FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 07/30/2024

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

26 Boulevard Royal – 4th floor

L-2449 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F a Form 40-F __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes __ No a

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s consolidated financial statements as of June 30, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

| | | | | | | | |

By: /s/ Guillermo Etchepareborda | | By: /s/ Sebastián Martí |

| Name: Guillermo Etchepareborda | | Name: Sebastián Martí |

| Title: Attorney in Fact | | Title: Attorney in Fact |

Dated: July 30, 2024

| | | | | |

| |

| |

| TERNIUM S.A. | |

| Consolidated Condensed Interim Financial Statements | |

as of June 30, 2024 | |

| and for the six-month periods | |

ended on June 30, 2024 and 2023

| |

| |

| |

| |

26 Boulevard Royal, 4th floor

| |

L – 2449 Luxembourg

| |

R.C.S. Luxembourg: B 98 668

| |

INDEX

| | | | | | | | |

| Page |

| |

| |

| |

Consolidated Condensed Interim Statements of Financial Position | |

Consolidated Condensed Interim Statements of Changes in Equity | |

Consolidated Condensed Interim Statements of Cash Flows | |

Notes to the Consolidated Condensed Interim Financial Statements | |

| 1 | General information and basis of presentation | |

| 2 | Accounting policies | |

| 3 | Acquisition of business – Increase of the participation in Usiminas Control Group and new governance structure of Usiminas | |

| 4 | Segment information | |

| 5 | Cost of sales | |

| 6 | Selling, general and administrative expenses | |

| 7 | Finance expense, Finance income and Other financial income (expenses), net | |

| 8 | Property, plant and equipment, net | |

| 9 | Intangible assets, net | |

| 10 | Investments in non-consolidated companies | |

| 11 | Distribution of dividends | |

| 12 | Income tax – Pillar Two | |

| 13 | Contingencies, commitments and restrictions on the distribution of profits | |

| 14 | Related party transactions | |

| 15 | Financial instruments by category and fair value measurement | |

| 16 | Foreign exchange restrictions in Argentina | |

| | |

| | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

| (All amounts in $ thousands) | | |

Consolidated Condensed Interim Income Statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Three-month period ended

June 30, | | Six-month period ended

June 30, |

| | Notes | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | (Unaudited) | | (Unaudited) |

| Net sales | | 4 | | 4,514,152 | | | 3,871,272 | | | 9,292,449 | | | 7,494,643 | |

| Cost of sales | | 5 | | (3,757,556) | | | (2,839,419) | | | (7,432,300) | | | (5,820,170) | |

| | | | | | | | | | |

| Gross profit | | | | 756,596 | | | 1,031,853 | | | 1,860,149 | | | 1,674,473 | |

| | | | | | | | | | |

| Selling, general and administrative expenses | | 6 | | (434,579) | | | (304,271) | | | (865,745) | | | (597,195) | |

| Other operating income (expense), net | | | | 48,504 | | | 4,159 | | | 50,973 | | | 11,853 | |

| | | | | | | | | | |

| Operating income | | 4 | | 370,521 | | | 731,741 | | | 1,045,377 | | | 1,089,131 | |

| | | | | | | | | | |

| Finance expense | | 7 | | (45,029) | | | (17,542) | | | (89,908) | | | (33,742) | |

| Finance income | | 7 | | 73,376 | | | 42,033 | | | 155,930 | | | 83,479 | |

| Other financial (expense) income, net | | 7 | | (66,949) | | | (42,481) | | | (267,174) | | | (59,900) | |

| | | | | | | | | | |

| Equity in earnings of non-consolidated companies | | 10 | | 14,772 | | | 27,301 | | | 34,332 | | | 62,176 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Provision for ongoing litigation related to the acquisition of a participation in Usiminas | | 13 | | (783,000) | | | — | | | (783,000) | | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| (Loss) Profit before income tax credit (expense) | | | | (436,309) | | | 741,052 | | | 95,557 | | | 1,141,144 | |

| | | | | | | | | | |

| Income tax (expense) credit | | 12 | | (306,817) | | | (5,169) | | | (347,252) | | | 74,259 | |

| | | | | | | | | | |

| (Loss) Profit for the period | | | | (743,126) | | | 735,883 | | | (251,695) | | | 1,215,403 | |

| | | | | | | | | | |

| Attributable to: | | | | | | | | | | |

| Owners of the parent | | | | (727,617) | | | 626,930 | | | (366,181) | | | 1,001,304 | |

| Non-controlling interest | | | | (15,509) | | | 108,953 | | | 114,486 | | | 214,099 | |

| | | | | | | | | | |

| (Loss) Profit for the period | | | | (743,126) | | | 735,883 | | | (251,695) | | | 1,215,403 | |

| | | | | | | | | | |

| Weighted average number of shares outstanding | | | | 1,963,076,776 | | | 1,963,076,776 | | | 1,963,076,776 | | | 1,963,076,776 | |

| | | | | | | | | | |

| Basic and diluted earnings per share for profit attributable to the equity holders of the company (expressed in $ per share) | | | | (0.37) | | | 0.32 | | | (0.19) | | | 0.51 | |

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2023.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

| (All amounts in $ thousands) | | |

Consolidated Condensed Interim Statements of Comprehensive Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Three-month period ended

June 30, | | Six-month period ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (Unaudited) | | (Unaudited) |

| (Loss) Profit for the period | | (743,126) | | 735,883 | | | (251,695) | | | 1,215,403 | |

| | | | | | | | |

| Items that may be reclassified subsequently to profit or loss: | | | | | | | | |

| Currency translation adjustment | | (326,920) | | | 1,591 | | | (427,198) | | | 3,240 | |

| Currency translation adjustment from participation in non-consolidated companies | | (40,368) | | | 42,305 | | | (52,153) | | | 62,610 | |

| Changes in the fair value of financial instruments at fair value through other comprehensive income | | 171,591 | | | (95,706) | | | 441,320 | | | (123,732) | |

| Income tax related to financial instruments at fair value | | (18,304) | | | (31,779) | | | 93,277 | | | (21,758) | |

| Changes in the fair value of derivatives classified as cash flow hedges | | (12,537) | | | — | | | (27,930) | | | — | |

| Income tax related to cash flow hedges | | 3,954 | | | — | | | 8,572 | | | — | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive income items from participation in non-consolidated companies | | — | | | (37) | | | — | | | 415 | |

| Items that will not be reclassified subsequently to profit or loss: | | | | | | | | |

| Remeasurement of post employment benefit obligations | | (3,798) | | | (879) | | | (9,212) | | | (879) | |

| Income tax relating to remeasurement of post employment benefit obligations | | 470 | | | 328 | | | 470 | | | 328 | |

| Remeasurement of post employment benefit obligations from participation in non-consolidated companies | | — | | | (7,745) | | | 53 | | | (7,561) | |

| | | | | | | | |

| Other comprehensive (loss) income for the period, net of tax | | (225,912) | | | (91,922) | | | 27,199 | | | (87,337) | |

| | | | | | | | |

| Total comprehensive (loss) income for the period | | (969,038) | | | 643,961 | | | (224,496) | | | 1,128,066 | |

| | | | | | | | |

| Attributable to: | | | | | | | | |

| Owners of the parent | | (715,743) | | | 510,092 | | | (105,281) | | | 894,029 | |

| Non-controlling interest | | (253,295) | | | 133,869 | | | (119,215) | | | 234,037 | |

| | | | | | | | |

| Total comprehensive (loss) income for the period | | (969,038) | | | 643,961 | | | (224,496) | | | 1,128,066 | |

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2023.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

| (All amounts in $ thousands) | | |

Consolidated Condensed Interim Statements of Financial Position

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Balances as of |

| | Notes | | June 30, 2024 | | December 31, 2023 |

| | | | (Unaudited) | | | | |

| ASSETS | | | | | | | | | | |

| | | | | | | | | | |

| Non-current assets | | | | | | | | | | |

| Property, plant and equipment, net | | 8 | | 7,911,186 | | | | | 7,637,687 | | | |

| Intangible assets, net | | 9 | | 1,049,670 | | | | | 996,048 | | | |

| Investments in non-consolidated companies | | 10 | | 497,486 | | | | | 517,265 | | | |

| Other investments | | | | 31,004 | | | | | 210,930 | | | |

| Deferred tax assets | | 3 | | 1,388,813 | | | | | 1,713,385 | | | |

| Receivables, net | | | | 943,473 | | | 11,821,632 | | | 1,073,245 | | | 12,148,560 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Current assets | | | | | | | | | | |

| Receivables, net | | | | 764,409 | | | | | 686,394 | | | |

| Current income tax assets | | | | 204,622 | | | | | 486,470 | | | |

| Derivative financial instruments | | | | 7,145 | | | | | 15,406 | | | |

| Inventories, net | | | | 5,048,040 | | | | | 4,948,376 | | | |

| Trade receivables, net | | | | 1,972,702 | | | | | 2,065,499 | | | |

| Other investments | | | | 2,117,091 | | | | | 1,975,646 | | | |

| Cash and cash equivalents | | | | 1,719,465 | | | 11,833,474 | | | 1,846,013 | | | 12,023,804 | |

| | | | | | | | | | |

| Assets classified as held for sale | | | | | | 8,035 | | | | | 6,740 | |

| | | | | | | | | | |

| | | | | | 11,841,509 | | | | | 12,030,544 | |

| | | | | | | | | | |

| Total Assets | | | | | | 23,663,141 | | | | | 24,179,104 | |

| | | | | | | | | | |

| EQUITY | | | | | | | | | | |

| Capital and reserves attributable to the owners of the parent | | | | | | 11,881,437 | | | | | 12,418,595 | |

| | | | | | | | | | |

| Non-controlling interest | | | | | | 4,274,049 | | | | | 4,393,264 | |

| | | | | | | | | | |

| Total Equity | | | | | | 16,155,486 | | | | | 16,811,859 | |

| | | | | | | | | | |

| LIABILITIES | | | | | | | | | | |

| | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | |

| Provisions | | | | 636,640 | | | | | 839,921 | | | |

| Deferred tax liabilities | | | | 29,957 | | | | | 170,820 | | | |

| Other liabilities | | | | 1,102,339 | | | | | 1,148,998 | | | |

| Trade payables | | | | 5,930 | | | | | 12,030 | | | |

| Lease liabilities | | | | 176,704 | | | | | 188,913 | | | |

| Borrowings | | | | 1,231,612 | | | 3,183,182 | | | 1,205,961 | | | 3,566,643 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Current liabilities | | | | | | | | | | |

| Provision for ongoing litigation related to the acquisition of a participation in Usiminas | | 13 | | 783,000 | | | | | — | | | |

| Current income tax liabilities | | 12 | | 37,510 | | | | | 137,388 | | | |

| Other liabilities | | | | 444,353 | | | | | 429,713 | | | |

| Trade payables | | | | 2,250,057 | | | | | 2,232,654 | | | |

| Derivative financial instruments | | | | 7,313 | | | | | 8,220 | | | |

| Lease liabilities | | | | 50,044 | | | | | 52,174 | | | |

| Borrowings | | | | 752,196 | | | 4,324,473 | | | 940,453 | | | 3,800,602 | |

| | | | | | | | | | |

| Total Liabilities | | | | | | 7,507,655 | | | | | 7,367,245 | |

| | | | | | | | | | |

| Total Equity and Liabilities | | | | | | 23,663,141 | | | | | 24,179,104 | |

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2023.

| | | | | | | | |

| TERNIUM S.A. |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

| (All amounts in $ thousands) |

Consolidated Condensed Interim Statements of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to the owners of the parent | | | | |

| | Capital stock

(1) | Treasury shares

(1) | Initial public offering expenses | Reserves

(2) | Capital stock issue discount

(3) | Currency translation adjustment | Retained earnings | Total | | Non-controlling interest | | Total Equity |

| |

| | | | | | | | | | | | | |

| Balance as of January 1, 2024 | | 2,004,743 | | (150,000) | | (23,295) | | 965,211 | | (2,324,866) | | (1,963,827) | | 13,910,629 | | 12,418,595 | | | 4,393,264 | | | 16,811,859 | |

| | | | | | | | | | | | | |

| (Loss) Profit for the period | | | | | | | | (366,181) | | (366,181) | | | 114,486 | | | (251,695) | |

| Other comprehensive income (loss) for the period | | | | | | | | | | | | | |

| Currency translation adjustment | | | | | | | (95,895) | | | (95,895) | | | (383,456) | | | (479,351) | |

| Remeasurement of post employment benefit obligations | | | | | (3,118) | | | | | (3,118) | | | (5,571) | | | (8,689) | |

| Cash flow hedges and others, net of tax | | | | | (17,729) | | | | | (17,729) | | | (1,629) | | | (19,358) | |

| Others (4) | | | | | 377,642 | | | | | 377,642 | | | 156,955 | | | 534,597 | |

| | | | | | | | | | | | | |

| Total comprehensive (loss) income for the period | | — | | — | | — | | 356,795 | | — | | (95,895) | | (366,181) | | (105,281) | | | (119,215) | | | (224,496) | |

| | | | | | | | | | | | | |

| Dividends paid in cash (5) | | | | | | | | (431,877) | | (431,877) | | | — | | | (431,877) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance as of June 30, 2024 (unaudited) | | 2,004,743 | | (150,000) | | (23,295) | | 1,322,006 | | (2,324,866) | | (2,059,722) | | 13,112,571 | | 11,881,437 | | | 4,274,049 | | | 16,155,486 | |

(1) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $ 1.00 per share. As of June 30, 2024, there were 2,004,743,442 shares issued. All issued shares are fully paid. Also, as of June 30, 2024, the Company held 41,666,666 shares as treasury shares.

(2) Includes legal reserve under Luxembourg law for $ 200.5 million, undistributable reserves under Luxembourg law for $ 1.4 billion and reserves related to the acquisition of non-controlling interest in subsidiaries for $ (72.4) million.

(3) Represents the difference between book value of non-monetary contributions received from shareholders under Luxembourg GAAP and IFRS.

(4) Includes mainly the changes of the fair value of financial instruments at fair value through other comprehensive income, net of tax.

(5) See note 11.

Dividends may be paid by Ternium to the extent distributable retained earnings calculated in accordance with Luxembourg law and regulations exist. Therefore, retained earnings included in these consolidated condensed interim financial statements may not be wholly distributable.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2023.

| | | | | | | | |

| TERNIUM S.A. |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for six-month periods ended June 30, 2024 and 2023 |

| (All amounts in $ thousands) |

Consolidated Condensed Interim Statements of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to the owners of the parent | | | | |

| | Capital stock

(1) | Treasury shares

(1) | Initial public offering expenses | Reserves

(2) | Capital stock issue discount

(3) | Currency translation adjustment | Retained earnings | Total | | Non-controlling interest | | Total Equity |

| |

| | | | | | | | | | | | | |

| Balance as of January 1, 2023 | | 2,004,743 | | (150,000) | | (23,295) | | 1,394,567 | | (2,324,866) | | (2,859,068) | | 13,803,878 | | 11,845,959 | | | 1,922,434 | | | 13,768,393 | |

| | | | | | | | | | | | | |

| Profit for the period | | | | | | | | 1,001,304 | | 1,001,304 | | | 214,099 | | | 1,215,403 | |

| Other comprehensive income (loss) for the period | | | | | | | | | | | | | |

| Currency translation adjustment | | | | | | | 60,495 | | | 60,495 | | | 5,355 | | | 65,850 | |

| Remeasurement of post employment benefit obligations | | | | | (7,544) | | | | | (7,544) | | | (568) | | | (8,112) | |

| | | | | | | | | | | | | |

| Others (4) | | | | | (160,226) | | | | | (160,226) | | | 15,151 | | | (145,075) | |

| | | | | | | | | | | | | |

| Total comprehensive income (loss) for the period | | — | | — | | — | | (167,770) | | — | | 60,495 | | 1,001,304 | | 894,029 | | | 234,037 | | | 1,128,066 | |

| | | | | | | | | | | | | |

| Dividends paid in cash | | | | | | | | (353,354) | | (353,354) | | | — | | | (353,354) | |

| Dividends paid in kind to non-controlling interest | | | | | | | | | — | | | (233,538) | | | (233,538) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance as of June 30, 2023 (unaudited) | | 2,004,743 | | (150,000) | | (23,295) | | 1,226,797 | | (2,324,866) | | (2,798,573) | | 14,451,828 | | 12,386,634 | | | 1,922,933 | | | 14,309,567 | |

(1) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $ 1.00 per share. As of June 30, 2023, there were 2,004,743,442 shares issued. All issued shares are fully paid. Also, as of June 30, 2023, the Company held 41,666,666 shares as treasury shares.

(2) Include legal reserve under Luxembourg law for $ 200.5 million, undistributable reserves under Luxembourg law for $ 1.4 billion and reserves related to the acquisition of non-controlling interest in subsidiaries for $ (72.4) million.

(3) Represents the difference between book value of non-monetary contributions received from shareholders under Luxembourg GAAP and IFRS.

(4) Includes mainly the changes of the fair value of financial instruments at fair value through other comprehensive income, net of tax.

Dividends may be paid by Ternium to the extent distributable retained earnings calculated in accordance with Luxembourg law and regulations exist. Therefore, retained earnings included in these consolidated condensed interim financial statements may not be wholly distributable.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2023.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

| (All amounts in $ thousands) |

Consolidated Condensed Interim Statements of Cash Flows

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Six-month period ended

June 30, | | |

| | Notes | | 2024 | | 2023 | | |

| | | | (Unaudited) | | |

| Cash flows from operating activities | | | | | | | | |

| (Loss) Profit for the period | | | | (251,695) | | | 1,215,403 | | | |

| Adjustments for: | | | | | | | | |

| Depreciation and amortization | | 8 & 9 | | 370,143 | | | 301,499 | | | |

| Income tax accruals less payments | | 12 | | 270,670 | | | (273,426) | | | |

| Equity in earnings of non-consolidated companies | | 10 | | (34,332) | | | (62,176) | | | |

| Interest accruals less payments/receipts, net | | | | (12,239) | | | (11,774) | | | |

| Changes in provisions | | | | (68,898) | | | 40 | | | |

| Changes in working capital (1) | | | | (96,818) | | | (386,874) | | | |

| Net foreign exchange results and others | | | | 172,132 | | | (19,307) | | | |

| Provision for ongoing litigation related to the acquisition of a participation in Usiminas | | 13 | | 783,000 | | | — | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash provided by operating activities | | | | 1,131,963 | | | 763,385 | | | |

| | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Capital expenditures | | 8 & 9 | | (858,325) | | | (434,268) | | | |

| Decrease (Increase) in other investments | | | | 329,282 | | | (513,210) | | | |

| Proceeds from the sale of property, plant and equipment | | | | 1,243 | | | 878 | | | |

| Dividends received from non-consolidated companies | | | | 1,943 | | | 15,162 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in investing activities | | | | (525,857) | | | (931,438) | | | |

| | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

| Dividends paid in cash to company’s shareholders | | 11 | | (431,877) | | | (353,354) | | | |

| Dividends paid in cash to non-controlling interest | | | | (46,242) | | | — | | | |

| | | | | | | | |

| | | | | | | | |

| Finance lease payments | | | | (33,273) | | | (26,966) | | | |

| Proceeds from borrowings | | | | 434,059 | | | 72,616 | | | |

| Repayments of borrowings | | | | (530,949) | | | (227,191) | | | |

| | | | | | | | |

| Net cash used in financing activities | | | | (608,282) | | | (534,895) | | | |

| | | | | | | | |

| Decrease in cash and cash equivalents | | | | (2,176) | | | (702,948) | | | |

| | | | | | | | |

| Movement in cash and cash equivalents | | | | | | | | |

| At January 1, | | | | 1,846,013 | | | 1,653,355 | | | |

| Effect of exchange rate changes | | | | (124,372) | | | (30,003) | | | |

| Decrease in cash and cash equivalents | | | | (2,176) | | | (702,948) | | | |

| | | | | | | | |

| Cash and cash equivalents as of June 30, (2) | | | | 1,719,465 | | | 920,404 | | | |

| | | | | | | | |

| Non-cash transactions: | | | | | | | | |

| Dividends paid in kind to non-controlling interest | | | | — | | | (233,538) | | | |

| Acquisition of PP&E under lease contract agreements | | | | 11,091 | | | 1,939 | | | |

| | | | | | | | |

(1) The working capital is impacted by non-cash movements of $ (200.6) million as of June 30, 2024 ($ 41.5 million as of June 30, 2023) due to the variations in the exchange rates used by subsidiaries.

(2) It includes restricted cash of $ 112 and $ 98 as of June 30, 2024 and 2023, respectively. In addition, the Company had other investments with a maturity of more than three months for $ 2,147,939 and $ 2,134,536 as of June 30, 2024 and 2023, respectively.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2023.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

Notes to the Consolidated Condensed Interim Financial Statements

1.GENERAL INFORMATION AND BASIS OF PRESENTATION

Ternium S.A. (the “Company” or “Ternium”), was incorporated on December 22, 2003 to hold investments in flat and long steel manufacturing and distributing companies. The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $ 1.00 per share. As of June 30, 2024, there were 2,004,743,442 shares issued. All issued shares are fully paid.

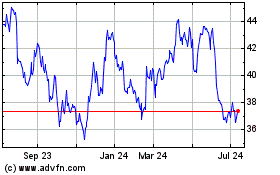

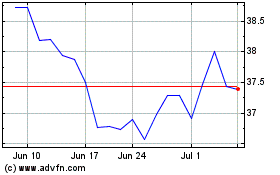

Ternium’s American Depositary Shares (“ADS”) trade on the New York Stock Exchange under the symbol “TX”.

The name and percentage of ownership of subsidiaries that have been included in consolidation in these Consolidated Condensed Interim Financial Statements are disclosed in Note 2 to the audited Consolidated Financial Statements for the year ended December 31, 2023.

The preparation of Consolidated Condensed Interim Financial Statements requires management to make estimates and assumptions that might affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the statement of financial position, and also the reported amounts of revenues and expenses for the reported periods. Actual results may differ from these estimates. The main assumptions and estimates were disclosed in the Consolidated Financial Statements for the year ended December 31, 2023, without significant changes since its publication.

2. ACCOUNTING POLICIES

These Consolidated Condensed Interim Financial Statements have been prepared in accordance with IAS 34, “Interim Financial Reporting” and are unaudited. These Consolidated Condensed Interim Financial Statements should be read in conjunction with the audited Consolidated Financial Statements for the year ended December 31, 2023,which have been prepared in accordance with IFRS Accounting Standards (International Financial Reporting Standards) as issued by the International Accounting Standards Board and in conformity with IFRS Accounting Standards as adopted by the European Union (“EU”). Recently issued accounting pronouncements were applied by the Company as from their respective dates.

These Consolidated Condensed Interim Financial Statements have been prepared following the same accounting policies used in the preparation of the audited Consolidated Financial Statements for the year ended December 31, 2023.

None of the accounting pronouncements issued after December 31, 2023, and as of the date of these Consolidated Condensed Interim Financial Statements have a material effect on the Company’s financial condition or result or operations.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

3. ACQUISITION OF BUSINESS – INCREASE OF THE PARTICIPATION IN USIMINAS CONTROL GROUP AND NEW GOVERNANCE STRUCTURE OF USIMINAS

(a) The participation in Usiminas as of June 30, 2023

On January 16, 2012, the Company’s subsidiaries, Ternium Investments and Ternium Argentina (together with its wholly-owned subsidiary Prosid Investments S.A., or "Prosid", and the Company’s affiliate, Confab Industrial S.A., a subsidiary of Tenaris, or TenarisConfab), joined the existing control group of Usiminas, a leading steel company in the Brazilian flat steel market, through the acquisition of 84.7, 30.0, and 25.0 million ordinary shares, respectively, and formed the so-called Ternium/Tenaris (T/T) Group.

On October 30, 2014, Ternium Investments acquired 51.4 million additional ordinary shares of Usiminas. On April 20, 2016, Ternium Investments subscribed to 7.0 million preferred shares of Usiminas and Ternium Argentina, together with Prosid, subscribed to an aggregate 1.5 million preferred shares of Usiminas. On July 19, 2016, Usiminas’ extraordinary general shareholders’ meeting homologated a capital increase, and Ternium Investments acquired 62.6 million additional ordinary shares, and Ternium Argentina and Prosid acquired an aggregate 13.8 million additional ordinary shares. As a result of these transactions, Ternium, through its subsidiaries Ternium Investments, Ternium Argentina and Prosid, owned as of June 30, 2023, 242.6 million ordinary shares of Usiminas (representing 34.4% of Usiminas’ ordinary shares) and 8.5 million of Usiminas’ preferred shares (representing 1.6% of Usiminas’ preferred shares), representing, in the aggregate, 20.4% of Usiminas’ share capital.

As of June 30, 2023, the Usiminas control group held, in the aggregate, 483.6 million ordinary shares bound to the Usiminas shareholders’ agreement, representing approximately 68.6% of Usiminas’ voting capital. The Usiminas control group, which was bound by a long-term shareholders’ agreement that governs the rights and obligations of Usiminas’ control group members, was composed as of such date of three sub-groups: the T/T Group; the NSC Group, comprising Nippon Steel Corporation (“NSC”), Metal One Corporation and Mitsubishi Corporation; and Usiminas’ pension fund Previdência Usiminas. The T/T Group held approximately 47.1% of the total shares held by the control group (39.5% corresponding to the Ternium entities and the other 7.6% corresponding to TenarisConfab); the NSC Group held approximately 45.9% of the total shares held by the control group; and Previdência Usiminas held the remaining 7%. The corporate governance rules reflected in the Usiminas shareholders agreement provided, among other things, that Usiminas’ executive board was composed of six members, including the chief executive officer and five vice-presidents, with Ternium and NSC nominating three members each. The right to nominate Usiminas’ chief executive officer alternated between Ternium and NSC at every 4-year interval, with the party that did not nominate the chief executive officer having the right to nominate the chairman of Usiminas’ board of directors for the same 4-year period. The Usiminas shareholders agreement also provided for an exit mechanism consisting of a buy-and-sell procedure—exercisable at any time after November 16, 2022, and applicable with respect to shares held by NSC and the T/T Group—, which would allow either Ternium or NSC to purchase all or a majority of the Usiminas shares held by the other shareholder.

(b) The acquisition of the additional participation

On March 30, 2023, Ternium S.A. announced that its subsidiaries Ternium Investments and Ternium Argentina, together with Confab, a subsidiary of its affiliate Tenaris S.A., all of which compose the T/T group within Usiminas control group, entered into a share purchase agreement to acquire from Nippon Steel Corporation, Mitsubishi and MetalOne (the “NSC group”), pro rata to their current participations in the T/T group, 68.7 million ordinary shares of Usinas Siderúrgicas de Minas Gerais S.A. – USIMINAS (“Usiminas”) at a price of BRL10 per ordinary share.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

3. ACQUISITION OF BUSINESS – INCREASE OF THE PARTICIPATION IN USIMINAS CONTROL GROUP AND NEW GOVERNANCE STRUCTURE OF USIMINAS (continued)

On July 3, 2023, the Company announced the completion of the acquisition of this additional participation. Pursuant to the transaction, Ternium paid $ 118.7 million in cash for 57.7 million ordinary shares, increasing its participation in the Usiminas control group to 51.5%.

The Usiminas control group holds the majority of Usiminas’ voting rights. Following the completion of the transaction, the T/T group holds an aggregate participation of 61.3% in the control group, with the NSC group and Previdência Usiminas (Usiminas employees’ pension fund) holding 31.7% and 7.1%, respectively. The Usiminas control group members also agreed a new governance structure, as a result of which the T/T group nominated a majority of the Usiminas board of directors, the CEO and four other members of Usiminas board of officers, and ordinary decisions are approved with a 55% majority of the control group shares.

Pursuant to the Usiminas shareholders agreement, as supplemented by the T/T Group shareholders’ agreement, Ternium started fully consolidating Usiminas balance sheet and results of operations in its consolidated financial statements beginning in July 2023.

(c) Remeasurement of the previously held interest

As of July 3, 2023, Ternium remeasured its former participation (20.4%) at its fair value as of such date and recognized in its Consolidated Condensed Interim Financial Statements as of and for the nine-month period ended September 30, 2023, the effects described below.

Consequently, Ternium valued its previously held interest by means of the market quotation of Usiminas share in the Brazilian stock market. Such value as of July 3, 2023, was of 7.36 BRL per share, amounting to a total of $ 385.9 million. This valuation results in the recognition of a loss of $ 441.4 million, which is included along with the gain related to the bargain purchase amounting to $ 270.4 million (see note 3 (d)) in the “Effect related to the increase of the participation in Usiminas” in the income statement for a total of $ 171.0 million.

In addition, IFRS 3, paragraph 42, establishes that the previous interest must be remeasured, and necessary adjustments made as if it were a disposal of the investment. In this case, items previously recognized in other comprehensive income, mainly the CTA (currency translation adjustment) should be recycled to results of the period. The accumulated loss in “Other comprehensive income” as of the acquisition date was $ 934.9 million.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

3. ACQUISITION OF BUSINESS – INCREASE OF THE PARTICIPATION IN USIMINAS CONTROL GROUP AND NEW GOVERNANCE STRUCTURE OF USIMINAS (continued)

(d) Fair value of net assets acquired

The fair values determined for the assets acquired and liabilities assumed arising from the acquisition and as of the acquisition date are as follows:

| | | | | | | | |

| Fair value of acquired assets and assumed liabilities: | | in $ thousands |

| | |

| Property, plant and equipment | | 904,780 |

| Investments in non-consolidated companies | | 400,037 |

| Inventories | | 1,707,311 |

| Cash and cash equivalents | | 781,072 |

| Other investments | | 247,005 |

| Trade receivables | | 764,257 |

| Allowance for doubtful accounts | | (44,626) |

| Other receivables | | 854,917 |

| Deferred tax assets | | 1,327,232 |

| Borrowings | | (1,224,399) |

| Provisions | | (856,153) |

| Trade payables | | (758,687) |

| Other assets and liabilities, net | | (509,486) |

| Net assets acquired | | 3,593,260 |

| | |

| Non-controlling interest | | (2,818,358) |

| Remeasurement of previously held interest in Usiminas | | (385,851) |

| Total Purchase consideration | | (118,686) |

| Bargain purchase gain | | 270,365 |

| | |

| Loss on the remeasurement of previously held interest in Usiminas | | (441,410) |

| Net loss effect related to the increase of the participation in Usiminas | | (171,045) |

The purchase price allocation disclosed above was prepared with the assistance of a third-party expert. Management applied significant judgment in estimating the fair value of assets acquired and liabilities assumed, which involved the use of significant estimates and assumptions in particular with respect to the estimation of the loss probability for the contingencies, including revenue forecasts, EBITDA margins, capital expenditures and discount rate for the cash flow projections. According to the purchase price allocation, the transaction led to the recognition of a bargain purchase of $ 270.4 million, recognized in the Consolidated Condensed Interim Financial Statements as of and for the nine-month period ended September 30, 2023.

(e) Put and call option

In addition to the share purchase and the new governance structure, a “put” and “call” mechanism was established according to the following scheme:

- NSC group will have the right, at any time after the closing of the transaction, to withdraw its remaining shares from the control group and sell them in the open market after giving the T/T group the opportunity to buy them at the 40-trading day average price per share immediately prior to the NSC group’s notice of withdrawal, as well as the right, at any time after the second anniversary of the closing, to sell such shares to the T/T group at BRL10 per share.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

3. ACQUISITION OF BUSINESS – INCREASE OF THE PARTICIPATION IN USIMINAS CONTROL GROUP AND NEW GOVERNANCE STRUCTURE OF USIMINAS (continued)

- At any time after the second anniversary of the closing of the transaction, the T/T group will have the right to buy the NSC group’s remaining interest in the Usiminas control group (153.1 million ordinary shares) at the higher of BRL10 per share and the 40-trading day average price per share immediately prior to the date of exercising the option.

- In the case of the T/T Group, Ternium will decide at its own discretion the execution of the call option, having Confab and Ternium Argentina the option to acquire the shares owned by NSC pro rata to their participation.

IAS 32 requires a liability to be recognized for written puts over non-controlling interests. The liability reflects the entity’s obligation to deliver cash or a financial asset. The financial liability is recognized at present value of the redemption amount and accreted through finance charges in the income statement over the contract period up to the final redemption amount. Ternium has recognized a liability associated with the put option of $ 242.5 million ($ 256.1 million as of June 30, 2024), accounted for in the statement of financial position under Other liabilities, with the corresponding debit in the statement of changes in equity under Non-controlling interest.

(f) Recognition of non-controlling interest

Ternium recognizes non-controlling interests in an acquired entity either at fair value or at the non-controlling interest’s proportionate share of the acquired entity’s net identifiable assets. This decision is made on an acquisition-by-acquisition basis. For the non-controlling interests in Usiminas, the Company elected to recognize the non-controlling interests at its proportionate share of the acquired net identifiable assets, which led to a non-controlling interest of $ 2,575.9 million, recognized in the Consolidated Condensed Interim Financial Statements as of and for the nine-month period ended September 30, 2023.

(g) Main contingencies associated with the acquired business

Contrary to the recognition principles in IAS 37 Provisions, Contingent Liabilities and Contingent Assets, IFRS 3 Business Combinations requires an acquirer of a business to recognize contingent liabilities assumed in a business acquisition at the acquisition date even if it is not probable that an outflow of resources will be required to settle the obligation.

| | | | | | | | |

| | in $ thousands |

| | |

| Provisions for contingencies recognized by Usiminas before business combination | | (199,677) |

| | |

| Provisions for contingencies recognized as part of the business combination: | | |

| Tax related contingencies | | (432,488) |

| Civil and other related contingencies | | (174,333) |

| Labour related contingencies | | (49,655) |

| Total Provision for contingencies | | (856,153) |

Contingencies estimated by Management were related to possible losses arising from administrative proceedings and litigation related to tax, civil and labour matters and based on the advice and assessment of internal and external legal advisors.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

3. ACQUISITION OF BUSINESS – INCREASE OF THE PARTICIPATION IN USIMINAS CONTROL GROUP AND NEW GOVERNANCE STRUCTURE OF USIMINAS (continued)

The main contingencies recognized in the consolidated condensed interim financial statements pursuant to IFRS 3 Business Combinations in connection with the acquisition of the additional participation in Usiminas and the full consolidation of Usiminas include the following:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Description | | Status | | As of the acquisition date (in $ thousands) | | As of June 30, 2024

(in $ thousands) |

| Labor lawsuits filed by employees, former employees and outsourced personnel of the Cubatão Plant, claiming severance pay and social security rights. | | Pending judgment by the Labor Court and administrative bodies, at different levels. | | 57,343 | | 47,655 |

| Tax proceeding in which the tax authorities seek the reversal of ICMS/SP credits on materials considered as consumables (refractory items and others). | | The Tax Debt was included in the Amnesty Program instituted by São Paulo State Law n. 17.843/23. | | 29,772 | | — |

| Labor lawsuits filed by employees, former employees and outsourced personnel of the Ipatinga Plant, claiming severance pay and social security rights. | | Pending judgment by the Labor Court and administrative bodies, at different levels. | | 15,112 | | 11,098 |

| Labor lawsuits filed by former employees challenging the amount of compensation paid on dismissals. | | Pending judgment. | | 10,837 | | 8,074 |

| | | | | | |

| | | | | | |

| Other contingencies | | | | 86,613 | | 57,676 |

| | | | | | |

| Provisions for contingencies recognized by Usiminas before business combination | | 199,677 | | 124,503 |

| | | | | | |

| | | | | | |

| Description | | Status | | As of the acquisition date (in $ thousands) | | As of June 30, 2024

(in $ thousands) |

| Objection filed against the decision that recognized only partially the credit rights established in a final and unappealable court decision that determined the exclusion of ICMS amounts from the calculation basis of PIS/COFINS-Imports. | | Pending judgment at administrative level. | | 94,792 | | 82,178 |

| Tax collection proceedings related to the collection of ICMS/SP on goods shipped to other countries without effective proof of export. | | Pending judgment by the trial court. | | 51,546 | | 44,687 |

| Tax proceedings seeking the reversal of ICMS/SP credits on materials considered as consumables (refractory items and others). | | Several case records, declaratory actions and tax collection proceedings, suspended or pending decision by higher courts. | | 38,640 | | 33,499 |

| ICMS – Action for annulment of the tax debt claimed by the State of Rio Grande do Sul due to failure to make the advance payment of the tax at the entry of goods coming from other States (rate differential ). | | Pending judgment by the trial court. | | 28,789 | | 24,958 |

| Tax assessment notice issued by the State of Minas Gerais concerning alleged reversal of ICMS credits on sale of electrical energy. | | Pending judgment at administrative level. | | 12,386 | | 10,738 |

| Other tax contingencies | | | | 206,335 | | 146,120 |

| | | | | | |

| Provisions for tax contingencies recognized as part of the business combination | | 432,488 | | 342,180 |

| | | | | | |

| Public Civil Action seeking the reimbursement of the amounts increased by means of a term of amendment to the Contractor's Agreement, due to alleged overbilling in the construction of a bridge in Brasília/DF. | | As of July 3, 2023, the claim was deemed groundless and was pending judgment of appeal. As of December 31, 2023, the action was dismissed as unfounded and the case was archived. | | 64,315 | | — |

| Public Civil Action seeking compensation for alleged damages caused to the State of Santa Catarina's Treasury related to improper expenditures incurred in the construction of a bridge. | | Pending conclusion of the expert evidence | | 21,113 | | 18,303 |

| Other civil and other contingencies (1) | | | | 88,905 | | 42,756 |

| Provisions for civil and other contingencies recognized as part of the business combination | | 174,333 | | 61,059 |

| | | | | | |

| Labor lawsuits filed by employees, former employees and outsourced personnel of the Cubatão Plant, claiming severance pay and social security rights. | | Pending judgment by the Labor Court and administrative bodies, at different levels. | | 27,123 | | 19,953 |

| Other labour contingencies (1) | | | | 22,532 | | 15,089 |

| Provisions for labour contingencies recognized as part of the business combination | | 49,655 | | 35,042 |

(1) Composed of individually non-significative contingencies

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

4. SEGMENT INFORMATION

OPERATING SEGMENTS

As of March 31, 2024, following the acquisition of an additional participation in Usiminas on July 3, 2023, the Chief Operating Decision Maker ("CODM") performed a review of the new business structure to decide on the allocation of resources and the assessment of performance, and decided to organize the Company in two operating segments: Steel and Mining.

The Steel segment includes the sales of steel products done by the Company's subsidiaries, which comprises mainly slabs, heavy plates, hot and cold rolled products, coated products, stamped steel parts for the automotive industry, roll-formed and tubular products, billets, bars and other products, including sales of energy.

The Mining segment includes the sales of mining products done by the Company's subsidiaries, mainly iron ore and iron ore pellets, and comprises the mining activities of Las Encinas, an iron ore mining company in which Ternium holds a 100% equity interest, the 50% of the operations and results performed by Peña Colorada, another iron ore mining company in which Ternium maintains that same percentage over its equity interest, and the mining activities of Mineraçao Usiminas, an iron ore mining company in which Usiminas holds a 70% equity interest.

Ternium's Chief Executive Officer ("CEO") functions as the CODM. The various geographic regions operate as an integrated steel producer. The CEO allocates resources and assesses performance of the Steel Segment as an integrated business and does the same with the Mining Segment. The CEO uses "Operating income - Management view" as per the below table as the key performance measure, which differs from operating income determined in accordance with IFRS principally as follows:

• The use of direct cost methodology to value inventories, while under IFRS they are valued at full cost, including absorption of production overheads and depreciation.

• The use of costs based on previously internally defined cost estimates, while, under IFRS, costs are calculated at historical cost (using the FIFO methodology).

• In the case of Usiminas, the use of costs based on the weighted average cost, while, under IFRS, costs are calculated under the FIFO methodology.

• Other differences related to other operating income and expenses.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

4. SEGMENT INFORMATION (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six-month period ended June 30, 2024 (Unaudited) |

| | Steel | | Mining | | Inter-segment eliminations | | Total |

| | | | | | | | |

| Operating income - Management view | | 871,270 | | | (73,592) | | | 14,752 | | | 812,430 | |

| Reconciliation: | | | | | | | | |

| Differences in Cost of sales | | | | | | | | 179,213 | |

| Differences in Other operating income (expense), net | | | | | | | | 53,734 | |

| | | | | | | | |

| Operating income - Under IFRS | | | | | | | | 1,045,377 | |

| | | | | | | | |

| Financial income (expense), net | | | | | | | | (201,152) | |

| Equity in earnings (losses) of non-consolidated companies | | | | | | | | 34,332 | |

| Provision for ongoing litigation related to the acquisition of a participation in Usiminas | | | | | | | | (783,000) | |

| | | | | | | | |

| Income before income tax expense - IFRS | | | | | | | | 95,557 | |

| | | | | | | | |

| Net sales from external customers | | 9,084,805 | | | 207,644 | | | — | | | 9,292,449 | |

| Net sales from transactions with other operating segments of the same entity | | — | | | 338,175 | | | (338,175) | | | — | |

| | | | | | | | |

| Depreciation and amortization | | (271,195) | | | (98,948) | | | — | | | (370,143) | |

| | | | | | | | |

| | Six-month period ended June 30, 2023 (Unaudited) |

| | Steel | | Mining | | Inter-segment eliminations | | Total |

| | | | | | | | |

| Operating income - Management view | | 1,117,369 | | | (30,944) | | | (8,880) | | | 1,077,545 | |

| Reconciliation: | | | | | | | | |

| Differences in Cost of sales | | | | | | | | 11,586 | |

| | | | | | | | |

| Operating income - Under IFRS | | | | | | | | 1,089,131 | |

| | | | | | | | |

| Financial income (expense), net | | | | | | | | (10,163) | |

| Equity in earnings (losses) of non-consolidated companies | | | | | | | | 62,176 | |

| | | | | | | | |

| Income before income tax expense - IFRS | | | | | | | | 1,141,144 | |

| | | | | | | | |

| Net sales from external customers | | 7,494,547 | | | 96 | | | — | | | 7,494,643 | |

| Net sales from transactions with other operating segments of the same entity | | — | | | 194,770 | | | (194,770) | | | — | |

| | | | | | | | |

| Depreciation and amortization | | (252,500) | | | (48,999) | | | — | | | (301,499) | |

Information on segment assets is not disclosed as it is not reviewed by the CEO.

GEOGRAPHICAL INFORMATION

The Company had no revenues attributable to the Company’s country of incorporation (Luxembourg) in 2024.

For purposes of reporting geographical information, net sales are allocated based on the customer’s location. Allocation of depreciation and amortization is based on the geographical location of the underlying assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six-month period ended June 30, 2024 (Unaudited) |

| | Mexico | | Southern region | | Brazil | | Other markets | | Total |

| | | | | | | | | | |

| Net sales | | 4,651,234 | | | 1,143,105 | | | 2,170,798 | | | 1,327,312 | | | 9,292,449 | |

| | | | | | | | | | |

| Non-current assets (1) | | 5,234,140 | | | 1,010,632 | | | 2,407,559 | | | 308,525 | | | 8,960,856 | |

| | | | | | | | | | |

| | Six-month period ended June 30, 2023 (Unaudited) |

| | Mexico | | Southern region | | Brazil | | Other markets | | Total |

| | | | | | | | | | |

| Net sales | | 4,713,028 | | | 1,738,048 | | | 145,799 | | | 897,768 | | | 7,494,643 | |

| | | | | | | | | | |

| Non-current assets (1) | | 4,859,342 | | | 870,248 | | | 1,250,190 | | | 312,651 | | | 7,292,431 | |

| | | | | | | | | | |

| (1) Includes Property, plant and equipment and Intangible assets. | | | | | | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

5. COST OF SALES

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| | | | |

| Inventories at the beginning of the year | | 4,948,376 | | | 3,470,214 | |

| | | | |

| | | | |

| Translation differences | | (174,797) | | | — | |

| | | | |

| Plus: Charges for the period | | | | |

Raw materials and consumables used and

other movements (1) | | 6,126,821 | | | 5,002,579 | |

| Services and fees | | 157,952 | | | 99,133 | |

| Labor cost | | 551,078 | | | 397,802 | |

| Depreciation of property, plant and equipment | | 305,326 | | | 260,729 | |

| Amortization of intangible assets | | 35,810 | | | 18,923 | |

| Maintenance expenses | | 484,272 | | | 341,107 | |

| Office expenses | | 8,107 | | | 6,180 | |

| Valuation allowance | | — | | | (15,333) | |

| Insurance | | 16,891 | | | 7,762 | |

| Change of obsolescence allowance | | 8,740 | | | (478) | |

| Recovery from sales of scrap and by-products | | (14,067) | | | (21,102) | |

| Others | | 25,831 | | | 11,257 | |

| | | | |

| Less: Inventories at the end of the period | | (5,048,040) | | | (3,758,603) | |

| | | | |

| Cost of Sales | | 7,432,300 | | | 5,820,170 | |

(1) It includes $ 70 million related to the readjustment of electricity transmission charges and to natural gas charges in Mexico.

6. SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| Services and fees | | 53,296 | | 40,224 |

| Labor cost | | 206,930 | | 156,460 |

| Depreciation of property, plant and equipment | | 11,537 | | 7,484 |

| Amortization of intangible assets | | 17,470 | | 14,363 |

| Maintenance and expenses | | 6,556 | | 4,095 |

| Taxes | | 72,181 | | 79,436 |

| Office expenses | | 44,336 | | 25,854 |

| Freight and transportation | | 432,696 | | 244,211 |

| Increase of allowance for doubtful accounts | | 2,007 | | | 12,294 | |

| Others | | 18,736 | | 12,774 |

| | | | |

| Selling, general and administrative expenses | | 865,745 | | | 597,195 | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

7. FINANCE EXPENSE, FINANCE INCOME AND OTHER FINANCIAL INCOME (EXPENSES), NET

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| Interest expense | | (89,908) | | | (33,742) | |

| | | | |

| Finance expense | | (89,908) | | | (33,742) | |

| | | | |

| Interest income | | 155,930 | | | 83,479 | |

| | | | |

| Finance income | | 155,930 | | | 83,479 | |

| | | | |

| Net foreign exchange loss | | (89,762) | | | (40,439) | |

| | | | |

| Change in fair value of financial assets (1) | | (143,413) | | | 26,307 | |

| Derivative contract results | | 1,760 | | | (36,104) | |

| Others | | (35,759) | | | (9,664) | |

| | | | |

| Other financial (expenses) income, net | | (267,174) | | | (59,900) | |

(1) Mainly related to the recycling of other comprehensive income from the sale of investments previously recognized at fair value through other comprehensive income.

8. PROPERTY, PLANT AND EQUIPMENT, NET

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| At the beginning of the year | | 7,637,687 | | | 6,261,887 | |

| | | | |

| | | | |

| Currency translation differences | | (159,722) | | | 1,501 | |

| Additions | | 762,175 | | | 340,326 | |

| Value adjustments of lease contracts | | 9,915 | | | 5,926 | |

| Disposals | | (19,801) | | | (17,180) | |

| Depreciation charge | | (316,863) | | | (268,213) | |

| Transfers and reclassifications | | (2,205) | | | 60 | |

| | | | |

| | | | |

| | | | |

| At the end of the period | | 7,911,186 | | | 6,324,307 | |

9. INTANGIBLE ASSETS, NET

| | | | | | | | | | | | | | |

| | | Six-month period ended

June 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| At the beginning of the year | | 996,048 | | | 944,409 | |

| | | | |

| | | | |

| Currency translation differences | | (4,920) | | | 8 | |

| Additions | | 115,150 | | | 57,053 | |

| Amortization charge | | (53,280) | | | (33,286) | |

| | | | |

| | | | |

| Transfers/Disposals | | (3,328) | | | (60) | |

| | | | |

| At the end of the period | | 1,049,670 | | | 968,124 | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

10. INVESTMENTS IN NON-CONSOLIDATED COMPANIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Company | | Country of incorporation | | Main activity | | Voting rights as of | | Value as of |

| | | | | | | | | |

| | | June 30, 2024 | | December 31, 2023 | | June 30, 2024 | | December 31, 2023 |

| | | | | | | | | | | | |

| Techgen S.A. de C.V. | | Mexico | | Provision of electric power | | 48.00% | | 48.00% | | 123,844 | | 116,849 |

| Unigal Usiminas Ltda. | | Brazil | | Manufacturing and selling of steel products | | 70.00% | | 70.00% | | 116,429 | | 124,064 |

| MRS Logística S.A | | Brazil | | Logistical services | | 11.41% | | 11.41% | | 218,674 | | 235,268 |

| Other non-consolidated companies (1) | | | | | | | | | | 38,539 | | 41,084 |

| | | | | | | | | | | | |

| | | | | | | | | | 497,486 | | 517,265 |

(1) It includes the investments held in Finma S.A.I.F., Recrotek S.R.L. de C.V., Gas Industrial de Monterrey S.A. de C.V., Modal Terminal de Graneis Ltda., Usiroll – Usiminas Court Tecnologia em Acabamento Superficial Ltda, Codeme Engenharia S.A, Terminal de Cargas Paraopeba Ltda., Terminal de Cargas Sarzedo Ltda., and Metalcentro Ltda.

Techgen S.A. de C.V.

Techgen stated as of and for the six-month period ended June 30, 2024, that revenues amounted to $ 67 million ($ 221 million as of June 30, 2023), net profit from continuing operations to $ 14 million ($ 34 million as of June 30, 2023), non-current assets to $ 729 million ($ 766 million as of December 31, 2023), current assets to $ 90 million ($ 175 million as of December 31, 2023), non-current liabilities to $ 440 million ($ 466 million as of December 31, 2023), current liabilities to $ 121 million ($ 232 million as of December 31, 2023) and shareholders’ equity to $ 258 million ($ 243 million as of December 31, 2023).

Unigal Usiminas Ltda.

Unigal stated as of and for the six-month period ended June 30, 2024, that non-current assets amounted to $ 140 million ($ 163 million as of December 31, 2023), current assets to $ 49 million ($ 40 million as of December 31, 2023), non-current liabilities to $ 42 million ($48 million as of December 31, 2023), current liabilities to $ 10 million ($ 11 million as of December 31, 2023) and shareholders’ equity to $ 137 million ($ 143 million as of December 31, 2023). Revenues amounted to $ 35 million and net profit from continuing operations to $ 12 million for the six-month period ended June 30, 2024.

MRS Logística S.A.

MRS Logística stated as of and for the six-month period ended June 30, 2024, that non-current assets to $ 2,456 million ($ 2,779 million as of December 31, 2023), current assets to $ 643 million ($ 954 million as of December 31, 2023), non-current liabilities to $ 1,428 million ($ 1,709 million as of December 31, 2023), current liabilities to $ 423 million ($ 704 million as of December 31, 2023) and shareholders’ equity to $ 1,248 million ($ 1,320 million as of December 31, 2023). Revenues amounted to $ 563 million and net profit from continuing operations to $ 108 million for the six-month period ended June 30, 2024.

11. DISTRIBUTION OF DIVIDENDS

During the annual shareholders’ meeting held on April 30, 2024, the shareholders approved a distribution of dividends of USD 0.33 per share (USD 3.30 per ADS). The annual dividend included the interim dividend of $0.11 per share ($1.10 per ADS) paid in November 2023. A net dividend of $0.22 per share ($2.20 per ADS) was paid on May 8, 2024, of approximately USD 441.0 million in the aggregate.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

12. INCOME TAX – PILLAR TWO

The Company is within the scope of the OECD Pillar Two model rules. Pillar Two legislation was enacted in Luxemburg, the jurisdiction in which the company is incorporated, and came into effect from 1 January 2024. The Company applies the exception to recognizing and disclosing information about deferred tax assets and liabilities related to Pillar Two income taxes, as provided in the amendments to IAS 12 issued in May 2023.

The Company estimates as current tax expense related to Pillar Two the amount of $ 9.8 million.

13. CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS

Contingencies, commitments and restrictions on the distributions of profits should be read in Note 25 to the Company’s audited Consolidated Financial Statements for the year ended December 31, 2023.

(i) Tax claims and other contingencies

Provision for ongoing litigation related to the acquisition of a participation in Usiminas

In 2013, the Company was notified of a lawsuit filed in Brazil by Companhia Siderúrgica Nacional, or CSN, and various entities affiliated with CSN against Ternium Investments, its subsidiary Ternium Argentina, and Tenaris’s subsidiary Confab, all of which compose the T/T Group under the Usiminas shareholders agreement. The entities named in the CSN lawsuit had acquired a participation in Usiminas in January 2012. The CSN lawsuit alleged that, under applicable Brazilian laws and rules, the acquirers were required to launch a tag-along tender offer to all non-controlling holders of Usiminas ordinary shares for a price per share equal to 80% of the price per share paid in such acquisition, or BRL 28.8, and sought an order to compel the acquirers to launch an offer at that price plus interest. If so ordered, the offer would need to be made to 182,609,851 ordinary shares of Usiminas not belonging to Usiminas’ control group. Ternium Investments and Ternium Argentina’s respective shares in the offer would be 60.6% and 21.5%.

On September 23, 2013, the first instance court dismissed the CSN lawsuit, and on February 8, 2017, the court of appeals maintained the understanding of the first instance court. On August 18, 2017, CSN filed an appeal to the Superior Court of Justice (SCJ) seeking the review and reversal of the decision issued by the Court of Appeals. On September 10, 2019, the SCJ declared CSN’s appeal admissible. On March 7, 2023, the SCJ, by majority vote, rejected CSN’s appeal. CSN made several submissions in connection with the SCJ decision, including a motion for clarification that challenged the merits of the SCJ decision. Decisions at the SCJ are adopted by majority vote. At an October 17, 2023 session, two justices of the SCJ voted in favor of remanding the case to the first instance for it to be retried following production and assessment of the new evidence, and two justices of the SCJ voted, without requiring any further evidence, in favor of granting CSN’s motion for clarification and reversing the March 7, 2023 decision that rejected CSN’s appeal; because the fifth member of SCJ excused himself from voting, a justice from another panel at the SCJ was summoned to produce the tie-breaking vote.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

13. CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS (continued)

On June 18, 2024, the SCJ completed its voting on CSN’s motion for clarification and reversed, by majority vote, its March 7, 2023 decision, and resolved that Ternium Investments, its subsidiary Ternium Argentina and Tenaris’s subsidiary Confab should pay CSN an indemnification in connection with the acquisition by the T/T Group a participation in Usiminas in January 2012, with CSN being allowed to retain ownership of the Usiminas ordinary shares it currently owns. Depending on how the indemnification is calculated by other courts, and assuming monetary adjustment and interest through June 30, 2024, the potential aggregate indemnification payable by Ternium Investments and Ternium Argentina could reach up to BRL 3.2 billion (approximately $ 578 million at the BRL/$ rate as of such date) and BRL 1.1 billion (approximately $ 205 million at the BRL/$ rate as of such date), respectively.

The Company continues to believe that all of CSN's claims and allegations are groundless and without merit, as confirmed by several opinions of Brazilian legal counsel, two decisions issued by the Brazilian securities regulator in February 2012 and December 2016, the first and second instance court decisions and the March 7, 2023 SCJ decision referred to above. The Company also believes that the June 18, 2024 SCJ decision on CSN’s motion for clarification is contrary to applicable substantive and procedural law and Ternium will file all available motions and appeals against the SCJ decision. Notwithstanding the foregoing, in light of the recent SCJ decision, the Company cannot predict the ultimate resolution on the matter.

BP Energía México (BPEM) – Arbitration process

On February 2022, BP Energía México (“BPEM”) started an arbitration process against Gas Industrial de Monterrey, S.A. de C.V. (“GIMSA”), Ternium México and Ternium Gas México (“Respondents”), claiming payment for the gas supply from February 12 to February 28, 2021, for $ 27.6 million, $ 12.4 million, and $ 2.4 million, plus V.A.T. and interest, respectively. On June 9, 2024, after the arbitration process was completed, the arbitration award was notified and the Arbitration Tribunal ordered the Respondents to pay BPEM $ 22.0 million, $ 9.9 million and $ 2.1 million, plus V.A.T. and interest, respectively. Additionally, the Parties were ordered to pay expenses and costs for $ 2.4 million.

Ternium México and GIMSA will file a request for interpretation and correction of the arbitral award, which would suspend its execution, and subsequently nullity of the arbitral award will be requested. It is important to notice that such strategy has low probabilities of success, so it is expected that the sense of the arbitral award will be confirmed.

(ii) Commitments

(a) Ternium Argentina signed agreements, mainly with Vale S.A. and Mineração Corumbaense Reunida S.A., to cover 80% of its required iron ore, pellets and iron ore fines volumes until December 31, 2024, for an estimated total amount of $ 208.0 million. Although they do not set a minimum amount or a minimum commitment to purchase a fixed volume, under certain circumstances a penalty is established for the party that fails of:

- 7% in case the annual operated volume is between 70% and 75% of the total volume of purchases of the Company; such percentage is applied over the difference between the actual purchased volume and the 80% of the total volume of purchases.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

13. CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS (continued)

-15% in case the annual operated volume is lower than 70% of the total volume of purchases of the Company; such percentage is applied over the difference between the actual purchased volume and the 80% of the total volume of purchases.

(b) Ternium Argentina signed an agreement with Air Liquide Argentina S.A. for the supply of oxygen, nitrogen and argon, for an aggregate amount of $ 58.7 million, which is due to terminate in 2037.

(c) Ternium Argentina signed various contracts within its investment plan for the future acquisition of Property, plant and equipment for a total of $ 49.9 million.

(d) Ternium Brasil also signed on March 2024 a contract with Primetals Technologies Brazil Ltda. for the provision of caster maintenance services for the steel plant. As of June 30, 2024, the outstanding amount of the mentioned services was approximately $ 145.7 million and is due to terminate in March 2034. The contract prevents the delivery of the minimum take-or-pay volume by Ternium and a minimum quantity of contracted hours by Primetals.

(e) Ternium Brasil signed on January 2024 a contract with Petrobras S.A. for the supply of petcoke. As of June 30, 2024, the outstanding amount of the agreement was approximately $ 99.7 million and is due to terminate in February 2026. The contract has minimum required volumes.

(f) Usiminas signed on April 2024 a purchase agreement with Bemisa Holding S.A. for the supply of iron ore for the Ipatinga steel plant until December 2024. The contract establishes that the monthly volumes traded by the parties represent a take or pay agreement, limited to 5%. The outstanding amount was approximately $ 28.0 million as of June 30, 2024.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

14. RELATED PARTY TRANSACTIONS

As of June 30, 2024, Techint Holdings S.à r.l. (“Techint”) indirectly owned 65.03% of the Company’s share capital and Tenaris Investments S.à r.l. (“Tenaris”) held 11.46% of the Company’s share capital. Each of Techint and Tenaris were controlled by San Faustin S.A., a Luxembourg company (“San Faustin”). Rocca & Partners Stichting Administratiekantoor Aandelen San Faustin (“RP STAK”), a private foundation (Stichting) located in the Netherlands, held voting shares in San Faustin sufficient in number to control San Faustin. No person or group of persons controls RP STAK.

The following transactions were carried out with related parties:

| | | | | | | | | | | | | | | | |

| | Six-month period ended

June 30, | | |

| | 2024 | | 2023 | | |

| | (Unaudited) | | |

| (i) Transactions | | | | | | |

| (a) Sales of goods and services | | | | | | |

| Sales of goods to non-consolidated parties | | 97,236 | | | 119,256 | | | |

| Sales of goods to other related parties | | 83,748 | | | 64,221 | | | |

| Sales of services and others to non-consolidated parties | | 90 | | | 84 | | | |

| Sales of services and others to other related parties | | 1,672 | | | 1,935 | | | |

| | | | | | |

| | 182,746 | | | 185,496 | | | |

| (b) Purchases of goods and services | | | | | | |

| Purchases of goods from non-consolidated parties | | 129,595 | | | 208,018 | | | |

| Purchases of goods from other related parties | | 47,943 | | | 35,709 | | | |

| Purchases of services and others from non-consolidated parties | | 38,189 | | | 5,784 | | | |

| Purchases of services and others from other related parties | | 76,487 | | | 40,902 | | | |

| | | | | | |

| | | | | | |

| | 292,214 | | | 290,413 | | | |

| (c) Financial results | | | | | | |

| Income with non-consolidated parties | | 6,667 | | | 6,204 | | | |

| Expenses in connection with lease contracts from other related parties | | (219) | | | (396) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | 6,448 | | | 5,808 | | | |

| (d) Dividends | | | | | | |

| Dividends from non-consolidated parties | | 2,011 | | | 214 | | | |

| | | | | | |

| | 2,011 | | | 214 | | | |

| (e) Other income and expenses | | | | | | |

| Income (expenses), net with non-consolidated parties | | 581 | | | 1,539 | | | |

| Income (expenses), net with other related parties | | 489 | | | 757 | | | |

| | | | | | |

| | 1,070 | | | 2,296 | | | |

| | | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 | |

| | (Unaudited) | | | |

| (ii) Period-end balances | | | | | |

| (a) Arising from sales/purchases of goods/services | | | | | |

| Receivables from non-consolidated parties | | 168,528 | | | 143,292 | | |

| Receivables from other related parties | | 33,492 | | | 29,402 | | |

| Advances to non-consolidated parties | | 2,211 | | | 2,843 | | |

| Advances to suppliers with other related parties | | 117,371 | | | 123,921 | | |

| Payables to non-consolidated parties | | (61,378) | | | (149,562) | | |

| Payables to other related parties | | (34,787) | | | (27,963) | | |

| Lease Liabilities with other related parties | | (2,454) | | | (1,379) | | |

| | | | | |

| | 222,983 | | | 120,554 | | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2024 |

and for the six-month periods ended June 30, 2024 and 2023 |

15. FINANCIAL INSTRUMENTS BY CATEGORY AND FAIR VALUE MEASUREMENT

1)Financial instruments by category

The accounting policies for financial instruments have been applied to the line items below. According to the scope and definitions set out in IFRS 7 and IAS 32, employers’ rights and obligations under employee benefit plans, and non-financial assets and liabilities such as advanced payments and income tax payables, are not included. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| As of June 30, 2024 (in $ thousands) | | Amortized

cost | | Assets at fair value through profit or loss | | Assets at fair value through OCI | | Total |

| | | | | | | | |

| (i) Assets as per statement of financial position | | | | | | | | |

| Receivables | | 443,934 | | | — | | | — | | | 443,934 | |

| Derivative financial instruments | | — | | | 7,145 | | | — | | | 7,145 | |

| Trade receivables | | 1,972,702 | | | — | | | — | | | 1,972,702 | |

| Other investments | | 759,331 | | | 139,852 | | | 1,248,756 | | | 2,147,939 | |

| Cash and cash equivalents | | 1,296,698 | | | 388,456 | | | 34,311 | | | 1,719,465 | |

| | | | | | | | |

| Total | | 4,472,665 | | | 535,453 | | | 1,283,067 | | | 6,291,185 | |

| | | | | | | | |

| As of June 30, 2024 (in $ thousands) | | Amortized

cost | | Liabilities at fair value through profit or loss | | | | Total |

| | | | | | | | |

| (ii) Liabilities as per statement of financial position | | | | | | | | |

| Other liabilities | | 445,810 | | | — | | | | | 445,810 | |

| Trade payables | | 2,154,555 | | | — | | | | | 2,154,555 | |

| Derivative financial instruments | | — | | | 7,313 | | | | | 7,313 | |

| Lease liabilities | | 226,748 | | | — | | | | | 226,748 | |

| Borrowings | | 1,983,808 | | | — | | | | | 1,983,808 | |

| | | | | | | | |

| Total | | 4,810,921 | | | 7,313 | | | | | 4,818,234 | |

2)Fair Value by Hierarchy

IFRS 13 requires for financial instruments that are measured at fair value, a disclosure of fair value measurements by level. See note 29 of the Consolidated Financial Statements as of December 31, 2023 for definitions of levels of fair values and figures at that date.

The following table presents the assets and liabilities that are measured at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair value measurement as of June 30, 2024

(in $ thousands): |