| | |

|

|

|

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

|

|

| FORM 11-K |

|

|

|

| (Mark One) |

|

(X) ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended December 31, 2021 |

|

| OR |

|

( ) TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

|

| For the transition period from ____________ to ____________ |

|

|

| Commission file number 1-4174 |

|

|

| A. Full title of the plan: |

|

| The Williams Investment Plus Plan |

|

|

| B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

|

| The Williams Companies, Inc. |

| One Williams Center |

| Tulsa, Oklahoma 74172 |

|

|

|

THE WILLIAMS INVESTMENT PLUS PLAN

INDEX TO FINANCIAL STATEMENTS

| | | | | | | | | | | | | | |

| |

| |

| Audited financial statements | |

| |

| |

| |

| |

| |

| |

| |

| Supplemental schedule | |

| |

| |

| |

| |

| |

| |

EX – 23 | |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of

The Williams Investment Plus Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Williams Investment Plus Plan (the Plan) as of December 31, 2021 and 2020, and the related statement of changes in net assets available for benefits for the year ended December 31, 2021 and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2021 and 2020, and the changes in its net assets available for benefits for the year ended December 31, 2021 in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedules Required by ERISA

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2021, (referred to as the “supplemental schedule”) has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

We have served as the Plan’s auditor since 1998.

Tulsa, Oklahoma

June 9, 2022

THE WILLIAMS INVESTMENT PLUS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

December 31, 2021 and 2020

| | | | | | | | | | | |

| 2021 | | 2020 |

| Assets: | | | |

Investments (at fair value) | $ | 1,701,979,822 | | | $ | 1,524,022,016 | |

Notes receivable from participants | 20,941,200 | | 20,738,596 |

Non-interest bearing cash | 341,046 | | 872,572 |

Receivables | 299,281 | | 3,243,880 |

Contribution receivable | 12,000,754 | | 10,852,778 |

| | | |

Total assets | 1,735,562,103 | | | 1,559,729,842 | |

| | | |

| Liabilities: | | | |

Accrued liabilities | 790,511 | | | 2,103,288 | |

| | | |

Total liabilities | 790,511 | | | 2,103,288 | |

| | | |

Net assets available for benefits | $ | 1,734,771,592 | | | $ | 1,557,626,554 | |

| | | |

See accompanying notes.

THE WILLIAMS INVESTMENT PLUS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Year Ended December 31, 2021

| | | | | |

| |

| Additions to net assets: | |

| Contributions: | |

Participant | $ | 51,935,894 | |

Employer | 45,037,480 | |

Rollovers | 9,024,755 | |

Total contributions | 105,998,129 | |

| |

| Net investment income: | |

Net increase in fair value of investments | 204,479,324 | |

Dividends | 19,010,193 | |

Interest | 29,188 | |

Total net investment income | 223,518,705 | |

| |

| Interest income on notes receivable from participants | 1,050,288 | |

| |

Total additions to net assets | 330,567,122 | |

| |

| Deductions from net assets: | |

Withdrawals | 150,577,133 | |

Administrative expenses | 2,798,084 | |

Dividend distributions | 46,867 | |

| |

Total deductions from net assets | 153,422,084 | |

| |

| Net increase during the year | 177,145,038 | |

| |

| Net assets available for benefits at beginning of year | 1,557,626,554 | |

| |

| Net assets available for benefits at end of year | $ | 1,734,771,592 | |

| |

See accompanying notes.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Note 1--Description of plan

The information included below regarding The Williams Investment Plus Plan (the “Plan”) provides only a general description of the Plan. Participants should refer to the Plan document, as amended and restated, and Summary Plan Description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan maintained for the benefit of substantially all employees of The Williams Companies, Inc., and its participating subsidiaries (collectively, “Williams” or “Employer”) as provided in the Plan. A small amount of the Plan is an employee stock ownership plan (“ESOP”) and includes shares of Williams common stock held in the Transtock and Williams Companies Employee Stock Ownership Plan (“WESOP”) Accounts, as defined in the Plan.

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Plan is intended to constitute a plan described in Section 404(c) of ERISA and Title 29 of the Code of Federal Regulations Section 2550.404c-1, and the fiduciaries of the Plan may be relieved of liability for any losses that are the direct and necessary result of investment instructions given by a participant or beneficiary.

Administration

The Administrative Committee is the Plan administrator. The Investment Committee has the responsibility to monitor the performance of the trustee, investment funds and investment managers, and select, remove, and replace the trustee, any investment fund and any investment manager. The Benefits Committee has the authority and responsibility to determine whether to override the terms of the Plan which require the availability of common stock issued by The Williams Companies, Inc. The Benefits Committee, in its settlor capacity, may amend the Plan, provided it is a nonmaterial amendment as detailed in the Plan. Fidelity Management Trust Company (“FMTC”) is the trustee and record keeper. Additionally, Fidelity Investments Institutional Operations Company, Inc., provides certain other record keeping services for the Plan.

Contributions

Each eligible participant has contribution accounts consisting primarily of, as applicable, pre-tax, Roth, catchup, rollover, and employer contribution accounts. Certain participants may also have additional contribution accounts, as applicable.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Each eligible employee participant may contribute from 1 percent to a maximum of 50 percent of their eligible compensation per pay period on a pre-tax and/or Roth basis. The maximum pre-tax and/or Roth contribution percentage for Highly Compensated Employees is subject to periodic adjustment in order to meet discrimination testing requirements and certain annual maximum statutory limits imposed by the Internal Revenue Service (“IRS”). The Employer will contribute an amount equal to 100 percent of each participant’s contribution per pay period up to a maximum of 6 percent of their eligible compensation. In addition, the Plan allows for discretionary Employer contributions. No such discretionary Employer contributions were made in 2021.

Additionally, eligible active employees who are not eligible to receive compensation credits under Williams’ defined benefit pension plan are eligible to receive a 4.5 percent Employer Fixed Annual Contribution made by Williams. The Employer Fixed Annual Contribution is made after the end of each Plan year and included in Contribution receivable on the Statements of Net Assets Available for Benefits. Eligible employees generally must be an active employee at year end to receive this contribution, with exceptions for retirement, disability, death, divestiture, and reduction in force.

The Plan also includes an automatic enrollment feature. Eligible participants who do not make an affirmative election to contribute or an affirmative election not to contribute within 60 days of hire are automatically enrolled in the Plan. If automatically enrolled, 3 percent of the participant’s eligible compensation is withheld on a pre-tax basis and invested in the default investment option designated by the Investment Committee. The participant has the right to change the contribution percentage, elect to discontinue contributions to the Plan, or make investment changes at any time.

Participants may elect to invest in various investment options provided they allocate their contribution in multiples of 1 percent and subject to certain other restrictions. Investment options include common/collective trusts, common stocks including common stocks held within separately managed accounts, mutual funds, and a self-directed brokerage fund. A participant may change their investment election at any time. Participants may also exchange or rebalance any investment in their Plan account in accordance with the Plan’s investment provisions.

The Plan does not allow participants’ contributions, including employer and employee contributions, loan payments, and rollovers to be made or invested in shares of Williams common stock. A small amount of Williams common stock continues to be held in the Transtock and WESOP Accounts within the Plan’s Legacy WMB Stock Fund. Dividend payments on Williams common stock not passed through to the participant continue to be reinvested in additional shares of Williams common stock until the participant elects to receive such dividends in cash.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Vesting

Participants have a nonforfeitable vested interest in the current fair value of the assets purchased with their contributions. Eligible participants become 20 percent vested in the employer contributions made on their behalf after one year of service as defined by the Plan. Such vesting increases an additional 20 percent for each year of service, and participants become 100 percent vested upon five years of service. In addition, a participant may become totally vested in their account by reason of their death, total and permanent disability, attainment of age 65, eligibility to receive early retirement benefits under a pension plan of Williams, reduction in work force, complete discontinuance of employer contributions, or termination or partial termination of the Plan. Upon certain sales of assets or companies, participants that have an involuntary termination of employment as a result of such sale are also 100 percent vested.

Employer contributions that are not vested at the time a participant withdraws from the Plan by reason of termination of employment, other than permanent job elimination or permanent reduction in work force, are used for certain items as specified in the Plan document, including the reduction of future employer contributions and payment of Plan expenses. During 2021, employer contributions were reduced by $879 thousand from forfeited nonvested accounts.

Distributions and in-service withdrawals

Participants are entitled to receive the vested portion of their account when they cease to be an employee of Williams for any reason including retirement. Upon termination of service, a participant has distribution options available as outlined in the Plan.

Generally, the payment of benefits under the Plan shall be made in cash. However, with respect to amounts held in the Plan’s Legacy WMB Stock Fund, the participant may request payment of benefits under the Plan in common stock held within the fund.

Eligible employee participants may request a partial withdrawal from the Plan of their rollover contribution accounts and a portion, as defined in the Plan document, of their Prior Plans After-Tax Account. Eligible employee participants may make two such withdrawals during any Plan year and are not suspended from participation in the Plan following such a withdrawal. Outstanding loans will reduce the amount available for partial withdrawals.

Eligible participants who have completed two years of service and who are employees may request an additional in-service withdrawal from the Plan. The amount available for this withdrawal is calculated as defined in the Plan, but in no event shall it exceed the vested portion of the participant’s Employer Matching Contribution Account, Employer Cash Contribution Account, and the balance of the After-Tax Account. Outstanding loans will reduce the amount available for additional in-service withdrawals. Upon electing an additional in-service withdrawal, a participant is suspended from participation in the Plan for three months. Only one such withdrawal may be made every 12 months.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

A participant who is at least age 59½ may request a post-59½ withdrawal from the Plan. The withdrawal can include the vested portion of certain of the participant’s employer and employee contribution accounts. Outstanding loans will reduce the amount available for post-59½ withdrawals. Such withdrawal may be requested at any time and does not cause the participant to be suspended from the Plan.

An eligible employee participant who has a balance in a WESOP Account or Transtock Account may withdraw such balance at any time. Such withdrawal does not cause the participant to be suspended from the Plan.

Withdrawals from an eligible employee participant’s Pre-Tax Account and Roth Account before age 59½ may be made if the participant has suffered a financial hardship condition, as defined in the Plan. Such withdrawal does not cause the participant to be suspended from the Plan.

A participant who is under age 59½ and is totally and permanently disabled, as defined in the Plan, may make a withdrawal from the eligible amounts in their Pre-Tax Account and Roth Account or request a full distribution from the Plan.

Participant loans

The Plan permits eligible employee participants to obtain up to two loans from their account balances within specified limitations. Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 reduced by the aggregate of the highest outstanding balances of such loans during the immediately preceding 12-month period, or 50 percent of their vested balance. Loan terms may not exceed 58 months unless the loan is for the purchase of a primary residence, in which case the loan term may not exceed 25 years. Periodic principal and interest payments are reinvested according to the participant’s current investment election on file. The interest rate is equal to the prime rate of interest plus one percentage point or such other rate as the Administrative Committee shall specify. Principal and interest are paid ratably through payroll deductions. If the participant’s employment is terminated, the participant may continue to make principal and interest payments subject to certain limitations. Participants may make additional partial payments of the loan at any time and in such form as required by the record keeper.

Other

Each participant has their own individual account. Contributions and investment earnings are recorded to individual participant accounts. Plan investments are valued daily. The fair value per share of each fund is multiplied by the number of shares of the fund held in the participant’s account to arrive at their account balance.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Net investment income (loss), including the net change in fair value of investments, on assets held in allocated accounts is applied to the individual participant accounts based on each participant’s account balances.

The ESOP allows for the election of dividend pass-through, which are cash dividends paid directly to participants, for the dividends received on the shares of Williams common stock held within the Plan’s ESOP.

While the Compensation and Management Development Committee of the Williams Board of Directors has not expressed any intent to terminate the Plan, it may do so, in its settlor capacity, at any time. In the event of any Plan termination, assets of the Plan will be distributed in accordance with the Plan document.

Note 2--Summary of significant accounting policies

Basis of accounting

The accompanying financial statements of the Plan are prepared on the accrual basis of accounting. However, benefit payments to participants are recorded when paid.

Notes receivable from participants

Notes receivable from participants are measured at their unpaid principal balance plus any estimated accrued and unpaid interest. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced, and a withdrawal is recorded. Thus, no allowance for credit losses is required or recorded.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires the Plan’s Administrative Committee to make estimates that affect the amounts reported in the financial statements, accompanying notes, and supplemental schedule. Actual results could differ from those estimates.

Risks and uncertainties

The Plan provides for various investment securities. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility risk. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the Statements of Net Assets Available for Benefits and participants’ account balances.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Investment valuation and income recognition

The Plan’s investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A discussion of fair value measurements is included in Note 3.

Purchases and sales of securities are recorded on a trade-date basis, which may result in amounts due to or from brokers related to unsettled trades. Dividend income is recorded on the ex-dividend date. Net increase (decrease) in fair value of investments includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Contributions

Participant contributions are recorded when Williams makes payroll deductions from eligible Plan participants. Employer contributions are accrued in the period in which they become obligations of Williams.

Administrative expenses

Certain administrative expenses, including audit and legal fees, of the Plan are paid by Williams.

Note 3--Fair value measurements

The fair value hierarchy prioritizes the inputs used to measure fair value, giving the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). Fair value balances are classified based on the observability of those inputs. The fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The Plan’s Level 1 investments primarily consist of mutual funds, common stocks, and money market funds that are traded on U.S. exchanges, as well as interest-bearing cash. The Plan’s Level 2 investments primarily consist of common stocks traded on foreign exchanges, certificates of deposit, and government and corporate bonds. The Plan’s Level 3 investments consist of private placement common stocks that are not traded on an exchange.

The fair values of common stocks traded on U.S. exchanges and exchange-traded funds within the self-directed brokerage fund are derived from quoted market prices as of the close of business on the last business day of the Plan year. The fair value of common stocks traded on foreign exchanges are also derived from quoted market prices as of the close of business on an active foreign exchange on the last business day of the Plan year. The valuation requires

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

translation of the foreign currency to U.S. dollars, and the foreign exchange rate used in the translation is considered an observable input to the valuation. Shares of money market funds and mutual funds are valued at fair value based on published market prices as of the close of business on the last business day of the Plan year, which represent the net asset values (“NAV”) of the shares held by the Plan. The carrying value of interest-bearing cash approximates fair value because of the short-term nature of this investment. The units of the common/collective trusts are valued at fair value using the NAV practical expedient as determined by the issuer based on the current fair values of the underlying assets of the fund (see Note 4). There have been no significant changes in the preceding valuation methodologies used at December 31, 2021 and 2020.

The valuation methods described above may produce a fair value that may not be indicative of net realizable value or reflective of future fair values. The use of different methodologies or assumptions to determine fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following table sets forth, by level within the fair value hierarchy, the Plan’s assets that are measured at fair value as of December 31, 2021 and 2020, with the exception of the common/collective trusts measured at fair value using the NAV practical expedient. The combined fair value for the common/collective trusts is provided to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Net Assets Available for Benefits.

| | | | | | | | | | | | | | | | | | | | | | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

2021: | | | | | | | |

Interest-bearing cash | $ | 3,825,101 | | | $ | — | | | $ | — | | | $ | 3,825,101 | |

Mutual funds | 277,986,044 | | | — | | | — | | | 277,986,044 | |

Self-directed brokerage fund | 111,636,945 | | | 2,108,606 | | | — | | | 113,745,551 | |

Common stocks | 474,824,470 | | | 3,590,671 | | | 342,256 | | | 478,757,397 | |

| $ | 868,272,560 | | | $ | 5,699,277 | | | $ | 342,256 | | | 874,314,093 | |

Common/collective trusts | | 827,665,729 | |

Total investments at fair value | | | | | | $ | 1,701,979,822 | |

| | | | | | | |

2020: | | | | | | | |

Interest-bearing cash | $ | 2,707,054 | | | $ | — | | | $ | — | | | $ | 2,707,054 | |

Mutual funds | 225,624,504 | | | — | | | — | | | 225,624,504 | |

Self-directed brokerage fund | 99,892,988 | | | 1,985,527 | | | — | | | 101,878,515 | |

Common stocks | 430,647,088 | | | 7,289,670 | | | 709,801 | | | 438,646,559 | |

| $ | 758,871,634 | | | $ | 9,275,197 | | | $ | 709,801 | | | 768,856,632 | |

Common/collective trusts | | 755,165,384 | |

Total investments at fair value | | | | | | $ | 1,524,022,016 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Note 4--Common/collective trusts

The Plan holds investments in several common/collective trusts that invest primarily in mutual funds, fixed income securities, and international equity securities. These common/collective trusts have no unfunded commitments. Generally, participant-directed redemptions occur daily. In some cases, FMTC may require up to ten days to settle these redemptions. However, FMTC may require additional notice for redemptions directed by a plan sponsor.

Additionally, the Plan holds investments in the Fidelity Managed Income Portfolio II Fund (“MIP II Fund”), a common/collective trust, which is managed by FMTC as trustee (“MIP II Fund Trustee”). Participant-directed withdrawals of MIP II Fund units may be made on any business day. Participant-directed exchanges to another investment option may be made on any business day as long as the exchange is not directed into a competing fund (money market funds or certain other types of fixed income funds). Transferred amounts must be held in a noncompeting investment option for 90 days before subsequent transfers to a competing fund may occur. Withdrawals directed by a plan sponsor must be preceded by 12-months written notice to the MIP II Fund Trustee. The MIP II Fund Trustee may in its discretion complete any such plan-level withdrawals before the expiration of such 12-month period. Additionally, the MIP II Fund Trustee may defer completing a withdrawal directed by a participant or plan sponsor where doing so might adversely affect the MIP II Fund portfolio. The MIP II Fund Trustee shall make the payments available as quickly as cash flows and prudent portfolio management permit.

Note 5--Transactions with parties-in-interest

Certain investments held by the Plan are managed by the trustee. Additionally, certain investments held within the Plan are in Williams common stock. Therefore, these transactions qualify as party-in-interest transactions. These transactions are exempt from the prohibited transaction rules.

Note 6--Tax status and federal income taxes

The Plan has received a determination letter from the IRS dated July 24, 2015, stating that the Plan, as amended, is qualified under Section 401(a) of the Internal Revenue Code (the “Code”) and, therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan has been further amended and restated. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The Plan administrator has indicated it will take the necessary steps, if any, to maintain the Plan’s compliance with the Code.

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| THE WILLIAMS INVESTMENT PLUS PLAN |

| NOTES TO FINANCIAL STATEMENTS |

| December 31, 2021 |

Plan management is required by generally accepted accounting principles to evaluate uncertain tax positions taken by the Plan. The financial statement impact of a tax position must be recognized when the position is more likely than not, based on its technical merits, to be sustained upon examination by the IRS. As of December 31, 2021 and 2020, there are no uncertain positions taken or expected to be taken.

Note 7--Differences between financial statements and Form 5500

The following is a reconciliation of Net Assets Available for Benefits per the financial statements to the Form 5500 at December 31:

| | | | | | | | | | | |

| 2021 | | 2020 |

Net assets available for benefits per the financial statements | $ | 1,734,771,592 | | | $ | 1,557,626,554 | |

| Amounts allocated to withdrawing participants | — | | | (1,355,343) | |

| Net assets available for benefits per the Form 5500 | $ | 1,734,771,592 | | | $ | 1,556,271,211 | |

The following is a reconciliation of Net increase during the year per the Statement of Changes in Net Assets Available for Benefits to net income (loss) per the Form 5500 for the year ended December 31, 2021:

| | | | | |

| Net increase during the year | $ | 177,145,038 | |

| Add: Amounts allocated to withdrawing participants at December 31, 2020 | 1,355,343 | |

| Net income per Form 5500 | $ | 178,500,381 | |

Amounts allocated to withdrawing participants are recorded on the Form 5500 for benefit payments that have been processed and approved for payment prior to December 31, but not yet paid as of that date.

SUPPLEMENTAL SCHEDULE

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| | | | | |

| Common/Collective Trusts | | | | |

| * | Fidelity Managed Income Portfolio II Class 4 | 81,793,822 shares | | $ | 81,793,822 | | |

| * | Fidelity Diversified International Commingled Pool | 3,422,675 shares | | 66,536,810 | |

| Prudential Core Plus Bond Fund Class 5 | 196,588 shares | | 38,352,280 | |

| Vanguard Target Retirement Income Trust I | 202,143 shares | | 13,333,336 | |

| Vanguard Target Retirement 2015 Trust I | 87,790 shares | | 5,873,155 | |

| Vanguard Target Retirement 2020 Trust I | 737,959 shares | | 53,590,600 | |

| Vanguard Target Retirement 2025 Trust I | 854,260 shares | | 64,624,782 | |

| Vanguard Target Retirement 2030 Trust I | 1,901,374 shares | | 148,611,373 | |

| Vanguard Target Retirement 2035 Trust I | 581,781 shares | | 47,566,377 | |

| Vanguard Target Retirement 2040 Trust I | 1,539,724 shares | | 132,908,955 | |

| Vanguard Target Retirement 2045 Trust I | 510,490 shares | | 45,254,917 | |

| Vanguard Target Retirement 2050 Trust I | 967,156 shares | | 86,550,821 | |

| Vanguard Target Retirement 2055 Trust I | 260,342 shares | | 28,408,524 | |

| Vanguard Target Retirement 2060 Trust I | 185,250 shares | | 10,618,558 | |

| Vanguard Target Retirement 2065 Trust I | 103,273 shares | | 3,641,419 | |

| | | | 827,665,729 | | |

| Registered Investment Companies | | | |

| PIMCO Real Return Fund Institutional Class | 948,544 shares | | 11,686,061 | |

| * | Fidelity U.S. Bond Index Fund | 1,190,177 shares | | 14,258,315 | |

| Vanguard Extended Market Index Fund Institutional | 261,875 shares | | 36,319,492 | |

| Vanguard Institutional Index Fund Institutional Plus | 485,769 shares | | 197,125,037 | |

| Vanguard Total International Stock Index Fund Institutional | 130,910 shares | | 17,904,505 | |

| | | | 277,293,410 | | |

| Common Stock | | | | |

| * | The Williams Companies, Inc. | 234,683 shares | | 6,113,826 | |

| | | | 6,113,826 | |

| Investments held in Separately Managed Accounts | | | |

| Macquarie U.S. Large Cap Value Equity Portfolio: | | | |

| Interest-bearing Cash: | | | |

| BROWN BROTHERS HARRIMAN STIF FUND | 717,559 shares | | 717,559 | |

| | | | | |

| Common Stock: | | | |

| AMERICAN INTERNATIONAL GROUP | 36,000 shares | | 2,046,960 | |

| ARCHER DANIELS MIDLAND CO | 29,615 shares | | 2,001,678 | |

| BAXTER INTL INC | 23,900 shares | | 2,051,576 | |

| BROADCOM INC | 3,400 shares | | 2,262,394 | |

| CIGNA CORP | 8,868 shares | | 2,036,359 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| CISCO SYSTEMS INC | 34,046 shares | | 2,157,495 | |

| COGNIZANT TECH SOLUTIONS CL A | 25,714 shares | | 2,281,346 | |

| COMCAST CORP CL A | 37,585 shares | | 1,891,653 | |

| CONAGRA BRANDS INC | 58,216 shares | | 1,988,076 | |

| CONOCOPHILLIPS | 26,981 shares | | 1,947,489 | |

| CVS HEALTH CORP | 21,684 shares | | 2,236,921 | |

| DISCOVER FIN SVCS | 15,627 shares | | 1,805,856 | |

| DISNEY (WALT) CO | 13,034 shares | | 2,018,836 | |

| DOLLAR GENERAL CORP | 8,390 shares | | 1,978,614 | |

| DOLLAR TREE INC | 14,900 shares | | 2,093,748 | |

| DOVER CORP | 11,665 shares | | 2,118,364 | |

| DUPONT DE NEMOURS INC | 25,936 shares | | 2,095,110 | |

| EDISON INTL | 32,600 shares | | 2,224,950 | |

| EQUITY RESIDENTIAL REIT | 23,089 shares | | 2,089,555 | |

| FIDELITY NATL INFORM SVCS INC | 18,745 shares | | 2,046,017 | |

| HONEYWELL INTL INC | 9,056 shares | | 1,888,266 | |

| JOHNSON & JOHNSON | 11,518 shares | | 1,970,384 | |

| MERCK & CO INC NEW | 26,149 shares | | 2,004,059 | |

| METLIFE INC | 31,076 shares | | 1,941,939 | |

| MOTOROLA SOLUTIONS INC | 8,200 shares | | 2,227,940 | |

| NORTHROP GRUMMAN CORP | 5,093 shares | | 1,971,348 | |

| ORACLE CORP | 20,738 shares | | 1,808,561 | |

| RAYTHEON TECHNOLOGIES CORP | 22,034 shares | | 1,896,246 | |

| TJX COMPANIES INC NEW | 26,700 shares | | 2,027,064 | |

| TRUIST FINL CORP | 33,300 shares | | 1,949,715 | | |

| US BANCORP DEL | 32,900 shares | | 1,847,993 | | |

| VERIZON COMMUNICATIONS INC | 37,822 shares | | 1,965,231 | | |

| VIATRIS INC | 142,411 shares | | 1,926,821 | | |

| | | | | |

| LSV U.S. Small/Mid Cap Value Equity Portfolio: | | | |

| Interest-bearing Cash: | | | |

| BROWN BROTHERS HARRIMAN STIF FUND | 1,085,631 shares | | 1,085,631 | | |

| | | | | |

| Common Stock: | | | |

| AARON'S CO INC/THE | 4,775 shares | | 117,704 | |

| ACUITY BRANDS INC | 1,825 shares | | 386,389 | |

| AGCO CORP | 2,000 shares | | 232,040 | |

| AIR LEASE CORP CL A | 3,100 shares | | 137,113 | |

| ALLISON TRANSMISSION HLDGS INC | 6,500 shares | | 236,275 | |

| AMC NETWORKS INC CL A | 3,600 shares | | 123,984 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| AMDOCS LTD | 3,800 shares | | 284,392 | |

| AMERICAN ASSETS TRUST INC | 6,800 shares | | 255,204 | |

| AMERICAN FINL GROUP INC OHIO | 1,900 shares | | 260,908 | |

| AMKOR TECHNOLOGY INC | 9,700 shares | | 240,463 | |

| AMPHASTAR PHARMACEUTICALS INC | 651 shares | | 15,162 | |

| APPLE HOSPITALITY REIT INC | 4,500 shares | | 72,675 | |

| ARC DOCUMENT SOLUTIONS INC | 12,700 shares | | 44,450 | |

| ARCBEST CORP | 2,900 shares | | 347,565 | |

| ARCONIC CORP | 825 shares | | 27,233 | |

| ARROW ELECTRONICS INC | 4,700 shares | | 631,069 | |

| ASSURED GUARANTY LTD | 2,100 shares | | 105,420 | |

| ATKORE INC | 5,400 shares | | 600,426 | |

| AVAYA HOLDINGS CORP | 3,600 shares | | 71,280 | |

| BERRY GLOBAL GROUP INC | 4,700 shares | | 346,766 | |

| BLOCK H & R INC | 11,100 shares | | 261,516 | |

| BORGWARNER INC | 4,600 shares | | 207,322 | |

| BRIDGEWATER BANCSHARES INC | 10,800 shares | | 191,052 | |

| BRIXMOR PPTY GROUP INC | 11,100 shares | | 282,051 | |

| BUNGE LIMITED | 1,100 shares | | 102,696 | |

| C N A FINANCIAL CORP | 8,800 shares | | 387,904 | |

| CABOT CORP | 3,700 shares | | 207,940 | |

| CAPRI HOLDINGS LTD | 1,400 shares | | 90,874 | |

| CARS.COM INC | 10,600 shares | | 170,554 | |

| CATALYST PHARMACEUTICALS INC | 22,600 shares | | 153,002 | |

| CHATHAM LODGING TRUST | 9,100 shares | | 124,852 | |

| CHEMOURS CO/ THE | 5,700 shares | | 191,292 | |

| CIRRUS LOGIC INC | 1,100 shares | | 101,222 | |

| CITY OFFICE REIT INC | 15,100 shares | | 297,772 | |

| CNO FINANCIAL GROUP INC | 16,200 shares | | 386,208 | |

| CNX RESOURCES CORP | 12,135 shares | | 166,856 | |

| CONSENSUS CLOUD SOLUTION | 233 shares | | 13,484 | |

| CORECIVIC INC | 8,000 shares | | 79,760 | |

| CSG SYSTEMS INTL INC | 3,300 shares | | 190,146 | |

| CUSTOMERS BANCORP INC | 7,500 shares | | 490,275 | |

| DANA INC | 8,800 shares | | 200,816 | |

| DAVITA INC | 2,500 shares | | 284,400 | |

| DELUXE CORP | 4,300 shares | | 138,073 | |

| DIODES INC | 1,200 shares | | 131,772 | |

| EASTMAN CHEMICAL CO | 2,200 shares | | 266,002 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| ENERGIZER HLDGS INC | 4,000 shares | | 160,400 | |

| FEDERAL AGRI MTG NON VTG CL C | 1,450 shares | | 179,698 | |

| FIDELITY NATIONAL FINL INC | 2,240 shares | | 116,883 | |

| FINANCIAL INSTITUTIONS INC | 6,500 shares | | 206,700 | |

| FIRST AMERICAN FINANCIAL CORP | 3,200 shares | | 250,336 | |

| FIRST BUSEY CORP | 7,500 shares | | 203,400 | |

| FIRST HORIZON CORP | 12,900 shares | | 210,657 | |

| FIRST INTERNET BANCORP | 5,400 shares | | 254,016 | |

| FOOT LOCKER INC | 3,700 shares | | 161,431 | |

| FRANKLIN STREET PPTYS CORP | 28,130 shares | | 167,374 | |

| GAMING AND LEISURE PROPRTI INC | 3,700 shares | | 180,042 | |

| GOODYEAR TIRE & RUBBER CO | 10,000 shares | | 213,200 | |

| GRAPHIC PACKAGING HOLDING CO | 5,300 shares | | 103,350 | |

| GRAY TELEVISION INC | 10,000 shares | | 201,600 | |

| GREAT SOUTHERN BANCORP INC | 2,914 shares | | 172,654 | |

| HANMI FINANCIAL CORPORATION | 8,800 shares | | 208,384 | |

| HARLEY-DAVIDSON INC | 5,800 shares | | 218,602 | |

| HAVERTY FURNITURE COS INC | 8,200 shares | | 250,674 | |

| HAWAIIAN HLDGS INC | 5,900 shares | | 108,383 | |

| HILLENBRAND INC | 2,660 shares | | 138,293 | |

| HILLTOP HLDGS I | 7,300 shares | | 256,522 | |

| HOLLYFRONTIER CORP | 8,680 shares | | 284,530 | |

| HOPE BANCORP INC | 16,800 shares | | 247,128 | |

| HORIZON BANCORP INC INDIANA | 2,800 shares | | 58,380 | |

| HUNTINGTON INGALLS INDUSTRIES INC | 1,000 shares | | 186,740 | |

| HUNTSMAN CORP | 9,000 shares | | 313,920 | |

| INDUSTRIAL LOGISTICS PROPERTIES TR | 7,587 shares | | 190,054 | |

| INGLES MARKETS INC-CL A | 2,600 shares | | 224,484 | |

| INGREDION INC | 2,600 shares | | 251,264 | |

| INNOVIVA INC | 16,700 shares | | 288,075 | |

| INVESTORS BANCORP INC | 23,700 shares | | 359,055 | |

| IRON MOUNTAIN INC | 3,900 shares | | 204,087 | |

| IRONWOOD PHARMA CL A (PEND) | 25,900 shares | | 301,994 | |

| JABIL INC | 7,600 shares | | 534,660 | |

| JAZZ PHARMA PLC | 2,000 shares | | 254,800 | |

| JETBLUE AIRWAYS CORP | 9,200 shares | | 131,008 | |

| JM SMUCKER CO/THE | 2,700 shares | | 366,714 | |

| JUNIPER NETWORKS INC | 5,200 shares | | 185,692 | |

| KELLY SERVICES INC CL A | 8,200 shares | | 137,514 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| KOHLS CORP | 2,800 shares | | 138,292 | |

| KOPPERS HLDGS INC | 4,900 shares | | 153,370 | |

| KRATON CORP | 2,700 shares | | 125,064 | |

| LANNETT INC | 6,900 shares | | 11,178 | |

| LEAR CORP NEW | 1,400 shares | | 256,130 | |

| M D C HOLDINGS INC | 5,076 shares | | 283,393 | |

| MANPOWERGROUP INC | 2,200 shares | | 214,126 | |

| MDU RESOURCES GROUP INC | 8,100 shares | | 249,804 | |

| MEDICAL PPTY TR INC | 11,100 shares | | 262,293 | |

| MERITOR INC | 11,500 shares | | 284,970 | |

| MGIC INVESTMENT CORP | 9,000 shares | | 129,780 | |

| MIDLAND STATES BANCORP INC | 7,200 shares | | 178,488 | |

| MILLERKNOLL INC | 3,200 shares | | 125,408 | |

| MODINE MANUFACTURING CO | 12,900 shares | | 130,161 | |

| MOLSON COORS BEVERAGE CO B | 6,900 shares | | 319,815 | |

| MOOG INC CL A | 1,800 shares | | 145,746 | |

| MOSAIC CO NEW | 8,100 shares | | 318,249 | |

| NATIONAL FUEL GAS CO NJ | 5,500 shares | | 351,670 | |

| NAVIENT CORP | 16,900 shares | | 358,618 | |

| NCR CORP | 3,300 shares | | 132,660 | |

| NEW MOUNTAIN FINANCE CORP | 11,800 shares | | 161,660 | |

| NEXSTAR MEDIA GROUP INC A | 1,676 shares | | 253,042 | |

| NRG ENERGY INC | 6,900 shares | | 297,252 | |

| O-I GLASS INC | 14,200 shares | | 170,826 | |

| ODP CORP/THE | 4,170 shares | | 163,798 | |

| OFFICE PROPERTIES INCOME TRUST | 7,076 shares | | 175,768 | |

| OMEGA HEALTHCARE INVESTORS INC | 6,800 shares | | 201,212 | |

| OSHKOSH CORP | 2,200 shares | | 247,962 | |

| OWENS CORNING INC | 2,600 shares | | 235,300 | |

| PARAMOUNT GLOBAL CL B | 4,700 shares | | 141,846 | |

| PATTERSON COMPANIES INC | 3,500 shares | | 102,725 | |

| PENNANTPARK INVESTMENT CORP | 33,903 shares | | 234,948 | |

| PENSKE AUTOMOTIVE GROUP INC | 4,300 shares | | 461,046 | |

| PIEDMONT OFFICE REALTY TRUST A | 13,500 shares | | 248,130 | |

| PLYMOUTH INDL REIT INC | 3,800 shares | | 121,600 | |

| PREMIER FINANCIAL CORP | 7,600 shares | | 234,916 | |

| PULTEGROUP INC | 6,300 shares | | 360,108 | |

| QURATE RETAIL INC | 13,600 shares | | 103,360 | |

| RADIAN GROUP INC | 9,800 shares | | 207,074 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| RBB BANCORP | 8,100 shares | | 212,220 | |

| REGIONAL MANAGEMENT CORP | 5,400 shares | | 310,284 | |

| REGIONS FINANCIAL CORP | 11,100 shares | | 241,980 | |

| REINSURANCE GROUP OF AMERICA | 1,700 shares | | 186,133 | |

| RELIANCE STEEL & ALUMINUM CO | 1,100 shares | | 178,442 | |

| RETAIL VALUE INC | 1,047 shares | | 6,722 | |

| REV GROUP INC | 10,500 shares | | 148,575 | |

| ROCKY BRANDS INC | 4,000 shares | | 159,200 | |

| SABRA HEALTHCARE REIT INC | 11,900 shares | | 161,126 | |

| SANMINA CORP | 4,600 shares | | 190,716 | |

| SCANSOURCE INC | 3,400 shares | | 119,272 | |

| SELECT MEDICAL HLDGS CORP | 4,850 shares | | 142,590 | |

| SILGAN HOLDINGS INC | 6,700 shares | | 287,028 | |

| SNAP-ON INCORPORATED | 1,000 shares | | 215,380 | |

| SONIC AUTOMOTIVE INC CL A | 5,300 shares | | 262,085 | |

| SPROUTS FMRS MKT INC | 8,700 shares | | 258,216 | |

| TD SYNNEX CORP | 1,313 shares | | 150,155 | |

| TOLL BROTHERS INC | 3,000 shares | | 217,170 | |

| TRITON INTERNATIONAL LTD | 4,800 shares | | 289,104 | |

| TRONOX HOLDINGS PLC | 6,200 shares | | 148,986 | |

| TTM TECHNOLOGIES INC | 7,400 shares | | 110,260 | |

| UGI CORP NEW | 5,000 shares | | 229,550 | |

| ULTRA CLEAN HOLDINGS INC | 4,100 shares | | 235,176 | |

| UNITED THERAPEUTICS CORP DEL | 1,600 shares | | 345,728 | |

| UNITI GROUP INC | 15,068 shares | | 211,103 | |

| UNIVERSAL HEALTH SVCS INC CL B | 2,100 shares | | 272,286 | |

| UNUM GROUP | 9,300 shares | | 228,501 | |

| VILLAGE SUPER MKT INC CL A NEW | 3,400 shares | | 79,526 | |

| VISHAY INTERTECHNOLOGY INC | 6,300 shares | | 137,781 | |

| VISTA OUTDOOR INC | 5,500 shares | | 253,385 | |

| VISTRA CORP | 16,300 shares | | 371,151 | |

| VOYA FINANCIAL INC | 4,800 shares | | 318,288 | |

| WEIS MARKETS INC | 3,000 shares | | 197,640 | |

| WESTERN UNION CO | 5,200 shares | | 92,768 | |

| WESTROCK CO | 7,300 shares | | 323,828 | |

| WHIRLPOOL CORP | 2,000 shares | | 469,320 | |

| WILLIAMS-SONOMA INC | 1,300 shares | | 219,869 | |

| WINNEBAGO INDUSTRIES INC | 2,200 shares | | 164,824 | |

| WORLD FUEL SERVICES CORP | 4,100 shares | | 108,527 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| XEROX HOLDINGS CORP | 8,825 shares | | 199,798 | |

| ZIFF DAVIS INC | 1,350 shares | | 149,661 | |

| ZIONS BANCORP | 8,200 shares | | 517,912 | |

| | | | | |

| T. Rowe Price U.S. Large-Cap Core Growth Equity Portfolio: | | | |

| Interest-bearing Cash: | | | |

| BROWN BROTHERS HARRIMAN STIF FUND | 748,338 shares | | 748,338 | |

| | | | | |

| Registered Investment Company: | | | |

| * | T Rowe Price Government Reserve Fund | 692,634 shares | | 692,634 | |

| | | | | |

| Common Stock: | | | |

| ADVANCED MICRO DEVICES INC | 25,878 shares | | 3,723,844 | |

| AFFIRM HOLDINGS INC | 8,958 shares | | 900,816 | |

| ALIGN TECHNOLOGY INC | 807 shares | | 530,344 | |

| ALPHABET INC CL A | 1,408 shares | | 4,079,032 | |

| ALPHABET INC CL C | 9,238 shares | | 26,730,984 | |

| AMAZON.COM INC | 8,850 shares | | 29,508,909 | |

| ANT INTL CO LTD CLASS C PP | 121,484 shares | | 229,605 | |

| APPLE INC | 130,727 shares | | 23,213,193 | |

| ASML HLDG NV (NY REG SHS) NEW YORK REGIST | 3,239 shares | | 2,578,697 | |

| ASTRAZENECA PLC SPONS ADR | 11,206 shares | | 652,750 | |

| ATLASSIAN CORP PLC CLS A | 3,403 shares | | 1,297,530 | |

| BILL.COM HOLDINGS INC | 4,000 shares | | 996,600 | |

| BLOCK INC CL A | 10,452 shares | | 1,688,103 | |

| CARVANA CO CL A | 12,407 shares | | 2,875,819 | |

| CHIPOTLE MEXICAN GRILL INC | 1,204 shares | | 2,104,893 | |

| CHUBB LTD | 4,185 shares | | 809,002 | |

| CINTAS CORP | 776 shares | | 343,900 | |

| COPART INC | 5,353 shares | | 811,622 | |

| COSTAR GROUP INC | 280 shares | | 22,128 | |

| COUPA SOFTWARE INC | 2,744 shares | | 433,689 | |

| CROWDSTRIKE HOLDINGS INC | 1,378 shares | | 282,146 | |

| DANAHER CORP | 10,559 shares | | 3,474,017 | |

| DATABRICKS INC SER G PC PP | 511 shares | | 112,651 | |

| DATADOG INC CL A | 4,282 shares | | 762,667 | |

| DELIVERY HERO SE | 3,414 shares | | 380,910 | |

| DISNEY (WALT) CO | 6,781 shares | | 1,050,309 | |

| DOCUSIGN INC | 5,737 shares | | 873,802 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| DOLLAR GENERAL CORP | 8,324 shares | | 1,963,049 | |

| DOORDASH INC | 12,686 shares | | 1,888,945 | |

| EQUIFAX INC | 1,427 shares | | 417,811 | |

| FISERV INC | 12,853 shares | | 1,334,013 | |

| FORTINET INC | 5,485 shares | | 1,971,309 | |

| GENERAL ELECTRIC CO | 8,350 shares | | 788,825 | |

| GOLDMAN SACHS GROUP INC | 7,563 shares | | 2,893,226 | |

| HASHICORP INC | 2,301 shares | | 209,483 | |

| HCA HEALTHCARE INC | 9,475 shares | | 2,434,317 | |

| HUMANA INC | 2,089 shares | | 969,004 | |

| INTUIT INC | 9,525 shares | | 6,126,671 | |

| INTUITIVE SURGICAL INC | 13,605 shares | | 4,888,277 | |

| LILLY (ELI) & CO | 12,023 shares | | 3,320,993 | |

| LINDE PLC | 2,422 shares | | 839,053 | |

| LULULEMON ATHLETICA INC | 5,661 shares | | 2,215,998 | |

| MARSH & MCLENNAN COS INC | 3,219 shares | | 559,527 | |

| MARVELL TECHNOLOGY INC | 16,737 shares | | 1,464,320 | |

| MASTERCARD INC CL A | 15,178 shares | | 5,453,759 | |

| META PLATFORMS INC CL A | 59,426 shares | | 19,987,935 | |

| MICROSOFT CORP | 99,753 shares | | 33,548,929 | |

| MONGODB INC CL A | 3,680 shares | | 1,948,008 | |

| MONOLITHIC POWER SYS INC | 1,863 shares | | 919,074 | |

| MSCI INC | 591 shares | | 362,100 | |

| NETFLIX INC | 9,064 shares | | 5,460,516 | |

| NIKE INC CL B | 14,474 shares | | 2,412,382 | |

| NVIDIA CORP | 33,312 shares | | 9,797,392 | |

| OPENDOOR TECHNOLOGIES INC | 26,200 shares | | 382,782 | |

| PAYCOM SOFTWARE INC | 611 shares | | 253,681 | |

| PAYPAL HLDGS INC | 15,253 shares | | 2,876,411 | |

| PINTEREST INC CL A | 31,285 shares | | 1,137,210 | |

| RIVIAN AUTOMOTIVE INC | 12,371 shares | | 1,282,749 | |

| RIVIAN AUTOMOTIVE INC(180 DAY LOCK UP) | 17,742 shares | | 1,655,701 | |

| ROKU INC CLASS A | 1,230 shares | | 280,686 | |

| ROPER TECHNOLOGIES INC | 2,756 shares | | 1,355,566 | |

| ROSS STORES INC | 18,687 shares | | 2,135,550 | |

| S&P GLOBAL INC | 4,275 shares | | 2,017,501 | |

| SALESFORCE.COM INC | 2,359 shares | | 599,493 | |

| SCHWAB CHARLES CORP | 16,370 shares | | 1,376,717 | |

| SEA LTD ADR | 21,163 shares | | 4,734,375 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| SERVICENOW INC | 10,685 shares | | 6,935,740 | |

| SHERWIN WILLIAMS CO | 488 shares | | 171,854 | |

| SHOPIFY INC CL A | 1,360 shares | | 1,873,250 | |

| SHOPIFY INC CL A | 65 shares | | 89,497 | |

| SNAP INC - A | 80,151 shares | | 3,769,502 | |

| SNOWFLAKE INC CL A | 1,582 shares | | 535,902 | |

| SPOTIFY TECHNOLOGY SA | 3,974 shares | | 930,035 | |

| STARBUCKS CORP | 6,273 shares | | 733,753 | |

| STRYKER CORP | 7,852 shares | | 2,099,782 | |

| SYNOPSYS INC | 8,423 shares | | 3,103,876 | |

| T-MOBILE US INC | 4,878 shares | | 565,750 | |

| TAIWAN SEMIC MFG CO LTD SP ADR | 8,291 shares | | 997,490 | |

| TE CONNECTIVITY LTD | 3,492 shares | | 563,399 | |

| TELEFLEX INC | 1,939 shares | | 636,923 | |

| TENCENT HOLDINGS LTD | 25,000 shares | | 1,464,563 | |

| TESLA INC | 7,421 shares | | 7,842,364 | |

| TEXAS INSTRUMENTS INC | 7,193 shares | | 1,355,665 | |

| THE BOOKING HOLDINGS INC | 593 shares | | 1,422,743 | |

| THERMO FISHER SCIENTIFIC INC | 2,874 shares | | 1,917,648 | |

| TJX COMPANIES INC NEW | 5,648 shares | | 428,796 | |

| TOAST INC | 1,235 shares | | 42,867 | |

| TRANSUNION | 4,000 shares | | 474,320 | |

| TWILIO INC CLASS A | 1,574 shares | | 414,497 | |

| UNITEDHEALTH GROUP INC | 11,506 shares | | 5,777,623 | |

| VEEVA SYS INC CL A | 3,102 shares | | 792,499 | |

| VISA INC CL A | 32,047 shares | | 6,944,905 | |

| ZOETIS INC CL A | 7,785 shares | | 1,899,774 | |

| ZOOM VIDEO COMMUNICATIONS INC CL A | 7,047 shares | | 1,296,014 | |

| | | | | |

| William Blair U.S. Small/Mid Cap Growth Equity Portfolio: | | | |

| Interest-bearing Cash: | | | |

| BROWN BROTHERS HARRIMAN STIF FUND | 1,273,573 shares | | 1,273,573 | |

| | | | | |

| Common Stock: | | | |

| 10X GENOMICS INC | 5,026 shares | | 748,673 | |

| ABIOMED INC | 3,595 shares | | 1,291,216 | |

| ACADIA HEALTHCARE CO INC | 16,286 shares | | 988,560 | |

| ALARM.COM HOLDINGS INC | 11,328 shares | | 960,728 | |

| AMEDISYS INC | 3,676 shares | | 595,071 | |

| ARES MANAGEMENT CORP CL A | 13,099 shares | | 1,064,556 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| AVALARA INC | 7,213 shares | | 931,270 | |

| AXON ENTERPRISE INC | 7,994 shares | | 1,255,058 | |

| AZENTA INC | 14,539 shares | | 1,499,116 | |

| BEAUTY HEALTH CO/THE | 21,374 shares | | 516,396 | |

| BIO TECHNE CORP | 2,764 shares | | 1,429,928 | |

| BLUEPRINT MEDICINES CORP | 7,395 shares | | 792,078 | |

| BRIGHT HORIZONS FAMILY SOLUTIONS INC | 8,402 shares | | 1,057,644 | |

| BRINKS CO | 18,820 shares | | 1,234,027 | |

| BUILDERS FIRSTSOURCE | 28,485 shares | | 2,441,449 | |

| BURLINGTON STORES INC | 4,339 shares | | 1,264,862 | |

| BWX TECHNOLOGIES INC | 26,906 shares | | 1,288,259 | |

| CABLE ONE INC | 481 shares | | 848,219 | |

| CAMECO CORP | 50,567 shares | | 1,102,866 | |

| CELSIUS HOLDINGS INC | 7,365 shares | | 549,208 | |

| CERTARA INC | 19,087 shares | | 542,453 | |

| CHARLES RIVER LABS INTL INC | 4,061 shares | | 1,530,104 | |

| CHART INDUSTRIES INC | 2,958 shares | | 471,771 | |

| CHEMED CORP | 1,924 shares | | 1,017,873 | |

| CROWN HOLDINGS INC | 14,897 shares | | 1,647,906 | |

| DENBURY INC | 13,173 shares | | 1,008,920 | |

| DYNATRACE INC | 24,795 shares | | 1,496,378 | |

| ENTEGRIS INC | 7,014 shares | | 972,000 | |

| EURONET WORLDWIDE INC | 11,071 shares | | 1,319,331 | |

| FIRSTSERVICE CORP | 4,132 shares | | 811,814 | |

| FOX FACTORY HOLDING CORP | 7,069 shares | | 1,202,437 | |

| GUIDEWIRE SOFTWARE INC | 7,892 shares | | 895,979 | |

| HALOZYME THERAPEUTICS INC | 21,529 shares | | 865,681 | |

| HEALTHEQUITY INC | 15,412 shares | | 681,827 | |

| HEICO CORP CL A | 4,407 shares | | 566,388 | |

| HELEN OF TROY LTD | 2,244 shares | | 548,591 | |

| HORIZON THERAPEUTICS PLC | 9,567 shares | | 1,030,940 | |

| INSMED INC | 19,860 shares | | 540,986 | |

| INSPIRE MEDICAL SYSTEMS INC | 3,676 shares | | 845,701 | |

| KORNIT DIGITAL LTD | 3,472 shares | | 528,612 | |

| LESLIE'S INC | 49,945 shares | | 1,181,699 | |

| LIGAND PHARMACEUTICALS | 5,176 shares | | 799,485 | |

| LINCOLN ELECTRIC HLDGS INC | 4,298 shares | | 599,442 | |

| LIVE NATION ENTERTAINMENT INC | 6,404 shares | | 766,495 | |

| MARTIN MARIETTA MATERIALS INC | 3,078 shares | | 1,355,921 | |

THE WILLIAMS INVESTMENT PLUS PLAN

EIN: 73‑0569878 PLAN: 008

Schedule H, line 4i - Schedule of Assets (held at end of year)

December 31, 2021

| | | | | | | | | | | | | | | | | |

| (a) | (b) Identity of issue, borrower, lessor,

or similar party | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (d) Cost** | (e) Current value | |

| MERCURY SYSTEMS INC | 13,968 shares | | 769,078 | |

| MERIT MEDICAL SYSTEMS INC | 11,200 shares | | 697,760 | |

| MKS INSTRUMENTS INC | 2,971 shares | | 517,459 | |

| NATIONAL INSTRUMENT CORP | 20,406 shares | | 891,130 | |

| NATIONAL VISION HOLDINGS INC | 18567 shares | | 891,030 | |

| NEW FORTRESS ENERGY INC | 17,571 shares | | 424,164 | |

| NICE LTD SPON ADR | 4,727 shares | | 1,435,117 | |

| NOVANTA INC | 4,403 shares | | 776,381 | |

| OVERSTOCK.COM INC DEL | 10,943 shares | | 645,746 | |

| PACIFIC BIOSCIENES OF CALI INC | 22,692 shares | | 464,278 | |

| PEGASYSTEMS INC | 5,386 shares | | 602,263 | |

| PENUMBRA INC | 4,976 shares | | 1,429,704 | |

| PERFORMANCE FOOD GROUP CO | 21,545 shares | | 988,700 | |

| PURE STORAGE INC CL A | 55,499 shares | | 1,806,492 | |

| REVOLVE GROUP INC | 15,515 shares | | 869,461 | |

| RITCHIE BROS AUCTIONEERS | 13,508 shares | | 826,825 | |

| SOLAREDGE TECHNOLOGIES INC | 3,933 shares | | 1,103,482 | |

| STEM INC | 19,769 shares | | 375,018 | |

| TREX CO INC | 14,017 shares | | 1,892,716 | |

| TWIST BIOSCIENCE CORP | 6,843 shares | | 529,580 | |

| VARONIS SYSTEMS INC | 15,004 shares | | 731,895 | |

| VERACYTE INC | 16,838 shares | | 693,726 | |

| VIRTU FINANCIAL INC- CL A | 42,045 shares | | 1,212,157 | |

| WESTERN ALLIANCE BANCORP | 9,896 shares | | 1,065,304 | |

| WOLFSPEED INC | 4,970 shares | | 555,497 | |

| WORKIVA INC | 6,348 shares | | 828,351 | |

| WYNDHAM HOTELS & RESORTS INC | 17,590 shares | | 1,576,944 | |

| ZYNGA INC | 123,967 shares | | 793,389 | |

| | | | 477,161,306 | | |

| | | | | |

| * | Self-Directed Brokerage Fund | A self-directed brokerage fund allowing participants to invest in a wide array of securities including but not limited to publicly traded stocks, mutual funds, exchange-traded funds, bonds, certificates of deposit, and money market funds at their discretion. | 113,745,551 | |

| | | | | |

| | Investments (at fair value) | | 1,701,979,822 | |

| | | | | |

| * | Participant Loans | Loans extended to participants at interest rates of 4.25% to 9.5% | | 20,941,200 | |

| | | | | |

| | | | $ | 1,722,921,022 | | |

*Party-in-interest

**Column not applicable for participant-directed investments.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

THE WILLIAMS INVESTMENT PLUS PLAN

(Name of Plan)

/s/Robert Biffle

Robert Biffle

Chairman, Administrative Committee

The Williams Companies, Inc.

Date: June 9, 2022

EXHIBIT INDEX

| | | | | | | | |

Exhibit

No. | | Description |

| 23 | | Consent of Independent Registered Public Accounting Firm |

| | |

| | |

| | |

| | |

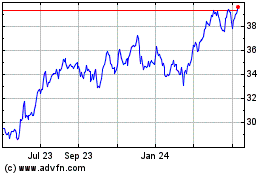

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Oct 2024 to Nov 2024

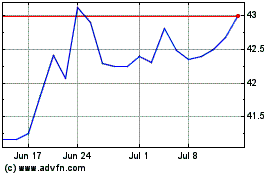

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Nov 2023 to Nov 2024