GRIMSBY, ONTARIO (TSX: ADW.A)(TSX: ADW.B) announced today its

results for the three and nine months ended December 31, 2007.

HIGHLIGHTS:

- Sales continue to increase due to solid growth in existing

brands and the introduction of new products

- Higher volumes of premium and ultra-premium brands drive

increased profitability

- Gross profit up 9.1% and 7.0% in the quarter and in the nine

months respectively

- Nine months net and comprehensive earnings up 16.6% to $10.6

million due to strong operating performance and the impact of the

reduction in future income tax rates

- Positive outlook on continued organic growth and strong

operating performance

Strong Operating Performance Continues

For the three months ended December 31, 2007 sales increased

4.5% to $66.1 million from $63.2 million last year. For the nine

months ended December 31, 2007, sales were up 3.7% to $184.4

million compared to $177.8 million for the same period last year.

The increases are due primarily to ongoing initiatives to grow

sales of the Company's premium and ultra-premium wines through all

trade channels and the introduction of new products over the last

twelve months.

"Our effective sales and marketing programs are generating solid

organic growth across our trade channels, and we look for this

growth to continue going forward," commented John Peller, President

and CEO.

Gross profit as a percentage of sales improved to 43.5% for the

three months ended December 31, 2007 compared to 41.7% in the same

period last year. For the first nine months of fiscal 2008, gross

profit as a percentage of sales was 43.1% compared to 41.7% last

year. The improved profit margins are the result of increased sales

of the Company's premium and ultra-premium wines and the positive

impact of the increase in value of the Canadian dollar which

partially offset the higher cost of grapes and wine purchased on

international markets. Selling and administrative expenses

increased marginally for the three and nine months ended December

31, 2007 at 28.6% and 29.5% of sales respectively, compared with

27.0% and 28.6% of sales for the same periods last year.

As a result of the increased sales and improved gross margins,

earnings before interest, taxes, amortization, other losses and

unusual items (EBITA) increased 5.8% to $9.8 million in the third

quarter of fiscal 2008 compared to $9.3 million last year. For the

first nine months of fiscal 2008, EBITA was up 6.8% to $25.0

million compared to $23.4 million for the same period last

year.

Net and comprehensive earnings for the three months ended

December 31, 2007 rose 21.0% to $5.0 million or $0.35 per Class A

share compared to $4.1 million or $0.29 per Class A share last

year. For the nine months ended December 31, 2007, net and

comprehensive earnings were up 16.6% to $10.6 million or $0.73 per

Class A share compared to $9.1 million or $0.63 per Class A share

for the same period last year. The Company's provision for future

income taxes were reduced during the third quarter of fiscal 2008

due to changes in future income tax rates that were part of the

most recent federal budget. Not including the other losses and

unusual items in each year and the impact of changes in future

income tax rates, net and comprehensive earnings for the third

quarter of fiscal 2008 increased 6.3% to $4.4 million compared to

the same period last year and for the nine months ended December

31, 2007, net and comprehensive earnings increased 8.8% to $10.0

million.

"We were very pleased to see strong growth in our gross margins

and profitability as we continue to implement programs aimed at

increasing operating efficiency while driving sales of our

higher-margin premium and ultra-premium brands," Mr. Peller

continued. "As the largest Canadian-owned winery in the country,

our goal is to produce the highest quality products, and going

forward we will maintain this commitment in all that we do."

Strong Financial Position

The Company's balance sheet remained strong as at December 31,

2007. Working capital was $24.4 million at the end of the third

quarter of fiscal 2008 compared to $25.3 million at March 31, 2007.

Shareholders' equity at December 31, 2007 rose to $103.0 million or

$6.91 per Class A share from $95.5 million or $6.41 per Class A

share at March 31, 2007 and $96.0 million or $6.45 per Class A

share at December 31, 2006.

"Looking ahead, we are confident that our growth and strong

operating performance will continue. Our solid presence in all our

trade channels, combined with increasing consumer demand for

premium and ultra-premium Canadian wines, provides a solid

foundation on which to grow and underpins the strength and

stability of our common share dividends," Mr. Peller concluded.

Financial Highlights (unaudited - complete consolidated financial

statements to follow)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Period Ended December 31, Three Months Nine Months

---------------------------------------------------------------------------

(in $,000 except per share amounts) 2007 2006 2007 2006

---------------------------------------------------------------------------

Sales 66,052 63,225 184,428 177,773

EBITA 9,823 9,286 25,019 23,416

Earnings before other income and

unusual items 6,457 6,085 14,971 13,756

Other income (loss) and unusual

items (221) (15) (301) (213)

Net and comprehensive earnings 5,013 4,142 10,579 9,074

Net earnings per share

(Basic per Class A share) $ 0.35 $ 0.29 $ 0.73 $ 0.63

Cash from operations

(after changes in non-cash

working capital items) (6,188) (3,289) 5,602 (2,311)

Working capital 24,439 28,882

Shareholders' equity per share $ 6.91 $ 6.41

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Andrew Peller Limited is a leading producer and marketer of

quality wines in Canada. With wineries in British Columbia, Ontario

and Nova Scotia, the Company markets wines produced from grapes

grown in Ontario's Niagara Peninsula, British Columbia's Okanagan

and Similkameen Valleys and vineyards around the world. The

Company's award-winning premium and ultra-premium brands include

Peller Estates, Trius, Hillebrand, Thirty Bench, Croc Crossing,

XOXO, Sandhill, Copper Moon, Calona Vineyards Artist Series and Red

Rooster VQA wines. Complementing these premium brands are a number

of popular priced products including Hochtaler, Domaine D'Or,

Schloss Laderheim, Royal and Sommet. With the acquisition of

Cascadia Brands Inc., the Company also markets craft beer under the

Granville Island brand. With a focus on serving the needs of all

wine consumers, the Company produces and markets consumer-made wine

kit products through Winexpert and Vineco International Products.

In addition, the Company owns and operates Vineyards Estate Wines

and WineCountry Vintners, independent wine retailers in Ontario

with more than 100 well-positioned retail locations. Andrew Peller

Limited common shares trade on the Toronto Stock Exchange (symbols

ADW.A and ADW.B).

The Company utilizes EBITA (defined as earnings before interest,

incomes taxes, depreciation, amortization, other income (losses)

and unusual items). EBITA is not a recognized measure under GAAP.

Management believes that EBITA is a useful supplemental measure to

net earnings, as it provides readers with an indication of cash

available for investment prior to debt service, capital

expenditures and income taxes. Readers are cautioned that EBITA

should not be construed as an alternative to net earnings

determined in accordance with GAAP as an indicator of the Company's

performance or to cash flows from operating, investing and

financing activities as a measure of liquidity and cash flows. In

addition, the Company's method of calculating EBITA may differ from

the methods used by other companies and, accordingly, may not be

comparable to measures used by other companies.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain

"forward-looking statements" within the meaning of applicable

securities laws, including the "safe harbour provision" of the

Securities Act (Ontario) with respect to Andrew Peller Limited (

the "Company") and its subsidiaries. Such statements include, but

are not limited to, statements about the growth of the business in

light of the Company's recent acquisitions; its launch of new

premium wines; sales trends in foreign markets; its supply of

domestically grown grapes; and current economic conditions. These

statements are subject to certain risks, assumptions and

uncertainties that could cause actual results to differ materially

from those included in the forward-looking statements. The words

"believe", "plan", "intend", "estimate", "expect" or "anticipate"

and similar expressions, as well as future or conditional verbs

such as "will", "should", "would" and "could" often identify

forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and

financial performance. With respect to forward-looking statements

contained in this news release, the Company has made assumptions

and applied certain factors regarding, among other things: future

grape, glass bottle and wine prices; its ability to obtain grapes,

imported wine, glass and its ability to obtain other raw materials;

fluctuations in the U.S./Canadian dollar exchange rates; its

ability to market products successfully to its anticipated

customers; the trade balance within the domestic Canadian wine

market; market trends; reliance on key personnel; protection of its

intellectual property rights; the economic environment; the

regulatory requirements regarding producing, marketing, advertising

and labelling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing

competition.

These forward-looking statements are also subject to the risks

and uncertainties discussed in this news release, in the "Risk

Factors" section and elsewhere in the Company's MD&A and other

risks detailed from time to time in the publicly filed disclosure

documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and assumptions

which could cause actual results to differ materially from those

conclusions, forecasts or projections anticipated in these

forward-looking statements. Because of these risks, uncertainties

and assumptions, you should not place undue reliance on these

forward-looking statements. The Company's forward-looking

statements are made only as of the date of this news release, and

except as required by applicable law, the Company undertakes no

obligation to update or revise these forward-looking statements to

reflect new information, future events or circumstances or

otherwise.

ANDREW PELLER LIMITED

CONSOLIDATED BALANCE SHEETS

(Unaudited) December 31 March 31

---------------------------------------------------------------------------

---------------------------------------------------------------------------

2007 2007

(000's) $ $

---------------------------------------------------------------------------

Assets

Current Assets

Accounts receivable 25,787 21,365

Inventories 91,155 82,990

Prepaid expenses 3,053 2,983

Income taxes recoverable - 319

-----------------------------

119,995 107,657

Property, plant and equipment 93,395 87,143

Goodwill 36,171 36,171

Other assets 7,275 7,985

-----------------------------

256,836 238,956

-----------------------------

-----------------------------

Liabilities

Current Liabilities

Bank indebtedness (Note 3) 61,629 51,449

Accounts payable and accrued liabilities 26,875 24,069

Dividends payable 1,088 917

Income taxes payable 97 -

Current portion of long - term debt 5,867 5,906

-----------------------------

95,556 82,341

Long-term debt 42,968 44,423

Employee future benefits 3,193 4,007

Future income taxes 12,153 12,663

-----------------------------

153,870 143,434

-----------------------------

Shareholders' Equity

Capital Stock (Note 4) 7,375 7,375

Retained Earnings 95,591 88,147

-----------------------------

102,966 95,522

-----------------------------

256,836 238,956

-----------------------------

-----------------------------

The accompanying notes are an integral part of these consolidated financial

statements.

ANDREW PELLER LIMITED

Consolidated Statements of Earnings, Comprehensive Earnings and Retained

Earnings

(Unaudited)

(000's) For the For the

Three Months Ended Nine Months Ended

December 31 December 31

2007 2006 2007 2006

$ $ $ $

---------------------------------------------------------------------------

Sales 66,052 63,225 184,428 177,773

Cost of goods sold, excluding

amortization 37,312 36,885 105,026 103,559

------------------------------------------

Gross profit 28,740 26,340 79,402 74,214

Selling and administration 18,917 17,054 54,383 50,798

------------------------------------------

Earnings before interest,

amortization, other items and

income taxes 9,823 9,286 25,019 23,416

Interest 1,519 1,335 4,383 3,993

Amortization of plant,

equipment and intangibles 1,847 1,866 5,665 5,667

------------------------------------------

Earnings before other items

and income taxes 6,457 6,085 14,971 13,756

Other losses (Note 1) 118 - 74 0

Unusual items 103 15 227 213

------------------------------------------

Earnings before income taxes 6,236 6,070 14,670 13,543

------------------------------------------

Provision for (recovery of)

income taxes

Current 1,945 1,856 4,670 4,264

Future (722) 72 (579) 205

------------------------------------------

1,223 1,928 4,091 4,469

------------------------------------------

Net and comprehensive earnings

for the period 5,013 4,142 10,579 9,074

------------------------------------------

Retained earnings- Beginning

of period 91,666 85,442 88,147 82,205

Impact of adopting accounting

pronouncements on April 1,

2007 (Note 1) - - 128 -

------------------------------------------

Retained earnings - Beginning

of period as restated 91,666 85,442 88,275 82,205

------------------------------------------

Dividends:

Class A and Class B 1,088 918 3,263 2,613

------------------------------------------

Retained earnings- End of

period 95,591 88,666 95,591 88,666

------------------------------------------

------------------------------------------

Net earnings per share

Basic and Diluted

Class A shares 0.35 0.29 0.73 0.63

------------------------------------------

------------------------------------------

Class B shares 0.30 0.25 0.63 0.54

------------------------------------------

------------------------------------------

The accompanying notes are an integral part of these consolidated financial

statements.

ANDREW PELLER LIMITED

Consolidated Statements of Cash Flows

(Unaudited) For the For the

(000's) Three Months Ended Nine Months Ended

December 31 December 31

2007 2006 2007 2006

$ $ $ $

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Cash provided by (used in)

Operating activities

Net earnings for the period 5,013 4,142 10,579 9,074

Items not affecting cash:

Amortization of plant, equipment and

intangibles 1,847 1,866 5,665 5,667

Unrealized loss on foreign exchange

contracts and interest rate

swaps (Note 1) 118 - 74 -

Employee future benefits (627) (93) (814) (279)

Future income taxes (722) 72 (579) 205

Non-cash interest expense 39 - 112 -

Amortization of deferred financing

costs - 36 - 107

--------------------------------------

--------------------------------------

5,668 6,023 15,037 14,774

Changes in non-cash working capital

items related to operations (Note 5) (11,856) (9,312) (9,435) (17,085)

--------------------------------------

(6,188) (3,289) 5,602 (2,311)

--------------------------------------

Investing activities

Acquisition of Cascadia, net of cash

acquired - - - (309)

Purchase of property and equipment (2,640) (2,293) (11,732) (5,237)

--------------------------------------

(2,640) (2,293) (11,732) (5,546)

--------------------------------------

Financing activities

Increase in deferred financing costs - (49) - (76)

Repayment of long-term debt (1,477) (1,472) (4,428) (4,400)

Increase in long-term debt - - 3,470 -

Increase in (repayment of) bank

indebtedness 11,392 8,021 10,180 14,807

Dividends paid (1,087) (918) (3,092) (2,474)

--------------------------------------

8,828 5,582 6,130 7,857

--------------------------------------

Cash at beginning and end of period - - - -

--------------------------------------

--------------------------------------

The accompanying notes are an integral part of these consolidated financial

statements.

Notes to the Interim Consolidated Financial Statements

December 31, 2007 and 2006

(in thousands of dollars, except per share amounts)

UNAUDITED

1. Summary of Significant Accounting Policies

The interim consolidated financial statements have been prepared

in accordance with accounting principles generally accepted in

Canada. The note disclosure for these interim consolidated

financial statements only presents material changes to the

disclosure found in the Company's audited consolidated financial

statements for the year ended March 31, 2007. These interim

consolidated financial statements should be read in conjunction

with those consolidated financial statements and follow the same

accounting policies as the audited consolidated financial

statements except as disclosed below. In the opinion of management,

the accompanying unaudited interim consolidated financial

statements contain all adjustments necessary to present fairly, in

all material respects the financial position of the Company as at

December 31, 2007 and for the three and nine-month periods then

ended.

Recently adopted accounting pronouncements

On April 1, 2007 the Company adopted the Canadian Institute of

Chartered Accountants (CICA) handbook sections 1530 "Comprehensive

Income," section 3251 "Equity," section 3855 "Financial Instruments

- Recognition and Measurement" and section 3865 "Hedges." As

required, these standards have been adopted prospectively and

comparative amounts for the periods have not been restated.

a) Comprehensive Income

Comprehensive income is comprised of net earnings or loss and

other comprehensive income (OCI). OCI represents the change in

equity for a period that arises from unrealized gains and losses on

available-for-sale securities and changes in the fair market value

of derivative instruments designated as hedges.

b) Equity

This section requires for separate presentation of changes in

equity for the period arising from net income, OCI, contributed

surplus, retained earnings, share capital and reserves. Accumulated

OCI would be included in the consolidated balance sheet as a

separate component of shareholders' equity. The Company does not

currently have any accumulated OCI.

c) Financial Instruments

This section establishes standards for the recognition and

measurement of financial instruments; which is comprised of

financial assets, financial liabilities, derivatives and

non-financial derivatives. All financial instruments are initially

recorded at fair value and are subsequently accounted for based on

one of four classifications: held for trading, held to maturity,

loans and receivables or available for sale. The classification of

a financial instrument depends on its characteristics and the

purpose for which it was acquired. Fair values are based upon

quoted market prices from active markets or are otherwise

determined using a variety of valuation techniques and models. The

Company's interest rate swaps and foreign exchange contracts are

derivatives and are recorded at fair value through other income. As

a result, on adoption of this standard, the Company recorded a net

increase of $216 to other assets, a net increase of $68 to future

income taxes, a net increase of $20 to long-term debt and an

opening retained earnings adjustment of $128.

d) Hedges

Hedge accounting is optional. When hedge accounting is not

applied, the change in the fair value of the hedging instrument is

recorded directly into earnings. The Company has chosen not to

designate any of its current hedging instruments as hedges for the

purpose of this section and has recorded the fair value adjustments

of these instruments through other income.

e) Transaction Costs

Transaction costs related to long-term debt are netted against

the carrying value of the liability and are then amortized over the

expected life of the instrument using the effective interest

method. On adoption of this new standard the Company recorded an

adjustment on April 1, 2007 to reduce other assets by $599 and

long-term debt by $599.

Recently issued accounting pronouncements

The Canadian Institute of Chartered Accountants ("CICA") issued

the following accounting standards effective for the fiscal years

beginning after October 1, 2007 and January 1, 2008:

a) Accounting Standards Section 3031 "Inventories" provides

guidance on the determination of cost and its subsequent

recognition as an expense, including any write-down to net

realizable value. It also provides guidance on the cost formulas

that are used to assign costs to inventories and is effective for

the fiscal years beginning after January 1, 2008.

b) Accounting Standards Section 3862 "Financial Instruments -

Disclosures" requires disclosures in the financial statements that

will enable users to evaluate: the significance of financial

instruments for a company's financial position and performance; and

the nature and extent of risks arising from financial instruments

to which a company is exposed during the period and at the balance

sheet date, and how a company manages those risks. This accounting

standard is effective for fiscal years beginning after October 1,

2007.

c) CICA Handbook Section 1535 "Capital Disclosures" establishes

standards for disclosing information about a Company's capital and

how it is managed to enable users of the financial statements to

evaluate the Company's objectives, policies and procedures for

managing capital. This section is effective for the fiscal years

beginning on or after October 1, 2007.

d) CICA Handbook Section 3863 "Financial Instruments -

Presentation" establishes standards for presentation of financial

instruments and non-financial derivatives. This section compliments

the existing CICA Handbook Section 3861 - Financial Instruments -

Disclosure and Presentation and is effective for fiscal years

beginning on or after October 1, 2007.

The Company has not yet determined the impact of adopting the

above accounting standards.

2. Seasonality

The third quarter of each year is historically the strongest in

terms of sales, gross profit and net earnings due to increased

consumer purchasing of the Company's products during the holiday

season.

3. Bank Indebtedness

On October 2, 2007, the Company obtained additional financing

from the Royal Bank of Canada in the form of a bulge demand

facility to finance additional working capital requirements. The

facility is in the amount of $10,000 and is available during the

months of November to January each year which increases the

Company's borrowing limit to $70,000 during this period. On January

28, 2008, the availability of the bulge demand facility was

extended further to April 30, 2008. As at December 31, 2007, $1,629

was drawn on this facility.

4. Capital Stock

At the Company's Annual and Special Meeting of Shareholders held

on September 20, 2006, Class B shareholders approved a

three-for-one split of the Class A and Class B shares for

shareholders of record at October 31, 2006. The Company recorded

the effect of the split retroactively to all disclosures of share

capital and per share amounts.

As at December 31, 2007 there were 11,888,241 Class A shares

issued and outstanding (March 31, 2007 - 11,888,241) and 3,004,041

Class B shares issued and outstanding (March 31, 2007 - 3,004,041).

There were 11,888,241 weighted average Class A shares outstanding

(2006 - 11,887,645) and 3,004,041 weighted average Class B shares

outstanding (2006 - 3,004,637) for the three and nine months ended

December 31, 2007.

5. Changes in non-cash working capital items

The change in non-cash working capital items is comprised of the

change in the following items:

For the Three Months For the Nine Months

Ended December 31 Ended December 31

2007 2006 2007 2006

-------- -------- ------- --------

$ $ $ $

Accounts receivable (1,815) (339) (4,422) (9,582)

Inventories (8,134) (8,824) (8,165) (10,165)

Prepaid expenses 1,716 201 (70) (1,310)

Accounts payable and accrued

liabilities (4,608) (2,062) 2,806 1,882

Income taxes payable/recoverable 985 1,712 416 2,090

-------- -------- ------- --------

(11,856) (9,312) (9,435) (17,085)

-------- -------- ------- --------

-------- -------- ------- --------

This news release contains forward-looking information that is

based upon assumptions and is subject to risks and uncertainties as

indicated in the cautionary note contained elsewhere in this news

release.

Contacts: Andrew Peller Limited Mr. Peter Patchet CFO and EVP

Human Resources (905) 643-4131 Ext. 2210 Email:

peter.patchet@andrewpeller.com

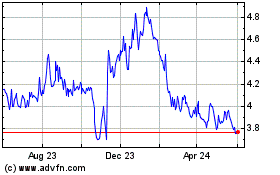

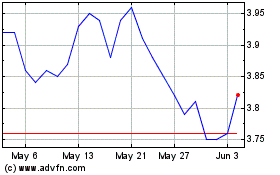

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jul 2023 to Jul 2024