Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) announces the Company's audited

consolidated financial results for the year ended December 31,

2023. For details of the audited consolidated financial statements,

Management's Discussion and Analysis, and Annual Information Form

for the year ended December 31, 2023, please see the Company's

filings on SEDAR+ at www.sedarplus.ca.

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise specified.

2023 AND RECENT HIGHLIGHTS

- On February 20, 2024, the Company closed its previously

announced financing package for a total of US$50 million from

Sprott Resource Streaming and Royalty Corp. and its affiliates

(“Sprott Streaming”) and Nebari Credit Fund II, LP (“Nebari Credit

Fund II”), as described in the Company’s news release dated January

22, 2024. $13,700 of the above proceeds was used to buy back two

existing 5% NSR royalties on various Premier Gold Project (“PGP”)

property claims, which was completed on March 15, 2024.

- On February 20, 2024, concurrently with the above-noted

financing package, the Company closed its previously announced

bought deal private placement financing, under which the Company

issued a total of 65,343,000 common shares of the Company (the

“Common Shares”) at a price of C$0.44 per Common Share, for gross

proceeds of $28,751.

- At the end of Q4 2023, overall construction excluding mine

development was 86% complete (approximately 94% as of February 29,

2024), compared with 66% complete at the end of Q3 2023. Numerous

pre-commissioning activities in the mill have commenced. The

Company anticipates introducing first ore into the mill by the end

of March 2024, and pouring first gold in April.

- PGP reached an important safety milestone in Q4 of 2023: one

million hours without lost time incidents (“LTI”). By the end of Q4

2023, this figure reached 1,143,029 hours LTI free. The

total recordable incident frequency has been reduced yet again

from 0.69 at the end of Q3 2023 to 0.52 by the end of Q4 2023.

- At the tailings storage facility (“TSF”), the south dam, north

dam, and southeast dam have been completed. The minor remaining

work is focused on the smaller east dam and spillway which is

expected to be completed by the end of March. The new

electrical substation was completed and all 138kV power lines were

pulled and linked up with the BC Hydro grid. Site powerup on the

138 kV line was completed in January 2024.

- The new water treatment plant was fully commissioned and began

operations in February 2024. The high-density sludge plant has been

successfully commissioned and water is being treated and discharged

into the environment. The moving bed bio-reactor is mechanically

and electrically complete and media is being loaded into the tanks.

The plant is anticipated to be brought into service by the end of

March 2024.

- In October 2023, the Company obtained a temporary use permit to

install a camp facility in the town of Stewart to provide

additional accommodations for workers at the Project. The Company

mobilized and installed living quarters with an initial capacity of

76 beds in early December 2023. This has alleviated some of the

pressure caused by the extended earthworks schedule.

- On September 19, 2023, the Company acquired a full-service

laboratory facility (“Assay Lab”) in Stewart, BC from Seacan Labs

Corp. The Assay Lab will be used to perform the testing required by

Ascot for mineral exploration, mining operation, and environmental

monitoring. During Q4 2023, the Assay Lab was re-commissioned for

use and is currently ramping up toward full capacity of 250-300

samples per day with a 24-hour turnaround.

- In Q3 2023, the Company’s underground mining contractor Procon

Mining & Tunnelling mobilized to site. In Q4 2023, underground

development at Big Missouri was re-commenced and is ongoing. As of

March 21, 2024, underground development at Big Missouri totaled

approximately 2,091 metres. In late 2023, underground decline

development commenced on the new Premier Portal close to the mill.

Mining development is being advanced down into the Premier deposit

for initial mining in the Prew Zone, with ore development

anticipated to begin in Q2 2024, and stope production following in

Q3 2024. As of March 15, 2024, underground development at Premier

totaled approximately 32 metres.

- On June 27, 2023, the Company closed a previously announced

US$14 million subordinated convertible credit facility (the

“Convertible Facility”) with Nebari Gold Fund 1, LP (“Nebari”). The

full proceeds from the Convertible Facility were used to repay

principal, accrued interest and fees of Ascot’s existing

subordinated convertible credit facility with Beedie Investments

Ltd. (“Beedie”).

- On April 20, 2023, the Company closed a previously announced

non-brokered private placement for total gross proceeds of $4,050

and consisted of 5,000,000 common shares of the Company, which

qualify as "flow-through shares" within the meaning of the Income

Tax Act (Canada) (the “FT Shares”), at a price of C$0.81 per FT

Share.

- The Company’s 2023 exploration program at PGP commenced in May,

which consisted of 88 holes totaling 11,886 metres and included

exploration drilling for resource expansion as well as in-fill

drilling of initial mining areas at the Big Missouri and Premier

deposits. Assay results were announced between August 2023 and

January 2024. Multiple high-grade intercepts were drilled,

including 98.84 g/t Au over 6.48m from a depth of 51.5m in hole

P23-2490, including 691.50 g/t Au over 0.90m. This was the all-time

second highest-grade drill intercept at Big Missouri and is the

Company’s highest-grade drill intercept property-wide since

2015.

- On January 19, 2023, the Company closed a previously announced

financing package. The financing package consisted of US$110

million as a deposit in respect of gold and silver streaming

agreements and a strategic equity investment of C$45 million, a

portion of which is structured as Canadian Development Expenditures

flow through shares, such that the total gross proceeds to the

Company was C$50 million.

FINANCIAL RESULTS FOR THE THREE MONTHS

AND YEAR ENDED DECEMBER 31, 2023

The Company reported a net income of $1,705 for

Q4 2023 compared to a net loss of $5,988 for Q4 2022. The net

income in Q4 2023 is mainly driven by the accounting gain on

increase in fair value of the stream buyback embedded derivatives

as a result of increase in gold prices and a decrease in market

credit spreads.

The Company reported a net loss of $10,430 for

2023 compared to $10,808 for 2022. The lower net loss is

attributable to a combination of key factors including a $2,405

decrease in stock-based compensation, and a $1,539 increase in gain

on change in fair value of the Stream buyback embedded derivatives,

partially offset by a $1,392 increase in environmental compliance

costs, and a $1,202 increase in deferred income tax expense.

LIQUIDITY AND CAPITAL

RESOURCES

As at December 31, 2023, the Company had cash

& cash equivalents of $26,974 and working capital deficiency of

$18,337. On February 20, 2024, the Company closed a bought deal

private placement for gross proceeds of $28,751 and a US$50 million

financing package consisting of a royalty restructuring and a cost

overrun facility. Management considered the negative net working

capital and the commitments that had existed at December 31, 2023

as well as the funding received subsequent to year end and

concluded that the Company now has sufficient funding for the next

twelve months of operations, including to progress from

construction to first gold pour, ramp-up, commercial production and

eventually steady-state operations.

During 2023, the Company issued 120,186,206

common shares, granted 9,789,358 stock options, issued 1,449,973

Deferred Share Units and 2,606,908 Restricted Share Units. Also,

564,152 stock options expired or were forfeited, and 55,530 stock

options, 452,006 Deferred Share Units and 721,597 Restricted Share

Units were exercised in 2023.

MANAGEMENT’S OUTLOOK FOR

2024

With the financing package closed on February

20, 2024, the Company believes that it has sufficient funding to

complete construction and ramp-up of PGP in 2024. The key

activities for remainder of 2024 include:

- Advancing the mining development at Big Missouri and at

Premier, with stoping activity at Premier starting in Q3 2024

- Completing recruitment of operating team personnel by the end

of March 2024

- First ore to the mill by the end of March 2024 and first gold

pour in April 2024, and commercial production in Q3 2024

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President &

CEO

For further information

contact:

David Stewart, P.Eng.VP, Corporate Development & Shareholder

Communicationsdstewart@ascotgold.com778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian junior exploration and

development company focused on re-starting the past producing

Premier Gold Mine, located on Nisga’a Nation Treaty Lands, in

British Columbia’s prolific Golden Triangle. Ascot shares trade on

the TSX under the ticker AOT. Concurrent with progressing the

development of Premier, the Company continues to explore its

properties for additional high-grade underground resources. Ascot

is committed to the safe and responsible development of Premier in

collaboration with Nisga’a Nation as outlined in the Benefits

Agreement.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com, or for a virtual

tour visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements").

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "believe", "plan",

"estimate", "expect", "targeted", "outlook", "on track" and

"intend" and statements that an event or result "may", "will",

"should", "could", “would” or "might" occur or be achieved and

other similar expressions. All statements, other than statements of

historical fact, included herein are forward-looking statements,

including statements in respect of advancement and development of

the PGP and the timing related thereto, the completion of the PGP

mine, the production of gold and management’s outlook for the

remainder of 2024 and beyond. These statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements, including risks

associated with entering into definitive agreements for the

transactions described herein; fulfilling the conditions to closing

of the transactions described herein, including the receipt of TSX

approvals; the business of Ascot; risks related to exploration and

potential development of Ascot's projects; business and economic

conditions in the mining industry generally; fluctuations in

commodity prices and currency exchange rates; uncertainties

relating to interpretation of drill results and the geology,

continuity and grade of mineral deposits; the need for cooperation

of government agencies and indigenous groups in the exploration and

development of Ascot’s properties and the issuance of required

permits; the need to obtain additional financing to develop

properties and uncertainty as to the availability and terms of

future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; and other risk factors as detailed

from time to time in Ascot's filings with Canadian securities

regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024 in the section entitled "Risk

Factors". Forward-looking statements are based on assumptions made

with regard to: the estimated costs associated with construction of

the Project; the timing of the anticipated start of production at

the Project; the ability to maintain throughput and production

levels at the PGP mill; the tax rate applicable to the Company;

future commodity prices; the grade of mineral resources and mineral

reserves; the ability of the Company to convert inferred mineral

resources to other categories; the ability of the Company to reduce

mining dilution; the ability to reduce capital costs; and

exploration plans. Forward-looking statements are based on

estimates and opinions of management at the date the statements are

made. Although Ascot believes that the expectations reflected in

such forward-looking statements and/or information are reasonable,

undue reliance should not be placed on forward-looking statements

since Ascot can give no assurance that such expectations will prove

to be correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

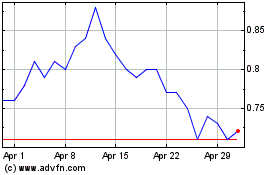

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Nov 2023 to Nov 2024