UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number

|

811-5497

|

|

|

|

Western Asset Municipal High Income Fund Inc.

|

|

(Exact name of registrant as specified in charter)

|

|

|

|

620 Eighth Avenue New York, NY

|

|

10018

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

|

|

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place,

Stamford, CT 06902

|

|

(Name and address of agent for service)

|

|

|

|

Registrant’s telephone number, including area code:

|

(888) 777-0102

|

|

|

|

|

Date of fiscal year end:

|

October 31

|

|

|

|

|

Date of reporting period:

|

April 30, 2011

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 1.

REPORT TO STOCKHOLDERS.

The

Semi-Annual

Report to Stockholders is filed herewith.

|

April 30, 2011

|

|

Semi-Annual Report

Western Asset Municipal High Income Fund Inc.

(MHF)

|

INVESTMENT PRODUCTS: NOT FDIC INSURED

·

NO BANK GUARANTEE

·

MAY LOSE VALUE

|

|

II

|

|

Western Asset Municipal High Income Fund Inc.

|

|

|

|

Fund objective

The Fund seeks high current income exempt from federal income taxes.

What’s inside

|

Letter from the chairman

|

|

II

|

|

|

|

|

|

Investment commentary

|

|

III

|

|

|

|

|

|

Fund at a glance

|

|

1

|

|

|

|

|

|

Spread duration

|

|

2

|

|

|

|

|

|

Effective duration

|

|

3

|

|

|

|

|

|

Schedule of investments

|

|

4

|

|

|

|

|

|

Statement of assets and liabilities

|

|

17

|

|

|

|

|

|

Statement of operations

|

|

18

|

|

|

|

|

|

Statements of changes in net assets

|

|

19

|

|

|

|

|

|

Financial highlights

|

|

20

|

|

|

|

|

|

Notes to financial statements

|

|

21

|

|

|

|

|

|

Board approval of management and subadvisory agreements

|

|

25

|

|

|

|

|

|

Additional shareholder information

|

|

31

|

|

|

|

|

|

Dividend reinvestment plan

|

|

32

|

|

Letter from the chairman

|

|

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Municipal High Income Fund Inc. for the six-month reporting period ended April 30, 2011. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/cef. Here you can gain immediate access to market and investment information, including:

·

Fund prices and performance,

·

Market insights and commentaries from our portfolio managers, and

·

A host of educational resources.

We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

May 27, 2011

|

|

|

|

Western Asset Municipal High Income Fund Inc.

|

|

III

|

Investment commentary

Economic review

While economic data remained mixed, the U.S. economy continued to expand over the six months ended April 30, 2011. Beginning in the fourth quarter of 2010 and continuing for most of the remainder of the period, fears regarding moderating economic growth were replaced with optimism for a strengthening economy in 2011. With investor sentiment improving, interest rates generally rose, negatively impacting some sectors of the fixed-income market. All told, investors who took on additional risk in their portfolios during the reporting period were generally rewarded.

Although the U.S. Department of Commerce continued to report positive U.S. gross domestic product (“GDP”)

i

growth, the expansion has been less robust than most other periods exiting a severe recession. According to the Commerce Department, GDP growth was 3.7%, 1.7%, 2.6% and 3.1% during the first, second, third and fourth quarters of 2010, respectively. For calendar 2010 as a whole, the economy expanded 2.9%. Based on the Commerce Department’s second estimate, first quarter 2011 GDP growth was 1.8%. This moderation in growth in the first quarter was due to a variety of factors, including less robust export activity, a decline in government spending and a deceleration in consumer spending given rising oil and food prices.

Turning to the job market, the unemployment rate moved lower during four of the last five months of the reporting period, though it remained elevated. The rate fell to 8.9% in February 2011, marking the first time the unemployment rate was below 9.0% since April 2009. Unemployment then ticked downward to 8.8% in March, but back up to 9.0% in April. While unemployment in the U.S. declined over the course of the reporting period, hiring has yet to rebound as strongly as in previous recoveries. The U.S. Department of Labor reported in May 2011 that approximately 13.7 million Americans looking for work have yet to find a job, and roughly 43% of these individuals have been out of work for more than six months. In addition, while the Federal Reserve Board (“Fed”)

ii

believes that unemployment will continue to decline, it projects that it will remain relatively high, between 7.5% and 8.0% at the end of 2012.

The long-ailing housing market continued to show signs of strain during the reporting period. Looking back, sales increased in the spring of 2010 largely due to the government’s $8,000 tax credit for first-time home buyers. However, this proved to be only a temporary boost, as sales subsequently weakened after the tax credit expired at the end of April. Existing-home sales did rebound somewhat toward the end of 2010 and in January 2011, as mortgage rates remained relatively low. However, according to the National Association of Realtors (“NAR”), existing-home sales then declined a sharp 8.9% in February, before increasing 3.5% in March and then falling 0.8% in April. At the end of April, the inventory of unsold homes was a 9.2 month supply at the current sales level, versus an 8.3 month supply in March. Existing-home prices remained disappointingly low, with the NAR reporting that the median existing-home price for all housing types was $163,700 in April 2011, down 5.0% from April 2010.

The manufacturing sector was one area of the economy that remained relatively strong during the reporting period. Based on the Institute for Supply Management’s PMI

iii

, the manufacturing

|

IV

|

|

Western Asset Municipal High Income Fund Inc.

|

|

|

|

Investment commentary (cont’d)

sector has grown twenty-one consecutive months since it began expanding in August 2009. After reaching a six-year peak of 60.4 in March 2010 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion), PMI data indicated somewhat more modest growth during the next nine months. However, in January 2011, the manufacturing sector expanded at its fastest pace since May 2004, with a reading of 60.8 versus 58.5 for the previous month. Manufacturing activity remained strong during the next three months and was 60.4 in April. The expansion in the manufacturing sector was broad based in April, with seventeen of eighteen industries tracked by the Institute for Supply Management growing during the month.

Financial market overview

Although the financial markets were, for the most part, characterized by healthy investor risk appetite and solid results by stocks and lower-quality bonds, there were periods of heightened volatility during the reporting period. The markets experienced sharp sell-offs in mid-November 2010, and again in mid-February and mid-March 2011. During those periods, investors tended to favor the relative safety of U.S. Treasury securities. However, these setbacks proved to be only temporary and, in each case, risk aversion was generally replaced with solid demand for riskier assets.

Due to signs that certain areas of the economy were moderating in the middle of 2010 (prior to the beginning of the reporting period), the Fed took further actions to spur the economy. At its August 10

th

meeting, the Fed announced an ongoing program that calls for using the proceeds from expiring agency debt and agency mortgage-backed securities to purchase longer-dated Treasury securities.

In addition, the Fed remained cautious given pockets of weakness in the economy. At its meeting in September 2010, the Fed said, “The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery. . . .” This led to speculation that the Fed may again move to purchase large amounts of agency and Treasury securities in an attempt to avoid a double-dip recession and ward off deflation.

The Fed then took additional action in early November 2010. Citing that “the pace of recovery in output and employment continues to be slow,” the Fed announced another round of quantitative easing to help stimulate the economy, entailing the purchase of $600 billion of long-term U.S. Treasury securities by the end of the second quarter of 2011. This, coupled with the Fed’s previously announced program to use the proceeds of expiring securities to purchase Treasuries, means it could buy a total of $850 billion to $900 billion of Treasury securities by the end of June 2011. At its meeting in April 2011, the Fed said it “continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate

iv

for an extended period.” The Fed also stated that it would end its program of purchasing $600 billion of Treasury securities on schedule at the end of June.

Fixed-income market review

After rallying in October 2010 (prior to the beginning of the reporting period) in the wake of the Fed indicating the possibility of another round of quantitative easing, the spread sectors

|

|

|

|

Western Asset Municipal High Income Fund Inc.

|

|

V

|

(non-Treasuries) started to weaken toward the middle of November. This occurred as financial troubles in Ireland resulted in a re-emergence of the European sovereign debt crisis. While most spread sectors regained their footing during the last five months of the reporting period, others, such as emerging market debt, produced mixed results given ongoing uncertainties in Europe, concerns regarding economic growth in China and its potential impact on the global economy, geopolitical unrest in the Middle East and Libya and the devastating earthquake and tsunami in Japan.

Both short- and long-term Treasury yields fluctuated but, overall, moved higher during the six months ended April 30, 2011. When the period began, two- and ten-year Treasury yields were 0.34% and 2.63%, respectively. Treasury yields initially moved lower, with two- and ten-year Treasury yields hitting their lows for the period of 0.33% and 2.53%, respectively, on November 4, 2010. Yields then moved sharply higher given expectations for stronger growth in 2011 and the potential for rising inflation. On February 14, 2011, two-year Treasury yields peaked at 0.87%, while ten-year Treasuries peaked at 3.75% on February 8, 2011. Treasury yields then declined as investor risk aversion increased given the uprising in Libya and, later, given the tragic events in Japan. Yields moved higher toward the end of March as investor risk appetite resumed, but then declined in April given disappointing first quarter 2011 GDP data. When the period ended on April 30, 2011, two-year Treasury yields were 0.61% and ten-year Treasury yields were 3.32%.

The municipal bond market lagged its taxable bond counterpart over the six months ended April 30, 2011. Over that period, the Barclays Capital Municipal Bond Index

v

and the Barclays Capital U.S. Aggregate Index

vi

returned -1.68% and 0.02%, respectively. The municipal bond market was negatively impacted by a sharp increase in issuance of Build America Bonds in advance of the expiration of the popular program at the end of 2010. These new securities were not readily absorbed by investor demand. In addition, there were some high profile issues regarding the financial well-being of some municipal bond issuers. However, the municipal market began to strengthen in April 2011 given improving tax revenues and a sharp decline in new issuance.

Performance review

For the six months ended April 30, 2011, Western Asset Municipal High Income Fund Inc. returned -2.69% based on its net asset value (“NAV”)

vii

and -5.62% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the Barclays Capital Municipal Bond Index, returned -1.68% for the same period. The Lipper High Yield Municipal Debt Closed-End Funds Category Average

viii

returned -5.21% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

Certain investors may be subject to the federal alternative minimum tax, and state and local taxes will apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

During this six-month period, the Fund made distributions to shareholders totaling $0.22 per share, which may have included a return of capital. The performance table shows the Fund’s

|

VI

|

|

Western Asset Municipal High Income Fund Inc.

|

|

|

|

Investment commentary (cont’d)

six-month total return based on its NAV and market price as of April 30, 2011.

Past performance is no guarantee of future results.

Performance Snapshot

as of April 30, 2011 (unaudited)

|

Price Per Share

|

|

6-Month

Total Return*

|

|

$7.39 (NAV)

|

|

-2.69%

|

|

$7.25 (Market Price)

|

|

-5.62%

|

All figures represent past performance and are not a guarantee of future results.

*

Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Looking for additional information?

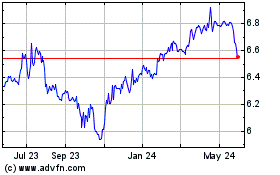

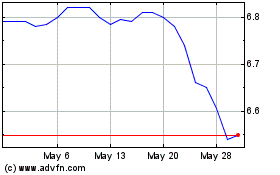

The Fund is traded under the symbol “MHF” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XMHFX” on most financial websites.

Barron’s

and the

Wall Street Journal’s

Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.leggmason.com/cef.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and

Chief Executive Officer

May 27, 2011

RISKS:

High-yield bonds involve greater credit and liquidity risks than investment grade bonds. As interest rates rise, bond prices fall, reducing the value of the Fund’s holdings. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

|

|

|

|

Western Asset Municipal High Income Fund Inc.

|

|

VII

|

|

i

|

Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time.

|

|

ii

|

The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments.

|

|

iii

|

The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector.

|

|

iv

|

The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day.

|

|

v

|

The Barclays Capital Municipal Bond Index is a market value weighted index of investment grade municipal bonds with maturities of one year or more.

|

|

vi

|

The Barclays Capital U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity.

|

|

vii

|

Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares.

|

|

viii

|

Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended April 30, 2011, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 14 funds in the Fund’s Lipper category.

|

(This page intentionally left blank.)

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

1

|

Fund at a glance

†

(unaudited)

Investment breakdown

(%) as a percent of total investments

|

†

|

The bar graph above represents the composition of the Fund’s investments as of April 30, 2011 and October 31, 2010. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time.

|

|

2

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Spread duration (unaudited)

Economic Exposure

— April 30, 2011

Spread duration measures the sensitivity to changes in spreads. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. Spread duration is quantified as the % change in price resulting from a 100 basis points change in spreads. For a security with positive spread duration, an increase in spreads would result in a price decline and a decline in spreads would result in a price increase. This chart highlights the market sector exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

|

BC Muni Bond

|

— Barclays Capital Municipal Bond Index

|

|

MHF

|

— Western Asset Municipal High Income Fund Inc.

|

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

3

|

Effective duration (unaudited)

Interest Rate Exposure

— April 30, 2011

Effective duration measures the sensitivity to changes in relevant interest rates. Effective duration is quantified as the % change in price resulting from a 100 basis points change in interest rates. For a security with positive effective duration, an increase in interest rates would result in a price decline and a decline in interest rates would result in a price increase. This chart highlights the interest rate exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

|

BC Muni Bond

|

— Barclays Capital Municipal Bond Index

|

|

MHF

|

— Western Asset Municipal High Income Fund Inc.

|

|

4

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Schedule of investments (unaudited)

April 30, 2011

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Municipal Bonds — 97.0%

|

|

|

|

|

|

|

|

|

|

|

Arizona — 1.7%

|

|

|

|

|

|

|

|

|

|

|

Pima County, AZ, IDA Revenue, Tucson Electric Power Co.

|

|

5.750

|

%

|

9/1/29

|

|

$1,000,000

|

|

$

|

1,002,210

|

|

|

Salt Verde, AZ, Financial Corp. Gas Revenue

|

|

5.000

|

%

|

12/1/37

|

|

1,500,000

|

|

1,236,795

|

|

|

University Medical Center Corp., AZ, Hospital Revenue

|

|

6.250

|

%

|

7/1/29

|

|

500,000

|

|

502,485

|

|

|

Total Arizona

|

|

|

|

|

|

|

|

2,741,490

|

|

|

Arkansas — 0.4%

|

|

|

|

|

|

|

|

|

|

|

Arkansas State Development Financing Authority, Industrial Facilities Revenue, Potlatch Corp. Projects

|

|

7.750

|

%

|

8/1/25

|

|

600,000

|

|

602,346

|

(a)

|

|

California — 4.5%

|

|

|

|

|

|

|

|

|

|

|

Golden State Tobacco Securitization Corp., California Tobacco Settlement Revenue, Asset Backed

|

|

7.800

|

%

|

6/1/42

|

|

2,000,000

|

|

2,288,400

|

(b)

|

|

M-S-R Energy Authority, CA, Gas Revenue

|

|

7.000

|

%

|

11/1/34

|

|

2,000,000

|

|

2,201,840

|

|

|

M-S-R Energy Authority, CA, Gas Revenue

|

|

6.500

|

%

|

11/1/39

|

|

2,000,000

|

|

2,058,020

|

|

|

Redding, CA, Redevelopment Agency, Tax Allocation, Shastec Redevelopment Project

|

|

5.000

|

%

|

9/1/29

|

|

600,000

|

|

502,104

|

|

|

Total California

|

|

|

|

|

|

|

|

7,050,364

|

|

|

Colorado — 5.1%

|

|

|

|

|

|

|

|

|

|

|

Colorado Educational & Cultural Facilities Authority Revenue:

|

|

|

|

|

|

|

|

|

|

|

Charter School Peak to Peak Project

|

|

7.500

|

%

|

8/15/21

|

|

665,000

|

|

678,120

|

(b)

|

|

Cheyenne Mountain Charter Academy

|

|

5.250

|

%

|

6/15/25

|

|

680,000

|

|

638,629

|

|

|

Cheyenne Mountain Charter Academy

|

|

5.125

|

%

|

6/15/32

|

|

510,000

|

|

446,444

|

|

|

Elbert County Charter

|

|

7.375

|

%

|

3/1/35

|

|

785,000

|

|

712,238

|

|

|

Public Authority for Colorado Energy, Natural Gas Purchase Revenue

|

|

6.125

|

%

|

11/15/23

|

|

4,000,000

|

|

4,224,160

|

|

|

Reata South Metropolitan District, CO, GO

|

|

7.250

|

%

|

6/1/37

|

|

1,000,000

|

|

799,960

|

|

|

Southlands, CO, Metropolitan District No. 1, GO

|

|

7.125

|

%

|

12/1/34

|

|

500,000

|

|

602,970

|

(b)

|

|

Total Colorado

|

|

|

|

|

|

|

|

8,102,521

|

|

|

Delaware — 4.0%

|

|

|

|

|

|

|

|

|

|

|

Delaware State EDA Revenue, Indian River Power LLC

|

|

5.375

|

%

|

10/1/45

|

|

4,000,000

|

|

3,447,160

|

|

|

Sussex County, DE, Recovery Zone Facility Revenue, NRG Energy Inc., Indian River Power LLC

|

|

6.000

|

%

|

10/1/40

|

|

3,000,000

|

|

2,864,580

|

|

|

Total Delaware

|

|

|

|

|

|

|

|

6,311,740

|

|

|

District of Columbia — 1.3%

|

|

|

|

|

|

|

|

|

|

|

District of Columbia COP, District Public Safety & Emergency, AMBAC

|

|

5.500

|

%

|

1/1/20

|

|

1,895,000

|

|

1,978,058

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

5

|

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Florida — 6.3%

|

|

|

|

|

|

|

|

|

|

|

Beacon Lakes, FL, Community Development District, Special Assessment

|

|

6.900

|

%

|

5/1/35

|

|

$ 815,000

|

|

$

|

761,789

|

|

|

Bonnet Creek Resort Community Development District, Special Assessment

|

|

7.500

|

%

|

5/1/34

|

|

1,500,000

|

|

1,377,690

|

|

|

Century Parc Community Development District, Special Assessment

|

|

7.000

|

%

|

11/1/31

|

|

885,000

|

|

851,547

|

|

|

Highlands County, FL, Health Facilities Authority Revenue, Adventist Health Systems

|

|

6.000

|

%

|

11/15/25

|

|

1,000,000

|

|

1,080,700

|

(b)

|

|

Martin County, FL, IDA Revenue, Indiantown Cogeneration Project

|

|

7.875

|

%

|

12/15/25

|

|

2,000,000

|

|

2,007,780

|

(a)

|

|

Orange County, FL, Health Facilities Authority Revenue, First Mortgage, GF, Orlando Inc. Project

|

|

9.000

|

%

|

7/1/31

|

|

1,000,000

|

|

970,920

|

|

|

Palm Beach County, FL, Health Facilities Authority Revenue, John F. Kennedy Memorial Hospital Inc. Project

|

|

9.500

|

%

|

8/1/13

|

|

225,000

|

|

248,699

|

(c)

|

|

Reunion East Community Development District, Special Assessment

|

|

7.375

|

%

|

5/1/33

|

|

2,000,000

|

|

1,322,420

|

|

|

Santa Rosa, FL, Bay Bridge Authority Revenue

|

|

6.250

|

%

|

7/1/28

|

|

1,000,000

|

|

401,030

|

|

|

University of Central Florida, COP, FGIC

|

|

5.000

|

%

|

10/1/25

|

|

1,000,000

|

|

911,590

|

|

|

Total Florida

|

|

|

|

|

|

|

|

9,934,165

|

|

|

Georgia — 6.8%

|

|

|

|

|

|

|

|

|

|

|

Atlanta, GA, Airport Revenue:

|

|

|

|

|

|

|

|

|

|

|

AGM

|

|

5.000

|

%

|

1/1/26

|

|

1,000,000

|

|

1,012,590

|

|

|

FGIC

|

|

5.625

|

%

|

1/1/30

|

|

1,000,000

|

|

999,340

|

(a)

|

|

Atlanta, GA, Development Authority Educational Facilities Revenue, Science Park LLC Project

|

|

5.000

|

%

|

7/1/32

|

|

2,000,000

|

|

1,949,180

|

|

|

Atlanta, GA, Tax Allocation, Atlantic Station Project

|

|

7.900

|

%

|

12/1/24

|

|

2,500,000

|

|

2,634,775

|

(b)

|

|

Atlanta, GA, Water & Wastewater Revenue

|

|

6.250

|

%

|

11/1/39

|

|

2,000,000

|

|

2,070,500

|

|

|

DeKalb, Newton & Gwinnett Counties, GA, Joint Development Authority Revenue, GGC Foundation LLC Project

|

|

6.125

|

%

|

7/1/40

|

|

1,000,000

|

|

1,064,200

|

|

|

Gainesville & Hall County, GA, Development Authority Revenue, Senior Living Facilities, Lanier Village Estates

|

|

7.250

|

%

|

11/15/29

|

|

1,000,000

|

|

1,001,650

|

|

|

Total Georgia

|

|

|

|

|

|

|

|

10,732,235

|

|

|

Hawaii — 2.7%

|

|

|

|

|

|

|

|

|

|

|

Hawaii State Department of Budget & Finance Special Purpose:

|

|

|

|

|

|

|

|

|

|

|

Revenue, Hawaiian Electric Co.

|

|

6.500

|

%

|

7/1/39

|

|

2,000,000

|

|

2,012,340

|

|

|

Senior Living Revenue

|

|

6.400

|

%

|

11/15/14

|

|

550,000

|

|

551,402

|

|

|

Senior Living Revenue

|

|

7.500

|

%

|

11/15/15

|

|

1,500,000

|

|

1,536,795

|

|

|

Senior Living Revenue, 15 Craigside Project

|

|

8.750

|

%

|

11/15/29

|

|

200,000

|

|

224,648

|

|

|

Total Hawaii

|

|

|

|

|

|

|

|

4,325,185

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

|

6

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Schedule of investments (unaudited) (cont’d)

April 30, 2011

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Illinois — 2.4%

|

|

|

|

|

|

|

|

|

|

|

Cook County, IL, Revenue, Navistar International Corp.

|

|

6.500

|

%

|

10/15/40

|

|

$2,000,000

|

|

$

|

2,018,140

|

|

|

Illinois Finance Authority Revenue:

|

|

|

|

|

|

|

|

|

|

|

Park Place of Elmhurst

|

|

8.125

|

%

|

5/15/40

|

|

1,000,000

|

|

950,530

|

|

|

Refunding, Chicago Charter School Project

|

|

5.000

|

%

|

12/1/26

|

|

1,000,000

|

|

866,760

|

|

|

Total Illinois

|

|

|

|

|

|

|

|

3,835,430

|

|

|

Indiana — 0.5%

|

|

|

|

|

|

|

|

|

|

|

County of St. Joseph, IN, EDR:

|

|

|

|

|

|

|

|

|

|

|

Holy Cross Village Notre Dame Project

|

|

6.000

|

%

|

5/15/26

|

|

285,000

|

|

258,751

|

|

|

Holy Cross Village Notre Dame Project

|

|

6.000

|

%

|

5/15/38

|

|

550,000

|

|

465,575

|

|

|

Total Indiana

|

|

|

|

|

|

|

|

724,326

|

|

|

Kansas — 0.7%

|

|

|

|

|

|

|

|

|

|

|

Salina, KS, Hospital Revenue, Refunding & Improvement Salina Regional Health

|

|

5.000

|

%

|

10/1/22

|

|

1,150,000

|

|

1,184,718

|

|

|

Kentucky — 1.3%

|

|

|

|

|

|

|

|

|

|

|

Owen County, KY, Waterworks System Revenue, Kentucky American Water Co. Project

|

|

6.250

|

%

|

6/1/39

|

|

2,000,000

|

|

2,050,800

|

|

|

Louisiana — 0.6%

|

|

|

|

|

|

|

|

|

|

|

Epps, LA, COP

|

|

8.000

|

%

|

6/1/18

|

|

930,000

|

|

924,476

|

|

|

Maryland — 1.9%

|

|

|

|

|

|

|

|

|

|

|

Maryland State Health & Higher EFA Revenue, Mercy Medical Center

|

|

6.250

|

%

|

7/1/31

|

|

3,000,000

|

|

3,001,920

|

|

|

Massachusetts — 1.2%

|

|

|

|

|

|

|

|

|

|

|

Boston, MA, Industrial Development Financing Authority Revenue, Roundhouse Hospitality LLC Project

|

|

7.875

|

%

|

3/1/25

|

|

785,000

|

|

646,604

|

(a)

|

|

Massachusetts State DFA Revenue, Tufts Medical Center Inc.

|

|

6.875

|

%

|

1/1/41

|

|

1,000,000

|

|

997,990

|

|

|

Massachusetts State Port Authority Revenue

|

|

13.000

|

%

|

7/1/13

|

|

210,000

|

|

240,828

|

(c)

|

|

Total Massachusetts

|

|

|

|

|

|

|

|

1,885,422

|

|

|

Michigan — 5.2%

|

|

|

|

|

|

|

|

|

|

|

Allen Academy, COP

|

|

7.500

|

%

|

6/1/23

|

|

2,130,000

|

|

2,124,803

|

|

|

Cesar Chavez Academy, COP

|

|

6.500

|

%

|

2/1/33

|

|

1,000,000

|

|

977,140

|

|

|

Cesar Chavez Academy, COP

|

|

8.000

|

%

|

2/1/33

|

|

1,000,000

|

|

1,038,710

|

|

|

Gaudior Academy, COP

|

|

7.250

|

%

|

4/1/34

|

|

1,000,000

|

|

881,940

|

|

|

Royal Oak, MI, Hospital Finance Authority Revenue, William Beaumont Hospital

|

|

8.250

|

%

|

9/1/39

|

|

2,000,000

|

|

2,273,480

|

|

|

Star International Academy, COP

|

|

7.000

|

%

|

3/1/33

|

|

940,000

|

|

895,557

|

|

|

Total Michigan

|

|

|

|

|

|

|

|

8,191,630

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

7

|

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Missouri — 0.8%

|

|

|

|

|

|

|

|

|

|

|

Missouri State HEFA Revenue, Refunding, St. Lukes Episcopal

|

|

5.000

|

%

|

12/1/21

|

|

$1,300,000

|

|

$

|

1,325,909

|

|

|

Montana — 1.3%

|

|

|

|

|

|

|

|

|

|

|

Montana State Board of Investment, Resource Recovery Revenue, Yellowstone Energy LP Project

|

|

7.000

|

%

|

12/31/19

|

|

2,205,000

|

|

2,075,611

|

(a)

|

|

New Jersey — 3.6%

|

|

|

|

|

|

|

|

|

|

|

Casino Reinvestment Development Authority Revenue, NATL

|

|

5.250

|

%

|

6/1/20

|

|

1,500,000

|

|

1,501,575

|

|

|

New Jersey State EDA Revenue, Refunding

|

|

6.875

|

%

|

1/1/37

|

|

5,000,000

|

|

4,252,000

|

(a)

|

|

Total New Jersey

|

|

|

|

|

|

|

|

5,753,575

|

|

|

New Mexico — 0.6%

|

|

|

|

|

|

|

|

|

|

|

Otero County, NM, Jail Project Revenue

|

|

7.500

|

%

|

12/1/24

|

|

1,000,000

|

|

962,950

|

|

|

New York — 5.1%

|

|

|

|

|

|

|

|

|

|

|

Brooklyn Arena, NY, Local Development Corp., Barclays Center Project

|

|

6.250

|

%

|

7/15/40

|

|

2,000,000

|

|

1,960,340

|

|

|

New York City, NY, IDA, Civic Facilities Revenue, Special Needs Facilities Pooled Program

|

|

8.125

|

%

|

7/1/19

|

|

385,000

|

|

393,655

|

|

|

New York Liberty Development Corp., Liberty Revenue, Refunding, Second Priority, Bank of America

|

|

6.375

|

%

|

7/15/49

|

|

5,000,000

|

|

5,001,050

|

|

|

Suffolk County, NY, IDA, Civic Facilities Revenue, Eastern Long Island Hospital Association

|

|

7.750

|

%

|

1/1/22

|

|

755,000

|

|

791,444

|

(b)

|

|

Total New York

|

|

|

|

|

|

|

|

8,146,489

|

|

|

Ohio — 2.7%

|

|

|

|

|

|

|

|

|

|

|

Cuyahoga County, OH, Hospital Facilities Revenue, Canton Inc. Project

|

|

7.500

|

%

|

1/1/30

|

|

1,465,000

|

|

1,468,633

|

|

|

Miami County, OH, Hospital Facilities Revenue, Refunding and Improvement Upper Valley Medical Center

|

|

5.250

|

%

|

5/15/21

|

|

1,500,000

|

|

1,518,465

|

|

|

Riversouth Authority, OH, Revenue, Riversouth Area Redevelopment

|

|

5.000

|

%

|

12/1/25

|

|

1,260,000

|

|

1,305,234

|

|

|

Total Ohio

|

|

|

|

|

|

|

|

4,292,332

|

|

|

Oklahoma — 1.5%

|

|

|

|

|

|

|

|

|

|

|

Tulsa County, OK, Industrial Authority, Senior Living Community Revenue:

|

|

|

|

|

|

|

|

|

|

|

Montereau Inc. Project

|

|

6.875

|

%

|

11/1/23

|

|

1,300,000

|

|

1,310,101

|

|

|

Montereau Inc. Project

|

|

7.125

|

%

|

11/1/30

|

|

1,000,000

|

|

1,001,630

|

|

|

Total Oklahoma

|

|

|

|

|

|

|

|

2,311,731

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

|

8

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Schedule of investments (unaudited) (cont’d)

April 30, 2011

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Pennsylvania — 4.3%

|

|

|

|

|

|

|

|

|

|

|

Cumberland County, PA, Municipal Authority Retirement Community Revenue, Wesley Affiliate Services Inc. Project

|

|

7.250

|

%

|

1/1/35

|

|

$1,000,000

|

|

$

|

1,117,500

|

(b)

|

|

Lebanon County, PA, Health Facilities Authority Revenue, Good Samaritan Hospital Project

|

|

6.000

|

%

|

11/15/35

|

|

1,000,000

|

|

867,840

|

|

|

Monroe County, PA, Hospital Authority Revenue, Pocono Medical Center

|

|

5.000

|

%

|

1/1/27

|

|

1,000,000

|

|

923,290

|

|

|

Northumberland County, PA, IDA Facilities Revenue, NHS Youth Services Inc. Project

|

|

7.500

|

%

|

2/15/29

|

|

900,000

|

|

761,589

|

|

|

Pennsylvania Economic Development Financing Authority, Health Systems Revenue, Albert Einstein Healthcare

|

|

6.250

|

%

|

10/15/23

|

|

2,000,000

|

|

2,063,400

|

|

|

Philadelphia, PA, Authority for IDR, Host Marriot LP Project, Remarketed 10/31/95

|

|

7.750

|

%

|

12/1/17

|

|

1,000,000

|

|

1,001,520

|

(a)

|

|

Total Pennsylvania

|

|

|

|

|

|

|

|

6,735,139

|

|

|

Puerto Rico — 0.6%

|

|

|

|

|

|

|

|

|

|

|

Puerto Rico Electric Power Authority, Power Revenue

|

|

5.250

|

%

|

7/1/40

|

|

1,000,000

|

|

876,120

|

|

|

Tennessee — 1.3%

|

|

|

|

|

|

|

|

|

|

|

Shelby County, TN, Health Educational & Housing Facilities Board Revenue, Trezevant Manor Project

|

|

5.750

|

%

|

9/1/37

|

|

2,500,000

|

|

2,054,275

|

|

|

Texas — 22.7%

|

|

|

|

|

|

|

|

|

|

|

Brazos River, TX, Harbor Industrial Development Corp., Environmental Facilities Revenue, Dow Chemical Co.

|

|

5.900

|

%

|

5/1/28

|

|

1,500,000

|

|

1,476,300

|

(a)(d)

|

|

Burnet County, TX, Public Facility Project Revenue

|

|

7.500

|

%

|

8/1/24

|

|

1,440,000

|

|

1,390,680

|

|

|

Garza County, TX, Public Facility Corp.

|

|

5.500

|

%

|

10/1/18

|

|

1,000,000

|

|

982,670

|

|

|

Garza County, TX, Public Facility Corp., Project Revenue

|

|

5.750

|

%

|

10/1/25

|

|

2,000,000

|

|

2,012,240

|

|

|

Gulf Coast of Texas, IDA, Solid Waste Disposal Revenue, CITGO Petroleum Corp. Project

|

|

7.500

|

%

|

10/1/12

|

|

2,000,000

|

|

2,027,400

|

(a)(d)

|

|

Harris County, TX, Cultural Education Facilities Finance Corp., Medical Facilities Revenue, Baylor College of Medicine

|

|

5.625

|

%

|

11/15/32

|

|

2,000,000

|

|

1,864,280

|

|

|

Houston, TX, Airport Systems Revenue, Special Facilities, Continental Airlines Inc. Project

|

|

6.125

|

%

|

7/15/27

|

|

2,750,000

|

|

2,513,720

|

(a)

|

|

Laredo, TX, ISD Public Facility Corp., Lease Revenue, AMBAC

|

|

5.000

|

%

|

8/1/29

|

|

1,000,000

|

|

1,000,520

|

|

|

Love Field Airport Modernization Corp, TX, Special Facilities Revenue, Southwest Airlines Co. Project

|

|

5.250

|

%

|

11/1/40

|

|

6,000,000

|

|

5,254,380

|

|

|

Midlothian, TX, Development Authority, Tax Increment Contract Revenue

|

|

6.200

|

%

|

11/15/29

|

|

1,000,000

|

|

1,000,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

9

|

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Texas — continued

|

|

|

|

|

|

|

|

|

|

|

North Texas Tollway Authority Revenue

|

|

5.750

|

%

|

1/1/40

|

|

$2,500,000

|

|

$

|

2,431,400

|

|

|

Texas Midwest Public Facility Corp. Revenue, Secure Treatment Facility Project

|

|

9.000

|

%

|

10/1/30

|

|

2,000,000

|

|

1,625,300

|

|

|

Texas Private Activity Bond Surface Transportation Corp., Senior Lien

|

|

6.875

|

%

|

12/31/39

|

|

2,000,000

|

|

2,035,600

|

|

|

Texas Private Activity Bond Surface Transportation Corp.

Revenue, LBJ Infrastructure Group LLC

|

|

7.000

|

%

|

6/30/40

|

|

4,000,000

|

|

4,099,880

|

|

|

Texas State Public Finance Authority:

|

|

|

|

|

|

|

|

|

|

|

Charter School Finance Corp. Revenue, Cosmos Foundation Inc.

|

|

6.200

|

%

|

2/15/40

|

|

1,000,000

|

|

947,390

|

|

|

Uplift Education

|

|

5.750

|

%

|

12/1/27

|

|

1,500,000

|

|

1,333,830

|

|

|

West Texas Detention Facility Corp. Revenue

|

|

8.000

|

%

|

2/1/25

|

|

1,865,000

|

|

1,653,640

|

|

|

Willacy County, TX, Local Government Corp. Revenue

|

|

6.875

|

%

|

9/1/28

|

|

1,000,000

|

|

856,270

|

|

|

Willacy County, TX, PFC Project Revenue

|

|

8.250

|

%

|

12/1/23

|

|

1,000,000

|

|

1,042,270

|

|

|

Willacy County, TX, PFC Project Revenue, County Jail

|

|

7.500

|

%

|

11/1/25

|

|

550,000

|

|

475,178

|

|

|

Total Texas

|

|

|

|

|

|

|

|

36,023,148

|

|

|

U.S. Virgin Islands — 1.6%

|

|

|

|

|

|

|

|

|

|

|

Virgin Islands Public Finance Authority Revenue, Matching Fund Loan

|

|

6.750

|

%

|

10/1/37

|

|

2,500,000

|

|

2,574,025

|

|

|

Virginia — 2.3%

|

|

|

|

|

|

|

|

|

|

|

Alexandria, VA, Redevelopment & Housing Authority, MFH Revenue, Parkwood Court Apartments Project

|

|

8.125

|

%

|

4/1/30

|

|

295,000

|

|

268,491

|

|

|

Broad Street CDA Revenue

|

|

7.500

|

%

|

6/1/33

|

|

748,000

|

|

863,260

|

(b)

|

|

Chesterfield County, VA, EDA, Solid Waste and Sewer Disposal Revenue, Virginia Electric Power Co. Project

|

|

5.600

|

%

|

11/1/31

|

|

2,500,000

|

|

2,484,925

|

(a)

|

|

Total Virginia

|

|

|

|

|

|

|

|

3,616,676

|

|

|

West Virginia — 1.4%

|

|

|

|

|

|

|

|

|

|

|

Pleasants County, WV, PCR, Refunding, County Commission Allegheny

|

|

5.250

|

%

|

10/15/37

|

|

2,500,000

|

|

2,265,100

|

|

|

Wisconsin — 0.6%

|

|

|

|

|

|

|

|

|

|

|

Wisconsin State HEFA Revenue, Aurora Health Care

|

|

6.400

|

%

|

4/15/33

|

|

1,000,000

|

|

1,011,220

|

|

|

Total Investments before Short-Term Investments (Cost — $157,031,008)

|

|

|

|

153,601,126

|

|

|

Short-Term Investments — 1.0%

|

|

|

|

|

|

|

|

|

|

|

Colorado — 0.1%

|

|

|

|

|

|

|

|

|

|

|

Denver, CO, City & County, COP, SPA-JPMorgan Chase

|

|

0.250

|

%

|

12/1/29

|

|

100,000

|

|

100,000

|

(e)(f)

|

|

Illinois — 0.6%

|

|

|

|

|

|

|

|

|

|

|

Chicago, IL, Sales Tax Revenue, SPA-JPMorgan Chase

|

|

0.270

|

%

|

1/1/34

|

|

1,000,000

|

|

1,000,000

|

(e)(f)

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

|

10

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Schedule of investments (unaudited) (cont’d)

April 30, 2011

Western Asset Municipal High Income Fund Inc.

|

Security

|

|

Rate

|

|

Maturity

Date

|

|

Face

Amount

|

|

Value

|

|

|

Indiana — 0.1%

|

|

|

|

|

|

|

|

|

|

|

Indiana State Finance Authority Revenue, Lease Appropriation, SPA-JPMorgan Chase

|

|

0.240

|

%

|

2/1/35

|

|

$ 100,000

|

|

$

100,000

|

(e)(f)

|

|

New Jersey — 0.1%

|

|

|

|

|

|

|

|

|

|

|

Rutgers State University, NJ, SPA-Landesbank Hessen-Thuringen

|

|

0.230

|

%

|

5/1/18

|

|

330,000

|

|

330,000

|

(e)(f)

|

|

Texas — 0.1%

|

|

|

|

|

|

|

|

|

|

|

Harris County, TX, Health Facilities Development Corp. Revenue, Methodist Hospital System

|

|

0.230

|

%

|

12/1/41

|

|

100,000

|

|

100,000

|

(e)(f)

|

|

Total Short-Term Investments (Cost — $1,630,000)

|

|

|

|

|

|

|

|

1,630,000

|

|

|

Total Investments — 98.0% (Cost — $158,661,008#)

|

|

|

|

|

|

|

|

155,231,126

|

|

|

Other Assets in Excess of Liabilities — 2.0%

|

|

|

|

|

|

|

|

3,189,950

|

|

|

Total Net Assets — 100.0%

|

|

|

|

|

|

|

|

$158,421,076

|

|

|

(a)

|

Income from this issue is considered a preference item for purposes of calculating the alternative minimum tax (“AMT”).

|

|

(b)

|

Pre-Refunded bonds are escrowed with U.S. government obligations and/or U.S. government agency securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings.

|

|

(c)

|

Bonds are escrowed to maturity by government securities and/or U.S. government agency securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings.

|

|

(d)

|

Maturity date shown represents the mandatory tender date.

|

|

(e)

|

Variable rate demand obligations have a demand feature under which the Fund can tender them back to the issuer or liquidity provider on no more than 7 days notice.

|

|

(f)

|

Maturity date shown is the final maturity date. The security may be sold back to the issuer before final maturity.

|

|

#

|

Aggregate cost for federal income tax purposes is substantially the same.

|

See Notes to Financial Statements.

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

11

|

Western Asset Municipal High Income Fund Inc.

Abbreviations used in this schedule:

|

AGM

|

— Assured Guaranty Municipal Corporation — Insured Bonds

|

|

AMBAC

|

— American Municipal Bond Assurance Corporation — Insured Bonds

|

|

CDA

|

— Communities Development Authority

|

|

COP

|

— Certificates of Participation

|

|

DFA

|

— Development Finance Agency

|

|

EDA

|

— Economic Development Authority

|

|

EDR

|

— Economic Development Revenue

|

|

EFA

|

— Educational Facilities Authority

|

|

FGIC

|

— Financial Guaranty Insurance Company — Insured Bonds

|

|

GO

|

— General Obligation

|

|

HEFA

|

— Health & Educational Facilities Authority

|

|

IDA

|

— Industrial Development Authority

|

|

IDR

|

— Industrial Development Revenue

|

|

ISD

|

— Independent School District

|

|

MFH

|

— Multi-Family Housing

|

|

NATL

|

— National Public Finance Guarantee Corporation — Insured Bonds

|

|

PCR

|

— Pollution Control Revenue

|

|

PFC

|

— Public Facilities Corporation

|

|

SPA

|

— Standby Bond Purchase Agreement — Insured Bonds

|

Summary of Investments by Industry*

|

Industrial revenue

|

|

31.7

|

%

|

|

Health care

|

|

18.1

|

|

|

Leasing

|

|

11.8

|

|

|

Transportation

|

|

7.1

|

|

|

Pre-refunded/escrowed to maturity

|

|

6.8

|

|

|

Education

|

|

5.9

|

|

|

Special tax obligation

|

|

5.9

|

|

|

Power

|

|

5.2

|

|

|

Other

|

|

2.9

|

|

|

Solid waste/resource recovery

|

|

1.6

|

|

|

Water & sewer

|

|

1.3

|

|

|

Local general obligation

|

|

0.5

|

|

|

Housing

|

|

0.2

|

|

|

Short-term investments

|

|

1.0

|

|

|

|

|

100.0

|

%

|

* As a percentage of total investments. Please note that Fund holdings are as of April 30, 2011 and are subject to change.

See Notes to Financial Statements.

|

12

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Schedule of investments (unaudited) (cont’d)

April 30, 2011

Western Asset Municipal High Income Fund Inc.

Ratings Table†

|

S&P/Moody’s/Fitch‡

|

|

|

|

|

AAA/Aaa

|

|

3.9

|

%

|

|

AA/Aa

|

|

2.1

|

|

|

A

|

|

22.2

|

|

|

BBB/Baa

|

|

37.7

|

|

|

BB/Ba

|

|

4.0

|

|

|

B

|

|

1.3

|

|

|

CCC/Caa

|

|

1.6

|

|

|

CC

|

|

1.0

|

|

|

C

|

|

0.3

|

|

|

A-1/VMIG1

|

|

1.0

|

|

|

NR

|

|

24.9

|

|

|

|

|

100.0

|

%

|

|

†

|

As a percentage of total investments.

|

|

‡

|

The ratings shown are based on each portfolio security’s rating as determined by S&P, Moody’s or Fitch, each a Nationally Recognized Statistical Ratings Organization (“NRSRO”). These ratings are the opinions of the NRSRO and are not measures of quality or guarantees of performance. Securities may be rated by other NRSROs, and these ratings may be higher or lower. In the event that a security is rated by multiple NRSROs and receives different ratings, the Fund will treat the security as being rated in the lowest rating category received from an NRSRO.

|

See pages 13 through 16 for definitions of ratings.

See Notes to Financial Statements.

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

13

|

Bond ratings

The definitions of the applicable rating symbols are set forth below:

Long-term security ratings (unaudited)

Standard & Poor’s Ratings Service (“Standard & Poor’s”)

Long-term Issue Credit Ratings — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (–) sign to show relative standings within the major rating categories.

|

AAA

|

—

|

An obligation rated “AAA” has the highest rating assigned by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is extremely strong.

|

|

AA

|

—

|

An obligation rated “AA” differs from the highest-rated obligations only to a small degree. The obligor’s capacity to meet its financial commitment on the obligation is very strong.

|

|

A

|

—

|

An obligation rated “A” is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. However, the obligor’s capacity to meet its financial commitment on the obligation is still strong.

|

|

BBB

|

—

|

An obligation rated “BBB” exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation.

|

|

BB

|

—

|

An obligation rated “BB” is less vulnerable to nonpayment than other speculative issues. However, it faces major ongoing uncertainties or exposure to adverse business, financial, or economic conditions, which could lead to the obligor’s inadequate capacity to meet its financial commitment on the obligation.

|

|

B

|

—

|

An obligation rated “B” is more vulnerable to nonpayment than obligations rated “BB”, but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor’s capacity or willingness to meet its financial commitment on the obligation.

|

|

CCC

|

—

|

An obligation rated “CCC” is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation.

|

|

CC

|

—

|

An obligation rated “CC” is currently highly vulnerable to nonpayment.

|

|

C

|

—

|

The “C” rating may be used to cover a situation where a bankruptcy petition has been filed or similar action has been taken, but payments on this obligation are being continued.

|

|

D

|

—

|

An obligation rated “D” is in payment default. The “D” rating category is used when payments on an obligation are not made on the date due, even if the applicable grace period has not expired, unless Standard & Poor’s believes that such payments will be made during such grace period. The “D” rating also will be used upon the filing of a bankruptcy petition or the taking of a similar action if payments of an obligation are jeopardized.

|

|

14

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

|

Long-term security ratings (unaudited) (cont’d)

Moody’s Investors Service (“Moody’s”) Long-term Obligation Ratings

— Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa,” where 1 is the highest and 3 the lowest ranking within its generic category.

|

Aaa

|

—

|

Obligations rated “Aaa” are judged to be of the highest quality, with minimal credit risk.

|

|

Aa

|

—

|

Obligations rated “Aa” are judged to be of high quality and are subject to very low credit risk.

|

|

A

|

—

|

Obligations rated “A” are considered upper-medium grade and are subject to low credit risk.

|

|

Baa

|

—

|

Obligations rated “Baa” are subject to moderate credit risk. They are considered medium grade and as such may possess certain speculative characteristics.

|

|

Ba

|

—

|

Obligations rated “Ba” are judged to have speculative elements and are subject to substantial credit risk.

|

|

B

|

—

|

Obligations rated “B” are considered speculative and are subject to high credit risk.

|

|

Caa

|

—

|

Obligations rated “Caa” are judged to be of poor standing and are subject to very high credit risk.

|

|

Ca

|

—

|

Obligations rated “Ca” are highly speculative and are likely in, or very near, default, with some prospect of recovery for principal and interest.

|

|

C

|

—

|

Obligations rated “C” are the lowest rated class and are typically in default, with little prospect of recovery for principal and interest.

|

Fitch Ratings Service (“Fitch”) Structured, Project & Public Finance Obligations

— Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (—) sign to show relative standings within the major rating categories.

|

AAA

|

—

|

Obligations rated “AAA” by Fitch denote the lowest expectation of default risk. They are assigned only in cases of exceptionally strong capacity for payment of financial commitments. This capacity is highly unlikely to be adversely affected by foreseeable events.

|

|

AA

|

—

|

Obligations rated “AA” denote expectations of very low default risk. They indicate very strong capacity for payment of financial commitments. This capacity is not significantly vulnerable to foreseeable events.

|

|

A

|

—

|

Obligations rated “A” denote expectations of low default risk. The capacity for payment of financial commitments is considered strong. This capacity may, nevertheless, be more vulnerable to adverse business or economic conditions than is the case for higher ratings.

|

|

BBB

|

—

|

Obligations rated “BBB” indicate that expectations of default risk are currently low. The capacity for payment of financial commitments is considered adequate but adverse business or economic conditions are more likely to impair this capacity.

|

|

BB

|

—

|

Obligations rated “BB” indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time; however, business or financial flexibility exists which supports the servicing of financial commitments.

|

|

B

|

—

|

Obligations rated “B” indicate that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment.

|

|

CCC

|

—

|

Default is a real possibility.

|

|

|

|

Western Asset Municipal High Income Fund Inc. 2011 Semi-Annual Report

|

|

15

|

Long-term security ratings (unaudited) (cont’d)

|

CC

|

—

|

Default of some kind appears probable.

|

|

C

|

—

|

Default is imminent or inevitable, or the issuer is in standstill.

|

|

NR

|

—

|

Indicates that the obligation is not rated by Standard & Poor’s, Moody’s or Fitch.

|

Short-term security ratings (unaudited)

Standard & Poor’s Municipal Short-Term Notes Ratings

|

SP-1

|

—

|

A short-term obligation rated “SP-1” is rated in the highest category by Standard & Poor’s. Strong capacity to pay principal and interest. An issue determined to possess a very strong capacity to pay debt service is given a plus (+) designation.

|

|

SP-2

|

—

|

A short-term obligation rated “SP-2” is a Standard & Poor’s rating indicating satisfactory capacity to pay principal and interest, with some vulnerability to adverse financial and economic changes over the term of the notes.

|

|

SP-3

|

—

|

A short-term obligation rated “SP-3” is a Standard & Poor’s rating indicating speculative capacity to pay principal and interest.

|

Standard & Poor’s Short-Term Issues Credit Ratings

|

A-1

|

—

|

A short-term obligation rated “A-1” is rated in the highest category by Standard & Poor’s. The obligor’s capacity to meet its financial commitment on the obligation is strong. Within this category, certain obligations are designated with a plus sign (+). This indicates that the obligor’s capacity to meet its financial commitment on these obligations is extremely strong.

|

|

A-2

|

—

|

A short-term obligation rated “A-2” by Standard & Poor’s is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher rating categories. However, the obligor’s capacity to meet its financial commitment on the obligation is satisfactory.

|

|

A-3

|

—

|

A short-term obligation rated “A-3” by Standard & Poor’s exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation.

|

|

B

|

—

|

A short-term obligation rated “B” by Standard & Poor’s is regarded as having significant speculative characteristics. Ratings of “B-1”, “B-2” and “B-3” may be assigned to indicate finer distinctions within the “B” category. The obligor currently has the capacity to meet its financial commitment on the obligation; however, it faces major ongoing uncertainties which could lead to the obligor’s inadequate capacity to meet its financial commitment on the obligation.

|