Form 8-K - Current report

November 20 2023 - 7:15AM

Edgar (US Regulatory)

0000783325false00007833252023-11-162023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 16, 2023

____________________

| | | | | | | | | | | | | | |

Commission

File Number | | Registrant; State of Incorporation;

Address; and Telephone Number | | IRS Employer

Identification No. |

| | | | |

| 001-09057 | | WEC ENERGY GROUP, INC. | | 39-1391525 |

(A Wisconsin Corporation)

231 West Michigan Street

P.O. Box 1331

Milwaukee, WI 53201

(414) 221-2345

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 Par Value | | WEC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 OTHER EVENTS

On January 6, 2023, The Peoples Gas Light and Coke Company (“PGL”) and North Shore Gas Company (“NSG”), utility subsidiaries of WEC Energy Group, Inc.(“WEC”), filed requests with the Illinois Commerce Commission (“ICC”) for regulatory review to set customer rates for natural gas for 2024.

On November 16, 2023, the ICC issued its written order in both rate reviews, approving the following base rate increases, which will be effective no later than December 15, 2023:

•$302.8 million (43.2%) base rate increase for PGL’s natural gas customers. This amount includes costs related to PGL’s Safety Modernization Program (“SMP”) currently being recovered under its Qualified Infrastructure Plant rider moving into base rates.

•$11.0 million (11.6%) base rate increase for NSG’s natural gas customers.

The ICC approved an authorized return on equity of 9.38% for both PGL and NSG, and set the common equity component average at 50.79% and 52.58% for PGL and NSG, respectively.

As part of its decisions, the ICC, among other things, disallowed $236.2 million of capital costs related to the construction and improvement of PGL’s shops and facilities. This amount includes $180.6 million of costs previously incurred by PGL and $55.6 million of future costs PGL planned to incur.

In addition, the ICC ordered PGL to pause spending on its SMP, whereby PGL is replacing Chicago’s aging natural gas infrastructure, until the ICC determines the optimal method of replacement and a prudent investment level. ICC Staff is to initiate the required proceeding no later than February 1, 2024, and the proceeding is not to exceed 12 months. The ICC indicated that the ordered pause is not intended to remove funding for emergency response work.

WEC is evaluating the potential financial implications of the orders, which may include the need to take a material charge related to the disallowance of capital costs previously incurred, but is not yet in a position to make any such determinations.

PGL and NSG anticipate seeking a rehearing of specific elements of the ICC’s orders.

FORWARD LOOKING DISCLAIMER

Certain statements contained in this press release are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are based upon management's current expectations and are subject to risks and uncertainties that could cause our actual results to differ materially from those contemplated in the statements. Readers are cautioned not to place undue reliance on these statements. Forward-looking statements include, among other things, statements concerning management's expectations and projections regarding earnings and future results. In some cases, forward-looking statements may be identified by reference to a future period or periods or by the use of forward- looking terminology such as "anticipates," "believes," "estimates," "expects," "forecasts," "guidance," "intends," "may," "objectives," "plans," "possible," "potential," "projects," "should," "targets," "will" or similar terms or variations of these terms.

Factors that could cause actual results to differ materially from those contemplated in any forward-looking statements include, but are not limited to: general economic conditions, including business and competitive conditions in the company's service territories; timing, resolution and impact of rate cases and other regulatory decisions; WEC’s ability to continue to successfully integrate the operations of its subsidiaries; availability of WEC’s generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes; unusual, varying or severe weather conditions; continued industry restructuring and consolidation; continued advances in, and adoption of, new technologies that produce power or reduce power consumption; energy and environmental conservation efforts; electrification initiatives, mandates and other efforts to reduce the use of natural gas; WEC’s ability to successfully acquire and/or dispose of assets and projects and to execute on its

capital plan; terrorist, physical or cyber-security threats or attacks and data security breaches; construction risks; labor disruptions; equity and bond market fluctuations; changes in WEC’s and its subsidiaries' ability to access the capital markets; changes in tax legislation or WEC’s ability to use certain tax benefits and carryforwards; federal, state, and local legislative and regulatory changes, including changes in rate setting policies or procedures and to environmental standards, the enforcement of these laws and regulations or permit conditions and changes in the interpretation of regulations by regulatory agencies; supply chain disruptions; inflation; political or geopolitical developments, including impacts on the global economy, supply chain and fuel prices, generally, from ongoing global conflicts; the impact from any health crises, including epidemics and pandemics; current and future litigation and regulatory investigations, proceedings or inquiries; changes in accounting standards; the financial performance of American Transmission Company as well as projects in which WEC’s energy infrastructure business invests; the ability of WEC to obtain additional generating capacity at competitive prices; goodwill and its possible impairment; and other factors described under the heading "Factors Affecting Results, Liquidity and Capital Resources" in Management's Discussion and Analysis of Financial Condition and Results of Operations and under the headings "Cautionary Statement Regarding Forward-Looking Information" and "Risk Factors" contained in WEC’s Form 10-K for the year ended December 31, 2022, and in subsequent reports filed with the Securities and Exchange Commission. Except as may be required by law, WEC expressly disclaims any obligation to publicly update or revise any forward-looking information.

| | | | | |

| SIGNATURES |

| |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

|

| |

| |

| |

| WEC ENERGY GROUP, INC. |

| (Registrant) |

| |

| /s/ William J. Guc |

| Date: November 20, 2023 | William J. Guc, Vice President and Controller

|

v3.23.3

Cover Page

|

Nov. 16, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 16, 2023

|

| Entity File Number |

001-09057

|

| Entity Registrant Name |

WEC ENERGY GROUP, INC.

|

| Entity Tax Identification Number |

39-1391525

|

| Entity Incorporation, State or Country Code |

WI

|

| Entity Address, Address Line One |

231 West Michigan Street

|

| Entity Address, Address Line Two |

P.O. Box 1331

|

| Entity Address, City or Town |

Milwaukee

|

| Entity Address, State or Province |

WI

|

| Entity Address, Postal Zip Code |

53201

|

| City Area Code |

414

|

| Local Phone Number |

221-2345

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.01 Par Value

|

| Trading Symbol |

WEC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000783325

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

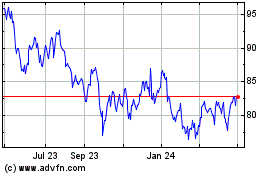

WEC Energy (NYSE:WEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

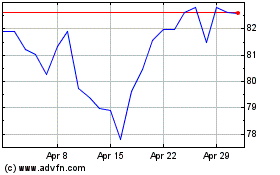

WEC Energy (NYSE:WEC)

Historical Stock Chart

From Jul 2023 to Jul 2024