This news release contains forward-looking information that is

based upon assumptions and is subject to risks and uncertainties as

indicated in the cautionary note contained elsewhere in this news

release.

Andrew Peller Limited (TSX: ADW.A)(TSX: ADW.B) (the "Company")

announced today its results for the three and nine months ended

December 31, 2008.

Solid Growth Continues

Sales for the three months ended December 31, 2008 increased

10.4% to $72.9 million from $66.1 million in the prior year. For

the first nine months of fiscal 2009 sales rose 9.5% to $201.9 from

$184.4 million for the same period last year. The increases are due

primarily to ongoing initiatives to grow sales of the Company's

blended varietal table and ultra-premium wines through all trade

channels, the introduction of new products and the acquisition of

World Vintners Inc. ("WVI") on June 30, 2008 and Small Winemakers

Collection Inc. ("SWM") on October 8, 2008.

Gross profit as a percentage of sales declined to 41.3% for the

three months ended December 31, 2008 compared to 43.5% in the same

period last year. For the first nine months of fiscal 2009, gross

profit as a percentage of sales was 41.7% compared to 43.1% for the

same period last year. The changes were due primarily to an

increase in the cost of domestic grapes and wine purchased on

international markets, the decline in value of the Canadian dollar

combined with higher packaging costs. Selling and administrative

expenses as a percentage of sales on a comparable basis for the

nine months ended December 31, 2008 were flat compared to the same

periods last year. The increase in dollar amounts is primarily due

to the acquisitions of WVI and SWM, the launch of new products and

increased efforts to market the Company's premium and ultra-premium

wines.

Not including net unrealized loss on derivative financial

instruments, unusual items in each year and the impact of future

federal income tax rate reductions, net earnings for the first nine

months of fiscal 2009 increased 5.4% to $10.6 million compared to

the same period last year. Included in net earnings (losses) in the

nine and three months ended December 31, 2008 were after-tax

non-cash charges of $7.1 million and $6.2 million related to

mark-to-market adjustments on interest rate swaps and foreign

exchange contracts. These derivative financial instruments are

considered to be effective economic hedges and have enabled

management to mitigate the volatility of changing prices on

operating costs and interest expense. The Company has not applied

hedge accounting to these instruments, however management expects

to hold these contracts to maturity and accordingly no gain or loss

would ultimately be recognized. For the period ended December 31,

2007, the Company recorded a one-time reduction in its income tax

provision which related to future federal income tax rate

reductions that took effect and resulted in saving of $0.75

million. For the nine months ended December 31, 2008, net earnings

were $3.1 million or $0.22 per Class A share compared to $10.6

million or $0.73 per Class A share for the same period last year

and a net loss of $2.0 million or $0.13 per Class A share for the

three months ended December 31, 2008 compared to net earnings of

$5.0 million or $0.35 per Class A share for the three months ended

December 31, 2007.

"We were pleased with our growth in the third quarter and first

nine months of fiscal 2009," commented John Peller, President and

CEO. "Looking ahead, we are beginning to experience a moderate

softening in demand within certain of our trade channels, including

our estate wineries, restaurant sales and our consumer made wine

business, due primarily to reduced consumer spending resulting from

the slowing of the North American economy. In addition, we expect

to see a slight reduction over the near term in sales of our

ultra-premium brands as consumers' trade down to lower priced

wines, resulting in some margin pressure through the next few

quarters."

Financial Position

Working capital was $36.3 million at the end of the third

quarter of fiscal 2009 compared to $26.6 million at March 31, 2008.

Excluding the after-tax impact of mark-to-market adjustments on

interest rate swaps and foreign exchange contracts, shareholders'

equity at December 31, 2008 amounts to $108.2 million or $7.27 per

common share compared to $102.7 million or $6.89 per common share

at March 31, 2008. While credit markets have tightened in recent

months, the Company has successfully refinanced its long-term debt

to April 30, 2015 and is working on converting its demand operating

facility to a one year committed facility.

Acquisition Completed

On October 8, 2008 the Company completed the acquisition of 100%

of the common shares of SWM, a premium wine importer and marketing

agent for fine wines in the Province of Ontario for consideration

of approximately $1.6 million.

Dividend Increase

As previously announced, common share dividends were increased

by 10% for shareholders of record on June 30, 2008. The annual

dividend on Class A shares was increased to $0.33 per share from

$0.30 per share. The dividend on Class B shares was increased to

$0.288 per share from $0.261 per share.

"With the moderate softening in demand we expect to experience

in the coming quarters, we are closely monitoring all of our costs

and will react should we see any significant reduction in business

levels going forward," Mr. Peller concluded.

Financial Highlights (unaudited - complete consolidated

financial statements to follow)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Period Ended December 31, Three Months Nine Months

----------------------------------------------------------------------------

(in $000 except per share amounts) 2008 2007 2008 2007

----------------------------------------------------------------------------

Sales $ 72,892 $ 66,052 $201,866 $184,428

EBITA 10,436 9,823 25,914 25,019

Earnings before unrealized

derivative losses, and unusual

items 6,559 6,457 15,194 14,971

Net unrealized derivative losses,

and unusual items (9,412) (221) (10,704) (301)

Net and comprehensive earnings (1,973) 5,013 3,124 10,579

Net earnings (loss) per share

(Basic per Class A share) ($ 0.13) $ 0.35 $ 0.22 $ 0.73

Cash from operations (1,373) (6,188)

(after changes in non-cash working

capital items) 1,322 5,602

Working capital 36,301 24,439

Shareholders' equity per share $6.79 $ 6.91

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Andrew Peller Limited is a leading producer and marketer of

quality wines in Canada. With wineries in British Columbia, Ontario

and Nova Scotia, the Company markets wines produced from grapes

grown in Ontario's Niagara Peninsula, British Columbia's Okanagan

and Similkameen Valleys and vineyards around the world. The

Company's award-winning premium and ultra-premium brands include

Peller Estates, Trius, Hillebrand, Thirty Bench, Croc Crossing,

XOXO, Sandhill, Copper Moon, Calona Vineyards Artist Series and Red

Rooster VQA wines. Complementing these premium brands are a number

of popular priced products including Hochtaler, Domaine D'Or,

Schloss Laderheim, Royal and Sommet. With the acquisition of

Cascadia Brands Inc., the Company also markets craft beer under the

Granville Island brand. With a focus on serving the needs of all

wine consumers, the Company produces and markets consumer-made wine

kit products through Winexpert and Vineco International Products.

In addition, the Company owns and operates Vineyards Estate Wines,

Aisle 43 and WineCountry Vintners, independent wine retailers in

Ontario with more than 100 well-positioned retail locations. Andrew

Peller Limited common shares trade on the Toronto Stock Exchange

(symbols ADW.A and ADW.B).

The Company utilizes EBITA (defined as earnings before interest,

incomes taxes, depreciation, amortization, unrealized derivative

losses, and unusual items). EBITA is not a recognized measure under

GAAP. Management believes that EBITA is a useful supplemental

measure to net earnings, as it provides readers with an indication

of cash available for investment prior to debt service, capital

expenditures and income taxes. Readers are cautioned that EBITA

should not be construed as an alternative to net earnings

determined in accordance with GAAP as an indicator of the Company's

performance or to cash flows from operating, investing and

financing activities as a measure of liquidity and cash flows. In

addition, the Company's method of calculating EBITA may differ from

the methods used by other companies and, accordingly, may not be

comparable to measures used by other companies.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain

"forward-looking statements" within the meaning of applicable

securities laws, including the "safe harbour provision" of the

Securities Act (Ontario) with respect to Andrew Peller Limited (the

"Company") and its subsidiaries. Such statements include, but are

not limited to, statements about the growth of the business in

light of the Company's recent acquisitions; its launch of new

premium wines; sales trends in foreign markets; its supply of

domestically grown grapes; and current economic conditions. These

statements are subject to certain risks, assumptions and

uncertainties that could cause actual results to differ materially

from those included in the forward-looking statements. The words

"believe", "plan", "intend", "estimate", "expect" or "anticipate"

and similar expressions, as well as future or conditional verbs

such as "will", "should", "would" and "could" often identify

forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and

financial performance. With respect to forward-looking statements

contained in this news release, the Company has made assumptions

and applied certain factors regarding, among other things: future

grape, glass bottle and wine prices; its ability to obtain grapes,

imported wine, glass and its ability to obtain other raw materials;

fluctuations in the U.S./Canadian dollar exchange rates; its

ability to market products successfully to its anticipated

customers; the trade balance within the domestic Canadian wine

market; market trends; reliance on key personnel; protection of its

intellectual property rights; the economic environment; the

regulatory requirements regarding producing, marketing, advertising

and labelling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing

competition.

These forward-looking statements are also subject to the risks

and uncertainties discussed in this news release, in the "Risk

Factors" section and elsewhere in the Company's MD&A and other

risks detailed from time to time in the publicly filed disclosure

documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and assumptions

which could cause actual results to differ materially from those

conclusions, forecasts or projections anticipated in these

forward-looking statements. Because of these risks, uncertainties

and assumptions, you should not place undue reliance on these

forward-looking statements. The Company's forward-looking

statements are made only as of the date of this news release, and

except as required by applicable law, the Company undertakes no

obligation to update or revise these forward-looking statements to

reflect new information, future events or circumstances or

otherwise.

ANDREW PELLER LIMITED

CONSOLIDATED BALANCE SHEETS

These financial statements have not been reviewed by our auditors

December 31 March 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2008 2008

(expressed in thousands of Canadian dollars) $ $

----------------------------------------------------------------------------

Assets

Current Assets

Accounts receivable 29,276 23,072

Inventories 108,083 93,817

Prepaid expenses and other assets 5,114 4,242

Income taxes recoverable 2,617 823

-------------------------

145,090 121,954

Property, plant and equipment 101,860 94,480

Goodwill (note 3) 45,684 36,171

Other assets 7,121 7,139

-------------------------

299,755 259,744

-------------------------

-------------------------

Liabilities

Current Liabilities

Bank indebtedness 58,836 57,722

Accounts payable and accrued liabilities 37,860 29,272

Dividends payable 1,197 1,088

Current derivative financial instruments (note 4) 4,738 432

Current portion of long - term debt (note 4) 6,158 6,831

-------------------------

108,789 95,345

Long-term debt (note 4) 72,911 46,412

Long-term derivative financial instruments (note 4) 5,857 534

Employee future benefits 2,950 3,167

Future income taxes 8,102 11,606

-------------------------

198,609 157,064

-------------------------

Shareholders' Equity

Capital Stock 7,375 7,375

Retained Earnings 93,771 95,305

-------------------------

101,146 102,680

-------------------------

299,755 259,744

-------------------------

-------------------------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

Consolidated Statements of (Loss) Earnings, Comprehensive (Loss) Earnings

and Retained Earnings

These financial statements have not been reviewed by our auditors

(expressed in thousands of Canadian dollars)

For the Three For the Nine

Months Ended Months Ended

December 31 December 31

2008 2007 2008 2007

$ $ $ $

------------------------------------------------------- ------------------

Sales 72,892 66,052 201,866 184,428

Cost of goods sold, excluding

amortization 42,809 37,312 117,745 105,026

------- ------- ------- --------

Gross profit 30,083 28,740 84,121 79,402

Selling and administration 19,647 18,917 58,207 54,383

------- ------- ------- --------

Earnings before interest and

amortization 10,436 9,823 25,914 25,019

Interest 1,828 1,519 4,735 4,383

Amortization of plant, equipment

and intangibles 2,049 1,847 5,985 5,665

------- ------- ------- --------

Earnings before other items 6,559 6,457 15,194 14,971

Net unrealized loss on derivative

financial instruments (8,969) (118) (10,147) (74)

Unusual items (443) (103) (557) (227)

------- ------- ------- --------

Earnings (loss) before income taxes (2,853) 6,236 4,490 14,670

------- ------- ------- --------

Provision for income taxes

Current 1,810 1,945 4,385 4,670

Future (2,690) (722) (3,019) (579)

------- ------- ------- --------

(880) 1,223 1,366 4,091

------- ------- ------- --------

Net and comprehensive (loss)

earnings for the period (1,973) 5,013 3,124 10,579

Retained earnings - Beginning

of period 96,941 91,666 95,305 88,147

Impact of adopting accounting

pronouncements on April 1, 2007 - - - 128

Impact of adopting accounting

pronouncement on April 1, 2008

(note 1) - - (1,067) -

------- ------- ------- --------

Retained earnings - Beginning of

period as restated 96,941 91,666 94,238 88,275

------- ------- ------- --------

Dividends:

Class A and Class B (1,197) (1,088) (3,591) (3,263)

------- ------- ------- --------

Retained earnings - End of period 93,771 95,591 93,771 95,591

------- ------- ------- --------

------- ------- ------- --------

Net (loss) earnings per share

Basic and diluted

Class A shares (0.13) 0.35 0.22 0.73

------- ------- ------- --------

------- ------- ------- --------

Class B shares (0.12) 0.30 0.19 0.63

------- ------- ------- --------

------- ------- ------- --------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

Consolidated Statements of Cash Flows

These financial statements have not been reviewed by our auditors

(expressed in thousands of Canadian dollars)

For the Three For the Nine

Months Ended Months Ended

December 31 December 31

2008 2007 2008 2007

$ $ $ $

------------------------------------------------------- ------------------

Cash provided by (used in)

Operating activities

Net (loss) earnings for the period (1,973) 5,013 3,124 10,579

Items not affecting cash:

Amortization of plant, equipment

and intangibles 2,049 1,847 5,985 5,665

Employee future benefits (14) (627) (217) (814)

Net unrealized loss on derivative

financial instruments 8,969 118 10,147 74

Future income taxes (2,690) (722) (3,019) (579)

Write-off of deferred financing

costs 366 - 366 -

Amortization of deferred financing

costs 51 39 144 112

------- ------- ------- --------

6,758 5,668 16,530 15,037

Changes in non-cash working capital

items related to operations (note 5) (8,131) (11,856) (15,208) (9,435)

------- ------- ------- --------

(1,373) (6,188) 1,322 5,602

------- ------- ------- --------

Investing activities

Acquisition of businesses (note 3) (1,610) - (16,582) -

Purchase of property and equipment (2,258) (2,640) (7,689) (11,732)

------- ------- ------- --------

(3,868) (2,640) (24,271) (11,732)

------- ------- ------- --------

Financing activities

Increase in deferred financing

costs (17) - (304) -

Increase in bank indebtedness 7,789 11,392 1,113 10,180

Increase in long-term debt (note 4) - - 29,036 3,470

Repayment of long-term debt (1,334) (1,477) (3,414) (4,428)

Dividends paid (1,197) (1,087) (3,482) (3,092)

------- ------- ------- --------

5,241 8,828 22,949 6,130

------- ------- ------- --------

Cash at beginning and end of period - - - -

------- ------- ------- --------

------- ------- ------- --------

Supplemental disclosure of cash flow

information

Cash paid during the period for

Interest 2,190 1,380 4,846 4,067

Income taxes 2,199 960 4,558 4,254

The accompanying notes are an integral part of these interim consolidated

financial statements

Notes to the Interim Consolidated Financial Statements

December 31, 2008 and 2007

(in thousands of dollars, except per share amounts)

UNAUDITED

1. Summary of Significant Accounting Policies

The interim consolidated financial statements have been prepared

in accordance with accounting principles generally accepted in

Canada. The note disclosure for these interim consolidated

financial statements only presents material changes to the

disclosure found in the Company's audited consolidated financial

statements for the years ended March 31, 2008 and 2007. These

interim consolidated financial statements should be read in

conjunction with those consolidated financial statements and follow

the same accounting policies as the audited consolidated financial

statements except as disclosed below. In the opinion of management,

the accompanying unaudited interim consolidated financial

statements contain all adjustments necessary to present fairly, in

all material respects the financial position of the Company as at

December 31, 2008 and for the three and nine-month period then

ended.

Recently adopted accounting pronouncements

On April 1, 2008 the Company adopted the Canadian Institute of

Chartered Accountants (CICA) handbook Sections 3031 "Inventories,"

Section 3862 "Financial Instruments - Disclosures," Section 3863

"Financial Instruments - Presentation" and Section 1535 "Capital

Disclosures."

a) Inventories

On April 1, 2008 the Company adopted the CICA Handbook Section

3031 "Inventories". This pronouncement provides guidance on the

determination of cost and its subsequent recognition as an expense,

including any write-down to net realizable value. It also provides

guidance on the cost formulas that are used to assign costs to

inventories and is effective for the Company's fiscal years

beginning on April 1, 2008. As required, this standard has been

adopted prospectively and comparative amounts have not been

restated. The change predominately relates to changes in the

application of overhead cost allocations to bulk and finished goods

inventory. As a result, on adoption of this standard, the Company

recorded an adjustment on April 1, 2008 to reduce inventories by

$1,552, reduce future income taxes by $485, and reduce opening

retained earnings by $1,067.

b) Financial Instruments Presentation and Disclosures, and

Capital Disclosures

On April 1, 2008 the Company adopted CICA handbook Section 3862

"Financial Instruments - Disclosures," section 3863 "Financial

Instruments - Presentation" and section 1535 "Capital Disclosures."

These sections require additional disclosures surrounding the

Company's financial instruments and capital. The following

disclosures are required under the new pronouncement:

Interest rate risk

The Company's interest rate risk arises mainly from the interest

rate impact on our cash, floating rate debt and interest rate swap.

Our interest rate management policy is to borrow at fixed rates to

match the duration of long lived assets. Floating rate funding is

used for short term borrowing.

The Company has fixed interest on long-term debt at 5.64% until

April 30, 2015 by entering into an interest rate swap. The

Company's short-term borrowings are funded using a floating

interest rate and as such are sensitive to interest rate movements.

As at December 31, 2008, with other variables unchanged, a 1%

change in interest rates would impact the Company's net earnings by

approximately $350, exclusive of the mark to market adjustments on

the interest rate swap.

Credit Risk

The Company's exposure to credit risk is very limited. Credit

risk for trade receivables is monitored through established credit

monitoring activities. Over 50% of the Company's accounts

receivable balance relates to amounts owing from Canadian

provincial liquor boards. Excluding accounts receivable from

Canadian provincial liquor board amounts, the Company does not have

a significant concentration of credit risk with any single

counterparty or group of counterparties. The maximum exposure to

credit risk is equal to the carrying value of the financial

assets.

Amounts owing from Canadian provincial liquor boards represent

$14,740 of the $29,276 in total accounts receivables all of which

has been deemed to be collectible. Of the remaining non provincial

liquor board balances, $2,734 had aged over sixty days as of

December 31, 2008. An allowance for doubtful accounts of $504 has

been provided against these accounts receivable amounts which the

Company has determined to represent a reasonable estimate of

amounts that may be uncollectible.

Liquidity Risk

The Company manages liquidity risk by maintaining adequate cash

and cash equivalent balances and by appropriately utilizing its

line of credit. Company management continuously monitors and

reviews both actual and forecasted cash flows and matches the

maturity profile of financial assets and financial liabilities.

Accounts payable are generally due within 30 days and long-term

debt payment requirements are disclosed in note 4.

The following table outlines the Company's contractual

obligations, including long-term debt, operating leases, and

commitments on short-term forward foreign exchange contracts used

to hedge the currency risk on U.S. dollar purchases as at December

31, 2008.

Less Greater

Than 1 2 - 3 4 - 5 Than 5

Total Year Years Years Years

Long-term debt 79,345 6,158 11,492 10,667 51,028

Operating leases 19,061 4,439 5,728 1,749 7,145

Pension obligations 5,707 847 2,541 1,694 625

Long-term grape contracts 357,461 25,845 51,637 51,179 228,800

----------------------------------------------

Total contractual obligations 461,574 37,289 71,398 65,289 287,598

----------------------------------------------

----------------------------------------------

Foreign exchange risk

The Company's foreign exchange risk arises on the purchase of

bulk wine and concentrate which are made in U.S. dollars and Euros.

The Company's strategy is to hedge approximately 50% - 80% of its

foreign exchange requirements prior to the beginning of each fiscal

year. The Company has entered into a series of foreign exchange

contracts as a hedge against movements in U.S. dollar and Euro

exchange rates. These contracts are reviewed regularly. A one

percent change in the value of the U.S. dollar and Euro would

impact the Company's net earnings by approximately $100 and $30

respectively.

Capital Disclosures

The Company's objective when managing capital is to safeguard

the Company's ability as a going concern, to provide an adequate

return to shareholders and to meet external capital requirements on

our debt and credit facilities. Unfunded capital expenditures are

limited to $10,000 on an annual basis and this is reviewed

quarterly.

As part of the existing debt agreement, three key financial

covenants are monitored on an ongoing basis by management to ensure

compliance with the agreement as follows:

- Funded debt to a rolling twelve month EBITDA

- Working capital ratio

- Fixed charge coverage ratio

In order to facilitate management of its capital requirements,

the Company prepares annual budgets that are updated as necessary

depending on various factors including general industry conditions.

The annual budget is approved by the Board of Directors. As at

December 31, 2008, the Company has remained in compliance with all

external lending agreement covenants.

Recently issued accounting pronouncements

International Financial Reporting Standards

In February 2008, the Canadian Accounting Standards Board

confirmed that the use of International Financial Reporting

Standards ("IFRS") will be required for Canadian publicly

accountable companies for fiscal years beginning on or after

January 1, 2011. The Company is currently evaluating the impact of

adopting IFRS.

Goodwill and intangible assets

In February 2008, The Canadian Institute of Chartered

Accountants issued Section 3064, "Goodwill and Intangible Assets"

which replaces Section 3062, "Goodwill and Other Intangible

Assets". The new standard provides guidance on the recognition,

measurement and disclosure of goodwill and intangible assets and is

effective for annual periods beginning on or after October 1, 2008.

The Company is currently evaluating the impact of adopting this

standard.

2. Seasonality

The third quarter of each year is historically the strongest in

terms of sales, gross profit and net earnings due to increased

consumer purchasing of the Company's products during the holiday

season.

3. Acquisitions

On June 13, 2008 the Company acquired 50% of the shares of Rocky

Ridge Vineyards Inc. ("Rocky Ridge") of Oliver, British Columbia

for consideration of $4,016, including acquisition costs. The

Company previously owned 50% of the shares of Rocky Ridge and as a

result of this transaction Rocky Ridge becomes a wholly-owned

subsidiary of the Company. The allocation of purchase price is

preliminary and is based on management's estimates of the fair

value of the assets acquired and liabilities assumed. Management is

currently obtaining fair market values for the net assets acquired,

including the estimated remaining useful lives. Details of net

assets acquired are as follows: vineyards - $4,400; goodwill -

$219; bank indebtedness - ($603). This transaction was accounted

for using the purchase method. The results of operations have been

fully consolidated with those of the Company's effective June 14,

2008.

On June 30, 2008 the Company's wholly-owned subsidiary, 1773008

Ontario Inc. acquired 100% of the common shares of World Vintners

Inc. for consideration of $10,956, including acquisition costs. The

allocation of purchase price is preliminary and is based on

management's estimates of the fair value of the assets acquired and

liabilities assumed. Management is currently obtaining fair market

values for the net assets and intangible assets acquired, including

the estimated remaining useful lives. Details of net assets

acquired based on preliminary allocations are as follows: accounts

receivable - $1,170; inventories - $1,269; income taxes recoverable

- $1,625; property, plant and equipment - $844; intangible assets -

$380; goodwill - $8,125; other assets - $72; accounts payable and

accrued liabilities - ($2,529). This transaction was accounted for

using the purchase method. The results of operations have been

included in the consolidated financial statements of the Company,

effective July 1, 2008.

On October 8, 2008 the Company acquired 100% of the outstanding

shares of The Small Winemakers Collection Inc. of Toronto, Ontario

for consideration of $1,610 including acquisition costs. The

allocation of purchase price is preliminary and is based on

management's estimates of the fair value of the assets acquired and

liabilities assumed. Management is currently obtaining fair market

values for the net assets and intangible assets acquired, including

the estimated remaining useful lives. Details of net assets

acquired based on preliminary allocations are as follows: accounts

receivables - $632; property, plant and equipment - $34; other

assets - $36; goodwill - $1,169; accounts payable and accrued

liabilities - $261. This transaction was accounted for using the

purchase method. The results of operations have been included in

the consolidated financial statements of the Company, effective

October 9, 2008.

The value assigned to goodwill in all three acquisitions is not

deductible for tax purposes.

4. Long-term debt and derivative financial instruments

On May 15, 2008, the Company's four existing term loans were

replaced with one seven year variable rate term facility in the

amount of $80,000. The new term loan is repayable in monthly

principal payments of $444 plus interest and matures on April 30,

2015. Subsequent to the repayment of the old term loans, the

Company unwound the three interest rate swaps related to the term

loans. The Company entered into a new interest rate swap which

effectively fixes the interest rate on the $80,000 term loan at

5.64% for the term of the debt effective July 2, 2008. However, the

Company does not apply hedge accounting to these interest rate

swaps. Accordingly mark-to- market losses of $8,929 and $9,629, for

the three and nine month periods were recorded through earnings

respectively.

As part of the acquisition of Rocky Ridge, on June 13, 2008 the

Company issued a promissory note to the seller of Rocky Ridge in

the amount of $1,650. The note incurs interest at 6% compounded

annually and is to be paid in two equal annual installments of

principal and interest on June 13, 2009 and June 13, 2010.

5. Changes in non-cash working capital items

The change in non-cash working capital items is comprised of the

change in the following items:

For the Three For the Nine

Months Ended Months Ended

December 31, December 31,

2008 2007 2008 2007

---- ---- ---- ----

$ $ $ $

Accounts receivable 1,077 (339) (4,402) (4,422)

Inventories (13,368) (8,824) (14,549) (8,165)

Prepaid expenses and other assets 498 201 (1,283) (70)

Accounts payable and accrued

liabilities 4,052 (2,062) 5,200 2,806

Income taxes recoverable (390) 1,712 (174) 416

--------- -------- -------- -------

(8,131) (11,856) (15,208) (9,435)

--------- -------- -------- -------

--------- -------- -------- -------

6. Comparative Figures

Certain of the prior year balances have been restated to conform

with the current year's presentation.

Contacts: Andrew Peller Limited Mr. Peter Patchet CFO and EVP

Human Resources (905) 643-4131 Ext. 2210 Email:

peter.patchet@andrewpeller.com

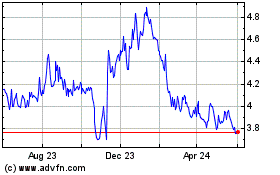

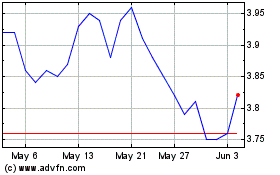

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jul 2023 to Jul 2024