Asante Gold Corporation (CSE: ASE | GSE:ASG |

FRANKFURT:1A9 | U.S.OTC:ASGOF) (“Asante” or the "Company")

is pleased to announce the extension of the Grasshopper Pit mineral

resource estimate (“MRE”). The Grasshopper Pit is within the

Bibiani Mining Lease and located less than 2km north of the Bibiani

processing plant. Asante commenced mining at the Grasshopper Pit Q2

2023.

Highlights

- Resource definition

drilling results confirm consistency of low-grade high tonnage

mineralization mainly within the oxide transition material

representing immediately accessible mineralized material with high

recovery rates.

- Constrained Indicated Resources of

1.88Mt @ 1.04 g/t for 56.5koz of contained gold within an optimal

pit shell of US$1,850/oz gold price.

- The MRE for Grasshopper is

supported by approximately 10,000m of historical drilling and

8,800m of recent drilling.

- Multiple shoots of mineralization

are open along strike and down plunge beyond the US$1,850 pit

shell.

- Further drilling is planned with

potential to grow the mineral resource beyond the current pit

shell.

- Majority of mineralized

material from the Grasshopper Pit is within the oxide transition

zone and expected to yield gold recovery above 90%.

- Starter pit development and

mining commenced in Q2 2023.

- Gold mineralization is

associated with the sheared metasedimentary sequence bounded by

well-defined footwall and hanging wall structures.

Dave Anthony, President and CEO of Asante,

stated,

“I am pleased to announce this resource

extension and development of the Grasshopper Starter Pit. This

reflects our commitment to maximizing the full potential of our

land position and mining operations. The results from our

accelerated resource definition drilling are highly encouraging and

underscore the remarkable consistency of the high tonnage

mineralization within the oxide transition material. With a

Constrained Indicated Resource of 56.5Koz of gold at 1.04g/t within

an optimized pit shell, we are poised to unlock substantial value

from the Grasshopper pit.

Notably, the majority of the mineralized

material in the Grasshopper Pit lies within the oxide transition

zone with anticipated gold recovery exceeding 90% and haulage

distance of less than 2km to the process plant. Moreover, the

presence of multiple shoots of mineralization along strike and down

plunge beyond the existing pit shell highlights the promising

opportunities for sustained expansion and underscores our long-term

commitment to maximizing the value of this asset.

With successful commencement of the starter pit

and mining activities in Q2 2023, we look forward to further

strengthening our position in the market and delivering exceptional

value for our shareholders and stakeholders. Our ongoing commitment

to responsible and sustainable mining practices remains unwavering

as we continue to drive growth and create lasting value for all

stakeholders.”

Details of Drill Results

Table 1: Grasshopper Drilling Results

|

Significant Drilling Intercepts - Grasshopper

Drilling |

|

Project Area |

Hole ID |

From(m) |

To(m) |

Interval(m) |

Au(g/t) |

Description |

|

GRASSHOPPER |

MGDD23-215 |

11.5 |

17.5 |

6.0 |

1.65 |

6m @ 1.65 Au(g/t) |

|

GRASSHOPPER |

MGDD23-218 |

57 |

68 |

11.0 |

2.73 |

11m @ 2.73 Au(g/t) |

|

GRASSHOPPER |

MGRC21-027 |

45 |

48 |

3.0 |

1.26 |

3m @ 1.26 Au(g/t) |

|

GRASSHOPPER |

MGRC21-029 |

57 |

67 |

10.0 |

3.46 |

10m @ 3.46 Au(g/t) |

|

GRASSHOPPER |

MGRC22-136 |

26 |

31 |

5.0 |

1.65 |

5m @ 1.65 Au(g/t) |

|

GRASSHOPPER |

MGRC22-138 |

45 |

53 |

8.0 |

3.46 |

8m @ 3.46 Au(g/t) |

|

GRASSHOPPER |

MGRC22-141 |

26 |

29 |

3.0 |

0.80 |

3m @ 0.8 Au(g/t) |

|

GRASSHOPPER |

MGRC22-142 |

52 |

57 |

5.0 |

0.83 |

5m @ 0.83 Au(g/t) |

|

GRASSHOPPER |

MGRC22-144 |

40 |

44 |

4.0 |

1.42 |

4m @ 1.42 Au(g/t) |

|

GRASSHOPPER |

MGRC22-147 |

85 |

88 |

3.0 |

0.55 |

3m @ 0.55 Au(g/t) |

|

GRASSHOPPER |

MGRC22-148 |

70 |

73 |

3.0 |

5.86 |

3m @ 5.86 Au(g/t) |

|

GRASSHOPPER |

MGRC22-149 |

89 |

92 |

3.0 |

0.98 |

3m @ 0.98 Au(g/t) |

|

GRASSHOPPER |

MGRC22-152 |

74 |

77 |

3.0 |

2.14 |

3m @ 2.14 Au(g/t) |

|

GRASSHOPPER |

MGRC22-153 |

57 |

60 |

3.0 |

0.85 |

3m @ 0.85 Au(g/t) |

|

GRASSHOPPER |

MGRC22-156 |

47 |

50 |

3.0 |

2.60 |

3m @ 2.6 Au(g/t) |

|

GRASSHOPPER |

MGRC22-157 |

58 |

67 |

9.0 |

1.70 |

9m @ 1.7 Au(g/t) |

|

GRASSHOPPER |

MGRC22-158 |

64 |

67 |

3.0 |

1.11 |

3m @ 1.11 Au(g/t) |

|

GRASSHOPPER |

MGRC22-186 |

48 |

51 |

3.0 |

0.77 |

3m @ 0.77 Au(g/t) |

|

GRASSHOPPER |

MGRC23-209 |

141 |

146 |

5.0 |

3.18 |

5m @ 3.18 Au(g/t) |

|

GRASSHOPPER |

MGRC23-232 |

4 |

7 |

3.0 |

1.46 |

3m @ 1.46 Au(g/t) |

|

GRASSHOPPER |

MGRC23-238 |

27 |

34 |

7.0 |

1.05 |

7m @ 1.05 Au(g/t) |

|

GRASSHOPPER |

MGRC23-239 |

49 |

52 |

3.0 |

2.21 |

3m @ 2.21 Au(g/t) |

|

GRASSHOPPER |

MGRC23-240 |

78 |

81 |

3.0 |

1.08 |

3m @ 1.08 Au(g/t) |

Notes:

- Intervals reported are down hole

lengths. True width estimated @ 80%.

- Length-weighted averages from

uncapped assays with assumptions of 0.5g/t cut off and <3m

internal waste.

Figure 1: Lidar image of the Bibiani mine

showing the Grasshopper pit in relation to mine infrastructure.

Figure 2: Longitudinal Section

of Grasshopper showing selected drill intercepts.

Figure 3: Longitudinal Section

of Grasshopper showing resource blocks (above 0.5g/t), and selected

drill intercepts indicating further resource expansion beyond the

current pit design

Grasshopper Estimation Approach and

Parameters

The effective date of the MRE for Grasshopper is

November 25, 2022. The model was undertaken by the technical team

of Mensin Gold Bibiani Limited and was reviewed by Kwamina

Ackun-Wood, the former Exploration Manager and Qualified Person as

defined by NI 43-101.

QA/QC

Asante employs a QA/QC program consistent with

NI 43-101 and industry best practices. Surface drilling was

conducted by GTS Drilling Services and Toomahit Drill Limited and

was supervised by the Asante exploration teams. Selected

drill core intervals were sawn in half with a diamond blade saw.

Half of the sampled core was left in the core box and the remaining

half was bagged and sealed. Asante utilizes accredited

laboratories, and the samples were transported to either

ALS-Kumasi, SGS or the Intertek laboratory in Tarkwa, Ghana. Gold

was analyzed by 50-gram fire assay with Atomic Absorption finish.

Certified reference material (CRM) standards and coarse blank

material are inserted every 20 samples. Drill intercepts cited

do not necessarily represent true widths, unless otherwise

noted.

Qualified Person Statement

Scientific and technical information contained

in this news release was reviewed and approved by Kwamina

Ackun-Wood, a member of the Australasian Institute of Mining and

Metallurgy, and the former Exploration Manager for Mensin Gold

Bibiani Limited, a wholly owned subsidiary of Asante, a “qualified

person” under NI 43-101.

About Asante Gold Corporation

Asante is a gold exploration, development and

operating company with a high-quality portfolio of projects and

mines in Ghana. Asante is currently operating the Bibiani and

Chirano Gold Mines and continues with detailed technical studies at

its Kubi Gold Development Project. All mines and exploration

projects are located on the prolific Bibiani and Ashanti Gold

Belts. Asante has an experienced and skilled team of mine finders,

builders and operators, with extensive experience in Ghana. The

Company is listed on the Canadian Securities Exchange, the Ghana

Stock Exchange and the Frankfurt Stock Exchange. Asante is also

exploring its Keyhole, Fahiakoba and Betenase projects for new

discoveries, all adjoining or along strike of major gold mines near

the centre of Ghana’s Golden Triangle. Additional information is

available on the Company’s website at www.asantegold.com.

About the Bibiani Gold Mine

Bibiani is an operating open pit gold mine

situated in the Western North Region of Ghana, with previous gold

production of more than 4.5 million ounces. It is fully permitted

with available mining and processing infrastructure on-site

consisting of a newly refurbished 3 million tonne per annum process

plant and existing mining infrastructure. Asante commenced mining

in late February 2022 with the first gold pour announced on July 7,

2022. Commercial production was announced November 10, 2022.

For additional information relating to the

mineral resource and mineral reserve estimates for the Bibiani Gold

Mine, please refer to Asante’s press releases dated July 18, 2022

and September 1, 2022 and the technical report filed on its SEDAR

profile (www.sedarplus.ca) on September 1, 2022.

About the Chirano Gold Mine

Chirano is an operating open pit and underground

mine located in the Western Region of Ghana, immediately south of

the Company’s Bibiani Gold Mine. Chirano was first explored and

developed in 1996 and began production in October 2005. The mine

comprises the Akwaaba, Suraw, Akoti South, Akoti North, Akoti

Extended, Paboase, Tano, Obra South, Obra, Sariehu and Mamnao open

pits and the Akwaaba and Paboase underground mines.

For additional information relating to the

mineral resource and mineral reserve estimates for the Chirano Gold

Mine, please refer to Asante’s press releases dated October 15,

2022 and May 15, 2023 and the technical report filed on its SEDAR

profile (www.sedarplus.ca).

For further information please

contact:

Dave Anthony, President & CEOFrederick Attakumah, Executive

Vice President and Country Director

info@asantegold.com+1 604 661 9400 or +233 303 972 147

Cautionary Statement on Forward-Looking

Statements

Certain statements in this news release

constitute forward-looking statements, including but not limited

to, estimated mineral resources, reserves, exploration results and

potential, development programs and potential synergies between

Chirano and Bibiani. Forward-looking statements involve risks,

uncertainties and other factors that could cause actual results,

performance, prospects, and opportunities to differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially from

these forward-looking statements include, but are not limited to,

variations in the nature, quality and quantity of any mineral

deposits that may be located, the Company’s inability to obtain any

necessary permits, consents or authorizations required for its

planned activities, the Company’s inability to raise the necessary

capital or to be fully able to implement its business strategies,

and the price of gold. The reader is referred to the Company’s

public disclosure record which is available on SEDAR+

(www.sedarplus.ca). Although the Company believes that the

assumptions and factors used in preparing the forward-looking

statements are reasonable, undue reliance should not be placed on

these statements, which only apply as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. Except as required by

securities laws and the policies of the securities exchanges on

which the Company is listed, the Company disclaims any intention or

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or

otherwise.

LEI Number: 529900F9PV1G9S5YD446. Neither IIROC

nor any stock exchange or other securities regulatory authority

accepts responsibility for the adequacy or accuracy of this

release.

Photos accompanying this announcement are available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f78b2ce0-c009-4f85-8e32-e55db365c621

https://www.globenewswire.com/NewsRoom/AttachmentNg/bbd2bbbd-e050-4cd1-a829-7e6a6a86fe93

https://www.globenewswire.com/NewsRoom/AttachmentNg/2fe94b9f-357b-40db-aa04-e6df7281eeaa

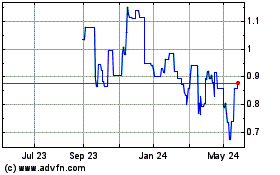

Asante Gold (TG:1A9)

Historical Stock Chart

From Nov 2024 to Dec 2024

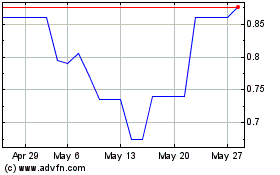

Asante Gold (TG:1A9)

Historical Stock Chart

From Dec 2023 to Dec 2024