Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) today provided

updated three-year production and operating guidance incorporating

the recently completed acquisition of the Magino mine, as well as

increased 2024 production guidance for the Mulatos District.

Capital guidance has also been updated to include the development

of the Puerto Del Aire (“PDA”) project and a revised initial

capital estimate for the Phase 3+ Expansion at Island Gold.

Consolidated 2024 production guidance for

existing operations (pre-Magino acquisition) has increased 4%

reflecting the outperformance of La Yaqui Grande, while 2025 and

2026 production guidance (excluding Magino) remains unchanged from

previous guidance issued in January 2024. Consolidated cost

guidance for existing operations remains largely unchanged with a

slight increase in 2024 cost guidance and no changes across 2025

and 2026.

The inclusion of Magino contributed to a 13%

increase in consolidated production guidance in 2024, and more than

20% increase in both 2025 and 2026, enhancing the Company’s strong

growth profile. All-in sustaining cost (“AISC”) guidance has

increased 11% on average across the three years reflecting Magino’s

relatively higher costs. Company-wide AISC is expected to remain

well below industry average and continue decreasing over the

longer-term driven by low-cost production growth at Island Gold,

and continued improvements at the Magino operation.

“The addition of Magino has enhanced our already

strong growth profile, and its integration with Island Gold is

expected to drive significant synergies and open up longer-term

opportunities. Our near-term rate of production has increased by

more than 20%. Longer-term we have the capacity to grow

company-wide production to approximately 900,000 ounces per year,

with further upside potential through future expansions of the

Island Gold District,” said John A. McCluskey, President and Chief

Executive Officer. “Our costs remain well below the industry

average and are expected to decrease significantly over the next

several years as we deliver on our low-cost growth initiatives.

Through growing production and declining costs, we expect to

deliver substantial free cash flow growth in the years ahead.”

Three Year Guidance Overview: Operating

Mines

|

|

2024 |

2025 |

2026 |

|

|

Current |

Previous(1) |

Current |

Previous(1) |

Current |

Previous(1) |

|

|

|

|

|

|

|

|

| Gold Production - ex Magino

(000 oz) |

510 - 540 |

485 - 525 |

470 - 510 |

470 - 510 |

520 - 560 |

520 - 560 |

|

Consolidated Gold Production (000

oz) |

550 - 590 |

485 - 525 |

575 - 625 |

470 - 510 |

630 - 680 |

520 - 560 |

|

|

|

|

|

|

|

|

| Total Cash Costs(2) - ex

Magino ($/oz) |

$840 - 890 |

$825 - 875 |

$700 - 800 |

$700 - 800 |

$675 - 775 |

$675 - 775 |

|

Consolidated Total Cash Costs

($/oz) |

$890 - 940 |

$825 - 875 |

$775 - 875 |

$700 - 800 |

$750 - 850 |

$675 - 775 |

|

|

|

|

|

|

|

|

| All-in Sustaining

Costs(2),(3) - ex Magino ($/oz) |

$1,150 -1,200 |

$1,125 - 1,175 |

$1,050 - 1,150 |

$1,050 - 1,150 |

$975 - 1,075 |

$975 - 1,075 |

| Consolidated All-in

Sustaining Costs(2),(3)

($/oz) |

$1,250 - 1,300 |

$1,125 - $1,175 |

$1,175 - 1,275 |

$1,050 -

1,150 |

$1,100 - 1,200 |

$975 -

1,075 |

|

|

|

|

|

|

|

|

(1) Previous guidance was issued on January 10, 2024

and related to Young-Davidson, Island Gold and Mulatos District

only.(2) Refer to the “Non-GAAP Measures and Additional

GAAP” disclosure at the end of this press release for a description

of these measures.(3) All-in sustaining cost guidance

for 2025 and 2026 includes similar assumptions for G&A and

stock based compensation as included in 2024.

-

2024 production guidance increased 13%: to between

550,000 and 590,000 ounces. This reflects increased production

guidance from the Mulatos District driven by the outperformance of

La Yaqui Grande (relative to previous guidance issued in January

2024), and the inclusion of Magino. Production from Magino has been

included post completion of the Argonaut Gold acquisition on July

12, 2024, representing slightly less than half a year of

production

-

2025 and 2026 production guidance increased by over

20%: reflecting the inclusion of Magino for full years and

the operation at planned capacity. This includes a 22% increase in

2025 production guidance, and 21% increase in 2026 guidance to

between 630,000 and 680,000 ounces. This represents 30% production

growth relative to the mid-point of previous 2024 guidance issued

at the start of the year

-

Longer-term production potential of 900,000+ oz per

year: through the development of PDA, with initial

production expected mid-2027, and growth from Lynn Lake with first

production as early as the second half of 2027. An evaluation of a

longer-term expansion of the Magino mill to 15,000 to 20,000 tonnes

per day (“tpd”) is also underway which could support additional

growth bringing production closer to one million ounces per

year

-

AISC guidance increased 11% on average between 2024 and

2026: reflecting the inclusion of relatively higher cost

Magino production. Costs remain well below the industry average

with steady improvements expected through 2026 driven by low-cost

production growth

-

Declining cost profile with AISC expected to decrease 10%

by 2026 compared to 2024: AISC is expected to decrease to

between $1,100 and $1,200 per ounce in 2026 driven by low-cost

growth at Island Gold and improving costs at Magino. Beyond 2026,

AISC is expected to decrease below $1,100 per ounce, reflecting

additional low-cost growth from Island Gold and Lynn Lake

Three Year Guidance Overview: Capital

|

|

2024 |

|

2025 |

2026 |

|

($ millions) |

Current |

Previous(2) |

Current |

Previous(2) |

Current |

Previous(2) |

|

|

|

|

|

|

|

|

| Sustaining & Growth

Capital (operating mines, ex. Exploration & Lynn Lake)(1) |

$325 - 365 |

$325 - 365 |

$310 - 350 |

$310 - 350 |

$175 - 200 |

$175 - 200 |

|

Addition of PDA |

- |

|

$20 |

|

$90 - 95 |

|

|

Addition of Magino |

$35 - 40 |

|

$55 - 60 |

|

$55 - 60 |

|

|

Changes to Phase 3+ Expansion |

($30) |

|

$40 - 45 |

|

$25 - 35 |

|

|

Total Capital (operating mines, ex. Exploration

& Lynn Lake)(1) |

$330 - 375 |

$325 - 365 |

$425 - 475 |

$310 - 350 |

$345 - 390 |

$175 - 200 |

|

|

|

|

|

|

|

|

(1) Refer to the "Non-GAAP Measures and Additional

GAAP" disclosure at the end of this press release for a description

of these measures.(2) Previous guidance was issued on

January 10, 2024 and related to Young-Davidson, Island Gold and

Mulatos District only.

- Capital spending increased

in 2025 and 2026 reflecting inclusion of Magino, PDA development,

and updated Phase 3+ Expansion capital:

- The main driver of the increase in

capital spending over the next three years is the inclusion of

growth and sustaining capital for the newly acquired Magino

operation, as well as growth capital for the development of PDA.

Both are in support of high-return, lower-risk organic growth

initiatives

- 2024 capital guidance range was

increased slightly to between $330 and $375 million (excluding

capitalized exploration), reflecting the inclusion of Magino from

July 2024 onward, largely offset by a reduction at Island Gold with

the mill expansion and tailings lifts no longer required with the

Magino acquisition

- 2025 and 2026 capital guidance was

revised to include:

- initial capital for the

high-return, PDA project as per the recently announced development

plan (see September 4, 2024 press release)

- the inclusion of Magino growth and

sustaining capital for the normal course operation, as well as for

the completion of the mill optimization and other projects that

were deferred by the previous operator

- additional capital for the

completion of the Phase 3+ Expansion

- Phase 3+ Expansion initial capital

has been increased by approximately $40 million with expected

completion on track for the first half of 2026. This represents a

5% increase from the initial capital estimate of $756 million

provided in the first half of 2022. Updated capital is now expected

to total $796 million, with $415 million remaining to be spent as

of June 30, 2024. The increase was driven by ongoing inflationary

pressures since 2022, and scope changes to the project, partly

offset by synergies from the Magino acquisition and the weaker

Canadian dollar

- Strong

ongoing free cash flow while funding high-return growth

initiatives: the Company generated $131 million in free

cash flow in the first half of 2024 and expects to continue

generating strong free cash flow at current gold prices while

funding the Phase 3+ Expansion at Island Gold, and development of

PDA. The completion of Phase 3+ Expansion in 2026 and PDA

development in 2027 are expected to drive growing free cash flow

generation through higher production, lower costs, and lower

capital spending

Guidance statements in this release are

forward-looking information. See the Assumptions section of this

release along with the cautionary note at the end of this

release.

Upcoming catalysts

- Burnt Timber and Linkwood

study (satellite deposits to Lynn Lake): Q4 2024

- 2024 year-end Mineral

Reserve and Resource update: February 2025

- Island Gold District Life

of Mine Plan: mid-2025

- Island Gold District

Expansion Study: Q4 2025

- Island Gold District,

Mulatos District & Young-Davidson exploration updates:

ongoing

2024 Guidance

|

|

2024 Guidance |

|

|

|

Young-Davidson |

IslandGold |

MaginoMine(1) |

MulatosDistrict |

LynnLake |

TotalCurrent |

TotalPrevious

(2) |

|

Gold production (000 oz) |

180 - 190 |

145 - 155 |

40 - 50 |

185 - 195 |

|

550 - 590 |

485 - 525 |

|

Total cash costs(3) ($/oz) |

$1,000 - 1,050 |

$550 - 600 |

$1,450 - 1,550 975 |

$925 - 975 |

- |

$890 - 940 |

$825 - 875 |

|

All-in sustaining costs(3) ($/oz) |

|

|

|

|

|

$1,250 - 1,300 |

$1,125 - 1,175 |

|

Mine-site all-in sustaining costs(3)(4)

($/oz) |

$1,225 - 1,275 |

$875 - 925 |

$2,250 - 2,350 |

$1,000 - 1,050 |

- |

|

|

|

Capital expenditures ($ millions) |

|

|

|

|

|

|

|

|

Sustaining capital(3) |

$40 - 45 |

$50 - 55 |

$35 - 40 |

$3 - 5 |

- |

$128 - 145 |

$93 - 105 |

|

Growth capital(3) |

$20 - 25 |

$180 - 200 |

- |

$2 - 5 |

- |

$202 - 230 |

$232 - 260 |

|

Total Sustaining and Growth Capital(3)

- producing mines ($ millions) |

$60 - 70 |

$230 - 255 |

$35 - 40 |

$5 - 10 |

- |

$330 - 375 |

$325 - 365 |

|

Growth capital(3) – development

projects ($ millions) |

|

|

|

|

$25 |

$25 |

$25 |

|

Capitalized exploration(3) ($ millions) |

$10 |

$13 |

$2 |

$9 |

$9 |

$43 |

$41 |

|

Total capital expenditures and capitalized

exploration(3) ($ millions) |

$70 - 80 |

$243 - 268 |

$37 - 42 |

$14 - 19 |

$34 |

$398 - 443 |

$391 - 431 |

(1) The guidance for the Magino Mine

is for Alamos’ ownership period from July 12, 2024 to December 31,

2024.(2) Previous guidance was issued on January 10,

2024 and related to Young-Davidson, Island Gold and Mulatos

District only.(3) Refer to the "Non-GAAP Measures and

Additional GAAP" disclosure at the end of this press release for a

description of these measures.(4) For the purposes of

calculating mine-site all-in sustaining costs at individual mine

sites, the Company does not include an allocation of corporate and

administrative and share based compensation expenses to the mine

sites.

Gold production in 2024 is expected to range

between 550,000 and 590,000 ounces, a 13% increase from the

guidance provided in January 2024 (based on mid-point). The

increase is driven by the incorporation of the Magino mine, as well

as increased guidance from the Mulatos District.

With the closing of the Argonaut Gold

acquisition on July 12, 2024, less than half a year of production

from Magino is being incorporated into 2024 estimates. Magino is

expected to produce 40,000 to 50,000 ounces in the second half of

2024. As previously outlined, the third quarter is expected to be

impacted by downtime to implement various improvements to the

crushing and conveying circuit. Combined with the partial reporting

period, third quarter Magino production is expected to be slightly

less than the second quarter. Production rates at Magino are

expected to improve in the fourth quarter and into 2025 reflecting

various improvements to the Magino mill that are being implemented

in the third quarter.

Reflecting the strong outperformance of La Yaqui

Grande during the first half of the year, Mulatos District

production guidance has been increased by 15% to between 185,000

and 195,000 ounces.

AISC guidance has increased 11% relative to

previous guidance (based on the mid-point) with nearly all of the

increase attributable to the inclusion of relatively higher cost

production from Magino during the ramp up of the operation.

Young-Davidson’s AISC guidance was increased by

4% to reflect higher realized costs during the first quarter which

had been impacted by temporary downtime to replace head ropes in

the Northgate shaft. Young-Davidson’s costs decreased significantly

in the second quarter and are expected to continue to improve in

the second half of the year. Additionally, the increase in the

Company’s share price during the year resulted in a revaluation of

previously issued stock based compensation which contributed to

approximately $10 per ounce increase in AISC guidance.

Capital guidance for 2024 has increased by 2%

relative to previous guidance. The increase reflects the inclusion

of Magino, largely offset by capital savings at Island Gold through

the integration of the two operations. With ore from Island Gold to

be processed at lower operating costs through the larger Magino

mill starting early 2025, the Island Gold mill expansion and

tailings lift previously planned for 2024 are no longer

required.

Capital spending at Magino during the second half of 2024 will

be comprised of capitalized stripping and equipment leases, as well

as ongoing work on the mill optimization.

2024 – 2026 Guidance: Operating Mines

|

|

2024 |

2025 |

2026 |

|

|

Current |

Previous(1) |

Current |

Previous(1) |

Current |

Previous(1) |

| Gold

Production (000 oz) |

|

|

|

|

|

|

|

Young-Davidson |

180 - 190 |

180 - 195 |

180 - 195 |

180 - 195 |

180 - 195 |

180 - 195 |

|

Island Gold

District(2) |

145 - 155 |

145 - 160 |

275 - 300 |

170 - 185(1) |

330 - 355 |

220 - 235(1) |

|

Magino

Mine(2) |

40 - 50 |

n/a |

n/a |

n/a |

|

Mulatos District |

185 - 195 |

160 - 170 |

120 - 130 |

120 - 130 |

120 - 130 |

120 - 130 |

|

Total Gold Production (000 oz) |

550 - 590 |

485 - 525 |

575 - 625 |

470 - 510 |

630 - 680 |

520 - 560 |

|

|

|

|

|

|

|

|

|

Total Cash

Costs(3)

($/oz) |

$890 - 940 |

$825 - 875 |

$775 - 875 |

$700 - 800 |

$750 - 850 |

$675 - 775 |

|

All-in Sustaining

Costs(3),(4)

($/oz) |

$1,250 - 1,300 |

$1,125 - 1,175 |

$1,175 - 1,275 |

$1,050 - 1,150 |

$1,100 - 1,200 |

$975 - 1,075 |

|

|

|

|

|

|

|

|

|

Sustaining

capital(3),(5)

($ millions) |

$128 - 145 |

$93 - 105 |

$145 - 160 |

$115 - 125 |

$135 - 150 |

$105 - 115 |

|

Growth

capital(3),(5)

($ millions) |

$202 - 230 |

$232 - 260 |

$280 - 315 |

$195 - 225 |

$210 - 240 |

$70 - 85 |

| Total sustaining &

growth

capital(3),(5)

(Operating mines; ex. Exploration) ($ millions) |

$330 - 375 |

$325 - 365 |

$425 - 475 |

$310 - 350 |

$345 - 390 |

$175 - 200 |

|

|

|

|

|

|

|

|

(1) Previous guidance was issued on January 10, 2024

and related to Young-Davidson, Island Gold and Mulatos District

only.(2) 2024 production and cost estimates are for the

Island Gold Mine, for 2025 and 2026 the Island Gold District

includes both the Island Gold and Magino mines.(3) Refer

to the “Non-GAAP Measures and Additional GAAP” disclosure at the

end of this press release for a description of these

measures.(4) All-in sustaining cost guidance for 2025

and 2026 includes similar assumptions for G&A and stock based

compensation as included in 2024.(5) Sustaining and

growth capital guidance is for producing mines and PDA development,

but excludes capital for Lynn Lake and capitalized exploration.

Production guidance for 2025 has increased 22%

relative to previous guidance reflecting a full year of production

from Magino, at higher milling rates. Starting in 2025, production

and costs from Magino will be reported as part of the Island Gold

District with both operations to be integrated and utilizing one

centralized mill and tailings facility. Milling rates at the Magino

mill are expected to increase to design rates of 10,000 tonnes per

day (“tpd”) within the fourth quarter of 2024, with a further

increase to an optimized rate of 11,200 tonnes per day expected

early in 2025.

At that point, the Island Gold mill will be shut

down and Island Gold ore will be processed through the Magino mill

at significantly lower processing costs. An expansion of the mill

to 12,400 tpd is expected to be completed in 2026 and coincide with

the completion of the Phase 3+ Expansion. This is expected to

accommodate 10,000 tpd of ore from Magino and 2,400 tpd from Island

Gold.

Production guidance for 2026 has increased 21%

to between 630,000 and 680,000 ounces. This represents a 30%

increase from previous guidance for 2024 reflecting the inclusion

of Magino, as well as the completion of the Phase 3+ Expansion at

Island Gold. There are no changes to 2025 and 2026 guidance for the

Company’s other operations compared to previous guidance.

This growth is expected to continue into 2027

driven by a full year of production following the completion of the

Phase 3+ Expansion, as well as initial production from PDA in the

second half of the year. The Lynn Lake project represents further

growth potential with initial production as early as the latter

part of 2027.

AISC guidance for 2025 and 2026 has increased

11% and 12%, respectively, relative to previous guidance.

Consistent with 2024, this reflects the inclusion of relatively

higher-cost production from Magino. AISC is expected to decrease to

between $1,100 and $1,200 per ounce in 2026, a 10% decrease from

2024 driven by low-cost growth at Island Gold, and improving costs

at Magino. This trend is expected to continue beyond 2026 with AISC

expected to decrease below $1,100 per ounce reflecting additional

low-cost growth from Island Gold and Lynn Lake.

Capital spending in 2025 and 2026 was revised

higher from the previous guidance to reflect:

-

capital for the construction of the high-return PDA project, as

outlined in the development plan announced on September 4,

2024

-

the inclusion of Magino and associated capital for tailings,

equipment leases, normal-course maintenance, as well as projects

that were deferred by the previous operator, including the

construction of a truck shop and fish habitat

-

capital to connect Magino to the electric grid by 2026. This is

expected to drive significant operating cost savings with power to

Magino currently generated by a Compressed Natural Gas (“CNG”)

plant

- a 5% increase in capital to

complete the Phase 3+ Expansion reflecting ongoing inflation since

the first half of 2022, and scope changes. This was largely offset

by synergies through the integration of Magino and Island Gold, as

well as the weaker Canadian dollar

(1) Production and AISC are based on mid-point of guidance;

previous guidance was issued on January 10, 2024 and related to

Young-Davidson, Island Gold and Mulatos District only.(2) Refer to

the “Non-GAAP Measures and Additional GAAP” disclosure at the end

of this press release for a description of these measures.(3) Total

consolidated all-in sustaining costs include corporate and

administrative and share based compensation expenses.

Updated Phase 3+ Expansion

CapitalThe Phase 3+ Expansion initial capital estimate has

been updated to reflect inflation and scope changes since the Phase

3+ Expansion Study was completed in the first half of 2022, as well

as synergies from the acquisition of Magino.

Initial capital for the Phase 3+ Expansion has

been increased by approximately $40 million to the expected

completion of the expansion in 2026. Initial capital is now

expected to total $796 million, a 5% increase from the initial

capital estimate of $756 million provided in the first half of

2022.

The increase was driven by ongoing inflationary

pressures since 2022, and scope changes to the project, partly

offset by synergies from the Magino acquisition, and the weaker

Canadian dollar. The key changes within the updated capital

estimate are as follows:

-

Magino mill expansion: $40 million increase for the expansion of

the Magino mill to 12,400 tpd by 2026. This will accommodate ore

from both Magino and the increased production from Island Gold

following the completion of the Phase 3+ Expansion

-

Inflation: $90 million increase in capital driven by more than two

years of labour and material inflation representing a 12% increase

on the total capital spend between 2022 and 2026. Since the Phase

3+ Expansion Study was completed in the first half of 2022,

company-wide inflation has averaged 5% per year

-

Scope changes: $30 million increase reflecting the following

changes to the project:

-

Relocation of crushing facility from surface to underground. This

will further optimize the flow of ore handling from the underground

to the mill, and reduce required maintenance of the hoisting

plant

-

Construction of a larger and modern administrative building at the

shaft site, replacing the existing buildings located near the

soon-to-be decommissioned Island Gold mill

-

Construction of a new haul road from the underground portal at

Island Gold to the Magino mill, allowing ore to be transported to

the larger Magino mill for processing starting early 2025

-

Synergies: $90 million decrease in capital with the mill expansion

at Island Gold no longer required. Ore from Island Gold is expected

to be processed through the significantly larger Magino mill

starting in 2025

-

Weaker Canadian dollar: $30 million decrease in capital based on

updated USD/CAD assumption of $0.75:1 to reflect more current

exchanges rates. The initial capital estimate prepared in 2022 was

based on a USD/CAD exchange rate of $0.78:1

In addition to the initial capital savings to be

realized through the cancellation of the Island Gold mill

expansion, the Company expects to benefit from additional life of

mine capital savings with no further expansions of the Island Gold

tailings facility required. The operation is also expected to

realize approximately $25 million per year of operating cost

savings through the integration of the two operations and use of

the significantly larger and more productive Magino mill to process

Island Gold ore.

As of June 30, 2024, $381 million had been spent

on the Phase 3+ Expansion, representing 48% of the updated initial

capital estimate. The Phase 3+ Expansion remains on track for

completion in the first half of 2026 with total remaining initial

capital expected to be $415 million.

AssumptionsThe 2024 to 2026

production forecast, operating cost and capital estimates remain

based on a USD/CAD foreign exchange rate of $0.75:1 and MXN/USD

foreign exchange rate of 17:1, with the exception of PDA capital

which is based on a foreign exchange rate of 18:1. Cost assumptions

for 2025 and 2026 are based on 2024 input costs and have not been

increased to reflect potential inflation in those years. These

estimates may be updated in the future to reflect inflation beyond

what is currently forecast for 2024.

Qualified PersonsChris

Bostwick, Alamos’ Senior Vice President, Technical Services, who is

a qualified person within the meaning of National Instrument 43-101

Standards of Disclosure for Mineral Projects, has reviewed and

approved the scientific and technical information contained in this

press release.

About AlamosAlamos is a

Canadian-based intermediate gold producer with diversified

production from three operations in North America. This includes

the Young-Davidson mine and Island Gold District in northern

Ontario, Canada, and the Mulatos District in Sonora State, Mexico.

Additionally, the Company has a strong portfolio of growth

projects, including the Phase 3+ Expansion at Island Gold, and the

Lynn Lake project in Manitoba, Canada. Alamos employs more than

2,400 people and is committed to the highest standards of

sustainable development. The Company’s shares are traded on the TSX

and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

|

Scott K. Parsons |

|

|

Senior Vice President, Corporate Development & Investor

Relations |

|

|

(416) 368-9932 x 5439 |

|

|

|

|

|

Khalid Elhaj |

|

|

Vice President, Business Development & Investor Relations |

|

|

(416) 368-9932 x 5427 |

|

|

ir@alamosgold.com |

|

|

|

|

The TSX and NYSE have not reviewed and do not accept

responsibility for the adequacy or accuracy of this release.

Cautionary NoteThis press

release contains or incorporates by reference “forward-looking

statements” and “forward-looking information” as defined under

applicable Canadian and U.S. securities laws. All statements, other

than statements of historical fact, which address events, results,

outcomes or developments that the Company expects to occur are, or

may be deemed to be, forward-looking statements and are generally,

but not always, identified by the use of forward-looking

terminology such as "expect", “assume”, “estimate”, “potential”,

“outlook”, “on track”, “continue”, “ongoing”, "will", “believe”,

“anticipate”, "intend", "estimate", "forecast", "budget", “target”,

“plan” or variations of such words and phrases and similar

expressions or statements that certain actions, events or results

“may", “could”, “would”, "might" or "will" be taken, occur or be

achieved or the negative connotation of such terms. Forward-looking

statements contained in this press release are based on

expectations, estimates and projections as of the date of this

press release.

Forward-looking statements in this press release

include, but may not be limited to, information, expectations and

guidance as to strategy, plans, future financial and operating

performance, such as expectations and guidance regarding: costs

(including cash costs, AISC, mine-site AISC, capital expenditures ,

exploration spending), cost structure and anticipated declining

cost profile; budgets; growth capital; sustaining capital; cash

flow; foreign exchange rates; gold and other metal price

assumptions; anticipated gold production, production rates, timing

of production, production potential and growth; returns to

stakeholders; the mine plan for and expected results from the

Puerto Del Aire (PDA) project as well as the Phase 3+ expansion at

Island Gold and timing of its progress and completion; feasibility

of, development of, and mine plan for, the Lynn Lake project and

potential growth in production resulting from the Lynn Lake

project; continued improvements at the Magino operation; expected

synergies and long-term opportunities from the integration of

Magino with Island Gold; future expansions of the Island Gold

District; upcoming catalysts, including expected timing, such as

the Burnt Timber and Linkwood study, 2024 Mineral Reserve and

Resource update, Island Gold District Life of Mine Plan and

expansion study as well as exploration updates; mining, milling and

processing and rates; mined and processed gold grades and weights;

mine life; Mineral Reserve life; planned exploration, drilling

targets, exploration potential and results; as well as any other

statements related to the Company's production forecasts and plans,

expected sustaining costs, expected improvements in cash flows and

margins, expectations of changes in capital expenditures, expansion

plans, project timelines, and expected sustainable productivity

increases, expected increases in mining activities and

corresponding cost efficiencies, cost estimates, sufficiency of

working capital for future commitments, Mineral Reserve and Mineral

Resource estimates, and other statements or information that

express management's expectations or estimates of future

performance, operational, geological or financial results.

The Company cautions that forward-looking

statements are necessarily based upon several factors and

assumptions that, while considered reasonable by management at the

time of making such statements, are inherently subject to

significant business, economic, technical, legal, political and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information.

Such factors and assumptions underlying the

forward-looking statements in this press release, include (without

limitation): changes to current estimates of Mineral Reserves and

Resources; changes to production estimates (which assume accuracy

of projected ore grade, mining rates, recovery timing and recovery

rate estimates and may be impacted by unscheduled maintenance,

weather issues, labour and contractor availability and other

operating or technical difficulties); operations may be exposed to

new illnesses, diseases, epidemics and pandemics (and any related

regulatory or government responses) and associated impact on the

broader market and the trading price of the Company’s shares;

provincial, state and federal orders or mandates (including with

respect to mining operations generally or auxiliary businesses or

services required for the Company’s operations) in Canada, Mexico,

the United States and Türkiye, all of which may affect many aspects

of the Company’s operations including the ability to transport

personnel to and from site, contractor and supply availability and

the ability to sell or deliver gold doré bars; fluctuations in the

price of gold or certain other commodities such as, diesel fuel,

natural gas and electricity; changes in foreign exchange rates

(particularly the Canadian dollar, U.S. dollar, Mexican peso and

Turkish Lira); the impact of inflation; changes in the Company’s

credit rating; any decision to declare a dividend; employee and

community relations; labour and contractor availability (and being

able to secure the same on favourable terms); the impact of

litigation and administrative proceedings (including but not

limited to the investment treaty claim announced on April 20, 2021

against the Republic of Türkiye by the Company’s wholly-owned

Netherlands subsidiaries, Alamos Gold Holdings Coöperatief U.A. and

Alamos Gold Holdings B.V., the application for judicial review of

the positive Decision Statement issued by the Ministry of

Environment and Climate Change Canada commenced by the Mathias

Colomb Cree Nation (MCCN) in respect of the Lynn Lake project and

the MCCN’s corresponding internal appeal of the Environment Act

Licences issued by the Province of Manitoba for the project) and

any resulting court, arbitral and/or administrative decisions;

disruptions affecting operations; availability of and increased

costs associated with mining inputs and labour; risks associated

with the startup of new mines; permitting, construction or other

delays in or with the Phase 3+ Expansion at Island Gold,

development of the PDA project, construction decisions and any

development of the Lynn Lake project, and/or the development or

updating of mine plans; changes with respect to the intended method

of accessing, mining and processing ore from Lynn Lake and the

deposit at PDA; exploration opportunities and potential in the

Mulatos District, at Young Davidson, Island Gold and/or Magino mine

not coming to fruition; inherent risks and hazards associated with

mining and mineral processing including environmental hazards,

industrial accidents, unusual or unexpected formations, pressures

and cave-ins; the risk that the Company’s mines may not perform as

planned; uncertainty with the Company's ability to secure

additional capital to execute its business plans; the speculative

nature of mineral exploration and development, including the risks

of obtaining and maintaining necessary licenses, permits and

authorizations, contests over title to properties; expropriation or

nationalization of property; political or economic developments in

Canada, Mexico, the United States, Türkiye and other jurisdictions

in which the Company may carry on business in the future; increased

costs and risks related to the potential impact of climate change;

changes in national and local government legislation, controls or

regulations (including tax and employment legislation) in

jurisdictions in which the Company does or may carry on business in

the future; the costs and timing of construction and development of

new deposits; risk of loss due to sabotage, protests and other

civil disturbances; disruptions in the maintenance or provision of

required infrastructure and information technology systems, the

impact of global liquidity and credit availability and the values

of assets and liabilities based on projected future cash flows;

risks arising from holding derivative instruments; and business

opportunities that may be pursued by the Company.

For a more detailed discussion of such risks and

other factors that may affect the Company's ability to achieve the

expectations set forth in the forward-looking statements contained

in this press release, see the Company’s latest 40-F/Annual

Information Form and Management’s Discussion and Analysis, each

under the heading “Risk Factors” available on the SEDAR+ website at

www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should

be reviewed in conjunction with the information and risk factors

and assumptions found in this press release.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Cautionary non-GAAP Measures and

Additional GAAP MeasuresNote that for purposes of this

section, GAAP refers to IFRS. The Company believes that investors

use certain non-GAAP and additional GAAP measures as indicators to

assess gold mining companies. They are intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared with GAAP.

“Cash flow from operating activities before

changes in non-cash working capital” is a non-GAAP performance

measure that could provide an indication of the Company’s ability

to generate cash flows from operations and is calculated by adding

back the change in non-cash working capital to “cash provided by

(used in) operating activities” as presented on the Company’s

consolidated statements of cash flows. “Cash flow per share” is

calculated by dividing “cash flow from operations before changes in

working capital” by the weighted average number of shares

outstanding for the period. “Free cash flow” is a non-GAAP

performance measure that is calculated as cash flows from

operations net of cash flows invested in mineral property, plant

and equipment and exploration and evaluation assets as presented on

the Company’s consolidated statements of cash flows and that would

provide an indication of the Company’s ability to generate cash

flows from its mineral projects. “Mine site free cash flow” is a

non-GAAP measure which includes cash flow from operating activities

at, less capital expenditures at each mine site. “Return on equity”

is defined as earnings from continuing operations divided by the

average total equity for the current and previous year. “Mining

cost per tonne of ore” and “cost per tonne of ore” are non-GAAP

performance measures that could provide an indication of the mining

and processing efficiency and effectiveness of the mine. These

measures are calculated by dividing the relevant mining and

processing costs and total costs by the tonnes of ore processed in

the period. “Cost per tonne of ore” is usually affected by

operating efficiencies and waste-to-ore ratios in the period.

“Sustaining capital” are expenditures that do not increase annual

gold ounce production at a mine site and excludes all expenditures

at the Company’s development projects. “Growth capital” are

expenditures primarily incurred at development projects and costs

related to major projects at existing operations, where these

projects will materially benefit the mine site. “Capitalized

exploration” are expenditures that meet the IFRS definition for

capitalization, and are incurred to further expand the known

Mineral Reserve and Resource at existing operations or development

projects. “Total capital expenditures per ounce produced” is a

non-GAAP term used to assess the level of capital intensity of a

project and is calculated by taking the total growth and sustaining

capital of a project divided by ounces produced life of mine.

“Total cash costs per ounce”, “all-in sustaining costs per ounce”,

“mine-site all-in sustaining costs”, and “all-in costs per ounce”

as used in this analysis are non-GAAP terms typically used by gold

mining companies to assess the level of gross margin available to

the Company by subtracting these costs from the unit price realized

during the period. These non-GAAP terms are also used to assess the

ability of a mining company to generate cash flow from operations.

There may be some variation in the method of computation of these

metrics as determined by the Company compared with other mining

companies. In this context, “total cash costs” reflects mining and

processing costs allocated from in-process and doré inventory and

associated royalties with ounces of gold sold in the period. Total

cash costs per ounce are exclusive of exploration costs. “All-in

sustaining costs per ounce” include total cash costs, exploration,

corporate and administrative, share based compensation and

sustaining capital costs. “Mine-site all-in sustaining costs”

include total cash costs, exploration, and sustaining capital costs

for the mine-site, but exclude an allocation of corporate and

administrative and share based compensation. “Adjusted net

earnings” and “adjusted earnings per share” are non-GAAP financial

measures with no standard meaning under IFRS. “Adjusted net

earnings” excludes the following from net earnings: foreign

exchange gain (loss), items included in other loss, certain

non-reoccurring items and foreign exchange gain (loss) recorded in

deferred tax expense. “Adjusted earnings per share” is calculated

by dividing “adjusted net earnings” by the weighted average number

of shares outstanding for the period. Additional GAAP measures that

are presented on the face of the Company’s consolidated statements

of comprehensive income and are not meant to be a substitute for

other subtotals or totals presented in accordance with IFRS, but

rather should be evaluated in conjunction with such IFRS measures.

This includes “Earnings from operations”, which is intended to

provide an indication of the Company’s operating performance, and

represents the amount of earnings before net finance

income/expense, foreign exchange gain/loss, other income/loss, and

income tax expense. Non-GAAP and additional GAAP measures do not

have a standardized meaning prescribed under IFRS and therefore may

not be comparable to similar measures presented by other companies.

A reconciliation of historical non-GAAP and additional GAAP

measures are available in the Company’s latest Management’s

Discussion and Analysis available online on the SEDAR+ website at

www.sedarplus.ca or on EDGAR at www.sec.gov and at

www.alamosgold.com.

Graphs accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/42606370-bfae-4488-a3e0-023ad84da0d6

https://www.globenewswire.com/NewsRoom/AttachmentNg/d3cba6ad-8b75-47b8-b2e6-9dafe0a06ea8

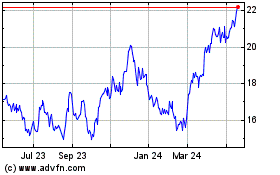

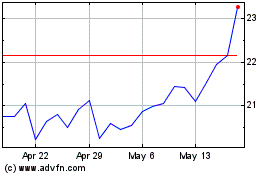

Alamos Gold (TSX:AGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Alamos Gold (TSX:AGI)

Historical Stock Chart

From Dec 2023 to Dec 2024