UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File No. 001-39000

Vista Energy, S.A.B. de C.V.

(Exact Name of the Registrant as Specified in the Charter)

N.A.

(Translation of

Registrant’s Name into English)

Pedregal 24, Floor 4,

Colonia Molino del Rey, Alcaldía Miguel Hidalgo

Mexico City, 11040

Mexico

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): Not applicable.

Contents of this Form 6-K

This Form 6-K for Vista Energy, S.A.B. de C.V. (“Vista” or the “Company”) contains the following

exhibit:

Exhibit 1: Second Quarter of 2023 Earnings Webcast Presentation

Forward-Looking Statements

Any statements contained

herein or in the attachments hereto regarding Vista that are not historical or current facts are forward-looking statements. These forward-looking statements convey Vista’s current expectations or

forecasts of future events. Forward-looking statements regarding Vista involve known and unknown risks, uncertainties and other factors that may cause Vista’s actual results, performance or achievements to be materially different from any

future results, performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors,” “Forward-Looking Statements” and other applicable

sections of Vista’s annual report filed with the United States Securities and Exchange Commission (“SEC”) and other applicable filings with the SEC and the Mexican National Banking and Securities Commission (Comisión Nacional

Bancaria y de Valores).

Enquiries:

Investor Relations:

ir@vistaenergy.com

Argentina: +54 11 3754 8500

Mexico: +52 55 8647 0128

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: July 14, 2023

|

|

|

| VISTA ENERGY, S.A.B. DE C.V. |

|

|

| By: |

|

/s/ Alejandro Cherñacov |

| Name: |

|

Alejandro Cherñacov |

| Title: |

|

Strategic Planning and Investor Relations Officer |

Exhibit 1 Second Quarter 2023 Earnings Webcast July 14, 2023

02 About projections and forward-looking statements Additional information

about Vista Energy, S.A.B. de C.V., a sociedad anónima bursátil de capital variable organized under the laws of Mexico (the“Company” or“Vista”) can be found in the“Investors” section on the website at

www.vistaoilandgas.com. This presentation does not constitute an offer to sell or the solicitation of any offer to buy any securities of the Company, in any jurisdiction. Securities may not be offered or sold in the United States absent registration

with the U.S. Securities Exchange Commission(“SEC”), the Mexican National Securities Registry held by the Mexican National Banking and Securities Commission(“CNBV”) or an exemption from such registrations. This presentation

does not contain all theCompany’s financial information. As a result, investors should read this presentation in conjunction with theCompany’s consolidated financial statements and other financial information available on

theCompany’s website. All the amounts contained herein are unaudited. Rounding amounts and percentages: Certain amounts and percentages included in this presentation have been rounded for ease of presentation. Percentage figures included in

this presentation have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this presentation may vary from those obtained by

performing the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this presentation may not sum due to rounding. This presentation contains certain metrics that do not have standardized

meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies. Such metrics have been included herein to provide readers with additional measures to evaluate

theCompany’s performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to the performance in previous periods. No reliance may be placed for any purpose

whatsoever on the information contained in this document or on its completeness. Certain information contained in this presentation has been obtained from published sources, which may not have been independently verified or audited. No

representation or warranty, express or implied, is given or will be given by or on behalf of the Company, or any of its affiliates (within the meaning of Rule 405 under the Act,“Affiliates”), members, directors, officers or employees or

any other person (the“RelatedParties”) as to the accuracy, completeness or fairness of the information or opinions contained in this presentation or any other material discussed verbally, and any reliance you place on them will be at

your sole risk. Any opinions presented herein are based on general information gathered at the time of writing and are subject to change without notice. In addition, no responsibility, obligation or liability (whether direct or indirect, in

contract, tort or otherwise) is or will be accepted by the Company or any of its Related Parties in relation to such information or opinions or any other matter in connection with this presentation or its contents or otherwise arising in connection

therewith. This presentation also includes certain non-IFRS (International Financial Reporting Standards) financial measures which have not been subject to a financial audit for any period. The information and opinions contained in this presentation

are provided as at the date of this presentation and are subject to verification, completion and change without notice. This presentation includes“forward-lookingstatements” concerning the future. The words such

as“believes,”“thinks,”“forecasts,”“expects,”“anticipates,”“intends,”“should,”“seeks,”“estimates,”“future” or similar expressions

are included with the intention of identifying statements about the future. For the avoidance of doubt, any projection, guidance or similar estimation about the future or future results, performance or achievements is a forward-looking statement.

Although the assumptions and estimates on which forward-looking statements are based are believed by our management to be reasonable and based on the best currently available information, such forward-looking statements are based on assumptions that

are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. There will be differences between actual and projected results, and actual results may be materially greater or materially less than those

contained in the projections. Projections related to production results as well as costs estimations– includingVista’s anticipated performance and guidance for 2023 included in this presentation– are based on information as of the

date of this presentation and reflect numerous assumptions including assumptions with respect to type curves for new well designs and certain frac spacing expectations, all of which are difficult to predict and many of which are beyond our control

and remain subject to several risks and uncertainties. The inclusion of the projected financial information in this document should not be regarded as an indication that we or our management considered or consider the projections to be a reliable

prediction of future events. As such, no representation can be made as to the attainability of projections, guidances or other estimations of future results, performance or achievements. We have not warranted the accuracy, reliability,

appropriateness or completeness of the projections to anyone. Neither our management nor any of our representatives has made or makes any representation to any person regarding our future performance compared to the information contained in the

projections, and none of them intends to or undertakes any obligation to update or otherwise revise the projections to reflect circumstances existing after the date when made or to reflect the occurrence of future events in the event that any or all

of the assumptions underlying the projections are shown to be in error. We may or may not refer back to these projections in our future periodic reports filed under the Exchange Act. These expectations and projections are subject to significant

known and unknown risks and uncertainties which may cause our actual results, performance or achievements, or industry results, to be materially different from any expected or projected results, performance or achievements expressed or implied by

such forward-looking statements. Many important factors could cause our actual results, performance or achievements to differ materially from those expressed or implied in our forward looking statements, including, among other things uncertainties

relating to future government concessions and exploration permits; adverse outcomes in litigation that may arise in the future; general political, economic, social, demographic and business conditions in Argentina, Mexico and in other countries in

which we operate; the impact of political developments and uncertainties relating to political and economic conditions in Argentina, including the policies of the government in Argentina; significant economic or political developments in Mexico and

the United States; uncertainties relating to future election results in Argentina and Mexico; changes in law, rules, regulations and interpretations and enforcements thereto applicable to the Argentine and Mexican energy sectors, including changes

to the regulatory environment in which we operate and changes to programs established to promote investments in the energy industry; any unexpected increases in financing costs or an inability to obtain financing and/or additional capital pursuant

to attractive terms; any changes in the capital markets in general that may affect the policies or attitude in Argentina and/or Mexico, and/or Argentine and Mexican companies with respect to financings extended to or investments made in Argentina

and Mexico or Argentine and Mexican companies; fines or other penalties and claims by the authorities and/or customers; any future restrictions on the ability to exchange Mexican or Argentine Pesos into foreign currencies or to transfer funds

abroad; the revocation or amendment of our respective concession agreements by the granting authority; our ability to implement our capital expenditures plans or business strategy, including our ability to obtain financing when necessary and on

reasonable terms; government intervention, including measures that result in changes to the Argentine and Mexican, labor markets, exchange markets or tax systems; continued and/or higher rates of inflation and fluctuations in exchange rates,

including the devaluation of the Mexican Peso or Argentine Peso; any force majeure events, or fluctuations or reductions in the value of Argentine public debt; changes to the demand for energy; uncertainties relating to the effects of the Covid 19

outbreak and its different variants; the effects of a pandemic or epidemic and any subsequent mandatory regulatory restrictions or containment measures; environmental, health and safety regulations and industry standards that are becoming more

stringent; energy markets, including the timing and extent of changes and volatility in commodity prices, and the impact of any protracted or material reduction in oil prices from historical averages; changes in the regulation of the energy and oil

and gas sector in Argentina and Mexico, and throughout Latin America; our relationship with our employees and our ability to retain key members of our senior management and key technical employees; the ability of our directors and officers to

identify an adequate number of potential acquisition opportunities; our expectations with respect to the performance of our recently acquired businesses; our expectations for future production, costs and crude oil prices used in our projections;

increased market competition in the energy sectors in Argentina and Mexico; potential changes in regulation and free trade agreements as a result of U S Mexican or other Latin American political conditions; environmental regulations and internal

policies to achieve global climate targets; and the ongoing conflict involving Russia and Ukraine. Forward looking statements speak only as of the date on which they were made, and we undertake no obligation to release publicly any updates or

revisions to any forward looking statements contained herein because of new information, future events or other factors. In light of these limitations, undue reliance should not be placed on forward looking statements contained in this presentation.

Further information concerning risks and uncertainties associated with these forward looking statements andVista’s business can be found inVista’s public disclosures filed on EDGAR (www.sec.gov) or at the web page of the Mexican Stock

Exchange (www.bmv.com.mx). You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements. This

presentation is not intended to constitute and should not be construed as investment advice. Other Information. Vista routinely posts important information for investors in the Investor Relations support section on its website, www.vistaenergy.com.

From time to time, Vista may use its website as a channel of distribution of material information. Accordingly, investors should monitorVista’s Investor Relations website, in addition to followingVista’s press releases, SEC filings,

public conference calls and webcasts.

03 Key metrics of the quarter Q2 2023-HIGHLIGHTS (1) (2) (3) Production

Revenues Lifting Cost CAPEX Oil Production 46.6 Mboe/d 39.2 Mbbl/d 231 $MM 4.8 $/boe 179 $MM +4% y-o-y +6% y-o-y (22)% y-o-y (38)% y-o-y +18% y-o-y (4) (6) (7) (5) Adj. EBITDA Free Cash Flow Net Leverage Ratio Adj. Net Income Adj. EPS 152 $MM (85)

$MM 0.54x 57 $MM 0.6 $/sh (25)% y-o-y (30)% y-o-y (35)% y-o-y (15)% y-o-y (1) Includes natural gas liquids (NGL) and excludes flared gas, injected gas and gas consumed in operations expenses + Gain related to the transfer of conventional assets +

Other non-cash costs related to the transfer of (2) Lifting cost includes production, transportation, treatment and field support services; excludes crude stock fluctuations, conventional assets + Impairment (recovery) of long-lived assets + other

adj. depreciation, royalties, direct taxes, commercial, exploration, G&A costs and Other non-cash costs related to the transfer (5) Free cash flow = Operating activities cash flow + Investing activities cash flow of conventional assets (6)

Adjusted net income/loss = Net (loss)/profit + Deferred income tax + Changes in fair value of warrants + Gain related to (3) Property, plant and equipment additions the transfer of conventional assets + Other non-cash costs related to the transfer

of conventional assets + impairment (4) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial results, net + Depreciation, (recovery) of long-lived assets depletion and amortization + Transaction costs related

to business combinations + Restructuring and reorganization (7) Adj. EPS = Adj. Net Income divided by weighted average number of ordinary shares

04 (1) Double-digit interannual production growth on a pro forma basis (2)

TOTAL PRODUCTION OIL PRODUCTION NATURAL GAS PRODUCTION Mboe/d Mbbl/d MMm3/d +4% +6% (10)% +20% +22% +7% 52.2 46.6 44.8 44.0 1.23 1.19 39.2 36.9 1.08 50.2 42.8 38.9 1.11 1.01 32.1 Q2-22 Q1-23 Q2-23 Q2-22 Q1-23 Q2-23 Q2-22 Q1-23 Q2-23 (3) (1)

Production from transferred assets Pro forma Actuals ▪ Interannual production growth reflects strong performance of shale oil projects, offsetting impact of the transaction to fully focus on shale operations as of March 1, 2023 ▪

Drilling and completion activity during the first semester concluded the de-risking of Aguila Mora and Bajada del Palo Este ▪ On track to deliver on 2023 production guidance (1) Pro forma production reflects production net of assets

transferred to Aconcagua on March 1, 2023. Shows production as if the transaction had occurred on March 1, 2022 (2) Includes oil, gas and LPG production. LPG production in Q2 2023 totaled 553 boe/d, compared to 407 boe/d in Q1 2023 and 426 boe/d in

Q2 2022 st (3) Includes Entre Lomas, Jarilla Quemada, Charco del Palenque, Jagüel de los Machos and 25 de Mayo-Medanito SE concessions transferred to Aconcagua, effective as of March 1 , 2023. Since that date Vista remains entitled to 40% of

crude oil and natural gas production and reserves, and 100% of LPG and condensates production and reserves, of such concessions

05 Successful pilots extend inventory to up to 1,150 wells ACTIVITY UPDATE

UPDATED WELL INVENTORY Block Wells Proved Landing Zones La Cocina BPO 550 Organic Bajada del Palo Este Lower Carbonate (BPE) AM-1 BPE 150 La Cocina La Cocina 25 BPE-1 AF 150 Organic Aguada Bandurria Federal Middle Carbonate Norte (AF) (BN) La Cocina

BN 150 BPE-2 BPE-3 Organic La Cocina Aguila AM 100 Middle Carbonate Bajada del Mora 40 Palo Oeste (AM) CAN 50 La Cocina 30 (BPO) 45 Coirón Amargo Norte Total inventory of up to 1,150 wells (CAN) (1) Pads tied-in to date : BPE AM WELL

PERFORMANCE Mboe AGUILA MORA BAJADA DEL PALO ESTE 180 ▪ Tied-in 2-well pad AM-1 in early ▪ Well BPE-2202h in pad BPE-2 currently showing robust BPE-2101h May, landed 1 well in La Cocina and 1 productivity with cumulative production

performing 72% 160 BPE-2103h (2) well in Middle Carbonate above BPO type curve after 80 days BPE-2302h 140 ▪ Pad cumulative production ▪ Robust performance in BPE-2202h reconfirms 150 BPE-2202h performing 4% above BPO type curve wells in

ready-to-drill inventory from 1 landing zone 120 AM-1011h (2) after 60 days AM-1012h ▪ Well BPE-2302h in pad BPE-3 cumulative production is 100 (2) BPO type curve ▪ Based on successful results, we performing 7% below BPO type curve after

90 days 80 added up to 100 ready-to-drill wells ▪ 2-well pad BPE-1 average cumulative production is to our inventory (2) performing 30% above BPO type curve after 360 days 60 40 COIRÓN AMARGO NORTE 20 ▪ Based on successful results

in BPE, we added up to 50 ready-to-drill wells to our inventory 0 0 10 20 30 40 50 60 70 80 90 (1) AM-1 is a 2-well pad. BPE-2 and BPE-3 are single-well pads (2) Normalized to a standard well design of 2,800 meters lateral length and 47 frac stages

per well

06 Continuous solid progress in Bajada del Palo Oeste ACTIVITY UPDATE OIL

TREATMENT CAPACITY ▪ Good progress in project to upgrade oil treatment plant 35 capacity to 70,000 bbl/d ▪ Scheduled to be online by the end of Q3-23 5 14 18 AM Aguada 40 Federal 11 (AF) Bajada del Palo Oeste BN 1 3 15 10 13 (BPO) Bajada

del 4 2 19 8 7 121716 9 6 Palo Este (BPE) Cube Bajada del CAN Palo Oeste Pads tied-in to date: BPO Vista oil (BPO) Pads with ongoing D&C activity: BPO treatment plant Vista oil treatment plant Battery Oil pipeline TIE-IN SCHEDULE # wells Ramp up

in activity expected to boost BAJADA DEL PALO OESTE production in Q3-23 and Q4-23 ▪ Solid performance to date, with 60 wells tied-in and producing on 12 (1) average 2% above BPO type curve for the first 360 days 9 ▪ Expecting to tie-in 8

wells in 4-well pads BPO-16 and BPO-17 as per cube development pilot in Jul-23 5 ▪ Currently drilling 4-well pads BPO-18 and BPO-19. Expected to be 3 completed and tied-in during Q3-23 and Q4-23, respectively ▪ On track to tie-in 21 BPO

wells in 2023 as per guidance, after unlocking evacuation capacity to boost production in Q3-23 and Q4-23 Q1-23 Q2-23 Q3-23 Q4-23 BPO BPE AF AM (1) Normalized to a standard well design of 2,800 meters lateral length and 47 frac stages per well.

Compares production of first 44 wells in BPO at 360 days

07 7 (1) Secured evacuation capacity to deliver on 2026 production targets

(1) OIL EVACUATION CAPACITY Mbbl/d 2022 2023 2024 2025 CONTRACTED CAPACITY IN PHASES 1 AND 2 OF OLDELVAL’S DUPLICAR PROJECT LA ESCONDIDA SWITCH FROM OLDELVAL PIPELINE TO VM NORTE PIPELINE TO REVERSAL TO INCREASE EVACUATION EXPORT TO CAPACITY

TO CHILE AND CHILE LUJAN DE CUYO REFINERY PIPELINE OLDELVAL CURRENT OLDELVAL VM NORTE PIPELINE OLDELVAL PIPELINE OLDELVAL PIPELINE EXISTING TOTAL CAPACITY OTASA PIPELINE OTASA OTASA CAPACITY EXPANSION CAPACITY EXPANSION CAPACITY TRUCKING CAPACITY

(2) 2022YE CAPACITY 2023YE PHASE 1 2024YE PHASE 2 2025YE CAPACITY 2025YE OTC OTC OTC ▪ Signed agreement with ENAP and initiated exports to Chile of up to Forecasted total oil 5.7 Mbbl/d through Oldelval/OTASA/OTC pipeline evacuation capacity

of ▪ Participating with 8% WI in Vaca Muerta Norte pipeline, will increase 100 Mbbl/d by YE 2025 export capacity to Chile to up to 12.5 Mbbl/d (est. by Q4-23) (1) Based on contracts signed by Vista and data provided by project operators.

Actual delivery dates might change subject to execution (2) Includes firm pipeline capacity of 35 Mbbl/d and additional capacity using friction-reducing agents of 9 Mbbl/d

08 Revenues reflect inventory build-up and softer prices REVENUES AVERAGE

CRUDE OIL PRICE AVERAGE NATURAL GAS PRICE $MM $/bbl $/MMBtu 1.5 2.4 1.6 (18)% (22)% 78.4 303.2 4.7 294.3 66.6 64.3 3.9 3.9 231.0 60% 50% 49% Q2-22 Q1-23 Q2-23 Q2-22 Q1-23 Q2-23 Q1-22 Q1-23 Q2-23 Total Revenues % of export in total revenues Oil

exports (MMbbl) (1) ▪ 55% of LTM revenues from export ▪ Realized oil prices of 63.1 $/bbl▪ Sequential decline driven by markets in the domestic market and lower export volumes to Chile (2) 68.6 $/bbl in the export market ▪

Recovery of normalized inventory levels to 108 Mbbl and re-routing of ▪ Exported 1.6 MMbbl (17.4 Mbbl/d) exports during Q2-23 resulted in the of crude oil, representing 48% of delay of 1 export cargo (~500 Mbbl) total oil sales volumes and 51%

of to the first week of July total oil revenues (1) Does not include trucking transportation cost from sales point to refinery. Total realized oil price net of this cost is 60.3$/bbl (2) Net of export tax. Export price before export tax was 74.1

$/bbl in Q2-23

09 Strong cost reduction driven by focus on shale operations (1) (1)(2)

LIFTING COST LIFTING COST PER BOE $MM $/boe (36)% (38)% 31.7 7.8 30.1 6.4 20.3 4.8 52.2 46.6 44.8 Q2-22 Q1-23 Q2-23 Q2-22 Q1-23 Q2-23 Lifting cost per boe Total production (Mboe/d) ▪ Lifting cost reduction captures an entire quarter with full

focus on shale oil operations ▪ On track to deliver on 5.5 $/boe lifting cost guidance for 2023 (1) Lifting cost includes production, transportation, treatment and field support services; excludes crude stock fluctuations, depreciation,

royalties, direct taxes, commercial, exploration, G&A costs and Other non-cash costs related to the transfer of conventional assets (2) Lifting cost is shown as Operating costs in our Income Statement. Lifting cost per boe = Operating costs /

Total production. Lifting cost for Q2-23 (4.8 $/boe) = Operating costs (20.3 $MM) / Total production (4.2 MMboe)

10 Solid margins despite softer prices (1) (2) ADJ. EBITDA ADJ. EBITDA

MARGIN NETBACK $MM % $/boe (25)% (3)p.p. (28)% 49.5 69% 204.4 202.1 67% 66% 43.5 151.8 35.8 78.4 66.6 64.3 Q2-22 Q1-23 Q2-23 Q2-22 Q1-23 Q2-23 Q2-22 Q1-23 Q2-23 Adj. EBITDA margin Realized crude oil price ($/bbl) ▪ Sequential decrease in Adj.

EBITDA reflects inventory build-up in export facilities ▪ Adj. EBITDA decreased y-o-y due to softer prices and 10 $MM of Other operating income from Trafigura JV in Q2-22 Going forward, we expect a boost in production, higher Adj. EBITDA and

Adj. EBITDA margins in Q3-23 and Q4-23, driven by planned increase in BPO drilling and completion activity with newly available evacuation capacity (1) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial

results, net + Depreciation, depletion and amortization + Transaction costs related to business combinations + Restructuring and reorganization expenses + Gain related to the transfer of conventional assets + Other non-cash costs related to the

transfer of conventional assets + Impairment (recovery) of long-lived assets + other adj. (2) Netback = Adj. EBITDA / Total production volumes

11 11 Acceleration in capex sets the stage for future growth (1) Q2 2023

CASH FLOW EVOLUTION CAPEX $MM $MM 179 162 151 Beginning of period Operating activities Investing activities Financing activities End of period Q2-22 Q1-23 Q2-23 (2) cash position cash flow cash flow cash flow cash position (3) FREE CASH FLOW ▪

Operating activities cash flow impacted by Income Tax payment of 36 $MM, $MM change in working capital of 17 $MM and advanced payments of infrastructure of 5 $MM 63 35 ▪ Cash flow used in investing in line with capex of 179 $MM for the quarter

▪ Financing activities cash flow reflects bond issuance of 13.5 $MM and repayment of 22.5 $MM syndicated loan installment ▪ Refinanced 40.8 $MM maturity from 2024 to 2026. We plan to repay the last th installment of our syndicated loan

for 22.5 $MM on July 20 . After this (85) repayment we will have no remaining maturities in 2023 ▪ Net leverage ratio at 0.54x LTM Adj. EBITDA Q2-22 Q1-23 Q2-23 (1) Cash is defined as Cash, bank balances and other short-term investments (2)

For the purpose of this graph, cash flow used in by financing activities is the sum of: (i) cash flow generated by financing activities for (30.0) $MM; (ii) effect of exposure to changes in the foreign currency rate of cash and cash equivalents and

other financial results for (12.9) $MM; and (iii) the variation in Government bonds for 0.3 $MM (3) Free cash flow = Operating activities cash flow + Investing activities cash flow

12 12 Solid financial position leaves us well-poised for acceleration (2)

GROSS LEVERAGE RATIO DEBT COMPOSITION X Adj. EBITDA % of total debt 5.6x 46% 68% 651 73% 78% 611 549 540 1.6x 54% 0.8x 0.7x 32% 27% 22% 2020 2021 2022 Q2-23 2020 2021 2022 Q2-23 (1) Gross leverage ratio Gross debt ($MM) Cross border Local (1) (2)

AVG. INTEREST RATE DEBT MATURITIES SCHEDULE % $MM Achieved AAA rating as local issuer (4) from Moody´s and Fitch 223 8.9% 8.3% 178 142 5.3% To be paid 108 111 th on July 20 82 3.0% 50.7 47.9 23 28.9 21.9 2020 2021 2022 Q2-23 Cash at 2023 2024

2025 2026 2027 2028-31 June 30, 2023 (3) Avg. interest rate Interest expense ($MM) Cross border Local (1) Includes dollar denominated and dollar linked debt only (2) Local debt includes debt to be settled in ARS pesos. Cross border includes debt to

be settled in US dollars (3) Q2-23 interest expense corresponds to 2023 estimate (4) Rating corresponds to Vista Energy Argentina S.A.U. for the Argentine market: AAA(arg) rating from FixScr (affiliate of Fitch Ratings), and AAA.ar rating for local

currency issuances from Moody´s Local (with a AA+.ar rating for foreign currency issuances)

13 Closing remarks Robust progress in Bajada del Palo Oeste leaves us on

track to meet production and cost guidance for the year Successful pilots in BPE and AM extend drilling inventory, providing significant growth potential Secured midstream and export evacuation capacity to deliver on 2026 production targets Solid

balance sheet and debt schedule leave us well-poised for further growth

Investor Day - Strategic Plan Update SAVE 26 THE SEPTEMBER 2023 9 AM ET

DATE Virtual event hosted by Miguel Galuccio, Chairman and CEO, and the Executive Team members

THANKS! Q&A

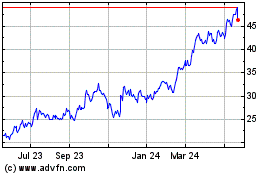

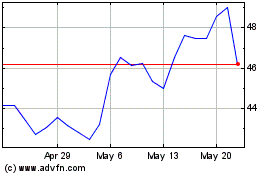

Vista Energy SAB de CV (NYSE:VIST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vista Energy SAB de CV (NYSE:VIST)

Historical Stock Chart

From Jul 2023 to Jul 2024