Increase in Signed Term Sheets, Closed

Commitments and Fundings Received $97.0 million from Liquidity

Events Renews Revolving Credit Facility Declares Third Quarter 2024

Distribution of $0.30 per Share

TriplePoint Venture Growth BDC Corp. (NYSE: TPVG) (the

“Company,” “TPVG,” “we,” “us,” or “our”), the leading financing

provider to venture growth stage companies backed by a select group

of venture capital firms in technology and other high growth

industries, today announced its financial results for the second

quarter ended June 30, 2024 and the declaration by its Board of

Directors of its third quarter 2024 distribution of $0.30 per

share.

Second Quarter 2024 Highlights

- Signed $188.4 million of term sheets with venture growth stage

companies at TriplePoint Capital LLC (“TPC”), representing a 44%

increase from the prior quarter, and TPVG closed $52.0 million of

new debt commitments to venture growth stage companies,

representing a 420% increase from the prior quarter;

- Funded $38.7 million in debt investments, representing an

increase of 186% from the prior quarter, to five portfolio

companies with a 15.5% weighted average annualized yield at

origination;

- Received $97.0 million from liquidity events comprised of $51.2

million of loan principal prepayments, $27.9 million of scheduled

principal amortization, $14.7 million in cash proceeds from the

disposition of debt investments and $3.2 million in cash proceeds

from the sale of warrant and equity investments;

- Achieved a 15.8% weighted average annualized portfolio yield on

debt investments for the quarter1;

- Earned net investment income of $12.6 million, or $0.33 per

share;

- Generated total investment income of $27.1 million;

- Realized an 14.6% return on average equity, based on net

investment income during the quarter;

- Nine debt portfolio companies raised an aggregate $442.6

million of capital in private financings during the quarter;

- Held debt investments in 44 portfolio companies, warrants in 94

portfolio companies and equity investments in 46 portfolio

companies as of June 30, 2024;

- Debt investment portfolio weighted average investment ranking

of 2.24 as of quarter’s end;

- Raised $18.2 million of net proceeds under the at-the-market

equity offering program (“ATM Program”);

- Net asset value of $353.0 million, or $8.83 per share, as of

June 30, 2024;

- Total liquidity of $340.7 million (giving effect to the

Revolving Credit Facility renewal post quarter-end) and total

unfunded commitments of $71.4 million;

- Ended the quarter with a 1.15x gross leverage ratio;

- Declared a second quarter distribution of $0.30 per share,

payable on September 30, 2024; bringing total declared

distributions to $15.75 per share since the Company’s initial

public offering; and

- Subsequent to the end of the quarter, the Company renewed its

Revolving Credit Facility to, among other things, extend the

revolving period to November 30, 2025 and the scheduled maturity

date to May 30, 2027, as well as set total commitments to $300

million.

Year to Date 2024 Highlights

- Earned net investment income of $28.1 million, or $0.74 per

share;

- Generated total investment income of $56.4 million;

- Paid distributions of $0.80 per share;

- Signed $318.8 million of term sheets with venture growth stage

companies at TPC and TPVG closed $62.0 million of new debt

commitments to venture growth stage companies;

- Funded $52.2 million in debt investments to seven portfolio

companies with a 15.2% weighted average annualized portfolio yield

at origination;

- 16 portfolio companies raised an aggregate $1.0 billion of

capital in private financings;

- Achieved a 15.6% weighted average annualized portfolio yield on

total debt investments 1 ;

- In April 2024, DBRS, Inc. issued TPVG’s investment grade

rating, with a BBB (low) Long-Term Issuer rating, with a stable

trend outlook;

- Raised $19.4 million of net proceeds under the ATM Program;

and

- Estimated undistributed taxable earnings from net investment

income (or “spillover income”) of $39.3 million, or $0.98 per

share, as of June 30, 2024.

_____________

1 Please see the last table in this press

release, titled "Weighted Average Portfolio Yield on Debt

Investments," for more information on the calculation of the

weighted average annualized portfolio yield on debt

investments.

“Given continued challenges in the venture capital markets, we

remained on our path of selectively increasing our investment

activity and positioning TPVG for the future,” said Jim Labe,

chairman and chief executive officer of TPVG. “We are pleased with

the notable increase in signed term sheets, closed debt commitments

and funding activity during the quarter and remained focused on

proactively managing and diversifying our portfolio, and preparing

for improving market conditions.”

“During the quarter, we took steps to build a strong foundation

for the future,“ said Sajal Srivastava, president and chief

investment officer of the Company. “We enter the second half of the

year with strong liquidity, an improved leverage ratio, a growing

pipeline, a meaningful portfolio of warrant and equity investments

and a dividend aligned with the earnings power of our

portfolio.”

PORTFOLIO AND INVESTMENT ACTIVITY

During the three months ended June 30, 2024, the Company entered

into $52.0 million of new debt commitments with five portfolio

companies, funded debt investments totaling $38.7 million to five

portfolio companies and acquired warrants valued at $0.3 million in

six portfolio companies. Debt investments funded during the quarter

carried a weighted average annualized portfolio yield of 15.5% at

origination. During the quarter, the Company received $51.2 million

of principal prepayments, $27.9 million of scheduled principal

amortization and $14.7 million from disposition of debt

investments. The weighted average annualized portfolio yield on

debt investments for the second quarter was 15.8%. The Company

calculates weighted average portfolio yield as the annualized rate

of the interest income recognized during the period divided by the

average amortized cost of debt investments in the portfolio during

the period. The return on average equity for the second quarter was

14.6% based on net investment income. The Company calculates return

on average equity as the annualized rate of net investment income

recognized during the period divided by the Company’s average net

asset value during the period.

As of June 30, 2024, the Company held debt investments in 44

portfolio companies, warrants in 94 portfolio companies and equity

investments in 46 portfolio companies. The total cost and fair

value of these investments were $745.6 million and $713.8 million,

respectively.

The following table shows the total portfolio investment

activity for the three and six months ended June 30, 2024 and

2023:

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

(in thousands)

2024

2023

2024

2023

Beginning portfolio at fair value

$

773,605

$

982,828

$

802,145

$

949,276

New debt investments, net(a)

37,727

30,164

50,882

86,538

Scheduled principal amortization

(27,884

)

(1,666

)

(34,696

)

(18,257

)

Principal prepayments and early

repayments

(51,239

)

(33,750

)

(82,081

)

(37,150

)

Net amortization and accretion of premiums

and discounts and end-of-term payments

2,185

4,172

2,589

9,490

Payment-in-kind coupon

3,821

2,597

7,609

4,682

New warrant investments

271

38

436

168

New equity investments

404

433

800

936

Proceeds from dispositions of

investments

(21,036

)

(3,173

)

(22,142

)

(3,173

)

Net realized gains (losses) on

investments

(18,943

)

1,863

(27,894

)

1,863

Net change in unrealized gains (losses) on

investments

14,859

(41,551

)

16,122

(52,418

)

Ending portfolio at fair value

$

713,770

$

941,955

$

713,770

$

941,955

_____________

(a) Debt balance is net of fees and

discounts applied to the loan at origination.

SIGNED TERM SHEETS

During the three months ended June 30, 2024, TPC entered into

$188.4 million of non-binding term sheets to venture growth stage

companies. These opportunities are subject to underwriting

conditions including, but not limited to, the completion of due

diligence, negotiation of definitive documentation and investment

committee approval, as well as compliance with the allocation

policy. Accordingly, there is no assurance that any or all of these

transactions will be completed or assigned to the Company.

UNFUNDED COMMITMENTS

As of June 30, 2024, the Company’s unfunded commitments totaled

$71.4 million, of which $5.0 million was dependent upon portfolio

companies reaching certain milestones. Of the $71.4 million of

unfunded commitments, $5.0 million will expire during 2024, $65.9

million will expire during 2025, and $0.5 million will expire

during 2026, if not drawn prior to expiration. Since these

commitments may expire without being drawn, unfunded commitments do

not necessarily represent future cash requirements or future

earning assets for the Company.

RESULTS OF OPERATIONS

Total investment and other income was $27.1 million for the

second quarter of 2024, representing a weighted average annualized

portfolio yield of 15.8% on debt investments, as compared to $35.2

million and 14.7% for the second quarter of 2023. The decrease in

total investment and other income was primarily due to a lower

weighted average principal amount outstanding on our income-bearing

debt investment portfolio. For the six months ended June 30, 2024,

the Company’s total investment and other income was $56.4 million,

as compared to $68.8 million for the six months ended June 30,

2023, representing a weighted average annualized portfolio yield on

total debt investments of 15.6% and 14.7%, respectively.

Operating expenses for the second quarter of 2024 were $14.5

million as compared to $16.3 million for the second quarter of

2023. Operating expenses for the second quarter of 2024 consisted

of $8.7 million of interest expense and amortization of fees, which

includes $1.8 million of one-time fees related to minimum

utilization on the Revolving Credit Facility, $3.8 million of base

management fees, $0.6 million of administration agreement expenses

and $1.3 million of general and administrative expenses. Due to the

total return requirement under the income component of our

incentive fee structure, our income incentive fees were reduced by

$2.5 million during the three months ended June 30, 2024. Operating

expenses for the second quarter of 2023 consisted of $9.9 million

of interest expense and amortization of fees, $4.5 million of base

management fees, $0.6 million of administration agreement expenses

and $1.3 million of general and administrative expenses. Due to the

total return requirement under the income component of our

incentive fee structure, our income incentive fees were reduced by

$3.8 million during the three months ended June 30, 2023. The

Company’s total operating expenses were $28.3 million and $31.4

million for the six months ended June 30, 2024 and 2023,

respectively.

For the second quarter of 2024, the Company recorded net

investment income of $12.6 million, or $0.33 per share, as compared

to $18.8 million, or $0.53 per share, for the second quarter of

2023. The decrease in net investment income between periods was

driven primarily by lower total investment and other income.

During the second quarter of 2024, the Company recognized net

realized losses on investments of $18.8 million, consisting

primarily of $20.2 million of net realized losses on the debt

investment portfolio from the write-off and restructuring of

investments, partially offset by $1.3 million of net warrant and

equity gains from the sale and dispositions of investments. During

the second quarter of 2023, the Company recognized net realized

gains on investments of $1.9 million.

Net change in unrealized gains on investments for the second

quarter of 2024 was $14.9 million, consisting of $12.8 million of

net unrealized gains on the warrant and equity portfolio resulting

from fair value adjustments and $10.9 million of net unrealized

gains from the reversal of previously recorded unrealized losses

from investments realized during the period, offset by $8.8 million

of net unrealized losses on the existing debt investment portfolio

resulting from fair value adjustments. Net change in unrealized

losses on investments for the second quarter of 2023 was $41.6

million. The Company’s net realized and unrealized losses were

$11.5 million for the six months ended June 30, 2024, compared to

net realized and unrealized losses of $50.6 million for the six

months ended June 30, 2023.

The Company’s net increase in net assets resulting from

operations for the second quarter of 2024 was $8.6 million, or

$0.22 per share, as compared to a net decrease in net assets

resulting from operations of $20.9 million, or $0.59 per share, for

the second quarter of 2023. For the six months ended June 30, 2024,

the Company’s net increase in net assets resulting from operations

was $16.6 million, or $0.43 per share, as compared to a net

decrease in net assets resulting from operations of $13.2 million,

or $0.37 per share, for the six months ended June 30, 2023.

CREDIT QUALITY

The Company maintains a credit watch list with portfolio

companies placed into one of five credit categories, with Clear, or

1, being the highest rating and Red, or 5, being the lowest.

Generally, all new loans receive an initial grade of White, or 2,

unless the portfolio company’s credit quality meets the

characteristics of another credit category.

As of June 30, 2024, the weighted average investment ranking of

the Company’s debt investment portfolio was 2.24, as compared to

2.21 at the end of the prior quarter. During the quarter ended June

30, 2024, portfolio company credit category changes, excluding

fundings and repayments, consisted of the following: one portfolio

company with a principal balance of $25.0 million was upgraded from

White (2) to Clear (1), one portfolio company with a principal

balance of $4.7 million was downgraded from Clear (1) to White (2),

one portfolio company with a principal balance of $13.0 million was

downgraded from White (2) to Yellow (3), one portfolio company with

a principal balance of $12.3 million was downgraded from White (2)

to Orange (4), one portfolio company with a principal balance of

$24.7 million was downgraded from Yellow (3) to Orange (4), and one

portfolio company with a principal balance of $0.7 million was

downgraded from Yellow (3) to Red (5).

The following table shows the credit categories for the

Company’s debt investments at fair value as of June 30, 2024 and

December 31, 2023:

June 30, 2024

December 31, 2023

Credit Category (dollars in

thousands)

Fair Value

Percentage of Total Debt

Investments

Number of Portfolio

Companies

Fair Value

Percentage of Total Debt

Investments

Number of Portfolio

Companies

Clear (1)

$

61,473

10.0

%

4

$

100,309

13.8

%

7

White (2)

400,272

65.0

27

471,195

64.5

28

Yellow (3)

95,768

15.6

6

117,792

16.1

8

Orange (4)

58,087

9.4

6

40,091

5.5

5

Red (5)

56

—

1

908

0.1

1

$

615,656

100.0

%

44

$

730,295

100.0

%

49

NET ASSET VALUE

As of June 30, 2024, the Company’s net assets were $353.0

million, or $8.83 per share, as compared to $346.3 million, or

$9.21 per share, as of December 31, 2023.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2024, the Company had total liquidity of $340.7

million, consisting of cash, cash equivalents and restricted cash

of $50.7 million and available capacity under its Revolving Credit

Facility of $290.0 million (adjusted for renewal of the Revolving

Credit Facility on August 6, 2024). As of June 30, 2024, the

Company held $0.5 million of stock and warrant positions in

publicly traded companies. The Company ended the quarter with a

1.15x gross leverage ratio and an asset coverage ratio of 187%.

The Company maintains an ATM Program with UBS Securities LLC,

providing for the issuance from time to time of shares of its

common stock. As of June 30, 2024, $56.5 million in shares remained

available for sale under the ATM Program.

DISTRIBUTION

On July 31, 2024, the Company’s board of directors declared a

regular quarterly distribution of $0.30 per share for the third

quarter, payable on September 30, 2024 to stockholders of record as

of September 16, 2024. As of June 30, 2024, the Company had

estimated spillover income of $39.3 million, or $0.98 per

share.

RECENT DEVELOPMENTS

Since June 30, 2024 and through August 6, 2024:

- TPC’s direct originations platform entered into $56.0 million

of additional non-binding signed term sheets with venture growth

stage companies;

- The Company closed $11.0 million of additional debt

commitments;

- The Company funded $6.3 million in new investments;

- On August 2, 2024, the Company’s board of directors appointed

Matthew Galiani to serve as interim Chief Financial Officer of the

Company, effective as of the close of business on August 9, 2024.

Mr. Galiani joined the Company in 2019 and has served as the

Company’s Controller since December 2022; and

- Subsequent to the end of the quarter, the Company renewed its

Revolving Credit Facility to, among other things, extend the

revolving period to November 30, 2025 and the scheduled maturity

date to May 30, 2027, as well as set total commitments to $300

million.

CONFERENCE CALL

The Company will host a conference call at 5:00 p.m. Eastern

Time, today, August 7, 2024, to discuss its financial results for

the quarter ended June 30, 2024. To listen to the call, investors

and analysts should dial (844) 826-3038 (domestic) or +1 (412)

317-5184 (international) and ask to join the TriplePoint Venture

Growth BDC Corp. call. Please dial in at least five minutes before

the scheduled start time. A replay of the call will be available

through September 7, 2024, by dialing (877) 344-7529 (domestic) or

+1 (412) 317-0088 (international) and entering conference ID

5227745. The conference call also will be available via a live

audio webcast in the investor relations section of the Company’s

website, https://www.tpvg.com. An online archive of the webcast

will be available on the Company’s website for one year after the

call.

ABOUT TRIPLEPOINT VENTURE GROWTH BDC CORP.

TriplePoint Venture Growth BDC Corp. is an externally-managed

business development company focused on providing customized debt

financing with warrants and direct equity investments to venture

growth stage companies in technology and other high growth

industries backed by a select group of venture capital firms. The

Company’s sponsor, TriplePoint Capital, is a Sand Hill Road-based

global investment platform which provides customized debt

financing, leasing, direct equity investments and other

complementary solutions to venture capital-backed companies in

technology and other high growth industries at every stage of their

development with unparalleled levels of creativity, flexibility and

service. For more information about TriplePoint Venture Growth BDC

Corp., visit https://www.tpvg.com. For more information about

TriplePoint Capital, visit https://www.triplepointcapital.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute

forward-looking statements. Forward-looking statements are not

guarantees of future performance, investment activity, financial

condition or results of operations and involve a number of

substantial risks and uncertainties, many of which are difficult to

predict and are generally beyond the Company’s control. Words such

as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,”

“continue,” “believes,” “seeks,” “estimates,” “would,” “could,”

“should,” “targets,” “projects,” and variations of these words and

similar expressions are intended to identify forward-looking

statements. Actual events, investment activity, performance,

condition or results may differ materially from those in the

forward-looking statements as a result of a number of factors,

including as a result of changes in economic, market or other

conditions, and the impact of such changes on the Company’s and its

portfolio companies’ results of operations and financial condition,

and those factors described from time to time in the Company’s

filings with the Securities and Exchange Commission. More

information on these risks and other potential factors that could

affect actual events and the Company’s performance and financial

results, including important factors that could cause actual

results to differ materially from plans, estimates or expectations

included herein or discussed on the webcast/conference call, is or

will be included in the Company’s filings with the Securities and

Exchange Commission, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the Company’s Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which reflect management’s opinions only as of the date hereof. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

TriplePoint Venture Growth BDC

Corp.

Consolidated Statements of

Assets and Liabilities

(in thousands, except per share

data)

June 30, 2024

December 31, 2023

Assets

(unaudited)

Investments at fair value (amortized cost

of $745,644 and $850,142, respectively)

$

713,770

$

802,145

Cash and cash equivalents

50,434

153,328

Restricted cash

241

18,254

Deferred credit facility costs

2,507

2,714

Prepaid expenses and other assets

4,316

2,384

Total assets

$

771,268

$

978,825

Liabilities

Revolving Credit Facility

$

10,000

$

215,000

2025 Notes, net

69,843

69,738

2026 Notes, net

199,262

199,041

2027 Notes, net

124,257

124,117

Other accrued expenses and liabilities

14,929

24,623

Total liabilities

$

418,291

$

632,519

Net assets

Preferred stock, par value $0.01 per share

(50,000 shares authorized; no shares issued and outstanding,

respectively)

$

—

$

—

Common stock, par value $0.01 per

share

399

376

Paid-in capital in excess of par value

514,023

492,934

Total distributable earnings (loss)

(161,445

)

(147,004

)

Total net assets

$

352,977

$

346,306

Total liabilities and net

assets

$

771,268

$

978,825

Shares of common stock outstanding (par

value $0.01 per share and 450,000 authorized)

39,953

37,620

Net asset value per share

$

8.83

$

9.21

TriplePoint Venture Growth BDC

Corp.

Consolidated Statements of

Operations

(in thousands, except per share

data)

For the Three Months Ended

June 30,

For the Six Months Ended

June 30,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Investment income

Interest income from investments

$

26,590

$

34,501

$

55,118

$

66,754

Other income

517

650

1,263

2,025

Total investment and other

income

$

27,107

$

35,151

$

56,381

$

68,779

Operating expenses

Base management fee

$

3,832

$

4,496

$

8,134

$

8,807

Income incentive fee

—

—

—

—

Interest expense and amortization of

fees

8,702

9,944

15,713

19,189

Administration agreement expenses

648

567

1,259

1,140

General and administrative expenses

1,321

1,307

3,148

2,227

Total operating expenses

$

14,503

$

16,314

$

28,254

$

31,363

Net investment income

$

12,604

$

18,837

$

28,127

$

37,416

Net realized and unrealized

gains/(losses)

Net realized gains (losses) on

investments

$

(18,846

)

$

1,859

$

(27,653

)

$

1,826

Net change in unrealized gains (losses) on

investments

14,859

(41,551

)

16,122

(52,418

)

Net realized and unrealized

gains/(losses)

$

(3,987

)

$

(39,692

)

$

(11,531

)

$

(50,592

)

Net increase (decrease) in net assets

resulting from operations

$

8,617

$

(20,855

)

$

16,596

$

(13,176

)

Per share information (basic and

diluted)

Net investment income per share

$

0.33

$

0.53

$

0.74

$

1.06

Net increase (decrease) in net assets per

share

$

0.22

$

(0.59

)

$

0.43

$

(0.37

)

Weighted average shares of common stock

outstanding

38,729

35,398

38,189

35,373

Total distributions declared per share

$

0.40

$

0.40

$

0.80

$

0.80

Weighted Average Portfolio

Yield

on Debt Investments

Ratios (Percentages, on an

annualized basis)(1)

For the Three Months Ended

June 30,

For the Six Months Ended

June 30,

2024

2023

2024

2023

Weighted average portfolio yield on debt

investments(2)

15.8

%

14.7

%

15.6

%

14.7

%

Coupon income

11.6

%

11.8

%

11.9

%

11.8

%

Accretion of discount

0.8

%

0.7

%

0.9

%

0.9

%

Accretion of end-of-term payments

1.5

%

1.6

%

1.5

%

1.7

%

Impact of prepayments during the

period

1.9

%

0.6

%

1.3

%

0.3

%

_____________

(1)

Weighted average portfolio yields on debt

investments for periods shown are the annualized rates of interest

income recognized during the period divided by the average

amortized cost of debt investments in the portfolio during the

period. The calculation of weighted average portfolio yields on

debt investments excludes any non-income producing debt

investments, but includes debt investments on non-accrual status.

The weighted average yields reported for these periods are

annualized and reflect the weighted average yields to

maturities.

(2)

The weighted average portfolio yields on

debt investments reflected above do not represent actual investment

returns to the Company’s stockholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807516128/en/

INVESTOR RELATIONS AND MEDIA CONTACT The IGB Group Leon

Berman 212-477-8438 lberman@igbir.com

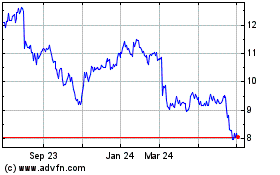

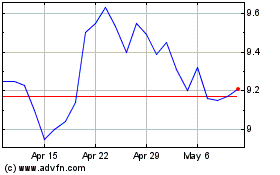

TriplePoint Venture Grow... (NYSE:TPVG)

Historical Stock Chart

From Oct 2024 to Nov 2024

TriplePoint Venture Grow... (NYSE:TPVG)

Historical Stock Chart

From Nov 2023 to Nov 2024