UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

3491-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica announces a debt tender offer to purchase of certain debt securities | 2 |

TELEFÓNICA, S.A., in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

Telefónica Emisiones S.A.U. ("Telefónica Emisiones") and Telefónica Europe B.V., ("Telefónica Europe" and, together with Telefónica Emisiones, the "Offerors"), have commenced a debt tender offer to purchase for cash (the "Offer") the debt securities issued by it and guaranteed by Telefónica, S.A. listed in the table below (collectively, the "Securities") with an aggregate principal amount up to $500 million.

Securities subject to the Offer

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Issuer of Security / Applicable Offeror | Title of Security | Principal Amount Outstanding | CUSIP/

ISIN | Acceptance Priority Level | Early Tender Premium(1) | Reference Security | Bloomberg Reference Page/

Screen | Fixed Spread (basis points) | Total Consideration(1)(2) | Sub-Cap |

| Telefónica Emisiones | 4.665% Notes due 2038 | $750,000,000 | 87938WAV5 / US87938WAV54 | 1 | $50 | 4.50% U.S. Treasury due November 15, 2033 | FIT1 | 175 | To be determined as described in the Offer to Purchase | $350 million in aggregate principal amount of the 2038 Notes |

| Telefónica Emisiones | 4.103% Notes due 2027 | $1,500,000,000 | 87938WAT0 / US87938WAT09 | 2 | $50 | 4.875% U.S. Treasury due October 31, 2028 | FIT1 | 100 | To be determined as described in the Offer to Purchase | N/A |

| Telefónica Europe | 8.250% Notes due 2030 | $1,250,000,000 | 879385AD4 / US879385AD49 | 3 | $50 | 4.50% U.S. Treasury due November 15, 2033 | FIT1 | 130 | To be determined as described in the Offer to Purchase | $100 million in aggregate principal amount of the 2030 Notes |

(1) Per $1,000 principal amount of Securities validly tendered at or prior to the Early Tender Deadline (as defined below) and accepted for purchase.

(2) For the avoidance of doubt, the Early Tender Premium (as defined below) is already included within the Total Consideration (as defined below) (which, in the case of all Securities will be calculated using the Fixed Spread (as defined below) over the relevant Reference Yield (as defined below), as described in the Offer to Purchase) and is not in addition to the Total Consideration. In addition, holders whose Securities are accepted for purchase will also receive accrued and unpaid interest on the principal amount of Securities from, and including, the most recent interest payment date prior to the applicable Settlement Date (as defined below) up to, but not including, the applicable Settlement Date, rounded to the nearest cent (“Accrued Interest”) on such Securities.

The amount of each series of Securities that is purchased will be determined in accordance with the acceptance priority levels specified in the table above (the "Acceptance Priority Level"), with 1 being the highest Acceptance Priority Level and 3 being the lowest Acceptance Priority Level, subject to the Maximum Tender Amount.

The Offer is being made upon and is subject to the terms and conditions set forth in the Offer to Purchase, dated 20 November 2023 (the "Offer to Purchase"). Capitalized terms used and not otherwise defined in this announcement have the meaning given in the Offer to Purchase.

The Offer will expire at 5:00 p.m., New York City time, on 19 December 2023 (such date and time, as it may be extended, the "Expiration Date"), unless earlier terminated. Tenders of Securities may be withdrawn at any time at or prior to, but not after, 5:00 p.m., New York City time, on 4 December 2023 (such date and time, as may be extended with respect to any series of Securities, the "Withdrawal Deadline"), unless the Offerors are required by applicable law to permit withdrawal.

The applicable "Total Consideration" payable for each series of Securities will be a price per $1,000 principal amount of such series of Securities that shall be equal to an amount calculated in accordance with the formula described in the Offer to Purchase by reference to the fixed spread applicable to the relevant series of Securities, as set forth in the table above over the yield of the reference security listed in the table above as of the applicable price determination date, expected to be on 5 December 2023 (the "Reference Yield"). Specifically, the Total Consideration for each series of Securities will equal (a) the value of the remaining payments of principal and interest on Securities of such series up to and including their maturity date, discounted to the Early Settlement Date at a discount rate equal to the sum of (x) the applicable Reference Yield plus (y) the applicable Fixed Spread, minus (b) Accrued Interest as of the Early Settlement Date.

Holders of Securities who validly tender and not withdraw their Securities at or prior to 5:00 p.m., New York City time, on 4 December 2023 (such date and time, as may be extended with respect to any series of Securities, the "Early Tender Deadline") and whose Securities are accepted for purchase will receive the applicable Total Consideration, which already includes the applicable early tender premium specified in the table above (the "Early Tender Premium"). Payment for Securities will be made as soon as reasonably practicable following the Early Tender Deadline (such date, the "Early Settlement Date"). The Offerors expect that the Early Settlement Date will be 7 December 2023, the second business day after the price determination date.

Holders of Securities who validly tender their Securities following the Early Tender Deadline and at or prior to the Expiration Date and whose Securities are accepted for purchase will only receive the applicable "Tender Offer Consideration" which is equal to the applicable Total Consideration minus the applicable Early Tender Premium. Payment for Securities will be made promptly following the Expiration Date (such date, the "Final Settlement Date"). The Offerors expect that the Final Settlement Date will be 22 December 2023, the third business day after the Expiration Date.

In addition to the applicable Total Consideration or Tender Offer Consideration, as the case may be, Accrued Interest will be paid in cash on all validly tendered Securities accepted for purchase.

Even if the Maximum Tender Amount is not reached as of the Early Tender Deadline, subject to the Sub-Caps, Securities validly tendered and not validly withdrawn at or prior to the Early Tender Deadline will be accepted for purchase in priority to Securities tendered following the Early Tender Deadline even if such Securities tendered following the Early Tender Deadline have a higher Acceptance Priority Level than Securities tendered at or prior to the Early Tender Deadline.

Securities of a series may be subject to proration as set out in the Offer to Purchase.

Each Offeror’s obligation to accept for payment and pay for the Securities validly tendered in the Offer is subject to the satisfaction or waiver of the conditions described in the Offer to Purchase. The Offer is not conditioned on any minimum amount of Securities being tendered. Subject to applicable law, the Offerors expressly reserve the right, in their sole discretion, to terminate the Offer with respect to any or all series of Securities if the conditions to the Offer are not satisfied. If the Offer is terminated at any time with respect to any series of Securities, the Securities of such series tendered pursuant to the Offer will be promptly returned to the tendering holders.

The purpose of the Offer is, amongst other things, to proactively manage the Offerors’ respective debt capital structure. Securities that are accepted in the Offer will be purchased by the applicable Offeror and retired and cancelled and will no longer remain outstanding obligations of the applicable Offeror.

The Offer may be amended, extended, terminated or withdrawn in whole or with respect to any series of Securities without amending, extending, terminating or withdrawing the Offer with respect to any other series of Securities. The Offerors reserve the right, subject to applicable law, to: (i) waive any and all conditions to the Offer; (ii) extend or terminate the Offer; (iii) increase or decrease the Maximum Tender Amount or any Sub-Cap; or (iv) otherwise amend the Offer in any respect.

Madrid, 20 November 2023

This announcement is for informational purposes only, none of the Offer, the Offer to Purchase or this announcement constitutes an offer of securities or the solicitation of an offer of securities in Spain which require the approval and the publication of a prospectus under Regulation (EU) 2017/1129, Spanish Law 6/2023, of 17 March, on the Securities Markets and the Investment Services (Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión), and its ancillary and related regulations. Accordingly, the Offer to Purchase has not been and will not be submitted for approval nor approved by the Spanish Securities Market Commission. The Offer is being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law. Please see the Offer to Purchase for certain important information on offer restrictions applicable to the Offer.

NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN ANY JURISDICTION IN WHICH SUCH DISTRIBUTION IS UNLAWFUL

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | November 20, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

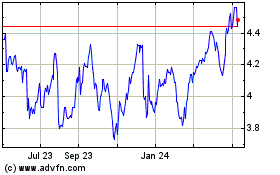

Telefonica (NYSE:TEF)

Historical Stock Chart

From Nov 2024 to Dec 2024

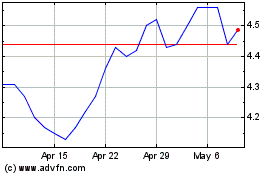

Telefonica (NYSE:TEF)

Historical Stock Chart

From Dec 2023 to Dec 2024