Hapag-Lloyd Backs 2023 Outlook After 1Q Hit From Weaker Demand

May 11 2023 - 2:21AM

Dow Jones News

By Adria Calatayud

Hapag-Lloyd on Thursday confirmed its 2023 outlook after

reporting sharp falls in first-quarter earnings and revenue, as

weaker shipping demand weighed on freight rates and transport

volumes.

The German shipping company said after-tax profit for the

quarter was $2.03 billion compared with $4.86 billion in the same

period of 2022, on revenue that was 33% lower at $6.03 billion.

Earnings before interest, taxes, depreciation and amortization

dropped to $2.38 billion from $5.31 billion.

The company attributed the declines to weak global demand that

resulted in a 4.9% fall in transport volumes against a backdrop of

cost inflation.

"The market environment has normalized, with corresponding

declines in demand and freight rates. This will undoubtedly have an

impact on our earnings over the course of the year, so we will be

keeping a very close eye on our costs," Chief Executive Rolf Habben

Jansen said.

Hapag-Lloyd confirmed its previous forecasts for 2023 Ebitda to

come in at between $4.3 billion and $6.5 billion, with earnings

before interest and taxes expected to be in a range of $2.1 billion

to $4.3 billion.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

May 11, 2023 02:06 ET (06:06 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

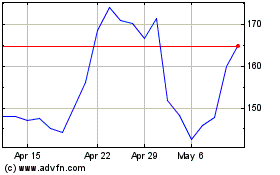

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

From Apr 2024 to May 2024

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

From May 2023 to May 2024