Western Asset Closed-End Municipal Bond Funds’ Earnings Data Now Available

February 04 2013 - 8:00AM

Business Wire

The Western Asset closed-end municipal bond funds (the Funds)

made additional data available today through its website,

www.lmcef.com. The data includes:

- 3-Month Average Earnings per

share. Represents the average monthly net investment income per

share over the past three months.

- 3-Month Average UNII per share.

Represents an estimate of the average undistributed net investment

Income balance over the past three months.

- Leverage through ARPS. As a

percentage of managed assets (net assets plus the liquidation value

of the Auction Rate Preferred Securities (“ARPS”) as of the date

indicated above.

The data is provided for the following funds: Western Asset

Intermediate Muni Fund Inc. (SBI), Western Asset Managed Municipals

Fund Inc. (MMU), Western Asset Municipal Defined Opportunity Trust

Inc. (MTT), Western Asset Municipal High Income Fund Inc. (MHF),

and Western Asset Municipal Partners Fund Inc. (MNP).

All data as of 12/31/12

3-Month Average

Ticker Fund Name

Current

Month

Distribution

Earnings per

Share

UNII

per Share

3-Month Average

Earnings/Current

Distribution Ratio

Leverage

Through ARPS

SBI Western Asset Intermediate Muni Fund Inc. $0.0400 $ 0.0413

$ 0.2527 103.3% 25.3% MMU Western Asset Managed Municipals

Fund Inc. $0.0650 $ 0.0661 $ 0.4147 101.7% 29.0% MTT Western Asset

Municipal Defined Opportunity Trust Inc. $0.0840 $ 0.0860 $ 0.0787

102.4% N/A MHF Western Asset Municipal High Income Fund Inc.

$0.0330 $ 0.0326 $ (0.0010) 98.8% N/A MNP Western

Asset Municipal Partners Fund Inc. $0.0700 $

0.0750 $ 0.4902 107.1% 34.3%

Distributions may be paid from investment income, realized

capital gains, return of capital or a combination thereof. The

distribution amount is subject to change and is not a quotation of

Fund performance. For more information about a distribution’s

composition refer to the Fund’s distribution press release or, if

applicable, the Section 19 notice located in the press release

section of our website, www.lmcef.com. For more information,

including current performance to most current month end, please

visit www.lmcef.com or call 1-888-777-0102.

This press release is not for tax reporting purposes but is

being provided to announce the amount of the Fund’s distributions

that have been declared by the Board of Directors. In early 2013

and early 2014, after definitive information is available, the Fund

will send shareholders a Form 1099-DIV, if applicable, specifying

how the distributions paid by the Fund during the prior calendar

year should be characterized for purposes of reporting the

distributions on a shareholder’s tax return (e.g., ordinary income,

long-term capital gain or return of capital).

The Funds are advised by Legg Mason Partners Fund Advisor, LLC,

a wholly owned subsidiary of Legg Mason, Inc., and are sub-advised

by Western Asset Management Company, an affiliate of the

advisor.

Legg Mason is the 6th largest closed-end fund manager in the

U.S., with $12.6 billion in closed-end assets under management as

of December 31, 2012.

All data and commentary provided in this press release are for

informational purposes only. All investments involve risk,

including possible loss of principal. Legg Mason, Inc. and its

affiliates do not engage in selling shares of the Fund.

For more information, please call 1-888-777-0102 or

consult the Funds’ website at www.lmcef.com.

SYMBOLS: NYSE: SBI, MMU, MTT, MHF, MNP

TN13-034

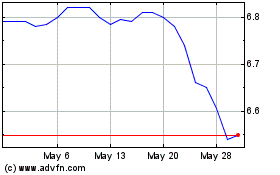

Western Asset Municipal ... (NYSE:MHF)

Historical Stock Chart

From Oct 2024 to Nov 2024

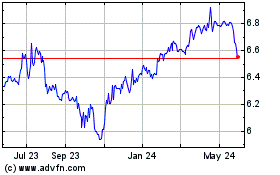

Western Asset Municipal ... (NYSE:MHF)

Historical Stock Chart

From Nov 2023 to Nov 2024