UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF

REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number: 811-04893

______________________________________________

The

TAIWAN FUND, INC.

________________________________________________________________________

(Exact name of registrant as specified in charter)

c/o STATE STREET BANK AND TRUST COMPANY

ONE LINCOLN STREET, P.O. BOX 5049

BOSTON, MA 02111-5049

________________________________________________________________________

(Address of principal executive offices)(Zip

code)

|

(Name and Address of Agent for Service)

|

Copy to:

|

|

State Street Bank and Trust Company

Attention: Brian F. Link

Vice President and Managing Counsel

1 Lincoln Street (SFC 0805)

Boston, MA 02111

|

Leonard B. Mackey, Jr., Esq.

Clifford Chance US LLP

31 West 52nd Street

New York, New York 10019

|

Registrant’s telephone number, including area code: 1-800-426-5523

Date of fiscal year end: August 31

Date of reporting period: November 30, 2019

ITEM 1. SCHEDULE OF INVESTMENTS

|

THE TAIWAN FUND, INC.

Schedule of Investments/November 30, 2019 (Showing Percentage of

Net Assets) (unaudited)

|

|

|

|

SHARES

|

|

|

US $

VALUE

(NOTE 1)

|

|

|

COMMON STOCKS – 84.4%

|

|

|

|

|

|

|

|

|

|

CONSUMER DISCRETIONARY — 6.3%

|

|

|

|

|

|

|

|

|

|

Electric & Machinery Industry — 2.4%

|

|

|

|

|

|

|

|

|

|

Global PMX Co., Ltd.

|

|

|

425,000

|

|

|

$

|

2,521,263

|

|

|

Hota Industrial Manufacturing Co., Ltd.

|

|

|

494,000

|

|

|

|

1,845,791

|

|

|

|

|

|

|

|

|

|

4,367,054

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Electronic Industry — 0.1%

|

|

|

|

|

|

|

|

|

|

Actron Technology Corp.

|

|

|

100,000

|

|

|

|

301,863

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Industry — 2.3%

|

|

|

|

|

|

|

|

|

|

Giant Manufacturing Co., Ltd.

|

|

|

325,000

|

|

|

|

2,354,108

|

|

|

Taiwan Paiho Ltd.

|

|

|

720,000

|

|

|

|

1,828,878

|

|

|

|

|

|

|

|

|

|

4,182,986

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles Industry — 0.7%

|

|

|

|

|

|

|

|

|

|

Eclat Textile Co., Ltd.

|

|

|

100,000

|

|

|

|

1,297,914

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading & Consumers' Goods Industry — 0.8%

|

|

|

|

|

|

|

|

|

|

Poya International Co., Ltd.

|

|

|

100,000

|

|

|

|

1,415,906

|

|

|

TOTAL CONSUMER DISCRETIONARY

|

|

|

|

|

|

|

11,565,723

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSUMER STAPLES — 1.2%

|

|

|

|

|

|

|

|

|

|

Food Industry — 1.2%

|

|

|

|

|

|

|

|

|

|

Charoen Pokphand Enterprise

|

|

|

380,000

|

|

|

|

810,803

|

|

|

Uni-President Enterprises Corp.

|

|

|

537,995

|

|

|

|

1,278,400

|

|

|

TOTAL CONSUMER STAPLES

|

|

|

|

|

|

|

2,089,203

|

|

|

|

|

|

|

|

|

|

|

|

|

INDUSTRIALS — 1.9%

|

|

|

|

|

|

|

|

|

|

Electric & Machinery Industry — 1.9%

|

|

|

|

|

|

|

|

|

|

Airtac International Group

|

|

|

176,000

|

|

|

|

2,543,911

|

|

|

Hiwin Technologies Corp.

|

|

|

110,000

|

|

|

|

939,185

|

|

|

TOTAL INDUSTRIALS

|

|

|

|

|

|

|

3,483,096

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION TECHNOLOGY — 73.4%

|

|

|

|

|

|

|

|

|

|

Communications & Internet Industry — 3.7%

|

|

|

|

|

|

|

|

|

|

Accton Technology Corp.

|

|

|

1,299,000

|

|

|

|

6,769,506

|

|

|

|

|

|

|

|

|

|

|

|

|

Computer & Peripheral Equipment Industry — 1.1%

|

|

|

|

|

|

|

|

|

|

Wistron Corp.

|

|

|

2,197,000

|

|

|

|

1,994,622

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Parts & Components Industry — 10.2%

|

|

|

|

|

|

|

|

|

|

Compeq Manufacturing Co., Ltd.

|

|

|

607,000

|

|

|

|

973,850

|

|

|

Delta Electronics, Inc.

|

|

|

803,000

|

|

|

|

3,684,633

|

|

|

Elite Material Co., Ltd.

|

|

|

230,000

|

|

|

|

919,683

|

|

|

FLEXium Interconnect, Inc.

|

|

|

726,000

|

|

|

|

2,688,845

|

|

|

Simplo Technology Co., Ltd.

|

|

|

99,000

|

|

|

|

989,659

|

|

|

Speed Tech Corp. *

|

|

|

866,000

|

|

|

|

2,162,836

|

|

|

Unimicron Technology Corp.

|

|

|

4,771,000

|

|

|

|

7,216,586

|

|

|

|

|

|

|

|

|

|

18,636,092

|

|

|

|

|

|

|

|

|

|

|

|

|

Optoelectronics Industry — 11.9%

|

|

|

|

|

|

|

|

|

|

Epistar Corp. *

|

|

|

5,477,000

|

|

|

|

5,887,992

|

|

|

Genius Electronic Optical Co., Ltd.

|

|

|

92,867

|

|

|

|

1,241,859

|

|

|

Global Lighting Technologies, Inc.

|

|

|

2,378,000

|

|

|

|

9,781,518

|

|

|

Largan Precision Co., Ltd.

|

|

|

34,000

|

|

|

|

4,942,233

|

|

|

|

|

|

|

|

|

|

21,853,602

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Electronic Industry — 4.3%

|

|

|

|

|

|

|

|

|

|

Chroma ATE, Inc.

|

|

|

307,000

|

|

|

|

1,403,664

|

|

|

Hon Hai Precision Industry Co., Ltd.

|

|

|

987,000

|

|

|

|

2,862,933

|

|

|

Kingpak Technology, Inc.

|

|

|

672,220

|

|

|

|

3,624,332

|

|

|

|

|

|

|

|

|

|

7,890,929

|

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductor Industry — 40.3%

|

|

|

|

|

|

|

|

|

|

ASE Technology Holding Co., Ltd.

|

|

|

2,475,000

|

|

|

|

6,132,643

|

|

|

ASMedia Technology, Inc.

|

|

|

105,000

|

|

|

|

1,951,295

|

|

|

Chipbond Technology Corp.

|

|

|

400,000

|

|

|

|

823,323

|

|

|

Chunghwa Precision Test Tech Co., Ltd.

|

|

|

20,000

|

|

|

|

578,162

|

|

|

Elan Microelectronics Corp.

|

|

|

459,000

|

|

|

|

1,344,934

|

|

|

Global Unichip Corp.

|

|

|

242,000

|

|

|

|

2,113,797

|

|

|

Kinsus Interconnect Technology Corp.

|

|

|

2,268,000

|

|

|

|

3,947,192

|

|

|

Macronix International

|

|

|

6,384,000

|

|

|

|

6,915,363

|

|

|

MediaTek, Inc.

|

|

|

392,000

|

|

|

|

5,415,447

|

|

|

RichWave Technology Corp.

|

|

|

485,000

|

|

|

|

2,670,556

|

|

|

Silergy Corp.

|

|

|

146,000

|

|

|

|

4,249,291

|

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

|

|

3,752,000

|

|

|

|

37,507,088

|

|

|

|

|

|

|

|

|

|

73,649,091

|

|

|

|

|

SHARES

|

|

|

US $

VALUE

(NOTE 1)

|

|

|

Technology Hardware Industry — 1.9%

|

|

|

|

|

|

|

|

|

|

Wiwynn Corp.

|

|

|

188,000

|

|

|

$

|

3,407,483

|

|

|

TOTAL INFORMATION TECHNOLOGY

|

|

|

|

|

|

|

134,201,325

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate — 1.6%

|

|

|

|

|

|

|

|

|

|

Building Material and Construction Industry — 1.6%

|

|

|

|

|

|

|

|

|

|

Kindom Development Co., Ltd.

|

|

|

2,926,000

|

|

|

|

2,968,149

|

|

|

Total Real Estate

|

|

|

|

|

|

|

2,968,149

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL COMMON STOCKS (Cost — $118,191,717)

|

|

|

|

|

|

|

154,307,496

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS — 84.4% (Cost — $118,191,717)

|

|

|

|

|

|

|

154,307,496

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS AND LIABILITIES, NET—15.6%

|

|

|

|

|

|

|

28,592,383

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS—100.0%

|

|

|

|

|

|

|

182,899,879

|

|

Legend:

US $ – United States dollar

The accompanying notes are an integral part

of the Schedule of Investments.

|

Notes

to Schedule of Investments (unaudited)

November 30, 2019

|

1. Organization. The Taiwan Fund, Inc. (the “Fund”),

a Delaware corporation, is registered under the Investment Company Act of 1940, as amended, as a diversified closed-end management

investment fund.

The Fund is an investment company and accordingly follows the investment

company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946

"Financial Services - Investment Companies."

The Fund concentrates its investments in the securities listed on

the Taiwan Stock Exchange. Because of this concentration, the Fund may be subject to certain additional risks not typically associated

with investing in securities of U.S. companies or the U.S. government, including (1) volatility of the Taiwan securities market,

(2) restrictions on repatriation of capital invested in Taiwan, (3) fluctuations in the rate of exchange between the New Taiwan

Dollar and the U.S. Dollar, and (4) political and economic risks. In addition, Republic of China accounting, auditing, financial

and other reporting standards are not equivalent to U.S. standards and, therefore, certain material disclosures may not be made,

and less information may be available to investors investing in Taiwan than in the United States. There is also generally less

regulation by governmental agencies and self-regulatory organizations with respect to the securities industry in Taiwan than there

is in the United States.

2. Basis of Presentation. The preparation of the Schedule

of Investments is in accordance with accounting principles generally accepted in the United States of America and requires management

to make estimates and assumptions that affect the reported amounts in the Schedule of Investments. Actual results could differ

from those estimates.

Security Valuation. All securities, including those traded

over-the-counter, for which market quotations are readily available are valued at the last sales price prior to the time of determination

of the Fund’s net asset value per share or, if there were no sales on such date, at the closing price quoted for such securities

(but if bid and asked quotations are available, at the mean between the last current bid and asked prices, rather than such quoted

closing price). These securities are generally categorized as Level 1 securities in the fair value hierarchy. In certain instances

where the price determined above may not represent fair market value, the value is determined in such manner as the Board of Directors

(the “Board”) may prescribe. Foreign securities may be valued at fair value according to procedures approved by the

Board if the closing price is not reflective of current market values due to trading or events occurring in the valuation time

of the Fund. In addition, substantial changes in values in the U.S. markets subsequent to the close of a foreign market may also

affect the values of securities traded in the foreign market. These securities may be categorized as Level 2 or Level 3 securities

in the fair value hierarchy, depending on the valuation inputs. Short-term investments, having a maturity of 60 days or less are

valued at amortized cost, which approximates market value, with accrued interest or discount earned included in interest receivable.

The Fund has adopted fair valuation accounting standards which establish

a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about

the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation

techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted unadjusted prices for identical

instruments in active markets to which the Fund has access at the date of measurement.

• Level 2 – quoted prices for similar instruments

in active markets; quoted prices for identical or similar instruments in markets that are not active; and model derived valuations

in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets

for which there are few transactions, the prices are not current, little public information exists or instances where prices vary

substantially over time or among brokered market makers.

• Level 3 – model derived valuations in which

one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect

the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available

information.

|

Investments in Securities

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Common Stocks^

|

|

$

|

154,307,496

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

154,307,496

|

|

|

Total

|

|

$

|

154,307,496

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

154,307,496

|

|

|

|

^

|

See schedule of investments for industry breakout.

|

The inputs or methodology used for valuing securities are not necessarily

an indication of the risk associated with investing in those securities.

|

Notes

to Schedule of Investments (unaudited)(continued)

November 30, 2019

|

Foreign Currency Translation. The financial accounting records

of the Fund are maintained in U.S. Dollars. Investment securities, other assets and liabilities denominated in a foreign currency

are translated into U.S. Dollars at the current exchange rate. Purchases and sales of securities, income receipts and expense payments

are translated into U.S. Dollars at the exchange rate on the dates of the transactions.

ITEM 2. CONTROLS AND PROCEDURES

|

|

(a)

|

The registrant’s principal executive and principal financial officers have concluded that

the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940,

as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of

this Form N-Q that includes the disclosure required by this paragraph, based on their evaluation of the controls and procedures

required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rule 13a-15(b) or 15d-15(b) under the Securities Exchange

Act of 1934, as amended, (17 CFR 240.13a-15(b) or 240.15d-15(b)).

|

|

|

(b)

|

There were no changes in the registrant’s internal control over financial reporting (as defined

in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant’s last fiscal quarter that

have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial

reporting.

|

ITEM 3. EXHIBITS

The certifications required by Rule 30a-2(a) of the 1940 Act (17

CFR 270.30a-2(a)), are attached as exhibits to this filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, the Registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

THE TAIWAN FUND, INC.

|

By:

|

/s/ Thomas Fuccillo

|

|

|

|

Thomas Fuccillo

|

|

|

|

President of The Taiwan Fund, Inc.

|

|

Date: 1/28/20

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By:

|

/s/ Thomas Fuccillo

|

|

|

|

Thomas Fuccillo

|

|

|

|

President of The Taiwan Fund, Inc.

|

|

Date: 1/28/20

|

By:

|

/s/ Monique Labbe

|

|

|

|

Monique Labbe

|

|

|

|

Chief Financial Officer of The Taiwan Fund, Inc.

|

|

Date: 1/28/20

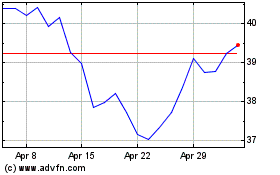

Taiwan (NYSE:TWN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Taiwan (NYSE:TWN)

Historical Stock Chart

From Jul 2023 to Jul 2024