In respect of the description of the shareholder litigation

contained in the Offer Document as well as the description of the

treatment of Deutsche B�rse shares as components of the DAX and the

STOXX indices contained in the Offer Document the following is

published:

Settlement of Shareholder Litigation

Following the announcement of the business combination agreement

between NYSE Euronext (“NYSE Euronext”), Deutsche B�rse AG

(“Deutsche B�rse”), Alpha Beta Netherlands Holding N.V., a public

limited liability company incorporated under the laws of the

Netherlands (“Holdco”), and Pomme Merger Corporation, a Delaware

corporation and wholly owned subsidiary of Holdco (“Merger Sub”)

pursuant to which NYSE Euronext and Deutsche B�rse AG agreed to

combine their respective businesses and become subsidiaries of

Holdco (the “combination”) on February 15, 2011, several complaints

were filed in the Delaware Court of Chancery (the “Delaware

Court”); the Supreme Court of the State of New York, County of New

York (the “New York Court”); and the U.S. District Court for the

Southern District of New York (the “SDNY”), each challenging the

proposed combination. The Delaware cases were subsequently

consolidated under the caption In re NYSE Euronext Shareholders

Litigation, Consol. C.A. No. 6220-VCS (the “Delaware action”). The

New York Court cases were coordinated, and a Master File was

created, under the caption In re NYSE Euronext Shareholders

Litigation, Index No. 773000/11 (the “New York action” and together

with the Delaware action, the “actions”). The actions were brought

as putative class actions on behalf of shareholders of NYSE

Euronext and variously name as defendants NYSE Euronext, its

directors at the time of the announcement of the combination

(together with NYSE Euronext, the “NYSE Euronext defendants”),

Deutsche B�rse, Merger Sub and Holdco, and allege that the

individual defendants breached their fiduciary duties in connection

with their consideration and approval of the combination and that

the entity defendants aided and abetted those breaches. On May 26,

2011, plaintiffs in the actions filed a motion in the Delaware

Court seeking a preliminary injunction enjoining the scheduled July

7, 2011 NYSE Euronext shareholder vote on the combination.

On June 16, 2011, the plaintiffs in the actions, the NYSE

Euronext defendants, Deutsche B�rse and Holdco entered into a

memorandum of understanding (“MOU”) setting forth their agreement

in principal regarding a proposed settlement of all claims asserted

in the actions. As part of the settlement, the NYSE Euronext

defendants acknowledged that the pendency and prosecution of the

actions were a factor in the NYSE Euronext board of directors’

decision to support management’s recommendation that Holdco declare

a special dividend and consequently provide appraisal rights.

Additionally, in the MOU, Holdco acknowledged its intent to

recommend to the Holdco board of directors that following the

completion of the combination Holdco act upon the recommendations

of the boards of directors of NYSE Euronext and Deutsche B�rse that

Holdco issue the special dividend subject to the approval of the

Holdco board of directors, consistent with its fiduciary duties. As

part of the settlement, the parties agreed to seek to remove or

withdraw any pending requests for interim relief, specifically

including plaintiffs’ motion for a preliminary injunction in the

Delaware action.

The settlement is contingent upon, among other items, the

execution of a formal stipulation of settlement, Delaware Court

approval following notice to the class, final dismissal of the

actions with prejudice, and the completion of the combination. If

Holdco were to fail to pay the special dividend, for any reason,

the parties would have the option to terminate the settlement. If

the settlement is consummated, it would release all claims that the

plaintiffs and all members of the class may have arising out of or

relating in any manner to the combination, as described in the MOU,

including the federal action pending in SDNY.

Decision made on treatment of Deutsche B�rse shares as

components of DAX and STOXX indices in context of planned merger

with NYSE Euronext

The Working Committee for Equity Indices decided to replace the

Deutsche B�rse share (ISIN DE0005810055) with the tendered

Deutsche B�rse share (ISIN DE000A1KRND6) with two trading days

notice, provided an acceptance threshold of at least 50 percent is

reached by the end of the initial acceptance period (i.e., on 13

July 2011) or at any time during the additional acceptance period.

Once the 50% threshold is achieved the then larger share class is

included in the DAX in accordance with the index rulebook. If the

tendered Deutsche B�rse share is still an index member after

closing or discontinuation of the transaction, the tendered

Deutsche B�rse share will be replaced by the Alpha Beta Netherlands

Holdings N.V. share (ISIN NL0009766997) or the Deutsche B�rse

share (ISIN DE0005810055), respectively, provided that, in the

case of the closing of the transaction, the Alpha Beta Netherlands

Holdings N.V. share fulfils the criteria for inclusion in the DAX.

Deutsche B�rse stated that it will follow the independent decision

of the Working Committee for Equity Indices and will implement the

adjustments as decided.

The Deutsche B�rse share (ISIN DE0005810055) will be

replaced in STOXX indices by the tendered Deutsche B�rse share

(ISIN DE000A1KRND6) with two trading days notice, provided an

acceptance threshold of at least 75 percent is reached by 13 July

2011 or at any time during the additional acceptance period. The

new free float market capitalisation will reflect the reached

acceptance level. If the tendered Deutsche B�rse share is still an

index member, after closing or discontinuation of the transaction,

the tendered Deutsche B�rse share will be replaced by the Alpha

Beta Netherlands Holdings N.V. share (ISIN NL0009766997) or

the Deutsche B�rse share (ISIN DE0005810055), respectively,

provided that, in the case of the closing of the transaction, the

Alpha Beta Netherlands Holdings N.V. share fulfils the criteria for

inclusion in the STOXX indices.

With an increasing number of Deutsche B�rse shares being

tendered until 13 July 2011, there is a strong probability that the

liquidity of the untendered Deutsche B�rse shares

(ISIN DE0005810055) will be significantly lower than the

liquidity of the tendered Deutsche B�rse shares

(ISIN DE000A1KRND6).

Safe Harbour Statement

In connection with the proposed business combination transaction

between NYSE Euronext and Deutsche Boerse AG, Alpha Beta

Netherlands Holding N.V. (“Holding”), a newly formed holding

company, has filed, and the SEC has declared effective on May 3,

2011, a Registration Statement on Form F-4 with the U.S. Securities

and Exchange Commission (“SEC”) that includes (1) a proxy statement

of NYSE Euronext that will also constitute a prospectus for Holding

and (2) an offering prospectus of Holding to be used in connection

with Holding’s offer to acquire Deutsche Boerse AG shares held by

U.S. holders. Holding has also filed an offer document with the

German Federal Financial Supervisory Authority (Bundesanstalt fuer

Finanzdienstleistungsaufsicht) (“BaFin”), which was approved by the

BaFin for publication pursuant to the German Takeover Act

(Wertpapiererwerbs-und Übernahmegesetz), and was published on May

4, 2011.

Investors and security holders are urged to read the definitive

proxy statement/prospectus, the offering prospectus, the offer

document, as amended, and published additional accompanying

information in connection with the exchange offer regarding the

proposed business combination transaction because they contain

important information. You may obtain a free copy of the definitive

proxy statement/prospectus, the offering prospectus and other

related documents filed by NYSE Euronext and Holding with the SEC

on the SEC’s website at www.sec.gov. The definitive proxy

statement/prospectus and other documents relating thereto may also

be obtained for free by accessing NYSE Euronext’s website at

www.nyse.com. The offer document, as amended, and published

additional accompanying information in connection with the exchange

offer are available at Holding’s website at

www.global-exchange-operator.com. Holders of Deutsche B�rse shares

who have accepted the exchange offer have certain withdrawal rights

which are set forth in the offer document.

This document is neither an offer to purchase nor a solicitation

of an offer to sell shares of Holding, Deutsche Boerse AG or NYSE

Euronext. The final terms and further provisions regarding the

public offer are disclosed in the offer document that has been

approved by the BaFin and in documents that have been filed with

the SEC.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S.

Securities Act of 1933, as amended, and applicable European

regulations. The exchange offer and the exchange offer document, as

amended, shall not constitute an issuance, publication or public

advertising of an offer pursuant to laws and regulations of

jurisdictions other than those of Germany, United Kingdom of Great

Britain and Northern Ireland and the United States of America. The

relevant final terms of the proposed business combination

transaction will be disclosed in the information documents reviewed

by the competent European market authorities.

Subject to certain exceptions, in particular with respect to

qualified institutional investors (tekikaku kikan toshika) as

defined in Article 2 para. 3 (i) of the Financial Instruments and

Exchange Act of Japan (Law No. 25 of 1948, as amended), the

exchange offer will not be made directly or indirectly in or into

Japan, or by use of the mails or by any means or instrumentality

(including without limitation, facsimile transmission, telephone

and the internet) of interstate or foreign commerce or any facility

of a national securities exchange of Japan. Accordingly, copies of

this announcement or any accompanying documents may not be,

directly or indirectly, mailed or otherwise distributed, forwarded

or transmitted in, into or from Japan.

The shares of Holding have not been, and will not be, registered

under the applicable securities laws of Japan. Accordingly, subject

to certain exceptions, in particular with respect to qualified

institutional investors (tekikaku kikan toshika) as defined in

Article 2 para. 3 (i) of the Financial Instruments and Exchange Act

of Japan (Law No. 25 of 1948, as amended), the shares of Holding

may not be offered or sold within Japan, or to or for the account

or benefit of any person in Japan.

Participants in the Solicitation

NYSE Euronext, Deutsche Boerse AG, Holding and their respective

directors and executive officers and other members of management

and employees may be deemed to be participants in the solicitation

of proxies from NYSE Euronext stockholders in respect of the

proposed business combination transaction. Additional information

regarding the interests of such potential participants will be

included in the definitive proxy statement/prospectus and the other

relevant documents filed with the SEC.

Forward-Looking Statements

This document includes forward-looking statements about NYSE

Euronext, Deutsche Boerse AG, Holding, the enlarged group and other

persons, which may include statements about the proposed business

combination, the likelihood that such transaction could be

consummated, the effects of any transaction on the businesses of

NYSE Euronext or Deutsche Boerse AG, and other statements that are

not historical facts. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future performance

and actual results of operations, financial condition and

liquidity, and the development of the industries in which NYSE

Euronext and Deutsche Boerse AG operate may differ materially from

those made in or suggested by the forward-looking statements

contained in this document. Any forward-looking statements speak

only as at the date of this document. Except as required by

applicable law, none of NYSE Euronext, Deutsche Boerse AG or

Holding undertakes any obligation to update or revise publicly any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Amsterdam, June 28, 2011

Alpha Beta Netherlands Holding N.V.

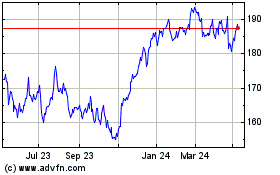

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Dec 2024 to Jan 2025

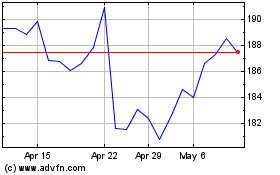

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Jan 2024 to Jan 2025