Transcontinental Realty Investors Inc. Announces Two Major Strategic Initiatives

June 14 2018 - 11:46AM

Business Wire

Transcontinental Realty Investors Inc., (NYSE: TCI)

announces it has executed the appropriate documents associated with

two proposed major transactions. The Dallas-based real estate

investment company is planning on entering into a strategic Joint

Venture, and in an unrelated transaction plans to sell its 4 major

commercial buildings.

Transcontinental Realty Investors has entered into a Joint

Venture with a major New York Stock Exchange financial institution.

This joint venture agreement conveys existing multifamily assets as

well as projects under development to a newly-formed entity called

Victory Abode Apartments, LLC. The assets involved include 41

existing properties and 12 properties under development

encompassing 8,082 apartment units, with the rights to jointly

develop 23 additional projects. (There are currently 28 projects in

TCI’s pipeline.) The appropriate request has now been submitted to

HUD and will likely be finalized this summer, pending formal

approval.

Transcontinental’s second major strategic transaction of the

year is the planned sale of its 4 commercial office buildings to a

private company with significant real estate holdings. A formal

contract has been executed and is subsequent to due diligence;

however TCI has ascertained reasonable assurances that the

purchaser has both significant real estate expertise and has the

appropriate financial backing to complete the transaction.

The sale of these four commercial assets is tied to the NOI

calculation at the end of the approximately 45 day due diligence

period. Given our previously announced increase in occupancy, TCI

is confident that the asset values will remain attractive to all

parties.

“I believe both of these initiatives further demonstrate our

ability to enhance shareholder value, aligned with the strategic

direction we announced two years ago,” commented Daniel J. Moos,

TCI’s President and CEO. “Our company has been dramatically

transformed to a highly viable operating company with solid

development capabilities in the Multi-Family arena.”

It is Transcontinental Realty Investors’ goal to successfully

close both of these transactions and to continue to invest in and

expand its Multi-Family Portfolio.

Transcontinental Realty Investors maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, developing, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the professional

management of apartments, office buildings, warehouses, and retail

centers that are "undervalued" or "underperforming" at the time of

acquisition. Value is added under Transcontinental ownership, and

the properties are repositioned into higher classifications through

physical improvements and improved management. Transcontinental

also develops new properties, such as luxury apartment homes

principally on land it owns or acquires.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180614005813/en/

On behalf of Transcontinental Realty Investors Inc.Chris

Childress, 469-522-4275

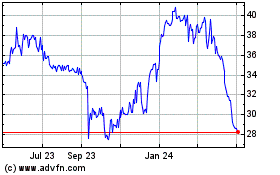

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jul 2023 to Jul 2024