Axis Auto Announces Intention to Make Normal Course Issuer Bid

November 24 2022 - 9:35AM

Business Wire

Axis Auto Finance Inc. (“Axis” or the “Company”)

(TSX: AXIS), a rapidly growing financial technology company

changing the way Canadians purchase and finance used vehicles,

announced today that the Toronto Stock Exchange (the “TSX”)

has accepted a notice filed by Axis of its intention to make a

Normal Course Issuer Bid (the “Bid”) for up to 6,105,497 of

its issued and outstanding common shares (the “Shares”). The

Bid will be conducted through Canaccord Genuity Corp., a member of

the TSX, and made in accordance with the policies of the TSX.

Purchases of Shares under the Bid may commence on November 26,

2022 and will terminate on November 25, 2023, or on such earlier

date as the Bid is complete. Purchases of Shares will be made

through the facilities of the TSX or alternative Canadian trading

systems in accordance with its rules.

The average daily trading volume of the Shares for the previous

six calendar months ("ADTV") ending October 31, 2022 was

6,432 Shares. On any trading day, purchases under the Bid will not

exceed 1,608 Shares. The price that the Company will pay for any

Shares purchased under the Bid will be the prevailing market price

at the time of purchase. Any Shares purchased by the Company will

be cancelled.

As of November 18, 2022, there were 122,109,949 Shares issued

and outstanding. The 6,105,497 Shares that may be repurchased under

the Bid represent approximately 5% of the issued and outstanding

Shares (as determined in accordance with the policies of the TSX)

on November 18, 2022.

Axis believes that its Shares have been trading in a price range

which does not adequately reflect the value of such shares in

relation to the business of Axis and its future business prospects.

As a result, depending upon future price movements and other

factors, Axis believes that its outstanding Shares may represent an

attractive investment to Axis. Furthermore, the purchases are

expected to benefit all persons who continue to hold Shares by

increasing their equity interest in Axis.

Pursuant to a previous notice of intention to conduct a normal

course issuer bid, under which the Company received approval from

the TSX Venture Exchange (the "TSXV") to purchase up to

6,907,562 Shares for the period from November 26, 2021 to November

25, 2022, to date, the Company has purchased an aggregate of

6,670,000 Shares on open market transactions through the facilities

of the TSXV, the TSX and alternative trading systems at a volume

weighted average purchase price of $0.61.

About Axis Auto Finance

Axis is a financial technology company changing the way

Canadians buy and finance used vehicles. Through our

direct-to-consumer portal, DriveAxis.ca, customers can choose their

next used vehicle, arrange financing, and get the car delivered to

their home. In addition, the company continues to grow B2B

non-prime auto loan originations by delivering innovative

technology solutions and superior service to its Dealer Partner

Network. All Axis auto loans report to Equifax, resulting in over

70% of customers seeing a significant improvement of their credit

scores. Further information on the Company can be found at

https://www.axisfinancegroup.com/investors-press-releases/.

The TSX Exchange has neither approved nor disapproved the

contents of this press release. Neither the Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the Exchange) accepts responsibility for the adequacy

or accuracy of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221124005237/en/

Axis Auto Finance Inc. Todd Hudson CEO (416) 633-5626

ir@axisautofinance.com

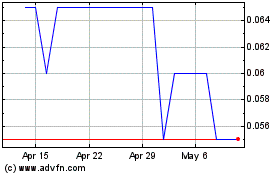

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Dec 2023 to Dec 2024