0001599489

false

0001599489

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2023 (August 8, 2023)

VERITIV

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other

jurisdiction of incorporation)

| 001-36479 |

|

46-3234977 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1000 Abernathy

Road NE |

|

|

| Building 400,

Suite 1700 |

|

|

| Atlanta,

Georgia |

|

30328 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (770) 391-8200

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.01 par value |

VRTV |

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of

Operations and Financial Condition. |

On August 8, 2023, Veritiv Corporation (the “Company”)

issued a press release containing certain financial results of the Company and its direct and indirect wholly-owned subsidiaries for

the three and six months ended June 30, 2023. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form

8-K.

The information in

this Current Report on Form 8-K will not be incorporated by reference into any registration statement or other document filed by the

Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

| Item 9.01. | Financial Statements

and Exhibits. |

(d) Exhibits.

The following exhibits are included with this report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

VERITIV CORPORATION |

| | | |

|

| Dated: |

August 8, 2023 | | |

/s/ Susan B. Salyer |

| | | |

Susan B. Salyer |

| | | |

Senior Vice President, General Counsel & Corporate Secretary |

Exhibit 99.1

Veritiv

Announces Second Quarter 2023 Financial Results

Second Quarter Highlights

| • | Net Income of $70.7 million,

a decrease of 22.4% from prior year |

| • | Diluted EPS of $5.15,

a decrease of 15.8% from prior year |

| • | Record second quarter

Adjusted EBITDA margin1 of 7.7% |

| • | 14 consecutive quarters

of year-over-year Adjusted EBITDA margin expansion |

ATLANTA

(August 8, 2023) – Veritiv

Corporation (NYSE: VRTV), a leading full-service provider of business-to-business products, services and solutions, today announced financial

results for the second quarter ended June 30, 2023.

“The second quarter highlighted

the value of our diversified and complementary portfolio of products and industry verticals. Despite challenging macroeconomic conditions,

Adjusted EBITDA for both Packaging and Facility Solutions improved sequentially and on a year-over-year basis, achieving record Adjusted

EBITDA margins for these segments,” said Sal Abbate, Chief Executive Officer. “This strong performance partially offset continued

intense industry-wide destocking and slowing demand headwinds in Print Solutions, resulting in record second quarter consolidated Adjusted

EBITDA margin."

Abbate concluded, “I am excited

to have reached an agreement with an affiliate of Clayton, Dubilier & Rice, LLC (CD&R) to acquire Veritiv, which we believe

delivers substantial value to our shareholders. This is a testament to our team’s hard work and dedication over the past several

years as the successful execution of our commercial and operational excellence strategies fundamentally improved our business. The transaction

will further enhance our resources and offer greater financial and operational flexibility as we deliver innovative and sustainable solutions

to our customers."

For the three months ended June 30,

2023, compared to the three months ended June 30, 2022:

| • | Net sales were $1.5 billion,

a decrease of 20.0% from the prior year; organic sales decreased 15.4%. |

| • | Net

income was $70.7 million, compared to $91.1 million in the prior year. Net restructuring

charges were none, compared to $1.4 million in the prior year. |

| • | Basic

and diluted earnings per share were $5.22 and $5.15, respectively, compared to $6.24 and

$6.12, respectively, in the prior year. |

| • | Adjusted

EBITDA was $112.2 million, a decrease of 17.7% from the prior year. |

| • | Adjusted

EBITDA margin was 7.7%, an increase of 20 basis points from the prior year. |

For the six months ended June 30,

2023, compared to the six months ended June 30, 2022:

| • | Net sales were $3.0 billion,

a decrease of 19.3% from the prior year; organic sales decreased 11.7%. |

| • | Net income was $139.4 million,

compared to $169.6 million in the prior year. Net restructuring charges were none, compared

to $4.1 million in the prior year. |

| • | Basic and diluted earnings per

share were $10.30 and $10.15, respectively, compared to $11.55 and $11.23, respectively,

in the prior year. |

| • | Adjusted EBITDA was $216.0

million, a decrease of 15.6% from the prior year. |

| • | Adjusted EBITDA margin was 7.3%,

an increase of 30 basis points from the prior year. |

For the three months ended June 30,

2023, net cash provided by operating activities was $94.4 million and free cash flow was $91.3 million. For the six months ended June 30,

2023, net cash provided by operating activities was $165.3 million and free cash flow was $159.3 million.

“We are pleased with strong free

cash flow of nearly $160 million generated during the first half of 2023.” said Eric Guerin, Chief Financial Officer.

In light of the previously announced

transaction with CD&R, Veritiv will not provide guidance or host a conference call or webcast to review the second quarter 2023 financial

results.

1Adjusted EBITDA margin,

a non-GAAP metric, is defined as Adjusted EBITDA as a percentage of net sales.

-----

Important information regarding measures

not presented in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") and related reconciliations of

non-GAAP financial measures to the most comparable U.S. GAAP measures can be found in the schedules to this press release, which should

be thoroughly reviewed.

About Veritiv

Veritiv Corporation (NYSE: VRTV), headquartered

in Atlanta, is a leading full-service provider of packaging, JanSan and hygiene products, services and solutions. Additionally, Veritiv

provides print and publishing products. Serving customers in a wide range of industries both in North America and globally, Veritiv has

distribution centers throughout the U.S. and Mexico, and team members around the world helping shape the success of its customers. For

more information about Veritiv and its business segments visit www.veritiv.com.

Safe Harbor Provision

This release contains certain forward-looking

statements that reflect Veritiv's current views with respect to certain current and future events. Specific forward-looking statements

include, among others, statements regarding the consummation of the proposed transaction. These forward-looking statements are and will

be, subject to many risks, uncertainties and factors which may cause future events to be materially different from these forward-looking

statements or anything implied therein. These risks and uncertainties include, but are not limited to: the timing, receipt and terms

and conditions of any required governmental or regulatory approvals of the proposed transaction that could reduce the anticipated benefits

of or cause the parties to abandon the proposed transaction; risks related to the satisfaction of the conditions to closing the proposed

transaction (including the failure to obtain necessary regulatory approvals or the necessary approvals of the Veritiv’s stockholders)

in the anticipated timeframe or at all; the risk that any announcements relating to the proposed transaction could have adverse effects

on the market price of Veritiv’s common stock; disruption from the proposed transaction making it more difficult to maintain business

and operational relationships, including retaining and hiring key personnel; the occurrence of any event, change or other circumstances

that could give rise to the termination of the merger agreement entered into in connection with the proposed transaction; risks related

to disruption of management’s attention from Veritiv’s ongoing business operations due to the proposed transaction; significant

transaction costs; the risk of litigation and/or regulatory actions related to the proposed transaction; global economic conditions;

adverse industry and market conditions; the ability to retain management and other personnel; and other economic, business, or competitive

factors. Any forward-looking statements in this release are based upon information available to Veritiv on the date of this release.

Veritiv does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear

that any statements expressed or implied therein will not be realized. Additional information on risk factors that could affect Veritiv

may be found in Veritiv's filings with the Securities and Exchange Commission (the “SEC”).

Additional Information

and Where to Find it

This filing may be deemed solicitation

material in respect of the proposed merger of an affiliate of Clayton, Dubilier & Rice, LLC with and into Veritiv. In connection

with the proposed merger transaction, Veritiv will file with the SEC and furnish to Veritiv’s stockholders a proxy statement and

other relevant documents. This filing does not constitute a solicitation of any vote or approval. Stockholders are urged to read the

proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the proposed merger or

incorporated by reference in the proxy statement because they will contain important information about the proposed merger.

Investors will be able to obtain free

of charge the proxy statement and other documents filed with the SEC at the SEC’s website at https://www.sec.gov. In addition,

the proxy statement and Veritiv’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K

and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of

1934 are available free of charge through Veritiv’s website at https://ir.veritiv.com/ as soon as reasonably practicable after

they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and

certain other members of management and employees of Veritiv may be deemed “participants” in the solicitation of proxies

from stockholders of Veritiv in favor of the proposed merger. Information regarding the persons who may, under the rules of the

SEC, be considered participants in the solicitation of the stockholders of Veritiv in connection with the proposed merger will be set

forth in the proxy statement and the other relevant documents to be filed with the SEC. You can find information about the Company’s

executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive

proxy statement for the 2023 annual meeting of stockholders as filed with the SEC on Schedule 14A on March 17, 2023.

Financial Statements

VERITIV CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in

millions, except per share data, unaudited)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales | |

$ | 1,457.3 | | |

$ | 1,820.7 | | |

$ | 2,967.5 | | |

$ | 3,678.8 | |

| Cost of products sold (exclusive of depreciation and amortization shown separately below) | |

| 1,096.6 | | |

| 1,410.9 | | |

| 2,240.7 | | |

| 2,866.3 | |

| Distribution expenses | |

| 88.7 | | |

| 98.2 | | |

| 178.4 | | |

| 210.4 | |

| Selling and administrative expenses | |

| 163.5 | | |

| 190.7 | | |

| 334.9 | | |

| 378.6 | |

| Gain on sale of businesses | |

| — | | |

| (10.0 | ) | |

| — | | |

| (10.0 | ) |

| Depreciation and amortization | |

| 9.6 | | |

| 11.1 | | |

| 19.7 | | |

| 23.8 | |

| Restructuring charges, net | |

| — | | |

| 1.4 | | |

| — | | |

| 4.1 | |

| Operating income | |

| 98.9 | | |

| 118.4 | | |

| 193.8 | | |

| 205.6 | |

| Interest expense, net | |

| 4.3 | | |

| 4.0 | | |

| 9.0 | | |

| 7.5 | |

| Other (income) expense, net | |

| (1.9 | ) | |

| (6.6 | ) | |

| (0.9 | ) | |

| (7.2 | ) |

| Income before income taxes | |

| 96.5 | | |

| 121.0 | | |

| 185.7 | | |

| 205.3 | |

| Income tax expense | |

| 25.8 | | |

| 29.9 | | |

| 46.3 | | |

| 35.7 | |

| Net income | |

$ | 70.7 | | |

$ | 91.1 | | |

$ | 139.4 | | |

$ | 169.6 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 5.22 | | |

$ | 6.24 | | |

$ | 10.30 | | |

$ | 11.55 | |

| Diluted | |

$ | 5.15 | | |

$ | 6.12 | | |

$ | 10.15 | | |

$ | 11.23 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 13.55 | | |

| 14.61 | | |

| 13.54 | | |

| 14.69 | |

| Diluted | |

| 13.72 | | |

| 14.88 | | |

| 13.73 | | |

| 15.10 | |

VERITIV CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars

in millions, except par value, unaudited)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 43.9 | | |

$ | 40.6 | |

| Accounts receivable, less allowances of $22.9 and $26.7, respectively | |

| 750.5 | | |

| 889.6 | |

| Inventories | |

| 487.0 | | |

| 423.9 | |

| Other current assets | |

| 95.0 | | |

| 103.7 | |

| Total current assets | |

| 1,376.4 | | |

| 1,457.8 | |

| Property and equipment (net of accumulated depreciation and amortization of $326.6 and $325.5, respectively) | |

| 124.2 | | |

| 127.5 | |

| Goodwill | |

| 96.3 | | |

| 96.3 | |

| Other intangibles, net | |

| 33.4 | | |

| 35.6 | |

| Deferred income tax assets | |

| 25.5 | | |

| 29.0 | |

| Other non-current assets | |

| 366.5 | | |

| 343.4 | |

| Total assets | |

$ | 2,022.3 | | |

$ | 2,089.6 | |

| Liabilities and shareholders' equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 418.1 | | |

$ | 452.9 | |

| Accrued payroll and benefits | |

| 46.8 | | |

| 106.2 | |

| Other accrued liabilities | |

| 147.2 | | |

| 154.1 | |

| Current portion of debt | |

| 14.2 | | |

| 13.4 | |

| Total current liabilities | |

| 626.3 | | |

| 726.6 | |

| Long-term debt, net of current portion | |

| 171.6 | | |

| 264.8 | |

| Defined benefit pension obligations | |

| 0.8 | | |

| 0.4 | |

| Other non-current liabilities | |

| 340.3 | | |

| 341.7 | |

| Total liabilities | |

| 1,139.0 | | |

| 1,333.5 | |

| Commitments and contingencies | |

| | | |

| | |

| Shareholders' equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value, 10.0 million shares authorized, none issued | |

| — | | |

| — | |

| Common stock, $0.01 par value, 100.0 million shares authorized; shares issued - 17.6 million and 17.5 million, respectively; shares outstanding - 13.6 million and 13.5 million, respectively | |

| 0.2 | | |

| 0.2 | |

| Additional paid-in capital | |

| 614.9 | | |

| 613.1 | |

| Accumulated earnings | |

| 595.0 | | |

| 472.6 | |

| Accumulated other comprehensive loss | |

| (9.7 | ) | |

| (12.7 | ) |

| Treasury stock at cost - 4.0 million and 4.0 million shares, respectively | |

| (317.1 | ) | |

| (317.1 | ) |

| Total shareholders' equity | |

| 883.3 | | |

| 756.1 | |

| Total liabilities and shareholders' equity | |

$ | 2,022.3 | | |

$ | 2,089.6 | |

VERITIV CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in

millions, unaudited)

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Operating activities | |

| | | |

| | |

| Net income | |

$ | 139.4 | | |

$ | 169.6 | |

| Depreciation and amortization | |

| 19.7 | | |

| 23.8 | |

| Amortization and write-off of deferred financing fees | |

| 0.8 | | |

| 0.8 | |

| Net (gains) losses on disposition of assets and sale of businesses | |

| 0.1 | | |

| (15.3 | ) |

| Provision for expected credit losses | |

| (1.8 | ) | |

| (0.1 | ) |

| Deferred income tax provision (benefit) | |

| 4.1 | | |

| (11.6 | ) |

| Stock-based compensation | |

| 5.4 | | |

| 5.9 | |

| Other non-cash items, net | |

| (1.7 | ) | |

| (7.0 | ) |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| 142.0 | | |

| (51.4 | ) |

| Inventories | |

| (60.8 | ) | |

| (25.4 | ) |

| Other current assets | |

| 10.2 | | |

| (1.5 | ) |

| Accounts payable | |

| (0.7 | ) | |

| 23.4 | |

| Accrued payroll and benefits | |

| (66.7 | ) | |

| (31.8 | ) |

| Other accrued liabilities | |

| 0.0 | | |

| (13.9 | ) |

| Other | |

| (24.7 | ) | |

| (3.2 | ) |

| Net cash provided by (used for) operating activities | |

| 165.3 | | |

| 62.3 | |

| Investing activities | |

| | | |

| | |

| Property and equipment additions | |

| (6.0 | ) | |

| (11.6 | ) |

| Proceeds from asset sales and sale of businesses, net of cash transferred | |

| 0.3 | | |

| 139.4 | |

| Proceeds from insurance related to property and equipment | |

| 0.1 | | |

| 3.5 | |

| Net cash provided by (used for) investing activities | |

| (5.6 | ) | |

| 131.3 | |

| Financing activities | |

| | | |

| | |

| Change in book overdrafts | |

| (36.4 | ) | |

| 12.9 | |

| Borrowings of long-term debt | |

| 2,744.0 | | |

| 3,111.5 | |

| Repayments of long-term debt | |

| (2,835.8 | ) | |

| (3,190.9 | ) |

| Payments under right-of-use finance leases | |

| (4.9 | ) | |

| (6.3 | ) |

| Payments under vendor-based financing arrangements | |

| (3.4 | ) | |

| (3.2 | ) |

| Purchase of treasury stock | |

| — | | |

| (104.8 | ) |

| Impact of tax withholding on share-based compensation | |

| (3.6 | ) | |

| (29.7 | ) |

| Dividends paid to shareholders | |

| (17.0 | ) | |

| — | |

| Other | |

| 0.3 | | |

| 0.3 | |

| Net cash provided by (used for) financing activities | |

| (156.8 | ) | |

| (210.2 | ) |

| Effect of exchange rate changes on cash | |

| 0.4 | | |

| (0.6 | ) |

| Net change in cash and cash equivalents | |

| 3.3 | | |

| (17.2 | ) |

| Cash and cash equivalents at beginning of period | |

| 40.6 | | |

| 49.3 | |

| Cash and cash equivalents at end of period | |

$ | 43.9 | | |

$ | 32.1 | |

| Supplemental cash flow information | |

| | | |

| | |

| Cash paid for income taxes, net of refunds | |

$ | 50.7 | | |

$ | 57.8 | |

| Cash paid for interest | |

| 8.0 | | |

| 6.4 | |

| Non-cash investing and financing activities | |

| | | |

| | |

| Non-cash additions to property and equipment for right-of-use finance leases and vendor-based financing arrangements | |

$ | 7.4 | | |

$ | 18.1 | |

| Non-cash additions to other non-current assets for right-of-use operating leases | |

| 45.4 | | |

| 37.3 | |

Non-GAAP Measures

We supplement

our financial information prepared in accordance with U.S. GAAP with certain non-GAAP measures including organic sales (net sales on

an average daily sales basis, excluding revenue from sold businesses and revenue from acquired businesses for a period of 12 months after

we complete the acquisition), Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, restructuring charges,

net, integration and acquisition expenses and other similar charges including any severance costs, costs associated with warehouse and

office openings or closings, consolidation, and relocation and other business optimization expenses, stock-based compensation expense,

changes in the LIFO reserve, non-restructuring asset impairment charges, non-restructuring severance charges, non-restructuring pension

charges (benefits), fair value adjustments related to contingent liabilities assumed in mergers and acquisitions and certain other adjustments),

free cash flow and other non-GAAP measures such as the Net Leverage Ratio (calculated as net debt divided by trailing twelve months of

Adjusted EBITDA) and Return on Invested Capital "ROIC" (calculated as Net Operating Profit After Tax divided by the sum of

net working capital and property and equipment. Net Operating Profit After Tax is defined as Adjusted EBITDA less depreciation and amortization

times 1 minus the standard tax rate1). We believe investors commonly use Adjusted EBITDA, free cash flow and these other non-GAAP

measures as key financial metrics for valuing companies; we also present organic sales to help investors better compare period-over-period

results. In addition, the credit agreement governing our Asset-Based Lending Facility (the "ABL Facility") permits us to exclude

the foregoing and other charges in calculating "Consolidated EBITDA", as defined in the ABL Facility. Consolidated EBITDA and

ROIC are also used as a basis for certain compensation programs sponsored by the Company.

Organic sales,

Adjusted EBITDA, free cash flow and these other non-GAAP measures are not alternative measures of financial performance or liquidity

under U.S. GAAP. Non-GAAP measures do not have definitions under U.S. GAAP and may be defined differently by, and not be comparable to,

similarly titled measures used by other companies. As a result, we consider and evaluate non-GAAP measures in connection with a review

of the most directly comparable measure calculated in accordance with U.S. GAAP. We caution investors not to place undue reliance on

such non-GAAP measures and to consider them with the most directly comparable U.S. GAAP measures. Organic sales, Adjusted EBITDA, free

cash flow and these other non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute

for analyzing our results as reported under U.S. GAAP. Please see the following tables for reconciliations of non-GAAP measures to the

most comparable U.S. GAAP measures.

1 The

Company uses a standard tax rate of 26%.

Table I

VERITIV CORPORATION

RECONCILIATION OF NON-GAAP MEASURES

NET

INCOME TO ADJUSTED EBITDA; ADJUSTED EBITDA MARGIN

(in

millions, unaudited)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net income | |

$ | 70.7 | | |

$ | 91.1 | | |

$ | 139.4 | | |

$ | 169.6 | |

| Interest expense, net | |

| 4.3 | | |

| 4.0 | | |

| 9.0 | | |

| 7.5 | |

| Income tax expense | |

| 25.8 | | |

| 29.9 | | |

| 46.3 | | |

| 35.7 | |

| Depreciation and amortization | |

| 9.6 | | |

| 11.1 | | |

| 19.7 | | |

| 23.8 | |

| EBITDA | |

| 110.4 | | |

| 136.1 | | |

| 214.4 | | |

| 236.6 | |

| Restructuring charges, net | |

| — | | |

| 1.4 | | |

| — | | |

| 4.1 | |

| Gain on sale of businesses | |

| — | | |

| (10.0 | ) | |

| — | | |

| (10.0 | ) |

| Facility closure charges, including (gain) loss from asset disposition | |

| 0.1 | | |

| (0.3 | ) | |

| 0.0 | | |

| (0.9 | ) |

| Stock-based compensation | |

| 3.6 | | |

| 3.1 | | |

| 5.4 | | |

| 5.9 | |

| LIFO reserve (decrease) increase | |

| (3.5 | ) | |

| 11.8 | | |

| (6.0 | ) | |

| 22.8 | |

| Non-restructuring severance charges | |

| (0.2 | ) | |

| (0.2 | ) | |

| 0.1 | | |

| 1.5 | |

| Non-restructuring pension charges (benefits) | |

| (1.0 | ) | |

| (7.0 | ) | |

| (0.8 | ) | |

| (7.0 | ) |

| Other | |

| 2.8 | | |

| 1.4 | | |

| 2.9 | | |

| 2.8 | |

| Adjusted EBITDA | |

$ | 112.2 | | |

$ | 136.3 | | |

$ | 216.0 | | |

$ | 255.8 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

$ | 1,457.3 | | |

$ | 1,820.7 | | |

$ | 2,967.5 | | |

$ | 3,678.8 | |

| Adjusted EBITDA as a % of net sales | |

| 7.7 | % | |

| 7.5 | % | |

| 7.3 | % | |

| 7.0 | % |

Table II

VERITIV CORPORATION

RECONCILIATION OF NON-GAAP MEASURES

FREE CASH FLOW

(in

millions, unaudited)

| | |

Three Months Ended

June 30, 2023 | | |

Six Months Ended

June 30, 2023 | |

| Net cash provided by (used for) operating activities | |

$ | 94.4 | | |

$ | 165.3 | |

| Less: Capital expenditures | |

| (3.1 | ) | |

| (6.0 | ) |

| Free cash flow | |

$ | 91.3 | | |

$ | 159.3 | |

Table III

VERITIV CORPORATION

RECONCILIATION OF NON-GAAP MEASURES

REPORTED NET SALES TO ORGANIC SALES

(in

millions, unaudited)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Reported net sales | |

$ | 1,457.3 | | |

$ | 1,820.7 | | |

$ | 2,967.5 | | |

$ | 3,678.8 | |

| Impact of change in selling days (1) | |

| — | | |

| — | | |

| — | | |

| — | |

| Net sales (on an average daily sales basis) | |

| 1,457.3 | | |

| 1,820.7 | | |

| 2,967.5 | | |

| 3,678.8 | |

| Business divestitures (2) | |

| — | | |

| (98.4 | ) | |

| — | | |

| (319.0 | ) |

| Organic sales | |

$ | 1,457.3 | | |

$ | 1,722.3 | | |

$ | 2,967.5 | | |

$ | 3,359.8 | |

| | |

| | | |

| | | |

| | | |

| | |

| Business Days | |

| 64 | | |

| 64 | | |

| 127 | | |

| 127 | |

| (1) | Adjustment

for differences in the number of selling days, if any. |

| (2) | Represents the net sales of each

of the following divested businesses prior to its respective divestiture: Veritiv Canada, Inc. (May 2, 2022) and the logistics

solutions business (September 1, 2022). |

Veritiv Contacts:

| Investors: Clark Dwyer, 844-845-2136 |

Media: Kristie Madara, 770-391-8471 |

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-36479

|

| Entity Registrant Name |

VERITIV

CORPORATION

|

| Entity Central Index Key |

0001599489

|

| Entity Tax Identification Number |

46-3234977

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1000 Abernathy

Road NE

|

| Entity Address, Address Line Two |

Building 400

|

| Entity Address, Address Line Three |

Suite 1700

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

770

|

| Local Phone Number |

391-8200

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.01 par value

|

| Trading Symbol |

VRTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

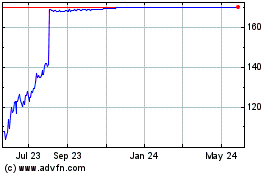

Veritiv (NYSE:VRTV)

Historical Stock Chart

From Jan 2025 to Feb 2025

Veritiv (NYSE:VRTV)

Historical Stock Chart

From Feb 2024 to Feb 2025