Accord Announces Second Quarter and First Half Earnings, Declares a 7% Increase in Quarterly Dividend and Resolves to Renew Nor

July 22 2012 - 2:56AM

PR Newswire (Canada)

TORONTO, July 24, 2012 /CNW/ - Accord Financial Corp. , a leading

North American provider of factoring and other asset-based

financial services to businesses, today released its interim

unaudited consolidated financial results for the three and six

months ended June 30, 2012. The financial results presented

in this release are reported in Canadian dollars and have been

prepared in accordance with International Financial Reporting

Standards. SUMMARY OF FINANCIAL RESULTS Three Months Ended June Six

Months Ended June 30 30 2012 2011 2012 2011 Factoring volume

(millions) $ 443 $ 455 $ 880 $ 937 Revenue $ 6,322,501 $ 6,828,201

$ 12,002,125 $ 13,695,478 Net earnings $ 1,243,038 $ 1,393,639 $

2,126,254 $ 2,992,107 Basic and diluted earnings $ 0.15 $ 0.16 $

0.25 $ 0.33 per common share Basic and diluted weighted average

number of shares 8,515,898 8,948,580 8,525,571 8,975,460 Net

earnings for the second quarter of 2012 declined 11% to $1,243,038

compared to $1,393,639 last year. Earnings declined mainly due to

lower revenue and, to a lesser extent, a higher provision for

credit and loan losses. Earnings per share were 15 cents

compared to 16 cents last year. Factoring volume declined 3% to

$443 million compared to $455 million last year largely due to

lower non-recourse volume. Revenue decreased 7% to $6,322,501

compared to $6,828,201 last year mainly due to lower non-recourse

volume, and somewhat lower average funds employed and yields

thereon. Net earnings for the first six months of 2012 declined 29%

to $2,126,254 compared with $2,992,107 in 2011 for similar reasons

to those noted above. Earnings per share were 25 cents compared to

33 cents last year. Factoring volume for the first half of 2012

declined 6% to $880 million largely as a result of lower

non-recourse volume. Revenue decreased 12% to $12,002,125

compared to $13,695,478 last year for reasons noted above.

Commenting on the second quarter and first half 2012 results, Mr.

Tom Henderson, the Company's President and CEO, stated: "Our

earnings are weaker compared to last year but we expect that the

second half of 2012 will be better than the first half. The

earnings for the quarter just ended do not yet reflect the impact

of the marketing initiatives Accord has undertaken. However,

where the results of those initiatives can clearly be seen is in

the build-up of funds employed that has occurred in our recourse

factoring business, particularly in the U.S. Funds employed

have increased 29% since the beginning of 2012 to $116 million at

June 30, 2012 and are within touching distance of our record high

$120 million. In addition, the pipeline of prospective transactions

continues to be satisfactory. This augurs well for the

Company's recourse business as we head into the second half of the

year. Our non-recourse business is also ramping up its marketing

campaign for our new product, AccordOctet." The Company's Board of

Directors today declared an increased quarterly dividend of $0.08

per common share, payable September 4, 2012 to shareholders of

record August 15, 2012. The Board also resolved, subject to

regulatory approval, to renew its normal course issuer bid which

expires August 7, 2012. Accord Financial Corp.

CONTACT: Please contact:Stuart AdairVice President, Chief Financial

OfficerAccord Financial Corp.77 Bloor Street West, 18th

floorToronto, ON M5S 1M2(416) 961-0304 Ext.

207sadair@accordfinancial.com

Copyright

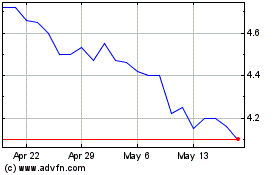

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jul 2023 to Jul 2024