Amerigo Resources Ltd. (TSX: ARG; ARREF: OTC)

(“Amerigo” or the “Company”) is pleased to announce its Board of

Directors (the “Board”) has reached a decision to reinstate the

declaration and payment of dividends, on a quarterly basis

commencing in the fourth quarter of 2021. The Company also

intends to commence a substantial issuer bid (the “Offer”) to

purchase for cancellation from Amerigo shareholders who choose to

participate up to Cdn$25,000,000 in value of its common shares in

the authorized share structure of the Company (the “Common

Shares”).

“Today’s announcements reflect Amerigo’s strong

operating and financial results and confidence in our outlook. We

have a strong balance sheet, and the financial flexibility to pay

quarterly dividends to shareholders commencing this year,” said

Aurora Davidson, Amerigo’s President and CEO. “The issuer bid will

also allow us to enact an orderly retirement of up to Cdn$25

million in the capital of Amerigo.”

The Offer is being made by way of a “modified

Dutch auction”, which will allow holders who choose to participate

in the Offer to individually select the price, within a price range

of not less than Cdn$1.18 and not more than Cdn$1.30 per Common

Share (in increments of Cdn$0.02 per Common Share), at which they

will tender their Common Shares to the Offer. Upon expiry of the

Offer, the Company will determine the lowest purchase price (the

“Purchase Price”) (which will not be less than Cdn$1.18 and not

more than Cdn$1.30 per Common Share) based on all tenders validly

deposited and not properly withdrawn pursuant to the Offer that

will allow it to purchase the maximum number of Common Shares

tendered to the Offer, having an aggregate purchase price not

exceeding Cdn$25,000,000.

Amerigo anticipates that the Offer will commence

on September 29, 2021, and expire on November 12, 2021, at 5 pm

Eastern Standard Time. The Board believes that the purchase of

Common Shares under the Offer represents an attractive investment

opportunity for Amerigo.

“Commencing in the fourth quarter of 2021, it is

the intention of the Board of Directors of Amerigo to declare and

pay quarterly dividends to our shareholders,” added Ms. Davidson.

“The Board continues to evaluate all options, including additional

share buybacks, to return capital to shareholders in a prudent

manner.”

The declaration of dividends will remain at the

discretion of the Board and will depend upon the financial results

of Amerigo and other factors of relevance determined by the Board

and will be subject to the maintenance of appropriate levels of

working capital.

Additional Details of the

Offer

If the Purchase Price is determined to be

Cdn$1.18 per Common Share (which is the minimum Purchase Price

under the Offer), the maximum number of Common Shares that may be

purchased by the Company under the Offer is 21,186,441 Common

Shares, which represents approximately 11.6% of the Common Shares

issued and outstanding as at September 27, 2021. If the Purchase

Price is determined to be Cdn$1.30 per Common Share (which is the

maximum Purchase Price under the Offer), the maximum number of

Common Shares that may be purchased by the Company under the Offer

is 19,230,769 Common Shares, which represents approximately 10.6%

of the Common Shares issued and outstanding as at September 27,

2021.

If Common Shares with an aggregate purchase

price of more than Cdn$25,000,000 are properly tendered and not

properly withdrawn, the Company will purchase the Common Shares on

a pro rata basis after giving effect to "odd lot" tenders (of

holders beneficially owning fewer than 100 Common Shares), which

will not be subject to pro-ration. In that case, all Common Shares

tendered at or below the finally determined Purchase Price will be

purchased, subject to pro-ration, at the same Purchase Price

determined pursuant to the terms of the Offer. Common Shares that

are not purchased, including all Common Shares tendered pursuant to

auction tenders at prices above the Purchase Price, will be

returned to shareholders.

The Offer and all deposits of Common Shares will

be subject to the terms and conditions set forth in an offer to

purchase, an accompanying issuer bid circular and a related letter

of transmittal and notice of guaranteed delivery (all such

documents, as amended or supplemented from time to time,

collectively constitute and are herein referred to as, the

“Offer Documents”). Further details of the Offer,

including the terms and conditions thereof and instructions for

tendering Common Shares, will be included in the Offer Documents.

The Company anticipates that the Offer Documents will be mailed to

shareholders, filed with the applicable Canadian securities

regulatory authorities and made available without charge on SEDAR

at www.sedar.com in accordance with applicable securities laws, as

well as being posted on the Company’s website at

www.amerigoresources.com, within the next week.

As at September 27, 2021, the Company had

181,961,078 Common Shares issued and outstanding. The Common Shares

are listed and posted for trading on the Toronto Stock Exchange

(the “TSX”) under the symbol “ARG”. On September

27, 2021, the last full trading day prior to the day the terms of

the Offer were publicly announced, the closing price of the Common

Shares on the TSX was Cdn$1.24.

Amerigo expects to fund any purchases of Common

Shares under the Offer using the Company’s available cash on hand.

All Common Shares purchased by the Company under the Offer will be

cancelled.

The Offer is not conditional upon any minimum

number of Common Shares being deposited. However, the Offer will be

subject to certain conditions that are customary for transactions

of this nature, all of which will be disclosed in the Offer

Documents.

Amerigo has retained Gowling WLG (Canada) LLP

(“Gowling WLG”) to act as legal counsel and

appointed Computershare Investor Services Inc. (the

“Depositary”) to act as depositary for the Offer.

Any questions or requests for information or assistance regarding

the Offer may be directed to the Depositary at the contact details

set out in the Offer Documents.

This news release is for informational

purposes only and does not constitute an offer to buy or the

solicitation of an offer to sell any Common Shares. The

solicitation and the offer to buy Common Shares will only be made

pursuant to the Offer Documents filed with the Canadian securities

regulatory authorities. The Offer will not be made to, nor will

deposits be accepted from or on behalf of, shareholders in any

jurisdiction in which the making or acceptance of the Offer would

not be in compliance with the laws of any such jurisdiction.

However, Amerigo may, in its sole discretion, take such action as

it may deem necessary to make the Offer in any such jurisdiction

and to extend the Offer to shareholders in any such

jurisdiction.

The Board has authorized and approved

the Offer. However, none of Amerigo, the Board, Gowling WLG or the

Depositary makes any recommendation to any shareholder as to

whether to deposit or refrain from depositing any or all of such

shareholder’s Common Shares pursuant to the Offer or as to the

purchase price or purchase prices at which shareholders may deposit

Common Shares to the Offer. Shareholders are strongly urged to

carefully review and evaluate all information provided in the Offer

Documents, to consult with their own financial, legal, investment,

tax and other professional advisors and to make their own decisions

as to whether to deposit Common Shares under the Offer and, if so,

how many Common Shares to deposit and the price or prices at which

to deposit.

About Amerigo

Amerigo Resources Ltd. is an innovative copper

producer with a long-term relationship with Corporación Nacional

del Cobre de Chile (“Codelco”), the world’s largest copper

producer.

Amerigo produces copper concentrate and

molybdenum concentrate as a by-product at the MVC operation in

Chile by processing fresh and historic tailings from Codelco’s El

Teniente mine, the world's largest underground copper mine. Tel:

(604) 681-2802; Fax: (604) 682-2802; Web: www.amerigoresources.com;

Listing: ARG: TSX.

For further information, please contact:

| Aurora Davidson |

Graham Farrell |

| President and CEO |

Investor Relations |

| (604) 697 6207 |

(416) 842-9003 |

| ad@amerigoresources.com |

Graham.Farrell@HarborAccessLLC.com |

| |

|

Forward-Looking Information

Forward-looking information

(“forward-looking statements”) is included in this

news release. These forward-looking statements are identified by

the use of terms such as “anticipate”, “believe”, “could”,

“estimate”, “expect”, “intend”, “may”, “plan”, “predict”,

“project”, “will”, “would”, and “should” and similar terms and

phrases, including references to assumptions. Such statements may

involve but are not limited to, Amerigo’s plans, objectives,

expectations and intentions, including Amerigo’s objectives and

expectations regarding the Offer and the size, timing and terms and

conditions of the Offer, the anticipated mailing date of the Offer

Documents and commencement date of the Offer, the expectation that

the Company will reinstate the declaration and payment of dividends

in the fourth quarter of 2021, and other comments with respect to

strategies, expectations, planned operations or future actions.

These forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such statements. Inherent in forward-looking

statements are risks and uncertainties beyond Amerigo’s ability to

predict or control, including risks that may affect Amerigo’s

operating or capital plans; risks generally encountered in the

permitting and development of mineral projects such as unusual or

unexpected geological formations, negotiations with government and

other third parties, unanticipated metallurgical difficulties,

delays associated with permits, approvals and permit appeals,

ground control problems, adverse weather conditions, process upsets

and equipment malfunctions; risks associated with labour

disturbances and availability of skilled labour and management;

risks related to the potential impact of global or national health

concerns, including COVID-19, and the inability of employees to

access sufficient healthcare; government or regulatory actions or

inactions; fluctuations in the market prices of Amerigo’s principal

commodities, which are cyclical and subject to substantial price

fluctuations; risks created through competition for mining projects

and properties; risks associated with lack of access to markets;

risks associated with availability of and Amerigo’s ability to

obtain both tailings from Codelco’s Division El Teniente’s current

production and historic tailings from tailings deposits; risks with

respect to the ability of Amerigo to draw down funds from lines of

credit and the availability of and ability of Amerigo to obtain

adequate funding on reasonable terms for expansions and

acquisitions; mine plan estimates; risks posed by fluctuations in

exchange rates and interest rates, as well as general economic

conditions; risks associated with environmental compliance and

changes in environmental legislation and regulation; risks

associated with Amerigo’s dependence on third parties for the

provision of critical services; risks associated with

non-performance by contractual counterparties; title risks; social

and political risks associated with operations in foreign

countries; risks of changes in laws affecting Amerigo’s operations

or their interpretation, including foreign exchange controls; and

risks associated with tax reassessments and legal proceedings.

Notwithstanding the efforts of Amerigo and MVC, there can be no

guarantee that Amerigo’s or MVC’s staff will not contract COVID-19

or that Amerigo’s and MVC’s measures to protect staff from COVID-19

will be effective. Many of these risks and uncertainties apply not

only to Amerigo and its operations, but also to Codelco and its

operations. Codelco’s ongoing mining operations provide a

significant portion of the materials Amerigo processes and its

resulting metals production, therefore these risks and

uncertainties may also affect their operations and in turn have a

material effect on Amerigo.

Actual results and developments are likely to

differ, and may differ materially, from those expressed or implied

by the forward-looking statements contained in this news release.

Such statements are based on several assumptions which may prove to

be incorrect, including, but not limited to, assumptions about:

- general business and economic

conditions;

- interest rates;

- changes in commodity and power

prices;

- acts of foreign governments and the

outcome of legal proceedings;

- the supply and demand for,

deliveries of, and the level and volatility of prices of copper and

other commodities and products used in Amerigo’s operations;

- the ongoing supply of material for

processing from Codelco’s current mining operations;

- the ability of Amerigo to

profitably extract and process material from the Cauquenes tailings

deposit;

- the timing of the receipt of and

retention of permits and other regulatory and governmental

approvals;

- Amerigo’s costs of production and

its production and productivity levels, as well as those of

Amerigo’s competitors;

- changes in credit market conditions

and conditions in financial markets generally;

- Amerigo’s ability to procure

equipment and operating supplies in sufficient quantities and on a

timely basis;

- the availability of qualified

employees and contractors for Amerigo’s operations;

- Amerigo’s ability to attract and

retain skilled staff;

- the satisfactory negotiation of

collective agreements with unionized employees;

- the impact of changes in foreign

exchange rates and capital repatriation on Amerigo’s costs and

results;

- costs of closure of various

operations;

- market competition;

- tax benefits and tax rates;

- the outcome of Amerigo’s copper

concentrate sales and treatment and refining charge

negotiations;

- the resolution of environmental and

other proceedings or disputes;

- the future supply of reasonably

priced power;

- rainfall in the vicinity of MVC

continuing to trend towards normal levels;

- average recoveries for fresh

tailings and Cauquenes tailings;

- Amerigo’s ability to obtain, comply

with and renew permits and licenses in a timely manner; and

- Amerigo’s ongoing relations with

its employees and entities with which it does business.

Future production levels and cost estimates

assume there are no adverse mining or other events which

significantly affect budgeted production levels. Although Amerigo

believes that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond Amerigo’s control, Amerigo cannot assure

that it will achieve or accomplish the expectations, beliefs or

projections described in the forward-looking statements.

Amerigo cautions you that the foregoing list of

important factors and assumptions is not exhaustive. Other events

or circumstances could cause Amerigo’s actual results to differ

materially from those estimated or projected and expressed in, or

implied by, its forward-looking statements. You should also

carefully consider the matters discussed under Risk Factors in

Amerigo’s Annual Information Form. The forward-looking statements

contained herein speak only as of the date of this news release and

except as required by law, Amerigo undertakes no obligation to

update publicly or otherwise revise any forward-looking statements

or the foregoing list of factors, whether as a result of new

information or future events or otherwise.

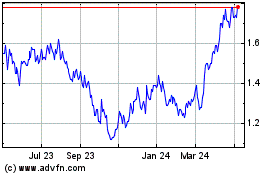

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Dec 2024 to Jan 2025

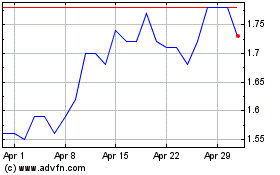

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Jan 2024 to Jan 2025