WIA and WIW Declare Monthly Distributions for December 2011 and January and February 2012

December 01 2011 - 5:05PM

Business Wire

Western Asset/Claymore Inflation-Linked Securities & Income

Fund (NYSE: WIA) and Western Asset/Claymore Inflation-Linked

Opportunities & Income Fund (NYSE: WIW) today announce their

regular monthly distribution amounts to be paid in December 2011

and January and February 2012. The regular monthly distribution

amounts for WIA and WIW will be $0.032 and $0.0335,

respectively.

Average Annual Return (as of 11/30/2011)

1-Year 3-Year 5-Year WIA

Market Price 1.67% 12.87% 7.20% WIA NAV

9.52% 13.42% 6.37% WIW Market Price 3.93%

14.50% 7.37% WIW NAV 9.57% 14.78%

6.55% Barclays U.S. Government Inflation-Linked 1-10 Year

Index 8.30% 9.97% 6.61%

The aforementioned returns assume reinvestment of

distributions. Performance data quoted represents past performance,

which is no guarantee of future results, and current performance

may be lower or higher than the figures shown. The investment

return and principal value of an investment will fluctuate with

changes in market conditions and other factors so that an

investor's shares, when sold, may be worth more or less than their

original cost. All returns for periods longer than one year are

annualized. The Barclays U.S. Government Inflation-Linked 1-10 Year

Index measures the performance of the intermediate U.S. TIPS

market.

The December 2011 distribution will be paid on December 30, 2011

to shareholders of record as of December 15, 2011 with an

ex-dividend date of December 13, 2011. The January 2012

distribution will be paid on January 31, 2012 to shareholders of

record as of December 30, 2011 with an ex-dividend date of December

28, 2011. The February 2012 distribution will be paid on February

29, 2012 to shareholders of record as of February 15, 2012 with an

ex-dividend date of February 13, 2012. If it is determined that a

notification is required, pursuant to Section 19(a) of the

Investment Company Act of 1940, as amended, such notice will be

posted to the Fund’s website after the close of business three

business days prior to the payable date.

About Western Asset Management

Western Asset Management Company, founded in 1971, is one of the

world’s premier fixed-income managers, with offices in Pasadena,

London and Singapore. Exclusively focused on fixed income, Western

Asset’s client base includes several of the largest companies in

the world as well as numerous public entities, healthcare

organizations, foundations and public pension plans. Western

Asset’s objective is to provide fixed-income clients with

value-oriented portfolios that are managed for the long term.

Western Asset believes significant inefficiencies exist in the

fixed income markets and by combining traditional analysis with

innovative technology, the firm attempts to add value by exploiting

these inefficiencies across eligible sectors. For the Fund, Western

Asset intends to employ proprietary risk management techniques that

were developed specifically to enhance other leveraged funds.

About Guggenheim Investments

Guggenheim Investments represents the investment management

division of Guggenheim Partners, LLC (“Guggenheim”), which consist

of investment managers with approximately $115 billion in combined

total assets*. Collectively, Guggenheim Investments has a long,

distinguished history of serving institutional investors,

ultra-high-net-worth individuals, family offices and financial

intermediaries. Guggenheim Investments offer clients a wide range

of differentiated capabilities built on a proven commitment to

investment excellence. Guggenheim Investments has offices in

Chicago, New York City and Santa Monica, along with a global

network of offices throughout the United States, Europe, and

Asia.

Guggenheim Investments is comprised of several investments

management entities within Guggenheim, which includes Guggenheim

Funds Distributors, Inc. and Guggenheim Funds Investment Advisors,

LLC. Guggenheim Funds Investment Advisors, LLC serves as Investment

Adviser for WIW. Guggenheim Funds Distributors, Inc. serves as

Servicing Agent for WIA. Western Asset Management Company serves as

the Investment Adviser for WIA.

* Asset figure is based upon the best available information as

of 9/30/2011 and consists of assets under management and serviced

assets of the various asset managers comprising Guggenheim

Investments. The total asset figure includes $8.7B of leverage for

assets under management and $0.8B of leverage for serviced

assets.

This information does not represent an offer to sell securities

of the Funds and it is not soliciting an offer to buy securities of

the Funds. There can be no assurance that the Funds will achieve

their investment objectives. The net asset value of the Funds will

fluctuate with the value of their underlying securities. It is

important to note that closed-end funds trade on their market

value, not net asset value, and closed-end funds often trade at a

discount to their net asset value. Past performance is not

indicative of future performance. An investment in the Funds is

subject to certain risks and other considerations. Such risks and

considerations include, but are not limited to: Interest Rate Risk,

Risks Relating to U.S. TIPS, Risks Relating to Inflation-Linked

Securities, Credit Risk, Lower Grade Securities Risk, Leverage

Risk, Issuer Risk, Smaller Companies Risk, Country Risk, Emerging

Markets Risk, Mortgage-Related Securities Risk, Prepayment Risk,

Reinvestment Risk, Derivatives Risk, Inflation/Deflation Risk,

Turnover Risk, Management Risk and Market Disruption Risk.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of the Funds

carefully before they invest. For this and more information,

visit www.guggenheimfunds.com or contact a securities

representative or Guggenheim Funds Distributors, Inc. 2455

Corporate West Drive, Lisle, Ill. 60532, 800-345-7999.

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY LOSE VALUEMember

FINRA/SIPC (12/11)

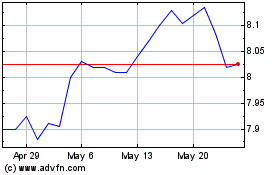

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Sep 2024 to Oct 2024

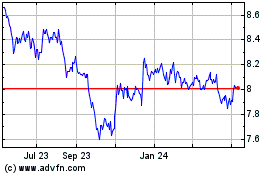

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Oct 2023 to Oct 2024