UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| þ | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| o | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material under §240.14a-12 |

WEAVE COMMUNICATIONS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| þ | No fee required. |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY COPY – SUBJECT TO COMPLETION

September , 2022

To Our Stockholders:

You are cordially invited to attend the Special Meeting of Stockholders (the “Special Meeting”), of Weave Communications, Inc. The Special Meeting will be held at 1331 West Powell Way, Lehi, Utah 84043 on November , 2022 at Eastern Time.

The matter expected to be acted upon at the Special Meeting is described in the accompanying Notice of Special Meeting of Stockholders and proxy statement. The Special Meeting materials include the notice, the proxy statement and the proxy card, each of which is enclosed.

Please use this opportunity to take part in our affairs by voting on the business to come before the Special Meeting. The proxy materials, including the accompanying notice, proxy statement and form of proxy are first being sent or given to the company’s stockholders on or around September , 2022. Our board of directors has fixed the close of business on September , 2022, as the record date for the Special Meeting (the “Record Date”), and only stockholders of record as of the Record Date may vote at the Special Meeting and any postponements or adjournments of the meeting. All stockholders are cordially invited to participate in the Special Meeting and any postponements or adjournments of the meeting. However, to ensure your representation at the Special Meeting, please vote as soon as possible by using the internet or telephone or by mailing the proxy card in the postage-paid envelope provided, as instructed in the proxy card. Returning the proxy card or voting electronically does NOT deprive you of your right to attend the meeting and to vote your shares for the matters acted upon at the meeting. Your vote is important. All stockholders are cordially invited to attend the Special Meeting in person. Whether or not you expect to attend and participate in the Special Meeting, please vote as soon as possible by submitting your proxy electronically via the internet or by telephone or by completing, signing and dating the proxy card and returning it in the postage paid envelope provided.

Sincerely,

Brett White

Interim Chief Executive Officer

| | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON NOVEMBER , 2022: THE PROXY MATERIALS, INCLUDING THE ACCOMPANYING NOTICE, PROXY STATEMENT AND PROXY CARD ARE AVAILABLE FREE OF CHARGE AT WWW.INVESTORVOTE.COM. |

WEAVE COMMUNICATIONS, INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

September , 2022

| | | | | | | | |

Time and Date: | Friday, November , 2022 at Eastern Time. |

| |

Place*: | The Special Meeting will be held at 1331 West Powell Way, Lehi, Utah 84043. |

| |

Item of Business: | Approve the one-time repricing of certain stock options issued under the Company’s 2015 Equity Incentive Plan (as amended, the “2015 Plan”) that are held by eligible service providers of the Company. |

| | |

Record Date: | Only stockholders of record at the close of business on September , 2022 are entitled to notice of, and to vote at, the Special Meeting and any adjournments thereof. |

| |

Proxy Voting: | Each share of common stock that you own represents one vote. |

| For questions regarding your stock ownership, you may contact us through our Investor Relations section of our website at https://investors.getweave.com/investor-resources/contact-ir or, if you are a registered holder, contact our transfer agent, Computershare Trust Company, N.A., through its website at www.computershare.com or by phone at (800) 736-3001. |

* Special Note Regarding COVID-19. Given the public health and safety concerns related to COVID-19, we ask that each stockholder evaluate the relative benefits to them personally of in person attendance at the Special Meeting and take advantage of the ability to vote by proxy via internet or telephone, as instructed on the proxy card that has been provided to you. If you elect to attend in person, we ask that you follow recommended guidance, mandates, and applicable executive orders from federal and state authorities, particularly as they relate to social distancing and attendance at public gatherings. If you are not feeling well or think you may have been exposed to COVID-19, we ask that you vote by proxy for the meeting. Should further developments with COVID-19 necessitate that we change any material aspects of the Special Meeting, we will make public disclosure of such changes. We thank you for your cooperation as we balance opportunities for stockholder engagement with the safety of our community and each of our stockholders.

By Order of the Board of Directors,

| | | | | |

| |

Brett White

Interim Chief Executive Officer | Stuart C. Harvey Jr. Chairperson of the Board |

WEAVE COMMUNICATIONS, INC.

PROXY STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

Page

WEAVE COMMUNICATIONS, INC.

________________

PROXY STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, NOVEMBER , 2022

________________

September , 2022

Information About Solicitation and Voting

The accompanying proxy is solicited on behalf of the board of directors of Weave Communications, Inc. for use at Weave Communications’ Special Meeting of Stockholders (the "Special Meeting" or “meeting”) to be held at 1331 West Powell Way, Lehi, Utah 84043 on November , 2022 at Eastern Time. References in the proxy statement for the Special Meeting (the “Proxy Statement”), to “we,” “us,” “our,” the “Company” or “Weave Communications” refer to Weave Communications Inc.

Questions and Answers About the Meeting and Related Topics

Q: What is the purpose of the meeting?

A: At the Special Meeting, stockholders will act upon the proposal described in this proxy statement.

Q: What proposal is scheduled to be voted on at the meeting?

A: Stockholders will be asked to vote on a proposal at the meeting to approve the one-time repricing of certain outstanding stock options issued under the Company’s 2015 Equity Incentive Plan (as amended, the “2015 Plan”) that are held by eligible service providers of the Company (the “Option Repricing Proposal”).

Q: Could matters other than the Option Repricing Proposal be decided at the meeting?

A: Our bylaws provide that business transacted at any special meeting of stockholders shall be limited to matters relating to the purpose or purposes stated in the notice of the meeting and only the Option Repricing Proposal is stated in the Notice of Special Meeting of Stockholders accompanying this proxy statement. If any other matter were to properly come before the meeting, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

Q: How does the board of directors recommend I vote on the Option Repricing Proposal?

A: Our board of directors recommends that you vote your shares “FOR” the Option Repricing Proposal.

Q: Who may vote at the Special Meeting?

A: Stockholders of record as of the close of business on September , 2022 (the “Record Date”), are entitled to receive notice of, to attend and participate, and to vote at the Special Meeting. At the close of business on the Record Date, there were shares of our common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and these proxy materials will be sent directly to you by Weave Communications, Inc.

Beneficial Owner of Shares Held in Street Name: Shares Registered in the Name of a Broker or Nominee

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and these proxy materials will be forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Because you are not the stockholder of record, you may not vote your shares at the Special Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Special Meeting. Beneficial owners must obtain a valid proxy from the organization that holds their shares and present it to Computershare Trust Company, N.A., at least three (3) business days in advance of the Special Meeting.

Q: How do I attend the Special Meeting?

A: The Special Meeting will be a meeting of stockholders to be held on November , 2022, Eastern Time at 1331 West Powell Way, Lehi, Utah 84043. The meeting will begin promptly at Eastern Time. We encourage you to arrive at the venue prior to the start time and you should allow ample time for the check-in procedures.

Although we are currently planning to hold the Special Meeting in person, we are monitoring the public health and travel concerns relating to COVID-19 and the related recommendations and protocols issued by federal, state and local governments. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described in this proxy statement) or in the event that it is not possible or advisable to hold our Special Meeting in person as originally planned, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. We will announce any such changes, including details on how to participate, in advance of the

meeting in a press release, a copy of which will be filed with the SEC as additional proxy solicitation materials and posted on our website. Accordingly, if you are planning to attend our Special Meeting, please monitor our website (at www.getweave.com) prior to the meeting date.

Q: What should I bring to check in at the Special Meeting?

A: All persons attending the Special Meeting will be required to present a current form of government-issued picture identification. If you are a stockholder of record and attend the Special Meeting, you may vote by ballot in person even if you have previously voted on a proxy card. If you hold shares beneficially in street name and wish to attend the Special Meeting and vote in person, you must provide a “legal proxy” from your bank, broker or other nominee and proof of ownership on the Record Date (such as a recent brokerage statement) or the voting instruction form mailed to you by your bank, broker or other nominee. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

Q: Can I submit questions prior to the meeting?

A: No, you may only submit questions during the meeting.

Q: How can I vote my shares in person at the Special Meeting?

A. You may attend the Special Meeting on November , 2022, at Eastern Time at 1331 West Powell Way, Lehi, Utah 84043. Shares held in your name as the stockholder of record may be voted at the Special Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. See below for more details. Even if you plan to attend the Special Meeting, we urge you to also vote by returning a proxy card or by submitting your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Special Meeting.

Q: How do I vote my shares without attending the Special Meeting?

A. Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Special Meeting. If you are a stockholder of record, you may vote by signing and returning the envelope provided with the proxy card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your brokerage firm, bank, broker-dealer, trust, or other similar organization or other holder of record. You may vote by mail or follow any other alternative voting procedure (such as telephone or internet voting) described on your proxy card. To use an alternative voting procedure, follow the instructions on each voting instruction form and/or proxy card that you receive. The alternative voting procedures are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may:

•vote by telephone or through the internet - in order to do so, please follow the instructions shown on your proxy card; or

•vote by mail –simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided.

Votes submitted by telephone or through the internet must be received by 11:59 p.m. Eastern Time, on November , 2022. If you vote by mail, your proxy card must be received by November , 2022. Submitting your proxy, whether by telephone, through the internet or by mail, will not affect your right to vote in person should you decide to attend and participate in the meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction form provided by your brokerage firm, bank, or other nominee as directed by your nominee. To vote in person at the Special Meeting, you must obtain a legal proxy from your nominee. Follow the instructions from your nominee included with our proxy materials or contact your nominee to request a proxy form.

Your vote is important. Whether or not you plan to participate in the Special Meeting, we urge you to vote by proxy to ensure that your vote is counted.

Q: How do I vote by internet or telephone?

A. If you wish to vote by internet or telephone, you may do so by following the voting instructions included on your proxy card or voting instruction form. Please have each proxy card or voting instruction form you received in hand when you vote over the internet or by telephone as you will need information specified therein to submit your vote. The giving of such a telephonic or internet proxy will not affect your right to vote in person (as detailed above) should you decide to attend the meeting.

The telephone and internet voting procedures are designed to authenticate stockholders' identities, to allow stockholders to give their voting instructions and to confirm that stockholders' instructions have been recorded properly.

Q: What shares can I vote?

A: Each share of Weave Communications common stock issued and outstanding as of the close of business on September , 2022 is entitled to vote on all items being voted on at the meeting. You may vote all shares owned by you as of September , 2022, including (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Q: How many votes am I entitled to per share?

A: Each holder of shares of common stock is entitled to one vote for each share of common stock held as of September , 2022.

Q: What is the quorum requirement for the meeting?

A: The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Special Meeting as of the Record Date must be present in person or represented by proxy at the Special Meeting in order to hold the Special Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Special Meeting if you are present and vote in person at the Special Meeting or if you have properly submitted a proxy.

Q: How are abstentions and broker non-votes treated?

A: Abstentions (i.e., shares present at the Special Meeting and marked “abstain”) are deemed to be shares presented or represented by proxy and entitled to vote, and are counted for purposes of determining whether a quorum is present. Abstentions have no effect on the Option Repricing Proposal.

A broker non-vote occurs when the beneficial owner of shares fails to provide the broker, bank or other nominee that holds the shares with specific instructions on how to vote on any "non-routine" matters brought to a vote at the stockholders meeting. In this situation, the broker, bank or other nominee will not vote on the “non-routine” matter. Broker non-votes are counted for purposes of determining whether a quorum is present and have no effect on the outcome of the Option Repricing Proposal.

Note that if you are a beneficial holder, brokers and other nominees will be entitled to vote your shares on “routine” matters without instructions from you. A broker or other nominee will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. The Option Repricing Proposal is considered a “non-routine” matter. Accordingly, your broker or nominee may not vote your shares on the Option Repricing Proposal without your instructions. We encourage you to provide voting instructions to your broker or other nominee whether or not you plan to attend the meeting.

Q: What is the vote required for the Option Repricing Proposal?

A: Approval of the Option Repricing Proposal will be obtained if the number of votes cast “FOR” the proposal at the Special Meeting exceeds the number of votes “AGAINST” the proposal.

Q: If I submit a proxy, how will it be voted?

A: When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Special Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in the Proxy Statement are properly presented at the Special Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Special Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described below under “Can I change my vote or revoke my proxy?”

Q: What should I do if I get more than one proxy card or voting instruction form?

A: Stockholders may receive more than one set of voting materials, including multiple copies of the proxy materials, proxy cards or voting instruction forms. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all of the proxy cards and voting instruction forms you receive relating to our Special Meeting to ensure that all of your shares are voted and counted.

Q: Can I change my vote or revoke my proxy?

A: You may change your vote or revoke your proxy at any time prior to the taking of the vote or the polls closing at the Special Meeting.

If you are the stockholder of record, you may change your vote by:

•granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method);

•providing a written notice of revocation to our Corporate Secretary at Weave Communications, Inc., 1331 W Powell Way, Lehi, Utah 84043, prior to your shares being voted;

•voting again via internet or by telephone no later than 11:59 p.m. Eastern Time on November , 2022; or

•attending the Special Meeting and voting at the meeting. Attending the Special Meeting will not cause your previously granted proxy to be revoked unless you specifically vote during the meeting.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Q. How can I get electronic access to the proxy materials?

A: Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Q: Is there a list of stockholders entitled to vote at the Special Meeting?

A: The names of stockholders of record entitled to vote will be available for inspection for ten (10) days prior to the meeting, the names of stockholders of record entitled to vote will be available for inspection by stockholders of record for any purpose germane to the meeting between the hours of 9:00 a.m. and 5:00 p.m., local time, at our offices located at 1331 W Powell Way, Lehi, Utah 84043. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to our Corporate Secretary at Weave Communications Inc., 1331 W Powell Way, Lehi, Utah 84043, or email ir@getweave.com to arrange for electronic access to the stockholder list.

Q: Who will tabulate the votes?

A: A representative of Computershare will serve as the Inspector of Elections and will tabulate the votes at the Special Meeting.

Q: Where can I find the voting results of the Special Meeting?

A: We will announce preliminary voting results at the Special Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Special Meeting.

Q: I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

A: The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process is commonly referred to as “householding.”

Brokers with account holders who are Weave Communications stockholders may be householding our proxy materials. A single set of proxy materials may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you notify your broker or Weave Communications that you no longer wish to participate in householding.

If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, you may (1) notify your broker, (2) direct your written request to: Investor Relations, Weave Communications, Inc., 1331 W Powell Way, Lehi, Utah 84043 or (3) contact our Investor Relations department by email at ir@getweave.com or by telephone at (385) 336-5493. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request householding of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

Q: What if I have questions about my Weave Communications shares or need to change my mailing address?

A: You may contact our transfer agent, Computershare Trust Company, N.A., by telephone at (800) 736-3001, through its website at www.computershare.com or by U.S. mail at 462 South 4th Street, Suite 1600, Louisville, KY 40202, if you have questions about your Weave Communications shares or need to change your mailing address.

Q: Who is soliciting my proxy and paying for the expense of solicitation?

A: The proxy for the Special Meeting is being solicited on behalf of our board of directors. We will pay the cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may, upon request, reimburse brokerage firms and other nominees for their expenses in forwarding proxy materials to beneficial owners. In addition to soliciting proxies by mail, we expect that our directors, officers and employees may solicit proxies in person or by telephone or facsimile. None of these individuals will receive any additional or special compensation for doing this, although we may reimburse these individuals for their reasonable out-of-pocket expenses. We do not expect to, but have the option to, retain a proxy solicitor. If you choose to access the proxy materials or vote via the internet or by phone, you are responsible for any internet access or phone charges you may incur.

Q: What are the requirements to propose actions to be included in our proxy materials for next year’s annual meeting of stockholders, or our 2023 Annual Meeting, or for consideration at our 2023 Annual Meeting?

A: Requirements for Stockholder Proposals to be considered for inclusion in our proxy materials for our 2023 Annual Meeting:

Our amended and restated bylaws provide that stockholders may present proposals for inclusion in our proxy statement by submitting their proposals in writing to the attention of our Corporate Secretary at our principal executive office. Our current principal executive office is located at 1331 W Powell Way, Lehi, Utah 84043. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and related SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. In order to be included in the proxy statement for our 2023 Annual Meeting, stockholder proposals must be received by our Corporate Secretary no later than December 15, 2022 and must otherwise comply with the requirements of Rule 14a-8 of the Exchange Act. If we do not receive a stockholder proposal by the deadline described above, we may exclude the proposal from our proxy statement for our annual stockholder meeting to be held in 2023.

Requirements for Stockholder Proposals to be presented at our 2023 Annual Meeting:

Our amended and restated bylaws provide that stockholders may present proposals to be considered at an annual meeting by providing timely notice to our Corporate Secretary at our principal executive office. To be timely for our 2023 Annual Meeting, our Corporate Secretary must receive the written notice at our principal executive office:

•not earlier than the close of business on January 26, 2023, and

•not later than the close of business on February 25, 2023.

If we hold our 2023 annual meeting of stockholders more than 30 days before or more than 60 days after May 26, 2023 (the one-year anniversary date of the Annual Meeting), then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received by our Secretary at our principal executive office:

•not earlier than the close of business on the 120th day prior to such annual meeting, and

•not later than the close of business on the later of (i) the 90th day prior to such annual meeting, or (ii) the tenth day following the day on which public announcement of the date of such annual meeting is first made.

To comply with the universal proxy rules (once effective), our stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice

that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 27, 2023.

A stockholder’s notice to our Corporate Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting the information required by our amended and restated bylaws. If a stockholder who has notified Weave Communications of such stockholder’s intention to present a proposal at an annual meeting does not appear to present such stockholder’s proposal at such meeting, Weave Communications does not need to present the proposal for vote at such meeting.

Q: How can I elect to receive my proxy materials electronically by email?

A: Registered stockholder (i.e., you hold your shares through our transfer agent, Computershare) – To receive future copies of our proxy materials by email, registered stockholders should go to www.envisionreports.com/WEAV and follow the enrollment instructions. Upon completion of enrollment, you will receive an email confirming the election to use the online services. The enrollment in the online program will remain in effect until the enrollment is cancelled.

Beneficial stockholders (i.e., you hold your shares through an intermediary, such as a bank or broker) – Most beneficial stockholders can elect to receive an email that will provide electronic versions of the proxy materials. To view a listing of participating brokerage firms and enroll in the online program, beneficial stockholders should go www.ProxyVote.com follow the enrollment instructions. The enrollment in the online program will remain in effect for as long as the brokerage account is active or until the enrollment is cancelled.

Enrolling to receive our future proxy materials online will save us the cost of printing and mailing documents, as well as help preserve our natural resources.

PROPOSAL: APPROVAL OF THE ONE-TIME REPRICING OF CERTAIN STOCK OPTIONS GRANTED UNDER THE 2015 EQUITY INCENTIVE PLAN

We are seeking stockholder approval of a one-time repricing (the “Option Repricing”) of stock options covering up to a total of 1,168,979 shares of our common stock granted from April 22, 2021 through September 6, 2021, which currently have per share exercise prices between $9.03 and $19.60 that are held by service providers of the Company as of the date the Option Repricing is approved by our stockholders (the “Repricing Date”). The repricing would only affect stock options held by "service providers" as defined under the 2015 Plan ("Eligible Participants") other than (x) any current or former member of our board of directors, (y) any of our current or former Chief Executive Officers and (z) former employees or other service providers. To qualify for the benefit, Eligible Participants must hold as of the Repricing Date options that: (i) were issued pursuant to the 2015 Plan, (ii) have a per share exercise price that is at least five percent (5%) greater than the Repriced Exercise Price (as defined below), and (iii) are outstanding and unexercised (the “Eligible Options”). On September , 2022, the fair market value of our common stock was $ per share.

On September 13, 2022, the compensation committee recommended and the board of directors approved, subject to the approval of the stockholders at the Special Meeting, the repricing of the Eligible Options, as of the Repricing Date, to the greatest of (x) $7.00, or (y) one hundred and ten percent (110%) of the volume weighted average per share closing price of the Company’s common stock on the New York Stock Exchange for the ten (10) trading days ending on and including the Repricing Date, rounded up to the nearest penny (the “Repriced Exercise Price”). In approving the Option Repricing, the board of directors considered the impact of the current exercise prices of the stock options on the incentives provided to service providers, the lack of retention value provided by the current stock options, and the impact of such options on the capital structure of the Company. There would be no other changes to our outstanding options under the 2015 Plan. The board of directors has determined that the Option Repricing is in the best interest of the Company and its stockholders. NONE OF OUR NON-EMPLOYEE DIRECTORS NOR ANY OF OUR CURRENT OR FORMER CHIEF EXECUTIVE OFFICERS WILL PARTICIPATE IN THE OPTION REPRICING. STOCKHOLDER APPROVAL IS NOT REQUIRED TO IMPLEMENT THE OPTION REPRICING UNDER THE 2015 PLAN. HOWEVER, THE BOARD OF DIRECTORS BELIEVES THAT SUBMITTING THE OPTION REPRICING TO THE STOCKHOLDERS FOR RATIFICATION IS GOOD CORPORATE GOVERNANCE. IF STOCKHOLDERS DO NOT APPROVE THE OPTION REPRICING, THEN WE WILL NOT INSTITUTE THE OPTION REPRICING DESCRIBED IN THIS PROPOSAL.

Specifics of the Option Repricing

Under the Option Repricing, on the Repricing Date, the Eligible Options held by individuals who are service providers as of the Repricing Date will automatically be repriced to the Repriced Exercise Price without any action on their part. If any holder of an Eligible Option ceases to be a service provider with the Company before the Repricing Date, his or her Eligible Options will not be repriced on the

Repricing Date. The following table provides information, as of September , 2022, regarding the Eligible Options eligible for the Option Repricing:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Position |

| Exercise Price of Eligible Options |

| Number of Shares Underlying Eligible Options |

| Weighted Average Price of Eligible Options |

| Weighted Average Remaining Term of Eligible Options (Years) |

| From: |

| To: |

|

|

|

| Staff Employees |

| $ | 9.03 | | | $ | 19.60 | | | 368,845 | | $ | 17.03 | | | 2.67 |

| Senior Management |

| $ | 9.03 | | | $ | 19.60 | | | 800,134 | | $ | 15.01 | | | 2.69 |

Option Repricing

The board of directors has determined that adverse changes in the market price of the Company’s common stock since the Eligible Options were granted could materially interfere with the Company’s efforts to retain the service of its existing service providers. Therefore, the board of directors recommends the Option Repricing to encourage an increasing alignment of service provider interests with those of our stockholders and increased service provider stake in the long-term performance and success of the Company. When the market price for the Company’s common stock is significantly below the applicable exercise price of an option (often referred to as “underwater” or “out-of-the-money”), for example, the board of directors believes that the option holder is not likely to exercise that option and will not have the desired incentive that the option was intended to provide.

Alternatives Considered

We considered several alternatives in arriving at our proposal, namely:

•We could do nothing. We are concerned that if we do not improve the Eligible Option holders’ prospects of receiving long-term value from their options, we will undermine their long-term commitment to us, which in turn could limit our ability to successfully implement our business plan. We will also forgo an opportunity to better align their interests with those of our stockholders.

•We could issue additional options or other types of equity awards. However, this would result in increasing our overhang of outstanding equity awards and lowering our shares available for future grant under our 2021 Plan (as defined below), and we believe that adjusting already outstanding options would better serve the interests of our stockholders.

•We considered an exchange of options of less than one for one as a means of offsetting the increase in value resulting from repricing options. Any exchange proposal would have

required compliance with tender offer rules and resulted in added costs, complexities and burdens on our resources.

Eligible Option Holders

The Option Repricing, if approved, would benefit 27% of our service providers. This amount includes some of our executive officers, other than our interim Chief Executive Officer. The following table lists, for each of our named executive officers, all of our current executive officers as a group, and all of our current service providers (other than our executive officers) as a group, the following information as of September , 2022: (i) the number of shares of our common stock subject to Eligible Options and (ii) the per share exercise prices of the Eligible Options. Each holder of an Eligible Option must continue to be a service provider of the Company through the Repricing Date in order to participate in the Option Repricing, and any such holder that terminates service with the Company before the Repricing Date will not have his or her Eligible Options repriced under the Option Repricing.

| | | | | | | | |

Name of Individual or Group | Number of Shares Subject to Eligible Options | Weighted Average Exercise Price of Eligible Options |

Brett White, Interim Chief Executive Officer, Chief Operating Officer, and President | – | – |

Roy Banks, Former Chief Executive Officer | – | – |

Wendy Harper, Former Chief Legal Officer | – | – |

Matt Hyde, Chief Revenue Officer | 298,702 | $ 15.26 |

| Executive Group | 348,702 | $ 15.88 |

| Non-Executive Officer Employee Group | 820,277 | $ 15.55 |

Accounting Treatment of the Option Repricing

Under Financial Accounting Standards Codification Topic 718, we will recognize any incremental compensation cost of the Eligible Options subject to the Option Repricing. We believe that the incremental compensation cost will be measured on the Repricing Date, if any, of the fair value of the repriced Eligible Options immediately following the Option Repricing over the fair value of the Eligible Options immediately prior to the Option Repricing.

Certain U.S. Federal Income Tax Consequences

For purposes of the incentive stock option rules, the repricing of an Eligible Option is treated as a new option granted as of the Repricing Date. The rules concerning the federal income tax consequences with respect to options granted pursuant to the 2015 Plan are quite technical. Moreover, the applicable statutory provisions are subject to change, as are their interpretations and applications, which may vary in

individual circumstances. Therefore, the following is designed to provide a general understanding of the U.S. federal income tax consequences with respect to such grants. In addition, the following discussion does not set forth any gift, estate, social security or state or local tax consequences that may be applicable and is limited to the U.S. federal income tax consequences to individuals who are citizens or residents of the United States, other than those individuals who are taxed on a residence basis in a foreign country.

Incentive Stock Options

No taxable income is reportable when an incentive stock option is granted or exercised, although the exercise may subject the optionee to the alternative minimum tax or may affect the determination of the optionee’s alternative minimum tax (unless the shares are sold or otherwise disposed of in the same year). If the optionee exercises the option and then later sells or otherwise disposes of the shares acquired more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the optionee exercises the option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option. For purposes of the alternative minimum tax, the difference between the option exercise price and the fair market value of the shares on the exercise date is treated as an adjustment item in computing the optionee’s alternative minimum taxable income in the year of exercise. In addition, special alternative minimum tax rules may apply to certain subsequent disqualifying dispositions of the shares or provide certain basis adjustments or tax credits for alternative minimum tax purposes.

Nonqualified Stock Options

No taxable income is reportable when a nonstatutory stock option with a per share exercise price at least equal to the fair market value of a share of the underlying stock on the date of grant is granted to an optionee. Upon exercise, the optionee will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the exercised shares subject to the option. Any taxable income recognized in connection with an option exercise by a service provider of the Company is subject to tax withholding by us. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss to the optionee.

Tax Effect for the Company

We generally will be entitled to a tax deduction in connection with the repriced Eligible Options in an amount equal to the ordinary income realized by the holder at the time the holder recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules limit the deductibility of compensation paid to our Chief Executive Officer and other “covered employees” within the meaning of

Code Section 162(m). Under Code Section 162(m), the annual compensation paid to any of these specified service providers will be deductible only to the extent that it does not exceed $1,000,000.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF ONE-TIME REPRICING OF CERTAIN STOCK OPTIONS GRANTED UNDER THE 2015 EQUITY INCENTIVE PLAN.

INTEREST OF CERTAIN PERSONS IN THE MATTER TO BE ACTED UPON

Neither any current or former member of our board of directors nor any of our current or former Chief Executive Officers shall be eligible to participate in the Option Repricing. However, if the Option Repricing Proposal is approved by stockholders, then the executive officers listed in the table below will have their Eligible Options adjusted to reduce the exercise price per share of each outstanding option to the Repriced Exercise Price. Our other current executive officers, including our Chief Financial Officer and Chief Legal Officer, do not hold any Eligible Options.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Shares Subject to Option Repricing | | Grant Date | | Current Option Exercise Price |

Matt Hyde, Chief Revenue Officer | | 298,702 | | 07/01/2021 | | $15.26 |

Ashish Chaudhary, Chief Technology Officer | | 50,000 | | 09/06/2021 | | $19.60 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of September , 2022 by:

•each stockholder known by us to be the beneficial owner of more than 5% of our common stock;

•each of our directors and director nominees;

•each of our named executive officers; and

•all of our directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned by them, subject to community property laws where applicable. Shares of our common stock subject to stock options that are currently exercisable or exercisable within 60 days of September , 2022 are deemed to be outstanding and to be beneficially owned by the person holding the stock options for the purpose of computing the percentage ownership of that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Percentage ownership of our common stock is based on shares of our common stock outstanding on September , 2022. Unless otherwise indicated, the address of each of the individuals and entities named below is c/o Weave Communications, Inc., 1331 W Powell Way, Lehi, Utah 84043.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Common Stock | | Options Exercisable within 60 days | | Aggregate Number of Shares Beneficially Owned | | % of Total Voting Power |

| 5% Stockholders |

| | | | | | | | |

Entities affiliated with Catalyst Investors QP IV, L.P.(1) | | 10,928,422 | | – | |

| | % |

Entities affiliated with Crosslink Capital(2) | | 9,589,063 | | – | |

| | % |

Entities affiliated with Bessemer Venture Partners(3) | | 7,566,659 | | – | |

| | % |

Entities affiliated with Tiger Global Private Investment Partners XI, L.P.(4) | | 7,032,570 | | – | |

| | % |

Entities affiliated with Pelion Ventures VI, L.P.(5) | | 5,946,330 | | – | |

| | % |

LEC Weave Holdings LLC(6) | | 3,500,634 | | – | |

| | % |

| | | | | | | | |

| Named Executive Officers and Directors: |

Tyler Newton(1) | | 10,928,422 | | – | |

| | % |

David Silverman(2) | | 9,589,063 | | – | |

| | % |

Blake G Modersitzki(5)(7) | | 5,983,330 | | – | |

| | % |

| Roy Banks | | 130,435 | |

| |

| | % |

| Erin Goodsell | | – | | – | | – | | * |

| Matt Hyde | | – | |

| |

| | * |

| Stuart C. Harvey, Jr. | | 2,660 | |

| |

| | * |

| Brett White | | – | |

| |

| | * |

| Debora Tomlin | | – | | – | | – | | * |

| George P. Scanlon | | – | | – | | – | | * |

| | | | | | | | |

All executive officers and directors as a group (10 persons) | |

| |

| |

| | % |

_________

* Represents beneficial ownership of less than one percent of the outstanding shares of our common stock.

(1) Based solely on a Schedule 13G filing by Catalyst Investors IV, L.P. on February 14, 2022, reporting shared voting and dispositive power over the shares. The stockholder’s address is 711 Fifth Avenue, Suite 600, New York, New York 10022.

(2) Based solely on a Schedule 13D filing by Crosslink Capital, Inc. on November 22, 2021, reporting shared voting and dispositive power over the shares. The stockholder’s address is 2180 Sand Hill Road, Suite 200, Menlo Park, CA 94025.

(3) Based solely on a Schedule 13G filing by Deer IX & Co. Ltd. on February 15, 2022, reporting sole voting and dispositive power over the shares. The stockholder’s address is c/o Bessemer Venture Partners,1865 Palmer Avenue; Suite 104, Larchmont, NY 10583.

(4) Based solely on a Schedule 13G filing by Tiger Global Management, LLC on November 17, 2021, reporting shared voting and dispositive power over the shares. The stockholder’s address is 9 West 57th Street, 35th Floor, New York, New York 10019.

(5) Based solely on a Schedule 13G filing by Pelion Ventures VI, L.P. on February 14, 2022, reporting shared voting and dispositive power over the shares. The stockholder’s address is c/o Pelion Venture Partners, 2750 E. Cottonwood Parkway, Suite 600, Salt Lake City, UT 84121.

(6) Based solely on a Schedule 13G filing by Lead Edge Capital Management, LLC, on February 14, 2022, as amended on August 4, 2022, reporting shared voting and dispositive power over the shares. The stockholder’s address is 96 Spring Street, 5th Floor, New York, NY 10012.

(7) Includes 37,000 shares directly held by Mr. Modersitzki.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Our named executive officers for the year ended December 31, 2021, which consisted of our principal executive officer and the next two most highly compensated executive officers, are:

•Roy Banks, our Former Chief Executive Officer;

•Wendy Harper, our Former Chief Legal Officer and Corporate Secretary; and

•Matt Hyde, our Chief Revenue Officer.

Summary Compensation Table

The following table provides information concerning compensation awarded to, earned by or paid to each of our named executive officers during 2020 and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($)(1) | | Option Awards ($)(2) | | All Other Compensation ($)(3) | | Total ($) |

Roy Banks

Former Chief Executive Officer and Director | | 2021 | | 358,455 | | 100,000 | | — | | 11,142 | | 469,597 |

| | 2020(4) | | 29,167 | | — | | 6,270,746 | | — | | 6,299,913 |

| | | | | | | | | | | | |

Wendy Harper

Former Chief Legal Officer and

Corporate Secretary | | 2021(5) | | 257,680 | | 250,250 | | 5,447,557 | | 7,593 | | 5,963,080 |

| | | | | | | | | | | | |

Matt Hyde

Chief Revenue Officer | | 2021(6) | | 208,985 | | 56,667 | | 2,715,140 | | 7,797 | | 2,988,589 |

| | | | | | | | | | | | |

_______________________

(1) For Messrs. Banks and Hyde, the amounts reported in this column represents their annual bonus earned for 2021. For Ms. Harper, the amount represents (i) a signing bonus of $100,000 paid in 2021 upon commencement of her employment pursuant to the terms of her February 2021 offer letter, (ii) a special bonus of $64,000 paid in 2021 upon the completion of our initial public offering, and (iii) an annual bonus earned for 2021 of $86,250. As further described below under “—2021 Bonus Plan,” 2021 annual bonuses for our named executive officers were paid pursuant to our 2021 Bonus Plan.

(2) The amounts reported in this column represent the aggregate grant date fair value of the stock options granted under the 2015 Plan to our named executive officers in 2020 and 2021 as computed in accordance with FASB ASC Topic 718. The assumptions used in calculating the dollar amount recognized for financial statement reporting purposes of the equity awards reported in this column for 2021 are set forth in Note 13 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021. The grant date fair value of the options was determined using the Black-Scholes option pricing model based on the fair market value on the date of grant. Note that the amounts reported in this column reflect the accounting value for these equity awards and do not correspond to the actual economic value that may be received by our named executive officers from the equity awards.

(3) Represents matching Company contributions under our 401(k) plan.

(4) Mr. Banks was hired as our Chief Executive Officer in December 2020. The amount listed above for Mr. Banks’ salary in 2020 represents the prorated portion of the salary to which he was entitled to based on the duration of his employment in 2020. Mr. Banks resigned from his position as our Chief Executive Officer effective August 15, 2022.

(5) Ms. Harper was hired as our Chef Legal Officer in March 2021. The amount listed above for Ms. Harper’s salary represents the prorated portion of the salary to which she was entitled to based on the duration of her employment in 2021. Ms. Harper’s annual base salary rate rose from $320,000 per year to $345,000 per year in November 2021 pursuant to her Employment Agreement with us dated November 1, 2021. Ms. Harper resigned from her position as our Chief Legal Officer effective May 2, 2022.

(6) Mr. Hyde was hired as our Chief Revenue Officer in March 2021. The amount listed above for Mr. Hyde’s salary represents the prorated portion of the salary to which he was entitled to based on the duration of his employment in 2021. Mr. Hyde’s annual base salary rate rose from $270,000 per year to $300,000 per year in November 2021 pursuant to his Employment Agreement with us dated November 1, 2021.

2021 Bonus Plan

At the start of 2021, we approved a bonus plan for our executive leadership team for 2021, the 2021 Bonus Plan. Each participant in the 2021 Bonus Plan was eligible to receive a cash bonus based on the achievement of robust Company-based performance goals. To be eligible to earn a bonus under the 2021 Bonus Plan, a participant had to remain continually employed by, and in good standing with, us through the date when such bonus is paid by the Company. All of our named executive officers participated in the 2021 Bonus Plan. Although the Company-based goals were not achieved at the threshold levels, for retention purposes, the compensation committee determined it was appropriate to payout bonuses based on individual performance and achievement. For our named executive officers, these payouts ranged from approximately 38% to 63% of their respective target amounts.

Executive Employment Arrangements

Roy Banks. Pursuant to his employment agreement with us which became effective in November 2021, Mr. Banks was entitled to an annual base salary of $425,000 and an annual cash incentive bonus based upon the achievement of certain objective or subjective criteria determined by our compensation committee, with a target amount of up to $200,000 for fiscal year 2021 and up to 100% of his base salary for fiscal year 2022 and thereafter. Mr. Banks’ employment was “at will” and was terminable by either party at any time. The agreement had an initial three-year term from November 2021, which would automatically renew for subsequent one-year periods unless either party notified the other of an intention not to renew the agreement. Mr. Banks was also entitled to severance payments and benefits upon a termination of his employment by us without cause or by Mr. Banks for good reason, as are explained below under “Potential Payments Upon Termination or Change in Control.”

Wendy Harper. Pursuant to her employment agreement with us which became effective in November 2021, Ms. Harper was entitled to an annual base salary of $345,000 and an annual cash incentive bonus based upon the achievement of certain objective or subjective criteria determined by our compensation committee, with a target amount of up to $138,000 for fiscal year 2021 and up to 45% of her base salary for fiscal year 2022 and thereafter. Ms. Harper’s employment was “at will” and was

terminable by either party at any time. The agreement had an initial three-year term from November 2021, which would automatically renew for subsequent one-year periods unless either party notified the other of an intention not to renew the agreement. Ms. Harper was also entitled to severance payments and benefits upon a termination of her employment by us without cause or by Ms. Harper for good reason, as are explained below under “Potential Payments Upon Termination or Change in Control.”

Matt Hyde. Pursuant to his employment agreement with us which became effective in November 2021, Mr. Hyde is entitled to an annual base salary of $300,000 and an annual cash incentive bonus based upon the achievement of certain objective or subjective criteria determined by our compensation committee, with a target amount of up to $150,000 for fiscal year 2021 and up to 50% of his base salary for fiscal year 2022 and thereafter. Mr. Hyde’s employment is “at will” and may be terminated by either party at any time. The agreement has an initial three-year term from November 2021, which will automatically renew for subsequent one-year periods unless either party notifies the other of an intention not to renew the agreement. Mr. Hyde is also entitled to severance payments and benefits upon a termination of his employment by us without cause or by Mr. Hyde for good reason, as are explained below under “Potential Payments Upon Termination or Change in Control.”

Potential Payments Upon Termination or Change in Control

Roy Banks

Under our employment agreement with Roy Banks, if his employment was terminated by us without cause or by Mr. Banks for good reason outside of the period beginning three months prior to and ending 12 months following a change in control (as such terms are defined in his employment agreement) and Mr. Banks executed a release of claims, Mr. Banks would be entitled to:

•the aggregate amount of his annual base salary, payable over a 12 month period from the date of termination; and

•reimbursement for COBRA premiums in an amount equal to his (and his eligible dependents’) monthly health premiums, at the coverage level in effect immediately prior to his termination, until the earlier of (a) 12 months following the date of termination and (b) the date that Mr. Banks (and his eligible dependents) become covered under similar plans.

In addition, Mr. Banks’s employment agreement provided that if his employment was terminated by us without cause or by him for good reason in the period beginning three months prior to and ending 12 months following a change in control and Mr. Banks executed a release of claims, he would be entitled to receive:

•a lump sum payment in the aggregate amount of 18 months of base salary;

•a lump sum cash payment equal to his prorated annual bonus for the calendar year of termination based on performance at 100% of target;

•reimbursement for COBRA premiums in an amount equal to his (and his eligible dependents’) monthly health premiums, at the coverage level in effect immediately prior to termination, until the earlier of (a) 18 months following the date of termination and (b) the date that Mr. Banks (and his eligible dependents) become covered under similar plans; and

•his outstanding unvested equity awards that are subject to time vesting will vest in full.

Wendy Harper and Matt Hyde

Under our employment agreements with Wendy Harper and Matt Hyde, if the respective named executive officer’s employment was or is terminated by us without cause, or, in the case of Ms. Harper, by her for good reason, outside of the period beginning three months prior to and ending 12 months following a change in control (as such terms are defined in their respective employment agreements) and the named executive officer executes a release of claims, then she or he, as the case may be, would or will be entitled to:

•the aggregate amount of the named executive officer’s annual base salary, payable over a 12 month period from the date of termination; and

•reimbursement for COBRA premiums in an amount equal to the named executive officer’s (and her or his eligible dependents’) monthly health premiums, at the coverage level in effect immediately prior to termination, until the earlier of (a) 12 months following the date of termination and (b) the date that the named executive officer (and her or his eligible dependents) become covered under similar plans.

In addition, Ms. Harper’s and Mr. Hyde’s employment agreements provide that if the respective named executive officer’s employment was or is terminated by us without cause or by her or him for good reason in the period beginning three months prior to and ending 12 months following a change in control and the named executive officer executes a release of claims, then she or he, as the case may be, would or will be entitled to receive:

•a lump sum payment in the aggregate amount of 12 months of base salary;

•a lump sum cash payment equal to the named executive officer’s prorated annual bonus for the calendar year of termination based on performance at 100% of target;

•reimbursement for COBRA premiums in an amount equal to the named executive officer’s (and her or his eligible dependents’) monthly health premiums, at the coverage level in effect immediately prior to termination, until the earlier of (a) 12 months following the date of

termination and (b) the date that the named executive officer (and her or his eligible dependents) become covered under similar plans; and

•any outstanding unvested equity awards of the named executive officer that are subject to time vesting will vest in full.

Hedging and Pledging Policy

Under the terms of our insider trading policy, no employees, contractors, consultants and members of our board of directors (and their respective family members and any affiliated entities, such as venture capital funds) may engage in hedging or monetization transactions involving our securities, such as prepaid variable forward contracts, equity swaps, collars or exchange funds. In addition, such persons may not hold our securities in a margin account or pledge our securities as collateral for a loan unless the pledge has been approved by our Compliance Officer.

Outstanding Equity Awards at Fiscal Year-End Table

The following table provides information regarding the outstanding stock option awards held by our named executive officers as of December 31, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Option Awards(1) |

| | | | Number of Securities Underlying Unexercised Options(2) | | | | |

| Name | | Grant Date | | Exercisable | | Unexercisable | | Exercise Price(3) | | Expiration Date |

| Roy Banks | | 12/23/2020 | | 488,132 | | 1,464,398 | | $10.76 | | 12/22/2030 |

| | | | | | | | | | |

| Wendy Harper | | 7/1/2021 | | — | | 600,000 | | 15.26 | | 6/30/2031 |

| | | | | | | | | | |

| Matt Hyde | | 7/1/2021 | | — | | 298,702 | | 15.26 | | 6/30/2031 |

_______________________

(1) All of the outstanding equity awards were granted under our 2015 Plan and are subject to acceleration of vesting upon the circumstances described in “—Potential Payments upon Termination or Change in Control” above.

(2) Each of these stock options vests as to 25% of the shares on the one-year anniversary of the vesting commencement date, and as to 1/48 of the shares each month thereafter over the following three years. The vesting commencement dates are December 1, 2020, March 15, 2021 and March 22, 2021 for Mr. Banks, Ms. Harper and Mr. Hyde, respectively.

(3) This column represents the fair market value of a share of our common stock on the date of grant as determined by our board of directors.

Director Compensation

The following table provides information concerning compensation awarded to, earned by or paid to each person who served as a non‑employee member of our board of directors during the fiscal year ended December 31, 2021. Mr. Banks is not included in the table below, as he is employed as our Chief Executive Officer, and receives no compensation for his service as a director. The compensation received by Mr. Banks as an employee is shown in “Executive Compensation-Summary Compensation Table” below.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($)(1) | | Option Awards ($)(2) | | Total ($) |

| Stuart C. Harvey Jr. | | 7,535 | | N/A | | 7,535 |

Blake G Modersitzki | | 6,003 | | N/A | | 6,003 |

Tyler Newton(3) | | 7,535 | | N/A | | 7,535 |

David Silverman(3) | | 6,258 | | N/A | | 6,258 |

| Debora Tomlin | | 5,236 | | N/A | | 5,236 |

| Brett White | | 7,024 | | N/A | | 7,024 |

_______________________

(1) Beginning November 15, 2021, our non-employee directors became entitled to receive annual fees payable quarterly in arrears for service on our board of directors and committees thereof pursuant to our non-employee director compensation policy, as described further below under “—Non-Employee Director Compensation Arrangements.”

(2) Our non‑employee directors held the following number of stock options as of December 31, 2021:

| | | | | | | | |

| Name | | Shares Subject to Outstanding Stock Options |

| Stuart C. Harvey Jr. | | 106,666 |

| Blake G Modersitzki | | N/A |

| Tyler Newton | | N/A |

| David Silverman | | N/A |

| Debora Tomlin | | 106,666 |

| Brett White | | 106,666 |

(3) Messrs. Newton and Silverman do not directly receive any compensation for their services as directors of the Company. Mr. Newton serves as a partner to Catalyst Investors, and Mr. Silverman is a control person of Crosslink LLC. Due to their services, all compensation and equity awards that Messrs. Newton and Silverman receive are payable and transferred to Catalyst Investors and Crosslink LLC, respectively.

Non-Employee Director Compensation Arrangements

Prior to the adoption of our non-employee director compensation policy, we had neither a formal compensation policy nor a formal policy of reimbursing expenses incurred by our non-employee directors in connection with their service. We reimbursed our non-employee directors for reasonable expenses incurred in connection with their attendance at board of directors or committee meetings and occasionally granted stock options, typically in connection with their appointment to our board of directors.

In connection with our initial public offering, our board of directors engaged Compensia, Inc., an independent compensation consultant, to assist with the development and adoption of our non-employee director compensation policy. Our policy, which became effective on November 15, 2021, is designed to obtain and retain the services of qualified persons to serve as members of our board of directors.

The policy provides for the following annual cash retainers, which are payable quarterly in arrears and pro-rated for partial quarters of service:

Annual Cash Retainer

•Non-employee member of board of directors: $35,000.

•Non-employee Chairperson: $20,000 (in addition to non-employee member retainer above).

•Non-Employee Lead Independent Director: $15,000 (in addition to non-employee member retainer above)

Annual Committee Cash Retainer:

•Audit Committee: $20,000 for Chair and $10,000 for other members.

•Compensation Committee: $12,000 for Chair and $6,000 for other members.

•Nominating and Governance Committee: $8,000 for Chair and $4,000 for other members.

Equity Grants

The policy also provides for grants of stock options or restricted stock units (in the discretion of our board of directors) to purchase shares of our common stock under the 2021 Equity Incentive Plan, or 2021 Plan, to the non-employee directors upon their initial election or appointment to our board of directors and annually during their continued service thereafter. Any stock options granted will have an exercise price equal to 100% of the fair market value of our common stock on the date of grant.

Each non-employee director who is elected or appointed for the first time to our board of directors (on or after November 15, 2021) will be granted an equity award with a grant date value of $300,000. The

initial grant will vest in three annual installments on the first, second and third anniversary of the grant date, subject to the director’s continued service through such vesting dates.

In addition, on the date of each annual meeting of our stockholders beginning with the 2022 annual meeting, we will grant each continuing non-employee director who has served on our board of directors for at least 6 months prior to the annual meeting an equity award with a grant date value of $150,000. The annual equity award will vest in full on the earlier of the one-year anniversary of the date of grant and the date of the next annual meeting of our stockholders, subject to the director’s continued service through such vesting date.

All equity awards to our non-employee directors will vest in full immediately prior to any change in control of ours.

Expense Reimbursement

Our non-employee director compensation policy also provides that we will reimburse our non-employee directors for reasonable expenses incurred in connection with the performance of their duties, in accordance with our travel and expense policy as in effect from time to time.

The non-employee director compensation program is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee during 2021 included Messrs. Modersitzki and Newton and Ms. Tomlin. None of the members of our compensation committee in 2021 was at any time during 2021 or at any other time one of our officers or employees, and other than Mr. Modersitzki, none had or have any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. During 2021, none of our executive officers served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation committee.

In November 2021, entities affiliated with Pelion Ventures VI, L.P., a holder of more than 5% of our common stock and an affiliate of a member of our board of directors, Blake G Modersitzki, purchased approximately 400,000 shares in our initial offering public offering at our initial public offering price of $24.00 per share.

OTHER MATTERS

Our board of directors does not presently intend to bring any other business before the Special Meeting and, so far as is known to our board of directors, no matters are to be brought before the Special Meeting except as specified in the Notice of Special Meeting of Stockholders. As to any business that may arise and properly come before the Special Meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

By Order of the Board of Directors,

Brett White

Interim Chief Executive Officer

Lehi, Utah

September , 2022

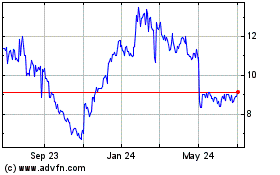

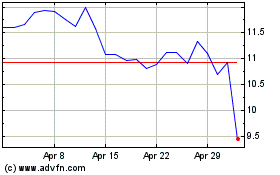

Weave Communications (NYSE:WEAV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Weave Communications (NYSE:WEAV)

Historical Stock Chart

From Nov 2023 to Nov 2024