Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 23 2023 - 4:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER SECURITIES EXCHANGE ACT OF 1934

For the month of February 2023

Commission File No. 001-39000

Vista Energy, S.A.B. de C.V.

(Exact Name of the Registrant as Specified in the Charter)

N.A.

(Translation of

Registrant’s Name into English)

Pedregal 24, Floor 4,

Colonia Molino del Rey, Alcaldía Miguel Hidalgo

Mexico City, 11040

Mexico

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): Not applicable.

Vista announces transaction to increase focus on shale oil assets

Mexico City, February 23, 2023 – Vista Energy, S.A.B. de C.V. (“Vista” or the “Company”) (NYSE: VIST; BMV: VISTA) announced

today a transaction to increase its focus on its shale oil operations in Vaca Muerta and strengthen shareholder returns.

Based on this premise, its

subsidiary Vista Energy Argentina S.A.U. (“Vista Argentina”) has reached a two-phased agreement (the “Transaction”) starting March 1st,

2023 (the “Effective Date”), with Petrolera Aconcagua Energía S.A. (“Aconcagua”), an in-basin upstream producer with integrated services focused on conventional production, which

will become the operator of certain Concessions (as described below) currently held by Vista. During the first phase of the Transaction, which will end no later than February 28th, 2027 (the

“Final Closing Date”), Aconcagua will be entitled to 60% of the hydrocarbons produced in the concessions and will bear 100% of the costs, taxes, and royalties of such Concessions, whereas Vista Argentina, will keep the entitlement to the

remaining 40% of the hydrocarbons produced and will receive from Aconcagua an upfront payment. Vista Argentina and Aconcagua will work jointly with the Provinces of Río Negro and Neuquén to negotiate an extension of the exploitation

and transportation concession titles governing each of the Concessions, pursuant to the terms provided for in the applicable regulation in Argentina. Vista Argentina will remain concession title holder until certain Provincial authorizations are

obtained, which shall be requested no later than the Final Closing Date, when the Concessions will be transferred to Aconcagua, subject to Provincial approvals.

“This innovative deal and operating model will allow Vista to fully focus on the development of Vaca Muerta and improve our ability to deliver on our

2026 targets by maintaining a high growth trajectory, whilst generating higher returns and additional free cash flow”, commented Miguel Galuccio, Chairman and Chief Executive Officer of the Company. He also added: “The transaction

streamlines our asset portfolio and improves our operating metrics, including our lifting cost, which is forecast to fall by 25% in 2023, allowing us to expand our margins and generate stronger financial returns”.

Under the terms of the Transaction, as of the Effective Date:

| |

(i) |

Aconcagua will become the operator of the following upstream concessions in the Neuquina Basin located in

Argentina: Entre Lomas, located in the Province of Neuquén, and Entre Lomas, Jarilla Quemada, Charco del Palenque, Jagüel de los Machos and 25 de Mayo-Medanito SE, located in the Province of Río Negro (the “Exploitation

Concessions”, as shown in Figure 1 below), and the Entre Lomas gas transportation concession, the Jarilla Quemada gas transportation concession, and the 25 de Mayo-Medanito SE crude oil transportation concession (the “Transportation

Concessions” and, jointly with the Exploitation Concessions, the “Concessions”); |

| |

(ii) |

Aconcagua will pay to Vista US$ 26.48 million in cash (US$ 10.00 million paid on February 15th, 2023, US$ 10.74 million to be paid on March 1st, 2024, US$ 5.74 million to be paid on March 1st, 2025); |

| |

(iii) |

Vista Argentina will retain 40% of the crude oil and natural gas production, and 100% of liquified petroleum

gas, gasoline, and condensates, from the Exploitation Concessions (with Aconcagua paying all costs, taxes, and royalties) until the earlier of (a) the Final Closing Date and (b) the date in which Vista Argentina receives a cumulative

production of 4 million barrels of crude oil and 300 million m3 of natural gas (the “Vista Retained Hydrocarbons”)1. On the other hand, Aconcagua will be entitled to 60% of the

crude oil and natural gas production from the Exploitation Concessions; |

| 1 |

If by February 28th, 2027, Vista has not received the Vista Retained Hydrocarbons, Aconcagua shall be obliged

to pay Vista an amount in cash to compensate for the missing volumes. |

| |

(iv) |

Aconcagua will pay 100% of Vista Argentina’s share of the capex, opex, royalties, taxes, and any other

costs associated with the Concessions; |

| |

(v) |

Vista Argentina will have the right to purchase from Aconcagua up to Aconcagua’s 60% share of the natural

gas produced by the Concessions at a price of US$ 1 per million BTU until the Final Closing Date; |

| |

(vi) |

Vista Argentina and Aconcagua will work jointly with the Provinces of Río Negro and Neuquén to

negotiate an extension of the exploitation and transportation concession titles governing the Concessions, including an upfront payment and an investment commitment, as per the terms set forth in the applicable regulation in Argentina;

|

| |

(vii) |

Vista Argentina will retain the right to explore and develop the Vaca Muerta formation in the Exploitation

Concessions and seek to obtain one or more independent and separate unconventional concessions to develop such resources; |

| |

(viii) |

Vista Argentina and Aconcagua have signed an agreement by which Vista Argentina will treat and transport 100%

of the crude oil produced in the Exploitation Concessions (with the exception of 25 de Mayo-Medanito SE and Jagüel de los Machos) until the expiration of the concession titles (including the potential

10-year extension); |

| |

(ix) |

Vista Argentina will remain concession title holder until no later than the Final Closing Date, when the

Concessions will be transferred to Aconcagua, subject to Provincial approvals. |

The net book value of the Concessions, as of December 31st, 2022, is US$ 106 million. The Entre Lomas Crude Oil Transportation Concession, which includes a 57,000 bbl/d oil treatment plant geographically located in the Entre Lomas Río Negro

concession and has a net book value of US$ 20 million as of December 31st, 2022, is excluded from the Transaction. Vista will have a put option to sell the Entre Lomas crude oil

transportation concession to Aconcagua at a price to be agreed by the parties.

About the Concessions

Each of the six Exploitation Concessions included in the Transaction constitutes an exploitation concession granted by the Province of Neuquén

(regarding the Entre Lomas Neuquén concession) and the Province of Río Negro (regarding the other five concessions) under the terms of the Argentine Hydrocarbons Law (17,319). The chart below shows key operational highlights of each

concession.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Province |

|

|

Surface

Area

(km2) |

|

|

2022

Production

(kboe/d) |

|

|

2022

P1 Reserves

(MMboe) |

|

|

Concession

expiration date |

|

| Entre Lomas Río Negro |

|

|

Río Negro |

|

|

|

337 |

|

|

|

3.4 |

|

|

|

6.0 |

|

|

|

2026 |

|

| Entre Lomas Neuquén |

|

|

Neuquén |

|

|

|

403 |

|

|

|

1.5 |

|

|

|

1.5 |

|

|

|

2026 |

|

| Jarilla Quemada |

|

|

Río Negro |

|

|

|

193 |

|

|

|

0.3 |

|

|

|

0.0 |

|

|

|

2040 |

|

| Charco del Palenque |

|

|

Río Negro |

|

|

|

194 |

|

|

|

0.7 |

|

|

|

2034 |

|

| 25 de Mayo Medanito SE |

|

|

Río Negro |

|

|

|

131 |

|

|

|

2.5 |

|

|

|

3.0 |

|

|

|

2026 |

|

| Jagüel de los Machos |

|

|

Río Negro |

|

|

|

196 |

|

|

|

2.9 |

|

|

|

2.7 |

|

|

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

1,454 |

|

|

|

10.6 |

|

|

|

13.9 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Entre Lomas Gas Transportation Concession was granted over the gas pipeline that connects the Gas

Treatment Plant located in the Charco Bayo field in the Entre Lomas exploitation concession (“PTG ELo”) with the trunk gas transportation system operated by Transportadora del Gas S.A. in the Province of Río Negro including PTG ELo

within said transportation concession. The Entre Lomas Gas Transportation Concession was originally granted for a term equivalent to the remaining term of validity of the Entre Lomas Río Negro exploitation concession.

The 25 de Mayo – Medanito SE Crude Oil Transportation Concession was granted over the pipeline that connects the Crude Treatment Plant located in 25 de

Mayo-Medanito SE (“PTC MED”), up to its connection with the crude oil transportation trunk system in “Medanito” operated by Oleoductos del Valle S.A. in the Province of Río Negro including within the transportation

concession to the PTC MED. The 25 de Mayo – Medanito SE Crude Oil Transportation Concession was originally granted for a term equivalent to the remaining term of validity of the 25 de Mayo – Medanito SE exploitation concession.

The Jarilla Quemada Gas Transportation Concession was granted over the pipeline from the Jarilla Quemada block to the Fiscal Metering Station located in the

45.47 km progressive of the Medanito - Mainqué Gas Pipeline.

The map below shows the geographical location of the Exploitation Concessions, as well

as Vista Argentina’s other concessions excluded from the Transaction.

Figure 1 – Conventional concessions included in the Transaction

Forward-Looking Statements

Any statements contained

herein or in the attachments hereto regarding Vista that are not historical or current facts are forward-looking statements. These forward-looking statements convey Vista’s current expectations or forecasts of future events. Forward-looking

statements regarding Vista involve known and unknown risks, uncertainties and other factors that may cause Vista’s actual results, performance or achievements to be materially different from any future results, performances or achievements

expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors,” “Forward-Looking Statements” and other applicable sections of Vista’s annual reports

and/or prospectuses filed with the United States Securities and Exchange Commission (“SEC”) and other applicable filings with the SEC and the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de

Valores).

Enquiries:

Investor Relations:

ir@vistaenergy.com

Argentina: +54 11 3754 8500

Mexico: +52 55 8647 0128

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: February 23, 2023

|

|

|

| VISTA ENERGY, S.A.B. DE C.V. |

|

|

| By: |

|

/s/ Alejandro Cherñacov |

| Name: |

|

Alejandro Cherñacov |

| Title: |

|

Strategic Planning and Investor Relations Officer |

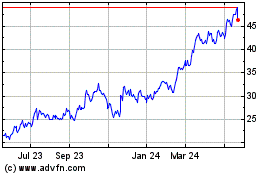

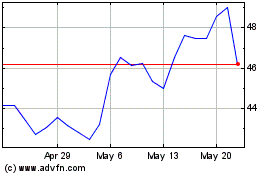

Vista Energy SAB de CV (NYSE:VIST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vista Energy SAB de CV (NYSE:VIST)

Historical Stock Chart

From Jul 2023 to Jul 2024