Resilient operating model poised to capture

anticipated textile and sustainable fiber demand recovery

Credit facility extended and expanded to

support future growth and liquidity

Unifi, Inc. (NYSE: UFI) (together with its consolidated

subsidiaries, “UNIFI”), makers of REPREVE and one of the world’s

leading innovators in recycled and synthetic yarns, today released

operating results for the first fiscal quarter ended October 2,

2022.

First Quarter Fiscal 2023

Overview

- Net sales were $179.5 million, a decrease of 8.4% from the

first quarter of fiscal 2022, primarily attributable to temporary

demand disruption in the Americas and Asia Segments from inventory

destocking measures taken by apparel brands and retailers.

- Revenues from REPREVE Fiber products represented 27% of net

sales, or $49.2 million, compared to 37%, or $71.9 million, in the

first quarter of fiscal 2022, impacted by lower sales volumes in

Asia.

- Gross profit was $6.6 million compared to $26.1 million for the

first quarter of fiscal 2022, primarily impacted by lower facility

utilization. Gross margin was 3.7% compared to 13.3% for the first

quarter of fiscal 2022.

- Operating loss was $4.7 million compared to operating income of

$13.3 million for the first quarter of fiscal 2022.

- Net loss was $7.8 million, or $0.44 per share, compared to net

income of $8.7 million, or $0.46 per share, for the first quarter

of fiscal 2022.

- Adjusted EBITDA was $2.3 million compared to $19.8 million for

the first quarter of fiscal 2022.

- In October 2022, an existing credit facility was amended and

extended to support future growth and to provide additional

liquidity.

- Frank Blake, non-executive Chairman of Delta Air Lines, Inc.,

joined the Board of Directors, adding decades of commercial

leadership experience.

Adjusted EBITDA and Net Debt are non-GAAP financial measures.

The schedules included in this press release reconcile each

non-GAAP financial measure to its most directly comparable GAAP

financial measure.

Eddie Ingle, Chief Executive Officer of Unifi, said, “Our first

quarter fiscal 2023 results were adversely impacted by a difficult

demand environment and volatile global market. With brand and

retailer inventories recently reaching historically high levels,

apparel companies and retailers reduced orders and delayed certain

programs into calendar 2023. As a result, our demand visibility

diminished quickly. While we believe these destocking measures will

be temporary, the duration of this disruption is uncertain.

Accordingly, we quickly implemented meaningful cost savings actions

in North America to improve the profit margins in the short- and

long-term periods. Our business remains well-positioned to support

the continued acceleration in the demand for sustainable

fibers.”

First Quarter Fiscal 2023 Compared to

First Quarter Fiscal 2022

Net sales decreased 8.4% to $179.5 million, from $196.0 million,

primarily driven by lower sales volumes for the Americas and Asia

Segments in connection with a recent decline in demand for textile

products from apparel brands. Such decline was partially offset by

higher selling prices following months of inflationary cost

increases. The demand for apparel production declined significantly

in the first quarter of fiscal 2023 as brands and retailers took

temporary actions to reduce their inventory levels. Accordingly,

the Americas and Asia Segments experienced revenue declines

following a reduction in ordering patterns from customers across

U.S. and global markets. Conversely, the Brazil Segment generated

strong sales performance within its domestic market where apparel

demand had not suffered.

Gross profit decreased to $6.6 million from $26.1 million.

Americas Segment gross profit decreased $14.1 million, primarily as

a result of lower sales volumes driving weaker productivity and

cost absorption. Brazil Segment gross profit decreased $3.2

million, which was consistent with the normalization of gross

profit levels that occurred during calendar 2022 following the

Brazil Segment’s strong performance during the pandemic recovery

period. The Asia Segment maintained a strong gross margin rate but

was impacted by weaker demand for apparel production.

Operating loss was $4.7 million compared to operating income of

$13.3 million in the first quarter of fiscal 2022, primarily due to

the decrease in gross profit. Net loss was $7.8 million, or $0.44

per share, compared to net income of $8.7 million, or $0.46 per

share, impacted by the weaker profitability in the U.S.

contributing to a higher effective tax rate. Adjusted EBITDA was

$2.3 million, compared to $19.8 million, consistent with the change

in operating income.

Debt principal was $127.0 million on October 2, 2022, compared

to $114.3 million on July 3, 2022. In connection with previously

anticipated investments in new yarn texturing innovation and

working capital to support future growth, cash and cash equivalents

decreased to $47.2 million on October 2, 2022 from $53.3 million on

July 3, 2022. Accordingly, Net Debt was $79.8 million on October 2,

2022 compared to $61.0 million on July 3, 2022.

Credit Facility Update

On October 28, 2022, UNIFI renewed and amended its existing

credit facility to expand the borrowing capacity and extend the

maturity date. The amended credit agreement allows for an increase

in borrowing capacity from $200.0 million to $230.0 million,

extends the maturity date from December 2023 to October 2027, and

contains pricing, terms, and conditions generally consistent with

those in place prior to the amendment.

Outlook

The operating environment and textile demand trends for the

apparel market are expected to remain suppressed for the remainder

of calendar 2022. Future demand visibility has diminished due to

changing forecasts from a number of customers. While UNIFI expects

significant demand recovery and profitability acceleration to occur

following the inventory destocking measures currently in progress

at major apparel brands and retailers, the timing of an apparel

production recovery is uncertain. Accordingly, UNIFI is withdrawing

its previously issued full year fiscal 2023 outlook and anticipates

the following for the second quarter of fiscal 2023:

- approximately 10% to 15% lower net sales than the first quarter

of fiscal 2023;

- continued profitability pressures and performance resembling

the first quarter of fiscal 2023, primarily attributable to weak

cost absorption in the Americas Segment in connection with a

seasonally-pressured period that includes annual customer shutdowns

and holidays exacerbated by lower-than-normal sales and

productivity levels driving consolidated Adjusted EBITDA between

$(5.0) million and $0.0 million;

- continued volatility and unfavorability in the effective tax

rate; and

- capital expenditures of approximately $10.0 million to $12.0

million, as UNIFI continues investing in new yarn texturing

machinery within the U.S., El Salvador, and Brazil.

Ingle continued, “While the current operating environment is

challenging, we are optimistic about the efforts we’re making to

remain the global sustainable fiber leader. Our REPREVE products

continue to see a high level of interest from our customers, and we

are continuing to invest in marketing and building awareness of our

flagship brand.”

Ingle concluded, “We are pleased to have the additional

liquidity afforded by our amended credit facility. As retail

apparel inventory levels decline and demand normalizes, we expect

to see our revenue and profitability accelerate in the second half

of fiscal 2023. We will continue to control costs, drive

efficiencies, and invest prudently in growth areas of the business

that will support strong long-term business expansion and value

creation for all of our stakeholders.”

First Quarter Fiscal 2023 Earnings

Conference Call

UNIFI will provide additional commentary regarding its first

quarter fiscal 2023 results and other developments during its

earnings conference call on November 4, 2022, at 8:30 a.m., Eastern

Time. The call can be accessed via a live audio webcast on UNIFI’s

website at http://investor.unifi.com. Additional supporting

materials and information related to the call will also be

available on UNIFI’s website.

About UNIFI

Unifi, Inc. (NYSE: UFI) is a global textile solutions provider

and one of the world's leading innovators in manufacturing

synthetic and recycled performance fibers. Through REPREVE, one of

UNIFI's proprietary technologies and the global leader in branded

recycled performance fibers, UNIFI has transformed more than 30

billion plastic bottles into recycled fiber for new apparel,

footwear, home goods, and other consumer products. UNIFI

continually innovates technologies to meet consumer needs in

moisture management, thermal regulation, antimicrobial protection,

UV protection, stretch, water resistance, and enhanced softness.

UNIFI collaborates with many of the world's most influential brands

in the sports apparel, fashion, home, automotive and other

industries. For more information about UNIFI, visit

www.unifi.com.

Financial Statements, Business Segment

Information and Reconciliations of Reported Results to Adjusted

Results to Follow

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per

share amounts)

For the Three Months

Ended

October 2, 2022

September 26, 2021

Net sales

$

179,519

$

195,992

Cost of sales

172,956

169,895

Gross profit

6,563

26,097

Selling, general and administrative

expenses

11,773

12,670

Provision (benefit) for bad debts

174

(80

)

Other operating (income) expense, net

(689

)

256

Operating (loss) income

(4,695

)

13,251

Interest income

(547

)

(258

)

Interest expense

1,247

696

Equity in earnings of unconsolidated

affiliates

(295

)

(280

)

(Loss) income before income taxes

(5,100

)

13,093

Provision for income taxes

2,734

4,413

Net (loss) income

$

(7,834

)

$

8,680

Net (loss) income per common share:

Basic

$

(0.44

)

$

0.47

Diluted

$

(0.44

)

$

0.46

Weighted average common shares

outstanding:

Basic

18,001

18,515

Diluted

18,001

18,997

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

October 2, 2022

July 3, 2022

ASSETS

Cash and cash equivalents

$

47,200

$

53,290

Receivables, net

90,755

106,565

Inventories

165,063

173,295

Income taxes receivable

1,432

160

Other current assets

14,336

18,956

Total current assets

318,786

352,266

Property, plant and equipment, net

219,430

216,338

Operating lease assets

8,247

8,829

Deferred income taxes

2,422

2,497

Other non-current assets

8,940

8,788

Total assets

$

557,825

$

588,718

LIABILITIES AND SHAREHOLDERS’

EQUITY

Accounts payable

$

44,428

$

73,544

Income taxes payable

1,925

1,526

Current operating lease liabilities

2,075

2,190

Current portion of long-term debt

11,875

11,726

Other current liabilities

18,421

19,806

Total current liabilities

78,724

108,792

Long-term debt

114,919

102,309

Non-current operating lease

liabilities

6,263

6,736

Deferred income taxes

4,935

4,983

Other long-term liabilities

4,685

4,449

Total liabilities

209,526

227,269

Commitments and contingencies

Common stock

1,801

1,798

Capital in excess of par value

66,709

66,120

Retained earnings

345,302

353,136

Accumulated other comprehensive loss

(65,513

)

(59,605

)

Total shareholders’ equity

348,299

361,449

Total liabilities and shareholders’

equity

$

557,825

$

588,718

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

For the Three Months

Ended

October 2, 2022

September 26, 2021

Cash and cash equivalents at beginning of

period

$

53,290

$

78,253

Operating activities:

Net (loss) income

(7,834

)

8,680

Adjustments to reconcile net (loss) income

to net cash used by operating activities:

Equity in earnings of unconsolidated

affiliates

(295

)

(280

)

Depreciation and amortization expense

6,740

6,365

Non-cash compensation expense

633

660

Deferred income taxes

(373

)

(3,463

)

Other, net

324

(100

)

Changes in assets and liabilities

(5,087

)

(27,670

)

Net cash used by operating activities

(5,892

)

(15,808

)

Investing activities:

Capital expenditures

(11,198

)

(9,300

)

Other, net

(222

)

31

Net cash used by investing activities

(11,420

)

(9,269

)

Financing activities:

Proceeds from long-term debt

67,949

882

Payments on long-term debt

(55,236

)

(3,427

)

Other, net

—

(222

)

Net cash provided (used) by financing

activities

12,713

(2,767

)

Effect of exchange rate changes on cash

and cash equivalents

(1,491

)

(853

)

Net decrease in cash and cash

equivalents

(6,090

)

(28,697

)

Cash and cash equivalents at end of

period

$

47,200

$

49,556

BUSINESS SEGMENT

INFORMATION

(Unaudited)

(In thousands)

Net sales details for each reportable

segment of UNIFI are as follows:

For the Three Months

Ended

October 2, 2022

September 26, 2021

Americas

$

107,644

$

110,826

Brazil

38,879

33,738

Asia

32,996

51,428

Consolidated net sales

$

179,519

$

195,992

Gross (loss) profit details for each

reportable segment of UNIFI are as follows:

For the Three Months

Ended

October 2, 2022

September 26, 2021

Americas

$

(4,869

)

$

9,186

Brazil

6,787

9,940

Asia

4,645

6,971

Consolidated gross profit

$

6,563

$

26,097

RECONCILIATIONS OF REPORTED

RESULTS TO ADJUSTED RESULTS

(Unaudited)

(In thousands)

EBITDA and Adjusted

EBITDA (Non-GAAP Financial

Measures)

The reconciliations of the amounts

reported under U.S. generally accepted accounting principles

(“GAAP”) for Net (loss) income to EBITDA and Adjusted EBITDA are

set forth below.

For the Three Months

Ended

October 2, 2022

September 26, 2021

Net (loss) income

$

(7,834

)

$

8,680

Interest expense, net

700

438

Provision for income taxes

2,734

4,413

Depreciation and amortization expense

(1)

6,697

6,308

EBITDA

2,297

19,839

Other adjustments (2)

—

—

Adjusted EBITDA

$

2,297

$

19,839

(1)

Within this reconciliation, depreciation

and amortization expense excludes the amortization of debt issuance

costs, which are reflected in interest expense, net. Within the

condensed consolidated statements of cash flows, amortization of

debt issuance costs is reflected in depreciation and amortization

expense.

(2)

For the periods presented, there were no

other adjustments necessary to reconcile Net (loss) income to

Adjusted EBITDA.

Adjusted Net (Loss)

Income and Adjusted EPS (Non-GAAP Financial Measures)

For the three months ended October 2, 2022

and September 26, 2021, there were no adjustments necessary to

reconcile Net (loss) income to Adjusted Net (Loss) Income or

Adjusted EPS.

Net Debt (Non-GAAP

Financial Measure)

Reconciliations of Net Debt are as

follows:

October 2, 2022

July 3, 2022

Long-term debt

$

114,919

$

102,309

Current portion of long-term debt

11,875

11,726

Unamortized debt issuance costs

210

255

Debt principal

127,004

114,290

Less: cash and cash equivalents

47,200

53,290

Net Debt

$

79,804

$

61,000

Cash and cash equivalents

At October 2, 2022 and July 3, 2022, UNIFI’s domestic operations

held approximately 7% and 1% of consolidated cash and cash

equivalents, respectively.

REPREVE Fiber

REPREVE Fiber represents UNIFI’s collection of fiber products on

its recycled platform, with or without added technologies.

Non-GAAP Financial

Measures

Certain non-GAAP financial measures included herein are designed

to complement the financial information presented in accordance

with GAAP. These non-GAAP financial measures include Earnings

Before Interest, Taxes, Depreciation and Amortization (“EBITDA”),

Adjusted EBITDA, Adjusted Net (Loss) Income, Adjusted EPS, and Net

Debt (together, the “non-GAAP financial measures”).

- EBITDA represents Net (loss) income before net interest

expense, income tax expense, and depreciation and amortization

expense.

- Adjusted EBITDA represents EBITDA adjusted to exclude, from

time to time, certain adjustments necessary to understand and

compare the underlying results of UNIFI.

- Adjusted Net (Loss) Income represents Net (loss) income

calculated under GAAP adjusted to exclude certain amounts.

Management believes the excluded amounts do not reflect the ongoing

operations and performance of UNIFI and/or exclusion may be

necessary to understand and compare the underlying results of

UNIFI.

- Adjusted EPS represents Adjusted Net (Loss) Income divided by

UNIFI’s weighted average common shares outstanding.

- Net Debt represents debt principal less cash and cash

equivalents.

The non-GAAP financial measures are not determined in accordance

with GAAP and should not be considered a substitute for performance

measures determined in accordance with GAAP. The calculations of

the non-GAAP financial measures are subjective, based on

management’s belief as to which items should be included or

excluded in order to provide the most reasonable and comparable

view of the underlying operating performance of the business. We

may, from time to time, modify the amounts used to determine our

non-GAAP financial measures.

We believe that these non-GAAP financial measures better reflect

UNIFI’s underlying operations and performance and that their use,

as operating performance measures, provides investors and analysts

with a measure of operating results unaffected by differences in

capital structures, capital investment cycles, and ages of related

assets, among otherwise comparable companies.

Management uses Adjusted EBITDA (i) as a measurement of

operating performance because it assists us in comparing our

operating performance on a consistent basis, as it removes the

impact of (a) items directly related to our asset base (primarily

depreciation and amortization) and (b) items that we would not

expect to occur as a part of our normal business on a regular

basis; (ii) for planning purposes, including the preparation of our

annual operating budget; (iii) as a valuation measure for

evaluating our operating performance and our capacity to incur and

service debt, fund capital expenditures, and expand our business;

and (iv) as one measure in determining the value of other

acquisitions and dispositions. Adjusted EBITDA is a key performance

metric utilized in the determination of variable compensation. We

also believe Adjusted EBITDA is an appropriate supplemental measure

of debt service capacity, because it serves as a high-level proxy

for cash generated from operations.

Management uses Adjusted Net (Loss) Income and Adjusted EPS (i)

as measurements of net operating performance because they assist us

in comparing such performance on a consistent basis, as they remove

the impact of (a) items that we would not expect to occur as a part

of our normal business on a regular basis and (b) components of the

provision for income taxes that we would not expect to occur as a

part of our underlying taxable operations; (ii) for planning

purposes, including the preparation of our annual operating budget;

and (iii) as measures in determining the value of other

acquisitions and dispositions.

Management uses Net Debt as a liquidity and leverage metric to

determine how much debt would remain if all cash and cash

equivalents were used to pay down debt principal.

In evaluating non-GAAP financial measures, investors should be

aware that, in the future, we may incur expenses similar to the

adjustments included herein. Our presentation of non-GAAP financial

measures should not be construed as indicating that our future

results will be unaffected by unusual or non-recurring items. Each

of our non-GAAP financial measures has limitations as an analytical

tool, and investors should not consider it in isolation or as a

substitute for analysis of our results or liquidity measures as

reported under GAAP. Some of these limitations are (i) it is not

adjusted for all non-cash income or expense items that are

reflected in our statements of cash flows; (ii) it does not reflect

the impact of earnings or charges resulting from matters we

consider not indicative of our ongoing operations; (iii) it does

not reflect changes in, or cash requirements for, our working

capital needs; (iv) it does not reflect the cash requirements

necessary to make payments on our debt; (v) it does not reflect our

future requirements for capital expenditures or contractual

commitments; (vi) it does not reflect limitations on or costs

related to transferring earnings from our subsidiaries to us; and

(vii) other companies in our industry may calculate this measure

differently than we do, limiting its usefulness as a comparative

measure.

Because of these limitations, these non-GAAP financial measures

should not be considered as a measure of discretionary cash

available to us to invest in the growth of our business or as a

measure of cash that will be available to us to meet our

obligations, including those under our outstanding debt

obligations. Investors should compensate for these limitations by

relying primarily on our GAAP results and using these measures only

as supplemental information.

Cautionary Statement on Forward-Looking

Statements

Certain statements included herein contain “forward-looking

statements” within the meaning of federal securities laws about the

financial condition and results of operations of UNIFI that are

based on management’s beliefs, assumptions and expectations about

our future economic performance, considering the information

currently available to management. An example of such

forward-looking statements include, among others, guidance

pertaining to our financial outlook. The words “believe,” “may,”

“could,” “will,” “should,” “would,” “anticipate,” “plan,”

“estimate,” “project,” “expect,” “intend,” “seek,” “strive” and

words of similar import, or the negative of such words, identify or

signal the presence of forward-looking statements. These statements

are not statements of historical fact, and they involve risks and

uncertainties that may cause our actual results, performance or

financial condition to differ materially from the expectations of

future results, performance or financial condition that we express

or imply in any forward-looking statement.

Factors that could contribute to such differences include, but

are not limited to: the competitive nature of the textile industry

and the impact of global competition; changes in the trade

regulatory environment and governmental policies and legislation;

the availability, sourcing and pricing of raw materials; general

domestic and international economic and industry conditions in

markets where UNIFI competes, including economic and political

factors over which UNIFI has no control; changes in consumer

spending, customer preferences, fashion trends and end uses for

products; the financial condition of UNIFI’s customers; the loss of

a significant customer or brand partner; natural disasters,

industrial accidents, power or water shortages, extreme weather

conditions and other disruptions at one of our facilities; the

disruption of operations, global demand, or financial performance

as a result of catastrophic or extraordinary events, including

epidemics or pandemics such as the recent strain of coronavirus;

the success of UNIFI’s strategic business initiatives; the

volatility of financial and credit markets; the ability to service

indebtedness and fund capital expenditures and strategic business

initiatives; the availability of and access to credit on reasonable

terms; changes in foreign currency exchange, interest and inflation

rates; fluctuations in production costs; the ability to protect

intellectual property; the strength and reputation of our brands;

employee relations; the ability to attract, retain and motivate key

employees; the impact of climate change or environmental, health

and safety regulations; and the impact of tax laws, the judicial or

administrative interpretations of tax laws and/or changes in such

laws or interpretations.

All such factors are difficult to predict, contain uncertainties

that may materially affect actual results and may be beyond our

control. New factors emerge from time to time, and it is not

possible for management to predict all such factors or to assess

the impact of each such factor on UNIFI. Any forward-looking

statement speaks only as of the date on which such statement is

made, and we do not undertake any obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which such statement is made, except as may be required

by federal securities laws. The above and other risks and

uncertainties are described in UNIFI’s most recent Annual Report on

Form 10-K, and additional risks or uncertainties may be described

from time to time in other reports filed by UNIFI with the

Securities and Exchange Commission pursuant to the Securities

Exchange Act of 1934, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221103005957/en/

Davis Snyder Alpha IR Group 312-445-2870 UFI@alpha-ir.com

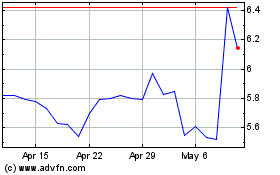

Unifi (NYSE:UFI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Unifi (NYSE:UFI)

Historical Stock Chart

From Nov 2023 to Nov 2024