Taro Pharmaceutical Industries Ltd. (NYSE: TARO) (“Taro” or the

“Company”) today provided unaudited financial results for the

quarter and nine months ended December 31, 2022.

Quarter ended December 31, 2022* Highlights ─ compared to

December 31, 2021

- Net sales of $139.2 million was line with the prior year

quarter. We continue to experience price pressures particularly in

the U.S. generic business.

- Gross profit of $64.0 million (46.0% of net sales) compared to

$76.0 million (54.7% of net sales).

- Research and development (R&D) expenses of $12.9 million

decreased $1.3 million.

- Selling, marketing, general and administrative expenses

(SG&A) of $49.9 million increased $25.0 million.

- Operating income of $1.3 million compared to operating income

of $37.0 million. The current year quarter operating result is

primarily attributable to the aforementioned price erosion, as well

as the on-going impact associated with our recent acquisition.

- Interest and other financial income of $6.6 million increased

$4.5 million.

- Tax expense of $1.9 million compared to $13.2 million in the

prior year quarter.

- Net income attributable to Taro was $7.3 million compared to

net income of $26.3 million, resulting in earnings per share of

$0.19 compared to earnings per share of $0.70.

Nine Months ended December 31, 2022* Highlights ─ compared to

December 31, 2021

- Net sales of $426.4 million increased $8.3 million.

- Gross profit of $192.6 million (45.2% of net sales compared to

51.6%) decreased $23.2 million.

- R&D expenses of $35.9 million decreased $3.7 million.

- SG&A of $148.2 million increased $75.7 million.

- Operating income of $8.4 million compared to $42.2 million.

Excluding the $61.4 million impact from the settlement and loss

contingencies charges in the prior year, operating income was

$103.6 million. The current year operating income primarily

reflects the six-month impact of the factors mentioned above.

- Interest and other financial income of $12.8 million increased

from $7.5 million.

- Net income attributable to Taro was $18.5 million compared to

$30.9 million, resulting in earnings per share of $0.49 compared to

earnings per share of $0.82. Excluding the impact from the

settlement and loss contingencies charges in the prior year, net

income was $99.2 million, resulting in diluted earnings per share

of $2.64.

Cash Flow and Balance Sheet Highlights

- Cash flow used in operations for the nine months ended December

31, 2022 was $24.9 million compared to $200.0 million for the nine

months ended December 31, 2021. Excluding the impact from the

settlement payments and settlement and loss contingencies charges

impacting both periods, cash flow provided by operations was $50.4

million compared to $124.6 million for the nine months ended

December 31, 2021.

- As of December 31, 2022, cash and cash equivalents, short-term

bank deposits and marketable securities (both short- and long-term)

decreased $54.6 million to $1.2 billion from March 31, 2022;

principally the result of settlement payments.

* The December 31, 2022 results include nine months’ results

from the February 28, 2022 acquisition of Alchemee.

The Company cautions that the foregoing 2022 financial

information (including Alchemee) is unaudited and is subject to

change.

************************

About Taro

Taro Pharmaceutical Industries Ltd. is a multinational,

science-based pharmaceutical company dedicated to meeting the needs

of its customers through the discovery, development, manufacturing

and marketing of the highest quality healthcare products. For

further information on Taro Pharmaceutical Industries Ltd., please

visit the Company’s website at www.taro.com.

SAFE HARBOR STATEMENT

The unaudited consolidated financial statements have been

prepared on the same basis as the annual consolidated financial

statements and, in the opinion of management, reflect all

adjustments necessary to present fairly the financial condition and

results of operations of the Company. The unaudited consolidated

financial statements should be read in conjunction with the

Company’s audited consolidated financial statements included in the

Company’s Annual Report on Form 20-F, as filed with the SEC.

Certain statements in this release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include, but are not limited

to, statements that do not describe historical facts or that refer

or relate to events or circumstances the Company “estimates,”

“believes,” or “expects” to happen or similar language, and

statements with respect to the Company’s financial performance,

availability of financial information, and estimates of financial

results and information for fiscal year 2023. Although the Company

believes the expectations reflected in such forward-looking

statements to be based on reasonable assumptions, it can give no

assurances that its expectations will be attained. Factors that

could cause actual results to differ include general domestic and

international economic conditions, industry and market conditions,

changes in the Company's financial position, litigation brought by

any party in any court in Israel, the United States, or any country

in which Taro operates, regulatory and legislative actions in the

countries in which Taro operates, and other risks detailed from

time to time in the Company’s SEC reports, including its Annual

Reports on Form 20-F. Forward-looking statements are applicable

only as of the date on which they are made. The Company undertakes

no obligations to update, change or revise any forward-looking

statement, whether as a result of new information, additional or

subsequent developments or otherwise.

**Financial Tables Follow**

TARO PHARMACEUTICAL INDUSTRIES LTD. SUMMARY CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited) (U.S. dollars in

thousands, except share data)

Quarter Ended Nine

Months Ended

December 31st

December 31st

2022

2021

2022

2021

Sales, net

$

139,202

$

138,984

$

426,365

$

418,083

Cost of sales

75,155

62,937

233,750

202,293

Impairment

—

13

—

13

Gross profit

64,047

76,034

192,615

215,777

Operating Expenses: Research and development

12,907

14,201

35,937

39,648

Selling, marketing, general and administrative

49,861

24,841

148,238

72,501

Settlements and loss contingencies

—

26

—

61,446

Operating income *

1,279

36,966

8,440

42,182

Financial (income) expense, net: Interest and other

financial income

(6,592

)

(2,090

)

(12,814

)

(7,503

)

Foreign exchange (income) expense

(738

)

544

2,344

555

Other gain, net

563

990

1,403

3,714

Income before income taxes

9,172

39,501

20,313

52,842

Tax expense

1,907

13,188

1,781

21,980

Net income attributable to Taro *

$

7,265

$

26,313

$

18,532

$

30,862

Net income per ordinary share attributable to Taro:

Basic and Diluted *

$

0.19

$

0.70

$

0.49

$

0.82

Weighted-average number of shares used to compute net

income per share: Basic and Diluted

37,584,891

37,584,891

37,584,891

37,584,891

May not foot due to rounding.

Note: Quarter and nine months ended December, 2022 includes

results from Alchemee (acquired February 28, 2022).

* Excluding the settlement and loss contingencies charges of

$61.4 million for the nine months ended December 31, 2021,

Operating income was $103.6 million, Net income attributable to

Taro was $99.2 million, and basic and diluted earnings per share

was $2.64.

TARO PHARMACEUTICAL INDUSTRIES LTD. SUMMARY CONSOLIDATED

BALANCE SHEETS (U.S. dollars in thousands)

December 31,

March 31,

2022

2022

ASSETS (unaudited) (audited) CURRENT ASSETS: Cash and cash

equivalents

$

91,973

$

251,134

Short-term bank deposits

169,568

47,586

Marketable securities

602,357

522,028

Accounts receivable and other: Trade, net

251,807

246,972

Other receivables and prepaid expenses

51,730

59,727

Inventories

222,675

210,439

TOTAL CURRENT ASSETS

1,390,110

1,337,886

Marketable securities

337,431

435,189

Property, plant and equipment, net

190,507

199,692

Deferred income taxes

121,100

124,882

Goodwill

12,718

11,820

Other assets

65,658

66,893

TOTAL ASSETS

$

2,117,524

$

2,176,362

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

69,549

$

68,232

Other current liabilities

304,526

363,886

TOTAL CURRENT LIABILITIES

374,075

432,118

Deferred taxes and other long-term liabilities

23,514

32,799

TOTAL LIABILITIES

397,589

464,917

Taro shareholders' equity

1,719,935

1,711,445

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

$

2,117,524

$

2,176,362

TARO PHARMACEUTICAL INDUSTRIES LTD.

SUMMARY CONSOLIDATED

STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

Nine Months Ended December

31,

2022

2021

Cash flows from operating activities: Net income

$

18,533

$

30,862

Adjustments required to reconcile net income (loss) to net cash

used in operating activities: Depreciation and amortization

21,320

19,248

Realized loss on sale of long-lived assets

2

551

Change in derivative instruments, net

(24

)

(536

)

Effect of change in exchange rate on marketable securities and bank

deposits

1,590

(39

)

Deferred income taxes, net

4,612

15,003

Increase in trade receivables, net

(5,168

)

(11,129

)

Increase in inventories, net

(12,361

)

(2,154

)

Decrease in other receivables, income tax receivables, prepaid

expenses and other

7,287

10,973

Decrease in trade, income tax, accrued expenses and other payables

(67,938

)

(270,482

)

Expense from amortization of marketable securities bonds, net

7,247

7,734

Net cash used in operating activities

(24,900

)

(199,969

)

Cash flows from investing activities: Purchase of

plant, property & equipment, net

(11,186

)

(9,121

)

Investment in other intangible assets

(122

)

(120

)

Investment in short-term bank deposits, net

(121,982

)

(35,573

)

Proceeds from (investment in) marketable securities, net

3,060

(17,161

)

Other investments

(2,000

)

—

Net cash used in investing activities

(132,230

)

(61,975

)

Cash flows from financing activities: Purchase of

treasury stock

—

(24,934

)

Net cash used in financing activities

—

(24,934

)

Effect of exchange rate changes on cash and cash

equivalents

(2,031

)

(209

)

Decrease in cash and cash equivalents

(159,161

)

(287,087

)

Cash and cash equivalents at beginning of period

251,134

605,177

Cash and cash equivalents at end of period

$

91,973

$

318,090

Cash Paid during the year for: Income taxes

$

3,415

$

5,667

Cash Received during the year for: Income taxes

$

14,156

$

2,351

Non-cash investing transactions: Purchase of property, plant

and equipment included in accounts payable

$

1,260

$

763

Non-cash financing transactions: Purchase of marketable

securities, net

$

2,710

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230124006013/en/

William J. Coote VP, CFO (914) 345-9001

William.Coote@taro.com

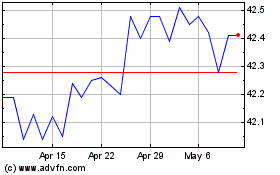

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

From Dec 2023 to Dec 2024