ISE and Hanweck Associates, LLC Announce Strategic Partnership

February 03 2010 - 8:30AM

Business Wire

The International Securities Exchange (ISE) and Hanweck

Associates, LLC, a premier financial-services provider specializing

in high-performance risk management and trading solutions for

institutional investors, announced today that ISE has made a

strategic investment in Hanweck Associates.

ISE’s minority investment will help Hanweck Associates support

further product development, expand its sales and technical support

teams, and meet the increasing market demand for real-time options

analytics as the options industry continues to grow.

“We believe that Hanweck Associates’ cutting-edge technology for

real-time options analytics is groundbreaking for the financial

industry, and we are excited to partner with them as they expand

their risk management and financial analytics tools for the options

market and other financial sectors,” said Gary Katz, President and

Chief Executive Officer of ISE. “As an industry leader in

high-performance, low-latency computing technology for options

market data, we also look forward to collaborating with Hanweck

Associates to enhance ISE’s suite of market data product

offerings.”

“As options trading volume and quote traffic continues to surge,

conventional market data systems are struggling to keep pace,”

explained Gerald A. Hanweck, Jr., PhD, Chief Executive Officer of

Hanweck Associates. “Hanweck Associates already delivers advanced

technologies, including graphics processing unit (GPU)-based

computing, to options market participants today. The support of

ISE, with its history of excellence in electronic options trading,

will undoubtedly help us broaden our reach and take these

applications to an entirely new level of performance.”

The investment follows a successful year for Hanweck Associates,

which saw the expansion of its real-time, low-latency options

analytics feed, VoleraFEED™, to vendor platforms including ACTIV

Financial, Interactive Data and SpryWare. In partnership with

Interactive Data, Hanweck Associates also released Options

Volatility Service™, an historical, end-of-day options and

analytics database service. Hanweck Associates continues to push

the envelope in high-performance computing with the release of its

VoleraAPI™, which opens the power of the Volera™ GPU-based engine

to financial engineers and developers.

Hanweck Associates’ VoleraFEED™ currently delivers real-time,

low-latency implied volatilities and Greeks to ISE’s front-end

options trading application, PrecISE Trade®. Built upon the

company’s Volera™ high-performance, GPU-based options analytics

engine, VoleraFEED™ delivers real-time implied volatilities and

Greeks on the entire U.S. OPRA universe with latency measured in

milliseconds. The Volera engine can perform tens of millions of

options valuations per second – 30 times faster than conventional

CPU-based systems. Volera’s innovative technology can reduce

operational costs by 90 percent, and easily scales to meet

ever-increasing OPRA message rates.

About ISE

The International Securities Exchange (ISE) operates a leading

U.S. options exchange and offers options trading on over 2,000

underlying equity, ETF, index, and FX products. As the first

all-electronic options exchange in the U.S., ISE transformed the

options industry by creating efficient markets through innovative

market structure and technology. Regulated by the Securities and

Exchange Commission (SEC) and a member-owner of The Options

Clearing Corporation (OCC), ISE provides investors with a

transparent marketplace for price and liquidity discovery on

centrally cleared options products. ISE continues to expand its

marketplace through the ongoing development of enhanced trading

functionality, new products, and market data services. As a

complement to its options business, ISE has expanded its reach into

multiple asset classes through strategic investments in financial

marketplaces that foster technology innovation and market

efficiency. Through minority investments, ISE participates in the

securities lending and equities markets. ISE also licenses its

proprietary Longitude technology for trading in event-driven

derivatives markets.

ISE is a wholly owned subsidiary of Eurex, a leading global

derivatives exchange. Eurex itself is jointly operated by Deutsche

B�rse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex

and ISE are the global market leader in individual equity and

equity index derivatives. For more information, visit

www.ise.com.

About Hanweck Associates, LLC

Hanweck Associates, LLC, provides high-performance risk

management and trading solutions for institutional investors. As an

established leader in high-performance financial computing, Hanweck

Associates pioneered commercial GPU-based computing solutions for

the financial industry with cutting-edge products such as the

Volera™ options analytics engine. The Hanweck Associates’ team of

seasoned traders, strategists, researchers, developers and

mathematicians unites decades of hands-on expertise in financial

markets and technology services at major financial institutions

with experience spanning all major asset classes and markets. For

more information, please visit www.hanweckassoc.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6165455&lang=en

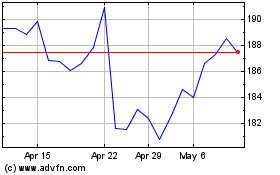

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Oct 2024 to Nov 2024

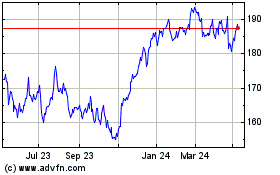

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Nov 2023 to Nov 2024