Bengal Energy Announces Closing of Purchase of Additional Interest in the Cuisinier Oil Field and Operational Update

December 18 2013 - 7:45PM

Marketwired Canada

Bengal Energy Ltd. (TSX:BNG) ("Bengal" or the "Company") is pleased to announce

the closing of the previously announced purchase of an additional 5.357% working

interest in the Cuisinier Oil Field and Petroleum Lease 303 ('PL303') (the

"Acquisition") in the Cooper-Eromanga Basin in Queensland, Australia and to

provide an operational update.

Closing of Acquisition

In addition to the incremental working interest acquired in Cuisinier, the

Acquisition also includes a further 8.08% interest in the Wompi Block (ATP 752),

resulting in working interests in those two projects of 30.357% and 38.08%,

respectively. With the increased working interest in Cuisinier, going forward

the Company will realize a greater proportion of production and a corresponding

impact on cash flows for periods subsequent to December 18, 2013. As a result,

Bengal estimates it will exit calendar 2013 with corporate net production

volumes between 500-550 boe/d, weighted over 90% to ultra-light crude oil which

commands a premium to Brent pricing and contributes to strong netbacks. This

exit production estimate reflects the increased working interest gained through

the Acquisition, production contributions from all 14 wells currently tied-in,

and incorporates production declines inherent with new production.

The effective date of the Acquisition is March 15, 2013, and the purchase price

of AUD $7.5 million / CAD $7.2 million remains subject to final closing

adjustments which are anticipated to be nominal. Bengal funded the acquisition

with proceeds from the CAD$8 million (gross) debt financing which closed July 5,

2013.

Operational Update

Bengal continues to advance its exploration and production projects in both

Australia and India.

Tookoonooka, Australia:

In Bengal's Tookoonooka permit (ATP 732), which is located in the emerging East

Flank oil fairway of the Cooper Basin, the Company's joint venture partner,

Beach Energy Ltd., commenced activity in December 2013. Under the terms of the

joint venture agreement, Beach will drill two wells and fund the acquisition of

an additional 300 km2 of 3D seismic up to a maximum commitment of AUD$11.5

million, in order to earn a 50% interest in the permit and assume operatorship.

On or about December 25, 2013, Beach intends to spud 'Tangalooma-1', the first

of its two fully funded wells in Tookoonooka. Tangalooma-1 is situated in close

proximity (2.1 km northeast) of Bengal's Caracal-1 well, a 52 degrees API light

oil discovery. The target for Tangalooma-1 is a deeper Hutton zone, which has

proven highly prolific in other regions within the East Flank of the Cooper

Basin, and is within 20 km of the Tangalooma-1 location. Based on this spud

date, and incorporating the impact of the holiday break, Bengal anticipates

having results from the well before the end of January 2014. Timing for drilling

of the second well in Tookoonooka will be dependent on the results from

Tangalooma-1, and Bengal will continue to provide updates as information comes

available.

On December 10, 2013, Beach commenced its seismic acquisition program ("The

Nassarius Survey") in the north portion of the permit, which is expected to

continue through the end of January, 2014. Following the acquisition and

processing of the Nassarius Survey, a comprehensive interpretation process will

be undertaken which is designed to identify future drilling locations.

"Bengal is very pleased to be working with one of the Cooper Basin's premier

operators, Beach Energy Ltd.," said Chayan Chakrabarty, President & CEO of

Bengal. "We believe that Beach's interest in funding the first two wells and

seismic acquisition demonstrates the great potential of our Tookoonooka asset."

Reg Nelson, President & CEO of Beach Energy Ltd. said, "Following our success in

the Western Flank of the Basin, Beach has been seeking an equivalent to that

region and believe we have found that opportunity with Tookoonooka in the

Eastern Flank. Our joint venture with Bengal enables Beach to apply its highly

successful Cooper Basin oil exploration and operational experience to further

unlock the potential of this underexplored area of the Basin."

Cuisinier, Australia:

At the end of November, the sixth and final well of the Company's 2013/2014

Cuisinier drilling campaign, Cuisinier-12, was successfully tied-in, bringing

the total gross number of wells on stream to 14.

Based on the results of the most recent drilling program in Cuisinier, Bengal

and its partners have developed a dynamic model of the field which incorporates

all production history and pressure data from the 14 producing wells, which will

directly contribute to an enhanced understanding of the reservoir and allow for

efficient exploitation of the field. The operator has indicated that the early

implementation of a pressure maintenance system would improve production and

ultimate recovery, and intends to initiate such a program during 2014, with

benefits expected by year-end.

Bengal plans to participate in an expanded 2014/2015 drilling program in

Cuisinier which includes 6 development wells, 2 appraisal wells and 1-2

contingent exploration wells located on new structures identified on 3-D

seismic. This program is scheduled to commence in second quarter of calendar

2014, and conclude in fourth quarter 2014. As a result, the impact of new

production volumes is expected in the latter half of calendar 2014.

Offshore AC/P47 Block, Australia:

In addition to its onshore assets in the Cooper Basin, Bengal holds a 100%

interest in an offshore exploration permit, AC/P 47, situated in the Timor Sea

off Australia's northwest coast. After extensive technical review internally and

externally by potential farm-in partners, the Company determined that this

permit is very high risk and does not contain sufficient technical merit to

justify further exploration capital expenditures. In February of 2013, the

Company lodged an application to relinquish this property and has now received

Notice of Cancellation of the permit from the Australian regulating authority

"NOPTA".

Onshore India

In Bengal's onshore India block situated within the Cauvery Basin, the Company

continues to coordinate with its partners to drill three exploration wells, the

first of which is scheduled to commence late in the first quarter of calendar

2014. All three locations are within an area of newly acquired 3D seismic and

are targeting formations between 1,200m and 2,000m depth, which are known oil

and gas producers in the offsetting Kovilkallappal and North Kovilkallappal

pools. These pools are situated between 6km and 10kms from Bengal's block, have

combined estimated recoverable reserves of more than 25 million boe according to

public sources, and are in an area with existing oil and gas infrastructure.

Continued activity in onshore India through the balance of calendar 2014 and

beyond will be dependent on the drilling results under the current planned work

program. Bengal has a 30% working interest in the block.

About Bengal

Bengal Energy Ltd. (TSX:BNG) is an international oil and gas exploration and

production company with producing and prospective light oil-weighted assets in

Australia and India. Bengal offers exposure to lower risk current production and

cash flow, combined with longer-term high potential impact exploration projects.

The Company's strategy is to achieve per share growth in cash flow, production

and reserves while establishing an attractive portfolio of future drilling and

exploration opportunities.

Additional information is available at www.bengalenergy.ca.

Forward-Looking Statements

This news release contains certain forward-looking statements or information

("forward-looking statements") as defined by applicable securities laws that

involve substantial known and unknown risks and uncertainties, many of which are

beyond Bengal's control. These statements relate to future events or our future

performance. All statements other than statements of historical fact may be

forward looking statements. The use of any of the words "plan", "expect",

"prospective", "project", "intend", "believe", "should", "anticipate",

"estimate", or other similar words or statements that certain events "may" or

"will" occur are intended to identify forward-looking statements. The

projections, estimates and beliefs contained in such forward looking statements

are based on management's estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to: the impact of economic

conditions in North America, Australia, India and globally; industry conditions;

changes in laws and regulations including, without limitation, the adoption of

new environmental laws and regulations and changes in how they are interpreted

and enforced; increased competition; the availability of qualified operating or

management personnel; fluctuations in commodity prices, foreign exchange or

interest rates; stock market volatility and fluctuations in market valuations of

companies with respect to announced transactions and the final valuations

thereof; and the ability to obtain required approvals and extensions from

regulatory authorities. We believe the expectations reflected in those

forward-looking statements are reasonable but, no assurances can be given that

any of the events anticipated by the forward-looking statements will transpire

or occur, or if any of them do so, what benefits that Bengal will derive from

them. As such, undue reliance should not be placed on forward-looking

statements.

Forward-looking statements contained herein include, but are not limited to,

statements regarding: Bengal's estimated oil production volumes after giving

effect to the organization of the additional interest in ATP 752; the

anticipated benefits of the Acquisition and anticipated year end production

increases as a result of the Acquisition; the anticipated closing adjustments in

respect of the Acquisition; the Company's expected drilling program in Cuisinier

for 2014/2015, as well as the expected timing for commencement and conclusion of

such drilling program; additional production volumes from Cuisinier as a result

of the 2014/2015 drilling programs; a proposed pressure maintenance system;

Beach's ongoing seismic acquisition program; Beach's intentions to spud

Tangalooma-1 and Bengal's anticipated announcement of results of such well; and

Bengal's proposed exploration wells onshore India. The forward looking

statements contained herein are subject to numerous known and unknown risks and

uncertainties that may cause Bengal's actual financial results, performance or

achievement in future periods to differ materially from those expressed in, or

implied by, these forward-looking statements, including but not limited to,

risks associated with: the failure to obtain required safety assessments and rig

acceptance; failure to secure required equipment and personnel; changes in

general global economic conditions including, without limitations, the economic

conditions in North America, Australia, India; increased competition; the

availability of qualified operating or management personnel; fluctuations in

commodity prices, foreign exchange or interest rates; changes in laws and

regulations including, without limitation, the adoption of new environmental and

tax laws and regulations and changes in how they are interpreted and enforced;

the results of exploration and development drilling and related activities; the

results of seismic activities and related operations; changes in anticipated

operating and transportation costs; changes in pipeline accessibility; the

ability to access sufficient capital from internal and external sources; failure

to obtain or delays in obtaining regulatory approvals; and stock market

volatility.

Readers are encouraged to review the material risks discussed in Bengal's Annual

Information Form for the year ended March 31, 2013 under the heading "Risk

Factors" and in Bengal's annual MD&A under the heading "Risk Factors". The

Company cautions that the foregoing list of assumptions, risks and uncertainties

is not exhaustive. The forward-looking statements contained in this news release

speak only as of the date hereof and Bengal does not assume any obligation to

publicly update or revise them to reflect new events or circumstances, except as

may be require pursuant to applicable securities laws.

Netbacks

Netback is a non-IFRS measure. Netback per bbl is calculated by dividing the

revenue less royalties, operating and transportation costs in total for the

Company by the total production of the Company measured in boe.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bengal Energy Ltd.

Chayan Chakrabarty

President & Chief Executive Officer

(403) 205-2526

Bengal Energy Ltd.

Jerrad Blanchard

Chief Financial Officer

(403) 205-2526

investor.relations@bengalenergy.ca

www.bengalenergy.ca

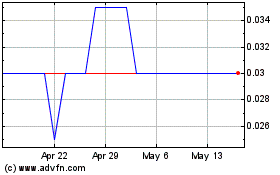

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Jun 2024 to Jul 2024

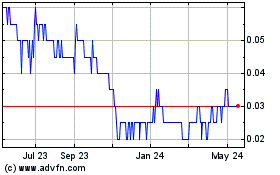

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Jul 2023 to Jul 2024