UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 09, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly Held Company

CNPJ/MF No. 16.404.287/0001-55

NIRE No. 29.300.016.331

MINUTES OF THE EXTRAORDINARY BOARD OF DIRECTORS’ MEETING

HELD ON AUGUST 9th, 2024

1. Date, Time, and Venue: On August 9th, 2024, at 8:00 am, through the Company’s videoconference system, a meeting of its Board of Directors (“Board”) was held.

2. Attendance: The following Directors attended the Meeting, representing its entirety: David Feffer (Chairman of the Board of Directors), Daniel Feffer (Vice-Chairman of the Board of Directors), Nildemar Secches (Vice-Chairman of the Board of Directors), Gabriela Feffer Moll, Maria Priscila Rodini Vansetti Machado, Paulo Rogerio Caffarelli, Paulo Sergio Kakinoff, Rodrigo Calvo Galindo and Walter Schalka. Also attended the meeting, as guests, Mrs. José Alberto de Abreu, President, Marcelo Feriozzi Bacci, Finance and Investor Relations Executive Officer and Mr. Marcos Moreno Chagas Assumpção, as secretary.

3. Call: The meeting has been timely called under article 13 of the Company’s Bylaws and clause 6.1 of the Board’s Internal Regulations.

4. Chairman and Secretary: The meeting was chaired by Mr. David Feffer and Mr. Marcos Moreno Chagas Assumpção acted as secretary.

5. Agenda: To resolve on: (i) the cancellation of shares held in treasury, without the Company’s capital reduction (“Share Cancellation”); (ii) the Company’s new share buyback program (“August/2024 Program”); and (iii) the authorization for the Company’s Board of Officers to perform all acts necessary to implement the resolutions that may be approved at the meeting.

6. Minutes in Summary Form: The Directors, unanimously and without reservations, resolved to draw up these minutes in summary form.

7. Resolutions: The attending Directors, unanimously and without reservations, resolved on:

7.1. The approval, pursuant to Section 12 and Section 30, paragraph 1, item “b”, of the Law No. 6,404, of December 15, 1976, as amended (“Brazilian Corporate Law”), the cancellation of 40,000,000 common shares issued by the Company and held in treasury under CNPJ/MF 16404287/0001-55 and 16404287/0033-32, without capital reduction, in particular for purposes of Section 9 and 10 of CVM Resolution No. 77, of March 29, 2022 (“CVM Resolution No. 77/22”), against the balances of the available profit reserves, excluding the balances of the reserves referred to in item I of paragraph 1 of Section 8 of CVM Resolution No. 77/22.

7.1.1. It is here consigned that the Company’s share capital will not be altered as a result of the Share Cancellation. Thus, the Company’s share capital of R$19,269,281,424.63 will be divided into 1,264,117,615 common shares, all nominative, book-entry and without par value.

7.1.2. It is here consigned that an Extraordinary General Meeting will be called in due course to adjust the number of shares into which the share capital is divided, as set forth in Section 5 of the Company’s Bylaws, considering the Share Cancellation hereby approved.

7.1.3. After the Share Cancellation, a reserve of 7,229,687 common shares remains in treasury, which may be used to comply with already approved incentive plans and any other plans that may be approved by the Company.

7.2. The approval, under the terms of the paragraph 1 of Section 30 of Brazilian Corporate Law and CVM Resolution No. 77/22, of the August/2024 Program, due to the significant evolution of the Company’s share buyback program approved at the Board of Directors Meeting held on January 26th, 2024, enabling the acquisition, by the Company, of up to 40,000,000 common shares of its own issuance, representing, approximately, 6.3% of the total free float shares on the present date, in operations to be carried out at B3 S.A. - Brasil, Bolsa, Balcão, at market prices, at the Company's convenience, considering the quotation value of its shares, which may be held in treasury, cancelled and/or sold later, as detailed in the Notice of Negotiation of Shares Issued by the Company, prepared according to the Exhibit G to CVM Resolution No. 80, of March 29, 2022, in the form of Exhibit I to these minutes.

7.2.1. To state that, on the present date, the Company has 633,598,784 free float shares, according to the definition given by article 67 of CVM Resolution No. 80, of March 29, 2022.

7.2.2. To state that the shares acquisitions in the scope of the August/2024 Program will be carried out using: (i) the balances of the available profit and capital reserves, excluding the balances of the reserves referred to in item I of paragraph 1 of Section 8 of CVM Resolution No. 77/22; and (ii) the realized profit for the current year, excluding the allocations to the formation of the reserves specified in item I of paragraph 1 of Section 8 of said Resolution, as determined in the Financial Statements for the period ended on June 30, 2024.

7.2.3. To state that the shares acquisitions in the scope of the August/2024 Program will be liquidated within 18 months, and hence the term of the August/2024 Program will end on February 9th, 2026 (including).

7.2.4. To consign that the shares acquisition in the scope of the August/2024 Program will be conducted by the following brokerage firms: (i) XP Investimentos CCTVM S.A.; (ii) Morgan Stanley CTVM S.A.; (iii) BTG Pactual Corretora de Títulos e Valores Mobiliários S.A.; (iv) J. P. Morgan CCVM S.A.; (v) Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; e (vi) Bradesco S.A. CTVM.

7.3. The Directors authorized the Company's Officers to carry out all acts necessary for the implementation of the above resolutions.

8. Closing: There being no further matters to be discussed, the meeting was closed. The minutes of the Meeting were drafted, read, and will be signed electronically by all

the Board members taking part, with the signatures having retroactive effect to the date of the meeting. It is noted that the documents and presentations that underpinned the matters discussed at this meeting have been archived on the Governance Portal. Signatures: Board Members: David Feffer, Daniel Feffer, Nildemar Secches, Gabriela Feffer Moll, Maria Priscila Rodini Vansetti Machado, Paulo Rogerio Cafarelli, Paulo Sergio Kakinoff, Rodrigo Calvo Galindo e Walter Schalka. This is a true copy of the original minutes drawn up in the Company’s records.

São Paulo, SP, August 9th, 2024.

_________________________________

Marcos Moreno Chagas Assumpção

Secretary

SUZANO S.A.

Publicly Held Company with Authorized Capital

Corporate Taxpayers’ Register (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) No. 29.300.016.331

MINUTES OF THE BOARD OF DIRECTORS MEETING

HELD ON AUGUST 9th, 2024

EXHIBIT I

Exhibit G to the CVM Resolution No. 80, dated March 29, 2022

Negotiation of Shares Issued by the Company

1. Justify in detail the purpose and the expected economic effects of the transaction:

The purpose of the Company’s shares buyback program approved at the Board of Directors meeting held on August 9th, 2024 (“August/2024 Program”) is to maximize the generation of value for the shareholders, as it allows the Company to efficiently allocate capital, considering the profitability potential of its stock, to provide greater future returns to its shareholders. Additionally, the acquisition signals to the market the management’s confidence in the Company’s performance.

Regarding its economic effects, the August/2024 Program may generate to the shareholders, (i) an eventual higher return in dividends and/or interest on shareholders’ equity, since the shares acquired by the Company are not entitled to receive dividends, so that dividends and/or interest on shareholders’ equity will be paid for a smaller number of shares, and (ii) an eventual increase of the percentage of shareholders’ interest in the Company, in the event of cancellation of shares held in treasury.

2. Inform the numbers of (i) free float stocks and (ii) stocks already held in treasury:

(i) the Company has on the present date: (i) 633,598,784 free float shares, according to the definition set forth in Section 67 of CVM Resolution No. 80, of March 29, 2022 (“CVM Resolution No. 80/22”); and (ii) the Company holds 47,229,687 shares of its own issuance in treasury, representing approximately 7.5% of the total free float shares, and part of these shares is canceled on this date, in accordance with the resolution of the Board of Directors, therefore remaining 7,229,687 shares.

3. Inform the number of stocks that may be acquired or disposed of:

The Company may acquire, within the scope of the August/2024 Program, up to 40,000,000 common shares of its own issuance, always in accordance with the limit of shares held in treasury, pursuant to Section 9 of CVM Resolution No. 77, of March 29, 2022. The total of shares covered in the August/2024 Program represents approximately 6.3% of the total free float shares issued by the Company on the present date.

4. Describe the main features of the derivative instruments that the company will use, if any

Not applicable, since the Company will carry out the transactions exclusively on the stock exchange, and will not make use of derivative instruments in this transaction.

5. Describe, if any, any existing voting agreements or guidelines between the company and the counterparty of the transactions:

Not applicable, since the Company will carry out the transactions exclusively on the stock exchange, and there are no previously identifiable counterparties.

6. In the event of transactions conducted outside of organized securities markets, inform: (a) the maximum (minimum) price at which the stocks will be acquired (sold); and (b) if applicable, the reasons justifying the transaction at prices more than ten percent (10%) higher, in the case of acquisition, or more than ten percent (10%) lower, in the case of sale, than the average quotation, weighted by volume, on the ten (10) previous trading sessions:

Not applicable since the Company will carry out the transactions exclusively on the stock exchange.

7. Inform, if any, the impacts that the negotiation will have on the composition of the shareholding control or the company’s administrative structure:

Not applicable since the Company does not foresee any significant impact of the concretization of the negotiations on the composition of the shareholding control or the Company’s administrative structure.

8. Identify the counterparties, if known, and, in the case of a related party to the company, as defined by the accounting rules that deal with this subject, also provide the information required by art. 9 of CVM Resolution No. 81, dated March 29, 2022:

Not applicable, since the Company will carry out the transactions exclusively on the stock exchange, and there are no previously identifiable counterparties.

9. Indicate the allocation of the earned income, if any:

Not applicable.

10. Indicate the maximum term for settlement of authorized transactions:

The final term to carry out the transaction is 18 months from the date of approval of the August/2024 Program by the Board of Directors (i.e., August 9th, 2024), so that said term will expire on February 9th, 2026 (including).

11. Identify institutions that will act as intermediaries, if any:

The acquisition of the shares encompassed in the August/2024 Program will be intermediated by the following brokerage firms: (i) XP Investimentos CCTVM S.A.; (ii) Morgan Stanley CTVM S.A.; (iii) BTG Pactual Corretora de Títulos e Valores Mobiliários S.A.; (iv) J. P. Morgan CCVM S.A.; (v) Goldman Sachs do Brasil Corretora de Títulos e Valores Mobiliários S.A.; e (vi) Bradesco S.A. CTVM.

12. Specify the available resources to be used, in accordance with art. 8, § 1, of CVM Resolution No. 77, dated March 29, 2022:

The shares acquisition will be carried out using: (i) the balances of the available profit and capital reserves, excluding the balances of the reserves referred to in item I of paragraph 1 of Section 8 of CVM Resolution No. 77, of March 29, 2022; and (ii) the

realized profit for the current year, excluding the allocations to the formation of the reserves specified in item I of paragraph 1 of Section 8 of said Resolution, as determined in the Financial Statements for the period ended on June 30, 2024.

13. Specify the reasons why the members of the board of directors are comfortable that the stocks buyback will not jeopardize the fulfillment of obligations to creditors or the payment of mandatory, fixed or minimum dividends:

In the opinion of the Company’s Board of Directors, the Company’s financial situation is compatible with the acquisition of shares within the scope of the August/2024 Program, and no impact is expected on: (i) the fulfillment of obligations assumed by the Company with creditors; and (ii) the payment of mandatory dividends, fixed or minimum, in view of the Company’s liquidity situation and cash generation.

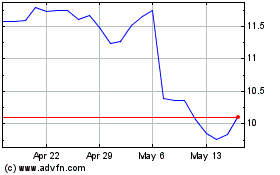

Suzano (NYSE:SUZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

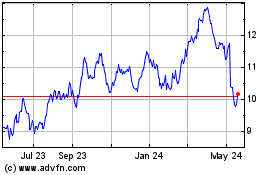

Suzano (NYSE:SUZ)

Historical Stock Chart

From Aug 2023 to Aug 2024