false

--12-31

0001599489

0001599489

2023-11-30

2023-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 30, 2023

VERITIV

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other

jurisdiction of incorporation)

| 001-36479 |

|

46-3234977 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1000 Abernathy

Road NE |

|

|

| Building 400,

Suite 1700 |

|

|

| Atlanta,

Georgia |

|

30328 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (770) 391-8200

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.01 par value |

VRTV |

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Introductory Note

On November 30, 2023

(the “Closing Date”), Veritiv Corporation (the “Company” or “Veritiv”), Verde

Purchaser, LLC (“Parent”), and Verde Merger Sub, Inc. (“Merger Subsidiary”) completed the transactions

contemplated by that certain Agreement and Plan of Merger, dated as of August 6, 2023 (as it has been

or may be amended, supplemented, waived or otherwise modified in accordance with its terms, the “Merger Agreement”), among

Veritiv, Parent and Merger Subsidiary. Parent and the Merger Subsidiary are affiliated with investment

funds advised by Clayton, Dubilier & Rice, LLC (“CD&R”), a US-based private equity firm. Pursuant to the

Merger Agreement, among other things, Merger Subsidiary merged with and into the Company (the “Merger”),

with the Company surviving as a wholly-owned subsidiary of Parent (the “Surviving Corporation”). Capitalized

terms used and not otherwise defined herein have the meaning set forth in the Merger Agreement.

Item 1.01. Entry into a Material Definitive

Agreement.

As described below, the Merger

was funded in part with proceeds from (i) a $600 million senior secured term loan facility (the “Term Loan Facility”),

(ii) $700 million aggregate principal amount of 10.500% senior secured notes due 2030 (the “2030 Notes”) issued by Parent

and (iii) a borrowing against a $825 million senior secured asset based revolving credit facility (the “ABL Facility”).

Term Loan Facility

On November 30, 2023,

Parent and Veritiv Operating Company, a Delaware corporation and direct subsidiary of the Company (together with Parent, the “Borrowers”

and each, a “Borrower”), as the initial borrowers, entered into (a) a Term Loan Credit Agreement (the “Term

Loan Credit Agreement”) by and among the Borrowers, Verde Intermediate Holdings, LLC, a Delaware limited liability company (“Holdings”),

the subsidiary guarantors from time to time party thereto, the lenders party thereto and Royal Bank of Canada, as administrative agent

and collateral agent, which provides for the Term Loan Facility. Holdings, Parent and certain subsidiaries of Parent are guarantors under

the Term Loan Credit Agreement (provided that the guarantee of Holdings is non-recourse and limited to the capital stock of Parent).

The obligations under the Term Loan Credit Agreement are secured on a first priority basis by the assets of Holdings, the Borrower and

the guarantors (subject to certain exclusions and exceptions).

The Term Loan Facility will

mature on November 30, 2030 and will bear interest at a floating rate per annum of, at the Borrower’s option of term SOFR plus

4.50% or a base rate plus 3.50%. The term SOFR rate and the base rate are subject to an interest rate floor of 0.00%. Borrowings

under the Term Loan Facility will amortize in equal quarterly installments in an amount equal to 1.00% per annum of the principal amount

with the remaining balance payable upon maturity.

The Term Loan Facility may

be prepaid at the Borrower’s option at any time, subject to minimum principal amount requirements. Prepayments of the Term Loan

Facility in connection with a repricing transaction (as defined in the Term Loan Credit Agreement) prior to May 30, 2024 are subject

to a 1.00% prepayment premium. Prepayments may otherwise be made without premium or penalty (other than customary breakage costs).

The Borrowers will be required

to prepay the loans under the Term Loan Credit Agreement, subject to certain exceptions, thresholds and reinvestment rights, with a specified

percentage of (i) the net cash proceeds of certain asset sales, (ii) the net cash proceeds of certain debt offerings and (iii) excess

cash flow.

The Term Loan Credit Agreement

contains certain covenants, which among other things, limit the ability of Parent and its restricted subsidiaries to (i) incur additional

indebtedness; (ii) pay dividends or make other restricted payments; (iii) make loans and investments; (iv) incur liens;

(v) sell assets; (vi) enter into affiliate transactions; (vii) enter into certain sale and leaseback transactions; (viii) enter

into agreements restricting Parent’s subsidiaries’ ability to pay dividends; and (ix) merge, consolidate or amalgamate

or sell all or substantially all of their property. These covenants are subject to a number of exceptions and qualifications that are

described in the Term Loan Credit Agreement. The Term Loan Credit Agreement provides for customary events of default which include (subject

in certain cases to customary grace and cure periods), among others, nonpayment of principal or interest, failure to comply with other

covenants or agreements in the Term Loan Credit Agreement, failure to pay certain other indebtedness, failure to pay certain final judgments,

failure of certain guarantees to be enforceable and certain events of bankruptcy or insolvency. These events of default are subject to

a number of qualifications, limitations and exceptions that are described in the Term Loan Credit Agreement.

ABL Facility

On November 30, 2023,

the Borrowers entered into an ABL Credit Agreement (the “ABL Credit Agreement”) by and among the Borrowers, Holdings, the

subsidiary guarantors from time to time party thereto, the lenders party thereto and Wells Fargo Bank, National Association, as administrative

agent and collateral agent, which provides for the $825 million ABL Facility, $100 million of which is available in the form of swingline

loans. Letters of credit may also be issued under the ABL Facility in an aggregate amount not exceeding $200 million. Amounts available

under the ABL Facility are available subject to a U.S. borrowing base and a Canadian borrowing base. Holdings, Parent and certain subsidiaries

of Parent are guarantors under the ABL Credit Agreement (provided that the guarantee of Holdings is non-recourse and limited to the capital

stock of Parent). The obligations under the ABL Credit Agreement are secured on a first priority basis by the assets of Holdings, the

Borrower and guarantors (subject to certain exclusions and exceptions).

The ABL Facility will mature

on November 30, 2028 and will initially bear interest at a floating rate per annum of, at the Borrower’s option, term SOFR

plus 1.75% or a base rate plus 0.75%, and thereafter be subject to a three level pricing grid based on average daily excess availability

(amount by which availability, the lesser of the aggregate amount of ABL commitments and the ABL borrowing base, exceeds the aggregate

outstanding amount of ABL Loans, swingline borrowings and outstanding letters of credit). The term SOFR rate and the base rate are subject

to an interest rate floor of 0.00%. Commitment fees of 0.25% per annum on the average daily undrawn portion of ABL commitments, are payable

to non-defaulting lenders quarterly in arrears after November 30, 2023 and upon the termination of the ABL commitments.

The ABL Facility may be prepaid

at Parent’s option at any time, subject to customary breakage costs.

If at any time the sum of

the outstanding amount under the ABL Facility (including ABL Loans, Letters of Credit outstanding and swingline borrowings thereunder)

exceeds availability (the lesser of the aggregate amount of ABL commitments and the ABL borrowing base), prepayments of ABL Loans and/or

swingline borrowings (and/or cash collateralization of letters of credit) shall be required in an amount equal to such excess.

The ABL Credit Agreement contains

certain covenants, which among other things, limit the ability of Parent and its restricted subsidiaries to (i) incur additional

indebtedness; (ii) pay dividends or make other restricted payments; (iii) make loans and investments; (iv) incur liens;

(v) sell assets; (vi) enter into affiliate transactions; (vii) enter into certain sale and leaseback transactions; (viii) enter

into agreements restricting Parent’s subsidiaries’ ability to pay dividends; and (ix) merge, consolidate or amalgamate

or sell all or substantially all of their property. These covenants are subject to a number of exceptions and qualifications that are

described in the ABL Credit Agreement. The ABL Credit Agreement provides for customary events of default which include (subject in certain

cases to customary grace and cure periods), among others, nonpayment of principal or interest, failure to comply with other covenants

or agreements in the ABL Credit Agreement, failure to pay certain other indebtedness, failure to pay certain final judgments, failure

of certain guarantees to be enforceable and certain events of bankruptcy or insolvency. These events of default are subject to a number

of qualifications, limitations and exceptions that are described in the ABL Credit Agreement. In addition, if certain specified availability

is less than 10% of availability under the ABL Facility at any time, Parent shall be required to satisfy a minimum consolidated fixed

charge coverage ratio for the most recent period of four consecutive fiscal quarters for which financial statements are available of at

least 1.0 to 1.0 and shall continue until the date that specified availability shall have been not less than 10% of availability at any

time during 20 consecutive calendar days.

2030 Notes

On November 30, 2023,

in connection with the issuance and sale by Parent to Goldman Sachs & Co. LLC and the other initial purchasers of the 2030 Notes

(the “Initial Purchasers”), Parent entered into an Indenture (the “Base Indenture”), by and among Parent and

Wilmington Trust, National Association, as trustee (in such capacity, the “Trustee”) and as collateral agent (in such capacity,

the “Collateral Agent”), supplemented by (i) a first supplemental indenture dated as of November 30, 2023 (the

“First Supplemental Indenture”), by and among Parent, the Trustee and the Collateral Agent, providing for the issuance of

the 2030 Notes and (ii) immediately following consummation of the Merger, a second supplemental indenture (the “Second Supplemental

Indenture” and together with the Base Indenture and First Supplemental Indenture, the “Indenture”), dated as of November 30,

2023, by and among Parent, the guarantors party thereto, the Trustee and the Collateral Agent, pursuant to which the guarantors jointly

and severally guaranteed the obligations of Parent under the Base Indenture and the Notes on a senior secured basis.

The 2030 Notes bear interest

at a rate of 10.500% per year, payable in cash in arrears on November 30 and May 30 of each year. The first interest payment

date will be May 30, 2024. The 2030 Notes will mature on November 30, 2030.

At any time prior to November 30,

2026, Parent may, at its option, redeem the 2030 Notes, in whole or in part, at a price equal to 100% of the principal amount, plus a

“make-whole” premium described below, plus accrued and unpaid interest, if any, on the 2030 Notes redeemed to, but not including,

the date of redemption (subject to the right of holders of record on the relevant record date to receive interest due on the relevant

interest payment date falling prior to or on the redemption date). Additionally, at any time and from time to time prior to November 30,

2026, Parent may, at its option, redeem up to 40% of the original aggregate principal amount of the 2030 Notes with the net proceeds of

certain equity offerings at a redemption price equal to 110.500% of the principal amount of the 2030 Notes, together with accrued and

unpaid interest, if any, on the Notes redeemed to, but not including, the date of redemption (subject to the right of holders of record

on the relevant record date to receive interest due on the relevant interest payment date falling prior to or on the redemption date);

provided, however, that if the 2030 Notes are being redeemed as described in this sentence, an aggregate principal amount of 2030 Notes

equal to at least 50% of the original aggregate principal amount of 2030 Notes must remain outstanding after such redemption (unless all

2030 Notes are redeemed substantially concurrently). In addition, during any 12-month period prior to November 30, 2026, Parent may,

at its option, redeem up to 10% of the original aggregate principal amount of the Notes at a redemption price (expressed as a percentage

of the principal amount thereof) equal to 103.000%, plus accrued and unpaid interest, if any, to, but not including, the date of redemption

(subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date falling

prior to or on the date of redemption). At any time and from time to time on and after November 30, 2026, Parent may, at its option,

redeem the 2030 Notes, in whole or in part, at the redemption prices (expressed as a percentage of the principal amount) set forth below,

plus accrued and unpaid interest, if any, on the 2030 Notes redeemed, to, but not including, the relevant redemption date (subject to

the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date falling prior

to or on the redemption date), if redeemed during the twelve-month period commencing on November 30 of the years indicated below:

| Year | |

Price | |

| 2026 | |

| 105.250 | % |

| 2027 | |

| 102.625 | % |

| 2028 and thereafter | |

| 100.000 | % |

If Parent experiences a “Change

of Control” (as defined in the Indenture) or sells certain of its assets, Parent will be required to repurchase the 2030 Notes at

101% of the principal amount of such 2030 Notes being repurchased, subject to certain conditions.

Parent will be required to

offer to purchase the 2030 Notes, subject to certain exceptions, in an amount equal to 100% of the net cash proceeds of certain asset

sales, subject to specified reinvestment rights.

The Indenture contains certain

covenants, which among other things, limit the ability of Parent and its restricted subsidiaries to (i) incur additional indebtedness;

(ii) pay dividends or make other restricted payments; (iii) make loans and investments; (iv) incur liens; (v) sell

assets; (vi) enter into affiliate transactions; (vii) enter into certain sale and leaseback transactions; (viii) enter

into agreements restricting Parent’s subsidiaries’ ability to pay dividends; and (ix) merge, consolidate or amalgamate

or sell all or substantially all of their property. These covenants are subject to a number of exceptions and qualifications that are

described in the Indenture. The Indenture provides for customary events of default which include (subject in certain cases to customary

grace and cure periods), among others, nonpayment of principal or interest, failure to comply with other covenants or agreements in the

2030 Notes or the Indenture, failure to pay certain other indebtedness, failure to pay certain final judgments, failure of certain guarantees

to be enforceable and certain events of bankruptcy or insolvency. These events of default are subject to a number of qualifications, limitations

and exceptions that are described in the Indenture.

The offer and sale of the

2030 Notes and the related guarantees were made in the United States only to persons (i) reasonably believed to be qualified institutional

buyers pursuant to an exemption from registration provided by Rule 144A promulgated under the Securities Act of 1933, as amended

(the “Securities Act”) and (ii) outside the United States to non-U.S. persons in compliance with Regulation

S under the Securities Act. The 2030 Notes and the related guarantees have not been registered under the Securities Act or the securities

laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from

such registration requirements.

Item 1.02. Termination of a Material Definitive

Agreement.

Concurrently with the closing

of the Merger, the Company repaid all loans and terminated all credit commitments outstanding under that certain ABL Credit Agreement,

dated as of July 1, 2014, among Veritiv Operating Company, the lenders party thereto, Bank of America, N.A., as administrative agent

and collateral agent, and the other parties thereto.

Item 2.01. Completion of Acquisition or Disposition

of Assets.

The information set forth

in the Introductory Note and in Items 3.03, 5.01, 5.02, and 5.03 of this Current Report on Form 8-K are incorporated by reference

in this Item 2.01.

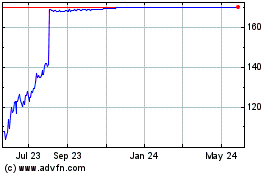

At

the effective time of the Merger (the “Effective Time”), each share of the Company’s common stock, par value $0.01

per share (“Common Stock”), issued and outstanding immediately prior to the Effective Time (other than (i) shares of

Common Stock held by Veritiv as treasury stock or owned by any subsidiary of Veritiv or by Parent or any subsidiary of Parent immediately

prior to the Effective Time and (ii) shares of Common Stock held by a holder who is entitled to demand and properly demands appraisal

of such shares in accordance with Section 262 of the Delaware General Corporation Law) was automatically cancelled and converted

into the right to receive $170 in cash, without interest (the “Merger Consideration”). Any shares of Common Stock held by

Veritiv as treasury stock or owned by any subsidiary of Veritiv or Parent or any subsidiary of Parent immediately prior to the Effective

Time were canceled, and no payment was made with respect thereto.

In addition, pursuant to the Merger Agreement,

at the Effective Time:

| · | each outstanding award of Veritiv’s service-based restricted stock

units (each, a “Company RSU Award”), whether or not vested, and whether settleable in shares of Common Stock or cash, was

canceled, and Veritiv paid or will promptly pay each holder thereof, an amount in cash equal to (i) the Merger Consideration multiplied

by (ii) the number of shares of Common Stock subject to such Company RSU Award, less any required withholding taxes under applicable

law; |

| · | each outstanding award of Veritiv’s performance share units (each,

a “Company PSU Award”), whether or not vested, and whether settleable in shares of Common Stock or cash, was canceled, and

Veritiv paid or will promptly pay each holder thereof an amount in cash equal to (i) the Merger Consideration multiplied by (ii) the

target number of performance share units subject to such Company PSU Award, less any required withholding taxes under applicable law; |

| · | each outstanding award (i) of Veritiv’s deferred stock units (each,

a “Company DSU Award”) and (ii) Veritiv’s phantom stock units (“Company Phantom Awards” and, together

with the Company DSU Awards, the “Company Director Equity Awards”), whether settleable in shares of Common Stock or cash,

was canceled, and Veritiv paid or will promptly pay (or will pay at such later time as would not result in the imposition of taxes under

Section 409A of the U.S. Internal Revenue Code of 1986, as amended) each holder thereof for each such Company Director Equity Award

an amount in cash equal to (i) the Merger Consideration multiplied by (ii) the number of shares of Common Stock subject to such

Company Director Equity Award, together with any cash dividends accrued, less any required withholding taxes under applicable law; |

| · | each then outstanding award of Veritiv’s performance-based units (each,

a “Company PBU Award”), whether or not vested, was canceled and Veritiv paid or promptly will pay each holder thereof an amount

in cash equal to $1.00 multiplied by the target number of performance-based units subject to such Company PBU Award, less any required

withholding taxes under applicable law. |

A copy of the Merger Agreement

is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The foregoing description of the Merger Agreement is only

a summary, does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.03.

Item 3.01. Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth

in the Introductory Note and in Item 2.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.01.

On

the Closing Date, the Company notified the New York Stock Exchange (the “NYSE”) that the Merger had been completed and requested

that the NYSE suspend trading of Common Stock on the NYSE prior to the opening of trading on the Closing Date. The Company also requested

that the NYSE file with the U.S. Securities and Exchange Commission (the “SEC”) a notification of removal from listing and

registration on Form 25 to effect the delisting of all shares of Common Stock from the NYSE and the deregistration of such shares

under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, trading

of the shares of Common Stock, which traded under the ticker symbol “VRTV” on

the NYSE, was suspended prior to the opening of trading on the NYSE on November 30, 2023.

In addition, upon effectiveness

of the Form 25, the Company intends to file a certification on Form 15 with the SEC to deregister all shares of Common Stock

and suspend of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

Item 3.03. Material Modification to Rights

of Security Holders.

The information set forth

in the Introductory Note and in Items 2.01, 3.01, 5.01 and 5.03 of this Current Report on Form 8-K is incorporated by reference in

this Item 3.03.

At the Effective Time, each

holder of shares of Common Stock outstanding immediately prior to the Effective Time ceased to have any rights as a stockholder of the

Company (other than the right to receive the Merger Consideration for such shares pursuant to the terms of the Merger Agreement).

Item 5.01. Changes in Control of the Registrant.

The information set forth

in the Introductory Note and in Items 2.01, 2.03, 3.03 and 5.02 of this Current Report on Form 8-K is incorporated by reference in

this Item 5.01.

As a result of the completion

of the Merger, a change in control of the Company occurred, and the Company became a wholly-owned subsidiary of Parent. The aggregate

Merger Consideration paid to Company stockholders was approximately $2,300 million. The funds used by Parent to consummate the Merger

and complete the related transactions came from equity contributions from the investment funds affiliated with CD&R, and proceeds

received in connection with debt financing pursuant to the Term Loan Credit Agreement, the ABL Credit Agreement and the Indenture along

with cash from the Company’s balance sheet.

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth

in the Introductory Note and in Item 2.01 of this Current Report on Form 8-K is incorporated by reference in this Item 5.02.

Directors

Pursuant to the terms of the

Merger Agreement, upon, but conditioned on the occurrence of, the Effective Time, Stephen E. Macadam, Salvatore A. Abbate, Autumn R. Bayles,

Shantella E. Cooper, David E. Flitman, Tracy A. Leinbach, Gregory B. Morrison, Michael P. Muldowney and Charles G. Ward, III each

resigned from their positions as members of the board of directors of the Company and from any and all committees of the board of directors

on which they served. In addition, pursuant to the terms of the Merger Agreement, from and after the Effective Time, Robert C. Volpe, Ian

A. Rorick and Kirsten Colwell, who were directors of Merger Subsidiary immediately before the Effective Time, became directors of the

Surviving Corporation. Immediately following the Effective Time, Salvatore A. Abbate, Eric J. Guerin and Susan B. Salyer were appointed

to the board of directors of the Surviving Corporation and Robert C. Volpe, Ian A. Rorick and Kirsten Colwell resigned from the board

of directors of the Surviving Corporation.

Officers

The officers of the Company

immediately prior to the Effective Time continued as officers of the Company.

Item 5.03. Amendments to Articles of Incorporation of Bylaws; Change

in Fiscal Year.

The information contained

in the Introductory Note and in Item 2.01 of this Current Report on Form 8-K is incorporated by reference in this Item 5.03.

Pursuant to the Merger Agreement,

at the Effective Time, the Amended and Restated Certificate of Incorporation of the Company was amended and restated in its entirety to

be in the form of the certificate of incorporation of Merger Subsidiary as in effect immediately prior to the Effective Time, except that

references to the Merger Subsidiary’s name were replaced with references to the Company’s name (the “Certificate of

Incorporation”). In addition, at the Effective Time, the Amended and Restated Bylaws of the Company, as in effect immediately prior

to the Effective Time, were amended and restated in their entirety to be in the form of the bylaws of Merger Subsidiary as in effect immediately

prior to the Effective Time, except that references to the Merger Subsidiary’s name were replaced with references to the Company’s

name (the “Bylaws”). Copies of the Certificate of Incorporation and the Bylaws are filed as Exhibits 3.1 and 3.2 to this Current

Report on Form 8-K, respectively, and are incorporated herein by reference.

Item 8.01. Other Events.

On the Closing Date, the Company

issued a press release announcing the closing of the Merger. A copy of the press release is attached hereto as Exhibit 99.1 and is

incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit

No. |

|

Description of Exhibit |

| 2.1 |

|

Agreement and Plan of Merger, dated as of August 6, 2023, by and among the among Veritiv Corporation, Verde Purchaser, LLC and Verde Merger Sub, Inc. (filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed on August 7, 2023 and incorporated herein by reference).* |

| 3.1 |

|

Amended and Restated Certificate of Incorporation of Veritiv Corporation. |

| 3.2 |

|

Amended and Restated Bylaws of Veritiv Corporation. |

| 99.1 |

|

Press Release, dated as of November 30, 2023. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*

Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The

Company hereby undertakes to furnish supplemental copies of any of the omitted schedules upon request by the SEC.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| VERITIV CORPORATION |

|

| |

|

| By: |

/s/ Susan B. Salyer |

|

| |

Susan B. Salyer |

|

| |

Senior Vice President, General Counsel & Corporate Secretary |

|

Dated: November 30, 2023

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

VERITIV CORPORATION

ARTICLE One

The name of the Corporation

is Veritiv Corporation (the “Corporation”)

ARTICLE Two

The address of the Corporation’s

registered office in the State of Delaware is 1209 Orange Street, in the City of Wilmington, County of New Castle, 19801. The name of

the Corporation’s registered agent at such address is The Corporation Trust Company.

ARTICLE Three

The

purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation

Law of the State of Delaware (as amended from time to time, the “DGCL”).

ARTICLE Four

The total number of shares of

capital stock that the Corporation has authority to issue is 1,000 shares of Common Stock, par value $0.01 per share.

ARTICLE Five

The Corporation is to have perpetual

existence.

ARTICLE Six

In furtherance and not in limitation

of the powers conferred by statute, the board of directors of the Corporation is expressly authorized to make, alter or repeal the bylaws

of the Corporation.

ARTICLE Seven

Meetings of stockholders may

be held within or outside of the State of Delaware, as the bylaws of the Corporation may provide. The books of the Corporation may be

kept outside the State of Delaware at such place or places as may be designated from time to time by the board of directors or in the

bylaws of the Corporation. Election of directors need not be by written ballot unless the bylaws of the Corporation so provide.

ARTICLE Eight

To

the fullest extent permitted by the DGCL as it now exists or may hereafter be amended (but, in the case of any such amendment, only to

the extent that such amendment permits the Corporation to provide broader exculpation rights than permitted prior thereto), a director

of the Corporation shall not be liable to the Corporation or its stockholders for monetary damages arising from a breach of fiduciary

duty as a director. Any repeal or modification of this ARTICLE EIGHT shall not adversely affect any right or protection of a director

existing hereunder with respect to any act or omission occurring at or prior to the time of such repeal or modification.

ARTICLE Nine

The Corporation expressly elects

not to be governed by §203 of the DGCL.

ARTICLE Ten

The Corporation reserves the

right to amend, alter, change or repeal any provision contained in this certificate of incorporation in the manner now or hereafter prescribed

herein and by the laws of the State of Delaware, and all rights conferred upon stockholders herein are granted subject to this reservation.

ARTICLE Eleven

To the maximum extent permitted

from time to time under the law of the State of Delaware, the Corporation renounces any interest or expectancy of the Corporation in,

or in being offered an opportunity to participate in, business opportunities that are from time to time presented to its officers, directors

or stockholders, other than those officers, directors or stockholders who are employees of the Corporation. No amendment or repeal of

this ARTICLE ELEVEN shall apply to or have any effect on the liability or alleged liability of any officer, director or stockholder

of the Corporation for or with respect to any opportunities of which such officer, director, or stockholder becomes aware prior to such

amendment or repeal.

* * * * *

Exhibit 3.2

AMENDED

AND RESTATED

BY-LAWS

OF

VERITIV

CORPORATION

A Delaware corporation

(Adopted as of November 30, 2023)

ARTICLE I

OFFICES

Section 1 Registered

Office. The registered office of Veritiv Corporation (the "Corporation") in the State of Delaware shall be

located at 1209 Orange Street, New Castle County, Wilmington, DE 19081. The name of the Corporation's registered agent at such address

shall be The Corporation Trust Company. The registered office and/or registered agent of the Corporation may be changed from time to

time by action of the board of directors of the Corporation (the "Board").

Section 2 Other

Offices. The Corporation may also have offices at such other places, both within and without the State of Delaware, as the

Board may from time to time determine or the business of the Corporation may require.

ARTICLE II

MEETINGS OF STOCKHOLDERS

Section 1 Annual

Meetings. An annual meeting of the stockholders shall be held each year within one hundred twenty (120) days after the close

of the immediately preceding fiscal year of the Corporation for the purpose of electing directors and conducting such other proper business

as may come before the meeting. The date, time and place, if any, and/or the means of remote communication, of the annual meeting shall

be determined by the chief executive officer of the Corporation; provided, however, that if the chief executive officer

does not act, the Board shall determine the date, time and place, if any, and/or the means of remote communication, of such meeting.

No annual meeting of stockholders need be held if not required by the Corporation's certificate of incorporation or by the General Corporation

Law of the State of Delaware.

Section 2 Special

Meetings. Special meetings of stockholders may be called for any purpose (including, without limitation, the filling of Board

vacancies and newly created directorships) and may be held at such time and place, within or without the State of Delaware, and/or by

means of remote communication, as shall be stated in a written notice of meeting. Such meetings may be called by the Board or the chief

executive officer only with five business days prior written notice (which notice period may not be waived) to the stockholders and shall

be called by the chief executive officer upon the written request of holders of shares entitled to cast not less than fifty percent of

the votes at the meeting, which written request shall state the purpose or purposes of the meeting and shall be delivered to the chief

executive officer. The date, time and place, if any, and/or remote communication, of any special meeting of stockholders shall be determined

by the chief executive officer of the Corporation; provided, however, that if the chief executive officer does not act, the Board shall

determine the date, time and place, if any, and/or the means of remote communication, of such meeting. On such written request, the chief

executive officer shall fix a date and time for such meeting within two (2) days after receipt of a request for such meeting in

such written request.

Section 3 Place

of Meetings. The Board may designate any place, either within or without the State of Delaware, and/or by means of remote

communication, as the place of meeting for any annual meeting or for any special meeting called by the Board. If no designation is made,

or if a special meeting be otherwise called, the place of meeting shall be the principal executive office of the Corporation.

Section 4 Notice.

Whenever stockholders are required or permitted to take any action at a meeting, written or printed notice stating the place, if any,

date and hour of the meeting, the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be

present in person and vote at such meeting, and, in the case of special meetings, the purpose or purposes, of such meeting, shall be

given to each stockholder entitled to vote at such meeting and to each director not less than ten (10) nor more than sixty (60)

days before the date of the meeting. All such notices shall be delivered, either personally, by mail, or by a form of electronic transmission

consented to by the stockholder to whom the notice is given, by or at the direction of the Board, the chief executive officer or the

secretary, and if mailed, such notice shall be deemed to be delivered when deposited in the United States mail, postage prepaid, addressed

to the stockholder at his, her or its address as the same appears on the records of the Corporation. If given by electronic transmission,

such notice shall be deemed to be delivered (a) if by facsimile telecommunication, when directed to a number at which the stockholder

has consented to receive notice; (b) if by electronic mail, when directed to an electronic mail address at which the stockholder

has consented to receive notice; (c) if by a posting on an electronic network together with separate notice to the stockholder of

such specific posting, upon the later of (1) such posting and (2) the giving of such separate notice; and (3) if

by any other form of electronic transmission, when directed to the stockholder. Any such consent shall be revocable by the stockholder

by written notice to the Corporation. Any such consent shall be deemed revoked if (1) the Corporation is unable to deliver by electronic

transmission two consecutive notices given by the Corporation in accordance with such consent and (2) such inability becomes known

to the secretary or an assistant secretary of the Corporation or to the transfer agent. Attendance of a person at a meeting shall constitute

a waiver of notice of such meeting, except when the person attends for the express purpose of objecting at the beginning of the meeting

to the transaction of any business because the meeting is not lawfully called or convened.

Section 5 Stockholders

List. The officer who has charge of the stock ledger of the Corporation shall make, at least ten (10) days before every

meeting of the stockholders, a complete list of the stockholders entitled to vote at such meeting arranged in alphabetical order, showing

the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination

of any stockholder, for any purpose germane to the meeting, for a period of at least ten (10) days prior to the meeting: (i) on

a reasonably accessible electronic network, provided that the information required to gain access to such list is provided with the notice

of the meeting, and/or (ii) during ordinary business hours, at the principal place of business of the Corporation. In the event

that the Corporation determines to make the list available on an electronic network, the Corporation may take reasonable steps to ensure

that such information is available only to stockholders of the Corporation. If the meeting is to be held at a place, then the list shall

be produced and kept at the time and place of the meeting during the whole time thereof, and may be inspected by any stockholder who

is present. If the meeting is to be held solely by means of remote communication, then the list shall also be open to the examination

of any stockholder during the whole time of the meeting on a reasonably accessible electronic network, and the information required to

access such list shall be provided with the notice of the meeting.

Section 6 Quorum.

The holders of a majority of the votes represented by the issued and outstanding shares of capital stock, entitled to vote thereon, present

in person or represented by proxy, shall constitute a quorum at all meetings of the stockholders, except as otherwise provided by statute

or by the certificate of incorporation. If a quorum is not present, the holders of a majority of the shares present in person or represented

by proxy at the meeting, and entitled to vote at the meeting, may adjourn the meeting to another time and/or place. When a quorum is

once present to commence a meeting of stockholders, it is not broken by the subsequent withdrawal of any stockholders or their proxies.

Section 7 Adjourned

Meetings. When a meeting is adjourned to another time and place, notice need not be given of the adjourned meeting if the

time, place, if any, thereof, and the means of remote communications, if any, by which stockholders and proxy holders may be deemed to

be present in person and vote at such adjourned meeting are announced at the meeting at which the adjournment is taken. At the adjourned

meeting, the Corporation may transact any business which might have been transacted at the original meeting. If the adjournment is for

more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned

meeting shall be given to each stockholder of record entitled to vote at the meeting.

Section 8 Vote

Required. When a quorum is present, the affirmative vote of the majority of shares present in person or represented by proxy

at the meeting and entitled to vote on the subject matter shall be the act of the stockholders, unless the question is one upon which

by express provisions of an applicable law or of the certificate of incorporation a different vote is required, in which case such express

provision shall govern and control the decision of such question.

Section 9 Voting

Rights. Except as otherwise provided by the General Corporation Law of the State of Delaware or by the certificate of incorporation

of the Corporation or any amendments thereto and subject to Section 3 of Article VI hereof, every stockholder shall at every

meeting of the stockholders be entitled to one vote in person or by proxy for each share of common stock held by such stockholder.

Section 10 Proxies.

Each stockholder entitled to vote at a meeting of stockholders or to express consent or dissent to corporate action in writing without

a meeting may authorize another person or persons to act for such stockholder by proxy, but no such proxy shall be voted or acted upon

after three (3) years from its date, unless the proxy provides for a longer period. At each meeting of the stockholders, and before

any voting commences, all proxies filed at or before the meeting shall be submitted to and examined by the secretary or a person designated

by the secretary, and no shares may be represented or voted under a proxy that has been found to be invalid or irregular.

Section 11 Action

by Written Consent. Unless otherwise provided in the certificate of incorporation, any action required to be taken at any

annual or special meeting of stockholders of the Corporation, or any action which may be taken at any annual or special meeting of such

stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth

the action so taken and bearing the dates of signature of the stockholders who signed the consent or consents, shall be signed by the

holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action

at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation by delivery

to its registered office in the state of Delaware, the Corporation's principal place of business, or an officer or agent of the Corporation

having custody of the book or books in which proceedings of meetings of the stockholders are recorded. Delivery made to the Corporation's

registered office shall be by hand or by certified or registered mail, return receipt requested or by reputable overnight courier service.

All consents properly delivered in accordance with this section shall be deemed to be recorded when so delivered. No written consent

shall be effective to take the corporate action referred to therein unless, within sixty (60) days after the earliest dated consent delivered

to the Corporation as required by this section, written consents signed by the holders of a sufficient number of shares to take such

corporate action are so recorded. Prompt notice of the taking of the corporate action without a meeting by less than unanimous written

consent shall be given to those stockholders who have not consented in writing. Any action taken pursuant to such written consent or

consents of the stockholders shall have the same force and effect as if taken by the stockholders at a meeting thereof.

Any copy, facsimile or other

reliable reproduction of a consent in writing may be substituted or used in lieu of the original writing for any and all purposes for

which the original writing could be used; provided that such copy, facsimile or other reproduction shall be a complete reproduction of

the entire original writing.

Section 12 Action

by Electronic Transmission Consent. An electronic transmission consenting to an action to be taken and transmitted by a stockholder

or proxyholder, or by a person or persons authorized to act for a stockholder or proxyholder, shall be deemed to be written, signed and

dated for the purposes of this section; provided that any such electronic transmission sets forth or is delivered with information from

which the Corporation can determine (A) that the electronic transmission was transmitted by the stockholder or proxyholder or by

a person or persons authorized to act for the stockholder or proxyholder and (B) the date on which such stockholder or proxyholder

or authorized person or persons transmitted such electronic transmission. The date on which such electronic transmission is transmitted

shall be deemed to be the date on which such consent was signed. No consent given by electronic transmission shall be deemed to have

been delivered until such consent is reproduced in paper form and until such paper form shall be delivered to the Corporation by delivery

to its registered office in the State of Delaware, its principal place of business or an officer or agent of the Corporation having custody

of the book in which proceedings of meetings of stockholders are recorded if, to the extent and in the manner provided by resolution

of the Board.

ARTICLE III

DIRECTORS

Section 1 General

Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board.

Section 2 Number,

Election and Term of Office. The number of directors which shall constitute the first Board shall be three (3). Thereafter,

the number of directors shall be established from time to time by resolution of the Board. The directors shall be elected by a plurality

of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote in the election of directors.

The directors shall be elected in this manner at the annual meeting of the stockholders, except as provided in Section 4 of this

Article III. Each director elected shall hold office until a successor is duly elected and qualified or until his or her earlier

death, resignation or removal as hereinafter provided.

Section 3 Removal

and Resignation. Any director or the entire Board may be removed at any time, with or without cause, by the holders of a majority

of the shares then entitled to vote at an election of directors. Whenever the holders of any class or series are entitled to elect one

or more directors by the provisions of the Corporation's certificate of incorporation, the provisions of this section shall apply, in

respect to the removal without cause of a director or directors so elected, to the vote of the holders of the outstanding shares of that

class or series and not to the vote of the outstanding shares as a whole. Any director may resign at any time upon notice given in writing

or by electronic transmission to the Corporation.

Section 4 Vacancies.

Except as otherwise provided in the certificate of incorporation of the Corporation, Board vacancies and newly created directorships

resulting from any increase in the authorized number of directors may be filled by a majority of the directors then in office, though

less than a quorum, or by a sole remaining director. Each director so chosen shall hold office until a successor is duly elected and

qualified or until his or her earlier death, resignation or removal as herein provided.

Notwithstanding the foregoing,

any such vacancy shall automatically reduce the authorized number of directors pro tanto, until such time as the holders of outstanding

shares of capital stock who are entitled to elect the director whose office is vacant shall have exercised their right to elect a director

to fill such vacancy, whereupon the authorized number of directors shall be automatically increased pro tanto. Each director so

chosen shall hold office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal as

herein provided.

Section 5 Annual

Meetings. The annual meeting of each newly elected Board shall be held without notice (other than notice under these by-laws)

immediately after, and at the same place, if any, as the annual meeting of stockholders.

Section 6 Other

Meetings and Notice. Regular meetings, other than the annual meeting, of the Board may be held without notice at such time

and at such place, if any, as shall from time to time be determined by resolution of the Board and promptly communicated to all directors

then in office. Special meetings of the Board may be called by or at the request of the chief executive officer or at least one of the

directors on at least 24 hours notice to each director, either personally, by telephone, by mail, telegraph, and/or by electronic transmission.

In like manner and on like notice, the chief executive officer must call a special meeting on the written request of at least 2 of the

directors promptly after receipt of such request.

Section 7 Quorum,

Required Vote and Adjournment. A majority of the total number of authorized directors shall constitute a quorum for the transaction

of business. The vote of a majority of directors present at a meeting at which a quorum is present shall be the act of the Board. If

a quorum shall not be present at any meeting of the Board, the directors present thereat may adjourn the meeting from time to time, without

notice other than announcement at the meeting, until a quorum shall be present. Except as otherwise required by the Corporation's certificate

of incorporation, each director shall be entitled to one vote.

Section 8 Committees.

The Board may, by resolution passed by a majority of the whole board, designate one or more committees, each committee to consist of

one or more of the directors of the Corporation, which to the extent provided in such resolution or these by-laws shall have and may

exercise the powers of the Board in the management and affairs of the Corporation, except as otherwise limited by law. The Board may

designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting

of the committee. Such committee or committees shall have such name or names as may be determined from time to time by resolution adopted

by the Board. Each committee shall keep regular minutes of its meetings and report the same to the Board when required.

Section 9 Committee

Rules. Each committee of the Board may fix its own rules of procedure and shall hold its meetings as provided by such

rules, except as may otherwise be provided by a resolution of the Board designating such committee. Unless otherwise provided in such

a resolution, the presence of a majority of the members of the committee then in office shall be necessary to constitute a quorum. In

the event that a member and that member's alternate, if alternates are designated by the Board as provided in Section 8 of this

Article III, of such committee is or are absent or disqualified, the member or members thereof present at any meeting and not disqualified

from voting, whether or not such member or members constitute a quorum, may unanimously appoint another member of the Board to act at

the meeting in place of any such absent or disqualified member.

Section 10 Executive

Committee. The Board may, by resolution adopted by a majority of the whole Board, designate two directors to constitute

an executive committee. The executive committee, to the extent provided in the resolution, shall have and may exercise all of the authority

of the Board in the management of the Corporation, except that the committee shall have no authority in reference to amending the certificate

of incorporation; adopting an agreement of merger or consolidation; recommending to the stockholders the sale, lease, or exchange of

all or substantially all of the Corporation's property and assets; recommending to the stockholders a dissolution of the Corporation

or a revocation of a dissolution; amending the by-laws of the Corporation; electing or removing directors or officers of the Corporation

or members of the executive committee; declaring dividends; or amending, altering, or repealing any resolution of the Board which, by

its terms, provides that it shall not be amended, altered or repealed by the executive committee. The Board shall have power at any time

to fill vacancies in, to change the size or membership of and to discharge the executive committee.

Section 11 Audit

Committee. The audit committee shall consist of not fewer than two (2) members of the Board as shall from time to time

be appointed by resolution of the Board. No member of the Board who is an affiliate of the Corporation or an officer or an employee of

the Corporation or any subsidiary of the Corporation shall be eligible to serve on the audit committee. The audit committee shall review

and, as it shall deem appropriate, recommend to the board internal accounting and financial controls for the Corporation and accounting

principles and auditing practices and procedures to be employed in the preparation and review of financial statements of the Corporation.

The audit committee shall make recommendations to the Board concerning the engagement of independent public accountants to audit the

annual financial statements of the Corporation and the scope of the audit to be undertaken by such accountants.

Section 12 Compensation

Committee. The compensation committee shall consist of not fewer than two (2) members of the Board as from time to time

shall be appointed by resolution of the Board. No member of the Board who is an affiliate of the Corporation or an officer or an employee

of the Corporation or any subsidiary of the Corporation shall be eligible to serve on the compensation committee. The compensation committee

shall review and, as it deems appropriate, recommend to the chief executive officer and the Board policies, practices and procedures

relating to the compensation of managerial and executive level employees and the establishment and administration of employee benefit

plans. The compensation committee shall have and exercise all authority under any employee stock option plans of the Corporation as the

committee described therein (unless the Board by resolution appoints any other committee to exercise such authority), and shall otherwise

advise and consult with the officers of the Corporation as may be requested regarding managerial personnel policies.

Section 13 Communications

Equipment. Members of the Board or any committee thereof may participate in and act at any meeting of such Board or committee

by means of conference telephone or other communications equipment by means of which all persons participating in the meeting can hear

each other, and participation in the meeting pursuant to this section shall constitute presence in person at the meeting.

Section 14 Waiver

of Notice and Presumption of Assent. Any member of the Board or any committee thereof who is present at a meeting shall be

conclusively presumed to have waived notice of such meeting, except when such member attends for the express purpose of objecting at

the beginning of the meeting to the transaction of any business because the meeting is not lawfully called or convened. Such member shall

be conclusively presumed to have assented to any action taken unless his or her dissent shall be entered in the minutes of the meeting

or unless his or her written dissent to such action shall be filed with the person acting as the secretary of the meeting before the

adjournment thereof or shall be forwarded by registered mail to the secretary of the Corporation immediately after the adjournment of

the meeting. Such right to dissent shall not apply to any member who voted in favor of such action.

Section 15 Action

by Written Consent. Unless otherwise restricted by the certificate of incorporation, any action required or permitted to be

taken at any meeting of the Board, or of any committee thereof, may be taken without a meeting if all members of the board or committee,

as the case may be, consent thereto in writing or by electronic transmission, and the writing or writings or electronic transmission

or transmissions are filed with the minutes of proceedings of the board, or committee. Such filing shall be in paper form if the minutes

are maintained in paper form and shall be in electronic form if the minutes are maintained in electronic form.

ARTICLE IV

OFFICERS

Section 1 Number.

The officers of the Corporation shall be elected by the Board and may consist of a chairman of the board, a vice chairman of the board,

a chief executive officer, one or more vice-presidents, a chief operating officer, a chief financial officer, an executive vice president,

a secretary, a treasurer, and such other officers and assistant officers as may be deemed necessary or desirable by the Board. Any number

of offices may be held by the same person. In its discretion, the Board may choose not to fill any office for any period as it may deem

advisable.

Section 2 Election

and Term of Office. The officers of the Corporation shall be elected annually by the Board at its first meeting held after

each annual meeting of stockholders or as soon thereafter as conveniently may be. Vacancies may be filled or new offices created and

filled at any meeting of the Board. Each officer shall hold office until a successor is duly elected and qualified or until his or her

earlier death, resignation or removal as hereinafter provided.

Section 3 Removal.

Any officer or agent elected by the Board may be removed by the Board whenever in its judgment the best interests of the Corporation

would be served thereby, but such removal shall be without prejudice to the contract rights, if any, of the person so removed.

Section 4 Vacancies.

Any vacancy occurring in any office because of death, resignation, removal, disqualification or otherwise, may be filled by the Board

for the unexpired portion of the term by the Board then in office.

Section 5 Compensation.

Compensation of all officers shall be fixed by the Board, and no officer shall be prevented from receiving such compensation by virtue

of his or her also being a director of the Corporation.

Section 6 Chairman

of the Board. Subject to the powers of the Board, the chairman of the board shall be in the general and active charge of the

entire business and affairs of the Corporation, and shall be its chief policy making officer. The chairman of the Board shall preside

at all meetings of the Board and at all meetings of the stockholders and shall have such other powers and perform such other duties as

may be prescribed by the Board or provided in these by-laws. Whenever the chief executive officer is unable to serve, by reason of sickness,

absence or otherwise, the chairman of the Board shall perform all the duties and responsibilities and exercise all the powers of the

chief executive officer.

Section 7 Vice-Chairman.

Whenever the chairman of the Board is unable to serve, by reason of sickness, absence, or otherwise, the vice-chairman shall have the

powers and perform the duties of the chairman of the board. The vice-chairman shall have such other powers and perform such other duties

as may be prescribed by the chairman of the board, the Board or these by-laws.

Section 8 Chief

Executive Officer. The chief executive officer shall be the chief executive officer of the Corporation; in the absence of

the chairman of the Board, shall preside at all meetings of the stockholders and Board at which he or she is present; subject to the

powers of the Board, and the chairman of the Board, shall have general charge of the business, affairs and property of the Corporation,

and control over its officers, agents and employees; and shall see that all orders and resolutions of the Board are carried into effect.

The chief executive officer shall execute bonds, mortgages and other contracts requiring a seal, under the seal of the Corporation, except

where required or permitted by law to be otherwise signed and executed and except where the signing and execution thereof shall be expressly

delegated by the Board to some other officer or agent of the Corporation. The chief executive officer shall have such other powers and

perform such other duties as may be prescribed by the chairman of the Board or the Board or as may be provided in these by-laws.

Section 9 Chief

Operating Officer. The chief operating officer of the Corporation, subject to the powers of the Board, shall engage in the

general and active management of the business of the Corporation; and shall see that all orders and resolutions of the Board are carried

into effect. The chief operating officer shall have such other powers and perform such other duties as may be prescribed by the chairman

of the Board, the chief executive officer or the Board or as may be provided in these by-laws.

Section 10 Chief

Financial Officer. The chief financial officer of the Corporation shall, under the direction of the chief executive officer,

be responsible for all financial and accounting matters and for the direction of the offices of treasurer and controller. The chief financial

officer shall have such other powers and perform such other duties as may be prescribed by the chairman of the Board, the chief executive

officer or the Board or as may be provided in these by-laws.

Section 11 Vice-presidents.

The vice-president, or if there shall be more than one, the vice-presidents in the order determined by the Board, shall, in the absence

or disability of the chief executive officer, act with all of the powers and be subject to all the restrictions of the chief executive

officer. The vice-presidents shall also perform such other duties and have such other powers as the Board, the chief executive officer

or these by-laws may, from time to time, prescribe.

Section 12 Secretary

and Assistant Secretaries. The secretary shall attend all meetings of the Board, all meetings of the committees thereof and

all meetings of the stockholders and record all the proceedings of the meetings in a book or books to be kept for that purpose. Under

the chief executive officer's supervision, the secretary shall give, or cause to be given, all notices required to be given by these

by-laws or by law, shall have such powers and perform such duties as the Board, the chief executive officer or these by-laws may, from

time to time, prescribe, and shall have custody of the corporate seal of the Corporation. The secretary, or an assistant secretary, shall

have authority to affix the corporate seal to any instrument requiring it and when so affixed, it may be attested by his or her signature

or by the signature of such assistant secretary. The Board may give general authority to any other officer to affix the seal of the Corporation

and to attest the affixing by his or her signature. The assistant secretary, or if there be more than one, the assistant secretaries

in the order determined by the Board, shall, in the absence or disability of the secretary, perform the duties and exercise the powers

of the secretary and shall perform such other duties and have such other powers as the Board, the president, or secretary may, from time

to time, prescribe.

Section 13 Treasurer

and Assistant Treasurer. The treasurer shall have the custody of the corporate funds and securities; shall keep full and accurate

accounts of receipts and disbursements in books belonging to the Corporation; shall deposit all monies and other valuable effects in

the name and to the credit of the Corporation as may be ordered by the Board; shall cause the funds of the Corporation to be disbursed

when such disbursements have been duly authorized, taking proper vouchers for such disbursements; and shall render to the chief executive

officer and the Board, at its regular meeting or when the Board so requires, an account of the Corporation; shall have such powers and

perform such duties as the Board, the chief executive officer or these by-laws may, from time to time, prescribe. If required by the

Board, the treasurer shall give the Corporation a bond (which shall be rendered every six years) in such sums and with such surety or

sureties as shall be satisfactory to the Board for the faithful performance of the duties of the office of treasurer and for the restoration

to the Corporation, in case of death, resignation, retirement, or removal from office, of all books, papers, vouchers, money, and other

property of whatever kind in the possession or under the control of the treasurer belonging to the Corporation. The assistant treasurer,

or if there shall be more than one, the assistant treasurers in the order determined by the Board, shall in the absence or disability

of the treasurer, perform the duties and exercise the powers of the treasurer. The assistant treasurers shall perform such other duties

and have such other powers as the Board, the chief executive officer or treasurer may, from time to time, prescribe.

Section 14 Other

Officers, Assistant Officers and Agents. Officers, assistant officers and agents, if any, other than those whose duties are

provided for in these by-laws, shall have such authority and perform such duties as may from time to time be prescribed by resolution

of the Board.

Section 15 Absence

or Disability of Officers. In the case of the absence or disability of any officer of the Corporation and of any person hereby

authorized to act in such officer's place during such officer's absence or disability, or for any other reason that the Board may deem

sufficient, the Board may by resolution delegate the powers and duties of such officer to any other officer or to any director, or to

any other person whom it may select.

ARTICLE V

INDEMNIFICATION OF OFFICERS, DIRECTORS AND OTHERS

Section 1 Nature

of Indemnity. Each person who was or is made a party or is threatened to be made a party to or is involved in any action,

suit or proceeding, whether brought by or in the right of the Corporation or any of its subsidiaries and whether civil, criminal, administrative

or investigative (hereinafter a "proceeding"), or any appeal of such proceeding, by reason of or arising out of the fact that

such person, or any other person for whom such person is the legal representative, is or was a director or officer of the Corporation

or is or was serving at the request of the Corporation as a director, officer, manager, general partner, employee, fiduciary, or agent

of another corporation or of a partnership, limited liability company, joint venture, trust or other enterprise, may be indemnified and

held harmless by the Corporation to the fullest extent which it is empowered to do so unless prohibited from doing so by the General

Corporation Law of the State of Delaware, as the same exists or may hereafter be amended (but, in the case of any such amendment, only

to the extent that such amendment permits the Corporation to provide broader indemnification rights than said law permitted the Corporation

to provide prior to such amendment) against all expense, liability and loss (including attorneys' fees actually and reasonably incurred

by such person in connection with such proceeding), and such indemnification shall inure to the benefit of his or her heirs, executors

and administrators; but only if such person acted in good faith and in a manner which such person reasonably believed to be (in the case

of such person's official capacity) in the best interests of the Corporation or (in all other cases) not opposed to the best interests

of the Corporation, and in addition, in the case of a criminal action or proceeding, such person had no reasonable cause to believe that

his or her conduct was unlawful; provided that, except as provided in Section 2 of this Article V, the Corporation shall indemnify

any such person seeking indemnification in connection with a proceeding initiated by such person only if such proceeding was authorized

by the Board of the Corporation. The right to indemnification conferred in this Article V shall be a contract right and, subject

to Sections 2 and 5 hereof, shall include the right to be paid by the Corporation the expenses incurred in defending any such

proceeding in advance of its final disposition. The Corporation may, by action of its Board, provide indemnification to employees and

agents of the Corporation with the same scope and effect as the foregoing indemnification of directors and officers.

Section 2 Procedure

for Indemnification of Directors and Officers. Any indemnification of a director or officer of the Corporation provided for

under Section 1 of this Article V or advance of expenses provided for under Section 5 of this Article V shall be

made promptly, and in any event within thirty (30) days, upon the written request of the director or officer. If a determination

by the Corporation that the director or officer is entitled to indemnification pursuant to this Article V is required, and the Corporation

fails to respond within sixty (60) days to a written request for indemnity, the Corporation shall be deemed to have approved the request.

If the Corporation wrongfully denies a written request for indemnification or advancing of expenses, in whole or in part, or if payment

in full pursuant to such request is not properly made within thirty (30) days, the right to indemnification or advances as granted

by this Article V shall be enforceable by the director or officer in any court of competent jurisdiction. Such person's costs and

expenses incurred in connection with successfully establishing his or her right to indemnification, in whole or in part, in any such

action shall also be indemnified by the Corporation. It shall be a defense to any such action (other than an action brought to enforce

a claim for expenses incurred in defending any proceeding in advance of its final disposition where the required undertaking, if any,

has been tendered to the Corporation) that the claimant has not met the standards of conduct which make it permissible under the General

Corporation Law of the State of Delaware for the Corporation to indemnify the claimant for the amount claimed, but the burden of such

defense shall be on the Corporation. Neither the failure of the Corporation (including its Board, independent legal counsel, or its stockholders)

to have made a determination prior to the commencement of such action that indemnification of the claimant is proper in the circumstances

because he or she has met the applicable standard of conduct set forth in the General Corporation Law of the State of Delaware, nor an

actual determination by the Corporation (including its Board, independent legal counsel, or its stockholders) that the claimant has not

met such applicable standard of conduct, shall be a defense to the action or create a presumption that the claimant has not met the applicable

standard of conduct. No officer or director will make any claim for indemnification against the Corporation by reason of the fact that

he, she, or it was a director, officer, employee, or agent of the Corporation or was serving at the request of the Corporation as a partner,

trustee, director, officer, employee, or agent of another entity (whether such claim is for judgments, damages, penalties, fines, costs,

amounts paid in settlement, losses, expenses, including any advancement thereof, or otherwise and whether such claim is pursuant to any

statute, charter document, bylaw, agreement, or otherwise) with respect to any action, suit, proceeding, complaint, claim, or demand

brought by the Corporation against such officer or director (whether such action, suit, proceeding, complaint, claim, or demand is pursuant

to applicable law or otherwise).

Section 3 Article Not

Exclusive. The rights to indemnification and the payment of expenses incurred in defending a proceeding in advance of its

final disposition conferred in this Article V shall not be exclusive of any other right which any person may have or hereafter acquire

under any statute, provision of the certificate of incorporation, by-law, agreement, vote of stockholders or disinterested directors

or otherwise.

Section 4 Insurance.

The Corporation may purchase and maintain insurance on its own behalf and on behalf of any person who is or was a director, officer,

employee, fiduciary, or agent of the Corporation or was serving at the request of the Corporation as a director, officer, employee or

agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him or her

and incurred by him or her in any such capacity, whether or not the Corporation would have the power to indemnify such person against

such liability under this Article V.

Section 5 Expenses.

Expenses incurred by any person described in Section 1 of this Article V in defending a proceeding shall be paid by the Corporation

in advance of such proceeding's final disposition unless otherwise determined by the Board in the specific case upon receipt of an undertaking

by or on behalf of the director or officer or other person to repay such amount if it shall ultimately be determined that such person

is not entitled to be indemnified by the Corporation. Such expenses incurred by other employees and agents may be so paid upon such terms

and conditions, if any, as the Board deems appropriate.

Section 6 Employees