ISE and Direct Edge Announce Selection of Telx for Data Center Services

June 24 2009 - 3:00PM

Business Wire

The International Securities Exchange (ISE) and Direct Edge

today announced that they have jointly selected Telx to provide

disaster recovery data center services as part of a comprehensive

new data center strategy program. Working together, ISE and Direct

Edge will offer their member firms access to a robust and secure

data center capable of managing the complex technology environment

of ISE�s options exchange and Direct Edge�s two equity trading

platforms. Furthermore, this initiative leverages the facilities

management agreement between the two firms and provides additional

synergies from the unique partnership between ISE and Direct Edge.

Direct Edge is the fastest growing marketplace in the U.S. equities

space, having recently become the third largest stock market in the

country. ISE operates the world�s largest equity options

exchange.

�Telx offers a multitude of network and connectivity options

that will provide flexibility for both ISE�s and Direct Edge�s

member firms. With their exceptional customer service and

state-of-the art technology, we are confident that Telx�s

customer-oriented approach will meet the unique needs of our

customers,� said Daniel Friel, ISE�s Chief Information Officer.

�Telx understands our customers� need for low-latency

connectivity,� said Steve Bonanno, Chief Technology Officer at

Direct Edge. �The numerous connectivity choices Telx offers will

help expedite the customer migration to the disaster recovery data

center, which we want to have happen swiftly and smoothly.�

�Telx is extremely pleased that we were able to satisfy ISE and

Direct Edge�s substantial infrastructure and performance

requirements. ISE�s and Direct Edge�s selection of Telx validates

our focus and growth in the financial services vertical as well as

in proximity hosting in key markets such as the New York/New Jersey

metro region, Chicago, and San Francisco,"�said Eric Shepcaro,

Chief Executive Officer of Telx.

ISE will be building out the Telx site over the coming eighteen

months in order to ensure a smooth migration for member firms to

the new Global Trading System platform in late 2010. Direct Edge

plans to launch its Telx-based disaster recovery site in the second

quarter of 2010, with customer migration expected to begin early in

the first quarter of 2010.

ISE Background

The International Securities Exchange (ISE) operates the world�s

largest equity options exchange and offers options trading on over

2,000 underlying equity, ETF, index, and FX products. As the first

all-electronic options exchange in the U.S., ISE transformed the

options industry by creating efficient markets through innovative

market structure and technology. Regulated by the Securities and

Exchange Commission (SEC) and a member-owner of The Options

Clearing Corporation (OCC), ISE provides investors with a

transparent marketplace for price and liquidity discovery on

centrally cleared options products. ISE continues to expand its

marketplace through the ongoing development of enhanced trading

functionality, new products, and market data services. As a

complement to its options business, ISE has expanded its reach into

multiple asset classes through strategic investments in financial

marketplaces that foster technology innovation and market

efficiency. Through minority investments, ISE participates in the

securities lending and equities markets.

ISE is a wholly owned subsidiary of Eurex, a leading global

derivatives exchange. Eurex itself is jointly owned by Deutsche

B�rse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex

and ISE are the global market leader in individual equity and

equity index derivatives. For more information, visit

www.ise.com.

Direct Edge Background

Direct Edge is the third largest U.S. equities marketplace,

offering the next generation of displayed markets. With U.S. cash

equities volume routinely exceeding 2 billion shares per day,

Direct Edge uses multiple ECN and exchange platforms and unique

order types to match complementary forms of liquidity based on

sensitivity to transaction cost, fill rate, fill speed, and

contra-side sophistication, while maintaining high execution

quality and low latencies. Headquartered in Jersey City, N.J.,

Direct Edge is owned by a consortium that includes the

International Securities Exchange, Knight Capital Group, Inc.,

Citadel Derivatives Group, The Goldman Sachs Group, and J.P.

Morgan. More information about Direct Edge is available at

http://www.directedge.com.

About Telx

Telx is a world-class leader in providing interconnectivity

solutions through their network-neutral and network rich,

colocation facilities. With 15 facilities in North America, Telx

offers cost effective networking solutions for customers to

seamlessly access diverse global networks and exchange information

in a secure and reliable environment. More than 650 leading

telecommunications carriers, ISPs, content providers and

enterprises rely on Telx�s world-class team to support their

mission-critical global infrastructure needs and to create a global

connectivity marketplace to dramatically expand their business

growth opportunities. Telx is a privately held company

headquartered in New York City with facilities in New York,

Atlanta, Chicago, Dallas, Los Angeles, San Francisco, Santa Clara,

Miami, Phoenix, Charlotte, as well as Weehawken and Clifton, N.J.

For more information about Telx, visit www.telx.com.

Photos/Multimedia�Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=5993937&lang=en

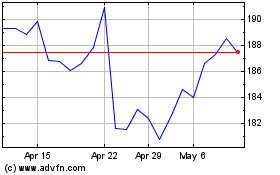

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Oct 2024 to Nov 2024

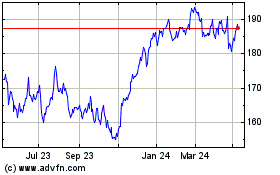

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Nov 2023 to Nov 2024