This news release contains forward-looking information that is based upon

assumptions and is subject to risks and uncertainties as indicated in the

cautionary note contained elsewhere in this news release.

Andrew Peller Limited (the "Company") (TSX:ADW.A)(TSX:ADW.B) announced today its

results for the three months ended June 30, 2008.

HIGHLIGHTS:

- Sales continue to increase due to solid growth in existing brands and the

introduction of new products

- Acquisition of premium consumer-made wine company to boost sales and earnings

- Purchase of remaining 50% of Rocky Ridge Vineyards Inc. to enhance premium

grape supply

- Common share dividends increased 10% effective June 30, 2008

Strong Operating Performance Continues

For the three months ended June 30, 2008 sales increased 4.3% to $59.6 million

from $57.1 million last year. The increase was due primarily to ongoing

initiatives to grow sales of the Company's premium and ultra-premium wines

through all trade channels and the introduction of new products over the last

twelve months.

Gross profit as a percentage of sales declined slightly to 41.8% for the three

months ended June 30, 2008 compared to 42.8% in the same period last year due to

an increase in packaging and wine costs experienced in the current year period.

Selling and administrative expenses increased marginally for the three months

ended June 30, 2008 to 29.8% of sales due primarily to costs associated with the

launch of new products over the last twelve months. This was the same percentage

of sales as last year.

Net and comprehensive earnings for the three months ended June 30, 2008 were

$2.7 million or $0.18 per Class A share compared to $2.9 million or $0.20 per

Class A share for the same period last year. Included in net and comprehensive

earnings in fiscal 2009 were other charges related to non-cash market-to-market

adjustments on interest rate swaps and foreign exchange contracts. Not including

the other losses and unusual items in each year net and comprehensive earnings

for the first quarter of fiscal 2009 increased 3.4% to $2.8 million compared to

the same period last year.

"We are pleased with our growth through the first quarter of the year, and

expect to generate another solid year of sales and earnings throughout the

balance of fiscal 2009," commented John Peller, President and CEO.

Strong Financial Position

The Company's balance sheet remained strong as at June 30, 2008. Working capital

was $40.1 million at the end of the first quarter of fiscal 2009 compared to

$26.6 million at March 31, 2008. Shareholders' equity at June 30, 2008 remained

relatively stable at $103.1 million or $6.92 per common share compared to $102.7

million or $6.90 per Class A share at March 31, 2008 and $97.5 million or $6.55

per Class A share at June 30, 2007.

Dividend Increase

As previously announced, common share dividends were increased by 10% for

shareholders of record on June 30, 2008. The annual dividend on Class A shares

was increased to $0.33 per share from $0.30 per share. The dividend on Class B

shares was increased to $0.288 per share from $0.261 per share.

Acquisitions to Enhance Performance

On June 13, 2008 the Company acquired the remaining 50% interest in Rocky Ridge

Vineyards Inc. located in the Similkameen Valley of British Columbia for cash

consideration of approximately $4.0 million. The purchase yields approximately

70 acres of premium vineyards and will be used to further enhance the Company's

supply of premium grapes for its VQA brands.

Effective June 30, 2008 the Company acquired 100% of the common shares of World

Vintners Inc. ("WVI"), a producer and seller of high quality consumer-made wine

kits. WVI's sales for its most recently-completed financial year ended July 31,

2007 were approximately $12.0 million. The acquisition brings to the Company a

dedicated network of 75 franchised wine-on-premise and retail outlets under the

Wine Kitz brand name. WVI also produces the popular Heron Bay brand sold through

independent wine-on-premise and retail outlets across Canada.

"The WVI acquisition significantly strengthens our presence as Canada's largest

producer and supplier of consumer-made wines, and we are confident it will

generate enhanced business opportunities as well as economies of scale and

synergies to increase our profitability," Mr. Peller concluded.

Financial Highlights (unaudited - complete consolidated financial statements to

follow)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Period Ended June 30, Three Months

----------------------------------------------------------------------------

(in $,000 except per share amounts) 2008 2007

----------------------------------------------------------------------------

Sales 59,618 57,140

EBITA 7,184 7,431

Earnings before other income and unusual items 3,972 4,106

Other income (loss) and unusual items (219) 314

Net and comprehensive earnings 2,653 2,914

Net earnings per share

(Basic per Class A share) $ 0.18 $ 0.20

Cash from operations

(after changes in non-cash working capital items) 1,444 (1,901)

Working capital 40,088 23,578

Shareholders' equity per share $ 6.92 $ 6.55

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Andrew Peller Limited is a leading producer and marketer of quality wines in

Canada. With wineries in British Columbia, Ontario and Nova Scotia, the Company

markets wines produced from grapes grown in Ontario's Niagara Peninsula, British

Columbia's Okanagan and Similkameen Valleys and vineyards around the world. The

Company's award-winning premium and ultra-premium brands include Peller Estates,

Trius, Hillebrand, Thirty Bench, Croc Crossing, XOXO, Sandhill, Copper Moon,

Calona Vineyards Artist Series and Red Rooster VQA wines. Complementing these

premium brands are a number of popular priced products including Hochtaler,

Domaine D'Or, Schloss Laderheim, Royal and Sommet. The Company also markets

craft beer under the Granville Island brand. With a focus on serving the needs

of all wine consumers, the Company produces and markets consumer-made wine kit

products through Winexpert, Vineco International Products and Wine Kitz. Their

broad range of high quality brands includes Selection, Vintners Reserve, World

Vineyard, KenRidge, California Connoisseur, Island Mist, Niagara Mist and Heron

Bay. In addition, the Company owns and operates Vineyards Estate Wines, Aisle 43

and WineCountry Vintners, independent wine retailers in Ontario with more than

100 well-positioned retail locations. Andrew Peller Limited common shares trade

on the Toronto Stock Exchange (symbols ADW.A and ADW.B).

The Company utilizes EBITA (defined as earnings before interest, incomes taxes,

depreciation, amortization, other income (losses) and unusual items). EBITA is

not a recognized measure under GAAP. Management believes that EBITA is a useful

supplemental measure to net earnings, as it provides readers with an indication

of cash available for investment prior to debt service, capital expenditures and

income taxes. Readers are cautioned that EBITA should not be construed as an

alternative to net earnings determined in accordance with GAAP as an indicator

of the Company's performance or to cash flows from operating, investing and

financing activities as a measure of liquidity and cash flows. In addition, the

Company's method of calculating EBITA may differ from the methods used by other

companies and, accordingly, may not be comparable to measures used by other

companies.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain "forward-looking statements"

within the meaning of applicable securities laws, including the "safe harbour

provision" of the Securities Act (Ontario) with respect to Andrew Peller Limited

( the "Company") and its subsidiaries. Such statements include, but are not

limited to, statements about the growth of the business in light of the

Company's recent acquisitions; its launch of new premium wines; sales trends in

foreign markets; its supply of domestically grown grapes; and current economic

conditions. These statements are subject to certain risks, assumptions and

uncertainties that could cause actual results to differ materially from those

included in the forward-looking statements. The words "believe", "plan",

"intend", "estimate", "expect" or "anticipate" and similar expressions, as well

as future or conditional verbs such as "will", "should", "would" and "could"

often identify forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and financial

performance. With respect to forward-looking statements contained in this news

release, the Company has made assumptions and applied certain factors regarding,

among other things: future grape, glass bottle and wine prices; its ability to

obtain grapes, imported wine, glass and its ability to obtain other raw

materials; fluctuations in the U.S./Canadian dollar exchange rates; its ability

to market products successfully to its anticipated customers; the trade balance

within the domestic Canadian wine market; market trends; reliance on key

personnel; protection of its intellectual property rights; the economic

environment; the regulatory requirements regarding producing, marketing,

advertising and labelling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing competition.

These forward-looking statements are also subject to the risks and uncertainties

discussed in this news release, in the "Risk Factors" section and elsewhere in

the Company's MD&A and other risks detailed from time to time in the publicly

filed disclosure documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of future

performance and involve risks, uncertainties and assumptions which could cause

actual results to differ materially from those conclusions, forecasts or

projections anticipated in these forward-looking statements. Because of these

risks, uncertainties and assumptions, you should not place undue reliance on

these forward-looking statements. The Company's forward-looking statements are

made only as of the date of this news release, and except as required by

applicable law, the Company undertakes no obligation to update or revise these

forward-looking statements to reflect new information, future events or

circumstances or otherwise.

ANDREW PELLER LIMITED

CONSOLIDATED BALANCE SHEETS (Unaudited)

These interim consolidated financial statements have not

been reviewed by our auditors June 30 March 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2008 2008

(expressed in thousands of Canadian dollars) $ $

----------------------------------------------------------------------------

Assets

Current Assets

Accounts receivable 24,212 23,072

Inventories 93,333 93,817

Prepaid expenses and other assets 4,663 4,242

Income taxes recoverable 2,180 823

--------------------

124,388 121,954

Property, plant and equipment 100,474 94,480

Goodwill 44,499 36,171

Other assets 7,457 7,139

--------------------

276,818 259,744

--------------------

--------------------

Liabilities

Current Liabilities

Bank indebtedness 47,164 57,722

Accounts payable and accrued liabilities 29,755 29,705

Dividends payable 1,197 1,088

Current portion of long-term debt 6,184 6,830

--------------------

84,300 95,345

Long-term debt 75,205 46,946

Employee future benefits 3,118 3,167

Future income taxes 11,126 11,606

--------------------

173,749 157,064

--------------------

Shareholders' Equity

Capital stock 7,375 7,375

Retained earnings 95,694 95,305

--------------------

103,069 102,680

--------------------

276,818 259,744

--------------------

--------------------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

Consolidated Statements of Earnings, Comprehensive Earnings

and Retained Earnings

For the three months ended June 30, 2008 and 2007

(Unaudited)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

These interim consolidated financial statements

have not been reviewed by our auditors 2008 2007

(expressed in thousands of Canadian dollars) $ $

----------------------------------------------------------------------------

Sales 59,618 57,140

Cost of goods sold, excluding amortization 34,682 32,674

------------------

Gross profit 24,936 24,466

Selling and administration 17,752 17,035

------------------

Earnings before interest and amortization 7,184 7,431

Interest 1,402 1,425

Amortization 1,810 1,900

------------------

Earnings before other items 3,972 4,106

Other (loss) income (161) 369

Unusual items (58) (55)

------------------

Earnings before income taxes 3,753 4,420

------------------

Provision for income taxes

Current 1,095 1,316

Future 5 190

------------------

1,100 1,506

------------------

Net and comprehensive earnings for the

period 2,653 2,914

------------------

Retained earnings- Beginning of period 95,305 88,147

Impact of adopting accounting

pronouncements on April 1, 2007 - 128

Impact of adopting accounting

pronouncement on April 1, 2008 (1,067) -

------------------

Retained earnings- Beginning of period

as restated 94,238 88,275

------------------

Dividends:

Class A and Class B (1,197) (1,088)

------------------

Retained earnings - End of period 95,694 90,101

------------------

------------------

Net earnings per share

Basic and diluted

Class A shares 0.18 0.20

------------------

------------------

Class B shares 0.16 0.17

------------------

------------------

The accompanying notes are an integral part of these interim consolidated

financial statements

ANDREW PELLER LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the three months ending June 30, 2008 and 2007 (Unaudited)

These interim consolidated financial statements have not been reviewed

by our auditors

----------------------------------------------------------------------------

(expressed in thousands of Canadian dollars)

2008 2007

$ $

----------------------------------------------------------------------------

Cash provided by (used in)

Operating activities

Net earnings for the period 2,653 2,914

Items not affecting cash:

Amortization of plant, equipment and intangibles 1,810 1,900

Employee future benefits -49 -25

Net unrealized loss (gain) on foreign

exchange contracts and interest rate swaps 161 -369

Future income taxes 5 190

Amortization of deferred financing costs 38 36

------------------

4,618 4,646

Changes in non-cash working capital

items related to operations -3,174 -6,547

------------------

1,444 -1,901

------------------

Investing activities

Acquisition of World Vintners Inc. -10,940 -

Acquisition of Rocky Ridge Vineyards Inc. -4,016 -

Purchase of property and equipment -2,498 (3,816)

------------------

-17,454 -3,816

------------------

Financing activities

Increase in deferred financing costs (214) -

(Decrease) increase in bank indebtedness -10,558 8,109

Increase in long-term debt 29,036 -

Repayment of long-term debt -1,166 -1,475

Dividends paid -1,088 -917

------------------

16,010 5,717

------------------

Cash at beginning and end of period - -

------------------

------------------

Supplemental disclosure of cash flow information

Cash paid during the period for

Interest 1,062 1,315

Income taxes 827 1,059

The accompanying notes are an integral part of these interim consolidated

financial statements

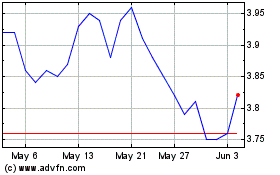

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

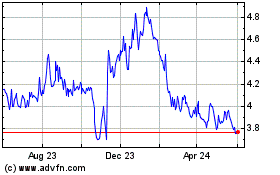

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jul 2023 to Jul 2024