Canadian Banc Recovery Corp.: Regular Monthly Dividend Declaration for Class A and Preferred Share

July 20 2009 - 9:00AM

Marketwired Canada

Canadian Banc Recovery Corp (formerly Prime Rate Plus Corp) ("The Company")

declares its regular monthly distribution of $0.06250 (5.00% annualized) for

each Class A share which reflects the distribution policy of prime rate in

Canada (2.25% as at July 15, 2009) plus 2% annually. The Company also declares

its regular monthly distribution of $0.04167 (5.00% annualized) for each

Preferred share which reflects the distribution policy of prime rate plus 0.75%

annually. An annual Class A and Preferred share payment of 5.00% is the minimum

payment as per the prospectus and the rate will not decline below this level.

Distributions are payable August 10, 2009 to shareholders on record as of July

31, 2009.

Since inception Class A shareholders have received a total of $3.99 per share

and Preferred shareholders have received a total of $2.44 per share inclusive of

this distribution, for a combined total of $6.43 per share.

The Company invests in a portfolio of six publicly traded Canadian Banks as

follows: Bank of Montreal, Canadian Imperial Bank of Commerce, National Bank of

Canada, Royal Bank of Canada, Bank of Nova Scotia, Toronto- Dominion Bank.

Shares held within the portfolio are expected to range between 5-20% in weight

but may vary at any time. To generate additional returns above the dividend

income earned on the portfolio, Prime Plus will engage in a selective covered

call writing program.

Distribution Details:

Class A Share (BK) $0.06250

Preferred Share (BK.PR.A) $0.04167

Ex-Dividend Date: July 29, 2009

Record Date: July 31, 2009

Payable Date: August 10, 2009

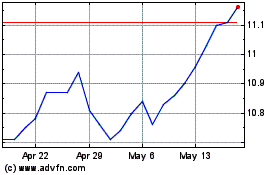

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jun 2024 to Jul 2024

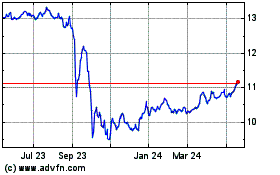

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jul 2023 to Jul 2024