Aimia Inc. to Issue C$125 Million of Cumulative Rate Reset Preferred Shares

January 06 2014 - 10:16AM

Marketwired Canada

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES

Aimia Inc. ("Aimia") (TSX:AIM) announced today that it has agreed to issue to a

syndicate of underwriters led by CIBC, TD Securities Inc., RBC Capital Markets

and BMO Capital Markets for distribution to the public, 5,000,000 Cumulative

Rate Reset Preferred Shares, Series 3 (the "Series 3 Preferred Shares"). The

Series 3 Preferred Shares will be issued at a price of C$25.00 per share, for

aggregate gross proceeds of C$125 million. Holders of the Series 3 Preferred

Shares will be entitled to receive a cumulative quarterly fixed dividend

yielding 6.25% annually for the initial five-year period ending March 31, 2019.

The dividend rate will be reset on March 31, 2019 and every five years

thereafter at a rate equal to the 5-year Government of Canada bond yield plus

4.20%. The Series 3 Preferred Shares will be redeemable by Aimia on March 31,

2019, and every five years thereafter in accordance with their terms.

Holders of Series 3 Preferred Shares will have the right, at their option, to

convert their shares into Cumulative Floating Rate Preferred Shares, Series 4

(the "Series 4 Preferred Shares"), subject to certain conditions, on March 31,

2019 and on March 31 every five years thereafter. Holders of the Series 4

Preferred Shares will be entitled to receive cumulative quarterly floating

dividends at a rate equal to the three-month Government of Canada Treasury Bill

yield plus 4.20%.

Aimia has granted the underwriters an option, exercisable in whole or in part

anytime up to 48 hours prior to the closing of the offering, to purchase an

additional 1,000,000 Series 3 Preferred Shares at the same offering price.

Should the option be fully exercised, the total gross proceeds of the financing

will be C$150 million.

The Series 3 Preferred Shares will be offered by way of a prospectus supplement

to the short form base shelf prospectus dated April 12, 2013 filed with the

securities regulatory authorities in all provinces and territories of Canada.

The net proceeds of the issue will be used by Aimia to supplement its financial

resources and for general corporate purposes.

The offering is expected to close on or about January 15, 2014, subject to

certain conditions, including conditions set forth in the underwriting

agreement.

About Aimia

Aimia Inc. is a global leader in loyalty management. Employing more than 4,000

people in over 20 countries worldwide, Aimia offers clients, partners and

members proven expertise in launching and managing coalition loyalty programs,

delivering proprietary loyalty services, creating value through loyalty

analytics and driving innovation in the emerging digital, mobile and social

communications spaces. Aimia owns and operates Aeroplan, Canada's premier

coalition loyalty program, Nectar, the United Kingdom's largest coalition

loyalty program, Nectar Italia, and Smart Button, a leading provider of SaaS

loyalty solutions. In addition, Aimia owns stakes in Air Miles Middle East,

Mexico's leading coalition loyalty program Club Premier, Brazil's Prismah

Fidelidade, China Rewards - the first coalition loyalty program in China that

enables members to earn and redeem a common currency, and i2c, a joint venture

with Sainsbury's offering insight and data analytics services in the UK to

retailers and suppliers. Aimia also holds a minority position in Cardlytics, a

US-based private company operating in card-linked marketing for electronic

banking.

Aimia is listed on the Toronto Stock Exchange (TSX:AIM). For more information,

visit us at www.aimia.com.

Caution Concerning Forward-Looking Statements

Forward-looking statements are included in this news release. These

forward-looking statements are identified by the use of terms and phrases such

as "anticipate", "believe", "could", "estimate", "expect", "intend", "may",

"plan", "predict", "project", "will", "would", and similar terms and phrases,

including references to assumptions. Such statements may involve but are not

limited to comments with respect to strategies, expectations, planned operations

or future actions.

Forward-looking statements, by their nature, are based on assumptions and are

subject to important risks and uncertainties. Any forecasts, predictions or

forward-looking statements cannot be relied upon due to, among other things,

changing external events and general uncertainties of the business and its

corporate structure. Results indicated in forward-looking statements may differ

materially from actual results for a number of reasons, including without

limitation, dependency on top accumulation partners and clients, changes to the

Aeroplan Program, conflicts of interest, greater than expected redemptions for

rewards, regulatory matters, retail market/economic conditions, industry

competition, Air Canada liquidity issues, Air Canada or travel industry

disruptions, airline industry changes and increased airline costs, supply and

capacity costs, unfunded future redemption costs, failure to safeguard databases

and consumer privacy, changes to coalition loyalty programs, seasonal nature of

the business, other factors and prior performance, foreign operations, legal

proceedings, reliance on key personnel, labour relations, pension liability,

technological disruptions and inability to use third party software, failure to

protect intellectual property rights, interest rate and currency fluctuations,

leverage and restrictive covenants in current and future indebtedness,

uncertainty of dividend payments, managing growth, credit ratings, as well as

the other factors identified in this news release and throughout Aimia's public

disclosure record on file with the Canadian securities regulatory authorities.

The forward-looking statements contained herein represent Aimia's expectations

as of January 6, 2014, and are subject to change after such date. However, Aimia

disclaims any intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events or otherwise,

except as required under applicable securities regulations.

The Series 3 Preferred Shares have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, or any state securities laws

and may not be offered or sold in the United States or to U.S. persons absent

registration or applicable exemption from the registration requirement of such

Act and applicable state securities laws. This news release shall not constitute

an offer to sell or the solicitation of an offer to buy, nor shall there be any

sale of these securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to qualification under the securities laws of

any such jurisdiction.

FOR FURTHER INFORMATION PLEASE CONTACT:

Media

Aimia Inc.

Krista Pawley

416-352-3794

krista.pawley@aimia.com

Analysts

Aimia Inc.

Karen Keyes

647-428-5280

karen.keyes@aimia.com

www.aimia.com

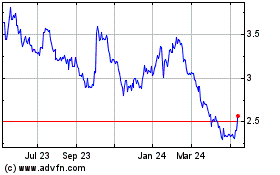

Aimia (TSX:AIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

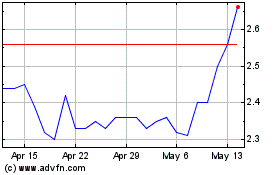

Aimia (TSX:AIM)

Historical Stock Chart

From Jan 2024 to Jan 2025