Accord Announces Record Third Quarter and Nine Months Earnings Per Share and Declares Regular Quarterly Dividend

October 18 2011 - 10:55AM

PR Newswire (Canada)

TORONTO, Oct. 20, 2011 /CNW/ - Accord Financial Corp. , a leading

North American provider of factoring and other asset-based

financial services to businesses, today released its interim

unaudited consolidated financial results for the three and nine

months ended September 30, 2011. The financial results

presented in this release are reported in Canadian dollars and have

been prepared in accordance with International Financial Reporting

Standards. SUMMARY OF FINANCIAL RESULTS Three Months Ended Sept. 30

Nine Months Ended Sept. 30 2011 2010 2011 2010 Factoring $ $ $

volume 524 $ 1,461 1,588 (millions) 582 Revenue $ 7,341,838 $ $

21,037,316 $ 23,189,517 8,141,361 Net $ 2,248,167 $ $ $ 5,283,087

earnings 1,367,399 5,240,274 Basic and $ $ $ $ diluted 0.25 0.15

0.59 0.56 earnings per common share Basic and 8,905,931 9,407,348

8,952,283 9,408,338 diluted weighted average number of shares Net

earnings for the third quarter of 2011 rose 64% to a third quarter

record $2,248,167 compared to $1,367,399 last year. Earnings rose

due to lower expenses. Earnings per share increased to a

third quarter record 25 cents compared to 15 cents last year.

Factoring volume declined 10% to $524 million compared to $582

million last year, while revenue also declined 10% to $7,341,838

compared to $8,141,361 last year, in both cases due to lower

non-recourse volume. Net earnings for the first nine months of 2011

declined slightly to $5,240,274 on lower revenue compared with last

year's record nine months earnings of $5,283,087. Earnings per

share were a nine month record 59 cents this year compared to 56

cents last year. Factoring volume for the first nine months of 2011

declined 8% to $1,461 million as a result of lower non-recourse

volume. Revenue decreased 9% to $21,037,316 compared to

$23,189,517 last year for the same reason. Commenting on the 2011

third quarter and nine month results, Mr. Tom Henderson, the

Company's President and CEO stated: "The record net earnings and

earnings per share achieved in the third quarter just ended are

very satisfying. Although revenue declined, reduced expenses more

than offset the revenue decrease as credit and loan losses,

impairment charges and overhead costs were lower. For the nine

months, net earnings were just below last year's record, although,

on a lower share count, we had record earnings per share for the

period. In Canada, we are doing very well in our recourse factoring

business where the portfolio continues to grow, although our

non-recourse business has been negatively impacted by the

aggressive appetite of the credit insurers. In the U.S., we are

beginning to see signs that the aggressiveness of banks is

subsiding and we are getting an increasing number of inquiries

culminating in a higher number of new transactions which we expect

to close." The Company's Board of Directors today declared a

regular quarterly dividend of $0.075 per share, payable December 1,

2011 to shareholders of record November 15, 2011. Accord

Financial Corp. CONTACT: Stuart AdairVice President, Chief

Financial OfficerAccord Financial Corp.77 Bloor Street West, 18th

floorToronto, ON M5S 1M2(416) 961-0304 Ext.

207sadair@accordfinancial.com

Copyright

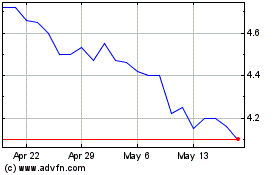

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jul 2023 to Jul 2024