0001599489

false

0001599489

2023-10-10

2023-10-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 10, 2023

VERITIV

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other

jurisdiction of incorporation)

| 001-36479 |

|

46-3234977 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1000 Abernathy

Road NE |

|

|

| Building 400,

Suite 1700 |

|

|

| Atlanta,

Georgia |

|

30328 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (770) 391-8200

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.01 par value |

VRTV |

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Supplement to Definitive Proxy Statement

As previously disclosed, on August 6, 2023, Veritiv Corporation

(“Veritiv” or the “Company”) entered into an Agreement and Plan of Merger (as it has been or may be amended, supplemented,

waived or otherwise modified in accordance with its terms, the “Merger Agreement”) by and among Veritiv, Verde Purchaser,

LLC, a Delaware limited liability company (“Parent”) that is affiliated with Clayton, Dubilier & Rice, LLC (“CD&R”),

and Verde Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger Subsidiary”). Upon

the terms and conditions set forth in the Merger Agreement, Merger Subsidiary will be merged with and into Veritiv (the “Merger”)

with Veritiv surviving the Merger as a wholly-owned subsidiary of Parent. As a result of the Merger, Veritiv will cease to be a publicly

traded company. On September 18, 2023, Veritiv filed a definitive proxy statement (the “Definitive Proxy Statement”)

with the Securities and Exchange Commission (the “SEC”) for the solicitation of proxies in connection with a special meeting

of Veritiv’s stockholders to be held on October 17, 2023 to consider and vote on several proposals, including the approval

and adoption of the Merger Agreement.

Between September 18, 2023, and September 28, 2023, four

purported stockholders of Veritiv commenced actions, captioned O’Dell v. Veritiv et al., Case No. 1:23-cv-08212 (S.D.N.Y.),

Wang v. Veritiv et al., No. 1:23-cv-08284 (S.D.N.Y.), Welsh v. Veritiv et al., No. 1:23-cv-08554 (S.D.N.Y.), and

Williams v. Veritiv et al., No. 1:23-cv-01070 (D. Del.), in the United States District Courts for the Southern District of

New York, and District of Delaware. The complaints name Veritiv and the members of Veritiv’s Board of Directors as defendants. The

complaints assert claims under Section 14(a) and Section 20(a) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and Rule 14a-9 promulgated under the Exchange Act, challenging the adequacy of disclosures relating

to the proposed transaction made in the Definitive Proxy Statement. The complaints seek, among other relief, an injunction preventing

the parties from consummating the proposed transaction, damages in the event the transaction is consummated, and an award of attorneys’

fees. Veritiv believes the claims asserted in the lawsuits are without merit. However, to avoid the risk of the complaints delaying or

adversely affecting the Merger and to minimize the costs, risks and uncertainties inherent in litigation, and without admitting any liability

or wrongdoing, Veritiv has determined to voluntarily supplement the Definitive Proxy Statement as described in this Current Report on

Form 8-K. Nothing in this Current Report on Form 8-K shall be deemed an admission of the legal necessity or materiality under

applicable laws of any of the disclosures set forth herein. Veritiv specifically denies all allegations in the complaints that any additional

disclosure was or is required.

SUPPLEMENT TO THE DEFINITIVE PROXY STATEMENT

The Company is providing additional information regarding the Definitive

Proxy Statement to its stockholders. These disclosures should be read in connection with, and should be deemed made as of the date of,

the Definitive Proxy Statement, which should be read in its entirety. To the extent that the information set forth herein differs from

or updates information contained in the Definitive Proxy Statement, the information set forth herein shall supersede or supplement the

information in the Definitive Proxy Statement. Defined terms used but not defined herein have the meanings set forth in the Definitive

Proxy Statement. Paragraph and page references used herein refer to the Definitive Proxy Statement

before any additions or deletions resulting from the supplemental disclosures. The Company makes the following amended and supplemental

disclosures (with additional language in bold and underlined text below):

The disclosure in the section entitled “The Merger — Background

of the Merger” is hereby amended and supplemented by adding the bold and underlined text below to the sixth paragraph on page 41

of the Definitive Proxy Statement:

On July 31, 2023, at the request of the Board

of Directors, CD&R provided an updated indication of interest to acquire Veritiv at a price of $168.00 per share of Common Stock in

cash, including draft forms of the Financing Letters and a draft of the Limited Guarantee. Neither CD&R’s July 31st

indication of interest, nor any of its other proposals, was contingent on the retention of Veritiv’s management.

The disclosure in the section entitled “The Merger — Opinion

of Veritiv’s Financial Advisor — Comparable Companies Analysis” that begins on page 52 of the Definitive

Proxy Statement is hereby amended and supplemented in its entirety as follows (with the bold and underlined text below indicating the

additional language):

Comparable Companies Analysis

Morgan Stanley performed a comparable companies

analysis, which attempts to provide an implied value of a company by comparing it to similar companies that are publicly traded. Morgan

Stanley reviewed and compared the publicly available equity analyst research estimate for Veritiv with comparable publicly available consensus

equity analyst research estimates for selected companies, selected based on Morgan Stanley’s professional judgement and experience,

that share similar business characteristics and have certain comparable operating characteristics including, among other things, similarly

sized revenue and/or revenue growth rates, market capitalizations, profitability, scale and/or other similar operating characteristics

(these companies are referred to as the “comparable companies”).

For

purposes of this analysis, Morgan Stanley analyzed the ratio of AV / Adjusted EBITDA estimated for calendar years 2023 and 2024 of Veritiv

and the ratio of AV / EBITDA estimated for calendar years 2023 and 2024 of each of the comparable companies based on publicly available

financial information for comparison purposes. Morgan Stanley utilized publicly available estimates of AV / EBITDA prepared by equity

research analysts and compiled by Capital IQ, available as of August 4, 2023. The AV / Adjusted EBITDA for Veritiv was calculated

as of August 4, 2023, and the AV / EBITDA for the comparable companies was calculated as of August 4, 2023.

These companies and their applicable multiples

were the following:

| Veritiv | |

AV/ Estimated 2023 Adjusted EBITDA | |

AV/ Estimated 2024 Adjusted EBITDA |

| Street Case | |

4.7x | |

5.2x |

| Comparable Company | |

AV/ Estimated 2023 EBITDA | |

AV/ Estimated 2024 EBITDA |

| Packaging / Food Services Distribution | |

| |

|

| Bunzl | |

10.7x | |

10.7x |

| Orora | |

8.6x | |

8.4x |

| Chemicals / Building Products Distribution | |

| |

|

| Reliance Steel & Aluminum | |

8.6x | |

9.7x |

| Builders FirstSource | |

8.0x | |

8.8x |

| Brenntag | |

7.8x | |

7.5x |

| GMS | |

6.8x | |

6.7x |

| BlueLinx | |

5.1x | |

4.4x |

| Print & Packaging | |

| |

|

| Pactiv Evergreen | |

6.6x | |

6.3x |

| International Paper | |

8.0x | |

8.2x |

| WestRock | |

6.6x | |

6.0x |

| Sylvamo | |

4.2x | |

4.5x |

Based

on its analysis of the relevant metrics for each of the comparable companies and upon the application of its professional judgment and

experience, Morgan Stanley selected representative ranges of AV / EBITDA multiples, and applied these ranges of multiples to the estimated

Adjusted EBITDA for Veritiv from the Street Case in order to calculate an aggregate value, from which Morgan Stanley then deducted Veritiv’s

net debt of $151 million (comprising debt, plus cash settled performance-based units and cash settled deferred share units

exercised at the Share price as of August 4, 2023, less cash) as of June 30, 2023 as provided by Veritiv’s management,

to reach an implied equity value. Based on the estimated 14.1 million outstanding shares of Common Stock on a fully diluted

basis (including outstanding performance share units, phantom shares, restricted stock units and deferred share units) as of July 14,

2023 as provided by Veritiv’s management, Morgan Stanley derived the following ranges of implied value per Share, rounded to the

nearest $0.25:

| Calendar Year Financial Statistic | |

Selected Multiple

Ranges | |

Implied Value

Per Share |

| Street Case | |

| |

|

| AV / Estimated 2023 Adjusted EBITDA | |

4.5x– 6.5x | |

$134.00-$198.50 |

| AV / Estimated 2024 Adjusted EBITDA | |

4.25x- 6.25x | |

$112.50-$170.50 |

No

company utilized in the comparable companies analysis is identical to Veritiv. In evaluating the comparable companies, Morgan Stanley

made numerous assumptions with respect to industry performance, general business, regulatory, economic, market and financial conditions

and other matters, many of which are beyond Veritiv’s control. These include, among other things, the impact of competition on Veritiv’s

business and its industry generally, industry growth, and the absence of any adverse material change in the financial condition and prospects

of Veritiv and its industry, and in the financial markets in general.

The disclosure in the section entitled “The Merger — Opinion

of Veritiv’s Financial Advisor — Discounted Cash Flow Analysis” on page 54 of the Definitive Proxy

Statement is hereby amended and supplemented in its entirety as follows (with the bold and underlined text below indicating the changed

or additional language):

Discounted Cash Flow Analysis

Morgan Stanley performed a discounted cash flow

analysis, which is designed to provide an implied value of a company by calculating the present value of the estimated future cash flows

and terminal value of that company. Morgan Stanley calculated a range of implied values per Share based on estimates of future cash flows

for the second half of calendar year 2023 through end of calendar year 2027. Morgan Stanley performed this analysis on the estimated future

cash flows contained in the forecasts representing the Management Case. Morgan Stanley based its analysis on the estimated unlevered free

cash flows expected to be generated by Veritiv. Morgan Stanley calculated terminal values based on a terminal AV / Adjusted EBITDA exit

multiple ranging from 4.5x to 6.5x (which Morgan Stanley based on Veritiv’s current and historical AV / Adjusted EBITDA multiples)

and a terminal Adjusted EBITDA for Veritiv of $412 million, assuming a normalized terminal Adjusted EBITDA margin of 6.5% which

was provided by Veritiv’s management. The unlevered free cash flows from the second half of calendar year 2023 through end of calendar

year 2027 and the terminal values were then discounted to present values as of August 4, 2023 using a range of discount rates of

10.8% to 12.6% (which Morgan Stanley derived based on is Morgan Stanley’s estimate of Veritiv’s

weighted average cost of capital) to calculate an implied aggregate value range for Veritiv. Based on its professional judgment

and experience, Morgan Stanley estimated the weighted average cost of capital for Veritiv using (i) the capital

asset pricing model and based on its professional judgment and experience to estimate the cost of equity,

utilizing a market risk premium of 6.0%, risk free rate of 4.1%, beta value of 1.35 and a sensitivity adjustment of (1.0%) to 1.0% and

(ii) the estimated cost of debt. Morgan Stanley utilized an estimated pre-tax cost of debt of 6.3% and an effective tax rate of 25.0%.

Morgan Stanley then adjusted the total implied aggregate value ranges by Veritiv’s net debt of $151 million (comprising

debt, plus cash settled performance-based units and cash settled deferred share units exercised at the Share price as of August 4,

2023, less cash) as of June 30, 2023 as provided by Veritiv’s management and divided the resulting implied total equity value

ranges by the number of 14.1 million outstanding shares of Common Stock on a fully diluted basis

(including outstanding performance share units, phantom shares, restricted stock units and deferred share units) as of July 14, 2023,

as provided by Veritiv’s management. Based on the above-described analysis, Morgan Stanley derived the following ranges of implied

values per Share, each rounded to the nearest $0.25:

| Source |

|

Implied Value

Per Share |

| Management Case |

|

$145.75 – $191.50 |

The disclosure in the section entitled “The Merger — Opinion

of Veritiv’s Financial Advisor — Discounted Equity Value Analysis” that begins on page 54 of the

Definitive Proxy Statement is hereby amended and supplemented in its entirety as follows (with the bold and underlined text below indicating

the changed or additional language):

Discounted Equity Value Analysis

Morgan

Stanley performed a discounted equity value analysis, which is designed to provide insight into a theoretical estimate of the future implied

value of a company’s equity as a function of such company’s estimated future earnings and a theoretical range of trading multiples.

The resulting estimated future implied value is subsequently discounted back to the present day at Veritiv’s cost of equity in order

to arrive at an illustrative estimate of the present value for Veritiv’s theoretical future implied stock price.

Morgan

Stanley calculated ranges of implied equity values per Share estimated as of December 31, 2025. In arriving at the estimated equity

values per Share, Morgan Stanley applied a AV / Adjusted EBITDA for the next twelve months (following December 31, 2025) ratio range

of 4.5x to 5.5x (which Morgan Stanley based on Veritiv’s current and historical AV / Adjusted EBITDA multiples) to

the Management Case. Morgan Stanley then discounted the resulting equity value, along with dividends estimated to be paid, to August 4,

2023 at a discount rate equal to the midpoint of Veritiv’s estimated cost of equity as of August 4, 2023 of 12.2%. Based

on its professional judgment and experience, Morgan Stanley estimated the cost of equity for Veritiv by using the capital asset

pricing model and based on its professional judgment and experience utilizing a market risk premium of 6.0%,

risk free rate of 4.1%, beta value of 1.35 and a sensitivity adjustment of (1.0%) to 1.0%.

Based on these calculations, this analysis implied

the following per Share value ranges for shares of Common Stock, each rounded to the nearest $0.25:

| Source | |

Implied Value

Per Share |

| Management Case | |

$165.50 – $194.25 |

The disclosure in the section entitled “The Merger — Opinion

of Veritiv’s Financial Advisor — General” that begins on page 57 of the Definitive Proxy Statement

is hereby amended and supplemented in its entirety as follows (with the bold and underlined text below indicating the additional language):

General

In connection with the review of the Merger by

the Board of Directors, Morgan Stanley performed a variety of financial and comparative analyses for purposes of rendering its opinion.

The preparation of a financial opinion is a complex process and is not necessarily susceptible to a partial analysis or summary description.

In arriving at its opinion, Morgan Stanley considered the results of all of its analyses as a whole and did not attribute any particular

weight to any analysis or factor it considered. Morgan Stanley believes that selecting any portion of its analyses, without considering

all analyses as a whole, would create an incomplete view of the process underlying its analyses and opinion. In addition, Morgan Stanley

may have given various analyses and factors more or less weight than other analyses and factors, and may have deemed various assumptions

more or less probable than other assumptions. As a result, the ranges of valuations resulting from any particular analysis described above

should not be taken to be Morgan Stanley’s view of the actual value of Veritiv.

In performing its analyses, Morgan Stanley made

numerous assumptions with regard to industry performance, general business, regulatory, economic, market and financial conditions and

other matters, all of which generally are beyond the control of Veritiv. These include, among other things, the impact of competition

on the business of Veritiv and its industry generally, industry growth, and the absence of any adverse material change in the financial

condition and prospects of Veritiv and its industry, and in the financial markets in general. Any estimates contained in Morgan Stanley’s

analyses are not necessarily indicative of future results or actual values, which may be significantly more or less favorable than those

suggested by such estimates.

Morgan Stanley conducted the analyses described

above solely as part of its analysis of the fairness from a financial point of view of the Merger Consideration to be received by the

holders of shares of Common Stock pursuant to the Merger Agreement to holders of shares of Common Stock (other than the Baupost Stockholders,

Parent and their respective affiliates), and in connection with the delivery of its opinion to the Board of Directors. These analyses

do not purport to be appraisals or to reflect the prices at which shares of Common Stock might actually trade.

The Merger Consideration to be received by the

holders of shares of Common Stock pursuant to the Merger Agreement was determined through arm’s-length negotiations between Veritiv

and Parent and was approved by the Board of Directors. Morgan Stanley acted as financial advisor to the Board of Directors during these

negotiations but did not, however, recommend any specific consideration to Veritiv or the Board of Directors, nor opine that any specific

consideration constituted the only appropriate consideration for the Merger. Morgan Stanley’s opinion did not address the relative

merits of the Merger as compared to any other alternative business transaction, or other alternatives, or whether or not such alternatives

could be achieved or are available.

Morgan Stanley’s opinion was not intended

to, and does not, constitute advice or a recommendation as to whether the holders of shares of Common Stock should act or vote in connection

with any of the transactions contemplated by the Merger Agreement. Morgan Stanley’s opinion and its presentation to the Board of

Directors was one of many factors taken into consideration by the Board of Directors in deciding to recommend the transactions contemplated

by the Merger Agreement, including the Merger. Consequently, the analyses as described above should not be viewed as determinative of

the opinion of the Board of Directors with respect to the Merger Consideration pursuant to the Merger Agreement or of whether the Board

of Directors would have been willing to recommend a transaction with different consideration. Morgan Stanley’s opinion was approved

by a committee of Morgan Stanley investment banking and other professionals in accordance with Morgan Stanley’s customary practice.

Morgan Stanley is a global financial services

firm engaged in the securities, investment management and individual wealth management businesses. Its securities business is engaged

in securities underwriting, trading and brokerage activities, foreign exchange, commodities and derivatives trading, prime brokerage,

as well as providing investment banking, financing and financial advisory services. Morgan Stanley, its affiliates, directors and officers

may at any time invest on a principal basis or manage funds that invest, hold long or short positions, finance positions, and may trade

or otherwise structure and effect transactions, for their own account or the accounts of its customers, in debt or equity securities or

loans of Veritiv, Parent, the Baupost Stockholders or any of their respective affiliates, or any other company, or any currency or commodity,

that may be involved in this transaction, or any related derivative instrument. In addition, Morgan Stanley, its affiliates, directors

or officers, including individuals working with Veritiv in connection with this transaction, may have committed, and may commit in the

future, to invest in investment funds managed by Parent, the Baupost Stockholders, or any of their respective affiliates, or in affiliates

of Morgan Stanley that may hold direct equity and/or partnership interests in private equity funds managed by Parent, the Baupost Stockholders

or any of their respective affiliates.

Under the terms of its engagement, Morgan Stanley

has acted as financial advisor to the Board of Directors, including providing the Board of Directors with a written financial opinion,

described in this section and attached as Annex B, in connection with the Merger, and Veritiv has agreed to pay Morgan Stanley a fee of

approximately $31 million for its services of which $8 million was payable upon the rendering of such opinion and the remainder of which

is contingent upon the closing of the Merger. Veritiv has also agreed to reimburse Morgan Stanley for its expenses, including fees of

outside counsel, in an amount not to exceed $200,000 without prior Veritiv consent (not to be unreasonably withheld). In addition, Veritiv

has agreed to indemnify Morgan Stanley and its affiliates, and its and their respective current and former officers, directors, employees

and agents and each other person, if any, controlling Morgan Stanley or any of its affiliates, against certain liabilities and expenses,

related to, arising out of or in connection with litigation and other actions relating to Morgan Stanley’s engagement.

In the two and a half years prior to the date

of Morgan Stanley’s opinion, Morgan Stanley and its affiliates have provided certain investment banking and other financial services

to Veritiv, Parent and its majority-controlled affiliates and Baupost, and have received certain fees in connection with financial services

from Parent and its majority-controlled affiliates of between $10 million and $20 million, including in connection with (i) financing

services for Parent and certain portfolio companies of Parent and (ii) financial advisory and capital markets services for Parent.

In addition, Morgan Stanley or an affiliate thereof is a lender to a majority-controlled affiliate of the Parent. In addition, representatives

of Morgan Stanley have participated in multiple coverage meetings with representatives of Parent, including participating at certain meetings

prior to May 2023 to present views on a potential acquisition of Veritiv and certain valuation analyses in connection therewith based

upon publicly available information. No senior member of the Morgan Stanley team representing Veritiv on the Merger was part of any such

coverage meetings, although certain team members have had access to the applicable presentation materials. Morgan Stanley and its affiliates

may also seek to provide financial advisory and financing services to such entities and their respective affiliates in the future and

would expect to receive fees for the rendering of these services. In the two and a half years prior to the date of Morgan Stanley’s

opinion, Morgan Stanley and its affiliates have not received any fees from Veritiv or Baupost for financial advisory or financing services.

The disclosure in the section entitled “The Merger — Interests

of Executive Officers and Directors of Veritiv in the Merger — Arrangements with Parent” on page 65 of

the Definitive Proxy Statement is hereby amended and supplemented in its entirety as follows (with the bold and underlined text below

indicating the additional language):

Arrangements with Parent

As of the date of this proxy statement, no executive

officer of Veritiv has entered into any agreement with Parent or any of its affiliates regarding individual employment arrangements with,

or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates following the consummation

of the Merger, nor has Parent made any proposal to any executive officer of Veritiv regarding these matters. Prior to and

following the Closing, however, Parent intends to have discussions with certain executive officers of Veritiv regarding employment with,

or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates and certain executive

officers of Veritiv may enter into agreements with, Parent, Merger Subsidiary, their subsidiaries or their respective affiliates regarding

employment with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates.

Cautionary Forward-Looking Statements

This Current Report contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Exchange Act, which include all statements that do not relate solely to historical or current facts, such as statements regarding

the Company’s expectations, intentions or strategies regarding the future, including strategies or plans as they relate to the

Merger. These forward-looking statements are and will be, subject to many risks, uncertainties and factors which may cause future events

to be materially different from these forward-looking statements or anything implied therein. These risks and uncertainties include, but

are not limited to: uncertainties as to the timing of the Merger; the timing, receipt and terms and conditions of any required governmental

or regulatory approvals of the Merger that could reduce the anticipated benefits of or cause the parties to abandon the Merger; risks

related to the satisfaction of the conditions to closing the Merger (including the failure to obtain necessary regulatory approvals or

the Company Stockholder Approval) in the anticipated timeframe or at all; the risk that any announcements relating to the Merger could

have adverse effects on the market price of the Common Stock; disruption from the Merger making it more difficult to maintain business

and operational relationships, including retaining and hiring key personnel; the occurrence of any event, change or other circumstances

that could give rise to the termination of the Merger Agreement, including in certain circumstances requiring the Company to pay a termination

fee; risks related to disruption of management’s attention from the Company’s ongoing business operations due to the Merger;

significant transaction costs; the risk of litigation and/or regulatory actions related to the Merger; global economic conditions; adverse

industry and market conditions; the ability to retain management and other personnel; and other economic, business, or competitive factors,

including factors described in the Company’s filings with the SEC. While the list of risks

and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the proxy statement will be, considered

representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences

in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption,

operational problems, financial loss, and legal liability to third parties and similar risks, any of which could have a material adverse

effect on the completion of the Merger and/or the Company’s consolidated financial condition, results of operations, credit rating

or liquidity. In light of the significant uncertainties in these forward-looking statements, the Company cannot assure you that the forward-looking

statements in this Current Report will prove to be accurate, and you should not regard these statements as a representation or warranty

by the Company, its directors, officers or employees or any other person that the Company will achieve its objectives and plans in any

specified time frame, or at all. Any forward-looking statements in this Current Report are based upon information available to

the Company on the date of this Current Report. Subject to applicable law, the Company does not undertake to publicly update or revise

its forward-looking statements.

Additional Information and Where to Find It

In

connection with the Merger, the Company has filed the Definitive Proxy Statement and other materials with the SEC and may also file other

documents with the SEC regarding the Merger. INVESTORS AND COMPANY STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND

ANY OTHER RELEVANT DOCUMENTS REGARDING THE MERGER CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE

MERGER. Investors and the Company’s stockholders may obtain, without charge, a copy of the Definitive Proxy Statement and other

relevant documents filed with the SEC by the Company from the SEC’s website at www.sec.gov. Copies of the Definitive Proxy Statement

and other relevant documents filed with the SEC by the Company may also be obtained free of charge on the Company’s website at

https://ir.veritiv.com/overview/default.aspx or by contacting the Company’s Investor Relations Department by email

at investor@veritivcorp.com at or by phone at (844)-845-2136.

Participants in the Solicitation

The directors, executive officers and certain other members of management

and employees of the Company may be deemed “participants” in the solicitation of proxies from stockholders of the Company

in favor of the Merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the

solicitation of the stockholders of the Company in connection with the Merger are set forth in the Definitive Proxy Statement and will

be set forth in the other relevant documents to be filed with the SEC. You can find information about the Company’s executive officers

and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive

proxy statement filed with the SEC on Schedule 14A on March 17, 2023 in advance of the 2023 Annual Meeting of the Company’s

stockholders.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

VERITIV CORPORATION |

|

| |

|

|

|

|

|

| |

Dated: |

October 10, 2023 |

|

/s/ Susan B. Salyer |

|

| |

|

|

|

Susan B. Salyer |

|

| |

|

|

|

Senior Vice President, General Counsel & Corporate Secretary |

|

v3.23.3

Cover

|

Oct. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 10, 2023

|

| Entity File Number |

001-36479

|

| Entity Registrant Name |

VERITIV

CORPORATION

|

| Entity Central Index Key |

0001599489

|

| Entity Tax Identification Number |

46-3234977

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1000 Abernathy

Road NE

|

| Entity Address, Address Line Two |

Building 400

|

| Entity Address, Address Line Three |

Suite 1700

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

770

|

| Local Phone Number |

391-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.01 par value

|

| Trading Symbol |

VRTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

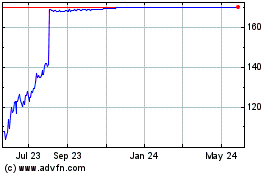

Veritiv (NYSE:VRTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Veritiv (NYSE:VRTV)

Historical Stock Chart

From Jan 2024 to Jan 2025