Altius Reports Third Quarter 2020 Attributable Royalty Revenue of Approximately $16.2 million

October 21 2020 - 8:12AM

Business Wire

Altius Minerals Corporation (TSX: ALS) (OTCQX: ATUSF)

(“Altius” or the “Corporation”) expects to report attributable

royalty revenue† of approximately $16.2 million ($0.39 per share)

for the third quarter ended September 30, 2020. This compares to

quarterly revenues of $13 million ($0.31 per share) in Q2 2020 and

$19.2 million ($0.45 per share) in the comparable quarter last

year.

Royalty revenue improved from last quarter primarily on improved

base metal pricing and a reduction in negative volume impacts from

COVID-19 related production and demand factors.

Base metal revenue of $8.7 million, or 53% of total royalty

revenue, was particularly strong during the quarter. Towards the

end of Q3 2020, Lundin Mining Corporation (“Lundin”) announced that

a main electrical substation failure had caused damage to four ball

and SAG mill motors and that there would be an interruption in

processing at the Chapada mine. Lundin stated that partial

processing would resume in the second week of Q4 2020 and

full-scale processing was expected within 60 days of the beginning

of Q4 2020. Subsequent to the quarter, on October 11, 2020, Hudbay

Minerals Inc. (“Hudbay”) announced that production from 777 was

temporarily interrupted after a hoist rope detached from the skip

within the production shaft and that Hudbay was currently assessing

remediation timelines.

Iron ore revenue was down by 66% compared to Q3 2019 as Iron Ore

Company of Canada ("IOC") elected not to pay dividends to

shareholders during the quarter. This in turn resulted in the

Corporation receiving lower dividends from its shareholding in

Labrador Iron Ore Royalty Corporation which serves as a pass

through vehicle for royalty revenues and dividends related to IOC

operations.

Potash revenue of $3.2 million was down 15% in Q3 2020 from the

same quarter one year ago, and down 21% from Q2 2020 on lower

realized potash prices which are partially the result of changes in

USD-CAD foreign exchange rates.

Thermal (electrical) coal revenue of $2.7 million in Q3 2020 was

slightly higher than the year ago comparable quarter, and higher

than the $2.2 million recorded in Q2 2020. The acquisition of the

minority interest from Liberty Metals & Mining Holdings LLC

announced on July 27, 2020 resulted in one month of the quarterly

revenue (July) being recognized on a 52.4% basis, while August and

September were recognized on a 100% basis.

Metallurgical coal revenue of $291,000 from Cheviot in Q3 2020

reflects sales from inventories only as Cheviot was formally closed

at the end of Q2 2020.

On October 13, 2020 Altius Renewable Royalties (“ARR”) announced

the formation of a joint venture with Apollo Infrastructure Funds

(“Apollo Funds”), which intends to invest up to US$200 million to

accelerate the growth of the renewable energy royalty business.

This strategic relationship will see Apollo Funds solely contribute

the next US$80 million of approved new investments after which

point funding will be on a 50/50 basis with Altius.

Summary of attributable

royalty revenue

(in thousands of Canadian

dollars)

Three months ended

September 30, 2020

Three months ended

September 30, 2019

Three months ended

June 30, 2020

Base metals

$8,677

$7,993

$4,835

Potash

$3,158

$3,730

$4,012

Thermal (electrical) coal

$2,668

$2,611

$2,206

Iron ore (1)

$1,293

$3,782

$1,293

Metallurgical coal

$291

$694

$466

Other royalties and interest

$141

$421

$223

Attributable royalty revenue

$16,228

$19,231

$13,035

See non-IFRS measures section of our MD&A for definition and

reconciliation of attributable royalty revenue (1) Labrador Iron

Ore Royalty Corporation dividends received

Third Quarter 2020 Financial Results Conference Call and

Webcast Details

Additional details relating to individual royalty performances

and asset level developments will be provided with the release of

full financial results, which will occur on November 11, 2020 after

the close of market, with a conference call to follow on November

12, 2020.

Date: November 12, 2020 Time: 9:00 AM EST Toll

Free Dial-In Number: +1(866) 521-4909 International Dial-In

Number: +1(647) 427-2311 Conference Call Title and ID:

Altius Third Quarter 2020 Financial Results; ID 9558089 Webcast

Link: Altius Q3 2020 Financial Results

†Attributable royalty revenue is a non-IFRS measure and does not

have any standardized meaning prescribed under IFRS. For a detailed

description and examples of the reconciliation of this measure,

please see the Corporation’s MD&A disclosures for prior

quarterly and annual reporting periods, which are available at

http://altiusminerals.com/financialstatements

About Altius

Altius’s strategy is to create

per share growth through a diversified portfolio of royalty assets

that relate to long life, high margin operations. This strategy

further provides shareholders with exposures that are well aligned

with sustainability-related global growth trends including the

electricity generation transition from fossil fuel to renewables,

transportation electrification, reduced emissions from steelmaking

and increasing agricultural yield requirements. These each hold the

potential to cause increased demand for many of Altius’s commodity

exposures including copper, renewable based electricity, several

key battery metals (lithium, nickel and cobalt), clean iron ore,

and potash. Altius has 41,464,462 common shares issued and

outstanding that are listed on Canada’s Toronto Stock Exchange. It

is a member of both the S&P/TSX Small Cap and S&P/TSX

Global Mining Indices.

Forward-Looking Information

This news release contains

forward-looking information. The statements are based on reasonable

assumptions and expectations of management and Altius provides no

assurance that actual events will meet management's expectations.

In certain cases, forward-looking information may be identified by

such terms as "anticipates", "believes", "could", "estimates",

"expects", "may", "shall", "will", or "would". Although Altius

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results or

developments may differ materially from those projected. Readers

should not place undue reliance on forward-looking information.

Altius does not undertake to update any forward-looking information

contained herein except in accordance with securities

regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201021005509/en/

Flora Wood Email: Fwood@altiusminerals.com Tel:

1.877.576.2209 Direct: +1(416)346.9020

Ben Lewis Email: Blewis@altiusminerals.com Tel:

1.877.576.2209

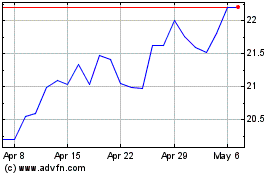

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Dec 2023 to Dec 2024