Western Asset Mortgage Capital Corporation

Strongly Encourages Stockholders to Vote “FOR” the Merger by

Monday, November 6, 2023

Western Asset Mortgage Capital Corporation (the “Company,” “we,”

or “WMC”) (NYSE: WMC) announced today that Glass Lewis became the

second leading independent proxy advisory firm, joining

Institutional Shareholder Services Inc. (ISS), to recommend that

stockholders vote “FOR” the proposed merger with AG Mortgage

Investment Trust, Inc. (“MITT”), in which each outstanding share of

WMC common stock will be converted into the right to receive (i)

1.498 shares of MITT common stock and (ii) the per share portion of

a cash payment equal to the lesser of $7,000,000 or approximately

9.9% of the aggregate per share merger consideration. Any

difference between $7,000,000 and such smaller amount will be used

to benefit the combined company post-closing by offsetting

reimbursable expenses that would otherwise be payable to AG REIT

Management, LLC, which would be the manager of the combined

company.

Bonnie Wongtrakool, Chief Executive Officer and Director of WMC,

said, “We are pleased that Glass Lewis recognizes the financial

benefits of the proposed merger and supports our Board of

Directors’ recommendation that stockholders vote

'FOR' the merger.”

As previously announced, a special meeting of stockholders of

WMC (the “Special Meeting”) will be held on November 7, 2023, at

9:00 a.m., Pacific Time, in virtual-only meeting format, to

consider and vote upon the proposed merger, among other

proposals.

“Every vote is important and we strongly encourage all

stockholders of WMC to follow the recommendations of Glass Lewis

and the Board of Directors by voting 'FOR' the merger. We recommend

that you enter your vote by November 6, 2023, in order to ensure

adequate time for tabulation prior to the special meeting,” added

Wongtrakool.

If WMC stockholders have any questions or need assistance in

voting their shares, they should contact WMC’s proxy solicitor,

Morrow Sodali, LLC, by calling +1 (800) 662-5200 (toll-free from

the U.S.) or +1 (203) 658-9400 (from foreign countries). In

addition, you may contact Larry Clark, WMC’s Investor Relations

representative, at +1 (310) 622-8223 or by email at

lclark@finprofiles.com.

If approved at the Special Meeting, the merger is expected to

close within two business days thereafter, subject to the

satisfaction of the remaining customary closing conditions set

forth in the merger agreement and discussed in the definitive joint

proxy statement/prospectus filed with the U.S. Securities and

Exchange Commission (the “SEC”) by WMC and MITT on September 29,

2023 and mailed to stockholders on or about October 3, 2023.

Following consummation of the merger, the separate corporate

existence of WMC will cease and WMC’s shares of common stock will

cease to be listed on the New York Stock Exchange.

ABOUT WMC

WMC is a real estate investment trust that invests in, finances,

and manages a diverse portfolio of assets consisting of Residential

Whole Loans, Non-Agency RMBS, and to a lesser extent GSE Risk

Transfer Securities, Commercial Loans, Non-Agency CMBS, Agency

RMBS, Agency CMBS, and ABS. WMC is externally managed and advised

by Western Asset Management Company, LLC, an investment advisor

registered with the Securities and Exchange Commission and a

wholly-owned subsidiary of Franklin Resources, Inc.

Important Additional Information and Where to Find It

In connection with the proposed merger of WMC with and into

AGMIT Merger Sub, LLC (the “Merger”), MITT has filed with the SEC a

registration statement on Form S-4 (File No. 333-274319) (the

“Registration Statement”), which was declared effective by the SEC

on September 29, 2023. The Registration Statement includes a

prospectus of MITT and a joint proxy statement of WMC and MITT (the

“joint proxy statement/prospectus”). The joint proxy

statement/prospectus contains important information about WMC, MITT

the proposed Merger and related matters. WMC and MITT may file with

the SEC other documents regarding the Merger. The definitive joint

proxy statement/prospectus has been sent to the stockholders of WMC

and MITT, and contains important information about WMC, MITT the

proposed Merger and related matters. This communication is not a

substitute for any proxy statement, registration statement, tender

or exchange offer statement, prospectus or other document WMC or

MITT has filed or may file with the SEC in connection with the

proposed Merger and related matters. INVESTORS AND SECURITY

HOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENT ON FORM S-4

AND THE RELATED JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL

AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS

THAT ARE FILED OR MAY BE FILED BY WMC AND MITT WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT WMC, MITT AND THE PROPOSED MERGER. Investors

and security holders may obtain copies of these documents free of

charge through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed by WMC with the SEC are also

available free of charge on WMC’s website at

www.westernassetmcc.com. Copies of the documents filed by MITT with

the SEC are also available free of charge on MITT’s website at

www.agmit.com.

Participants in the Solicitation Relating to the

Merger

WMC, MITT and certain of their respective directors and

executive officers and certain other affiliates of WMC and MITT may

be deemed to be participants in the solicitation of proxies from

the common stockholders of WMC and MITT in respect of the proposed

Merger. Information regarding WMC and its directors and executive

officers and their ownership of common stock of WMC can be found in

WMC’s Annual Report on Form 10-K for the fiscal year ended December

31, 2022, filed with the SEC on March 13, 2023, and in its

definitive proxy statement relating to its 2023 annual meeting of

stockholders, filed with the SEC on May 2, 2023. Information

regarding MITT and its directors and executive officers and their

ownership of common stock of MITT can be found in MITT’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022,

filed with the SEC on February 27, 2023, and in its definitive

proxy statement relating to its 2023 annual meeting of

stockholders, filed with the SEC on March 22, 2023. Additional

information regarding the interests of such participants in the

Merger is included in the joint proxy statement/prospectus and

other relevant documents relating to the proposed Merger filed with

the SEC. These documents are available free of charge on the SEC’s

website and from WMC or MITT, as applicable, using the sources

indicated above.

No Offer or Solicitation

This communication and the information contained herein shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended (the “Securities Act”). This communication may be deemed to

be solicitation material in respect of the proposed Merger.

Forward-Looking Statements

This document contains certain “forward-looking” statements

within the meaning of Section 27A of the Securities Act and Section

21E of the Securities Exchange Act of 1934, as amended. WMC and

MITT intend such forward-looking statements to be covered by the

safe harbor provisions for forward-looking statements contained in

the Private Securities Litigation Reform Act of 1995 and include

this statement for purposes of complying with the safe harbor

provisions. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,”

“projects,” “could,” “estimates” or variations of such words and

other similar expressions are intended to identify such

forward-looking statements, which generally are not historical in

nature, but not all forward-looking statements include such

identifying words. Forward-looking statements regarding WMC and

MITT include, but are not limited to, statements related to the

proposed Merger, including the anticipated timing, benefits and

financial and operational impact thereof; other statements of

management’s belief, intentions or goals; and other statements that

are not historical facts. These forward-looking statements are

based on each of the companies’ current plans, objectives,

estimates, expectations and intentions and inherently involve

significant risks and uncertainties. Actual results and the timing

of events could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and

uncertainties associated with: WMC’s and MITT’s ability to complete

the proposed Merger on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to

securing the necessary stockholder approval from WMC’s and MITT’s

respective stockholders and satisfaction of other closing

conditions to consummate the proposed Merger; the occurrence of any

event, change or other circumstance that could give rise to the

termination of the Merger Agreement; risks related to diverting the

attention of WMC and MITT management from ongoing business

operations; failure to realize the expected benefits of the

proposed Merger; significant transaction costs and/or unknown or

inestimable liabilities; the risk of stockholder litigation in

connection with the proposed Merger, including resulting expense or

delay; the risk that WMC’s and MITT’s respective businesses will

not be integrated successfully or that such integration may be more

difficult, time-consuming or costly than expected; and effects

relating to the announcement of the proposed Merger or any further

announcements or the consummation of the proposed Merger on the

market price of WMC’s and MITT’s common stock. Additional risks and

uncertainties related to WMC’s and MITT’s business are included

under the headings “Forward-Looking Statements” and “Risk Factors”

in WMC’s and MITT’s Annual Report on Form 10-K for the year ended

December 31, 2022, WMC’s and MITT’s Quarterly Report on Form 10-Q

for the quarter ended June 30, 2023, the joint proxy

statement/prospectus and in other reports and documents filed by

either company with the SEC from time to time. Moreover, other

risks and uncertainties of which WMC or MITT are not currently

aware may also affect each of the companies’ forward-looking

statements and may cause actual results and the timing of events to

differ materially from those anticipated. The forward-looking

statements made in this communication are made only as of the date

hereof or as of the dates indicated in the forward-looking

statements, even if they are subsequently made available by WMC or

MITT on their respective websites or otherwise. Neither WMC nor

MITT undertakes any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102798098/en/

Investors Western Asset Mortgage Capital Corporation

Larry Clark Financial Profiles, Inc. (310) 622-8223

lclark@finprofiles.com

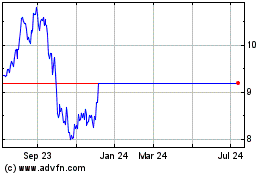

Western Asset Mortgage C... (NYSE:WMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

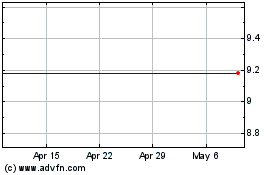

Western Asset Mortgage C... (NYSE:WMC)

Historical Stock Chart

From Nov 2023 to Nov 2024