Bonterra Energy Corp. (Bonterra) (www.bonterraenergy.com) (TSX:BNE) reports the

results of the independent reserve report prepared by Sproule Associates Limited

with an effective date of December 31, 2012 for Spartan Oil Corp.; provides a

pro forma reserves summary; updates its 2013 operating cost guidance; and

corrects its finding, development and acquisition costs excluding future

development costs for 2012.

Highlights

-- Proved plus Probable (P+P) reserves on a pro forma basis of 70.5 million

BOE with approximately 78 percent oil and liquids.

-- Approximately 74 percent of total reserves are classified as proved

reserves with 26 percent classified as probable reserves.

Corporate Reserves Information (Spartan Oil Corp. Only)

Spartan Oil Corp. (Spartan) engaged the services of Sproule Associates Limited

to prepare a reserve evaluation with an effective date of December 31, 2012. The

gross reserve figures from the following tables represent Spartan's ownership

interest before royalties and before consideration of the company's royalty

interests at December 31, 2012. Tables may not add due to rounding.

Summary of Gross Oil and Gas Reserves as of December 31, 2012

Light and Natural Natural Gas

Medium Oil Gas Liquids BOE(1)

Reserve Category: (Mbbl) (MMcf) (Mbbl) (MBOE)

----------------------------------------------------------------------------

PROVED

Developed Producing 6,019.8 9,762 462.8 8,109.6

Developed Non-Producing 600.2 685 37.9 752.3

Undeveloped 8,115.4 10,005 533.2 10,316.1

----------------------------------------------------------------------------

TOTAL PROVED 14,735.4 20,452 1,033.9 19,177.9

PROBABLE 4,941.0 6,411 317.9 6,327.4

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 19,676.4 26,863 1,351.7 25,505.3

----------------------------------------------------------------------------

Reconciliation of Company Gross Reserves by Principal Product Type as of

December 31, 2012

Light and Medium Oil and

Natural Gas Liquids Natural Gas

----------------------------------------------------------------------------

Proved plus Proved plus

Proved Probable Proved Probable

(Mbbl) (Mbbl) (Mmcf) (Mmcf)

----------------------------------------------------------------------------

December 31, 2011 12,838.2 18,639.4 11,822 16,750

Extension 966.2 1,628.3 740 1,214

Infill Drilling 690.0 1,110.3 390 793

Improved Recovery - - - -

Technical Revisions 2,027.0 380.1 8,515 9,109

Discoveries - - - -

Acquisitions 77.2 98.1 40 51

Dispositions - - - -

Economic factors 0.2 1.4 (1) -

Production (829.5) (829.8) (1,054) (1,054)

----------------------------------------------------------------------------

December 31, 2012 15,769.3 21,028.1 20,452 26,863

----------------------------------------------------------------------------

BOE(1)

--------------------------------------------------

Proved Plus

Proved Probable

(MBOE) (MBOE)

--------------------------------------------------

December 31, 2011 14,808.5 21,431.1

Extension 1,089.5 1,830.6

Infill Drilling 755.0 1,242.5

Improved Recovery - -

Technical Revisions 3,446.2 1,898.3

Discoveries - -

Acquisitions 83.9 106.6

Dispositions - -

Economic factors - 1.4

Production (1,005.2) (1,005.5)

--------------------------------------------------

December 31, 2012 19,177.9 25,505.3

--------------------------------------------------

Summary of Net Present Values of Future Net Revenue as of December 31, 2012

Net Present Value Before Income

Taxes

Discounted at (% per Year)

($ Millions) 0% 5% 10%

----------------------------------------------------------------------------

Reserve Category:

----------------------------------------------------------------------------

PROVED

Developed Producing 428,694 296,926 228,451

Developed Non-Producing 42,920 29,235 22,314

Undeveloped 437,088 236,173 138,422

----------------------------------------------------------------------------

TOTAL PROVED 908,702 562,333 389,187

PROBABLE 387,226 149,581 73,082

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 1,295,929 711,914 462,269

----------------------------------------------------------------------------

Pro Forma Reserves (Bonterra and Spartan)

Summary of Gross Oil and Gas Reserves as of December 31, 2012

Light and Natural Natural Gas

Medium Oil Gas Liquids BOE(1)

Reserve Category: (Mbbl) (MMcf) (Mbbl) (MBOE)

----------------------------------------------------------------------------

PROVED

Developed Producing 20,435.5 42,799 1,828.5 29,397.2

Developed Non-Producing 966.5 3,314 89.7 1,608.6

Undeveloped 16,267.0 23,597 1,106.7 21,306.5

----------------------------------------------------------------------------

TOTAL PROVED 37,669.0 69,710 3,024.9 52,312.2

PROBABLE 12,954.1 25,374 1,041.9 18,225.0

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 50,623.1 95,084 4,066.7 70,537.2

----------------------------------------------------------------------------

Summary of Net Present Values of Future Net Revenue as of December 31, 2012

Net Present Value Before

Income Taxes

Discounted at (% per

Year)

($ Millions) 0% 5% 10%

----------------------------------------------------------------------------

Reserve Category:

----------------------------------------------------------------------------

PROVED

Developed Producing 1,270,577 839,852 634,987

Developed Non-Producing 69,742 45,731 33,802

Undeveloped 830,149 427,672 234,625

----------------------------------------------------------------------------

TOTAL PROVED 2,170,468 1,313,254 903,414

PROBABLE 1,001,822 385,562 191,763

----------------------------------------------------------------------------

TOTAL PROVED PLUS PROBABLE 3,172,291 1,698,816 1,095,178

----------------------------------------------------------------------------

Update: Bonterra 2013 Operating Cost Guidance

Bonterra closed the acquisition of Spartan in January, 2013 and announced

guidance based on the combined entity on February 5, 2013. The guidance reported

included operating costs expected to average approximately $15.00 per BOE on an

annualized basis. However, this only included Bonterra operating costs. On a

consolidated basis of Bonterra and Spartan, the operating costs for the combined

entity are expected to average $12.45 per BOE for the period commencing from the

acquisition date of January 25, 2013 to December 31, 2013.

Correction: Finding, Development and Acquisition (FD&A) Costs

The Company has historically been active in its capital development program.

Over three years, Bonterra has incurred the following FD&A (3) costs excluding

Future Development Costs:

2012

FD&A 2011 FD&A 2010 FD&A

Costs per Costs per Costs per Three Year

BOE(1)(2)(3) BOE(1)(2)(3) BOE(1)(2)(3) Average(4)

----------------------------------------------------------------------------

Proved Reserve Net

Additions $ 13.64 $ 33.22 $ 13.89 $ 16.22

Proved plus Probable

Reserve Net

Additions $ 16.05 $ 15.38 $ 13.02 $ 14.79

----------------------------------------------------------------------------

(1) Barrels of Oil Equivalent may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 MCF: 1 bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead.

(2) The aggregate of the exploration and development costs incurred in the most

recent financial year and the change during that year in estimated future

development costs generally will not reflect total finding and development costs

related to reserve additions for that year.

(3) FD&A costs are net of proceeds of disposal and the FD&A costs per BOE are

based on reserves acquired net of reserves disposed of.

(4) Three year average is calculated using three year total capital costs and

reserve additions on both a Proved and Proved plus Probable basis

Certain financial and operating information, such as finding and development

costs and net asset values, included in this press release for the year ended

December 31, 2012 are based on estimated unaudited financial results for the

year and are subject to the same limitations as discussed under Forward Looking

Statements set out below. These estimated amounts may change upon the completion

of audited financial statements for the year ended December 31, 2012 and changes

could be material. All reserve numbers provided above are Spartan's interest

before royalties.

It should not be assumed that the estimates of future net revenue presented in

the above tables represent the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be attained and

variances could be material. Estimates of reserves and future net revenues for

individual properties may not reflect the same confidence level as estimates of

reserves and future net revenues for all properties due to the effects of

aggregation.

Caution Regarding Engineering Terms:

Disclosure provided herein in respect of barrels of oil equivalent (BOE) may be

misleading, particularly if used in isolation. In accordance with NI 51-101, a

BOE conversion ratio of 6 MCF to 1 barrel has been used in all cases in this

disclosure. This BOE conversion ratio is based on an energy equivalency

conversion method primarily available at the burner tip and does not represent a

value equivalency at the wellhead.

Caution Regarding Forward Looking Information:

Certain information set forth in this press release, including management's

assessment of Bonterra's future plans and operations, contains forward-looking

statements. By their nature, forward-looking statements are subject to numerous

risks and uncertainties, some of which are beyond Bonterra's control, including

the impact of general economic conditions, industry conditions, volatility of

commodity prices, currency fluctuations, imprecision of reserve estimates,

environmental risks, competition from other industry participants, the lack of

availability of qualified personnel or management, stock market volatility and

ability to access sufficient capital from internal and external sources. Readers

are cautioned that the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on forward-looking

statements. Bonterra's actual results, performance or achievement could differ

materially from those expressed in, or implied by these forward-looking

statements, and, accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or occur, or if any

of them do so, what benefits that Bonterra will derive therefrom. Bonterra

disclaims any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Bonterra Energy Corp.

George F. Fink

Chairman and CEO

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Robb M. Thompson

CFO and Secretary

(403) 262-5307

(403) 265-7488 (FAX)

Bonterra Energy Corp.

Kirsten Lankester

Manager, Investor Relations

(403) 262-5307

(403) 265-7488 (FAX)

info@bonterraenergy.com

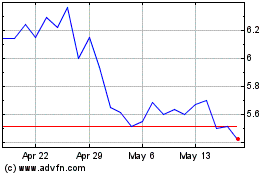

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

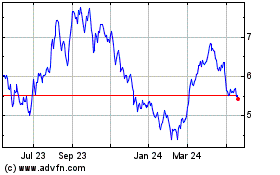

Bonterra Energy (TSX:BNE)

Historical Stock Chart

From Jul 2023 to Jul 2024