Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") today announced results for its third quarter ended

September 30, 2022. “Allied’s third-quarter operations were

encouraging, especially in the context of growing macro-economic

uncertainty,” said Michael Emory, President & CEO. “Average

in-place net rent per occupied square foot in our rental portfolio

rose to $25.56, up 3.8% from the comparable quarter last year and

1.1% from the second quarter. For us, this is a key operating

metric with respect to the productive capacity of our rental

portfolio and bodes well for our future.”

Financial Results

Allied’s third-quarter financial results were

in-line with its internal forecast and with external expectations.

FFO per unit was 60.6 cents, down 2.9% from the comparable quarter

last year and identical to the second quarter. AFFO per unit was

52.6 cents, up 1.3% from the comparable quarter last year and down

3.1% from the second quarter. NAV per unit at quarter-end was

$51.10, down slightly from the end of the second quarter due to a

decline in value in Allied’s Calgary portfolio. The financial

results are summarized below:

| |

As at September 30 |

| (In

thousands except for per unit and % amounts) |

|

2022 |

|

|

2021 |

|

Change |

% Change |

|

Investment properties (1)(4) |

$ |

10,775,019 |

|

$ |

9,210,666 |

|

$ |

1,564,353 |

|

17.0 |

% |

| Unencumbered

investment properties (2) |

$ |

9,498,180 |

|

$ |

8,738,850 |

|

$ |

759,330 |

|

8.7 |

% |

| Total Assets

(1)(4) |

$ |

11,680,033 |

|

$ |

10,086,673 |

|

$ |

1,593,360 |

|

15.8 |

% |

| Cost of PUD as a % of

GBV (2) |

|

12.1% |

|

|

10.8% |

|

|

1.3% |

|

— |

|

| NAV per unit

(6) |

$ |

51.10 |

|

$ |

49.50 |

|

$ |

1.60 |

|

3.2 |

% |

| Debt

(1) |

$ |

3,985,742 |

|

$ |

3,286,518 |

|

$ |

699,224 |

|

21.3 |

% |

| Total indebtedness

ratio (2) |

|

34.3% |

|

|

32.9% |

|

|

1.4% |

|

— |

|

| Annualized Adjusted

EBITDA (2) |

$ |

414,664 |

|

$ |

375,764 |

|

$ |

38,900 |

|

10.4 |

% |

| Net debt as a multiple

of Annualized Adjusted EBITDA (2) |

9.6x |

|

8.6x |

|

1.0x |

|

— |

|

|

Interest-coverage ratio including capitalized interest and

excluding financing prepayment costs

(2)(3) |

2.9x |

|

3.4x |

|

(0.5x) |

|

— |

|

| |

|

|

|

|

| |

For the three months ended September 30 |

| (In

thousands except for per unit and % amounts) |

|

2022 |

|

|

2021 |

|

Change |

% Change |

|

Rental Revenue (1)(4) |

$ |

157,166 |

|

$ |

142,654 |

|

$ |

14,512 |

|

10.2 |

% |

| Net income

(1) |

$ |

46,743 |

|

$ |

107,185 |

|

$ |

(60,442) |

|

(56.4 |

%) |

| Net income excluding

fair value adjustments, financing prepayment costs and

impairment (2)(3)(5) |

$ |

65,581 |

|

$ |

68,071 |

|

$ |

(2,490) |

|

(3.7 |

%) |

| Adjusted

EBITDA (2) |

$ |

103,666 |

|

$ |

93,941 |

|

$ |

9,725 |

|

10.4 |

% |

| Same asset NOI -

rental portfolio (2) |

$ |

84,373 |

|

$ |

84,895 |

|

$ |

(522) |

|

(0.6 |

%) |

| Same asset NOI - total

portfolio (2) |

$ |

85,639 |

|

$ |

87,071 |

|

$ |

(1,432) |

|

(1.6 |

%) |

| FFO

(2) |

$ |

85,332 |

|

$ |

41,690 |

|

$ |

43,642 |

|

104.7 |

% |

| FFO per unit

(2) |

$ |

0.611 |

|

$ |

0.327 |

|

$ |

0.284 |

|

86.9 |

% |

| FFO pay-out

ratio (2) |

|

71.6% |

|

|

129.8% |

|

|

(58.2)% |

|

— |

|

| All amounts below are

excluding condominium related items, financing prepayment costs and

the mark-to-market adjustment on unit-based compensation

(2)(3) |

|

|

|

|

|

FFO |

$ |

84,747 |

|

$ |

79,537 |

|

$ |

5,210 |

|

6.6 |

% |

|

FFO per unit (diluted) |

$ |

0.606 |

|

$ |

0.624 |

|

$ |

(0.018) |

|

(2.9 |

%) |

|

FFO pay-out ratio |

|

72.1% |

|

|

68.0% |

|

|

4.1% |

|

— |

|

|

AFFO |

$ |

73,508 |

|

$ |

66,132 |

|

$ |

7,376 |

|

11.2 |

% |

|

AFFO per unit (diluted) |

$ |

0.526 |

|

$ |

0.519 |

|

$ |

0.007 |

|

1.3 |

% |

|

AFFO pay-out ratio |

|

83.2% |

|

|

81.8% |

|

|

1.4% |

|

— |

|

|

|

|

|

|

|

| |

For the nine months ended September 30 |

| (In

thousands except for per unit and % amounts) |

|

2022 |

|

|

2021 |

|

Change |

% Change |

|

Rental Revenue (1)(4) |

$ |

456,403 |

|

$ |

422,164 |

|

$ |

34,239 |

|

8.1 |

% |

| Net income

(1) |

$ |

333,971 |

|

$ |

283,230 |

|

$ |

50,741 |

|

17.9 |

% |

| Net income excluding

fair value adjustments, financing prepayment costs and

impairment (2)(3)(5) |

$ |

207,285 |

|

$ |

197,410 |

|

$ |

9,875 |

|

5.0 |

% |

| Adjusted

EBITDA (2) |

$ |

296,489 |

|

$ |

274,207 |

|

$ |

22,282 |

|

8.1 |

% |

| Same asset NOI -

rental portfolio (2) |

$ |

252,873 |

|

$ |

251,660 |

|

$ |

1,213 |

|

0.5 |

% |

| Same asset NOI - total

portfolio (2) |

$ |

255,835 |

|

$ |

256,475 |

|

$ |

(640) |

|

(0.2 |

%) |

| FFO

(2) |

$ |

247,722 |

|

$ |

177,685 |

|

$ |

70,037 |

|

39.4 |

% |

| FFO per unit

(2) |

$ |

1.822 |

|

$ |

1.395 |

|

$ |

0.427 |

|

30.6 |

% |

| FFO pay-out

ratio (2) |

|

71.9% |

|

|

91.3% |

|

|

(19.4%) |

|

— |

|

| All amounts below are

excluding condominium related items, financing prepayment costs and

the mark-to-market adjustment on unit-based compensation

(2)(3) |

|

|

|

|

|

FFO |

$ |

247,067 |

|

$ |

230,039 |

|

$ |

17,028 |

|

7.4 |

% |

|

FFO per unit (diluted) |

$ |

1.817 |

|

$ |

1.806 |

|

$ |

0.011 |

|

0.6 |

% |

|

FFO pay-out ratio |

|

72.1% |

|

|

70.6% |

|

|

1.5% |

|

— |

|

|

AFFO |

$ |

221,026 |

|

$ |

200,441 |

|

$ |

20,585 |

|

10.3 |

% |

|

AFFO per unit (diluted) |

$ |

1.625 |

|

$ |

1.573 |

|

$ |

0.052 |

|

3.3 |

% |

|

AFFO pay-out ratio |

|

80.6% |

|

|

81.0% |

|

|

(0.4%) |

|

— |

|

(1) This measure is presented on an IFRS

basis.(2) This is a non-IFRS measure. Refer to the Non-IFRS

Measures section below and on page 21 of the Management's

Discussion and Analysis of Results of Operations and Financial

Condition (the "MD&A") as at September 30, 2022.(3) For

the three and nine months ended September 30, 2022, Allied

incurred $nil and $nil, respectively, (September 30, 2021 -

$37,728 and $51,889, respectively) of financing prepayment costs in

connection with the favourable refinancing of unsecured debentures

and first mortgages. (4) Prior to Q4 2021, the comparative figures

for investment properties, total assets, and rental revenue were

reported on a proportionate share basis. The comparative figures

for the prior period have been revised to an IFRS basis.(5) Prior

to Q4 2021, the comparative figure for net income excluding fair

value adjustments, financing prepayment costs and impairment was

calculated on a proportionate share basis. The comparative figure

for the prior period has been revised to be calculated on an IFRS

basis.(6) Net asset value per unit ("NAV per unit") is calculated

as follows: total equity as at the corresponding period ended, (per

the unaudited condensed consolidated balance sheets) divided by the

actual number of Units and class B limited partnership units of

Allied Properties Exchangeable Limited Partnership ("Exchangeable

LP Units") outstanding at period end.

Leasing Results and

Highlights

For the nine months ended September 30,

2022, Allied leased 56.9% of the GLA covered by expiring leases,

with an average increase in net rent per square foot of 7.5%.

Combined with new leasing activity, this gave rise to the lease

metrics set out in the table below:

|

|

Q3 2022 |

Q2 2022 |

Change |

% Change |

|

Leased area |

|

90.7% |

|

|

90.9% |

|

|

(0.2%) |

|

— |

|

| Occupied

area |

|

89.6% |

|

|

89.5% |

|

|

0.1% |

|

— |

|

|

Average in-place net rent per occupied square

foot |

$ |

25.56 |

|

$ |

25.29 |

|

$ |

0.27 |

|

1.1 |

% |

Given the scale of Allied’s rental portfolio,

upgrade activity is now constant in all markets, particularly

Montréal, Toronto and Vancouver. The goal of the upgrade activity

is to serve users better and to boost net rent per occupied square

foot over time. At the end of the third quarter, Allied’s rental

portfolio was comprised of (i) 14,407,984 square feet of GLA in

buildings that are largely stabilized and (ii) 559,741 square feet

of GLA in buildings that are undergoing active upgrade. The

occupied area of the former was 90.2%, with leased area at 91.4%.

The occupied area of the latter was 74.6%, with leased area at

74.6%.

Allocation of Capital

Allied is focusing on completing the

developments in its pipeline, which Management expects will add

approximately $82 million to annual EBITDA over the next few years.

This alone will improve Allied’s relatively strong debt-metrics in

an organic manner.

Outlook

Allied’s internal forecast for 2022 calls for

low-to-mid-single-digit percentage growth in each of same-asset

NOI, FFO per unit and AFFO per unit. Allied does not forecast NAV

per unit growth in any given time period.

Allied continues to have deep confidence in, and

commitment to, its strategy of consolidating and intensifying

distinctive urban workspace and network-dense UDCs in Canada’s

major cities. Allied firmly believes that its strategy is

underpinned by the most important secular trends in Canadian and

global real estate. Allied also firmly believes that it has the

properties, the financial strength, the people and the platform

necessary to execute its strategy for the ongoing benefit of its

Unitholders and other constituents.

Non-IFRS MeasuresManagement

uses financial measures based on International Financial Reporting

Standards ("IFRS") and non-IFRS measures to assess Allied's

performance. Non-IFRS measures do not have any standardized meaning

prescribed under IFRS, and therefore, should not be construed as

alternatives to net income or cash flow from operating activities

calculated in accordance with IFRS. Refer to the Non-IFRS Measures

section on page 17 of the MD&A as at September 30, 2022,

available on www.sedar.com, for an explanation of the composition

of the non-IFRS measures used in this press release and their

usefulness for readers in assessing Allied's performance. Such

explanation is incorporated by reference herein.

Reconciliations of Non-IFRS

Measures

The following tables reconcile the non-IFRS

measures to the most comparable IFRS measures for the three and

nine months ended September 30, 2022 and the comparable

periods in 2021. These terms do not have any standardized meaning

prescribed under IFRS and may not be comparable to similarly titled

measures presented by other publicly traded entities.

Adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization ("Adjusted

EBITDA")The following table reconciles Allied's net income

and comprehensive income to Adjusted EBITDA, a non-IFRS measure,

for the three and nine months ended September 30, 2022 and

September 30, 2021.

| |

Three months ended |

|

Nine months ended |

|

|

September 30, 2022 |

|

September 30, 2021 |

|

|

September 30, 2022 |

|

September 30, 2021 |

|

|

Net income and comprehensive income for the period |

$ |

46,743 |

|

$ |

107,185 |

|

|

$ |

333,971 |

|

$ |

283,230 |

|

| Interest expense (1) |

|

21,324 |

|

|

54,242 |

|

|

|

56,834 |

|

|

102,897 |

|

| Amortization of other

assets |

|

410 |

|

|

285 |

|

|

|

940 |

|

|

894 |

|

| Amortization of improvement

allowances |

|

8,295 |

|

|

8,183 |

|

|

|

24,636 |

|

|

24,165 |

|

| Impairment of residential

inventory |

|

15,729 |

|

|

— |

|

|

|

15,729 |

|

|

— |

|

| Fair value loss (gain) on

investment properties and investment properties held for sale

(2) |

|

17,519 |

|

|

(75,077 |

) |

|

|

(98,943 |

) |

|

(120,623 |

) |

| Fair value gain on derivative

instruments |

|

(5,668 |

) |

|

(877 |

) |

|

|

(35,610 |

) |

|

(16,356 |

) |

|

Mark-to-market adjustment on unit-based compensation |

|

(686 |

) |

|

— |

|

|

|

(1,068 |

) |

|

— |

|

|

Adjusted EBITDA |

$ |

103,666 |

|

$ |

93,941 |

|

|

$ |

296,489 |

|

$ |

274,207 |

|

(1) Includes Allied's proportionate share of the

equity accounted investment for interest expense of $nil and $nil

for the three and nine months ended September 30, 2022,

respectively (September 30, 2021 - $180 and $190,

respectively).(2) Includes Allied's proportionate share of the

equity accounted investment for fair value loss on investment

properties of $8,056 and $6,794 for the three and nine months ended

September 30, 2022, respectively (September 30, 2021 -

fair value loss on investment properties of $888 and $730,

respectively).

Net income excluding fair value adjustments, financing

prepayment costs and impairment

The following table reconciles Allied's net

income and comprehensive income to net income excluding fair value

adjustments, financing prepayment costs and impairment, a non-IFRS

measure, for the three and nine months ended September 30,

2022 and September 30, 2021.

| |

Three months ended |

|

Nine months ended |

| |

September 30, 2022 |

September 30, 2021 |

|

September 30, 2022 |

September 30, 2021 |

|

Net income and comprehensive income |

$ |

46,743 |

|

$ |

107,185 |

|

|

$ |

333,971 |

|

$ |

283,230 |

|

| Fair value loss (gain) on

investment properties and investment properties held for sale |

|

9,463 |

|

|

(75,965 |

) |

|

|

(105,737 |

) |

|

(121,353 |

) |

| Fair value gain on derivative

instruments |

|

(5,668 |

) |

|

(877 |

) |

|

|

(35,610 |

) |

|

(16,356 |

) |

| Mark-to-market adjustment on

unit-based compensation |

|

(686 |

) |

|

— |

|

|

|

(1,068 |

) |

|

— |

|

| Financing prepayment

costs |

|

— |

|

|

37,728 |

|

|

|

— |

|

|

51,889 |

|

|

Impairment of residential inventory |

|

15,729 |

|

|

— |

|

|

|

15,729 |

|

|

— |

|

|

Net income excluding fair value adjustments, financing

prepayment costs and impairment (1) |

$ |

65,581 |

|

$ |

68,071 |

|

|

$ |

207,285 |

|

$ |

197,410 |

|

(1) The comparative figure for the prior period

has been revised to be calculated on an IFRS basis.

Same Asset NOI

Same asset NOI, a non-IFRS measure, is measured

as the net operating income for the properties that Allied owned

and operated for the entire duration of both the current and

comparative period. Same asset NOI of the assets held for sale for

the three and nine months ended September 30, 2022 consists of

one investment property that Allied classified as held for sale.

The following tables reconcile Allied's same asset NOI to operating

income for the three and nine months ended September 30, 2022

and September 30, 2021.

| |

Three months ended |

Change |

| |

September 30, 2022 |

September 30, 2021 |

$ |

% |

|

Rental Portfolio - Same Asset NOI |

$ |

84,373 |

|

$ |

84,895 |

|

$ |

(522 |

) |

(0.6 |

)% |

| Development Portfolio - Same

Asset NOI |

$ |

1,199 |

|

$ |

2,090 |

|

$ |

(891 |

) |

(42.6 |

%) |

| Assets

Held for Sale - Same Asset NOI |

$ |

67 |

|

$ |

86 |

|

$ |

(19 |

) |

(22.1 |

%) |

|

Total Portfolio - Same Asset NOI |

$ |

85,639 |

|

$ |

87,071 |

|

$ |

(1,432 |

) |

(1.6 |

%) |

|

Acquisitions |

|

10,036 |

|

|

274 |

|

|

9,762 |

|

|

|

Dispositions |

|

99 |

|

|

384 |

|

|

(285 |

) |

|

|

Lease terminations |

|

29 |

|

|

443 |

|

|

(414 |

) |

|

|

Development fees and corporate items |

|

2,040 |

|

|

3,061 |

|

|

(1,021 |

) |

|

|

NOI |

$ |

97,843 |

|

$ |

91,233 |

|

$ |

6,610 |

|

7.2 |

% |

|

Amortization of improvement allowances |

|

(8,295 |

) |

|

(8,183 |

) |

|

(112 |

) |

|

|

Amortization of straight-line rents |

|

2,860 |

|

|

879 |

|

|

1,981 |

|

|

|

Operating income, proportionate basis |

$ |

92,408 |

|

$ |

83,929 |

|

$ |

8,479 |

|

10.1 |

% |

| Less:

investment in joint venture |

|

734 |

|

|

387 |

|

|

347 |

|

89.7 |

% |

|

Operating income, IFRS basis |

$ |

91,674 |

|

$ |

83,542 |

|

$ |

8,132 |

|

9.7 |

% |

|

|

|

|

|

|

| |

Nine months ended |

Change |

| |

September 30, 2022 |

September 30, 2021 |

$ |

% |

|

Rental Portfolio - Same Asset NOI |

$ |

252,873 |

|

$ |

251,660 |

|

$ |

1,213 |

|

0.5 |

% |

| Development Portfolio - Same

Asset NOI |

$ |

2,728 |

|

$ |

4,573 |

|

$ |

(1,845 |

) |

(40.3 |

)% |

| Assets

Held for Sale - Same Asset NOI |

$ |

234 |

|

$ |

242 |

|

$ |

(8 |

) |

(3.3 |

)% |

|

Total Portfolio - Same Asset NOI |

$ |

255,835 |

|

$ |

256,475 |

|

$ |

(640 |

) |

(0.2 |

)% |

|

Acquisitions |

|

22,485 |

|

|

940 |

|

|

21,545 |

|

|

|

Dispositions |

|

1,324 |

|

|

1,155 |

|

|

169 |

|

|

|

Lease terminations |

|

352 |

|

|

1,013 |

|

|

(661 |

) |

|

|

Development fees and corporate items |

|

7,514 |

|

|

8,898 |

|

|

(1,384 |

) |

|

|

NOI |

$ |

287,510 |

|

$ |

268,481 |

|

$ |

19,029 |

|

7.1 |

% |

|

Amortization of improvement allowances |

|

(24,636 |

) |

|

(24,165 |

) |

|

(471 |

) |

|

|

Amortization of straight-line rents |

|

4,602 |

|

|

3,588 |

|

|

1,014 |

|

|

|

Operating income, proportionate basis |

$ |

267,476 |

|

$ |

247,904 |

|

$ |

19,572 |

|

7.9 |

% |

| Less:

investment in joint venture |

|

1,818 |

|

|

1,318 |

|

|

500 |

|

37.9 |

% |

|

Operating income, IFRS basis |

$ |

265,658 |

|

$ |

246,586 |

|

$ |

19,072 |

|

7.7 |

% |

Funds from operations ("FFO") and

Adjusted funds from operations ("AFFO")The following

tables reconcile Allied's net income to FFO, FFO excluding

condominium related items, financing prepayment costs and the

mark-to-market adjustment on unit-based compensation, AFFO, and

AFFO excluding condominium related items, financing prepayment

costs and the mark-to-market adjustment on unit-based compensation,

which are non-IFRS measures, for the three and nine months ended

September 30, 2022 and September 30, 2021.

| |

Three months ended |

|

|

September 30, 2022 |

September 30, 2021 |

Change |

|

Net income and comprehensive income |

$ |

46,743 |

|

$ |

107,185 |

|

$ |

(60,442 |

) |

| Adjustment to fair value of

investment properties and investment properties held for sale |

|

9,463 |

|

|

(75,965 |

) |

|

85,428 |

|

| Adjustment to fair value of

derivative instruments |

|

(5,668 |

) |

|

(877 |

) |

|

(4,791 |

) |

| Impairment of residential

inventory |

|

15,729 |

|

|

— |

|

|

15,729 |

|

| Incremental leasing costs |

|

2,233 |

|

|

1,918 |

|

|

315 |

|

| Amortization of improvement

allowances |

|

8,137 |

|

|

8,095 |

|

|

42 |

|

| Amortization of property,

plant and equipment (1) |

|

125 |

|

|

— |

|

|

125 |

|

| Adjustments relating to joint

venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

8,056 |

|

|

888 |

|

|

7,168 |

|

|

Amortization of improvement allowances |

|

158 |

|

|

88 |

|

|

70 |

|

|

Interest expense(2) |

|

356 |

|

|

358 |

|

|

(2 |

) |

|

FFO |

$ |

85,332 |

|

$ |

41,690 |

|

$ |

43,642 |

|

| |

|

|

|

| Condominium marketing

costs |

|

101 |

|

|

119 |

|

|

(18 |

) |

| Financing prepayment

costs |

|

— |

|

|

37,728 |

|

|

(37,728 |

) |

|

Mark-to-market adjustment on unit-based compensation |

|

(686 |

) |

|

— |

|

|

(686 |

) |

|

FFO excluding condominium related items, financing prepayment costs

and the mark-to-market adjustment on unit-based compensation |

$ |

84,747 |

|

$ |

79,537 |

|

$ |

5,210 |

|

| Amortization of straight-line

rents |

|

(2,758 |

) |

|

(609 |

) |

|

(2,149 |

) |

| Regular leasing

expenditures |

|

(4,123 |

) |

|

(8,394 |

) |

|

4,271 |

|

| Regular maintenance capital

expenditures |

|

(534 |

) |

|

(637 |

) |

|

103 |

|

| Incremental leasing costs

(related to regular leasing expenditures) |

|

(1,563 |

) |

|

(1,342 |

) |

|

(221 |

) |

| Recoverable maintenance

capital expenditures |

|

(2,159 |

) |

|

(2,153 |

) |

|

(6 |

) |

| Adjustment relating to joint

venture: |

|

|

|

|

Amortization of straight-line rents |

|

(102 |

) |

|

(270 |

) |

|

168 |

|

|

AFFO excluding condominium related items, financing prepayment

costs and the mark-to-market adjustment on unit-based

compensation |

$ |

73,508 |

|

$ |

66,132 |

|

$ |

7,376 |

|

|

|

|

|

|

| Weighted average number of

units (3) |

|

|

|

|

Basic |

|

139,762,081 |

|

|

127,260,451 |

|

|

12,501,630 |

|

|

Diluted |

|

139,765,373 |

|

|

127,447,002 |

|

|

12,318,371 |

|

| |

|

|

|

| Per unit - basic |

|

|

|

| FFO |

$ |

0.611 |

|

$ |

0.328 |

|

$ |

0.283 |

|

| FFO excluding condominium

related items, financing prepayment costs and the mark-to-market

adjustment on unit-based compensation |

$ |

0.606 |

|

$ |

0.625 |

|

$ |

(0.019 |

) |

| AFFO excluding condominium

related items, financing prepayment costs and the mark-to-market

adjustment on unit-based compensation |

$ |

0.526 |

|

$ |

0.520 |

|

$ |

0.006 |

|

| |

|

|

|

| Per unit - diluted |

|

|

|

| FFO |

$ |

0.611 |

|

$ |

0.327 |

|

$ |

0.284 |

|

| FFO excluding condominium

related items, financing prepayment costs and the mark-to-market

adjustment on unit-based compensation |

$ |

0.606 |

|

$ |

0.624 |

|

$ |

(0.018 |

) |

| AFFO excluding condominium

related items, financing prepayment costs and the mark-to-market

adjustment on unit-based compensation |

$ |

0.526 |

|

$ |

0.519 |

|

$ |

0.007 |

|

| |

|

|

|

| Pay-out Ratio |

|

|

|

| FFO |

|

71.6 |

% |

|

129.8 |

% |

|

(58.2 |

%) |

| FFO excluding condominium

related items, financing prepayment costs and the mark-to-market

adjustment on unit-based compensation |

|

72.1 |

% |

|

68.0 |

% |

|

4.1 |

% |

| AFFO

excluding condominium related items, financing prepayment costs and

the mark-to-market adjustment on unit-based compensation |

|

83.2 |

% |

|

81.8 |

% |

|

1.4 |

% |

|

|

|

|

|

| |

Nine months ended |

|

|

September 30, 2022 |

September 30, 2021 |

Change |

|

Net income and comprehensive income |

$ |

333,971 |

|

$ |

283,230 |

|

$ |

50,741 |

|

| Adjustment to fair value of

investment properties and investment properties held for sale |

|

(105,737 |

) |

|

(121,353 |

) |

|

15,616 |

|

| Adjustment to fair value of

derivative instruments |

|

(35,610 |

) |

|

(16,356 |

) |

|

(19,254 |

) |

| Impairment of residential

inventory |

|

15,729 |

|

|

— |

|

|

15,729 |

|

| Incremental leasing costs |

|

6,802 |

|

|

5,789 |

|

|

1,013 |

|

| Amortization of improvement

allowances |

|

24,187 |

|

|

24,176 |

|

|

11 |

|

| Amortization of property,

plant and equipment (1) |

|

125 |

|

|

— |

|

|

125 |

|

| Adjustments relating to joint

venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

6,794 |

|

|

730 |

|

|

6,064 |

|

|

Amortization of improvement allowances |

|

449 |

|

|

(11 |

) |

|

460 |

|

|

Interest expense (2) |

|

1,012 |

|

|

1,480 |

|

|

(468 |

) |

|

FFO |

$ |

247,722 |

|

$ |

177,685 |

|

$ |

70,037 |

|

| Condominium marketing

costs |

|

413 |

|

|

465 |

|

|

(52 |

) |

| Financing prepayment

costs |

|

— |

|

|

51,889 |

|

|

(51,889 |

) |

|

Mark-to-market adjustment on unit-based compensation |

|

(1,068 |

) |

|

— |

|

|

(1,068 |

) |

|

FFO excluding condominium related items, financing prepayment costs

and mark-to-market adjustment on unit-based compensation |

$ |

247,067 |

|

$ |

230,039 |

|

$ |

17,028 |

|

| Amortization of straight-line

rents |

|

(4,018 |

) |

|

(2,780 |

) |

|

(1,238 |

) |

| Regular leasing

expenditures |

|

(11,101 |

) |

|

(13,924 |

) |

|

2,823 |

|

| Regular maintenance capital

expenditures |

|

(1,625 |

) |

|

(2,761 |

) |

|

1,136 |

|

| Incremental leasing costs

(related to regular leasing expenditures) |

|

(4,761 |

) |

|

(4,052 |

) |

|

(709 |

) |

| Recoverable maintenance

capital expenditures |

|

(3,952 |

) |

|

(5,273 |

) |

|

1,321 |

|

| Adjustment relating to joint

venture: |

|

|

|

|

Amortization of straight-line rents |

|

(584 |

) |

|

(808 |

) |

|

224 |

|

|

AFFO excluding condominium related items, financing prepayment

costs and mark-to-market adjustment on unit-based compensation |

$ |

221,026 |

|

$ |

200,441 |

|

$ |

20,585 |

|

|

|

|

|

|

| Weighted average number of

units (3) |

|

|

|

|

Basic |

|

135,908,624 |

|

|

127,259,634 |

|

|

8,648,990 |

|

|

Diluted |

|

135,990,362 |

|

|

127,403,570 |

|

|

8,586,792 |

|

| |

|

|

|

| Per unit - basic |

|

|

|

| FFO |

$ |

1.823 |

|

$ |

1.396 |

|

$ |

0.427 |

|

| FFO excluding condominium

related items, financing prepayment costs and mark-to-market

adjustment on unit-based compensation |

$ |

1.818 |

|

$ |

1.808 |

|

$ |

0.010 |

|

| AFFO excluding condominium

related items, financing prepayment costs and mark-to-market

adjustment on unit-based compensation |

$ |

1.626 |

|

$ |

1.575 |

|

$ |

0.051 |

|

| |

|

|

|

| Per unit - diluted |

|

|

|

| FFO |

$ |

1.822 |

|

$ |

1.395 |

|

$ |

0.427 |

|

| FFO excluding condominium

related items, financing prepayment costs and mark-to-market

adjustment on unit-based compensation |

$ |

1.817 |

|

$ |

1.806 |

|

$ |

0.011 |

|

| AFFO excluding condominium

related items, financing prepayment costs and mark-to-market

adjustment on unit-based compensation |

$ |

1.625 |

|

$ |

1.573 |

|

$ |

0.052 |

|

| |

|

|

|

| Pay-out Ratio |

|

|

|

| FFO |

|

71.9 |

% |

|

91.3 |

% |

|

(19.4 |

%) |

| FFO excluding condominium

related items, financing prepayment costs and mark-to-market

adjustment on unit-based compensation |

|

72.1 |

% |

|

70.6 |

% |

|

1.5 |

% |

| AFFO

excluding condominium related items, financing prepayment costs and

mark-to-market adjustment on unit-based compensation |

|

80.6 |

% |

|

81.0 |

% |

|

(0.4 |

%) |

(1) Property, plant and equipment relates to owner-occupied

property.(2) This amount represents interest expense on Allied's

joint venture investment in TELUS Sky and is not capitalized under

IFRS, but is allowed as an adjustment under REALPAC's definition of

FFO. (3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units are classified as

equity in the unaudited condensed consolidated balance sheets as

non-controlling interests.

Cautionary Statements

This press release may contain forward-looking

statements with respect to Allied, its operations, strategy,

financial performance and condition and the expected impact of the

global pandemic and consequent economic disruption. These

statements generally can be identified by use of forward-looking

words such as "forecast", “may”, “will”, “expect”, “estimate”,

“anticipate”, “intends”, “believe” or “continue” or the negative

thereof or similar variations. Allied’s actual results and

performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations, including the effect of the global

pandemic and consequent economic disruption. Important factors that

could cause actual results to differ materially from expectations

include, among other things, general economic and market factors,

competition, changes in government regulations and the factors

described under “Risk Factors” in Allied’s Annual Information Form

which is available at www.sedar.com. The cautionary statements

qualify all forward-looking statements attributable to Allied and

persons acting on its behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release, and Allied has no obligation to update such

statements.

About Allied

Allied is a leading operator of distinctive

urban workspace in Canada’s major cities and network-dense UDC

space in Toronto. Allied’s mission is to provide knowledge-based

organizations with workspace and UDC space that is sustainable and

conducive to human wellness, creativity, connectivity and

diversity. Allied’s vision is to make a continuous contribution to

cities and culture that elevates and inspires the humanity in all

people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Michael EmoryPresident & Chief Executive

Officer(416) 977-0643memory@alliedreit.com

Tom BurnsExecutive Vice President & Chief Operating

Officer(416) 977-9002tburns@alliedreit.com

Cecilia WilliamsExecutive Vice President &

Chief Financial Officer(416) 977-9002cwilliams@alliedreit.com

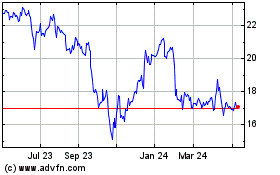

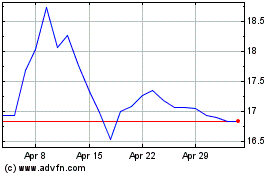

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024