 through the merger with Burlington

Resources, serving as senior vice president of operations for

Burlington Canada. Earlier, he was vice president for the North

American Division at Gulf Canada Resources, where he worked for 17

years. Mr. Hrap previously served as chairman of the API Upstream

Committee, a Board member of the Independent Petroleum Association

of America (IPAA) and a member of the U.S. Oil & Gas

Association. He is also a Director of Tall City III Exploration LLC

and WildFire Energy I LLC, and also serves as an Industry Advisor

to Warburg Pincus. Mr. Hrap graduated from the University of

Manitoba with a Bachelor of Science in Mechanical Engineering in

1982. In 1995, he graduated from the University of Calgary with a

Master in Business Administration.

Baytex has an ongoing board renewal process led

by its Nominating and Governance Committee. In the last year, we

have significantly restructured our board. Throughout this renewal

process, our intent has been to create an efficient board with

complementary skill sets suited to our business, ensure

independence and increase diversity.

|

|

Conference Call Today9:00 a.m. MST (11:00

a.m. EST) |

|

|

|

Baytex will host a conference call today, March 4, 2020, starting

at 9:00am MST (11:00am EST). To participate, please dial toll free

in North America 1-800-319-4610 or international 1-416-915-3239.

Alternatively, to listen to the conference call online, please

enter http://services.choruscall.ca/links/baytexq4ye20200304.html

in your web browser.An archived recording of the conference call

will be available shortly after the event by accessing the webcast

link above. The conference call will also be archived on the Baytex

website at www.baytexenergy.com. |

|

Additional Information

Our audited consolidated financial statements

for the year ended December 31, 2019 and the related Management's

Discussion and Analysis of the operating and financial results can

be accessed on our website at www.baytexenergy.com and will be

available shortly through SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.shtml.

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

business strategies, plans and objectives; that we have flexibility

to execute our business plan driving free cash flow and

strengthening our balance sheet; our 2020 production and capital

expenditure guidance; that our exploration and development program

is expended to be fully funded by adjusted funds flow at a WTI

price US$50/bbl; the percentage of our net crude oil exposure that

is hedged for 2020; that we continue to advance the delineation of

East Duvernay shale; our plan to complete two wells at Pembina in

Q2/2020; that we have de-risked our 38 kilometer acreage fairway in

Pembina; that our long-term note maturity schedule provides us

significant flexibility and liquidity to execute our business plan;

that after completing the announced redemption of long-term notes

our credit facilities will be one-third undrawn, we will have over

$300 million of liquidity and the weighted average cost of our debt

will be approximately 6%; that we have a strong drilling inventory

of approximately 10 or more years in each core area (Viking, Eagle

Ford and Heavy Oil); we are committed to stable production,

generating free cash flow and strengthening our balance sheet; our

expected Q1/2020 production volumes and exploration and development

expenditures; that we remain well positioned to generate free cash

flow in 2020; our guidance for 2020 exploration and

development expenditures, production, royalty rate, operating,

transportation, general and administration and interest expense and

leasing expenditures and asset retirement obligations.

In addition, information and statements relating

to reserves are deemed to be forward-looking statements, as they

involve implied assessment, based on certain estimates and

assumptions, that the reserves described exist in quantities

predicted or estimated, and that they can be profitably produced in

the future.

These forward-looking statements are based on

certain key assumptions regarding, among other things: petroleum

and natural gas prices and differentials between light, medium and

heavy oil prices; well production rates and reserve volumes; our

ability to add production and reserves through our exploration and

development activities; capital expenditure levels; our ability to

borrow under our credit agreements; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax

and royalty regimes; our ability to develop our crude oil and

natural gas properties in the manner currently contemplated; and

current industry conditions, laws and regulations continuing in

effect (or, where changes are proposed, such changes being adopted

as anticipated). Readers are cautioned that such assumptions,

although considered reasonable by Baytex at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: the volatility of oil and natural

gas prices and price differentials; availability and cost of

gathering, processing and pipeline systems; failure to comply with

the covenants in our debt agreements; the availability and cost of

capital or borrowing; that our credit facilities may not provide

sufficient liquidity or may not be renewed; risks associated with a

third-party operating our Eagle Ford properties; the cost of

developing and operating our assets; depletion of our reserves;

risks associated with the exploitation of our properties and our

ability to acquire reserves; new regulations on hydraulic

fracturing; restrictions on or access to water or other fluids;

changes in government regulations that affect the oil and gas

industry; regulations regarding the disposal of fluids; changes in

environmental, health and safety regulations; public perception and

its influence on the regulatory regime; restrictions or costs

imposed by climate change initiatives; variations in interest rates

and foreign exchange rates; risks associated with our hedging

activities; changes in income tax or other laws or government

incentive programs; uncertainties associated with estimating oil

and natural gas reserves; our inability to fully insure against all

risks; risks of counterparty default; risks associated with

acquiring, developing and exploring for oil and natural gas and

other aspects of our operations; risks associated with large

projects; risks related to our thermal heavy oil projects;

alternatives to and changing demand for petroleum products; risks

associated with our use of information technology systems; risks

associated with the ownership of our securities, including changes

in market-based factors; risks for United States and other

non-resident shareholders, including the ability to enforce civil

remedies, differing practices for reporting reserves and

production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control.

These and additional risk factors are discussed

in our Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2019, to be filed with Canadian securities regulatory

authorities and the U.S. Securities and Exchange Commission not

later than March 31, 2020 and in our other public filings

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on Baytex’s current and future operations and such

information may not be appropriate for other purposes.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Non-GAAP Financial and Capital

Management Measures

In this news release, we refer to certain

financial measures (such as adjusted funds flow, EBITDA,

exploration and development expenditures, free cash flow, net debt

and operating netback) which do not have any standardized meaning

prescribed by Canadian GAAP (“non-GAAP measures”) and are

considered non-GAAP measures. While adjusted funds flow, EBITDA,

exploration and development expenditures, free cash flow, net debt

and operating netback are commonly used in the oil and gas

industry, our determination of these measures may not be comparable

with calculations of similar measures for other issuers.

Adjusted funds flow is not a measurement based

on generally accepted accounting principles ("GAAP") in Canada, but

is a financial term commonly used in the oil and gas industry. We

define adjusted funds flow as cash flow from operating activities

adjusted for changes in non-cash operating working capital and

asset retirement obligations settled. Our determination of adjusted

funds flow may not be comparable to other issuers. We consider

adjusted funds flow a key measure that provides a more complete

understanding of operating performance and our ability to generate

funds for exploration and development expenditures, debt repayment,

settlement of our abandonment obligations and potential future

dividends. In addition, we use a ratio of net debt to adjusted

funds flow to manage our capital structure. We eliminate

settlements of abandonment obligations from cash flow from

operations as the amounts can be discretionary and may vary from

period to period depending on our capital programs and the maturity

of our operating areas. The settlement of abandonment obligations

are managed with our capital budgeting process which considers

available adjusted funds flow. Changes in non-cash working capital

are eliminated in the determination of adjusted funds flow as the

timing of collection, payment and incurrence is variable and by

excluding them from the calculation we are able to provide a more

meaningful measure of our cash flow on a continuing basis. For a

reconciliation of adjusted funds flow to cash flow from operating

activities, see Management's Discussion and Analysis of the

operating and financial results for the year ended December 31,

2019.

EBITDA is not a measurement based on GAAP in

Canada. EBITDA is defined as net income or loss adjusted for

financing and interest expenses, unrealized gains and losses on

financial derivatives, income tax, non-recurring losses, payments

on lease obligations, certain specific unrealized and non-cash

transactions (including depletion, exploration and evaluation

expenses, unrealized gains and losses on financial derivatives and

foreign exchange and share-based compensation).

Exploration and development expenditures is not

a measurement based on GAAP in Canada. We define exploration and

development expenditures as additions to exploration and evaluation

assets combined with additions to oil and gas properties. Our

definition of exploration and development expenditures may not be

comparable to other issuers. We use exploration and development

expenditures to measure and evaluate the performance of our capital

programs. The total amount of exploration and development

expenditures is managed as part of our budgeting process and can

vary from period to period depending on the availability of

adjusted funds flow and other sources of liquidity.

Free cash flow is not a measurement based on

GAAP in Canada. We define free cash flow as adjusted funds flow

less exploration and development expenditures (both non-GAAP

measures discussed above), payments on lease obligations, and asset

retirement obligations settled. Our determination of free cash flow

may not be comparable to other issuers. We use free cash flow to

evaluate funds available for debt repayment, common share

repurchases, potential future dividends and acquisition and

disposition opportunities.

Net debt is not a measurement based on GAAP in

Canada. We define net debt to be the sum of cash, trade and other

accounts receivable, trade and other accounts payable, and the

principal amount of both the long-term notes and the bank loan. Our

definition of net debt may not be comparable to other issuers. We

believe that this measure assists in providing a more complete

understanding of our cash liabilities and provides a key measure to

assess our liquidity. We use the principal amounts of the bank loan

and long-term notes outstanding in the calculation of net debt as

these amounts represent our ultimate repayment obligation at

maturity. The carrying amount of debt issue costs associated with

the bank loan and long-term notes is excluded on the basis that

these amounts have already been paid by Baytex at inception of the

contract and do not represent an additional source of capital or

repayment obligation.

Operating netback is not a measurement based on

GAAP in Canada, but is a financial term commonly used in the oil

and gas industry. Operating netback is equal to petroleum and

natural gas sales less blending expense, royalties, production and

operating expense and transportation expense divided by barrels of

oil equivalent sales volume for the applicable period. Our

determination of operating netback may not be comparable with the

calculation of similar measures for other entities. We

believe that this measure assists in characterizing our ability to

generate cash margin on a unit of production basis and is a key

measure used to evaluate our operating performance.

Advisory Regarding Oil and Gas Information

The reserves information contained in this press

release has been prepared in accordance with National Instrument

51-101 "Standards of Disclosure for Oil and Gas Activities" of the

Canadian Securities Administrators ("NI 51-101"). Complete NI

51-101 reserves disclosure will be included in our Annual

Information Form for the year ended December 31, 2019, which will

be filed on or before March 31, 2020. Listed below are

cautionary statements that are specifically required by NI

51-101:

- Where applicable, oil equivalent

amounts have been calculated using a conversion rate of six

thousand cubic feet of natural gas to one barrel of oil. BOEs

may be misleading, particularly if used in isolation. A boe

conversion ratio of six thousand cubic feet of natural gas to one

barrel of oil is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

- With respect to finding and

development costs, the aggregate of the exploration and development

costs incurred in the most recent financial year and the change

during that year in estimated future development costs generally

will not reflect total finding and development costs related to

reserves additions for that year.

References herein to average 30-day initial

production rates and other short-term production rates are useful

in confirming the presence of hydrocarbons, however, such rates are

not determinative of the rates at which such wells will commence

production and decline thereafter and are not indicative of long

term performance or of ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating aggregate production for us or the assets for which

such rates are provided. A pressure transient analysis or well-test

interpretation has not been carried out in respect of all wells.

Accordingly, we caution that the test results should be considered

to be preliminary.

Throughout this news release, “oil and NGL”

refers to heavy oil, bitumen, light and medium oil, tight oil,

condensate and natural gas liquids (“NGL”) product types as defined

by NI 51-101. The following table shows Baytex’s disaggregated

production volumes for the year ended December 31, 2019. The NI

51-101 product types are included as follows: “Heavy Oil” - heavy

oil and bitumen, “Light and Medium Oil” - light and medium oil,

tight oil and condensate, “NGL” - natural gas liquids and “Natural

Gas” - shale gas and conventional natural gas.

|

|

|

HeavyOil(bbl/d) |

|

LightandMediumOil(bbl/d) |

|

NGL(bbl/d) |

|

NaturalGas(Mcf/d) |

|

OilEquivalent(boe/d) |

|

Canada - Heavy |

|

|

|

|

|

|

|

|

|

|

|

Peace River |

|

14,334 |

|

14 |

|

45 |

|

14,503 |

|

16,810 |

|

Lloydminster |

|

12,407 |

|

— |

|

— |

|

964 |

|

12,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Canada - Light |

|

|

|

|

|

|

|

|

|

|

|

Viking |

|

— |

|

20,527 |

|

125 |

|

11,361 |

|

22,546 |

|

Duvernay |

|

— |

|

928 |

|

491 |

|

1,613 |

|

1,688 |

|

Remaining properties |

|

— |

|

889 |

|

703 |

|

20,528 |

|

5,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

|

|

|

|

|

|

|

|

|

|

Eagle Ford |

|

— |

|

21,229 |

|

8,865 |

|

53,773 |

|

39,055 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

26,741 |

|

43,587 |

|

10,229 |

|

102,742 |

|

97,680 |

Capital efficiency means the cost to drill,

complete, equip and tie-in a well divided by the initial production

rate of the well on a boe basis over its initial 365 days of

production.

Finding and development costs are calculated on

a per boe basis by dividing the aggregate of the change in future

development costs from the prior year for the particular reserve

category and the costs incurred on exploration and development

activities in the year by the change in reserves from the prior

year for the reserve category.

Recycle ratio means operating netback divided by

finding and development costs for the particular reserves

category.

This press release discloses drilling inventory.

Drilling inventory refers to Baytex’s total proved, probable and

unbooked locations. Proved locations and probable locations account

for drilling locations in our inventory that have associated proved

and/or probable reserves. Unbooked locations are internal estimates

based on our prospective acreage and an assumption as to the number

of wells that can be drilled per section based on industry practice

and internal review. Unbooked locations do not have attributed

reserves. Unbooked locations are farther away from existing wells

and, therefore, there is more uncertainty whether wells will be

drilled in such locations and if drilled there is more uncertainty

whether such wells will result in additional oil and gas reserves,

resources or production. In the Eagle Ford, Baytex’s net drilling

locations include 140 proved and 83 probable locations as at

December 31, 2019 and 52 unbooked locations. In the Viking,

Baytex’s net drilling locations include 1,080 proved and 319

probable locations as at December 31, 2019 and 636 unbooked

locations. In Peace River, Baytex’s net drilling locations include

77 proved and 75 probable locations as at December 31, 2019 and 100

unbooked locations. In Lloydminster, Baytex’s net drilling

locations include 178 proved and 63 probable locations as at

December 31, 2019 and 361 unbooked locations. In the Duvernay,

Baytex’s net drilling locations include 11 proved and 10 probable

locations as at December 31, 2019 and 295 unbooked locations.

Notice to United States Readers

The petroleum and natural gas reserves contained

in this press release have generally been prepared in accordance

with Canadian disclosure standards, which are not comparable in all

respects to United States or other foreign disclosure

standards. For example, the United States Securities and

Exchange Commission (the "SEC") requires oil and gas issuers, in

their filings with the SEC, to disclose only "proved reserves", but

permits the optional disclosure of "probable reserves" (each as

defined in SEC rules). Canadian securities laws require oil and gas

issuers disclose their reserves in accordance with NI 51-101, which

requires disclosure of not only "proved reserves" but also

"probable reserves". Additionally, NI 51-101 defines "proved

reserves" and "probable reserves" differently from the SEC rules.

Accordingly, proved and probable reserves disclosed in this press

release may not be comparable to United States standards. Probable

reserves are higher risk and are generally believed to be less

likely to be accurately estimated or recovered than proved

reserves.

In addition, under Canadian disclosure

requirements and industry practice, reserves and production are

reported using gross volumes, which are volumes prior to deduction

of royalty and similar payments. The SEC rules require reserves and

production to be presented using net volumes, after deduction of

applicable royalties and similar payments.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged in

the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 83% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex’s common shares trade on the Toronto Stock Exchange and the

New York Stock Exchange under the symbol BTE.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Vice President, Capital

Markets

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

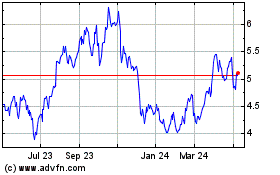

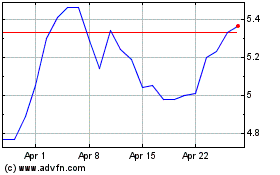

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Dec 2023 to Dec 2024