Health Care REIT, Inc. (NYSE:HCN) today announced

operating results for the company’s second quarter ended June 30,

2013.

“Health Care REIT’s unique relationships, immersion in health

care, and asset allocation position the company to capture above

average growth in all economic climates,” commented George L.

Chapman, Chairman and CEO of Health Care REIT. “Our portfolio

generated excellent 3.8% same store cash NOI growth during the

second quarter, headlined by an 8.4% increase in our seniors

housing operating portfolio. Our relationship investment strategy

generated two new portfolio partners, Revera and Avery Healthcare,

in the attractive Canadian and U.K. markets. These investments

bring our year-to-date total to $5 billion in high-quality,

accretive health care real estate expected to produce attractive

cash flow growth and total returns for our shareholders.”

Recent Highlights

- Reported 2Q13 normalized FFO of $0.93

per share, a 4% increase versus 2Q12

- Reported 2Q13 normalized FAD of $0.82

per share, a 4% increase versus 2Q12

- Increased 2Q13 same-store cash NOI by

3.8%, including 8.4% growth in the seniors housing operating

portfolio

- Increased private pay mix to 82% in

2Q13 from 74% in 2Q12

- Issued 23 million shares of common

stock, generating $1.7 billion of proceeds in May

- Received $366 million in proceeds on

dispositions in the first half of 2013, generating $52 million in

gains

- Completed gross new investments of $1.5

billion in 2Q13 and $959 million in 3Q13 to-date

- Expanded international portfolio with

$1.3 billion investment in Canada with Revera in May and $213

million investment in the U.K. with Avery Healthcare in July

- Completed final tranche of $4.3 billion

investment with Sunrise Senior Living in July

Dividends for Second Quarter

2013 As previously announced, the Board of

Directors declared a cash dividend for the quarter ended June 30,

2013 of $0.765 per share, as compared to $0.74 per share for the

same period in 2012, representing a 3.4% increase. On August 20,

2013, the company will pay its 169th consecutive quarterly cash

dividend. The declaration and payment of quarterly dividends

remains subject to review by and approval of the Board of

Directors.

Second Quarter Investment

Highlights During the quarter, the company

completed the previously announced $1.3 billion partnership with

Revera Inc. to own 47 properties in attractive Canadian markets.

The company owns a 75% interest in the portfolio and Revera owns

the remaining 25% interest. The portfolio was previously owned 100%

by Revera and is primarily comprised of independent living

communities, with many offering a continuum of care that includes

assisted living and/or memory care. Revera manages the communities

under an incentive-based management contract. The company expects

the portfolio to generate an initial unlevered NOI yield of 7%.

Please see the press release announcing the transaction dated May

8, 2013, for additional highlights of the transaction. The release

is available on the Investor Relations tab of the company’s

website.

Investment Subsequent to Quarter

End Subsequent to the end of the second quarter,

the company completed a $213 million (£140 million) sale/leaseback

transaction with Avery Healthcare. The acquired portfolio includes

14 seniors housing communities with 940 beds in the United Kingdom.

The average age of the communities is two years. Avery is one of

England’s premier and most active seniors housing

developers/operators. The lease is absolute net with capital

expenditures funded by Avery. Rent under the lease will

generate an initial yield of 7% and increase 3% per year over the

initial 20-year lease term. Avery will guarantee the lease. Health

Care REIT has an exclusive option to invest in Avery’s future

acquisitions and new developments. The company expects to acquire

up to four new seniors housing communities per year upon completion

of construction, and will add each community to the master lease.

Avery will fund all working capital associated with the lease-up of

each community. The Avery portfolio investment is consistent

with the company’s strategy to own high-quality, private pay real

estate in attractive markets operated by best-in-class

providers. Including the 14 Avery communities, the company has

investments in 45 seniors housing communities located in attractive

U.K. markets with an investment balance of $1.6 billion.

Sunrise Acquisition Update

As previously announced, the company completed the $745.2

million final phase of the Sunrise Senior Living property portfolio

acquisition on July 1, 2013. The aggregate $4.3 billion investment

includes 120 wholly-owned properties and five properties owned in

joint ventures with third parties. The company expects the

portfolio to generate an unlevered NOI yield exceeding 6.5% in the

second half of 2013.

Sunrise Property Count Reconciliation

Announced8/22/12

Completed5/7/13

Completed7/1/13

Wholly Owned 20 71 120 Joint Venture 105 54 5

Total

125 125 125 Sunrise Investments

Reconciliation ($ millions)

Announced8/22/12

Completed5/7/13

Completed7/1/13

Debt Assumed(1) $970.0 $444.6 $389.5 Cash Required $950.0 $3,084.4

$3,884.7

Acquisition Amount $1,920.0 $3,529.0

$4,274.2 (1) Debt assumed is net of payoffs that

occurred as of closing or shortly thereafter.

Outlook for 2013 The

company affirms its 2013 guidance and assumptions as previously

announced and continues to expect to generate normalized FFO in a

range of $3.70 to $3.80 per diluted share and normalized FAD in a

range of $3.25 to $3.35 per diluted share, both representing a

5%-8% increase. The company is revising its 2013 net income

guidance primarily to reflect the net impact of the Revera and

Avery acquisitions, the May common stock issuance, depreciation and

amortization adjustments, normalizing items and gains/losses on

property sales. The company now expects to report net income

attributable to common stockholders in a range of $0.58 to $0.68

per diluted share. The company’s guidance does not include any

additional 2013 investments beyond what it has announced, nor any

transaction costs, capital transactions, impairments, unanticipated

additions to the loan loss reserve or other additional one-time

items, including any additional cash payments other than normal

monthly rental payments. Please see the exhibits for a

reconciliation of the outlook for net income available to common

stockholders to normalized FFO and FAD. The company will provide

additional detail regarding its 2013 outlook and assumptions on the

second quarter 2013 conference call.

Conference Call Information

The company has scheduled a conference call on Tuesday,

August 6, 2013 at 10:00 a.m. Eastern Time to discuss its second

quarter 2013 results, industry trends, portfolio performance and

outlook for 2013. Telephone access will be available by dialing

888-346-2469 or 706-758-4923 (international). For those unable to

listen to the call live, a taped rebroadcast will be available

beginning two hours after completion of the call through August 20,

2013. To access the rebroadcast, dial 855-859-2056 or 404-537-3406

(international). The conference ID number is 17358998. To

participate in the webcast, log on to www.hcreit.com 15 minutes

before the call to download the necessary software. Replays will be

available for 90 days.

Supplemental Reporting

Measures The company believes that net income

attributable to common stockholders (NICS), as defined by U.S.

generally accepted accounting principles (U.S. GAAP), is the most

appropriate earnings measurement. However, the company considers

funds from operations (FFO) and funds available for distribution

(FAD) to be useful supplemental measures of its operating

performance. Historical cost accounting for real estate assets in

accordance with U.S. GAAP implicitly assumes that the value of real

estate assets diminishes predictably over time as evidenced by the

provision for depreciation. However, since real estate values have

historically risen or fallen with market conditions, many industry

investors and analysts have considered presentations of operating

results for real estate companies that use historical cost

accounting to be insufficient. In response, the National

Association of Real Estate Investment Trusts (NAREIT) created FFO

as a supplemental measure of operating performance for REITs that

excludes historical cost depreciation from net income. FFO, as

defined by NAREIT, means net income, computed in accordance with

U.S. GAAP, excluding gains (or losses) from sales of real estate

and impairments of depreciable assets, plus real estate

depreciation and amortization, and after adjustments for

unconsolidated entities. Normalized FFO represents FFO adjusted for

certain items detailed in Exhibit 1. FAD represents FFO excluding

net straight-line rental adjustments, amortization related to

above/below market leases and amortization of non-cash interest

expenses and less cash used to fund capital expenditures, tenant

improvements and lease commissions. Normalized FAD represents FAD

excluding prepaid/straight-line rent cash receipts and adjusted for

certain items detailed in Exhibit 1. The company believes that

normalized FFO and normalized FAD are useful supplemental measures

of operating performance because investors and equity analysts may

use these measures to compare the operating performance of the

company between periods or as compared to other REITs or other

companies on a consistent basis without having to account for

differences caused by unanticipated and/or incalculable items. The

company’s supplemental reporting measures and similarly entitled

financial measures are widely used by investors and equity analysts

in the valuation, comparison and investment recommendations of

companies. The company’s management uses these financial measures

to facilitate internal and external comparisons to historical

operating results and in making operating decisions. Additionally,

they are utilized by the Board of Directors to evaluate management.

The supplemental reporting measures do not represent net income or

cash flow provided from operating activities as determined in

accordance with U.S. GAAP and should not be considered as

alternative measures of profitability or liquidity. Finally, the

supplemental reporting measures, as defined by the company, may not

be comparable to similarly entitled items reported by other real

estate investment trusts or other companies. Please see the

exhibits for reconciliations of supplemental reporting measures and

the supplemental information package for the quarter ended June 30,

2013, which is available on the company’s website (www.hcreit.com),

for information and reconciliations of additional supplemental

reporting measures.

About Health Care REIT, Inc.

Health Care REIT, Inc., an S&P 500 company with

headquarters in Toledo, Ohio, is a real estate investment trust

that invests across the full spectrum of seniors housing and health

care real estate. The company also provides an extensive array of

property management and development services. As of June 30, 2013,

the company’s broadly diversified portfolio consisted of 1,183

properties in 46 states, the United Kingdom, and Canada. More

information is available on the company’s website at

www.hcreit.com.

Forward-Looking Statements and Risk

Factors This document may contain

“forward-looking” statements as defined in the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

concern and are based upon, among other things, the possible

expansion of the company’s portfolio; the sale of facilities; the

performance of its operators/tenants and facilities; its ability to

enter into agreements with viable new tenants for vacant space or

for facilities that the company takes back from financially

troubled tenants, if any; its occupancy rates; its ability to

acquire, develop and/or manage facilities; its ability to make

distributions to stockholders; its policies and plans regarding

investments, financings and other matters; its ability to

successfully manage the risks associated with international

expansion and operations; its tax status as a real estate

investment trust; its critical accounting policies; its ability to

appropriately balance the use of debt and equity; its ability to

access capital markets or other sources of funds; and its ability

to meet its earnings guidance. When the company uses words such as

“may,” “will,” “intend,” “should,” “believe,” “expect,”

“anticipate,” “project,” “estimate” or similar expressions, it is

making forward-looking statements. Forward-looking statements are

not guarantees of future performance and involve risks and

uncertainties. The company’s expected results may not be achieved,

and actual results may differ materially from expectations. This

may be a result of various factors, including, but not limited to:

the status of the economy; the status of capital markets, including

availability and cost of capital; issues facing the health care

industry, including compliance with, and changes to, regulations

and payment policies, responding to government investigations and

punitive settlements and operators’/tenants’ difficulty in

cost-effectively obtaining and maintaining adequate liability and

other insurance; changes in financing terms; competition within the

health care, seniors housing and life science industries; negative

developments in the operating results or financial condition of

operators/tenants, including, but not limited to, their ability to

pay rent and repay loans; the company’s ability to transition or

sell facilities with profitable results; the failure to make new

investments as and when anticipated; acts of God affecting the

company’s facilities; the company’s ability to re-lease space at

similar rates as vacancies occur; the company’s ability to timely

reinvest sale proceeds at similar rates to assets sold;

operator/tenant or joint venture partner bankruptcies or

insolvencies; the cooperation of joint venture partners; government

regulations affecting Medicare and Medicaid reimbursement rates and

operational requirements; regulatory approval and market acceptance

of the products and technologies of life science tenants; liability

or contract claims by or against operators/tenants; unanticipated

difficulties and/or expenditures relating to future acquisitions;

environmental laws affecting the company’s facilities; changes in

rules or practices governing the company’s financial reporting; the

movement of U.S. and foreign currency exchange rates; and legal and

operational matters, including real estate investment trust

qualification and key management personnel recruitment and

retention. Finally, the company assumes no obligation to update or

revise any forward-looking statements or to update the reasons why

actual results could differ from those projected in any

forward-looking statements.

HEALTH CARE REIT, INC. Financial Exhibits

Consolidated Balance Sheets (unaudited) (in

thousands) June 30, 2013

2012

Assets Real estate investments: Land and land

improvements $ 1,710,084 $ 1,189,280 Buildings and improvements

18,776,842 14,057,887 Acquired lease intangibles 928,910 524,145

Real property held for sale, net of accumulated depreciation 31,882

193,307 Construction in progress 137,481 170,785

21,585,199 16,135,404 Less accumulated depreciation and intangible

amortization (1,933,439) (1,369,449) Net real

property owned 19,651,760 14,765,955 Real estate loans

receivable(1) 312,356 300,000 Net real estate

investments 19,964,116 15,065,955 Other assets: Investments in

unconsolidated entities 768,737 460,962 Goodwill 68,321 68,321

Deferred loan expenses 71,218 60,597 Cash and cash equivalents

512,472 204,895 Restricted cash 212,812 79,619 Receivables and

other assets(2) 598,717 407,077 2,232,277

1,281,471

Total assets $ 22,196,393 $ 16,347,426

Liabilities and equity Liabilities: Borrowings under

unsecured lines of credit arrangements $ - $ 393,000 Senior

unsecured notes 6,604,979 4,910,871 Secured debt 2,875,606

2,299,674 Capital lease obligations 79,481 81,955 Accrued expenses

and other liabilities 539,361 400,065 Total

liabilities 10,099,427 8,085,565 Redeemable noncontrolling

interests 32,810 34,068 Equity: Preferred stock 1,022,917 1,022,917

Common stock 285,085 214,592 Capital in excess of par value

12,263,927 8,129,913 Treasury stock (21,248) (17,272) Cumulative

net income 2,264,573 2,023,769 Cumulative dividends (4,127,597)

(3,309,558) Accumulated other comprehensive income (49,174)

(13,590) Other equity 5,678 7,302 Total Health Care

REIT, Inc. stockholders’ equity 11,644,161 8,058,073 Noncontrolling

interests 419,995 169,720

Total equity

12,064,156 8,227,793

Total liabilities and equity $

22,196,393 $ 16,347,426 (1) Includes non-accrual loan

balances of $4,230,000 and $12,956,000 at June 30, 2013 and 2012,

respectively. (2) Includes net straight-line receivable balances of

$174,138,000 and $144,612,000 at June 30, 2013 and 2012,

respectively.

Consolidated Statements of Income

(unaudited) (in thousands, except per share data)

Three Months Ended Six Months Ended June 30,

June 30, 2013 2012 2013 2012 Revenues: Rental income

$ 302,465 $ 263,704 $ 598,753 $ 512,662 Resident fees and service

370,995 165,654 698,319 323,828 Interest income 7,640 7,879 16,696

16,020 Other income 1,025 1,482 1,725

3,166 Gross revenues 682,125 438,719 1,315,493 855,676

Expenses: Interest expense 110,629 91,299 220,585 179,780 Property

operating expenses 278,587 135,839 531,941 264,641 Depreciation and

amortization 200,108 127,599 386,837 248,136 General and

administrative expenses 23,902 25,870 51,081 53,621 Transaction

costs 28,136 28,691 94,116 34,270 Loss (gain) on derivatives, net

(2,716) (2,676) (407) (2,121) Loss (gain) on extinguishment of

debt, net - 576 (308) 576 Total

expenses 638,646 407,198 1,283,845 778,903 Income (loss)

from continuing operations before income taxes

and income from unconsolidated

entities 43,479 31,521 31,648 76,773 Income tax (expense)

benefit (1,215) (1,447) (3,978) (2,918) Income (loss) from

unconsolidated entities (5,461) 1,456 (3,198)

2,989 Income (loss) from continuing operations 36,803 31,530

24,472 76,844 Discontinued operations: Gain (loss) on sales

of properties, net (29,997) 32,450 52,495 33,219 Income (loss) from

discontinued operations, net 375 12,895 2,013

24,266 (29,622) 45,345 54,508

57,485 Net income (loss) 7,181 76,875 78,980 134,329 Less:

Preferred dividends 16,602 16,719 33,203 35,926 Preferred stock

redemption charge - 6,242 - 6,242 Net income (loss) attributable to

noncontrolling interests (913) (821) (774)

(1,876) Net income (loss) attributable to common

stockholders $ (8,508) $ 54,735 $ 46,551 $ 94,037 Average

number of common shares outstanding: Basic 273,091 213,498 266,602

206,612 Diluted 276,481 215,138 266,602 208,237 Net income

(loss) attributable to common stockholders per share: Basic $

(0.03) $ 0.26 $ 0.17 $ 0.46 Diluted $ (0.03) $ 0.25 $ 0.17 $ 0.45

Common dividends per share $ 0.765 $ 0.74 $ 1.53 $ 1.48

Normalizing

Items

Exhibit 1 (in

thousands, except per share data)

Three Months Ended Six Months Ended June 30, June 30, 2013 2012

2013 2012 Transaction costs $ 28,136 (1) $ 28,691 $ 94,116 $ 34,270

Special stock compensation grants - - - 4,316 Loss (gain) on

derivatives, net (2,716)(2) (2,676) (407) (2,121) Loss (gain) on

extinguishment of debt, net - 576 (308) 576 Held for sale hospital

operating expenses - - - 215 Preferred stock redemption charge -

6,242 - 6,242 Less: Normalizing items attributable to

noncontrolling interests and unconsolidated entities, net

(11) - (11) - Total $ 25,409 $ 32,833 $ 93,390

$ 43,498 Average diluted common shares outstanding 276,481

215,138 269,580 208,237 Net amount per diluted share $ 0.09 $ 0.15

$ 0.35 $ 0.21 Notes: (1) Primarily costs incurred

with seniors housing acquisitions. (2) Related to currency hedges

executed to lock the exchange rates on international transactions.

Funds Available

for Distribution Reconciliation

Exhibit 2 (in thousands, except per share data)

Three Months Ended Six Months Ended June 30,

June 30, 2013 2012 2013 2012 Net income (loss) attributable to

common stockholders $ (8,508) $ 54,735 $ 46,551 $ 94,037

Depreciation and amortization(1) 200,477 132,963 387,599 260,385

Losses/impairments (gains) on properties, net 29,997 (32,450)

(52,495) (33,219) Noncontrolling interests(2) (6,831) (4,569)

(11,911) (9,059) Unconsolidated entities(3) 11,348 6,641 25,269

7,478 Gross straight-line rental income (13,683) (12,792) (28,329)

(23,931) Prepaid/straight-line rent receipts 184 2,123 4,441 3,138

Amortization related to above (below) market leases, net 40 47 195

(205) Non-cash interest expense 1,237 2,849 4,731 6,542 Cap-ex,

tenant improvements, lease commissions (12,174)

(10,647) (24,059) (19,233) Funds available for

distribution 202,087 138,900 351,992 285,933 Normalizing items,

net(4) 25,409 32,833 93,390 43,498 Prepaid/straight-line rent

receipts (184) (2,123) (4,441) (3,138)

Funds available for distribution - normalized $ 227,312 $ 169,610 $

440,941 $ 326,293 Average diluted common shares outstanding

276,481 215,138 269,580 208,237 Per share data: Net income

(loss) attributable to common stockholders $ (0.03) $ 0.25 $ 0.17 $

0.45 Funds available for distribution $ 0.73 $ 0.65 $ 1.31 $ 1.37

Funds available for distribution - normalized $ 0.82 $ 0.79 $ 1.64

$ 1.57 Normalized FAD Payout Ratio: Dividends per common

share $ 0.765 $ 0.74 $ 1.53 $ 1.48 FAD per diluted share -

normalized $ 0.82 $ 0.79 $ 1.64 $ 1.57 Normalized FAD payout ratio

93% 94% 93% 94% Notes: (1) Depreciation and amortization

includes depreciation and amortization from discontinued

operations. (2) Represents noncontrolling interests' share of net

FAD adjustments. (3) Represents HCN's share of net FAD adjustments

from unconsolidated entities. (4) See Exhibit 1.

Funds From

Operations Reconciliation

Exhibit 3 (in thousands, except per share data)

Three Months Ended Six Months Ended June 30,

June 30, 2013 2012 2013 2012 Net income (loss) attributable to

common stockholders $ (8,508) $ 54,735 $ 46,551 $ 94,037

Depreciation and amortization(1) 200,477 132,963 387,599 260,385

Losses/impairments (gains) on properties, net 29,997 (32,450)

(52,495) (33,219) Noncontrolling interests(2) (7,821) (5,190)

(13,614) (10,179) Unconsolidated entities(3) 16,521

7,873 33,504 10,759 Funds from operations 230,666

157,931 401,545 321,783 Normalizing items, net(4) 25,409

32,833 93,390 43,498 Funds from operations -

normalized $ 256,075 $ 190,764 $ 494,935 $ 365,281 Average

diluted common shares outstanding 276,481 215,138 269,580 208,237

Per share data: Net income (loss) attributable to common

stockholders $ (0.03) $ 0.25 $ 0.17 $ 0.45 Funds from operations $

0.83 $ 0.73 $ 1.49 $ 1.55 Funds from operations - normalized $ 0.93

$ 0.89 $ 1.84 $ 1.75 Normalized FFO Payout Ratio: Dividends

per common share $ 0.765 $ 0.74 $ 1.53 $ 1.48 FFO per diluted share

- normalized $ 0.93 $ 0.89 $ 1.84 $ 1.75 Normalized FFO payout

ratio 82% 83% 83% 85%

Notes: (1) Depreciation and amortization includes depreciation and

amortization from discontinued operations. (2) Represents

noncontrolling interests' share of net FFO adjustments. (3)

Represents HCN's share of net FFO adjustments from unconsolidated

entities. (4) See Exhibit 1.

Outlook

Reconciliations: Year Ended December 31, 2013

Exhibit 4 (in thousands, except per share data)

Prior Outlook Current Outlook Low High

Low High

FFO

Reconciliation:

Net income attributable to common stockholders $ 0.70 $ 0.80 $ 0.58

$ 0.68 Losses/impairments (gains) on sale of properties, net (0.31)

(0.31) (0.19) (0.19) Depreciation and amortization(1) 3.06

3.06 2.97 2.97 Funds from operations 3.45 3.55

3.36 3.46 Normalizing items, net(2) 0.25 0.25

0.34 0.34 Funds from operations - normalized $ 3.70 $ 3.80 $

3.70 $ 3.80

FAD

Reconciliation:

Net income attributable to common stockholders $ 0.70 $ 0.80 $ 0.58

$ 0.68 Losses/impairments (gains) on sale of properties, net (0.31)

(0.31) (0.19) (0.19) Depreciation and amortization(1) 3.06 3.06

2.97 2.97 Net straight-line rent and above/below amortization(1)

(0.18) (0.18) (0.18) (0.18) Non-cash interest expense(1) 0.04 0.04

- - Cap-ex, tenant improvements, lease commissions(1) (0.29)

(0.29) (0.25) (0.25)

Funds available for distribution

3.02 3.12 2.93 3.03 Normalizing items, net(2) 0.25 0.25 0.34 0.34

Prepaid/straight-line rent receipts (0.02) (0.02)

(0.02) (0.02) Funds available for distribution -

normalized $ 3.25 $ 3.35 $ 3.25 $ 3.35

Notes: (1) Amounts presented net of noncontrolling interests' share

and HCN's share of unconsolidated entities. (2) See Exhibit 1.

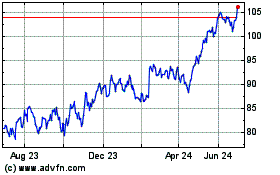

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Jul 2023 to Jul 2024