Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

July 26 2023 - 11:48AM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

l

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

92

.9

%

Brazil

:

3

.1

%

50,495

Atacadao

SA

$

95,052

0.1

34,776

Banco

do

Brasil

SA

307,160

0.3

76,941

BB

Seguridade

Participacoes

SA

471,507

0.4

81,277

Cia

Siderurgica

Nacional

SA

195,130

0.2

11,500

Engie

Brasil

Energia

SA

96,156

0.1

93,587

(1)(2)

Hapvida

Participacoes

e

Investimentos

S/A

73,419

0.1

17,758

Hypera

SA

143,827

0.1

83,977

Natura

&

Co.

Holding

SA

229,586

0.2

37,410

Raia

Drogasil

SA

210,156

0.2

55,948

Rumo

SA

229,271

0.2

21,669

Telefonica

Brasil

SA

172,470

0.2

98,362

TOTVS

SA

560,318

0.5

44,149

Vale

SA

562,338

0.5

3,346,390

3.1

Chile

:

0

.4

%

166,800

Cencosud

SA

315,065

0.3

708,473

Enel

Americas

SA

91,349

0.1

406,414

0.4

China

:

28

.2

%

243,100

(2)

Alibaba

Group

Holding

Ltd.

2,419,424

2.3

374,000

Aluminum

Corp.

of

China

Ltd.

-

Class

H

165,509

0.2

10,200

Anhui

Gujing

Distillery

Co.

Ltd.

-

Class

B

167,133

0.2

17,578

Anhui

Yingjia

Distillery

Co.

Ltd.

-

Class

A

139,746

0.1

31,000

ANTA

Sports

Products

Ltd.

316,842

0.3

7,950

Autohome,

Inc.,

ADR

227,529

0.2

10,650

(2)

Baidu,

Inc.

-

Class

A

163,522

0.2

1,871,000

Bank

of

China

Ltd.

-

Class

H

732,417

0.7

212,500

Bank

of

Jiangsu

Co.

Ltd.

-

Class

A

221,980

0.2

26,000

BYD

Co.

Ltd.

-

Class

H

785,134

0.7

43,500

BYD

Electronic

International

Co.

Ltd.

126,623

0.1

65,500

By-health

Co.

Ltd.

-

Class

A

209,919

0.2

95,600

CECEP

Solar

Energy

Co.

Ltd.

-

Class

A

94,067

0.1

26,700

CETC

Cyberspace

Security

Technology

Co.

Ltd.

-

Class

A

111,191

0.1

2,674,000

China

Cinda

Asset

Management

Co.

Ltd.

-

Class

H

296,996

0.3

950,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

451,802

0.4

160,000

China

Conch

Venture

Holdings

Ltd.

200,987

0.2

1,504,000

China

Construction

Bank

Corp.

-

Class

H

962,081

0.9

683,000

China

Everbright

Bank

Co.

Ltd.

-

Class

H

210,156

0.2

191,500

China

Hongqiao

Group

Ltd.

135,905

0.1

177,000

China

Longyuan

Power

Group

Corp.

Ltd.

-

Class

H

198,682

0.2

151,000

China

Medical

System

Holdings

Ltd.

212,590

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

104,000

China

Meidong

Auto

Holdings

Ltd.

$

133,843

0.1

51,000

China

Mengniu

Dairy

Co.

Ltd.

198,219

0.2

136,500

China

Merchants

Bank

Co.

Ltd.

-

Class

H

634,746

0.6

145,485

China

Merchants

Port

Holdings

Co.

Ltd.

211,040

0.2

260,000

China

Oilfield

Services

Ltd.

-

Class

H

264,723

0.2

50,500

China

Overseas

Land

&

Investment

Ltd.

102,482

0.1

128,400

China

Pacific

Insurance

Group

Co.

Ltd.

-

Class

H

325,004

0.3

456,000

China

Railway

Group

Ltd.

-

Class

H

300,474

0.3

34,000

China

Resources

Land

Ltd.

127,260

0.1

103,000

(1)

China

Resources

Pharmaceutical

Group

Ltd.

98,886

0.1

50,000

China

Shenhua

Energy

Co.

Ltd.

-

Class

H

158,066

0.1

2,878,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

316,096

0.3

72,000

Chinasoft

International

Ltd.

42,955

0.0

105,000

CITIC

Securities

Co.

Ltd.

-

Class

H

193,340

0.2

152,300

COSCO

SHIPPING

Development

Co.

Ltd.

-

Class

A

53,589

0.1

94,500

COSCO

SHIPPING

Holdings

Co.

Ltd.

-

Class

H

83,271

0.1

250,000

COSCO

SHIPPING

Ports

Ltd.

157,408

0.1

63,360

CSPC

Pharmaceutical

Group

Ltd.

55,201

0.1

44,000

Dong-E-E-Jiao

Co.

Ltd.

-

Class

A

305,222

0.3

720,000

Dongfeng

Motor

Group

Co.

Ltd.

-

Class

H

311,799

0.3

410,000

Far

East

Horizon

Ltd.

343,551

0.3

352,000

Fosun

International

Ltd.

232,158

0.2

16,800

(1)

Ganfeng

Lithium

Group

Co.

Ltd.

-

Class

H

106,340

0.1

5,100

G-bits

Network

Technology

Xiamen

Co.

Ltd.

-

Class

A

401,911

0.4

281,000

Geely

Automobile

Holdings

Ltd.

327,364

0.3

53,400

GRG

Banking

Equipment

Co.

Ltd.

-

Class

A

93,874

0.1

30,000

(1)

Hansoh

Pharmaceutical

Group

Co.

Ltd.

49,932

0.0

23,800

Henan

Shenhuo

Coal

&

Power

Co.

Ltd.

-

Class

A

42,898

0.0

43,500

Hengan

International

Group

Co.

Ltd.

184,941

0.2

16,500

Hubei

Jumpcan

Pharmaceutical

Co.

Ltd.

-

Class

A

73,609

0.1

53,167

Hubei

Xingfa

Chemicals

Group

Co.

Ltd.

-

Class

A

160,012

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

1,265,592

Industrial

&

Commercial

Bank

of

China

Ltd.

-

Class

H

$

675,877

0.6

59,300

Industrial

Bank

Co.

Ltd.

-

Class

A

138,212

0.1

57,437

Inner

Mongolia

ERDOS

Resources

Co.

Ltd.

-

Class

A

111,962

0.1

72,900

Inner

Mongolia

Yitai

Coal

Co.

Ltd.

-

Class

B

94,048

0.1

17,400

Jafron

Biomedical

Co.

Ltd.

-

Class

A

67,711

0.1

35,452

JD.com,

Inc.

-

Class

A

577,570

0.5

23,400

Jiangsu

Zhongtian

Technology

Co.

Ltd.

-

Class

A

47,823

0.0

159,600

Joincare

Pharmaceutical

Group

Industry

Co.

Ltd.

-

Class

A

308,357

0.3

25,700

Keda

Industrial

Group

Co.

Ltd.

-

Class

A

38,394

0.0

105,000

Kingboard

Holdings

Ltd.

282,915

0.3

119,800

Kingsoft

Corp.

Ltd.

435,529

0.4

426,000

Kunlun

Energy

Co.

Ltd.

339,797

0.3

43,500

Li

Ning

Co.

Ltd.

233,726

0.2

17,500

(1)

Longfor

Group

Holdings

Ltd.

33,701

0.0

45,500

LONGi

Green

Energy

Technology

Co.

Ltd.

-

Class

A

184,502

0.2

72,320

(1)(2)

Meituan

-

Class

B

1,015,465

0.9

46,900

NetEase,

Inc.

797,715

0.7

34,200

(1)

Nongfu

Spring

Co.

Ltd.

-

Class

H

183,366

0.2

12,200

Ovctek

China,

Inc.

-

Class

A

48,012

0.0

8,291

(2)

PDD

Holdings,

Inc.,

ADR

541,568

0.5

1,080,000

People's

Insurance

Co.

Group

of

China

Ltd.

-

Class

H

408,362

0.4

578,000

PetroChina

Co.

Ltd.

-

Class

H

373,613

0.3

42,450

(1)

Pharmaron

Beijing

Co.

Ltd.

-

Class

H

156,780

0.1

440,000

PICC

Property

&

Casualty

Co.

Ltd.

-

Class

H

524,881

0.5

45,400

Ping

An

Bank

Co.

Ltd.

-

Class

A

74,218

0.1

91,000

Ping

An

Insurance

Group

Co.

of

China

Ltd.

-

Class

H

577,503

0.5

264,000

(1)

Postal

Savings

Bank

of

China

Co.

Ltd.

-

Class

H

165,873

0.2

6,427

Qifu

Technology,

Inc.

88,371

0.1

33,600

Shandong

Weigao

Group

Medical

Polymer

Co.

Ltd.

-

Class

H

49,612

0.0

36,950

Shanghai

Baosight

Software

Co.

Ltd.

-

Class

B

122,848

0.1

140,900

Shanghai

Construction

Group

Co.

Ltd.

-

Class

A

52,372

0.1

42,500

Shanghai

Fosun

Pharmaceutical

Group

Co.

Ltd.

-

Class

H

115,757

0.1

4,100

Shanxi

Xinghuacun

Fen

Wine

Factory

Co.

Ltd.

-

Class

A

121,268

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China:

(continued)

4,500

Shenzhen

Mindray

Bio-

Medical

Electronics

Co.

Ltd.

-

Class

A

$

190,639

0.2

66,700

Shenzhen

Senior

Technology

Material

Co.

Ltd.

-

Class

A

151,979

0.1

16,800

Sunny

Optical

Technology

Group

Co.

Ltd.

158,138

0.1

45,300

Suzhou

Dongshan

Precision

Manufacturing

Co.

Ltd.

-

Class

A

161,934

0.2

83,400

Tencent

Holdings

Ltd.

3,300,500

3.1

96,000

Tingyi

Cayman

Islands

Holding

Corp.

143,807

0.1

269,000

(1)

Topsports

International

Holdings

Ltd.

209,020

0.2

130,000

TravelSky

Technology

Ltd.

-

Class

H

237,159

0.2

151,000

Uni-President

China

Holdings

Ltd.

131,230

0.1

37,600

Weihai

Guangwei

Composites

Co.

Ltd.

-

Class

A

155,155

0.1

67,500

Xiamen

C

&

D,

Inc.

-

Class

A

110,335

0.1

37,600

Yintai

Gold

Co.

Ltd.

-

Class

A

68,533

0.1

9,230

YongXing

Special

Materials

Technology

Co.

Ltd.

-

Class

A

82,235

0.1

119,200

Youngor

Group

Co.

Ltd.

-

Class

A

115,270

0.1

6,961

Yum

China

Holdings,

Inc.

393,018

0.4

3,100

(2)

Yunnan

Energy

New

Material

Co.

Ltd.

-

Class

A

39,737

0.0

48,268

Zangge

Mining

Co.

Ltd.

-

Class

A

156,107

0.1

170,000

Zhejiang

Expressway

Co.

Ltd.

-

Class

H

125,905

0.1

63,000

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

265,123

0.2

126,000

Zijin

Mining

Group

Co.

Ltd.

-

Class

H

171,380

0.2

114,000

ZTE

Corp.

-

Class

H

350,033

0.3

6,950

ZTO

Express

Cayman,

Inc.,

ADR

175,418

0.2

30,520,812

28.2

Colombia

:

0

.2

%

64,063

Interconexion

Electrica

SA

ESP

253,373

0.2

Czechia

:

0

.2

%

8,228

Komercni

Banka

AS

245,293

0.2

Egypt

:

0

.1

%

204,102

Eastern

Co.

SAE

125,912

0.1

Greece

:

1

.2

%

76,907

(2)

Eurobank

Ergasias

Services

and

Holdings

SA

120,216

0.1

15,767

Hellenic

Telecommunications

Organization

SA

241,517

0.2

11,742

JUMBO

SA

272,502

0.3

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Greece:

(continued)

8,381

Motor

Oil

Hellas

Corinth

Refineries

SA

$

216,492

0.2

26,435

OPAP

SA

451,384

0.4

1,302,111

1.2

Hong

Kong

:

0

.3

%

288,000

Bosideng

International

Holdings

Ltd.

119,572

0.1

27,000

Country

Garden

Services

Holdings

Co.

Ltd.

31,475

0.0

254,000

Kingboard

Laminates

Holdings

Ltd.

232,450

0.2

103,000

Sino

Biopharmaceutical

Ltd.

49,102

0.0

21,000

Vinda

International

Holdings

Ltd.

50,550

0.0

483,149

0.3

Hungary

:

0

.1

%

6,181

Richter

Gedeon

Nyrt

155,960

0.1

India

:

13

.2

%

15,090

Aurobindo

Pharma

Ltd.

120,049

0.1

85,643

Axis

Bank

Ltd.

945,145

0.9

1,980

Bajaj

Finance

Ltd.

166,982

0.2

196,046

Bank

of

Baroda

437,372

0.4

409,338

Bharat

Electronics

Ltd.

554,341

0.5

55,369

Bharat

Petroleum

Corp.

Ltd.

243,117

0.2

10,874

Cholamandalam

Investment

and

Finance

Co.

Ltd.

137,963

0.1

25,827

Cipla

Ltd./India

297,338

0.3

48,418

HCL

Technologies

Ltd.

668,906

0.6

19,089

Hindalco

Industries

Ltd.

93,464

0.1

98,054

Hindustan

Petroleum

Corp.

Ltd.

309,056

0.3

137,224

ICICI

Bank

Ltd.

1,569,246

1.5

5,793

Info

Edge

India

Ltd.

284,704

0.3

82,686

Infosys

Ltd.

1,314,462

1.2

103,269

ITC

Ltd.

555,467

0.5

25,545

Kotak

Mahindra

Bank

Ltd.

620,535

0.6

33,215

Larsen

&

Toubro

Ltd.

884,005

0.8

20,572

Mahindra

&

Mahindra

Ltd.

327,570

0.3

2,663

Mphasis

Ltd.

62,536

0.1

141,726

NTPC

Ltd.

297,220

0.3

249,856

Oil

&

Natural

Gas

Corp.

Ltd.

467,231

0.4

116,047

Power

Grid

Corp.

of

India

Ltd.

327,724

0.3

7,680

Reliance

Industries

Ltd.

228,978

0.2

63,574

Samvardhana

Motherson

International

Ltd.

60,653

0.1

19,666

Shriram

Finance

Ltd.

332,341

0.3

4,764

SRF

Ltd.

144,890

0.1

33,578

Sun

Pharmaceutical

Industries

Ltd.

395,911

0.4

24,927

Tata

Consultancy

Services

Ltd.

989,578

0.9

14,431

Tech

Mahindra

Ltd.

194,194

0.2

62,451

UPL

Ltd.

516,458

0.5

99,191

Vedanta

Ltd.

333,175

0.3

33,863

Wipro

Ltd.

165,309

0.2

14,045,920

13.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Indonesia

:

0

.3

%

759,800

Adaro

Energy

Indonesia

Tbk

PT

$

103,249

0.1

124,000

Bank

Negara

Indonesia

Persero

Tbk

PT

74,799

0.1

99,800

United

Tractors

Tbk

PT

148,180

0.1

326,228

0.3

Luxembourg

:

0

.5

%

26,724

Reinet

Investments

SCA

528,551

0.5

Malaysia

:

1

.5

%

147,200

AMMB

Holdings

Bhd

116,035

0.1

239,400

CIMB

Group

Holdings

Bhd

249,904

0.2

394,300

Genting

Bhd

358,510

0.3

751,000

Genting

Malaysia

Bhd

408,182

0.4

62,800

Petronas

Chemicals

Group

Bhd

89,145

0.1

63,600

Public

Bank

Bhd

52,483

0.1

90,900

RHB

Bank

Bhd

105,352

0.1

206,800

Telekom

Malaysia

Bhd

228,234

0.2

1,607,845

1.5

Mexico

:

2

.4

%

63,313

Arca

Continental

SAB

de

CV

639,966

0.6

449,804

Fibra

Uno

Administracion

SA

de

CV

656,054

0.6

66,574

Fomento

Economico

Mexicano

SAB

de

CV

672,289

0.6

250,830

Operadora

De

Sites

Mexicanos

SAB

de

CV

-

Class

1

246,874

0.2

31,546

Promotora

y

Operadora

de

Infraestructura

SAB

de

CV

307,078

0.3

23,722

Wal-Mart

de

Mexico

SAB

de

CV

90,240

0.1

2,612,501

2.4

Peru

:

0

.1

%

1,080

Credicorp

Ltd.

139,806

0.1

Philippines

:

1

.0

%

130,114

BDO

Unibank,

Inc.

315,267

0.3

53,480

International

Container

Terminal

Services,

Inc.

185,710

0.2

348,000

Metropolitan

Bank

&

Trust

Co.

357,078

0.3

14,660

SM

Investments

Corp.

242,430

0.2

1,100,485

1.0

Poland

:

0

.7

%

26,499

Polski

Koncern

Naftowy

ORLEN

SA

377,301

0.4

36,456

Powszechny

Zaklad

Ubezpieczen

SA

332,414

0.3

709,715

0.7

Qatar

:

1

.0

%

158,465

Commercial

Bank

PSQC

243,863

0.2

196,430

Mesaieed

Petrochemical

Holding

Co.

106,164

0.1

99,926

Ooredoo

QPSC

291,268

0.3

94,857

Qatar

Islamic

Bank

SAQ

456,288

0.4

1,097,583

1.0

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Romania

:

0

.2

%

44,607

NEPI

Rockcastle

NV

$

254,810

0.2

Russia

:

0.0

%

354,185

(2)(3)

Alrosa

PJSC

—

0.0

10,144,776

(3)

Inter

RAO

UES

PJSC

—

0.0

15,442

(3)

LUKOIL

PJSC

—

0.0

3

(3)

Magnit

PJSC

—

0.0

9,459

(2)(3)

Magnit

PJSC

—

0.0

116,758

(3)

Mobile

TeleSystems

PJSC

—

0.0

4,585

(2)(3)

Severstal

PAO

—

0.0

130,134

(3)

Surgutneftegas

PJSC

—

0.0

125,422

(3)

Tatneft

PJSC

—

0.0

—

0.0

Saudi

Arabia

:

3

.4

%

39,951

Alinma

Bank

347,515

0.3

50,554

Arab

National

Bank

342,763

0.3

30,852

Banque

Saudi

Fransi

327,364

0.3

60,605

Etihad

Etisalat

Co.

694,660

0.6

1,691

Nahdi

Medical

Co.

76,715

0.1

25,537

Riyad

Bank

222,920

0.2

7,136

SABIC

Agri-Nutrients

Co.

237,481

0.2

42,654

Sahara

International

Petrochemical

Co.

404,040

0.4

58,089

Saudi

Electricity

Co.

334,173

0.3

74,569

Saudi

National

Bank

733,396

0.7

3,721,027

3.4

Singapore

:

0

.4

%

53,300

(1)

BOC

Aviation

Ltd.

391,357

0.4

South

Africa

:

2

.6

%

20,925

Absa

Group

Ltd.

163,727

0.2

9,440

African

Rainbow

Minerals

Ltd.

98,739

0.1

42,498

Exxaro

Resources

Ltd.

345,221

0.3

467,892

Growthpoint

Properties

Ltd.

277,384

0.3

28,767

Harmony

Gold

Mining

Co.

Ltd.

136,106

0.1

64,587

Impala

Platinum

Holdings

Ltd.

518,570

0.5

13,954

MTN

Group

Ltd.

86,312

0.1

726

Naspers

Ltd.

-

Class

N

109,520

0.1

5,345

Nedbank

Group

Ltd.

56,427

0.1

11,443

Sasol

Ltd.

133,803

0.1

17,409

Shoprite

Holdings

Ltd.

172,612

0.2

301,470

Sibanye

Stillwater

Ltd.

532,660

0.5

2,631,081

2.6

South

Korea

:

10

.9

%

2,410

BGF

retail

Co.

Ltd.

346,095

0.3

21,084

Cheil

Worldwide,

Inc.

291,153

0.3

6,586

CJ

Corp.

439,340

0.4

1,870

DB

Insurance

Co.

Ltd.

104,381

0.1

7,571

Doosan

Bobcat,

Inc.

304,559

0.3

3,389

E-MART,

Inc.

215,201

0.2

568

F&F

Co.

Ltd.

55,312

0.1

13,731

GS

Holdings

Corp.

398,376

0.4

20,518

Hana

Financial

Group,

Inc.

640,058

0.6

1,896

Hanmi

Pharm

Co.

Ltd.

417,203

0.4

6,364

HD

Hyundai

Co.

Ltd.

273,889

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

South

Korea:

(continued)

1,978

Hyundai

Engineering

&

Construction

Co.

Ltd.

$

56,991

0.1

3,581

Hyundai

Mobis

Co.

Ltd.

601,147

0.6

5,073

Hyundai

Motor

Co.

763,366

0.7

12,444

Industrial

Bank

of

Korea

95,671

0.1

29,293

Kangwon

Land,

Inc.

402,087

0.4

17,591

KB

Financial

Group,

Inc.

634,351

0.6

12,060

Kia

Corp.

779,144

0.7

527

LG

Chem

Ltd.

274,656

0.3

1,036

LG

Innotek

Co.

Ltd.

239,206

0.2

20,382

LG

Uplus

Corp.

172,573

0.2

5,681

Lotte

Shopping

Co.

Ltd.

341,968

0.3

899

Orion

Corp./Republic

of

Korea

87,478

0.1

413

POSCO

Holdings,

Inc.

111,910

0.1

8,262

S-1

Corp.

338,180

0.3

2,281

Samsung

C&T

Corp.

190,000

0.2

2,101

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

356,855

0.3

1,059

Samsung

SDI

Co.

Ltd.

572,072

0.5

21,986

Samsung

Securities

Co.

Ltd.

608,489

0.6

17,690

Shinhan

Financial

Group

Co.

Ltd.

466,085

0.4

2,239

SK,

Inc.

283,040

0.3

54,848

Woori

Financial

Group,

Inc.

494,551

0.5

11,355,387

10.9

Taiwan

:

16

.3

%

29,000

Accton

Technology

Corp.

332,508

0.3

77,000

ASE

Technology

Holding

Co.

Ltd.

278,243

0.3

11,000

Chailease

Holding

Co.

Ltd.

72,384

0.1

75,000

Delta

Electronics,

Inc.

770,172

0.7

41,000

E

Ink

Holdings,

Inc.

275,624

0.3

7,000

eMemory

Technology,

Inc.

417,340

0.4

46,200

Evergreen

Marine

Corp.

Taiwan

Ltd.

229,281

0.2

36,000

Globalwafers

Co.

Ltd.

588,633

0.6

320,000

Hon

Hai

Precision

Industry

Co.

Ltd.

1,107,130

1.0

277,000

Inventec

Corp.

331,996

0.3

218,000

Lite-On

Technology

Corp.

630,731

0.6

37,000

MediaTek,

Inc.

909,223

0.8

21,000

Nan

Ya

Printed

Circuit

Board

Corp.

206,124

0.2

27,000

Novatek

Microelectronics

Corp.

372,770

0.3

33,000

President

Chain

Store

Corp.

300,038

0.3

14,000

Realtek

Semiconductor

Corp.

173,505

0.2

435,962

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

7,889,967

7.3

87,000

Unimicron

Technology

Corp.

508,886

0.5

52,000

Uni-President

Enterprises

Corp.

125,634

0.1

505,000

United

Microelectronics

Corp.

845,261

0.8

11,000

Wiwynn

Corp.

413,554

0.4

7,000

Yageo

Corp.

115,345

0.1

31,000

Yang

Ming

Marine

Transport

Corp.

61,171

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Taiwan:

(continued)

110,000

Zhen

Ding

Technology

Holding

Ltd.

$

414,078

0.4

17,369,598

16.3

Thailand

:

2

.3

%

403,300

Bangkok

Dusit

Medical

Services

PCL

-

Class

F

326,964

0.3

17,300

Bumrungrad

Hospital

PCL

110,765

0.1

109,000

Central

Retail

Corp.

PCL

131,468

0.1

55,500

Electricity

Generating

PCL

230,355

0.2

74,100

Kasikornbank

PCL

275,623

0.3

468,700

Land

&

Houses

PCL

114,411

0.1

368,700

Minor

International

PCL

357,259

0.3

45,500

PTT

Exploration

&

Production

PCL

182,191

0.2

353,800

PTT

Global

Chemical

PCL

358,011

0.3

140,300

SCB

X

PCL

416,942

0.4

2,503,989

2.3

Turkey

:

0

.4

%

22,554

BIM

Birlesik

Magazalar

AS

153,483

0.1

49,034

KOC

Holding

AS

186,128

0.2

78,719

Turkcell

Iletisim

Hizmetleri

AS

127,168

0.1

466,779

0.4

United

Arab

Emirates

:

1

.9

%

166,004

Abu

Dhabi

Commercial

Bank

PJSC

361,119

0.3

181,083

Aldar

Properties

PJSC

251,057

0.2

206,188

Dubai

Islamic

Bank

PJSC

295,182

0.3

378,195

Emaar

Properties

PJSC

632,282

0.6

140,028

Emirates

NBD

Bank

PJSC

519,865

0.5

2,059,505

1.9

United

Kingdom

:

0.0

%

13,603

(2)(3)

X5

Retail

Group

NV,

GDR

—

0.0

Total

Common

Stock

(Cost

$104,978,232)

99,761,581

92.9

EXCHANGE-TRADED

FUNDS

:

2

.6

%

73,944

iShares

MSCI

Emerging

Markets

ETF

2,823,921

2.6

Total

Exchange-Traded

Funds

(Cost

$2,881,471)

2,823,921

2.6

PREFERRED

STOCK

:

3

.6

%

Brazil

:

1

.7

%

256,875

Cia

Energetica

de

Minas

Gerais

589,871

0.6

10,987

Gerdau

SA

52,236

0.1

206,660

Petroleo

Brasileiro

SA

1,068,067

1.0

1,710,174

1.7

Chile

:

0

.4

%

6,343

Sociedad

Quimica

y

Minera

de

Chile

SA

408,769

0.4

Shares

RA

Value

Percentage

of

Net

Assets

PREFERRED

STOCK:

(continued)

South

Korea

:

1

.5

%

37,347

Samsung

Electronics

Co.

Ltd.

$

1,644,958

1.5

Total

Preferred

Stock

(Cost

$3,399,360)

3,763,901

3.6

Total

Long-Term

Investments

(Cost

$111,259,063)

106,349,403

99.1

SHORT-TERM

INVESTMENTS

:

0

.7

%

Mutual

Funds:

0.7%

796,000

(4)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.000%

(Cost

$796,000)

796,000

0.7

Total

Short-Term

Investments

(Cost

$796,000)

796,000

0.7

Total

Investments

in

Securities

(Cost

$112,055,063)

$

107,145,403

99.8

Assets

in

Excess

of

Other

Liabilities

255,273

0.2

Net

Assets

$

107,400,676

100.0

ADR

American

Depositary

Receipt

GDR

Global

Depositary

Receipt

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

May

31,

2023.

Sector

Diversification

Percentage

of

Net

Assets

Information

Technology

23

.2

%

Financials

20

.9

Consumer

Discretionary

12

.1

Communication

Services

7

.9

Industrials

7

.3

Materials

6

.4

Consumer

Staples

5

.5

Energy

4

.5

Health

Care

3

.6

Utilities

2

.7

Exchange-Traded

Funds

2

.6

Real

Estate

2

.4

Short-Term

Investments

0

.7

Assets

in

Excess

of

Other

Liabilities

0

.2

Net

Assets

100

.0

%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

May

31,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

May

31,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Brazil

$

3,346,390

$

—

$

—

$

3,346,390

Chile

406,414

—

—

406,414

China

1,827,815

28,692,997

—

30,520,812

Colombia

253,373

—

—

253,373

Czechia

—

245,293

—

245,293

Egypt

—

125,912

—

125,912

Greece

—

1,302,111

—

1,302,111

Hong

Kong

—

483,149

—

483,149

Hungary

—

155,960

—

155,960

India

—

14,045,920

—

14,045,920

Indonesia

—

326,228

—

326,228

Luxembourg

528,551

—

—

528,551

Malaysia

—

1,607,845

—

1,607,845

Mexico

2,612,501

—

—

2,612,501

Peru

139,806

—

—

139,806

Philippines

—

1,100,485

—

1,100,485

Poland

—

709,715

—

709,715

Qatar

291,268

806,315

—

1,097,583

Romania

254,810

—

—

254,810

Russia

—

—

—

—

Saudi

Arabia

—

3,721,027

—

3,721,027

Singapore

—

391,357

—

391,357

South

Africa

864,083

1,766,998

—

2,631,081

South

Korea

—

11,355,387

—

11,355,387

Taiwan

—

17,369,598

—

17,369,598

Thailand

—

2,503,989

—

2,503,989

Turkey

127,168

339,611

—

466,779

United

Arab

Emirates

361,119

1,698,386

—

2,059,505

United

Kingdom

—

—

—

—

Total

Common

Stock

11,013,298

88,748,283

—

99,761,581

Exchange-Traded

Funds

2,823,921

—

—

2,823,921

Preferred

Stock

2,118,943

1,644,958

—

3,763,901

Short-Term

Investments

796,000

—

—

796,000

Total

Investments,

at

fair

value

$

16,752,162

$

90,393,241

$

—

$

107,145,403

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(

66,393

)

$

—

$

(

66,393

)

Total

Liabilities

$

—

$

(

66,393

)

$

—

$

(

66,393

)

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

PORTFOLIO

OF

INVESTMENTS

as

of

May

31,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

T

At

May

31,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Emerging

Markets

High

Dividend

Equity

Fund:

Description

Counterparty

Put/Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

iShares

MSCI

Emerging

Markets

ETF

Royal

Bank

of

Canada

Call

06/02/23

USD

39.390

276,720

USD

10,484,921

$

195,115

$

(

620

)

iShares

MSCI

Emerging

Markets

ETF

UBS

AG

Call

06/16/23

USD

38.980

279,630

USD

10,595,181

147,701

(

65,773

)

$

342,816

$

(

66,393

)

Currency

Abbreviations:

USD

United

States

Dollar

Net

unrealized

depreciation

consisted

of:

Gross

Unrealized

Appreciation

$

13,475,194

Gross

Unrealized

Depreciation

(

18,384,854

)

Net

Unrealized

Depreciation

$

(

9,819,320

)

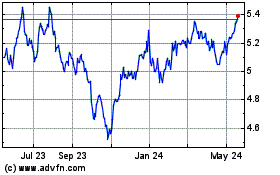

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Nov 2024 to Dec 2024

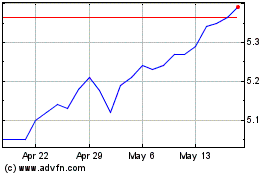

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Dec 2023 to Dec 2024