This news release contains forward-looking information that is

based upon assumptions and is subject to risks and uncertainties as

indicated in the cautionary note contained elsewhere in this news

release.

Andrew Peller Limited (the "Company") (TSX: ADW.A)(TSX: ADW.B)

announced today its results for the three months ended June 30,

2008.

HIGHLIGHTS:

- Sales continue to increase due to solid growth in existing

brands and the introduction of new products

- Acquisition of premium consumer-made wine company to boost

sales and earnings

- Purchase of remaining 50% of Rocky Ridge Vineyards Inc. to

enhance premium grape supply

- Common share dividends increased 10% effective June 30,

2008

Strong Operating Performance Continues

For the three months ended June 30, 2008 sales increased 4.3% to

$59.6 million from $57.1 million last year. The increase was due

primarily to ongoing initiatives to grow sales of the Company's

premium and ultra-premium wines through all trade channels and the

introduction of new products over the last twelve months.

Gross profit as a percentage of sales declined slightly to 41.8%

for the three months ended June 30, 2008 compared to 42.8% in the

same period last year due to an increase in packaging and wine

costs experienced in the current year period. Selling and

administrative expenses increased marginally for the three months

ended June 30, 2008 to 29.8% of sales due primarily to costs

associated with the launch of new products over the last twelve

months. This was the same percentage of sales as last year.

Net and comprehensive earnings for the three months ended June

30, 2008 were $2.7 million or $0.18 per Class A share compared to

$2.9 million or $0.20 per Class A share for the same period last

year. Included in net and comprehensive earnings in fiscal 2009

were other charges related to non-cash market-to-market adjustments

on interest rate swaps and foreign exchange contracts. Not

including the other losses and unusual items in each year net and

comprehensive earnings for the first quarter of fiscal 2009

increased 3.4% to $2.8 million compared to the same period last

year.

"We are pleased with our growth through the first quarter of the

year, and expect to generate another solid year of sales and

earnings throughout the balance of fiscal 2009," commented John

Peller, President and CEO.

Strong Financial Position

The Company's balance sheet remained strong as at June 30, 2008.

Working capital was $40.1 million at the end of the first quarter

of fiscal 2009 compared to $26.6 million at March 31, 2008.

Shareholders' equity at June 30, 2008 remained relatively stable at

$103.1 million or $6.92 per common share compared to $102.7 million

or $6.90 per Class A share at March 31, 2008 and $97.5 million or

$6.55 per Class A share at June 30, 2007.

Dividend Increase

As previously announced, common share dividends were increased

by 10% for shareholders of record on June 30, 2008. The annual

dividend on Class A shares was increased to $0.33 per share from

$0.30 per share. The dividend on Class B shares was increased to

$0.288 per share from $0.261 per share.

Acquisitions to Enhance Performance

On June 13, 2008 the Company acquired the remaining 50% interest

in Rocky Ridge Vineyards Inc. located in the Similkameen Valley of

British Columbia for cash consideration of approximately $4.0

million. The purchase yields approximately 70 acres of premium

vineyards and will be used to further enhance the Company's supply

of premium grapes for its VQA brands.

Effective June 30, 2008 the Company acquired 100% of the common

shares of World Vintners Inc. ("WVI"), a producer and seller of

high quality consumer-made wine kits. WVI's sales for its most

recently-completed financial year ended July 31, 2007 were

approximately $12.0 million. The acquisition brings to the Company

a dedicated network of 75 franchised wine-on-premise and retail

outlets under the Wine Kitz brand name. WVI also produces the

popular Heron Bay brand sold through independent wine-on-premise

and retail outlets across Canada.

"The WVI acquisition significantly strengthens our presence as

Canada's largest producer and supplier of consumer-made wines, and

we are confident it will generate enhanced business opportunities

as well as economies of scale and synergies to increase our

profitability," Mr. Peller concluded.

Financial Highlights (unaudited - complete consolidated

financial statements to follow)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Period Ended June 30, Three Months

----------------------------------------------------------------------------

(in $,000 except per share amounts) 2008 2007

----------------------------------------------------------------------------

Sales 59,618 57,140

EBITA 7,184 7,431

Earnings before other income and unusual items 3,972 4,106

Other income (loss) and unusual items (219) 314

Net and comprehensive earnings 2,653 2,914

Net earnings per share

(Basic per Class A share) $ 0.18 $ 0.20

Cash from operations

(after changes in non-cash working capital items) 1,444 (1,901)

Working capital 40,088 23,578

Shareholders' equity per share $ 6.92 $ 6.55

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Andrew Peller Limited is a leading producer and marketer of

quality wines in Canada. With wineries in British Columbia, Ontario

and Nova Scotia, the Company markets wines produced from grapes

grown in Ontario's Niagara Peninsula, British Columbia's Okanagan

and Similkameen Valleys and vineyards around the world. The

Company's award-winning premium and ultra-premium brands include

Peller Estates, Trius, Hillebrand, Thirty Bench, Croc Crossing,

XOXO, Sandhill, Copper Moon, Calona Vineyards Artist Series and Red

Rooster VQA wines. Complementing these premium brands are a number

of popular priced products including Hochtaler, Domaine D'Or,

Schloss Laderheim, Royal and Sommet. The Company also markets craft

beer under the Granville Island brand. With a focus on serving the

needs of all wine consumers, the Company produces and markets

consumer-made wine kit products through Winexpert, Vineco

International Products and Wine Kitz. Their broad range of high

quality brands includes Selection, Vintners Reserve, World

Vineyard, KenRidge, California Connoisseur, Island Mist, Niagara

Mist and Heron Bay. In addition, the Company owns and operates

Vineyards Estate Wines, Aisle 43 and WineCountry Vintners,

independent wine retailers in Ontario with more than 100

well-positioned retail locations. Andrew Peller Limited common

shares trade on the Toronto Stock Exchange (symbols ADW.A and

ADW.B).

The Company utilizes EBITA (defined as earnings before interest,

incomes taxes, depreciation, amortization, other income (losses)

and unusual items). EBITA is not a recognized measure under GAAP.

Management believes that EBITA is a useful supplemental measure to

net earnings, as it provides readers with an indication of cash

available for investment prior to debt service, capital

expenditures and income taxes. Readers are cautioned that EBITA

should not be construed as an alternative to net earnings

determined in accordance with GAAP as an indicator of the Company's

performance or to cash flows from operating, investing and

financing activities as a measure of liquidity and cash flows. In

addition, the Company's method of calculating EBITA may differ from

the methods used by other companies and, accordingly, may not be

comparable to measures used by other companies.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain

"forward-looking statements" within the meaning of applicable

securities laws, including the "safe harbour provision" of the

Securities Act (Ontario) with respect to Andrew Peller Limited (

the "Company") and its subsidiaries. Such statements include, but

are not limited to, statements about the growth of the business in

light of the Company's recent acquisitions; its launch of new

premium wines; sales trends in foreign markets; its supply of

domestically grown grapes; and current economic conditions. These

statements are subject to certain risks, assumptions and

uncertainties that could cause actual results to differ materially

from those included in the forward-looking statements. The words

"believe", "plan", "intend", "estimate", "expect" or "anticipate"

and similar expressions, as well as future or conditional verbs

such as "will", "should", "would" and "could" often identify

forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and

financial performance. With respect to forward-looking statements

contained in this news release, the Company has made assumptions

and applied certain factors regarding, among other things: future

grape, glass bottle and wine prices; its ability to obtain grapes,

imported wine, glass and its ability to obtain other raw materials;

fluctuations in the U.S./Canadian dollar exchange rates; its

ability to market products successfully to its anticipated

customers; the trade balance within the domestic Canadian wine

market; market trends; reliance on key personnel; protection of its

intellectual property rights; the economic environment; the

regulatory requirements regarding producing, marketing, advertising

and labelling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing

competition.

These forward-looking statements are also subject to the risks

and uncertainties discussed in this news release, in the "Risk

Factors" section and elsewhere in the Company's MD&A and other

risks detailed from time to time in the publicly filed disclosure

documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and assumptions

which could cause actual results to differ materially from those

conclusions, forecasts or projections anticipated in these

forward-looking statements. Because of these risks, uncertainties

and assumptions, you should not place undue reliance on these

forward-looking statements. The Company's forward-looking

statements are made only as of the date of this news release, and

except as required by applicable law, the Company undertakes no

obligation to update or revise these forward-looking statements to

reflect new information, future events or circumstances or

otherwise.

ANDREW PELLER LIMITED

CONSOLIDATED BALANCE SHEETS (Unaudited)

These interim consolidated financial statements have not

been reviewed by our auditors June 30 March 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2008 2008

(expressed in thousands of Canadian dollars) $ $

----------------------------------------------------------------------------

Assets

Current Assets

Accounts receivable 24,212 23,072

Inventories 93,333 93,817

Prepaid expenses and other assets 4,663 4,242

Income taxes recoverable 2,180 823

--------------------

124,388 121,954

Property, plant and equipment 100,474 94,480

Goodwill 44,499 36,171

Other assets 7,457 7,139

--------------------

276,818 259,744

--------------------

--------------------

Liabilities

Current Liabilities

Bank indebtedness 47,164 57,722

Accounts payable and accrued liabilities 29,755 29,705

Dividends payable 1,197 1,088

Current portion of long-term debt 6,184 6,830

--------------------

84,300 95,345

Long-term debt 75,205 46,946

Employee future benefits 3,118 3,167

Future income taxes 11,126 11,606

--------------------

173,749 157,064

--------------------

Shareholders' Equity

Capital stock 7,375 7,375

Retained earnings 95,694 95,305

--------------------

103,069 102,680

--------------------

276,818 259,744

--------------------

--------------------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

Consolidated Statements of Earnings, Comprehensive Earnings

and Retained Earnings

For the three months ended June 30, 2008 and 2007

(Unaudited)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

These interim consolidated financial statements

have not been reviewed by our auditors 2008 2007

(expressed in thousands of Canadian dollars) $ $

----------------------------------------------------------------------------

Sales 59,618 57,140

Cost of goods sold, excluding amortization 34,682 32,674

------------------

Gross profit 24,936 24,466

Selling and administration 17,752 17,035

------------------

Earnings before interest and amortization 7,184 7,431

Interest 1,402 1,425

Amortization 1,810 1,900

------------------

Earnings before other items 3,972 4,106

Other (loss) income (161) 369

Unusual items (58) (55)

------------------

Earnings before income taxes 3,753 4,420

------------------

Provision for income taxes

Current 1,095 1,316

Future 5 190

------------------

1,100 1,506

------------------

Net and comprehensive earnings for the

period 2,653 2,914

------------------

Retained earnings- Beginning of period 95,305 88,147

Impact of adopting accounting

pronouncements on April 1, 2007 - 128

Impact of adopting accounting

pronouncement on April 1, 2008 (1,067) -

------------------

Retained earnings- Beginning of period

as restated 94,238 88,275

------------------

Dividends:

Class A and Class B (1,197) (1,088)

------------------

Retained earnings - End of period 95,694 90,101

------------------

------------------

Net earnings per share

Basic and diluted

Class A shares 0.18 0.20

------------------

------------------

Class B shares 0.16 0.17

------------------

------------------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the three months ending June 30, 2008 and 2007 (Unaudited)

These interim consolidated financial statements have not been reviewed

by our auditors

----------------------------------------------------------------------------

(expressed in thousands of Canadian dollars)

2008 2007

$ $

----------------------------------------------------------------------------

Cash provided by (used in)

Operating activities

Net earnings for the period 2,653 2,914

Items not affecting cash:

Amortization of plant, equipment and intangibles 1,810 1,900

Employee future benefits -49 -25

Net unrealized loss (gain) on foreign

exchange contracts and interest rate swaps 161 -369

Future income taxes 5 190

Amortization of deferred financing costs 38 36

------------------

4,618 4,646

Changes in non-cash working capital

items related to operations -3,174 -6,547

------------------

1,444 -1,901

------------------

Investing activities

Acquisition of World Vintners Inc. -10,940 -

Acquisition of Rocky Ridge Vineyards Inc. -4,016 -

Purchase of property and equipment -2,498 (3,816)

------------------

-17,454 -3,816

------------------

Financing activities

Increase in deferred financing costs (214) -

(Decrease) increase in bank indebtedness -10,558 8,109

Increase in long-term debt 29,036 -

Repayment of long-term debt -1,166 -1,475

Dividends paid -1,088 -917

------------------

16,010 5,717

------------------

Cash at beginning and end of period - -

------------------

------------------

Supplemental disclosure of cash flow information

Cash paid during the period for

Interest 1,062 1,315

Income taxes 827 1,059

The accompanying notes are an integral part of these interim consolidated

financial statements

Contacts: Andrew Peller Limited Mr. Peter Patchet CFO and EVP

Human Resources (905) 643-4131 Ext. 2210 Email:

peter.patchet@andrewpeller.com

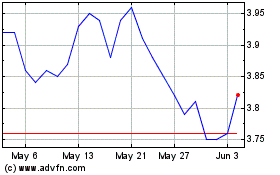

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

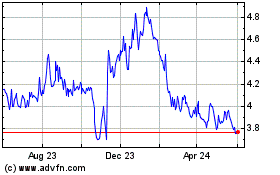

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jul 2023 to Jul 2024