- Fourth quarter total revenue of $37.7 million, up 18%

year-over-year

- Full year total revenue of $142.1 million, up 23%

year-over-year

- Significant gross and operating margin improvement

year-over-year following strategic and operational actions

Weave Communications, Inc. (NYSE: WEAV), a leading all-in-one

customer communications and engagement software platform for small

and medium-sized businesses, today announced its financial results

for the fourth quarter and year ended December 31, 2022.

“We made a lot of important progress towards configuring our

business for success in 2022, and have taken important steps to

improve our efficiency,” said CEO Brett White. “We are set up well

to carry our momentum into 2023 as we continue building for future

growth, while remaining focused on delivering strong operational

performance and an accelerated path to breakeven.”

Fourth Quarter 2022 Financial Highlights

- Total revenue was $37.7 million, representing a 18%

year-over-year increase compared to $31.8 million in the fourth

quarter of 2021.

- GAAP loss from operations was $9.7 million, compared to a GAAP

loss from operations of $13.6 million in the fourth quarter of

2021.

- Non-GAAP loss from operations was $4.2 million, compared to a

non-GAAP loss from operations of $10.6 million in the fourth

quarter of 2021.

- GAAP net loss attributable to common stockholders was $9.3

million, or $0.14 per share, compared to a GAAP net loss

attributable to common stockholders of $14.3 million, or $0.34 per

share, in the fourth quarter of 2021.

- Non-GAAP net loss attributable to common stockholders was $3.7

million, or $0.06 per share, compared to a non-GAAP net loss

attributable to common stockholders of $11.0 million, or $0.26 per

share, in the fourth quarter of 2021.

- Dollar-Based Net Retention Rate (NRR) was 99% as of December

31, 2022.

- Dollar-Based Gross Retention Rate (GRR) was 94% as of December

31, 2022.

Full Year 2022 Financial Highlights:

- Total revenue was $142.1 million, representing a 23%

year-over-year increase compared to $115.9 million in 2021.

- GAAP loss from operations was $49.7 million, compared to a GAAP

loss from operations of $50.4 million in 2021.

- Non-GAAP loss from operations was $31.0 million, compared to a

non-GAAP loss from operations of $36.3 million in 2021.

- GAAP net loss attributable to common stockholders was $49.7

million, or $0.76 per share, compared to a GAAP net loss

attributable to common stockholders of $53.7 million, or $2.60 per

share, in 2021.

- Non-GAAP net loss attributable to common stockholders was $31.0

million, or $0.48 per share, compared to a non-GAAP net loss

attributable to common stockholders of $37.6 million, or $1.82 per

share, in 2021.

- Added 3,362 net new customer locations in 2022 and had 27,193

customer locations as of December 31, 2022.

Financial First Quarter and Full Year 2023 Outlook

The company expects the following financial results for the

three months ending March 31, 2023 and full year ending December

31, 2023:

First Quarter

Full Year

(in millions)

Total revenue

$37.5 - $38.5

$156.0 - 160.0

Non-GAAP loss from operations

$(4.5) - $(5.5)

$(21.3) - $(17.3)

Weighted average share count

66.0

68.0

The guidance provided above constitutes forward-looking

statements and actual results may differ materially. Refer to the

“Forward-Looking Statements” safe harbor section below for

information on the factors that could cause our actual results to

differ materially from these forward-looking statements.

Non-GAAP loss from operations excludes estimates for, among

other things, stock-based compensation expense. A reconciliation of

this non-GAAP financial guidance measure to a corresponding GAAP

financial guidance measure is not available on a forward-looking

basis because we do not provide guidance on GAAP net loss from

operations and are not able to present the various reconciling cash

and non-cash items between GAAP loss from operations and non-GAAP

loss from operations without unreasonable effort. In particular,

stock-based compensation expense is impacted by our future hiring

and retention needs, as well as the future fair market value of our

common stock, all of which is difficult to predict and is subject

to change. The actual amount of these expenses during 2023 will

have a significant impact on our future GAAP financial results.

Webcast

The company will host a conference call and webcast for analysts

and investors on Wednesday, February 22, 2023, beginning at 5 p.m.

EDT.

Individuals interested in listening to the conference call may

do so by dialing (412) 902-1020 or (877) 502-7186 for toll free.

Please reference the following conference ID: 13735741. The live

webcast and a webcast replay of the conference call can be accessed

from the investor relations page of Weave’s website at

investors.getweave.com.

About Weave

Weave is the all-in-one customer communication and engagement

platform for small and medium-sized businesses. From the first

phone call to the final invoice and every touchpoint in between,

Weave connects the entire customer journey. Weave’s software

solutions transform how local businesses attract, communicate with

and engage customers to grow their business. Weave has set the bar

for Utah startup achievement & work culture. In the past year,

Weave has been named a member of the Forbes Cloud 100, a Certified

Great Place to Work, and a G2 leader in Patient Engagement,

Optometry, Dental Practice Management and Patient Relationship

Management software. To learn more, visit

www.getweave.com/newsroom/

Forward Looking Statements

This press release and the accompanying conference call contain

forward-looking statements including, among others, current

estimates of first quarter and full year 2023 revenue and non-GAAP

loss from operations and statements in the quotes of our Chief

Executive Officer.

These forward-looking statements involve risks and

uncertainties. If any of these risks or uncertainties materialize,

or if any of our assumptions prove incorrect, our actual results

could differ materially from the results expressed or implied by

these forward-looking statements. These risks and uncertainties

include risks associated with: transitions in company leadership;

our ability to attract new customers, retain existing customers and

increase our customers’ use of our platform; our ability to manage

our growth; the impact of the global COVID-19 pandemic on our

company; our ability to maintain and enhance our brand and increase

market awareness of our company, platform and products; customer

adoption of our platform and products; expansion into new vertical

markets; customer acquisition costs and sales and marketing

strategies; competition; our ability to enhance our platform and

products; interruptions in service; general business and economic

conditions; and the risks described in the filings we make from

time to time with the Securities and Exchange Commission (SEC),

including the risks described under the heading “Risk Factors” in

our Quarterly Report on Form 10-Q for the three months ended

September 30, 2022, filed with the SEC on November 10, 2022, which

should be read in conjunction with our financial results and

forward-looking statements and is available on the SEC Filings

section of the Investor Relations page of our website at

investors.getweave.com/.

All forward-looking statements in this press release are based

on information available to us as of the date hereof, and we do not

assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist

after the date on which they were made.

Channels for Disclosure of Information

Weave Communications uses the investor relations page on our

website, blog posts on our website, press releases, public

conference calls, webcasts, our twitter feed (@getweave), our

Facebook page, and our LinkedIn page as the means of complying with

our disclosure obligations under Regulation FD. We encourage

investors, the media, and others to follow the channels listed

above, in addition to following Weave Communications’ press

releases, SEC filings, and public conference calls and webcasts,

and to review the information disclosed through such channels.

Supplemental Financial Information

Dollar-Based Net Revenue Retention (NRR)

For retention rate calculations, we use adjusted monthly revenue

(AMR), which is calculated for each location as the sum of (i) the

subscription component of revenue for each month and (ii) the

average of the trailing-three-month recurring payments revenue. To

calculate our NRR, we first identify the cohort of locations (the

Base Locations) that were active in a particular month (the Base

Month). We then divide AMR for the Base Locations in the same month

of the subsequent year (the Comparison Month), by AMR in the Base

Month to derive a monthly NRR. We derive our annual NRR as of any

date by taking a weighted average of the monthly net retention

rates over the trailing twelve months prior to such date.

Dollar-Based Gross Revenue Retention (GRR)

To calculate our GRR, we first identify the cohort of locations

(the Base Locations) that were under subscription in a particular

month (the Base Month). We then calculate the effect of reductions

in revenue from customer location terminations by measuring the

amount of AMR in the Base Month for Base Locations still under

subscription twelve months subsequent to the Base Month (Remaining

AMR). We then divide Remaining AMR for the Base Locations by AMR in

the Base Month for the Base Locations to derive a monthly gross

retention rate. We calculate GRR as of any date by taking a

weighted average of the monthly gross retention rates over the

trailing twelve months prior to such date. GRR reflects the effect

of customer locations that terminate their subscriptions, but does

not reflect changes in revenue due to revenue expansion, revenue

contraction, or addition of new customer locations.

Number of Locations

We measure locations as the total number of customer locations

under subscription active on the Weave platform as of the end of

each month. A single organization or customer with multiple

divisions, segments, offices or subsidiaries is counted as multiple

locations if they have entered into subscriptions for each

location.

As a reminder, we only provide customer location information on

an annual basis with annual and Q4 results and do not provided this

information with financial statements or earnings releases covering

interim periods.

Non-GAAP Financial Measures

In this press release, Weave Communications has provided

financial information that has not been prepared in accordance with

generally accepted accounting principles in the United States

(GAAP). We disclose the following historical non-GAAP financial

measures in this press release: non-GAAP net loss or non-GAAP net

loss attributable to common stockholders, non-GAAP net loss margin,

non-GAAP net loss per share, non-GAAP gross profit, non-GAAP gross

margin, non-GAAP loss from operations, non-GAAP operating margin,

adjusted EBITDA and free cash flow. We use these non-GAAP financial

measures internally in analyzing our financial results and

evaluating our ongoing operational performance. We believe that

these non-GAAP financial measures provide an additional tool for

investors to use in understanding and evaluating ongoing operating

results and trends in the same manner as our management and board

of directors. Our use of these non-GAAP financial measures has

limitations as an analytical tool, and you should not consider them

in isolation or as a substitute for analysis of our financial

results as reported under GAAP. Because of these and other

limitations, you should consider these non-GAAP financial measures

along with other GAAP-based financial performance measures,

including various cash flow metrics, operating income (loss), net

loss, and our GAAP financial results. We have provided a

reconciliation of these non-GAAP financial measures to their most

directly comparable GAAP measures in the tables included in this

press release, and investors are encouraged to review the

reconciliation.

Non-GAAP net loss, non-GAAP net loss margin and non-GAAP net

loss per share

We define non-GAAP net loss or non-GAAP net loss attributable to

common stockholders as GAAP net loss attributable to common

stockholders less stock-based compensation expense and non-cash

cumulative dividends on redeemable convertible preferred stock, and

non-GAAP net loss margin as non-GAAP net loss as a percentage of

revenue. Non-GAAP net loss per share is calculated as non-GAAP net

loss divided by the diluted weighted-average shares

outstanding.

Non-GAAP gross profit and non-GAAP gross margin

We define non-GAAP gross profit as GAAP gross profit less

stock-based compensation expense, and non-GAAP gross margin as

non-GAAP gross profit as a percentage of revenue.

Non-GAAP operating expenses

We define non-GAAP operating expenses, in the aggregate or its

individual components (i.e., sales and marketing, research and

development or general and administrative), as the applicable GAAP

operating expenses less the applicable stock-based compensation

expense.

Non-GAAP loss from operations and non-GAAP loss from

operations margin

We define non-GAAP loss from operations as GAAP loss from

operations less stock-based compensation expense, and non-GAAP loss

from operations margin as non-GAAP loss from operations as a

percentage of revenue.

Adjusted EBITDA

EBITDA is defined as earnings before interest expense, provision

for income taxes, depreciation, and amortization. Our depreciation

adjustment includes depreciation on operating fixed assets and does

not include depreciation on phone hardware provided to our

customers. We further adjust EBITDA to exclude stock-based

compensation expense, a non-cash item. We believe that adjusted

EBITDA provides management and investors consistency and

comparability with our past financial performance and facilitates

period-to-period comparisons of operations. Additionally,

management uses adjusted EBITDA to measure our financial and

operational performance and prepare our budgets.

Free Cash Flow

We define free cash flow as net cash used in operating

activities, less purchases of property and equipment and

capitalized internal-use software costs. We believe that free cash

flow is a useful indicator of liquidity that provides useful

information to management and investors, even if negative, as it

provides information about the amount of cash consumed by our

combined operating and investing activities. For example, as free

cash flow has been negative, we have needed to access cash reserves

or other sources of capital for these investments.

The foregoing non-GAAP financial measures have a number of

limitations. For example, the non-GAAP financial information

presented above may be determined or calculated differently by

other companies and may not be directly comparable to that of other

companies. In addition, free cash flow does not reflect our future

contractual commitments and the total increase or decrease of our

cash balance for a given period. Further, Adjusted EBITDA excludes

some costs, namely, non-cash stock-based compensation expense.

Therefore, adjusted EBITDA does not reflect the non-cash impact of

stock-based compensation expense or working capital needs, that

will continue for the foreseeable future. All of these limitations

could reduce the usefulness of these non-GAAP financial measures as

analytical tools.

WEAVE COMMUNICATIONS,

INC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands

except share amounts)

December 31, 2022

December 31, 2021

ASSETS

Current assets:

Cash and cash equivalents

$

61,997

135,996

Short-term investments

51,340

—

Accounts receivable

3,296

3,059

Deferred contract costs, net

9,881

8,931

Prepaid expenses and other current

assets

6,374

6,461

Total current assets

132,888

154,447

Non-current assets:

Property and equipment, net

10,773

24,502

Operating lease right-of-use assets

45,110

—

Finance lease right-of-use assets

10,589

—

Deferred contract costs, net, less current

portion

8,146

7,873

Other non-current assets

843

663

TOTAL ASSETS

$

208,349

$

187,485

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

3,793

$

4,061

Accrued liabilities

13,636

12,250

Deferred revenue

34,136

29,511

Current portion of operating lease

liabilities

3,662

—

Current portion of finance lease

liabilities

6,992

8,485

Current portion of long-term debt

10,000

—

Total current liabilities

72,219

54,307

Non-current liabilities:

Deferred rent

—

4,319

Operating lease liabilities, less current

portion

46,914

—

Finance lease liabilities, less current

portion

5,997

6,558

Long-term debt

—

10,000

Total liabilities

125,130

75,184

Stockholders' equity:

Preferred stock, $0.00001 par value per

share; 10,000,000 shares authorized, zero shares issued and

outstanding as of December 31, 2022 and December 31, 2021

—

—

Common stock, $0.00001 par value per

share; 500,000,000 shares authorized as of December 31, 2022 and

2021, respectively; 65,739,053 and 64,324,628 issued and

outstanding as of December 31, 2022 and 2021, respectively

—

—

Additional paid-in capital

314,884

294,230

Accumulated deficit

(231,636

)

(181,898

)

Accumulated other comprehensive loss

(29

)

(31

)

Total stockholders' equity

83,219

112,301

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

208,349

$

187,485

WEAVE COMMUNICATIONS,

INC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands,

except share and per share data)

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Revenue

$

37,685

$

31,840

$

142,117

$

115,871

Cost of revenue

12,751

13,679

53,276

49,372

Gross profit

24,934

18,161

88,841

66,499

Operating expenses:

Sales and marketing

16,118

15,769

65,378

58,244

Research and development

8,185

7,119

30,714

27,009

General and administrative

10,376

8,920

42,453

31,637

Total operating expenses

34,679

31,808

138,545

116,890

Loss from operations

(9,745

)

(13,647

)

(49,704

)

(50,391

)

Other income (expense):

Interest expense

(436

)

(308

)

(1,441

)

(1,184

)

Other income (expense), net

937

(65

)

1,511

(55

)

Loss before income taxes

(9,244

)

(14,020

)

(49,634

)

(51,630

)

Provision for income taxes

(22

)

(48

)

(104

)

(60

)

Net loss

$

(9,266

)

$

(14,068

)

$

(49,738

)

$

(51,690

)

Less: cumulative dividends on redeemable

convertible preferred stock

—

(270

)

—

(1,961

)

Net loss attributable to common

stockholders

$

(9,266

)

$

(14,338

)

$

(49,738

)

$

(53,651

)

Net loss per share attributable to common

stockholders - basic and diluted

$

(0.14

)

$

(0.34

)

$

(0.76

)

$

(2.60

)

Weighted-average common shares outstanding

- basic and diluted

65,629,940

42,553,188

65,083,198

20,636,583

WEAVE COMMUNICATIONS,

INC

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited, in

thousands)

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

CASH FLOWS FROM OPERATING

ACTIVITIES

Net loss

$

(9,266

)

$

(14,068

)

$

(49,738

)

$

(51,690

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

3,120

3,390

12,964

12,140

Amortization of operating right-of-use

assets

630

—

3,372

—

Provision for losses on accounts

receivable

271

128

729

355

Amortization of contract costs

2,884

2,564

11,120

9,410

Loss on disposal of assets

(6

)

—

4

—

Stock-based compensation

5,525

3,044

18,752

14,091

Net accretion of discounts on short-term

investments

(413

)

—

(413

)

—

Changes in operating assets and

liabilities:

—

—

—

—

Accounts receivable

86

1,393

(966

)

(870

)

Deferred contract costs

(3,082

)

(2,787

)

(12,343

)

(12,828

)

Prepaid expenses and other assets

(1,799

)

(1,532

)

(93

)

(4,073

)

Accounts payable

382

(515

)

(330

)

583

Accrued liabilities

(2,137

)

(4,268

)

1,786

1,564

Operating lease liabilities

(537

)

—

(2,225

)

—

Deferred revenue

1,501

1,068

4,615

6,627

Deferred rent

—

1,178

—

4,318

Net cash used in operating activities

(2,841

)

(10,405

)

(12,766

)

(20,373

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchases of short-term investments

(50,915

)

—

(50,915

)

—

Proceeds from sale of assets

7

—

16

—

Purchases of property and equipment

(704

)

(1,331

)

(1,895

)

(7,376

)

Capitalized internal-use software

costs

(229

)

(461

)

(1,232

)

(2,433

)

Net cash used in investing activities

(51,841

)

(1,792

)

(54,026

)

(9,809

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from advance on line of

credit

—

5

—

6,000

Principal payments on finance leases

(2,015

)

(2,048

)

(8,709

)

(7,860

)

Proceeds from stock option exercises

336

926

1,315

4,166

Proceeds from initial public offering, net

of underwriting discounts

—

111,600

—

111,600

Paid offering costs

—

(2,681

)

(671

)

(3,426

)

Proceeds from the employee stock purchase

plan

—

—

858

—

Net cash provided by (used in) financing

activities

(1,679

)

107,802

(7,207

)

110,480

NET INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS

(56,361

)

95,605

(73,999

)

80,298

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD

118,358

40,391

135,996

55,698

CASH AND CASH EQUIVALENTS, END OF

PERIOD

$

61,997

$

135,996

$

61,997

$

135,996

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the period for

interest

$

436

$

308

$

1,441

$

1,184

Cash paid during the period for income

taxes

$

22

$

—

$

104

$

—

SUPPLEMENTAL DISCLOSURE OF NONCASH

INVESTING AND FINANCING ACTIVITIES:

Equipment purchases financed with accounts

payable

$

13

$

78

$

13

$

78

Finance lease liabilities arising from

obtaining finance lease right-of-use assets

$

1,996

$

1,037

$

6,655

$

8,461

Accrued unpaid offering costs

$

—

$

400

$

—

$

400

Unrealized gain on short-term

investments

$

12

$

—

$

12

$

—

WEAVE COMMUNICATIONS,

INC

DISAGGREGATED REVENUE AND COST

OF REVENUE (GAAP)

(unaudited, in

thousands)

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Subscription and payment

processing:

Revenue

$

36,163

$

30,332

$

136,592

$

108,841

Cost of revenue

(8,633

)

(8,400

)

(35,008

)

(29,454

)

Gross profit

$

27,530

$

21,932

$

101,584

$

79,387

Gross margin

76

%

72

%

74

%

73

%

Onboarding:

Revenue

$

428

$

599

$

1,288

$

3,687

Cost of revenue

(2,093

)

(2,894

)

(9,612

)

(10,941

)

Gross profit

$

(1,665

)

$

(2,295

)

$

(8,324

)

$

(7,254

)

Gross margin

(389

)%

(383

)%

(646

)%

(197

)%

Hardware:

Revenue

$

1,094

$

909

$

4,237

$

3,343

Cost of revenue

(2,025

)

(2,385

)

(8,656

)

(8,977

)

Gross profit

$

(931

)

$

(1,476

)

$

(4,419

)

$

(5,634

)

Gross margin

(85

)%

(162

)%

(104

)%

(169

)%

WEAVE COMMUNICATIONS, INC

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited, in thousands, except share and per share

data)

The following tables reconcile the specific items excluded from

GAAP in the calculation of non-GAAP financial measures for the

periods indicated below

Non-GAAP gross profit

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Gross profit

$

24,934

$

18,161

$

88,841

$

66,499

Stock-based compensation add back

209

108

723

526

Non-GAAP gross profit

$

25,143

$

18,269

$

89,564

$

67,025

GAAP gross margin

66

%

57

%

63

%

57

%

Non-GAAP gross margin

67

%

57

%

63

%

58

%

Non-GAAP operating expenses

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Sales and marketing

$

16,118

$

15,769

$

65,378

$

58,244

Stock-based compensation excluded

(1,105

)

(458

)

(3,436

)

(1,962

)

Non-GAAP sales and marketing

$

15,013

$

15,311

$

61,942

$

56,282

Research and development

$

8,185

$

7,119

$

30,714

$

27,009

Stock-based compensation excluded

(1,654

)

(554

)

(4,576

)

(3,545

)

Non-GAAP research and development

$

6,531

$

6,565

$

26,138

$

23,464

General and administrative

$

10,376

$

8,920

$

42,453

$

31,637

Stock-based compensation excluded

(2,557

)

(1,924

)

(10,017

)

(8,058

)

Non-GAAP general and administrative

$

7,819

$

6,996

$

32,436

$

23,579

Non-GAAP loss from operations

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Loss from operations

$

(9,745

)

$

(13,647

)

$

(49,704

)

$

(50,391

)

Stock-based compensation add back

5,525

3,044

18,752

14,091

Non-GAAP loss from operations

$

(4,220

)

$

(10,603

)

$

(30,952

)

$

(36,300

)

GAAP loss from operations margin

(26

)%

(43

)%

(35

)%

(43

)%

Non-GAAP loss from operations margin

(11

)%

(33

)%

(22

)%

(31

)%

Non-GAAP net loss

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Net loss attributable to common

stockholders

$

(9,266

)

$

(14,338

)

$

(49,738

)

$

(53,651

)

Stock-based compensation add back

5,525

3,044

18,752

14,091

Non-cash cumulative dividends on

redeemable convertible preferred stock

—

270

—

1,961

Non-GAAP net loss attributable to common

stockholders

$

(3,741

)

$

(11,024

)

$

(30,986

)

$

(37,599

)

GAAP net loss margin

(25

)%

(45

)%

(35

)%

(46

)%

Non-GAAP net loss margin

(10

)%

(35

)%

(22

)%

(32

)%

GAAP net loss per share attributable to

common stockholders - basic and diluted

$

(0.14

)

$

(0.34

)

$

(0.76

)

$

(2.60

)

Non-GAAP net loss per share attributable

to common stockholders - basic and diluted

$

(0.06

)

$

(0.26

)

$

(0.48

)

$

(1.82

)

Weighted-average common shares outstanding

- basic and diluted

65,629,940

42,553,188

65,083,198

20,636,583

Adjusted EBITDA

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Net loss

$

(9,266

)

$

(14,068

)

$

(49,738

)

$

(51,690

)

Interest on outstanding debt

436

308

1,441

1,184

Provision for income taxes

22

48

104

60

Depreciation

606

686

2,609

2,269

Amortization

289

302

1,140

815

Stock-based compensation

5,525

3,044

18,752

14,091

Adjusted EBITDA

$

(2,388

)

$

(9,680

)

$

(25,692

)

$

(33,271

)

Free Cash Flow

Three Months Ended December

31,

Year Ended December

31,

2022

2021

2022

2021

Net cash used in operating activities

$

(2,841

)

$

(10,405

)

$

(12,766

)

$

(20,373

)

Less: Purchases of property and

equipment

(704

)

(1,331

)

(1,895

)

(7,376

)

Less: Capitalized internal-use software

costs

(229

)

(461

)

(1,232

)

(2,433

)

Free cash flow

$

(3,774

)

$

(12,197

)

$

(15,893

)

$

(30,182

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230222005263/en/

Investor Relations Contact Mark McReynolds Head of

Investor Relations ir@getweave.com

Media Contact Kali Geldis Senior Director of

Communications pr@getweave.com

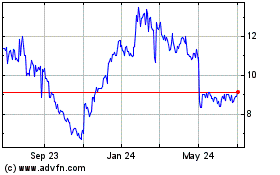

Weave Communications (NYSE:WEAV)

Historical Stock Chart

From Oct 2024 to Nov 2024

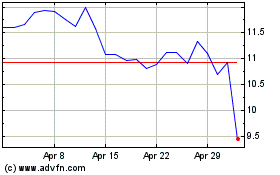

Weave Communications (NYSE:WEAV)

Historical Stock Chart

From Nov 2023 to Nov 2024