false 0000766704 0000766704 2024-06-03 2024-06-03 0000766704 us-gaap:CommonStockMember 2024-06-03 2024-06-03 0000766704 well:GuaranteeOf4.800NotesDue2028IssuedByWelltowerOpLlcMember 2024-06-03 2024-06-03 0000766704 well:GuaranteeOf4.500NotesDue2034IssuedByWelltowerOpLlcMember 2024-06-03 2024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 3, 2024

Welltower Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8923 |

|

34-1096634 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 4500 Dorr Street, Toledo, Ohio |

|

43615 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrants’ telephone number, including area code: (419) 247-2800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, $1.00 par value per share |

|

WELL |

|

New York Stock Exchange |

| Guarantee of 4.800% Notes due 2028 issued by Welltower OP LLC |

|

WELL/28 |

|

New York Stock Exchange |

| Guarantee of 4.500% Notes due 2034 issued by Welltower OP LLC |

|

WELL/34 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On June 3, 2024, Welltower Inc. (the “Company”) issued a business update presentation. A copy of the presentation is furnished as Exhibit 99.1 to this Current Report, and is incorporated herein by reference.

The information included in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

WELLTOWER INC. |

|

|

|

|

| Date: June 3, 2024 |

|

|

|

By: |

|

/s/ MATTHEW MCQUEEN |

| |

|

|

|

Name: Matthew McQueen |

| |

|

|

|

Title: Executive Vice President – General Counsel

& Corporate Secretary |

Exhibit 99.1 Business Update June 3, 2024

Forward Looking Statements and Risk Factors This document contains

“forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. When Welltower uses words such as “may,” “will,” “intend,” “should,” “believe,”

“expect,” “anticipate,” “project,” “pro forma,” “estimate” or similar expressions that do not relate solely to historical matters, Welltower is making forward-looking statements.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause Welltower’s actual results to differ materially from Welltower’s expectations discussed in the forward-looking

statements. This may be a result of various factors, including, but not limited to: the status of the economy; the status of capital markets, including availability and cost of capital; issues facing the health care industry, including compliance

with, and changes to, regulations and payment policies, responding to government investigations and punitive settlements and operators’/tenants’ difficulty in cost effectively obtaining and maintaining adequate liability and other

insurance; changes in financing terms; competition within the health care and seniors housing industries; negative developments in the operating results or financial condition of operators/tenants, including, but not limited to, their ability to pay

rent and repay loans; Welltower’s ability to transition or sell properties with profitable results; the failure to make new investments or acquisitions as and when anticipated; natural disasters, health emergencies (such as the COVID-19

pandemic) and other acts of God affecting Welltower’s properties; Welltower’s ability to re-lease space at similar rates as vacancies occur; Welltower’s ability to timely reinvest sale proceeds at similar rates to assets sold;

operator/tenant or joint venture partner bankruptcies or insolvencies; the cooperation of joint venture partners; government regulations affecting Medicare and Medicaid reimbursement rates and operational requirements; liability or contract claims

by or against operators/tenants; unanticipated difficulties and/or expenditures relating to future investments or acquisitions; environmental laws affecting Welltower’s properties; changes in rules or practices governing Welltower’s

financial reporting; the movement of U.S. and foreign currency exchange rates; Welltower’s ability to maintain its qualification as a REIT; key management personnel recruitment and retention; and other risks described in Welltower’s

reports filed from time to time with the SEC. Welltower undertakes no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise, or to update the reasons why actual results

could differ from those projected in any forward-looking statements. 2

Recent Highlights – Since Previous Business Update on April 29,

2024 (1) Dividend Update 2024 Guidance Update • Announced that the Board of Directors approved a 10% increase in the quarterly Raised 2024 guidance range for normalized funds from operations (FFO) dividend to $0.67 per diluted share reflecting

Welltower’s solid financial performance, attributable to common stockholders to $4.05 – $4.17 per diluted share, driven low payout ratio owing to outsized levels of cash flow growth, and the Board’s largely by robust and accretive

capital deployment activity confidence in the Company’s strong growth prospects going forward Holiday by Atria Portfolio Transition • Reached an agreement with Atria Senior Living to transition 89 Holiday by Atria communities to six of

Welltower’s existing operating partners with strong operating acumen and deep expertise in their respective regions • Seniors Housing Operating Portfolio Update Revised 2024 FFO Guidance Previous 2024 FFO Guidance • Seniors housing

fundamentals remain healthy entering peak leasing season (June 3, 2024) (April 29, 2024) $4.02 - $4.15 $4.05 - $4.17 • Notable strength continues to be experienced in non-same store properties, with per diluted share per diluted share recently

transitioned assets generating stronger than anticipated results Capital Deployment Update • Since April 29, 2024 entered into agreements to close in excess of $1.0 billion of Midpoint of 2024 normalized FFO guidance range investments, in

addition to the previously announced $2.8 billion closed or under (2) contract increased by $0.025 per diluted share to $4.11 • Capital deployment opportunity set continues to expand, with deal flow accelerating across all regions, property

types, and up and down the capital stack Welltower Credit Rating Outlook Revised to Positive • On May 22, 2024, S&P Global revised Welltower’s credit rating outlook to positive from stable, citing strong seniors housing industry

tailwinds, a materially strengthened balance sheet, and an expectation that key credit metrics will continue to improve going forward 1. See “Supplemental Financial Measures” at the end of this presentation for definitions and

reconciliations of non-GAAP financial measures 3 2. Represents pro rata gross investments across acquisitions and loans and excludes development funding; $2.8 billion of under contract investments previously disclosed on April 29, 2024

Welltower’s Unique Value Creation Flywheel Established Competitive

Advantages Driving Sustainable Shareholder Value Creation Internal Growth Welltower Value-Add and Moat • Long-term demographic tailwinds and significant decline in new Best-in-class: supply expected to drive continued outsized growth for

• Local & regional operators: Superior managers with significant regional extended period Industry-Leading density operating under highly aligned RIDEA 3.0/4.0 contracts Operational • RevPOR growth (unit revenue) expected to continue

to outpace • Data analytics: Unparalleled data analytics platform developed over the Results ExpPOR growth (unit expense), resulting in further operating past eight years informing both capital allocation and operating platform margin

expansion decisions • Industry-leading results being driven by Welltower’s superior • Operating platform: Institutionalization of portfolio expected to drive micro-market locations, disciplined capital allocation strategy, further

efficiencies while improving both the resident and employee and highly aligned partners with significant regional density experience Properties are worth substantially more on Welltower’s platform Welltower’s Competitive Advantages

✓Regional Operators Capital Allocation Superior Ability to Capitalize the Opportunity ✓Data Analytics • Macroeconomic uncertainty and capital markets dislocation • Access to a plurality of capital sources including common

✓Operating Platform creating opportunities to acquire assets at increasingly attractive equity, private equity, unsecured and secured debt, and basis, going-in yields, and unlevered IRRs exchangeable notes Unprecedented Access to External

Growth • Granular approach to capital allocation provides opportunity to • Ability to opportunistically pivot between each capital source Capital Opportunity acquire assets at deep discounts to replacement cost while based upon cost and

availability complementing Welltower’s regional density strategy • Robust near-term available liquidity (including cash on hand, (1) • Completed nearly $15.0 billion of investments since 4Q2020 at line of credit capacity, expected

loan payoffs and disposition attractive high-single-digit to low-double-digit unlevered IRRs with proceeds) can fully fund announced acquisitions potential for further upside from WELL platform enhancements Welltower competes on Data Science,

Operating Platform and Capital Allocation Capabilities - NOT cost of capital 4 1. Represents completed investment activity as of May 31, 2024

Societal & Technological Trends | Impact on Real Estate Sectors

Precedent for Extended Period of Compounding Cash Flow Growth Driven by Shifting Secular Tailwinds THEME REAL ESTATE SECTOR IMPACT E-Commerce Industrial / Logistics Themes of the Life Sciences Lab Space last 10 years Operationalization of Real

Estate Self Storage / Single Family Rentals Theme of the AGING OF THE POPULATION HEALTH CARE next 10+ years 5

Atria/Holiday Portfolio Transition Maximizing NOI Potential Through

Regional Densification Strategy

Executive Summary • Welltower to transition 89 Holiday by Atria

properties to six existing regional operators, including Arrow, Cogir US, Discovery, QSL, Sagora and StoryPoint • As of June 3, 2024, 27 of the 89 properties have transitioned with the remaining 62 properties expected to transition in 3Q2024

• The transitions will create strong geographic density with best-in-class regional operating partners across the US that have a proven track record in markets where the properties are located (see case studies on slides 13-17) •

Meaningful NOI growth is expected post-transition through occupancy upside and completion of portfolio-wide renovation program Current Regional Densification Occupancy of Operating Partners Closing Status Properties Opportunity Transitioning

Properties Sagora Texas & Southern US Closed 14 73% StoryPoint Midwest Closed 13 74% Arrow Plains ~3Q2024 6 84% Cogir US Pacific Northwest ~3Q2024 20 77% Discovery California & Florida ~3Q2024 23 78% QSL Southeast ~3Q2024 13 78% (1)

Potential NOI upside of nearly $47 million upon achievement of pre-COVID occupancy and margin $20 million+ of additional upside beyond pre-COVID stabilization if underwritten economics are achieved 7 1. See slide 25 “Path to Recovery”

for details regarding additional underlying assumptions

New Communities Holiday Transitions | Regional Densification

Illustration In-Place Communities Cogir US – Pacific Northwest StoryPoint - Midwest QSL - Southeast South Carolina Seattle MSA Michigan Mississippi Georgia Washington Louisiana Portland MSA Ohio Indiana Blake at Carnes Crossroads (2) Oregon

Acquisition QSL 5-Pack (2) Acquisition (1) (1) (1) Average Drive Time Average Drive Time Average Drive Time of of ~35 Minutes of ~45 Minutes ~85 minutes Quebec and Southeast Ontario Southeast QO uebe ntario c • The Welltower-QSL strategic

partnership began in 2021 and • The Welltower-Cogir US relationship began in 2018 and, • The Welltower-StoryPoint relationship began in 2010 and, pro forma for the Atria transitions, will expand to 45 pro forma for the transitions,

StoryPoint will operate 94 pro forma for the transition assets, QSL will manage 25 Welltower-owned communities across the Southeast communities Welltower-owned communities • QSL’s strong operating performance in recent years has •

Cogir maintains significant expertise in operating clusters • StoryPoint has significant experience operating resulted in an expansion of its Welltower-managed portfolio of independent living assets in California and the Pacific independent

living assets proximate to each other across through both transitions and acquisitions, including the Blake Northwest Midwest markets at Carnes Cross Roads and a five-community portfolio • Cogir has achieved strong post-COVID performance

• StoryPoint also has a strong history of integrating transition acquired in October 2021 and December 2023, respectively. through a localized approach to leadership and operations, and acquisition properties into its management portfolio The

Holiday assets are proximate to existing communities, allowing the company to successfully expand into while fostering high-quality, consumer-focused brands which should drive additional revenue and expense neighboring markets synergies Creating

clusters of communities managed by the same operator to capture significant synergies Note: See slides 13-17 for case studies reflecting success achieved through regional densification strategy 8 1. Represents the average time driving between each

Holiday by Atria transition community and the closest in-place asset prior to the transition 2. See slide 17 for more information on the Blake at Carnes Crossroads and the QSL 5-pack acquisitions

Updated Holiday Per Unit Basis Transition Assets Properties Units Per

Unit Total Purchase Price 89 10,500 $149,900 On target to deliver renovated portfolio at all-in (+) Completed renovations 8,100 basis significantly below replacement cost and comparable transactions (+) In-process renovations 1,500 Portfolio

expected to stabilize at an 8%+ yield (+) Manager investment reimbursement/transition costs 4,700 on Welltower’s all-in, after capex basis Basis at Transition 89 10,500 164,200 (+) Expected post-transition renovation spend 6,700 Expected

All-In Basis After Capex 89 10,500 $171,000 9

Case Study | Hawaii Kai Prior Holiday Property Transition

Case Study | Hawaii Kai – Prior Holiday Property Transition

Upside potential at premier Holiday property could fully fund portfolio renovations Hawaii Kai Overview • Hawaii Kai was selected during underwriting of the Holiday portfolio as an opportunity for substantive Target Metrics Amount

redevelopment Units 372 • Oakmont was identified by Welltower’s data science platform as the new operator of the property; the property was subsequently transitioned in December 2022 (1) th ACU Score 100 percentile • Based on

competition and demographics, the property, which is located in Honolulu, scores better than th 97% of WELL’s portfolio Neighborhood Score 87 percentile • The site is unique among competitors given its ocean views, low density, and fee

simple ownership. th Final Site Score 97 percentile Additionally, ~25% of the units have front yards Upside Potential • Beyond the operator transition, several areas for further NOI upside also identified: • Opportunity to add memory

care units given acute shortage on the island • Execute value enhancing capex to increase curb appeal and drive higher rents • Additional targeted investments likely to include high- ROI projects to improve energy efficiency 11 1.

Adjusted Competition Unit

Case Study | Hawaii Kai Upside Potential Oakmont has brought

best-in-class operational expertise; NOI substantially improved BEFORE value-add renovation Illustrative Hawaii Kai Performance and Per Unit Value Creation 1Q24 Illustrative Value Creation Potential (000s) Expected Improvement over pre-COVID: At

Acquisition Annualized Potential Units 372 44% RevPOR growth + Results ~125% NOI growth Purchase Price $78,584 Occupancy 76% 82% 95% Potential Value ($763k/unit exit price) $283,850 RevPOR $5,400 $6,236 $7,410 Value Creation $202,266 NOI (000s)

$4,024 $7,248 $14,192 Renovation CapEx $46,500 Net value creation from one property has NOI Margin 22% 32% 45% the potential to essentially fund capex for Net Value Creation $158,766 the entire portfolio Per 89 Transition Communities $1,784

12

Welltower Regional Density Case Studies Deepening Relationships with

Best-in-Class Local & Regional Operators

Case Studies | Regional Densification Strategy Data Science Driven

Active Portfolio Management and Disciplined Capital Allocation Creating Regional Densification • Welltower continues to take an active approach to portfolio management, deepening relationships with leading operators in key markets and regions,

through data science driven asset management and value add initiatives • Greater regional density also allows for an expansion of career growth opportunities for employees and improved retention • Case studies herein detail our

transition of assets to Cogir, StoryPoint, and QSL which reflect our strategy of creating regional density with our strongest partners • Additional upside expected over time through location-based operational synergies and the build out of the

asset management platform Operator Transitions Portfolio Acquisition & Operator Transition Case Study 1 Case Study 2 Case Study 3 Slide 15 Slides 16 - 17 In 2021, Welltower transitioned management of Welltower acquired a portfolio of seniors

housing four predominately memory care facilities in the assets in Ohio and the Southeast, which were Pacific Northwest to Cogir, resulting in subsequently transitioned to StoryPoint and QSL, substantial NOI margin and occupancy respectively,

resulting in significant NOI growth improvement and outsized value creation 14

Cogir Case Study | Soleil Portfolio Transition Transition of four

assets to Cogir US has resulted in NOI margin and occupancy well above prior peak Regional Snapshot • In mid-2021, Welltower transitioned the Soleil portfolio (“Soleil”) of four communities consisting of 196 units to Cogir in

Atria-Holiday Asset California and Washington state. The portfolio was transitioned due to Cogir’s strong regional density in the area and its Soleil Portfolio Existing Cogir US Cogir US Office proven ability to generate superior returns at

transition assets • Cogir US was selected to operate the portfolio due to its strong operational history in the Pacific Northwest, data-driven culture, Cogir US Regional and history of successfully improving operations at transitioned assets

Office • As of April 2024, the portfolio attained 83.9% occupancy and a 19.7% NOI margin (+790 bps and +600 bps higher than prior peak Seattle MSA levels, respectively), representing superior operating metrics for a predominantly memory care

portfolio Washington • Cogir attributed performance to its regional density, which has enabled its operational teams to develop a deep understanding of local markets, and through active asset management • On-the-ground personnel teams at

the communities excel at creating a positive resident experience and are supported by senior management teams working in close proximity to the properties Portland MSA Oregon Soleil fits seamlessly within the existing Cogir US portfolio, allowing

for increased operating efficiencies and continued growth in property-level fundamentals through greater regional density Cogir US Regional Office (1) (1) April 2024 T-3 occupancy under April 2024 T-3 NOI margin under Cogir is now ~790 bps higher

than its Pre- Cogir is now ~600 bps higher than its Pre-COVID high COVID high Nevada 20.0% California 85.0% 19.7% 83.9% 80.0% 15.0% 75.0% 13.8% 76.0% San Francisco MSA 10.0% 70.0% 65.0% 5.0% 60.0% 61.1% 0.0% 55.0% -4.1% 50.0% -5.0% Feb'20 Jun'21

(Transition) Apr'24 Feb'20 Jun'21 (Transition) Apr'24 15 1. T-3 NOI margin and occupancy represent the average of the trailing three months’ operating results

StoryPoint Case Study | Danbury Portfolio Acquisition & Transition

Acquisition of 19 assets and concurrent transition to StoryPoint has resulted in material occupancy and NOI improvement Regional Snapshot • In mid-2022, Welltower acquired the Danbury portfolio (“Danbury”) of 19 communities

consisting of ~2,000 units, which were transitioned to StoryPoint Senior Living concurrent with closing • StoryPoint was selected to operate Danbury due to its track record of success in operating properties in high-end Midwest micro- markets

and integrating consumer-focused brands onto its management platform • In its most recent reporting period, Danbury attained 85.4% occupancy and 23.6% NOI margin which was ~1,300 bps and ~1,800 bps higher, respectively, than its pre-transition

period metrics • StoryPoint attributed the improved performance to strong execution by its transition team in integrating the assets into its Cleveland MSA broader portfolio and the significant operational synergies achieved due to the

proximity of the Danbury portfolio to its existing managed assets in the region Ohio The post-acquisition transition of the portfolio to StoryPoint has resulted in greater micromarket density, more efficient asset management, expense synergies, and

ultimately incremental value for WELL Columbus MSA (1) (1) April 2024 T-3 Occupancy is now ~1,300 bps April 2024 T-3 NOI Margin is now ~1,800 higher than its pre-transition occupancy bps higher than its pre-transition margin 23.6% Cincinnati MSA

85.4% 72.7% 5.1% Acquired Portfolio Existing StoryPoint Asset Atria-Holiday Asset Aug'22 (Transition) Apr'24 Aug'22 (Transition) Apr'24 16 1. T-3 NOI margin and occupancy represent the average of the trailing three months’ operating results

QSL Case Study | Recent Acquisitions & Transitions Significant

expansion of QSL relationship following strong operational performance in Southeast clusters The Blake at Carnes Cross Roads: • QSL has a strong history of integrating southeast based transition assets fluidly into their existing portfolio of

properties 100.0% Occupancy increased ~2,900 bps since October 2021 • In October 2021, the Blake at Carnes Cross Roads in South Carolina was acquired and transitioned to QSL at 66.4% 95.0% occupancy and reached 95% occupancy less than 15

months post transition 94.9% 90.0% • Following QSL’s rapid operational improvement at the Blake, Welltower transitioned to QSL a five-property portfolio which was acquired in December 2023. 85.0% • The five-property portfolio

consists of 481 units located in attractive micro-markets across the Southeast 80.0% • The portfolio has outperformed with NOI ~18% higher than original underwriting 75.0% 70.0% • Welltower is creating greater regional density with QSL,

one of its strongest operating partners, through the recent 5-property portfolio acquisition/transition and the upcoming transition of the Southeast Holiday properties 65.0% 66.4% • With an average drive time of ~85 minutes between the QSL

portfolio and the transition assets, Welltower has created 60.0% clusters of communities through which significant operational synergies are expected to be achieved through more focused Oct'21 (Transition) Stabilization asset management and

complementary product offerings Regional Snapshot In-Place QSL Asset QSL 5-Pack Acquisition (In-Place) Atria-Holiday Asset Blake at Carnes Crossroads (In-Place) South Carolina Mississippi Georgia Louisiana 17

Seniors Housing Trends (Unchanged since prior update)

Supply-Demand Imbalance Expected to Support Sustained Occupancy Growth

in 2024+ Per previous business update issued April 29, 2024 Seniors Housing Demand Remains Robust…. ….While Supply Continues to Decline Rapidly (1) TTM Absorption Construction Pipeline NIC MAP Primary and Secondary Markets NIC Primary

and Secondary Markets TTM Absorption Average Starts Pre-Covid Average 60K 13K 1Q24 construction TTM Absorption since 1Q22 +135% starts down to GFC (2) 40K vs. Pre-Pandemic average levels and represent a 11K ~75% decline from peak 20K 9K 0K 7K -20K

Welltower 1Q2024 Year-over-Year Occupancy 5K +340 bps -40K 3K -60K -80K 1K 19 1. Source: National Investment Center for Seniors Housing & Care 2. Pre-pandemic average from1Q09-1Q20

Favorable Unit Economics Driving Substantial Margin Expansion Per

previous business update issued April 29, 2024 (1) Unit Revenue and Expense Trends Same Store RevPOR Same Store ExpPOR RevPOR growth continues to 14% outpace ExpPOR growth, driving +320 bps of SS NOI margin 12% expansion in 1Q2024 vs. 1Q2023 10% 8%

6% 4% 2% 0% -2% -4% 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 20 1. Represents year-over year SS RevPOR and SS ExpPOR growth

percentages. See 1Q24 Non-GAAP Financial Measures on Welltower’s investor relations section on its website for more information

Seniors Housing | Compelling Backdrop for Multi-Year Revenue Growth Per

previous business update issued April 29, 2024 Accelerating 80+ Population Growth Coinciding with Diminishing New Supply & Improved Affordability US 80+ Population Growth Seniors Housing TTM Construction Starts Seniors Housing Affordability

Indexed Growth Since 2008 20M 45k 4.4% population growth in 2023 Significant Pricing Power Supported by 19M marked the HIGHEST level in 52 years Wealth Creation for Older Age Cohort 40k 18M 300% 35k 17M 250% Affordability +3.5x since 2008 16M 30k

Rent Growth +1.6x since 2008 200% 15M 25k 14M 150% 13M 20k 100% 12M 15k 50% 11M 0% 10k 10M 21 Sources: Organization for Economic Co-operation and Development, NIC MAP Vision, Federal Reserve Survey of Consumer Finances

Minimal New Supply in Coming Years Sets Stage For Multi-Year Occupancy

Gains Per previous business update issued April 29, 2024 Declining Deliveries Amplified by Elevated Level of Units Coming out of Service Deliveries Obsolescence Net Inventory Growth TTM Deliveries TTM Deliveries (% Inventory) TTM Deletions TTM

Deletions (% Inventory) TTM Inventory Growth Annual Inventory Growth (%YoY) 43k 4.5% 0k 0.0% 35k 4.0% SH TTM unit removals remain -2k 41k 0.2% elevated at 1.2% of inventory 3.5% 4.0% -4k 30k 39k 0.4% 3.0% -6k 37k 0.6% 25k 3.5% -8k 2.5% 35k 0.8% -10k

20k 2.0% 33k 1.0% 3.0% -12k 1.5% 31k 1.2% 15k -14k 1.0% 29k 1.4% 2.5% -16k 10k 0.5% 27k 1.6% -18k SH TTM deliveries -32% since 1Q18 Net Inventory Growth -56% since 1Q18 25k 2.0% -20k 1.8% 5k 0.0% Declining Deliveries + High Inventory Obsolescence

Anemic Inventory Growth 22 Source: National Investment Center for Seniors Housing & Care

Muted Seniors Housing Supply Expected Through the End of the Decade Per

previous business update issued April 29, 2024 Disruption in Construction Financing Market and Dismantling of Development Teams Expected to Result in Multi-Year Period of Diminished Supply Surge in interest rates over the past 18 months has resulted

in prohibitively expensive floating rate debt for developers, in rare instances in which construction financing is extended • Average spreads over SOFR range from 350 bps to >400 bps, implying a 9%-10%+ all-in cost for construction loans

• Stringent lending standards and greater capital reserve requirements are increasing capital charges and further raising the cost of construction financing • Loan-to-cost ratios have declined to ~50%, requiring developers to provide

greater upfront equity and pressuring levered IRRs • Higher construction/financing costs and greater equity requirements causing many developers & construction lenders to meaningfully reduce activity • Development platforms being

dismantled given muted construction starts; need to rebuild human capital prior to development capital formation Developers Face Extended Timeline to Project Stabilization FOLLOWING Rebuilding of Development Teams AND Return of Construction

Financing Human Capital Entitlements Construction Breakeven Stabilization Formation ~1 year 1-5+ years 2 years 2 years 1 year Average time to stabilization totals approximately 7 years with many projects in high-barrier-to-entry markets taking

significantly longer 23

Global Financial Crisis Case Study Per previous business update issued

April 29, 2024 Resilient Demand During GFC Driven By Needs-Based Nature of Seniors Housing TTM Market Rent Growth Existing Home Sales Seniors Housing Average Occupancy 7.0 4.0% 95% Seniors housing occupancy remained stable 6.5 2.0% through the GFC

despite a significant deterioration in home sales and values Nearly 50% decline in home 6.0 0.0% sales from peak to trough 90% 5.5 -2.0% 5.0 -4.0% 85% 4.5 -6.0% 4.0 -8.0% Office 80% Retail 3.5 -10.0% Multi-Family Industrial Seniors Housing 3.0

-12.0% 75% 2008 2009 2010 2011 2012 24 Sources: NIC MAP Vision, CoStar and Bloomberg

SHO Portfolio | Path to Recovery Per previous business update issued

April 29, 2024 Category NOI ($M) $490 million embedded NOI growth in return (1) A) 1Q24 Total Portfolio - IPNOI Portfolio 1,343 to pre-COVID occupancy and margin B) Revera + Chartwell JV Ownership Increase + Announced NNN Conversion 47 C) 1Q24 Total

Portfolio – Adjusted IPNOI Portfolio 1,390 Occupancy 88.4% D) 4Q19 Open Property Occupancy Recovery (ex. Transitions) 9 E) Transition Properties 106 $2,000M F) Fill-Up Properties 87 $1,880 $204 G) Lease-Up of Acquisitions (4Q20-1Q24) 84 H)

1Q24 Total Portfolio - Post COVID Recovery NOI 1,676 $1,676 $84 $1,700M I) Upside Assuming 1Q24 Realized RevPOR 204 Occupancy $87 J) 1Q24 Total Portfolio - Post COVID Recovery NOI Assuming 1Q24 RevPOR 1,880 82.4% $106 A) 1Q24 Portfolio In-Place NOI

$9 $1,390 $47 $1,400M Adjustment to 1Q24 IPNOI to reflect increased ownership stake in properties owned in prior JVs with Revera and $1,343 B) (2) Chartwell and announced NNN Conversion C) Adjusted 1Q24 Portfolio In-Place NOI D) Incremental NOI from

return to 4Q19 NOI levels for properties open in 4Q19, excluding segment or operator transitions $1,100M E) Incremental NOI from properties open in 4Q19 that subsequently underwent operator or segment transitions Incremental NOI from development

properties delivered subsequent to 4Q19 and properties acquired subsequent to F) 4Q19 and prior to 4Q20. NOI stabilization assumes return to pre-COVID NOI for acquisition properties and underwritten stabilized NOI for development properties $800M G)

Incremental NOI from stabilization of properties acquired between 4Q20 and 1Q24 H) 1Q24 portfolio post-COVID recovery NOI. Represents portfolio occupancy of 88.4% and operating margin of 31.1% (3) I) Incremental NOI assuming realized 1Q24 RevPOR for

properties open in 4Q19 $500M A B C D E F G H I J J) 1Q24 portfolio post-COVID recovery NOI based on 1Q24 realized RevPOR Potential for ADDITIONAL UPSIDE assuming return to PEAK OCCUPANCY of 91.2% in 4Q15 1. Represents $1,344 million of IPNOI in

1Q2024, excluding $1 million of HHS. See “Supplemental Financial Measures” at the end of this presentation for definitions and reconciliations of non-GAAP financial measures 25 2. Categories D through G assume increased ownership stake

in properties owned in prior joint ventures with Revera and Chartwell 3. Incremental NOI assumes realized 1Q24 RevPOR for properties open in 4Q19, including those within buckets D, E, and G

Balance Sheet

Plurality of Capital Sources Per previous business update issued April

29, 2024 Leveraging Efficient & Low-Cost Capital to Execute Investment Strategy ✓ Access to secured and unsecured ✓ Pivot between multiple sources of capital ✓ Recycle capital to improve portfolio quality debt financing

based upon cost and availability and capitalize on market inefficiencies $20B | PUBLIC EQUITY $19B | DEBT • Efficiently raised primarily via ATM & DRIP • Investment grade balance programs since 2015 sheet (BBB+/Baa1) with access to a

plurality of debt capital $4B | PRIVATE CAPITAL GDP Denominated Secured Debt • Capital raised via joint venture partnerships USD Term Loan with institutional capital partners $57B Exchangeable Notes CAD Denominated Secured Debt $14B |

DISPOSITIONS USD Denominated Secured Debt • Asset sales completed since 2015 Senior Unsecured Debt • Investments across multiple property types allow for opportunistic harvesting of assets, taking advantage of relative value 27 Note:

Data as of January 1, 2015 through March 31, 2024

On May 22, 2024, S&P Global revised Welltower’s credit

(1,2,3) rating outlook to positive from stable, citing strong Well-Laddered Debt Maturity Schedule seniors housing industry tailwinds, a materially strengthened balance sheet, and an expectation that key credit metrics will continue to improve going

forward Weighted Average Maturity of 6.0 Years (in millions) USD Unsecured USD Secured USD Convertible Debt GBP Unsecured CAD Unsecured CAD Secured Weighted Average Interest $6,000 5.04% 4.88% 4.75% $5,000 4.66% 4.03% 4.03% 3.81% 3.79% $4,000 3.38%

3.13% Liquidity profile includes $4.0B of 2.77% $3,000 revolving credit capacity $2,000 $1,000 $0 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Thereafter ($mm) 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 After Unsecured Debt - 1,260 700

1,906 2,480 1,050 750 1,350 1,050 - 1,782 Secured Debt 401 855 181 292 117 353 91 40 52 367 156 Total 401 2,115 881 2,198 2,597 1,403 841 1,390 1,102 367 1,938 1. As of March 31, 2024 2. Represents principal amounts due excluding unamortized

premiums/discounts or other fair value adjustments as reflected on the balance sheet 28 3. 2027 includes a $1,000,000,000 unsecured term loan and a CAD $250,000,000 unsecured term loan (approximately $184,638,000 USD at March 31, 2024). The loans

mature on July 19, 2026. The interest rates on the loans are adjusted SOFR + 0.85% for USD and CDOR + 0.85% for CAD. Both term loans may be extended for two successive terms of six months at our option.

Supplemental Financial Measures

FFO and Normalized FFO Historical cost accounting for real estate

assets in accordance with U.S. GAAP implicitly assumes that the value of real estate assets diminishes predictably over time as evidenced by the provision for depreciation. However, since real estate values have historically risen or fallen with

market conditions, many industry investors and analysts have considered presentations of operating results for real estate companies that use historical cost accounting to be insufficient. In response, the National Association of Real Estate

Investment Trusts ( NAREIT ) created FFO as a supplemental measure of operating performance for REITs that excludes historical cost depreciation from net income. FFO attributable to common stockholders, as defined by NAREIT, means net income

attributable to common stockholders, computed in accordance with U.S. GAAP, excluding gains (or losses) from sales of real estate and impairments of depreciable assets, plus real estate depreciation and amortization, and after adjustments for

unconsolidated entities and noncontrolling interests. Normalized FFO attributable to common stockholders represents FFO adjusted for certain items detailed in the reconciliations and described in our earnings press releases for the relevant periods.

We believe that Normalized FFO attributable to common stockholders is a useful supplemental measure of operating performance because investors and equity analysts may use this measure to compare our operating performance between periods or to other

REITs or other companies on a consistent basis without having to account for differences caused by unanticipated and/or incalculable items. 30

Earnings Outlook Reconciliation (in millions, except per share data)

Year Ended December 31, 2024 Prior Outlook Current Outlook Low High Low High FFO Reconciliation: Net income attributable to common stockholders $ 879 $ 957 $ 868 $ 940 (1,2) Impairments and losses (gains) on real estate dispositions, net (154) (154)

(154) (154) (1) Depreciation and amortization 1,638 1,638 1,653 1,653 NAREIT FFO attributable to common stockholders 2,363 2,441 2,367 2,439 (1,3) Normalizing items, net 29 29 55 55 Normalized FFO attributable to common stockholders $ 2,392 $ 2,470

$ 2,422 $ 2,494 Diluted per share data attributable to common stockholders: Net income $ 1.48 $ 1.61 $ 1.45 $ 1.57 NAREIT FFO $ 3.97 $ 4.10 $ 3.96 $ 4.08 Normalized FFO $ 4.02 $ 4.15 $ 4.05 $ 4.17 Normalized FFO midpoint $ 4.085 $ 4.11 (1) Other

items: Net straight-line rent and above/below market rent amortization $ (138) $ (138) $ (138) $ (138) Non-cash interest expenses 48 48 48 48 Recurring cap-ex, tenant improvements, and lease commissions (235) (235) (235) (235) Stock-based

compensation 40 40 40 40 (1) Amounts presented net of noncontrolling interests' share and Welltower's share of unconsolidated entities. (2) Includes estimated gains on projected dispositions. (3) See our earnings press release for more information.

Also includes incremental expense expected to be recognized in the quarter beyond what has been accrued in conjunction with the termination of a property management agreement. 31

NOI, IPNOI, SSNOI, RevPOR, ExpPOR, SS RevPOR & SS ExpPOR We define

NOI as total revenues, including tenant reimbursements, less property operating expenses. Property operating expenses represent costs associated with managing, maintaining and servicing tenants for our properties. These expenses include, but are not

limited to, property-related payroll and benefits, property management fees paid to operators, marketing, housekeeping, food service, maintenance, utilities, property taxes and insurance. General and administrative expenses represent general

overhead costs that are unrelated to property operations and unallocable to the properties. These expenses include, but are not limited to, payroll and benefits related to corporate employees, professional services, office expenses and depreciation

of corporate fixed assets. IPNOI represents NOI excluding interest income, other income and non-IPNOI and adjusted for timing of current quarter portfolio changes such as acquisitions, development conversions, segment transitions, dispositions and

investments held for sale. SSNOI is used to evaluate the operating performance of our properties using a consistent population which controls for changes in the composition of our portfolio. As used herein, same store is generally defined as those

revenue-generating properties in the portfolio for the relevant year-over-year reporting periods. Acquisitions and development conversions are included in the same store amounts five full quarters after acquisition or being placed into service. Land

parcels, loans and sub-leases, as well as any properties sold or classified as held for sale during the period, are excluded from the same store amounts. Redeveloped properties (including major refurbishments of a Seniors Housing Operating property

where 20% or more of units are simultaneously taken out of commission for 30 days or more or Outpatient Medical properties undergoing a change in intended use) are excluded from the same store amounts until five full quarters post completion of the

redevelopment. Properties undergoing operator transitions and/or segment transitions are also excluded from the same store amounts until five full quarters post completion of the operator transition or segment transition. In addition, properties

significantly impacted by force majeure, acts of God or other extraordinary adverse events are excluded from same store amounts until five full quarters after the properties are placed back into service. SSNOI excludes non-cash NOI and includes

adjustments to present consistent property ownership percentages and to translate Canadian properties and UK properties using a consistent exchange rate. Normalizers include adjustments that in management’s opinion are appropriate in

considering SSNOI, a supplemental, non-GAAP performance measure. None of these adjustments, which may increase or decrease SSNOI, are reflected in our financial statements prepared in accordance with U.S. GAAP. Significant normalizers (defined as

any that individually exceed 0.50% of SSNOI growth per property type) are separately disclosed and explained in the relevant supplemental reporting package. We believe NOI, IPNOI and SSNOI provide investors relevant and useful information because

they measure the operating performance of our properties at the property level on an unleveraged basis. We use NOI, IPNOI and SSNOI to make decisions about resource allocations and to assess the property level performance of our properties. No

reconciliation of the forecasted range for SSNOI on a combined basis or by property type is included in this release because we are unable to quantify certain amounts that would be required to be included in the comparable GAAP financial measure

without unreasonable efforts, and we believe such reconciliations would imply a degree of precision that could be confusing or misleading to investors. RevPOR represents the average revenues generated per occupied room per month at our Seniors

Housing Operating properties and ExpPOR represents the average expenses per occupied room per month at our Seniors Housing Operating properties. These metrics are calculated as the pro rata version of resident fees and services revenues or property

operating expenses per the income statement divided by average monthly occupied room days. SS RevPOR and SS ExpPOR are used to evaluate the RevPOR and ExpPOR performance of our properties under a consistent population, which eliminates changes in

the composition of our portfolio. They are based on the same pool of properties used for SSNOI and includes any revenue or expense normalizations used for SSNOI. We use RevPOR, ExpPOR, SS RevPOR and SS ExpPOR to evaluate the revenue-generating

capacity and profit potential of our Seniors Housing Operating portfolio independent of fluctuating occupancy rates. They are also used in comparison against industry and competitor statistics, if known, to evaluate the quality of our Seniors

Housing Operating portfolio. 32

In-Place NOI Reconciliations (dollars in thousands) March 31, 2024

In-Place NOI by property type March 31, 2024 % of Total Net income (loss) $ 131,634 Seniors Housing Operating $ 1,344,032 51 % Loss (gain) on real estate dispositions, net (4,707) Seniors Housing Triple-net 407,064 16 % Loss (income) from

unconsolidated entities 7,783 Outpatient Medical 526,384 20 % Income tax expense (benefit) 6,191 Long-Term/Post-Acute Care 332,320 13 % Other expenses 14,131 Total In-Place NOI $ 2,609,800 100 % Impairment of assets 43,331 Provision for loan losses,

net 1,014 Loss (gain) on extinguishment of debt, net 6 Loss (gain) on derivatives and financial instruments, net (3,054) In-Place NOI by property type 1Q21 % of Total General and administrative expenses 53,318 Seniors Housing Operating $ 647,632

Depreciation and amortization 365,863 Seniors Housing Triple-net Interest expense 147,318 Outpatient Medical Consolidated net operating income 762,828 Health System (1) NOI attributable to unconsolidated investments 32,090 Long-Term/Post-Acute Care

(2) NOI attributable to noncontrolling interests (22,796) Total In-Place NOI Pro rata net operating income (NOI) 772,122 Adjust: Interest income (56,869) Other income (27,068) Sold / held for sale (8,384) (3) Non-operational 1,921 (4) Non In-Place

NOI (30,882) (5) Timing adjustments 1,610 In-Place NOI 652,450 Annualized In-Place NOI $ 2,609,800 (1) Represents Welltower's interest in joint ventures where Welltower is the minority partner. (2) Represents minority partner's interest in joint

ventures where Welltower is the majority partner. (3) Primarily includes development properties and land parcels. (4) Primarily represents non-cash NOI. (5) Represents timing adjustments for current quarter acquisitions, construction conversions and

segment or operator transitions. 33

SSNOI Reconciliation (dollars in thousands) March 31, 2024 March 31,

2023 % growth YOY Net income (loss) $ 131,634 $ 28,635 Loss (gain) on real estate dispositions, net (4,707) (747) Loss (income) from unconsolidated entities 7,783 7,071 Income tax expense (benefit) 6,191 3,045 Other expenses 14,131 22,745 Impairment

of assets 43,331 12,629 Provision for loan losses 1,014 777 Loss (gain) on extinguishment of debt, net 6 5 Loss (gain) on derivatives and financial instruments, net (3,054) 930 General and administrative expenses 53,318 44,371 Depreciation and

amortization 365,863 339,112 Interest expense 147,318 144,403 Consolidated NOI 762,828 602,976 (1) NOI attributable to unconsolidated investments 32,090 26,354 (2) NOI attributable to noncontrolling interests (22,796) (25,057) (3) Pro rata NOI

772,122 604,273 Non-cash NOI attributable to same store properties (11,530) (28,727) NOI attributable to non-same store properties (222,298) (101,335) (4) Currency and ownership adjustments (713) 3,779 (5) Other adjustments 1,558 (545) Same Store

NOI (SSNOI) $ 539,139 $ 477,445 12.9% Seniors Housing Operating 266,907 212,749 25.5% Seniors Housing Triple-net 93,740 90,310 3.8% Outpatient Medical 119,184 116,879 2.0% Long-Term/Post-Acute Care 59,308 57,507 3.1% Total SSNOI $ 539,139 $ 477,445

12.9% (1) Represents Welltower's interests in joint ventures where Welltower is the minority partner. (2) Represents minority partners' interests in joint ventures where Welltower is the majority partner. (3) Represents Welltower's pro rata share of

NOI. (4) Includes adjustments to reflect consistent property ownership percentages and foreign currency exchange rates for properties in the U.K. and Canada. (5) Includes other adjustments described in the 1Q24 Supplemental Information package.

34

SHO RevPOR Growth Reconciliation (dollars in thousands, except SS

RevPOR and units) March 31, 2023 March 31, 2024 SHO SS RevPOR Growth Consolidated SHO revenues $ 1,136,681 $ 1,366,760 (1) Unconsolidated SHO revenues attributable to WELL 59,581 63,581 (2) SHO revenues attributable to noncontrolling interests

(52,518) (43,523) (3) SHO pro rata revenues 1,143,744 1,386,818 Non-cash and non-RevPOR revenues on same store properties (1,935) (1,295) Revenues attributable to non-same store properties (239,416) (381,958) (4) Currency and ownership adjustments

6,049 (1,317) (5) SHO SS RevPOR revenues $ 908,442 $ 1,002,248 (6) Average occupied units/month 57,143 59,502 (7) SHO SS RevPOR $ 5,373 $ 5,630 SS RevPOR YOY growth — 4.8 % (8) SHO SS RevPOR revenue adjustment for leap year $ 3,093 (5) SHO SS

RevPOR total revenues adjusted for leap year $ 911,535 (6) Average occupied units/month 57,143 (7) SHO SS RevPOR adjusted for leap year $ 5,332 SS RevPOR YOY growth adjusted for leap year 5.6 % (1) Represents Welltower's interests in joint ventures

where Welltower is the minority partner. (2) Represents minority partners' interests in joint ventures where Welltower is the majority partner. (3) Represents SHO revenues at Welltower pro rata ownership. (4) Includes where appropriate adjustments

to reflect consistent property ownership percentages, to translate Canadian properties at a USD/CAD rate of 1.36 and to translate UK properties at a GBP/USD rate of 1.25. (5) Represents SS SHO RevPOR revenues at Welltower pro rata ownership. (6)

Represents average occupied units for SS properties on a pro rata basis. (7) Represents pro rata SS average revenues generated per occupied room per month, and adjusted, where applicable, for consistent number of days per quarter. (8) Represents

adjustment for one incremental day for operators that bill daily. 35

SHO SS ExpPOR Growth Reconciliation (dollars in thousands, except SS

ExpPOR and units) March 31, 2023 March 31, 2024 SHO SS ExpPOR Growth Consolidated SHO property operating expenses $ 883,784 $ 1,019,347 (1) Unconsolidated SHO expenses attributable to WELL 47,455 41,799 (2) SHO expenses attributable to

noncontrolling interests (36,258) (26,164) (3) SHO pro rata expenses 894,981 1,034,982 Non-cash expenses on same store properties (257) (212) Expenses attributable to non-same store properties (204,263) (295,851) (4) Currency and ownership

adjustments 5,692 (943) (5) Normalizing adjustment for management fee 4,298 — (6) Normalizing adjustment for casualty related expenses (3,931) (1,945) (7) Other normalizing adjustments — 198 (8) SHO SS expenses $ 696,520 $ 736,229 SHO SS

expense YOY growth 5.7 % (9) Average occupied units/month 57,143 59,502 (10) SHO SS ExpPOR $ 4,119 $ 4,136 SS ExpPOR YOY growth 0.4 % (11) SHO SS ExpPOR expense adjustment for leap year $ 4,288 (8) SHO SS ExpPOR total expenses adjusted for leap year

$ 700,808 (9) Average occupied units/month 57,143 (10) SHO SS ExpPOR adjusted for leap year $ 4,099 SS ExpPOR YOY growth adjusted for leap year 0.9 % (1) Represents Welltower's interests in joint ventures where Welltower is the minority partner. (2)

Represents minority partners' interests in joint ventures where Welltower is the majority partner. (3) Represents SHO property operating expenses at Welltower pro rata ownership. (4) Includes where appropriate adjustments to reflect consistent

property ownership percentages, to translate Canadian properties at a USD/CAD rate of 1.36 and to translate UK properties at a GBP/USD rate of 1.25. (5) Represents normalizing adjustment related to the disposition of our ownership interest in two

Seniors Housing Operating management company investments. (6) Represents normalizing adjustment related to casualty related expenses net of any insurance reimbursements. (7) Represents aggregate normalizing adjustments which are individually less

than .50% of SSNOI growth. (8) Represents SHO same store property operating expenses at Welltower pro rata ownership. (9) Represents average occupied units for SS properties. (10) Represents pro rata SS average expenses per occupied room per month,

and adjusted, where applicable, for consistent number of days per quarter. 36 (11) Represents estimate of one incremental day of variable expenses.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=well_GuaranteeOf4.800NotesDue2028IssuedByWelltowerOpLlcMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=well_GuaranteeOf4.500NotesDue2034IssuedByWelltowerOpLlcMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

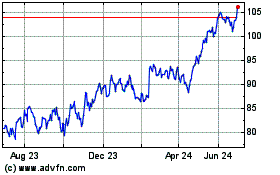

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Jul 2024 to Aug 2024

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Aug 2023 to Aug 2024