Kering: Press release - First-half 2024 results

KERING_Press release - First-half 2024 results - 24 07 2024

PRESS RELEASE

|

July 24, 2024

|

FIRST-HALF 2024 RESULTS

Group revenue: €9,018

million

down 11% as reported and on a comparable basis

Recurring operating income:

€1,582 million

Net income attributable to the Group:

€878 million

“In a challenging market environment, which

adds pressure on our top line and profitability, we are working

assiduously to create the conditions for a return to growth. Our

Houses pursue their investments to enrich their offer, intensify

the impact of their communications, and reinforce the exclusivity

of their distribution. We make certain that every one of these

investments creates value for the long term. While the current

context might impact the pace of our execution, our determination

and confidence are stronger than ever.”

François-Henri Pinault, Chairman and

Chief Executive Officer

- Group

revenue amounted to €9.0 billion in the first half

of 2024, down 11% both as reported and on a comparable

basis.

- In the

second quarter of 2024, revenue totaled €4.5 billion, also

down 11% as reported and on a comparable basis. The decline in

revenue as reported includes a negative currency effect of 1% and a

positive scope effect of 1% from the consolidation of Creed.

- Sales from the

directly operated retail network fell by 12% on a comparable basis

in the second quarter, adversely affected by lower store traffic.

Trends in the various regions in the second quarter remained

broadly in line with the first quarter, apart from a sequential

improvement in Japan and a deceleration in Asia-Pacific.

- Wholesale and Other revenue fell 6%

on a comparable basis, as the Group continued to enhance the

exclusivity of its Houses’ distribution. Kering Eyewear pursued its

positive trend.

- As the Group

maintains its ongoing investment in its Houses, recurring

operating income fell 42% to €1.6 billion in the first

half, in line with the guidance provided when the Group reported

its first-quarter 2024 revenue. Recurring operating

margin was 17.5%, significantly lower than in the first

half of 2023, resulting from negative operational leverage. The

Group prioritizes expenditures aimed at nurturing the desirability

of its Houses and maintains strict control over all operating

expenses.

- Net

income attributable to the Group was €878 million in the

first half of 2024.

- Free

cash flow from operations remained high at €1.9 billion in

the first half excluding real estate acquisitions, thanks to good

inventory management in particular. Including the acquisition of a

prestigious property on Fifth Avenue in New York City, free cash

flow from operations totaled €1.1 billion.

Operating performance

(1) On a comparable

scope and exchange rate basis.

Revenue

(in € millions) |

|

H1 2024 |

H1 2023 |

Reported change |

Comparable change

(1) |

|

|

|

|

|

|

|

|

Gucci |

|

4,085 |

5,128 |

-20% |

-18% |

|

Yves Saint Laurent |

|

1,441 |

1,576 |

-9% |

-7% |

|

Bottega Veneta |

|

836 |

833 |

+0% |

+3% |

|

Other Houses |

|

1,717 |

1,856 |

-7% |

-6% |

|

Kering Eyewear and Corporate |

|

1,067 |

869 |

+23% |

+7% |

|

|

|

|

|

|

|

|

Eliminations |

|

(128) |

(127) |

N/A |

N/A |

|

|

|

|

|

|

|

|

KERING |

|

9,018 |

10,135 |

-11% |

-11% |

Recurring operating income

(in € millions) |

|

H1 2024 |

H1 2023 |

Change |

|

|

|

|

|

|

|

Gucci |

|

1,007 |

1,810 |

-44% |

|

Yves Saint Laurent |

|

316 |

481 |

-34% |

|

Bottega Veneta |

|

121 |

169 |

-28% |

|

Other Houses |

|

44 |

224 |

-80% |

|

Kering Eyewear and Corporate |

|

101 |

63 |

+61% |

|

|

|

|

|

|

|

Eliminations |

|

(7) |

(8) |

N/A |

|

|

|

|

|

|

|

KERING |

|

1,582 |

2,739 |

-42% |

Gucci

In the first half of 2024,

Gucci’s revenue was €4.1 billion, down 20% as

reported and down 18% on a comparable basis. Sales from the

directly operated retail network dropped 20% on a comparable basis,

while wholesale revenue was down 9%.

In the second quarter of 2024,

the House's sales were down 19% on a comparable basis, with a 20%

decline in the directly operated retail network. Performances in

each region were broadly in line with those of the prior quarter,

including a continuing marked decrease in Asia-Pacific. Gucci's new

offering, rolled out in stores in line with plans, is well

received, while sales of carryovers remained lower.

Gucci's recurring operating

income totaled €1.0 billion in the first half of 2024.

Recurring operating margin was 24.7%, reflecting

investments to pursue the House's long-term strategic

initiatives.

Yves Saint Laurent

Yves Saint Laurent's revenue in the

first half of 2024 was €1.4 billion, down 9% as reported

and down 7% on a comparable basis. On a comparable basis, the

House's sales from its directly operated retail network were down

6% while wholesale revenue fell 25%.

In the second quarter of 2024,

Yves Saint Laurent's sales were down 9% on a comparable basis, with

an 8% decline in the directly operated retail network. Performance

deteriorated in Asia-Pacific, while trends in Japan showed a

sequential improvement. The House pursued initiatives targeting

local customers, and its new collections were very well received.

Wholesale revenue was down 25% in the second quarter.

Yves Saint Laurent's recurring operating

income was €316 million in the first half and its

recurring operating margin was 22.0%, as the House

continues to invest in its communications and clientele

initiatives.

Bottega Veneta

Bottega Veneta had a record first

half, with revenue of €836 million,

unchanged as reported and up 3% on a comparable basis. Sales from

the directly operated retail network rose by 8% on a comparable

basis, while wholesale revenue was down 19% on a comparable

basis.

In the second quarter, the House's revenue was

up 4% on a comparable basis. Sales in the directly operated retail

network rose 7% on a comparable basis, supported by double-digit

growth in Western Europe and North America and strong momentum in

the Middle East. Sales in Asia-Pacific were resilient. Wholesale

revenue was down 13%.

Bottega Veneta’s recurring operating

income for the first half of 2024 totaled €121 million,

and its recurring operating margin was 14.5%,

reflecting significant communications expenditure as well as highly

exclusive clienteling events.

Other Houses

The Other Houses' revenue in

the first half of 2024 was €1.7 billion, down 7%

as reported and down 6% on a comparable basis. Sales from the

directly operated retail network rose 1% on a comparable basis,

while wholesale was down 21%.

Second quarter 2024 sales were

down 5% on a comparable basis, with contrasted performance across

Houses. Sales in the directly operated retail network were stable

year-on-year on a comparable basis. Jewelry Houses Boucheron and

Pomellato both achieved double-digit growth. Balenciaga's sales

from its directly operated retail network were unchanged on a

comparable basis. Alexander McQueen continued its creative

transition. Brioni posted strong revenue growth from its directly

operated retail network on a comparable basis. Wholesale revenue of

Other Houses was down 16%.

The Other Houses' recurring operating

income in the first half of 2024 amounted

to €44 million, resulting in a recurring operating

margin of 2.6%. That performance is attributable to

significant reinvestment in communications at Balenciaga and the

impact of the transition at Alexander McQueen, while Boucheron

delivered sharply higher operating income.

Kering Eyewear and Corporate

In the first half of 2024,

total revenue from the Kering Eyewear and

Corporate segment was €1.1 billion, mainly from the

activities of Kering Eyewear and Kering Beauté, the latter

comprising the sales of Creed.

Kering Eyewear's revenue in the

first half of 2024 totaled €914 million, up 5% as

reported and up 6% on a comparable basis.

In the second quarter, Kering

Eyewear's sales rose by 3% both on a comparable basis and as

reported, driven by solid progression of the brands in its

portfolio.

In the first half, Kering

Eyewear's recurring operating income was €196

million. Recurring operating income for the

segment was €101 million, after taking into

account Kering Beauté's recurring operating income along with

Corporate costs (€95 million).

Financial performance

In the first half of 2024, net financial

expense amounted to €288 million.

The effective tax rate on

recurring income was 26.9%.

Net income attributable to the

Group was €878 million.

Cash flow and financial position

The Group's free cash flow from

operations was €1.1 billion in the first half of 2024.

Excluding the acquisition of a prestigious property on Fifth Avenue

in New York City, free cash flow from operations totaled €1.9

billion.

At June 30, 2024, Kering's net

debt amounted to €9.9 billion.

Outlook

To achieve its long-term vision, Kering invests

in the development of its Houses, so that they continuously

strengthen their desirability and the exclusivity of their

distribution, strike a perfect balance between creative innovation

and timelessness, and achieve the highest standards in terms of

quality, sustainability, and experience for their customers. In an

environment of ongoing economic and geopolitical uncertainty,

Kering will continue to execute on its strategy and vision, in

pursuit of two key ambitions: to maintain a trajectory of long-term

profitable growth, and to confirm its status as one of the most

influential groups in the Luxury industry.

Considering the uncertainties weighing on the

evolution of demand from luxury consumers in the coming months

following the slowdown recorded in the first half of 2024, Kering’s

recurring operating income in the second half of 2024 could be down

by approximately 30% compared to the second half of 2023 (*).

The group prioritizes expenses and initiatives

supporting the long-term development and growth of its houses,

while pursuing with determination the actions required in the

current situation to optimize its cost structure.

(*) Based on the scope of consolidation and exchange rates at

the time of first-half 2024 reporting.

***

At its July 24, 2024, meeting, Kering's

Board of Directors, chaired by François-Henri Pinault, approved the

consolidated financial statements for the six months ended June 30,

2024, which were subject to a limited review.

WEBCAST

Kering will present

its first-half 2024 results in an audiocast, which

will be accessible here at 5.45pm (CET) on

Wednesday, July 24, 2024.

The presentation will

be followed by a Q&A session for analysts and investors.

The slides (in PDF

format) will be available ahead of the audiocast at

www.kering.com.

A replay of the

webcast will also be available at www.kering.com.

About Kering

Kering is a global Luxury group that manages

the development of a collection of renowned Houses in Fashion,

Leather Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta,

Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, Dodo,

Qeelin, Ginori 1735, as well as Kering Eyewear and Kering Beauté.

By placing creativity at the heart of its strategy, Kering enables

its Houses to set new limits in terms of their creative expression

while crafting tomorrow’s Luxury in a sustainable and responsible

way. We capture these beliefs in our signature: Empowering

Imagination. In 2023, Kering had 49,000 employees and revenue of

€19.6 billion.

Contacts

|

Press |

|

|

| Emilie

Gargatte |

+33 (0)1 45 64 61

20 |

emilie.gargatte@kering.com |

| Marie de

Montreynaud |

+33 (0)1 45 64 62

53 |

marie.demontreynaud@kering.com |

| |

|

|

|

Analysts/investors |

|

|

| Claire

Roblet |

+33 (0)1 45 64 61

49 |

claire.roblet@kering.com |

| Julien

Brosillon |

+33 (0)1 45 64 62

30 |

julien.brosillon@kering.com |

APPENDICES

EXCERPT FROM THE CONSOLIDATED FINANCIAL STATEMENTS AND

ADDITIONAL

INFORMATION RELATING TO THE FIRST-HALF 2024

RESULTS

SITUATION AS OF JUNE 30, 2024

|

| |

|

|

|

|

| |

|

|

|

|

| |

Contents |

|

page |

|

| |

|

|

|

|

| |

Announcements since January 1, 2024 |

8 |

|

| |

Consolidated income statement |

9 |

|

| |

Consolidated statement of comprehensive

income |

10 |

|

| |

Consolidated balance sheet |

11 |

|

| |

Consolidated statement of cash flows |

12 |

|

| |

Breakdown of revenue |

13 |

|

| |

Main definitions |

14 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

HIGHLIGHTS AND ANNOUNCEMENTS SINCE

JANUARY 1, 2024

Acquisition of strategic real-estate

assets in New York and Milan

January 22, 2024 – Kering announced the acquisition of a

prestigious New York City property comprising luxury retail spaces

across multiple floors and totaling approximately 115,000 sq. ft,

or 10,700 sq. m. The building is located at 715-717 Fifth Avenue

and the price paid was $963 million (the equivalent of €885 million

on the date of the announcement).

April 4, 2024 – Kering announced the acquisition of the company

that owns the iconic building located at 8 Via Monte Napoleone in

Milan, for a consideration of approximately €1.3 billion. This

18th-century building is located on the most prestigious corner of

Milan’s Quadrilatero della Moda fashion district. It has

five floors and gross floorspace of approximately 127,000 sq.

ft, or 11,800 sq. m.

These two investments form part of Kering’s selective real-estate

strategy aimed at securing key locations that are highly desirable

for its Houses.

“Triple A” CDP score for Kering's

climate commitments

February 6, 2024 – Kering is one of only 10 companies worldwide to

achieve a score of AAA following the Carbon Disclosure Project’s

annual assessment, which covers more than 21,000 companies. Kering

is the only company in its sector to earn this distinction,

confirming its leadership in terms of transparency and performance

as regards protecting the climate, forests and water.

Dual-tranche bond issue for a total

amount of €1.75 billion

March 5, 2024 – Kering carried out a dual-tranche bond issue for a

total of €1.75 billion, consisting of:

- a €1 billion tranche with an 8-year maturity and a 3.375% coupon;

and

- a €750 million tranche with a 12-year maturity and a 3.625%

coupon.

The issue forms part of the Group’s active liquidity management and

increases Kering's financial flexibility.

Creation of a tool to measure ecological

impact in Asia-Pacific in partnership with the National University

of Singapore

May 13, 2024 – Kering and the National University of Singapore

(NUS) officially announced that they were forming a partnership as

part of a research project. The aim of the project is to develop a

reference framework for measuring the impact of sustainability

strategies adopted by large corporations in Asia-Pacific. Over a

three-year period, the project will look at those corporations'

ecological transition strategies and environmental reports and

prepares a baseline study. That study is intended for business

leaders, investors, institutional investors and NGOs, and will be a

useful resource for measuring progress made by industries in the

region.

APPOINTMENTS SINCE JANUARY 1,

2024

Appointments to Kering’s Executive

Committee

April 2, 2024 – Kering announced the appointment of Mélanie

Flouquet, Chief Strategy Officer, and Armelle Poulou, Chief

Financial Officer, to the Group’s Executive Committee.

June 6, 2024 – Kering announced the appointment of Laurent Claquin

as its Chief Brand Officer and a member of the Executive Committee,

effective July 1, 2024.

Appointments to Kering’s Board of

Directors

April 25, 2024 – The Annual General Meeting has approved the

appointment of three new independent directors on the

recommendation of the Board of Directors and its Appointments and

Governance Committee: Rachel Duan, Giovanna Melandri and Dominique

D’Hinnin.

Appointment of Ewa Abrams as President

of Kering Americas

July 15, 2024 – Ewa Abrams, currently General Counsel of Kering

Americas, has been appointed as President of Kering Americas

effective August 1, 2024. She will report directly to Jean-Marc

Duplaix, Deputy CEO in charge of Operations and Finance.

CONSOLIDATED INCOME STATEMENT

|

(in € millions) |

First half 2024 |

First half 2023 |

|

CONTINUING OPERATIONS |

|

|

|

Revenue |

9,018 |

10,135 |

|

Cost of sales |

(2,310) |

(2,405) |

|

Gross margin |

6,708 |

7,730 |

|

Other personnel expenses |

(1,547) |

(1,505) |

|

Other recurring operating income and expenses |

(3,579) |

(3,486) |

|

Recurring operating income |

1,582 |

2,739 |

|

Other non-recurring operating income and expenses |

(13) |

- |

|

Operating income |

1,569 |

2,739 |

|

Financial result |

(288) |

(204) |

|

Income before tax |

1,281 |

2,535 |

|

Income tax expense |

(345) |

(692) |

|

Share in earnings (losses) of equity-accounted companies |

4 |

3 |

|

Net income from continuing operations |

940 |

1,846 |

|

o/w attributable to the Group |

878 |

1,785 |

|

o/w attributable to minority interests |

62 |

61 |

|

DISCONTINUED OPERATIONS |

|

|

|

Net income (loss) from discontinued

operations |

- |

- |

|

o/w attributable to the Group |

- |

- |

|

o/w attributable to minority interests |

- |

- |

|

GROUP TOTAL |

|

|

|

Net income of consolidated companies |

940 |

1,846 |

|

o/w attributable to the Group |

878 |

1,785 |

|

o/w attributable to minority interests |

62 |

61 |

|

(in € millions) |

First half 2024 |

First half 2023 |

|

Net income attributable to the Group |

878 |

1,785 |

|

Basic earnings per share (in €) |

7.16 |

14.60 |

|

Diluted earnings per share (in €) |

7.16 |

14.59 |

|

Net income from continuing operations attributable to the

Group |

878 |

1,785 |

|

Basic earnings per share (in €) |

7.16 |

14.60 |

|

Diluted earnings per share (in €) |

7.16 |

14.59 |

|

Net income from continuing operations (excluding

non‑recurring items) attributable

to the Group |

888 |

1,789 |

|

Basic earnings per share (in €) |

7.24 |

14.63 |

|

Diluted earnings per share (in €) |

7.24 |

14.62 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

|

(in € millions) |

First half 2024 |

First half 2023 |

|

Net income |

940 |

1,846 |

|

o/w attributable to the Group |

878 |

1,785 |

|

o/w attributable to minority interests |

62 |

61 |

Change in currency translation adjustments relating to

consolidated

Subsidiaries |

11 |

(95) |

|

change in currency translation adjustments |

11 |

(95) |

|

amounts transferred to the income statement |

- |

- |

|

Change in foreign currency cash flow hedges |

(63) |

119 |

|

change in fair value |

(16) |

204 |

|

amounts transferred to the income statement |

(52) |

(79) |

|

tax effects |

5 |

(6) |

Change in other comprehensive income (loss) of

equity‑accounted

Companies |

- |

- |

|

change in fair value |

- |

- |

|

amounts transferred to the income statement |

- |

- |

|

Gains and losses recognized in equity, to be transferred to the

income statement |

(52) |

24 |

|

Change in provisions for pensions and other post-employment

benefits |

(6) |

(2) |

|

change in actuarial gains and losses |

(8) |

(2) |

|

tax effects |

2 |

- |

|

Change in financial assets measured at fair

value |

15 |

16 |

|

change in fair value |

13 |

22 |

|

tax effects |

2 |

(6) |

Gains and losses recognized in equity, not to be

transferred to the income

Statement |

9 |

14 |

|

Total gains and losses recognized in equity |

(43) |

38 |

|

o/w attributable to the Group |

(44) |

40 |

|

o/w attributable to minority interests |

1 |

(2) |

|

COMPREHENSIVE INCOME |

897 |

1,884 |

|

o/w attributable to the Group |

834 |

1,825 |

|

o/w attributable to minority interests |

63 |

59 |

CONSOLIDATED BALANCE SHEET

Assets

|

(in € millions) |

June 30, 2024 |

Dec. 31, 2023 |

|

Goodwill |

7,090 |

7,112 |

|

Brands and other intangible assets |

8,185 |

8,178 |

|

Lease right-of-use assets |

5,098 |

4,984 |

|

Property plant and equipment |

6,314 |

5,341 |

|

Investments in equity-accounted companies |

1,775 |

1,750 |

|

Non-current financial assets |

483 |

536 |

|

Deferred tax assets |

1,507 |

1,520 |

|

Other non-current assets |

35 |

16 |

|

Non current assets |

30,487 |

29,437 |

|

Inventories |

4,346 |

4,550 |

|

Trade receivables and accrued income |

1,155 |

1,151 |

|

Current tax receivables |

762 |

765 |

|

Current financial assets |

64 |

136 |

|

Other current assets |

1,404 |

1,406 |

|

Cash and cash equivalents |

3,934 |

3,922 |

|

Current assets |

11,665 |

11,930 |

|

Assets held for sale |

- |

- |

|

TOTAL ASSETS |

42,152 |

41,367 |

Equity and liabilities

|

(in € millions) |

June 30, 2024 |

Dec. 31, 2023 |

|

Equity attributable to the Group |

14,901 |

15,212 |

|

Equity attributable to the minority interests |

849 |

798 |

|

Equity |

15,750 |

16,010 |

|

Non-current borrowings |

11,018 |

10,026 |

|

Non-current lease liabilities |

4,593 |

4,511 |

|

Non-current financial liabilities |

7 |

13 |

|

Non-current provisions for pensions and other post-employment

benefits |

78 |

68 |

|

Non-current provisions |

27 |

21 |

|

Deferred tax liabilities |

1,793 |

1,776 |

|

Other non-current liabilities |

433 |

311 |

|

Non current liabilities |

17,949 |

16,726 |

|

Current borrowings |

2,838 |

2,400 |

|

Current lease liabilities |

914 |

884 |

|

Current financial liabilities |

58 |

588 |

|

Trade payables and accrued expenses |

2,132 |

2,200 |

|

Current provisions for pensions and other post-employment

benefits |

13 |

12 |

|

Current provisions |

135 |

163 |

|

Current tax liabilities |

743 |

536 |

|

Other current liabilities |

1,620 |

1,848 |

|

Current liabilities |

8,453 |

8,631 |

|

Liabilities associated with assets held for

sale |

- |

- |

|

TOTAL EQUITY AND LIABILITIES |

42,152 |

41,367 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in € millions) |

First half 2024 |

First half 2023 |

|

Net income from continuing operations |

940 |

1,846 |

Net recurring charges to depreciation, amortization

and provision on non-current operating assets |

1,013 |

878 |

|

Other non-cash (income) expenses |

10 |

(139) |

|

Cash flow received from operating activities |

1,963 |

2,585 |

|

Interest paid (received) |

229 |

173 |

|

Dividends received |

(2) |

(7) |

|

Current tax expense |

312 |

684 |

Cash flow received from operating activities before

tax

dividends and interests |

2,502 |

3,435 |

|

Change in working capital requirement |

44 |

(419) |

|

Income tax paid |

(100) |

(419) |

|

Net cash received from operating activities |

2,446 |

2,597 |

|

Acquisitions of property, plant and equipment and intangible

assets |

(1,391) |

(1,891) |

|

Disposals of property, plant and equipment and intangible

assets |

- |

117 |

|

Acquisitions of subsidiaries and associates, net of cash

acquired |

(23) |

(55) |

|

Disposals of subsidiaries and associates, net of cash

transferred |

- |

- |

|

Acquisitions of other financial assets |

(35) |

(24) |

|

Disposals of other financial assets |

97 |

96 |

|

Interest and dividends received |

30 |

14 |

|

Net cash received from (used in) investing

activities |

(1,322) |

(1,743) |

|

Increase (decrease) in share capital and other transactions |

- |

- |

|

Dividends paid to shareholders of Kering SA |

(1,716) |

(1,712) |

|

Dividends paid to minority interests in consolidated

subsidiaries |

(6) |

(12) |

|

Transactions with minority interests |

(3) |

(26) |

|

(Acquisitions) disposals of Kering treasury shares |

3 |

(7) |

|

Issuance of bonds and bank debt |

1,750 |

1,508 |

|

Redemption of bonds and bank debt |

(512) |

(658) |

|

Issuance (redemption) of other borrowings |

153 |

(408) |

|

Repayment of lease liabilities |

(530) |

(419) |

|

Interest paid and equivalent |

(254) |

(178) |

|

Net cash received from (used in) from financing

activities |

(1,116) |

(1,912) |

|

Net cash received from (used in) discontinued operations |

- |

- |

|

Impact of exchange rate variations on cash and cash

equivalents |

37 |

14 |

|

Net increase (decrease) in cash and cash

equivalents |

46 |

(1,044) |

|

|

|

|

|

Cash and cash equivalents at opening |

3,650 |

4,094 |

|

Cash and cash equivalents at closing |

3,696 |

3,050 |

REVENUE FOR THE FIRST AND SECOND

QUARTERS

(in € millions)

|

|

H1 2024 |

H1 2023

|

Reported

change |

Comparable change

(1) |

Q2 2024 |

Q2 2023

|

Reported

change |

Comparable change

(1) |

Q1 2024 |

Q1 2023 |

Reported

change |

Comparable change

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gucci |

|

4,085 |

5,128 |

-20% |

-18% |

2,006 |

2,512 |

-20% |

-19% |

2,079 |

2,616 |

-21% |

-18% |

|

Yves Saint Laurent |

|

1,441 |

1,576 |

-9% |

-7% |

701 |

770 |

-9% |

-9% |

740 |

806 |

-8% |

-6% |

|

Bottega Veneta |

|

836 |

833 |

+0% |

+3% |

448 |

438 |

+2% |

+4% |

388 |

395 |

-2% |

+2% |

|

Other Houses |

|

1,717 |

1,856 |

-7% |

-6% |

893 |

966 |

-8% |

-5% |

824 |

890 |

-7% |

-6% |

|

Kering Eyewear and Corporate |

|

1,067 |

869 |

+23% |

+7% |

531 |

436 |

+22% |

+5% |

536 |

433 |

+24% |

+9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eliminations |

|

(128) |

(127) |

- |

- |

(65) |

(64) |

- |

- |

(63) |

(63) |

- |

- |

|

KERING |

|

9,018 |

10,135 |

-11% |

-11% |

4,514 |

5,058 |

-11% |

-11% |

4,504 |

5,077 |

-11% |

-10% |

(1) Change on a comparable scope and

exchange rate basis.

MAIN DEFINITIONS

“Reported” and “comparable”

growth

The Group’s “reported” growth corresponds to the change in reported

revenue (previously referred to as “actual” growth) between two

periods.

The Group measures “comparable” growth (also referred to as

“organic” growth) in its business by comparing revenue between two

periods at constant scope and exchange rates.

Changes in scope are dealt with as follows for the periods

concerned:

- the portion of revenue relating to

acquired entities is excluded from the current period;

- the portion relating to entities

divested or in the process of being divested is excluded from the

previous period.

Currency effects are calculated by applying the

average exchange rates for the current period to amounts in the

previous period.

Recurring operating

income

The Group’s operating income includes all revenues and expenses

directly related to its activities, whether these revenues and

expenses are recurring or arise from non-recurring decisions or

transactions.

Other non-recurring operating income and expenses consist of items

that, by their nature, amount or frequency, could distort the

assessment of the Group’s operating performance as reflected in its

recurring operating income. They include changes in scope, the

impairment of goodwill and brands and, where material, of property,

plant and equipment and intangible assets, capital gains and losses

on disposals of non-current assets, restructuring costs and

disputes.

“Recurring operating income” is therefore an alternative

performance indicator for the Group, defined as the difference

between operating income and other non-recurring operating income

and expenses. This indicator is intended to facilitate

understanding of the operating performance of the Group and its

Houses and can therefore be used as a way to estimate recurring

performance. It is presented in a manner that is consistent and

stable over the long term in order to ensure the continuity and

relevance of financial information.

EBITDA

The Group uses EBITDA as an alternative performance indicator to

monitor its operating performance. This financial indicator

corresponds to recurring operating income plus net charges to

depreciation, amortization and provisions on non-current operating

assets recognized in recurring operating income.

Free cash flow from operations,

available cash flow from operations and available cash

flow

The Group uses an intermediate line item, “Free cash flow from

operations”, to monitor its financial performance. This financial

indicator measures net operating cash flow less net operating

investments (defined as acquisitions and disposals of property,

plant and equipment and intangible assets).

The Group has also defined a new indicator, “Available cash flow

from operations”, in order to take into account capitalized fixed

lease payments (repayments of principal and interest) pursuant to

IFRS 16, and thereby reflect all of its operating cash flows.

“Available cash flow” therefore corresponds to available cash flow

from operations plus interest and dividends received, less interest

paid and equivalent (excluding leases).

Net debt

Net debt is one of the Group’s main financial indicators, and is

defined as borrowings less cash and cash equivalents. Lease

liabilities are not included in the calculation of this indicator.

Borrowings include put options granted to minority interests. The

cost of net debt corresponds to all financial income and expenses

associated with these items, including the impact of derivative

instruments used to hedge the fair value of borrowings.

Effective tax rate on recurring

income

The effective tax rate on recurring income corresponds to the

effective tax rate excluding tax effects relating to other

non-recurring operating income and expenses.

- KERING_Press release - First-half 2024 results - 24 07

2024

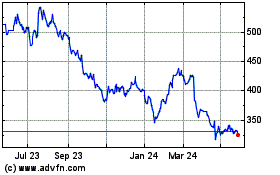

Kering (TG:PPX)

Historical Stock Chart

From Oct 2024 to Nov 2024

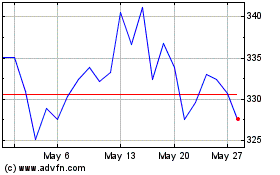

Kering (TG:PPX)

Historical Stock Chart

From Nov 2023 to Nov 2024