FMC Technologies Reports 20 Percent Increase in Third Quarter 2003 Earnings To $0.30 Per Share

October 27 2003 - 8:10PM

PR Newswire (US)

FMC Technologies Reports 20 Percent Increase in Third Quarter 2003

Earnings To $0.30 Per Share Highlights: - Earnings per diluted

share of $0.30, up 20 percent from third quarter 2002 results -

Energy Systems' sales and operating earnings up 11 percent and 24

percent, respectively - Strong cash flow from operations partially

offset the increase in net debt arising from the acquisition of CDS

Engineering - Earnings guidance maintained for full-year 2003 at

the upper end of the range of $1.05 - $1.15 HOUSTON and CHICAGO,

Oct. 27 /PRNewswire-FirstCall/ -- FMC Technologies, Inc. today

reported third quarter 2003 sales of $560.1 million and earnings

per diluted share of $0.30. Third quarter 2003 earnings per diluted

share are up 20 percent from $0.25 in the third quarter of 2002.

"We had a strong third quarter, reflecting the continuing strength

of our Energy Systems businesses," said Joseph H. Netherland,

Chairman, President and Chief Executive Officer. "Our third quarter

results were driven by our subsea systems business as well as our

surface and fluid control businesses, which benefited from

increased drilling activity. Earnings from our Energy Systems

businesses in the third quarter improved 24 percent over the prior

year. We remain on target to achieve our full-year 2003 earnings

forecast at the upper end of the range of $1.05 to $1.15 per

diluted share." Review of Operations - Third Quarter 2003 Sales for

Energy Systems, comprising Energy Production Systems and Energy

Processing Systems were $375.6 million in the third quarter of

2003, up 11 percent from $339.9 million in the third quarter of

2002. Earnings for the third quarter were $22.1 million, up from

$17.8 million in the same period last year. Energy Production

Systems' third quarter sales and profits increased 12 percent and

11 percent, respectively, over last year. Energy Production

Systems' sales increased due to higher sales in the subsea and

surface systems businesses. Segment operating profit improvements

were driven by the surface and subsea businesses where gains were

more than sufficient to offset lower margins from the floating

production systems business due in part to the Sonatrach contract.

Energy Processing Systems' third quarter sales and profits

increased 8 percent and 56 percent, respectively, over the

prior-year third quarter. The sales improvement was the result of

strength in the fluid control and measurement businesses.

Improvements in both the fluid control and loading systems

businesses contributed positively to the quarter's profits.

Strength in U.S. land drilling activity positively affected sales

and profits of WECO(R)/Chiksan(R) equipment. Energy Systems'

inbound orders were $316.4 million for the third quarter, down 2

percent from $321.7 million in the third quarter of 2002.

Sequentially, inbound orders were up 7 percent from $296.9 million

in the second quarter of 2003. Energy Systems' total backlog at the

end of the third quarter was $788.0 million, up 3 percent from

$762.9 million at the end of the third quarter of 2002, but down 7

percent from $847.2 million at the end of the second quarter of

2003. Energy Production Systems' inbound orders for the quarter

were down 4 percent from the year-ago period due primarily to

delays in subsea project award decisions partially offset by

increases in floating production systems. Inbound orders were up 13

percent sequentially as higher floating production systems orders

more than offset the effect of subsea project award delays. Energy

Processing Systems' inbound orders for the quarter increased 4

percent over the prior year on strong fluid control and loading

systems orders, but decreased 4 percent sequentially, due primarily

to large inbound orders in the second quarter for fluid control

equipment. FoodTech's third quarter sales of $127.2 million were up

6 percent from $120.4 million in the third quarter of 2002, and

earnings of $9.9 million increased 29 percent compared to $7.7

million in the year-ago period. Segment operating profit benefited

from higher sales volumes and lower costs including an adjustment

made for a foreign sales tax. Airport Systems' third quarter sales

of $58.7 million were down 11 percent from $66.3 million in the

third quarter of 2002, while earnings of $5.3 million were down 10

percent from $5.9 million in the prior-year period. The earnings

decline is the result of lower sales of Halvorsen loaders partially

offset by improvements in sales of ground support equipment outside

of the United States and, to a lesser extent, improvements in the

Jetway(R) passenger boarding bridge business. Corporate expense in

the third quarter of 2003 of $5.9 million compared with the

prior-year period expense of $5.6 million. Other expense, net, of

$0.6 million in the third quarter of 2003 compared with other

income, net, of $0.9 million in the prior-year period, which

included a gain on sale of a corporate aircraft. Net interest

expense in the third quarter of 2003 was $2.2 million, down from

$3.1 million in the third quarter of 2002. During the quarter the

company invested $50 million to acquire a controlling interest in

CDS Engineering and made a $15 million contribution to its pension

fund. However, net debt increased only $26 million to $218 million

from $192 million at the end of the second quarter. Depreciation

and amortization for the third quarter of 2003 was $14.5 million.

Capital expenditures during the third quarter of 2003 totaled $15.2

million. Summary and Outlook FMC Technologies reported strong third

quarter results, primarily due to the strength of its Energy

Systems businesses. Subsea systems sales and profits were strong

while increased drilling activity positively affected the Company's

surface completion and WECO(R)/Chiksan(R) businesses. FoodTech

sales and earnings improved on higher food processing and citrus

volumes. Airport Systems showed some profit improvement in the

ground support equipment and Jetway(R) businesses; however, overall

profit declined due to lower volumes of Halvorsen loaders.

Management maintains full-year 2003 earnings guidance at the upper

end of the range of its $1.05 to $1.15 per diluted share estimate.

After two years of rapid subsea growth, the Company expects to see

subsea revenues decline in 2004. This, combined with uncertainty

over the profitability of the Sonatrach contract, will slow the

growth of the Energy Production Systems business in 2004. Energy

Processing Systems is expected to benefit from higher levels of

oilfield activity while FoodTech and Airport Systems are expected

to benefit from improved general economic conditions. Overall, the

Company expects full-year 2004 earnings per share to increase in

the vicinity of 10 percent over 2003. FMC Technologies, Inc.

(http://www.fmctechnologies.com/ ) is a global leader providing

mission-critical technology solutions for the energy, food

processing and air transportation industries. The Company designs,

manufactures and services technologically sophisticated systems and

products for its customers through its Energy Systems (comprising

Energy Production and Energy Processing), FoodTech and Airport

Systems businesses. FMC Technologies employs approximately 8,500

people and operates 32 manufacturing facilities in 15 countries.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this news release that are

forward-looking statements are subject to various risks and

uncertainties concerning specific factors described in FMC

Technologies' 2002 Form 10-K and other filings with the U.S.

Securities and Exchange Commission. Such information contained

herein represents management's best judgment as of the date hereof

based on information currently available. FMC Technologies does not

intend to update this information and disclaims any legal

obligation to the contrary. Historical information is not

necessarily indicative of future performance. FMC Technologies,

Inc. will conduct its third quarter 2003 conference call at 10:00

a.m. (Eastern Standard Time) on Tuesday, October 28, 2003. The

event will be available at http://www.fmctechnologies.com/ . It

also will be available for replay after the event at the same

website address. FMC TECHNOLOGIES, INC. AND CONSOLIDATED

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited

and in millions, except per share amounts) Three Months Ended Nine

Months Ended September 30 September 30 2003 2002 2003 2002 Revenue

$560.1 $525.4 $1,669.7 $1,491.3 Costs and expenses 529.2 498.0

1,588.4 1,424.1 30.9 27.4 81.3 67.2 Minority interests 0.1 0.7 0.5

1.7 Net interest expense 2.2 3.1 6.9 9.8 Income before income taxes

28.6 23.6 73.9 55.7 Provision for income taxes 8.3 6.8 21.5 16.1

Income before the cumulative effect of a change in accounting

principle 20.3 16.8 52.4 39.6 Cumulative effect of a change in

accounting principle, net of income taxes (A) --- --- --- (193.8)

Net income (loss) $20.3 $16.8 $52.4 $(154.2) Basic earnings (loss)

per share: (B) Income before the cumulative effect of a change in

accounting principle $0.31 $0.26 $0.79 $0.61 Cumulative effect of a

change in accounting principle (A) --- --- --- (2.97) Basic

earnings (loss) per share $0.31 $0.26 $0.79 $(2.36) Basic weighted

average shares outstanding 66.2 65.4 66.0 65.3 Diluted earnings

(loss) per share: (B) Income before the cumulative effect of a

change in accounting principle $0.30 $0.25 $0.79 $0.59 Cumulative

effect of a change in accounting principle (A) --- --- --- (2.91)

Diluted earnings (loss) per share $0.30 $0.25 $0.79 $(2.32) Diluted

weighted average shares outstanding 67.1 66.8 66.8 66.8 (A) The

cumulative effect of a change in accounting principle, net of

income taxes, resulted from the adoption of Statement of Financial

Accounting Standards No. 142 in 2002. (B) In certain instances,

earnings per share do not recalculate using the data presented due

to rounding. FMC TECHNOLOGIES, INC. AND CONSOLIDATED SUBSIDIARIES

BUSINESS SEGMENT DATA (Unaudited and in millions) Three Months

Ended Nine Months Ended September 30 September 30 2003 2002 2003

2002 Revenue Energy Production Systems $271.2 $241.4 $826.8 $666.8

Energy Processing Systems 106.1 98.6 304.1 285.9 Intercompany

eliminations (1.7) (0.1) (2.0) (1.4) Subtotal Energy Systems 375.6

339.9 1,128.9 951.3 FoodTech 127.2 120.4 387.8 364.7 Airport

Systems 58.7 66.3 158.1 179.4 Intercompany eliminations (1.4) (1.2)

(5.1) (4.1) $560.1 $525.4 $1,669.7 $1,491.3 Income before income

taxes Energy Production Systems $14.0 $12.6 $50.1 $34.2 Energy

Processing Systems 8.1 5.2 17.6 15.7 Subtotal Energy Systems 22.1

17.8 67.7 49.9 FoodTech 9.9 7.7 31.4 28.9 Airport Systems 5.3 5.9

8.0 10.2 Segment operating profit 37.3 31.4 107.1 89.0 Corporate

expense (5.9) (5.6) (18.3) (17.6) Other income (expense), net (A)

(0.6) 0.9 (8.0) (5.9) Income before net interest expense and income

taxes 30.8 26.7 80.8 65.5 Net interest expense (2.2) (3.1) (6.9)

(9.8) Income before income taxes and the cumulative effect of a

change in accounting principle $28.6 $23.6 $73.9 $55.7 (A) Other

income (expense), net, is primarily comprised of LIFO inventory

adjustments, expenses related to employee pension and other

postretirement employee benefits, expenses related to the

transition to a new payroll and benefit administration service

center, foreign currency-related gains and losses and amortization

expense for restricted stock. FMC TECHNOLOGIES, INC. AND

CONSOLIDATED SUBSIDIARIES BUSINESS SEGMENT DATA (Unaudited and in

millions) Three Months Ended Nine Months Ended September 30

September 30 2003 2002 2003 2002 Inbound orders Energy Production

Systems $206.8 $216.3 $667.8 $747.1 Energy Processing Systems 109.6

105.4 316.7 291.3 Subtotal Energy Systems 316.4 321.7 984.5 1,038.4

FoodTech 126.9 92.2 401.2 349.5 Airport Systems 46.7 47.8 158.9

122.3 Total inbound orders $490.0 $461.7 $1,544.6 $1,510.2

September 30 2003 2002 Order backlog Energy Production Systems

$663.8 $651.6 Energy Processing Systems 124.2 111.3 Subtotal Energy

Systems 788.0 762.9 FoodTech 120.6 106.2 Airport Systems 112.7

106.3 Total order backlog $1,021.3 $975.4 FMC TECHNOLOGIES, INC.

AND CONSOLIDATED SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions) September 30, 2003 December 31, (Unaudited) 2002 Cash

and cash equivalents $50.4 $32.4 Trade receivables, net 466.8 419.2

Inventories 294.2 273.1 Other current assets 74.8 87.9 Total

current assets 886.2 812.6 Property, plant and equipment, net 317.7

306.1 Goodwill 111.9 83.6 Intangible assets, net 69.8 36.3 Other

assets 112.3 124.1 Total assets $1,497.9 $1,362.7 Short-term debt

and current portion of long-term debt $33.2 $59.5 Accounts payable,

trade and other 468.1 421.2 Other current liabilities 269.3 247.5

Total current liabilities 770.6 728.2 Long-term debt, less current

portion 235.1 175.4 Other liabilities 129.0 155.3 Common stock 0.7

0.7 Other stockholders' equity 362.5 303.1 Total liabilities and

stockholders' equity $1,497.9 $1,362.7 FMC TECHNOLOGIES, INC. AND

CONSOLIDATED SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOW (Unaudited and in millions) Nine Months Ended September 30

2003 2002 Cash provided (required) by operating activities of

continuing operations: Income before the cumulative effect of a

change in accounting principle $52.4 $39.6 Depreciation and

amortization 41.2 35.5 Other 12.0 (7.3) Net cash provided by

operating activities of continuing operations 105.6 67.8 Net cash

required by discontinued operations (4.9) (4.4) Cash provided

(required) by investing activities: Retirement of sale leaseback

obligations (35.9) --- Capital expenditures (42.9) (48.3) Business

acquisition, net of cash acquired (A) (43.9) --- Other 4.0 3.1 Net

cash required by investing activities (118.7) (45.2) Cash provided

(required) by financing activities: Net increase (decrease) in

short-term debt (26.2) 4.6 Net increase (decrease) in long- term

debt 52.7 (8.7) Payments to FMC Corporation --- (4.4) Issuance of

capital stock, net of stock acquired for employee benefit plans 9.0

1.0 Net cash provided (required) by financing activities 35.5 (7.5)

Effect of changes in foreign exchange rates on cash and cash

equivalents 0.5 (0.1) Increase in cash and cash equivalents 18.0

10.6 Cash and cash equivalents, beginning of period 32.4 28.0 Cash

and cash equivalents, end of period $50.4 $38.6 (A) Business

acquisition, net of cash acquired, is related to the acquisition of

55% of CDS Engineering ("CDS") in the third quarter of 2003. Cash

outflow due to the acquisition is made up of $47.9 million paid to

the seller plus $0.4 million of acquisition costs, net of $4.4

million of acquired cash. The net cash outflow of $43.9 million,

plus assumed debt of $6.9 million, includes $1.1 million of CDS'

minority interest in its net debt.

http://www.newscom.com/cgi-bin/prnh/20010611/FMCLOGO

http://photoarchive.ap.org/ DATASOURCE: FMC Technologies, Inc.

CONTACT: media, Marvin Brown, +1-281-591-4212, or Bruce Bullock,

+1-281-591-4429, or investors, Maryann Seaman, +1-312-861-6414, all

of FMC Technologies, Inc. Web site: http://www.fmctechnologies.com/

Copyright

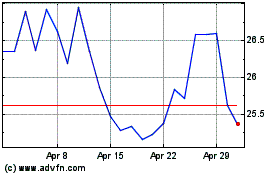

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Jul 2023 to Jul 2024